Get State Of Oregon Lodging Tax Form

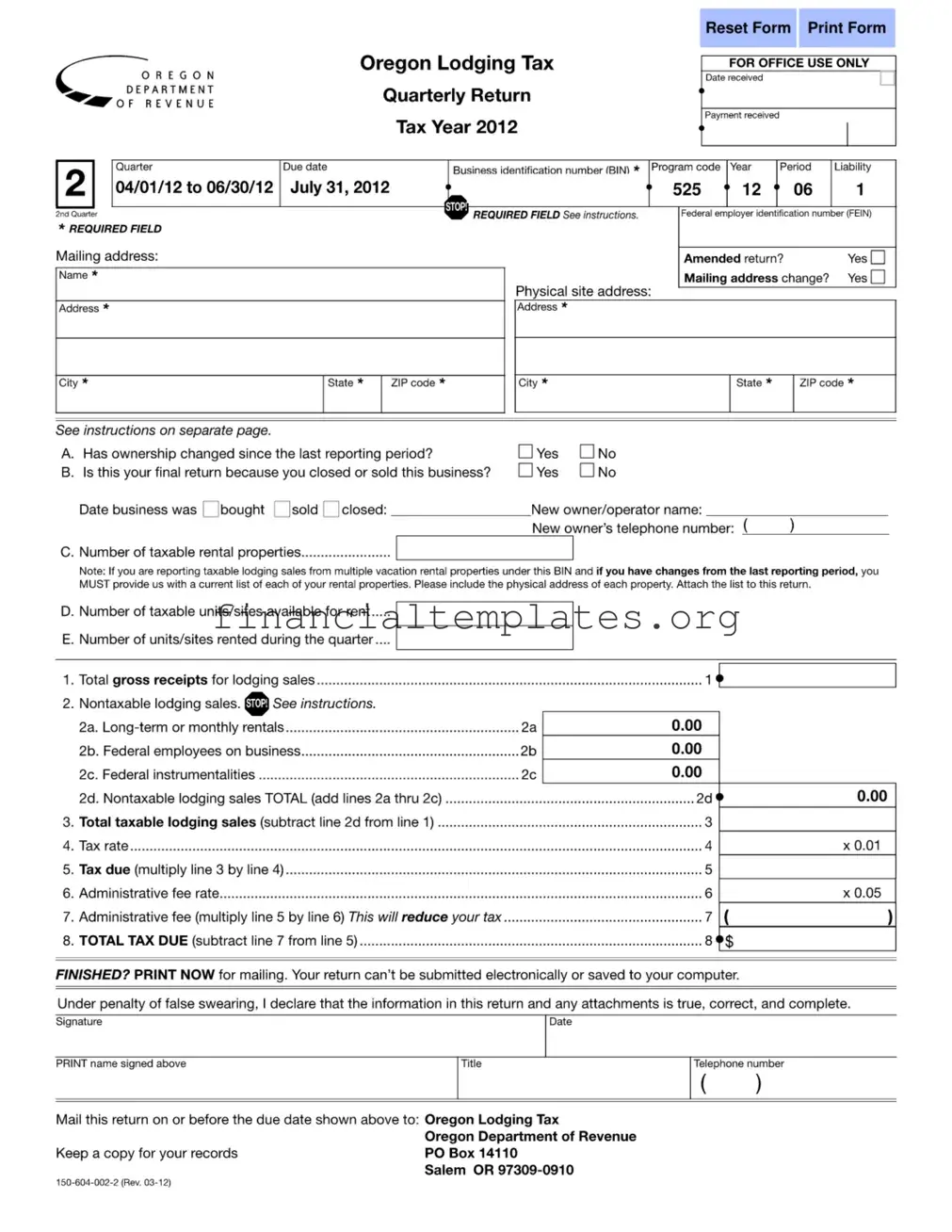

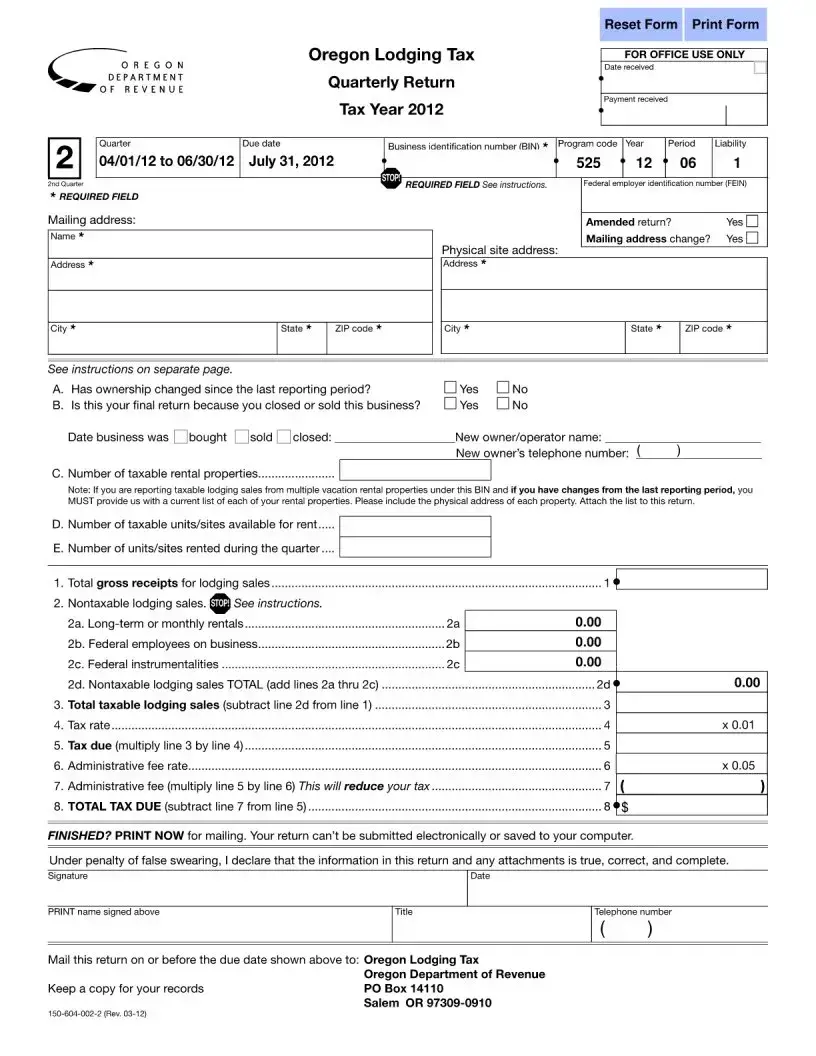

Embarking on the journey of understanding the State of Oregon Lodging Tax Quarterly Return, especially for the tax year 2012, invites both seasoned and novice providers into the nuanced world of tax compliance specific to the lodging industry within the state. At its core, this form serves as a critical vehicle for the accurate reporting and remittance of taxes collected from guests staying at temporary lodging facilities, a ritual that unfolds on a quarterly basis. It mandates the provision of details such as the business identification number (BIN), a must-have for ensuring the form's association with the correct entity, and delves into the nitty-gritty of ownership changes, the delineation between taxable and non-taxable lodging sales, and the rigor of capturing gross receipts for lodging sales. Furthermore, the form prompts providers to spell out specifics regarding the number of rental units available and those actually rented, alongside a calculation section that ultimately determines the tax due, including any applicable administrative fees. This meticulous compilation of data not only adheres to tax laws but strategically aids in the quantification of lodging activities within Oregon's borders. What's more, the directives accompanying the form guide providers through every step of the process, from distinguishing between non-taxable sales, like those to federal employees on official business, to the final step of submission – which notably cannot be done electronically but requires a traditional mailing route. This form embodies a blend of regulatory compliance and operational insight, positioned as a cornerstone document for lodging providers operating within the vibrant state of Oregon.

State Of Oregon Lodging Tax Example

Document Specifics

| Fact Name | Description |

|---|---|

| Tax Collection Period | The Oregon Lodging Tax Quarterly Return for the Tax Year 2012 covered the period from April 1, 2012, to June 30, 2012. |

| Due Date | The due date for the quarterly return was July 31, 2012. |

| Required Identification Numbers | Both the Business Identification Number (BIN) and the Federal Employer Identification Number (FEIN) are required fields on the form. |

| Amendment and Address Change | The form allows lodging providers to indicate if the return is amended or if there has been a change in the mailing address. |

| Ownership Changes and Closing Information | Providers must indicate any change in ownership, if the business was sold or closed, and provide details of the new owner if applicable. |

| Taxable Lodging Sales Calculation | Details required for calculating taxable lodging sales include total gross receipts, exemptions, and the total number of units/sites rented. |

| Mailing and Submission | The return must be printed and mailed to the Oregon Department of Revenue; electronic submission is not available. |

Guide to Writing State Of Oregon Lodging Tax

Filing the State of Oregon Lodging Tax form is a process that requires attention to detail and accuracy. Lodging providers in Oregon are obligated to submit this form on a quarterly basis to accurately report their earnings from lodging sales and pay the appropriate taxes due. This not only keeps your business compliant but also contributes to the state’s efforts in promoting tourism and related activities. Below are the steps you need to follow to complete and submit your form correctly.

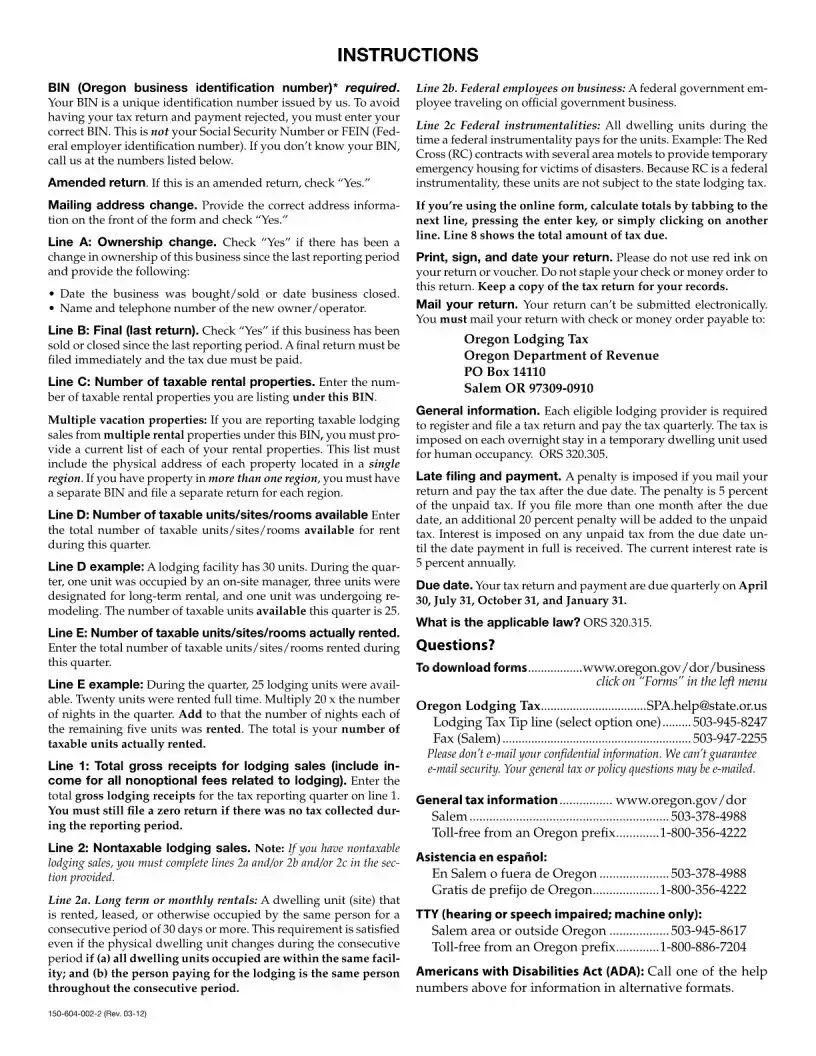

- Ensure you have your Business Identification Number (BIN) ready; it's a required field. Your BIN is a unique number issued to your business and is not your Social Security Number or Federal Employer Identification Number (FEIN). If you're unaware of your BIN, you must contact the provided numbers for assistance.

- If this submission is an amended return, mark "Yes" in the corresponding field to indicate that the form corrects previously submitted information.

- Update your mailing address if there have been any changes since the last reporting period and mark "Yes" in the "Mailing address change?" field.

- Under section A, indicate whether ownership has changed since the last reporting period. If "Yes," provide the necessary details about the new ownership including the date of the change and the new owner's information.

- In section B, determine if this is your final return due to business closure or sale. If "Yes," additional steps might be required to finalize your business's account with the tax authority.

- For both sections C and D, fill in the number of taxable rental properties and units you have. Be thorough in calculating how many units were available for rent and how many were actually rented over the quarter.

- Under section E, indicate the number of units that were actually rented during the quarter.

- Line 1 requires you to enter the total gross receipts for lodging sales. Include all income from non-optional fees related to lodging.

- On lines 2a, 2b, and 2c, report any nontaxable lodging sales, including long-term rentals, federal employees on business, and transactions paid by federal instrumentalities.

- Calculate your total taxable lodging sales by subtracting line 2d (nontaxable lodging sales total) from line 1.

- Apply the tax rate to your taxable lodging sales to determine the tax due, and then calculate the administrative fee. Subtract the fee from your tax due to find the total tax owed.

- Review your form for accuracy, then print and sign it. Include your title and a contact telephone number below your signature.

- Lastly, mail your completed form and payment (if applicable) to the provided address for the Oregon Lodging Tax. Remember, electronic submissions are not accepted, so ensure your form is mailed before the due date to avoid penalties.

Completing the State of Oregon Lodging Tax form accurately and timely is crucial for compliance and maintaining the integrity of your business operations. Remember to keep a copy of the completed form for your records and to reference in preparation for the next filing period.

Understanding State Of Oregon Lodging Tax

What is the State of Oregon Lodging Tax Quarterly Return?

The State of Oregon Lodging Tax Quarterly Return is a form used by lodging providers in Oregon to report and pay lodging taxes on a quarterly basis. This form calculates the tax due based on the total gross receipts for lodging sales, subtracting any nontaxable lodging sales, and applying the relevant tax rate. It is essential for businesses providing temporary dwelling units for human occupancy.

Who is required to file this return?

Any lodging provider offering temporary lodging units for human occupancy in Oregon is required to file this return. This includes hotels, motels, vacation rentals, and other forms of short-term lodging. Lodging providers must register, file the return, and pay the lodging tax quarterly.

What are the key fields that need to be completed on the form?

Lodging providers must complete several key fields on the form, including the business identification number (BIN), federal employer identification number (FEIN), mailing and physical site addresses, ownership information, number of taxable rental properties and units/sites available for rent, gross receipts for lodging sales, and breakdown of nontaxable lodging sales. Providers must also compute the taxable lodging sales, apply the tax rate, and calculate the tax due.

How is the taxable lodging sales amount calculated?

To calculate taxable lodging sales, subtract the total of nontaxable lodging sales (line 2d on the form) from the total gross receipts for lodging sales (line 1). Nontaxable lodging sales include long-term rentals, sales to federal employees on official business, and sales paid by federal instrumentalities.

What constitutes nontaxable lodging sales?

Nontaxable lodging sales include long-term or monthly rentals (rentals to the same person for a consecutive period of 30 days or more), lodging used by federal employees on official government business, and lodging paid for by federal instrumentalities.

What if the ownership of the business changes or it closes?

If there has been a change in the ownership of the lodging business or it has closed, this information must be indicated on the form. For ownership changes, the date of change and new owner’s details are required. If the business is closing, this must be marked as the final return, and immediate filing and payment of any tax due are required.

How can lodging providers report taxable lodging sales from multiple properties?

If lodging providers are reporting taxable lodging sales from multiple properties under the same BIN, they must provide a current list of each rental property, including the physical address of each property. This list should be attached to the lodging tax return form.

What if there were no taxable lodging sales during the quarter?

Lodging providers must file a return even if there were no taxable lodging sales during the quarter. In such cases, a zero return (indicating no tax collected) should be filed.

How and where do lodging providers submit the form and payment?

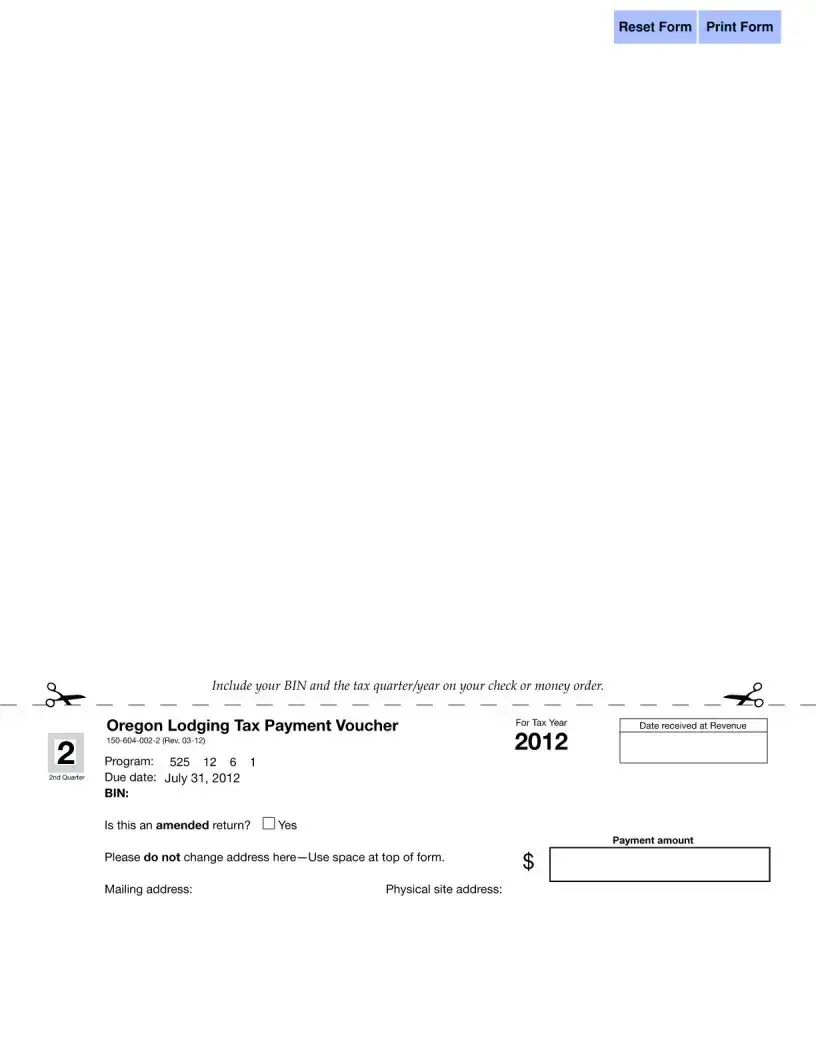

The form cannot be submitted electronically or saved to a computer. Lodging providers must print the completed form, sign it, and mail it with a check or money order payable to "Oregon Lodging Tax" to the Oregon Department of Revenue at the address provided on the form. It is vital to include the correct Business Identification Number (BIN) and follow the form's instructions to avoid rejection.

Common mistakes

When filling out the State of Oregon Lodging Tax Form, people often make mistakes that can lead to inaccuracies or even penalties. It's important to be mindful of these common errors:

- Not entering the correct Business Identification Number (BIN). This is not the same as your Social Security Number or Federal Employer Identification Number (FEIN).

- Failing to indicate if the return is an amended return by checking "Yes" where applicable.

- Omitting or inaccurately providing the mailing address change. If there has been a change, "Yes" must be checked and the new address correctly provided on the front of the form.

- Incorrectly reporting a change in ownership. If there has been a change since the last reporting period, it is crucial to check "Yes" and provide the date of change and new owner/operator details.

- Not properly declaring the form as the final return after selling or closing the business since the last reporting period.

- Incorrect calculation or reporting of the number of taxable rental properties, especially when managing multiple vacation rental properties.

- Providing incorrect numbers for both the taxable units/sites available for rent and the actual units/sites rented during the quarter.

- Miscalculating nontaxable lodging sales. Ensure to properly account for long-term or monthly rentals, federal employees on business, and stays paid for by federal instrumentalities.

- Not properly calculating the total taxable lodging sales, tax due, and administrative fees, leading to incorrect payment amounts.

It's also important to remember:

- To print, sign, and mail the return with a check or money order payable to the Oregon Lodging Tax if you're not submitting it electronically.

- All income for nonoptional fees related to lodging should be included in total gross receipts for lodging sales.

- Keep a copy of the tax return for your records.

By avoiding these common mistakes, you can ensure that your State of Oregon Lodging Tax Form is accurately and thoroughly completed, helping you avoid potential issues with your submission.

Documents used along the form

When managing the State of Oregon Lodging Tax, it's essential to understand that various other documents and forms often accompany this process to ensure compliance and efficiency. These documents support the accurate reporting and management of lodging taxes and related business activities. Whether for record-keeping, verification, or compliance purposes, each plays a crucial role in the broader context of lodging tax administration.

- Business Identification Number (BIN) Application: Before filing any tax forms, a BIN must be obtained from the Oregon Department of Revenue, serving as a unique identifier for your business.

- Change of Address Form: Used to officially update the business's mailing or physical address with the Oregon Department of Revenue, ensuring all correspondence and documents reach the correct location.

- Amended Return Form: This form is necessary if mistakes were made on the initial lodging tax return, allowing businesses to correct and resubmit their information.

- Final Return Form: Needed when a business is closing or changing ownership, this form finalizes the business's tax responsibilities within the state.

- Employee Identification Number (EIN) Confirmation Letter: Issued by the IRS, this document confirms a business's EIN, which is often required alongside the BIN for tax reporting purposes.

- Property Listing: For businesses with multiple rental properties, a current list with the physical address of each property must be maintained and submitted when changes occur.

- Nontaxable Lodging Sales Documentation: Records that support exemptions claimed on the lodging tax return, such as documentation for long-term rentals or federal employees on official business.

- Quarterly Gross Receipts Records: Detailed records of all lodging sales (taxable and nontaxable) for the quarter, supporting the figures reported on the lodging tax return.

- Payment Records: Documentation of the payment submitted with the lodging tax return, providing proof of compliance and timely payment of taxes due.

Understanding and utilizing these documents in conjunction with the State of Oregon Lodging Tax form can significantly streamline tax reporting and compliance processes. Proper documentation not only ensures legal compliance but also aids in efficient business operations and financial planning. For assistance with any of these forms or documents, it's advisable to consult with a professional knowledgeable in Oregon lodging taxes and regulations.

Similar forms

The State and Local Sales Tax Return is a document commonly used by businesses to report and pay the sales taxes they have collected. Similarly, the State of Oregon Lodging Tax form requires lodging providers to report their total gross receipts for lodging sales, specify nontaxable sales, and calculate the taxes due. Both forms are essential for ensuring compliance with tax laws, require detailed reporting of taxable and nontaxable transactions, and help in the collection of taxes that fund public services.

The Employer's Quarterly Federal Tax Return (Form 941) is another similar document, which employers use to report income taxes, Social Security tax, or Medicare tax withheld from employees' paychecks. Like the Oregon Lodging Tax form, it is filed on a quarterly basis, includes calculations for determining the amount of tax owed, and requires accurate record-keeping of taxable transactions. Both forms play a crucial role in the administration of tax responsibilities for businesses.

The Transient Occupancy Tax Return, used by hotels, motels, and other lodging establishments, is closely related to the Oregon Lodging Tax form. It involves the collection of taxes from guests for short-term rentals, with both forms requiring the declaration of gross receipts from lodging, deductions for nontaxable sales, and calculation of the tax due. They ensure that the lodging industry contributes to local government financing.

Similar to the State of Oregon Lodging Tax form, the Use Tax Return is completed by businesses and individuals who purchase items for use, storage, or consumption on which no sales tax has been collected. Both forms account for situations where taxation at the point of sale might not have been levailed properly or completely, covering different aspects of taxation to ensure all due taxes are paid.

The Business License Renewal forms, which businesses file annually or biennially depending on jurisdictional requirements, share similarities with the Oregon Lodging Tax form in that they both require businesses to provide updates on their operational status. These forms might include reporting changes in ownership, which is a specific data point required on the Oregon Lodging Tax form. Although the focus of the two forms differs, they both serve as periodic checks on businesses for regulatory and tax compliance.

The Property Tax Declaration form, required by property owners, is somewhat analogous to the Oregon Lodging Tax form. This form involves declaring the value of one's property to assess property taxes accurately, while the Oregon form deals with reporting income generated from lodging. Both forms require detailed reporting and impact taxes, with one focusing on property ownership and the other on operating lodging facilities.

Lastly, the Excise Tax Return bears resemblance to the Oregon Lodging Tax form, as it is another type of tax return that businesses must file. This form applies to specific goods or services, like alcohol, tobacco, or fuel. Both forms involve the calculation and remittance of taxes based on sales or usage, requiring businesses to keep accurate records and report them periodically to the relevant tax authorities.

Dos and Don'ts

When filling out the State of Oregon Lodging Tax form, ensuring accuracy and compliance with state regulations is paramount. Here are ten tips to help you navigate the process smoothly. These guidelines aim to avoid common pitfalls and ensure your lodging tax filing is correct and timely.

- Do read the instructions provided with the form carefully before starting. This ensures you understand all requirements and how to properly report your lodging sales and taxes.

- Do ensure that your Business Identification Number (BIN) is correctly entered. This number is crucial for your return to be processed accurately.

- Do check the box and provide additional information if this is an amended return or if your mailing address has changed since your last filing.

- Do accurately report the total number of taxable rental properties. If reporting for multiple properties, attach a current list with their physical addresses as required.

- Do carefully calculate and enter the total gross receipts for lodging sales. This includes all income from non-optional fees related to lodging.

- Do clearly report any nontaxable lodging sales, filling out the sections for long-term rentals, federal employees on business, and federal instrumentalities as applicable.

- Do subtract the total nontaxable lodging sales from your gross receipts to accurately determine your total taxable lodging sales.

- Do ensure that the total tax due is calculated correctly by applying the tax rate to your total taxable lodging sales.

- Do sign and date the form. Unsigned forms are not valid and can lead to delays in processing.

- Do mail your completed form to the specified address on or before the due date to avoid penalties for late submission.

- Don't use your Social Security Number or Federal Employer Identification Number (FEIN) in place of your BIN.

- Don't overlook marking the form as an 'amended return' when necessary or failing to report a mailing address change.

- Don't misreport the number of taxable rental properties or fail to attach the required list for multiple properties.

- Don't neglect to accurately categorize and calculate nontaxable lodging sales, as this impacts your taxable sales calculation.

- Don't estimate or guess when completing your gross receipts and taxable sales; use actual figures for accuracy.

- Don't forget to calculate and report the administrative fee correctly. This is often overlooked but is crucial for accurate tax reporting.

- Don't finalize your return without double-checking all figures, especially calculations for tax and administrative fees.

- Don't use red ink on your return or voucher, as this can cause issues with processing.

- Don't staple your check or money order to the return. It should be included but not attached to the paperwork.

- Don't disregard the mailing deadline. Late submissions can lead to penalties that could have been easily avoided with timely mailing.

Adhering to these do's and don'ts can significantly streamline the filing process for the State of Oregon Lodging Tax, ensuring you remain compliant while minimizing potential errors or delays. Always keep a copy of your submitted form and any correspondence for your records.

Misconceptions

When it comes to the State of Oregon Lodging Tax form, misconceptions can lead to errors in filling it out correctly. Let's clear up four common misunderstandings:

- The Business Identification Number (BIN) is the same as your Social Security Number or Federal Employer Identification Number (FEIN). In reality, your BIN is a unique number issued by the state of Oregon, separate from your social security or FEIN. It's crucial to use the correct BIN to avoid rejection of your tax return.

- You can file your return electronically. Unfortunately, this is not the case. The form must be printed and mailed to the Oregon Department of Revenue. It's important to ensure that all sections are completed accurately before mailing to avoid delays or penalties.

- If you didn't collect any lodging taxes during the quarter, you don't need to file a return. This is incorrect. All lodging providers must file a return for each quarter, even if no tax was collected. If no transactions occurred, you would submit a zero return.

- All lodging sales are taxable. Not all lodging sales are subject to tax. There are exemptions, such as long-term or monthly rentals (rented for 30 days or more to the same person), federal employees on official business, and properties paid for by federal instrumentalities like the Red Cross during emergencies. These nontaxable lodging sales must be reported but are not subject to tax.

Understanding these key points helps ensure that you are complying with Oregon's lodging tax requirements and avoiding common pitfalls that can lead to errors in your tax return. Always refer to the most current forms and guidelines provided by the Oregon Department of Revenue for the accurate preparation of your lodging tax return.

Key takeaways

Filling out and using the State of Oregon Lodging Tax form correctly requires attention to detail and an understanding of specific requirements. Here are key takeaways to ensure compliance and accuracy:

- Ensure you use the correct Business Identification Number (BIN), which is different from your Social Security Number or Federal Employer Identification Number (FEIN). This unique number is crucial for the form's acceptance.

- Clearly indicate if the return is an amended return or if there has been a mailing address change. This information is vital for proper processing and record-keeping.

- Report any changes in ownership or if this is the final return due to closing or selling the business. Providing the date and new owner’s contact information is necessary for transitional tax obligations.

- Accurately report the number of taxable rental properties, units/sites available, and units/sites actually rented during the quarter. For properties in more than one region, separate BINs and returns are required.

- Discern between taxable and nontaxable lodging sales. Certain conditions, like long-term rentals over 30 consecutive days or lodgings paid for by federal instrumentalities, are exempt from taxes and should be reported accordingly.

- Calculate and report the total tax due correctly. This involves accounting for all gross receipts, excluding any nontaxable sales, and applying the tax and administrative fee rates to ascertain the amount owed.

Lastly, remember that the form cannot be submitted electronically and must be printed, signed, and mailed by the due date to the Oregon Department of Revenue. Keeping a copy of the completed form for your records is also a good practice for any future reference.

Popular PDF Documents

Virginia 760 - Requiring black ink for submissions, this form is part of Virginia's effort to streamline tax processing and ensure clarity.

Irs Form 14242 - Form 14242 is your way to inform the IRS about potentially illegal tax strategies.