Get State Nevada Tax Form

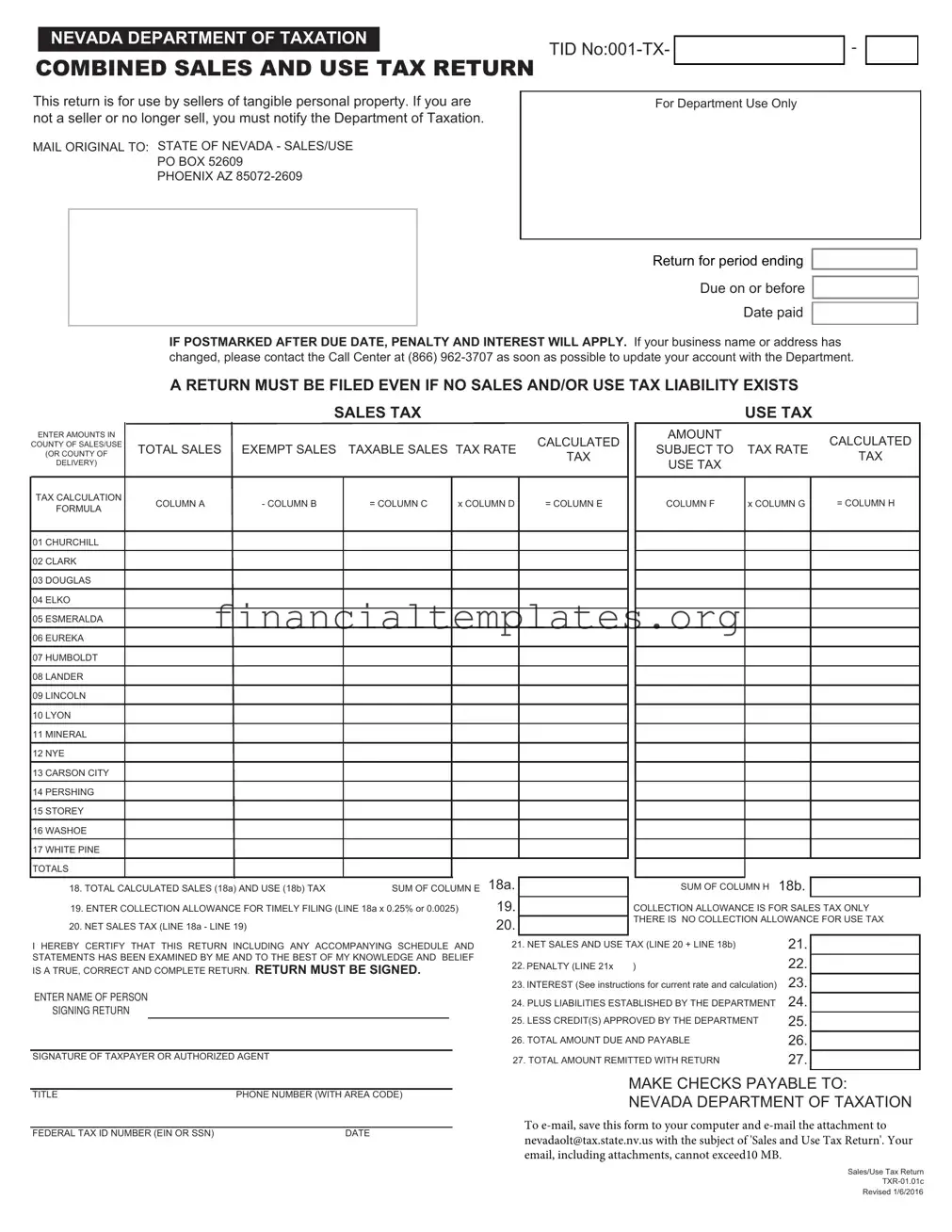

The State of Nevada Tax form, specifically designed for the combined sales and use tax return, serves as a critical document for sellers of tangible personal property within the state. This form, issued by the Nevada Department of Taxation, is an essential tool for businesses to report and remit sales and use taxes correctly to the state. It comprehensively covers various aspects including the total sales, exempt sales, taxable sales, tax rates by county, and the calculated tax due. For compliance, it is mandatory for all registered sellers to file this return even if there is no tax liability for the period in question. Additionally, the form contains sections for adjustments such as collection allowance for timely filing, penalties for late submissions based on the number of days past the due date, interest calculations, and any credits or liabilities from previous periods. The aim is to ensure accuracy and compliance with state tax laws, and it requires sellers to keep detailed records for verification by the Department's auditors. The procedure for filing, along with the necessity of reporting any business changes to the Department of Taxation, underscores the importance of this form in maintaining fiscal responsibility and adherence to state regulations.

State Nevada Tax Example

NEVADA DEPARTMENT OF TAXATION

TID

COMBINED SALES AND USE TAX RETURN

-

This return is for use by sellers of tangible personal property. If you are not a seller or no longer sell, you must notify the Department of Taxation.

MAIL ORIGINAL TO: STATE OF NEVADA - SALES/USE

PO BOX 52609

PHOENIX AZ

For Department Use Only

Return for period ending

Due on or before

Date paid

IF POSTMARKED AFTER DUE DATE, PENALTY AND INTEREST WILL APPLY. If your business name or address has changed, please contact the Call Center at (866)

|

|

|

A RETURN MUST BE FILED EVEN IF NO SALES AND/OR USE TAX LIABILITY EXISTS |

|

|||||||||||||

|

|

|

|

SALES TAX |

|

|

|

|

|

|

|

USE TAX |

|

||||

ENTER AMOUNTS IN |

|

|

|

|

|

|

|

|

|

CALCULATED |

|

|

AMOUNT |

|

|

|

CALCULATED |

COUNTY OF SALES/USE |

|

TOTAL SALES |

EXEMPT SALES |

TAXABLE SALES TAX RATE |

|

|

SUBJECT TO |

TAX RATE |

|||||||||

(OR COUNTY OF |

|

TAX |

|

|

TAX |

||||||||||||

DELIVERY) |

|

|

|

|

|

|

|

|

|

|

|

USE TAX |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAX CALCULATION |

|

|

COLUMN A |

- COLUMN B |

= COLUMN C |

x COLUMN D |

|

= COLUMN E |

|

|

COLUMN F |

x COLUMN G |

|

= COLUMN H |

|||

FORMULA |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

01 CHURCHILL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

02 CLARK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

03 DOUGLAS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

04 ELKO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

05 ESMERALDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

06 EUREKA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

07 HUMBOLDT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

08 LANDER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

09 LINCOLN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 LYON |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 MINERAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 NYE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 CARSON CITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 PERSHING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 STOREY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 WASHOE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 WHITE PINE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18a. |

|

|

|

|

|

|

18b. |

|

|

||

18. TOTAL CALCULATED SALES (18a) AND USE (18b) TAX |

SUM OF COLUMN E |

|

|

|

|

SUM OF COLUMN H |

|

|

|||||||||

|

|

|

|

|

|

19. |

|

|

|

|

|

|

|||||

19. ENTER COLLECTION ALLOWANCE FOR TIMELY FILING (LINE 18a x 0.25% or 0.0025) |

|

|

|

COLLECTION ALLOWANCE IS FOR SALES TAX ONLY |

|||||||||||||

20. NET SALES TAX (LINE 18a - LINE 19) |

|

|

|

20. |

|

|

|

THERE IS NO COLLECTION ALLOWANCE FOR USE TAX |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

I HEREBY CERTIFY THAT THIS RETURN INCLUDING ANY ACCOMPANYING SCHEDULE AND |

21. NET SALES AND USE TAX (LINE 20 + LINE 18b) |

|

21. |

|

|

||||||||||||

STATEMENTS HAS BEEN EXAMINED BY ME AND TO THE BEST OF MY KNOWLEDGE AND BELIEF |

22. |

PENALTY (LINE 21x |

) |

|

|

22. |

|

|

|||||||||

IS A TRUE, CORRECT AND COMPLETE RETURN. RETURN MUST BE SIGNED. |

|

|

|

|

|

||||||||||||

|

23. INTEREST (See instructions for current rate and calculation) |

23. |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

ENTER NAME OF PERSON |

|

|

|

|

24. PLUS LIABILITIES ESTABLISHED BY THE DEPARTMENT |

24. |

|

|

|||||||||

SIGNING RETURN |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

25. LESS CREDIT(S) APPROVED BY THE DEPARTMENT |

25. |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

26. TOTAL AMOUNT DUE AND PAYABLE |

|

26. |

|

|

|||||

SIGNATURE OF TAXPAYER OR AUTHORIZED AGENT |

|

|

|

27. TOTAL AMOUNT REMITTED WITH RETURN |

|

27. |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

TITLE |

PHONE NUMBER (WITH AREA CODE) |

|

|

FEDERAL TAX ID NUMBER (EIN OR SSN) |

DATE |

MAKE CHECKS PAYABLE TO:

NEVADA DEPARTMENT OF TAXATION

To

Sales/Use Tax Return

Revised 1/6/2016

COMBINED SALES AND USE TAX RETURN INSTRUCTIONS

This return is for use by sellers of tangible personal property registered with the Department

A RETURN MUST BE FILED EVEN IF NO TAX LIABILITY EXISTS

LINES 1 THROUGH 17

COLUMN A: TOTAL SALES - On the appropriate county line, enter the amount of all sales (excluding the sales tax collected) related to Nevada business including (a) cash sales; (b) conditional sales; (c) sales exempt from tax.

COLUMN B: EXEMPT SALES - Enter that portion of your sales not subject to tax, i.e., sales (a) for which you receive a resale certificate; (b) to Federal Government, State of Nevada, its agencies, cities or counties and school districts; (c) to religious or charitable organizations for which you have copies of exemption letters on file; (d) newspapers of general circulation published at least once a week; (e) animals, seeds, annual plants and fertilizer, the end product of which is food for human consumption; (f) motor vehicle or special fuels used in internal combustion or diesel engines; (g) wood, presto logs, pellets, petroleum, gas and any other matter used to produce domestic heat and sold for home or household use; (h) prescription medicines dispensed pursuant to a prescription by a licensed physician, dentist or chiropodist; (i) food products sold for home preparation and consumption; (j)

.

COLUMN C: TAXABLE SALES - Total Sales (Column A) - Exempt Sales (Column B) = Taxable Sales (Column C).

COLUMN E: CALCULATED TAX - Taxable Sales (Column C) × Tax Rate (Column D) = Calculated Tax (Column E).

COLUMN F: AMOUNT SUBJECT TO USE TAX - On the appropriate county line, enter (a) the purchase price of merchandise, equipment or other tangible personal property purchased without payment of Nevada tax (by use of your resale certificate, or any other reason) and that was stored, used or consumed by you rather than being resold. NOTE: If you have a contract exemption, give contract exemption number.

COLUMN H: CALCULATED TAX - Amount Subject to Use Tax (Column F) × Tax Rate (Column G) = Calculated Tax (Column H).

LINE 18A Enter the total of Column E.

LINE 18B Enter the total of Column H.

LINE 19 Take the Collection Allowance only if the return and taxes are postmarked on or before the due date as shown on the face of this return. If not postmarked by the due date, the Collection Allowance is not allowed. To calculate the Collection Allowance multiply Line 18a × 0.25% (or .0025). NOTE: Pursuant to NRS 372.370, the Collection Allowance is applicable to Sales Tax only.

LINE 20 Subtract Line 19 from Line 18a and enter the result.

LINE 21 Add Line 20 to Line 18b and enter the result.

LINE 22 If this return is not submitted/postmarked and taxes are not paid on or before the due date as shown on the face of this return, the amount of penalty due is based on the number of days the payment is late per NAC 360.395 (see table below). The maximum penalty amount is 10%.

Number of days late |

Penalty Percentage |

Multiply by: |

|

|

|

1 - 10 |

2% |

0.02 |

|

|

|

11 - 15 |

4% |

0.04 |

|

|

|

16 - 20 |

6% |

0.06 |

|

|

|

21- 30 |

8% |

0.08 |

|

|

|

31 + |

10% |

0.10 |

|

|

|

Determine the number of days late the payment is, and multiply the net tax owed (Line 21) by the appropriate rate based on the table to the left. The result is the amount of penalty that should be entered. For example, if the taxes were due January 31, but not paid until February 15. The number of days late is 15 so the penalty is 4%. The penalty and interest amounts are automatically calculated for you if this form is completed on your computer.

LINE 23 To calculate interest, multiply Line 21 x 0.75% (or .0075) for each month payment is late.

LINE 24 Enter any amount due for prior reporting periods for which you have received a Department of Taxation billing notice.

LINE 25 Enter amount due to you for overpayment made in prior reporting periods for which you have received a Department of Taxation credit notice. Do not take the credit if you have applied for a refund. NOTE: Only credits established by the Department may be used.

LINE 26 Add Lines 21, 22, 23, 24 and then subtract Line 25 and enter the result.

LINE 27 Enter the total amount paid with this return.

Complete and detailed records of all sales, as well as income from all sources and expenditures for all purposes, must be kept so your return can be verified by a Department auditor.

YOU MUST COMPLETE THE SIGNATURE PORTION BY TYPING IN THE NAME OF THE PERSON SIGNING THE RETURN AND MAIL TO: Nevada Department of Taxation, PO Box 52609, Phoenix, AZ

local office.

DO NOT SUBMIT A PHOTOCOPY OF A PRIOR PERIOD FORM, YOUR FILING WILL POST INCORRECTLY.

If you have questions concerning this return, please call our Department's Call Center at (866)

SALES/USE TAX RETURN INSTRUCTIONS

Revised 01/04/2016

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is intended for sellers of tangible personal property to file their combined sales and use tax return. |

| Filing Requirement | A return must be filed even if no sales and/or use tax liability exists. |

| Penalties and Interest | Penalties and interest apply if the form is postmarked after the due date, with specific increases in penalties depending on the number of days late. |

| Governing Laws | The filing and calculation of taxes, including penalties and interest for late submissions, are governed by Nevada Revised Statutes (NRS) 372.370 and Nevada Administrative Code (NAC) 360.395. |

Guide to Writing State Nevada Tax

Filling out the State Nevada Tax form, specifically the Combined Sales and Use Tax Return, is an important process for sellers of tangible personal property in Nevada. This guide will navigate the steps to accurately complete the form. Managing this process meticulously ensures compliance with state tax laws and helps avoid any potential fines or penalties for late or incorrect submissions.

- Start by obtaining the Combined Sales and Use Tax Return form from the Nevada Department of Taxation website or your local office.

- Enter the TID Number at the top of the form, marked as "TID No:001-TX-".

- Fill out the "Return for period ending" section by entering the last date of the reporting period for which you are filing.

- Review the due date for submission on the form to ensure timely filing and avoid penalties.

- If there has been any change in your business name or address, contact the Call Center at (866) 962-3707 before submitting the form.

- Under 'SALES TAX' section, start with 'COLUMN A - TOTAL SALES' for each county you've had sales in, excluding the sales tax collected.

- In 'COLUMN B - EXEMPT SALES', enter the portion of your sales not subject to tax. Include sales to certain entities or certain types of products according to the provided categories.

- Calculate 'COLUMN C - TAXABLE SALES' by subtracting Column B from Column A for each county.

- Apply the tax rate for each county (COLUMN D) to the taxable sales (COLUMN C) to find the 'COLUMN E - CALCULATED TAX'.

- For 'USE TAX', enter 'COLUMN F - AMOUNT SUBJECT TO USE TAX' for merchandise or property used or consumed in each county without paying Nevada sales tax.

- Calculate 'COLUMN H - CALCULATED TAX' for use tax, applying the tax rate (COLUMN G) to the amount subject to use tax (COLUMN F).

- Sum up COLUMN E entries for line 18a and COLUMN H for line 18b, entering the total calculated sales and use tax, respectively.

- Calculate the Collection Allowance for timely filing on line 19, if eligible.

- Determine the NET SALES TAX on line 20 by subtracting line 19 from line 18a.

- Add lines 20 and 18b to find the NET SALES AND USE TAX due on line 21.

- Calculate any PENALTY due using the provided table for late payments and enter this on line 22.

- Calculate INTEREST for late payments on line 23, applying the current rate to the net tax owed for each month the payment is late.

- Add any additional LIABILITIES established by the Department on line 24.

- Subtract any CREDITS approved by the Department from the total on line 25.

- Sum lines 21 through 24, subtract line 25, and enter TOTAL AMOUNT DUE AND PAYABLE on line 26.

- Enter the TOTAL AMOUNT REMITTED WITH RETURN on line 27.

- Complete the signature portion by entering the name and title of the person signing the return, their phone number, and the date.

- Prepare a check payable to the "Nevada Department of Taxation" and mail the form to the provided address or email it as directed on the form.

It's crucial to keep comprehensive records of all transactions, as this information may be necessary for verification by a Department auditor. For further guidance or if there are any queries regarding the return, sellers are encouraged to contact the Nevada Department of Taxation's Call Center. Properly completing and submitting this form is key to fulfilling tax obligations in Nevada.

Understanding State Nevada Tax

FAQ Section About the State Nevada Tax Form

Who needs to fill out the State Nevada Tax form?

This form is specifically designed for sellers of tangible personal property who are registered with the Department of Taxation in Nevada. If you're engaged in selling physical goods, this form is relevant to you.When is the tax return due, and what happens if I submit it late?

The due date is indicated on the form itself, but remember, it's crucial to submit the return and any associated payments on or before this date. Late submissions will trigger a penalty and interest charges. The penalty percentage increases based on how many days late your submission is, up to a maximum of 10%.Is it necessary to file a return if my business had no sales?

Yes, it is. Even if your business didn't have any taxable sales or use tax liability, you're required to file a return. This ensures your records with the Department of Taxation stay up-to-date and accurate.How is the Taxable Sales figure calculated?

To find your Taxable Sales amount, subtract your Exempt Sales (Column B) from your Total Sales (Column A). This figure represents the sales subject to tax, and you'll multiply it by the appropriate tax rate to calculate the tax due.What if my business name or address has changed?

If there's been a change to your business name or address, it's important to notify the Department of Taxation as soon as possible. You can do this by contacting their Call Center for assistance with updating your account information.How can I calculate the Collection Allowance, and when is it allowed?

The Collection Allowance is a benefit for timely filers and applies only to the Sales Tax portion of your tax liability. Calculate it by multiplying Line 18a (your total calculated sales tax) by 0.25% (or .0025). Remember, this allowance is not granted if your tax return is postmarked after the due date.

For further assistance or if you have more specific questions, don't hesitate to reach out to the Nevada Department of Taxation's Call Center. They are readily available to help ensure your compliance with state tax laws.

Common mistakes

Filling out tax forms is a critical task that requires attention to detail—especially when dealing with State Nevada Tax forms for sales and use tax. Even small mistakes can lead to audits, fines, or delays. Here's a closer look at common errors people often make, presented in a structured manner to aid in understanding and avoidance.

Not updating business information: It's important to notify the Nevada Department of Taxation if your business name or address changes. This ensures all correspondence and important tax documents reach you.

Ignoring zero returns: Even if you don't owe sales or use tax for a period, you must file a return. Failing to do so can result in penalties.

Incorrectly calculating total sales: Ensure that all sales, excluding sales tax collected, are accurately reported. This includes cash sales, conditional sales, and exempt sales.

Misreporting exempt sales: Properly identify and exclude sales not subject to tax. This includes sales to government entities, religious or charitable organizations, and out-of-state sales, among others.

Calculating taxable sales incorrectly: Taxable sales are the difference between total sales and exempt sales. Confusion or errors in this calculation can lead to an incorrect tax liability.

Misunderstanding the use tax: Remember to include the purchase price of merchandise used or consumed by your business that was not initially taxed in Nevada. This is a commonly overlooked category.

Forgetting the collection allowance: If you file and pay on time, you're entitled to a collection allowance. Failing to deduct this allowance from your sales tax can result in overpayment.

Inaccurate calculations of penalties and interest: Late filings and payments lead to penalties and interest. These must be calculated based on the number of days late and the amount owed.

While the process may seem daunting, knowing what mistakes to avoid can significantly streamline your filing process. Here are additional tips to keep you on the right track:

- Review every section before submission: Take the time to double-check each part of the form. A second look can catch mistakes you may initially overlook.

- Keep detailed records: Accurate and comprehensive records of all sales and transactions simplify filing and can be invaluable if the Department of Taxation requests verification.

- Seek clarification when needed: If there's anything you don't understand, the Nevada Department of Taxation's Call Center is a resource. Better to ask than assume and make an error.

- Use available resources: The Department of Taxation's website offers updated information and guidance. It's an excellent resource for any questions or clarifications needed.

Approaching your sales and use tax return with a careful, informed strategy not only ensures compliance but also minimizes stress. Be meticulous, stay informed, and when in doubt, seek help.

Documents used along the form

When preparing and filing the State of Nevada Combined Sales and Use Tax Return, businesses operating within Nevada must ensure they gather and complete additional forms and documents to comply with state tax regulations effectively. These documents are essential for various reasons, including reporting accurate sales and use tax, claiming eligible deductions or exemptions, and maintaining compliance with state tax laws. Understanding each of these documents will aid in the seamless processing of your tax obligations.

- Business Registration Form: This document is required for any new business or entity operating within Nevada, registering the business with the Nevada Department of Taxation and obtaining a Tax Identification Number (TID).

- Exemption Certificates for Sales Tax: Used by businesses to document tax-exempt transactions, such as sales to nonprofit organizations or for resale, preventing unnecessary tax charges.

- Annual Resale Certificate: Enables retailers to purchase items for resale without paying sales tax at the point of purchase. It must be renewed yearly and presented to suppliers.

- Employee Withholding Allowance Certificate: Although Nevada does not have a state income tax, for businesses operating in multiple states, this federal form (W-4) is critical for determining the correct federal income tax to withhold from employees' wages.

- Modification of Business Information Form: Necessary for any changes in business details such as address, ownership, or business name, ensuring the Department of Taxation has current information.

- Use Tax Payment Form: Required for reporting use tax on items purchased for business use without payment of Nevada sales tax at the time of purchase, ensuring compliance with tax laws.

- Sales and Use Tax Refund Request Form: Used by businesses to apply for refunds on overpaid sales and use taxes. This may involve complex documentation to substantiate the refund claim.

- Nevada Tax Notes Subscription Form: Though not a requirement, subscribing to Nevada Tax Notes provides valuable updates on tax laws, ensuring businesses stay informed on relevant tax issues.

Gathering and maintaining these documents can significantly ease the process of filing your sales and use tax returns in Nevada. By understanding the purpose and requirement of each form, businesses can ensure they remain compliant with state tax regulations, avoid penalties for non-compliance, and potentially benefit from eligible tax exemptions and deductions. Always check with the Nevada Department of Taxation or a tax professional to ensure you have all necessary documentation for your specific situation.

Similar forms

The Nevada Department of Taxation's Combined Sales and Use Tax Return is quite similar to the California Sales and Use Tax Return. Both forms require businesses to report sales, deductions for exempt sales, and calculate the amount of sales and use tax owed. These forms focus on businesses selling tangible personal property and necessitate detailed breakdowns by county or district to determine the applicable tax rates. This meticulous reporting ensures that the correct amount of tax is collected and remitted to the state, tailored to the unique tax jurisdictional requirements within each state.

Another document that shares similarities with the Nevada State Tax form is the New York Sales and Use Tax Return. Like Nevada's form, it's designed for sellers of tangible goods, but it also accommodates service providers where applicable tax laws apply. Both require the report of total sales, exempt sales, and the calculation of taxable sales. They are thorough in ensuring businesses accurately report and remit taxes based on the specific tax rates applicable in various localities within the state, highlighting the emphasis on locality-specific taxation in sales and use tax law.

The Texas Sales and Use Tax Return parallels Nevada's in structure, focusing on the taxable transactions related to tangible personal property. Both forms necessitate the division of sales into total, exempt, and taxable categories, with subsequent tax calculations based on defined rates. The emphasis on geographic specificity is present in the Texas version, requiring sellers to report based on the location of sales to ensure compliance with county and city tax regulations, akin to Nevada's county-based reporting.

Florida's Sales and Use Tax Return also resembles Nevada's, with sections dedicated to reporting total sales, exempt transactions, and calculating taxes owed. Both states' forms emphasize the importance of distinguishing between types of sales to accurately apply tax rates. They cater to businesses engaged in selling tangible personal property but also cover other taxable activities under their respective state laws, underlining the broad applicability of sales and use tax requirements.

The Illinois Sales and Use Tax Return shares commonalities with the Nevada form, with both demanding detailed sales reporting and the breakdown of taxable versus exempt sales. The forms serve the purpose of collecting tax on retail sales of tangible personal property and certain services, and they require businesses to meticulously calculate the tax due, based on varied tax rates across different jurisdictions within the state. This complexity underscores the importance of accuracy in tax reporting and remittance.

Similar to the Nevada Sales and Use Tax Return, the Pennsylvania Sales and Use Tax Return requires retailers and service providers to itemize sales and calculate due taxes. These forms are integral to the state’s ability to collect taxes on a wide range of transactions involving tangible personal property. The requirement to differentiate between exempt and taxable sales is a key feature, guiding businesses through the process of determining their tax liability with precision.

The Colorado Sales and Use Tax Return, while serving a similar purpose as Nevada's, adapts to Colorado’s tax structure by requiring sellers to report state and local tax liabilities. Like Nevada's form, it focuses on the sale of tangible goods but also encompasses taxable services, emphasizing the collection of taxes based on jurisdiction-specific rates. This highlights the tailored approach states adopt in sales and use tax collection, adapting to local tax codes and jurisdictions.

Michigan's Sales and Use Tax Return also aligns closely with Nevada's form in its aim and structure. Both documents are essential for the reporting and remittance of taxes from the sale of tangible personal property. The forms necessitate detailed reporting of sales activities, categorizing them to identify taxable and exempt sales, thereby facilitating the accurate application of tax rates and ensuring compliance with state tax laws.

The Arizona Transaction Privilege Tax (TPT) Return shares similarities with the Nevada Sales and Use Tax Return, emphasizing taxable transactions related to tangible property. Though termed differently, Arizona’s TPT Return encompasses aspects of sales and use tax, requiring detailed reporting and calculation akin to Nevada’s form. Both forms underscore the importance of geographic and jurisdiction-specific reporting, reflecting the nuanced nature of tax obligations across different states.

Oregon, while not having a general sales and use tax, has specific tax forms for businesses engaged in activities that are taxable, such as the Corporate Activity Tax (CAT) Return. This form, though not a direct counterpart to Nevada’s Sales and Use Tax Return, is similar in its requirement for businesses to report transactions and calculate tax liabilities based on the rules specific to Oregon. This showcases the diverse approaches states take in taxing business activities, even in the absence of a traditional sales and use tax system.

Dos and Don'ts

When completing the State Nevada Tax Form, specifically the Combined Sales and Use Tax Return, individuals and businesses need to navigate the process with precision to ensure accuracy and compliance. Here, we provide a set of guidelines meant to assist in correctly filling out the form while avoiding common pitfalls.

Do's

- Verify your TID Number at the top of the form to ensure correct identification and processing.

- Contact the Nevada Department of Taxation immediately if there’s been a change in your business name or address.

- File a return even if you do not have sales and/or use tax liability for the reporting period.

- Accurately separate total sales from exempt sales in the provided columns to ensure only taxable sales are subject to tax calculation.

- Calculate the tax accurately by applying the correct tax rate to your taxable sales and amount subject to use tax.

- Enter the total calculated sales and use tax correctly to avoid discrepancies.

- Claim the collection allowance if your return and tax payment are postmarked by the due date.

- Ensure the signature portion is completed with the name of the person authorized to sign the return.

- Keep detailed records of all sales and transactions as these may be verified by a Department auditor.

Don'ts

- Don’t overlook notifying the Nevada Department of Taxation if your business no longer sells the specified tangible personal property.

- Don’t miss the due date, as late submissions are subject to penalty and interest.

- Don’t forget to calculate and enter the collection allowance for timely filing on line 19 for sales tax only.

- Don’t miscalculate the penalty and interest due if the return is submitted or taxes are paid after the due date.

- Don’t submit a photocopy of a prior period form, as this will lead to incorrect posting of your filing.

- Don’t leave the signature section blank—this must be signed by the taxpayer or authorized agent.

- Don’t underestimate the importance of keeping comprehensive records for audit purposes.

- Don’t hesitate to contact the Nevada Department of Taxation's Call Center with questions regarding your return.

- Don’t ignore instructions on how to complete the form, especially when calculating penalties, interest, and applicable collection allowances.

Adherence to these guidelines can facilitate a smoother filing process, ensuring compliance with state tax laws and potentially avoiding unnecessary errors or penalties.

Misconceptions

When discussing the State of Nevada tax form, several misconceptions frequently arise, complicating the understanding and proper filing of taxes. Addressing these misunderstandings is crucial for ensuring taxpayers fulfill their obligations accurately and benefit from available provisions.

Misconception 1: A return is not required if there is no sales or use tax liability. Regardless of whether a business has taxable sales or purchases in the reporting period, Nevada mandates that a return be filed. This requirement ensures that the Department of Taxation has a complete record of a business's activities, even if no tax is due.

Misconception 2: Collection allowance applies to both sales and use tax. The collection allowance, designed to cover the costs incurred by businesses in collecting the tax, is available only for sales tax. This means that when a business files timely, it can deduct a small percentage (0.25%) from the sales tax owed, but no such allowance exists for use tax.

Misconception 3: Penalties are standard regardless of the delay in payment. The amount of penalty a business faces for late payment increases with the number of days the payment is overdue. Starting at 2% for delays of up to 10 days and potentially reaching 10% for delays beyond 31 days, penalties are structured to encourage timely compliance.

Misconception 4: Sales outside of Nevada are subject to state sales tax. Sales made to customers outside of Nevada are not subject to Nevada sales tax. This exemption is crucial for businesses engaging in interstate commerce, highlighting the importance of correctly classifying sales to ensure accurate tax reporting and compliance.

These misconceptions underscore the importance of thoroughly understanding the nuances of Nevada's tax laws and regulations. By dispelling these myths, businesses can better navigate their tax responsibilities, ensuring compliance and avoiding unnecessary penalties.

Key takeaways

Filing the Nevada Department of Taxation's Combined Sales and Use Tax Return is essential for sellers of tangible personal property in Nevada. Understanding the key components and requirements of this form can help ensure compliance with state tax laws. Here are five important takeaways:

- The form requires sellers to report both sales and use taxes together. Sales tax is based on the sale of tangible personal property within Nevada, while use tax applies to the storage, use, or consumption of tangible personal property in Nevada when Nevada sales tax has not been paid.

- Even if a business has no sales or use tax liability for the reporting period, a return must still be filed. This requirement emphasizes the state's commitment to maintaining accurate tax records and ensures that all businesses stay accountable for their potential tax obligations.

- Calculating taxes involves subtracting exempt sales from total sales to determine taxable sales, then applying the appropriate tax rate. Similarly, for use tax, the purchase price of tangible personal property bought without Nevada tax and used, stored, or consumed in Nevada is subject to taxation.

- A collection allowance is available for businesses that file their return and pay their taxes on or before the due date. This incentive, calculated as a percentage of the sales tax due, is designed to encourage timely compliance with tax obligations.

- Penalties and interest apply if the return is filed or taxes are paid after the due date. The penalty rate increases with the number of days the payment is late, and interest is calculated as a monthly rate on the unpaid tax. Understanding these additional costs can motivate timely filing and payment.

Completing and submitting the Nevada Combined Sales and Use Tax Return accurately and on time is crucial for businesses. It ensures compliance with state tax laws, helps avoid unnecessary penalties and interest, and contributes to the smooth operation of Nevada's tax collection efforts. For more specific guidance or clarification on filling out this form, the Department of Taxation's Call Center is a valuable resource for sellers.

Popular PDF Documents

Fire Incident Reports - Facilitates the identification of equipment or procedural failures through detailed incident and response documentation.

Health Insurance Marketplace Statement - To avoid tax filing errors, the 1095-A form provides vital information on insurance costs and advance credit payments.

IRS 1095-B - The IRS uses data from the 1095-B form to administer various parts of the Affordable Care Act.