Get State Income Tax Exemption Form

The State Income Tax Exemption Test Certificate is a crucial document for individuals seeking to halt the withholding of state income taxes from their pay. Established under the guidance of the Privacy Act of 1974, it falls under the authority of 5 USC 5516, 5517, and Executive Order 9397 from November 1943. The primary aim of this certificate is to aid service members in ceasing state income tax withholdings for a specified tax year by providing their Social Security Number (SSN) for positive identification. This action is voluntary but failing to furnish this certificate will result in the continued withholding of state income taxes. The information collected is integrated into the active duty pay system records and may be shared with state tax authorities among other routine users. Specifically, the form is pertinent to residents of New Jersey, New York, and Oregon. To qualify for this exemption, individuals must meet three conditions regarding their place of residence both within and outside their state of legal residence, including the duration spent within the state during the tax year. The form clarifies that certain types of accommodation are not considered 'places of abode' for the purpose of this exemption. It also notes that withholding will cease the month following the certificate's filing, with no retroactive adjustments. This document provides a structured process for service members to certify their tax exemption status while ensuring accurate record-keeping and compliance with relevant legal requirements.

State Income Tax Exemption Example

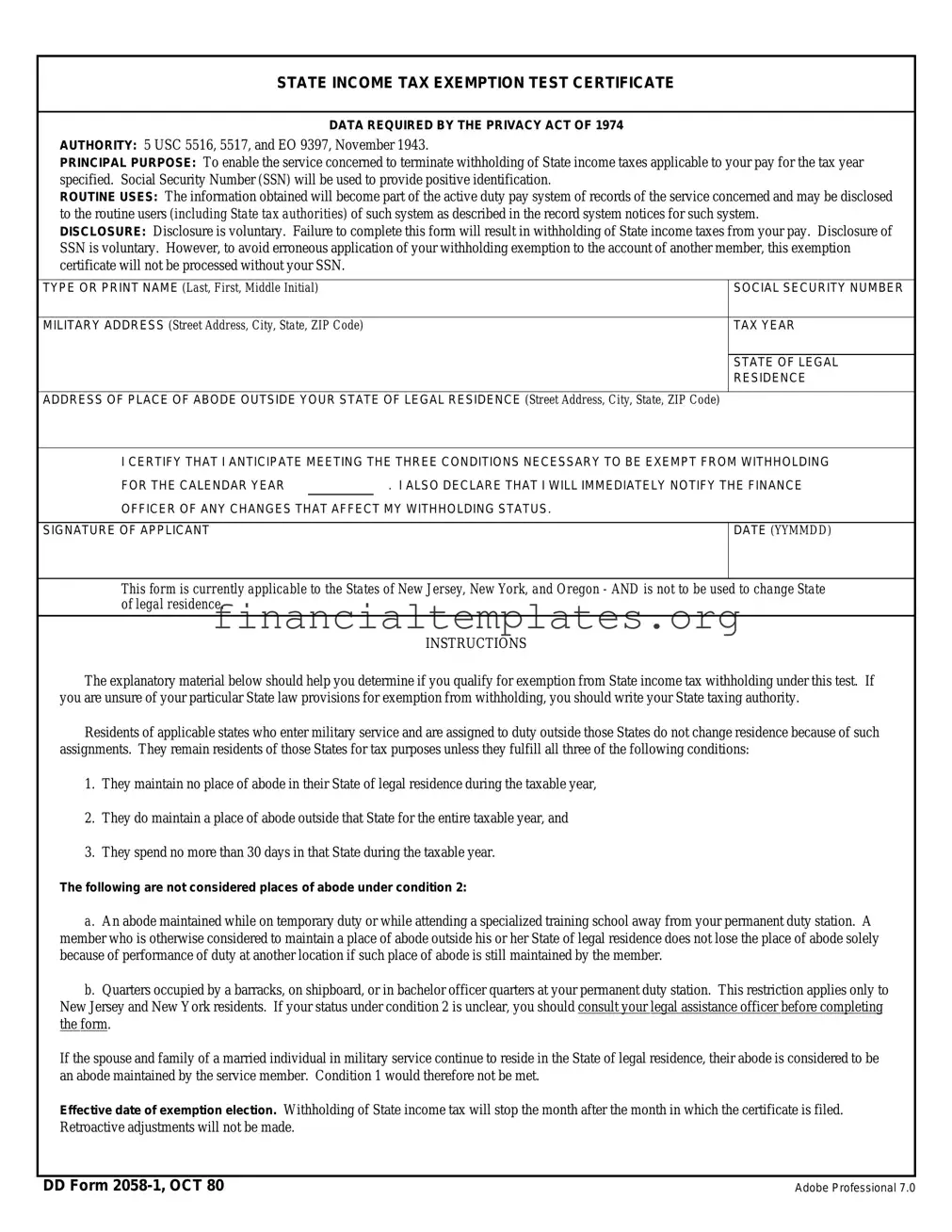

STATE INCOME TAX EXEMPTION TEST CERTIFICATE

DATA REQUIRED BY THE PRIVACY ACT OF 1974

AUTHORITY: 5 USC 5516, 5517, and EO 9397, November 1943.

PRINCIPAL PURPOSE: To enable the service concerned to terminate withholding of State income taxes applicable to your pay for the tax year specified. Social Security Number (SSN) will be used to provide positive identification.

ROUTINE USES: The information obtained will become part of the active duty pay system of records of the service concerned and may be disclosed to the routine users (including State tax authorities) of such system as described in the record system notices for such system.

DISCLOSURE: Disclosure is voluntary. Failure to complete this form will result in withholding of State income taxes from your pay. Disclosure of SSN is voluntary. However, to avoid erroneous application of your withholding exemption to the account of another member, this exemption certificate will not be processed without your SSN.

TYPE OR PRINT NAME (Last, First, Middle Initial) |

|

SOCIAL SECURITY NUMBER |

|

|

|

|

|

MILITARY ADDRESS (Street Address, City, State, ZIP Code) |

|

TAX YEAR |

|

|

|

|

|

|

|

|

STATE OF LEGAL |

|

|

|

RESIDENCE |

|

|

|

|

ADDRESS OF PLACE OF ABODE OUTSIDE YOUR STATE OF LEGAL RESIDENCE (Street Address, City, State, ZIP Code) |

|||

|

|

||

I CERTIFY THAT I ANTICIPATE MEETING THE THREE CONDITIONS NECESSARY TO BE EXEMPT FROM WITHHOLDING |

|||

FOR THE CALENDAR YEAR |

. I ALSO DECLARE THAT I WILL IMMEDIATELY NOTIFY THE FINANCE |

||

|

|

|

|

OFFICER OF ANY CHANGES THAT AFFECT MY WITHHOLDING STATUS. |

|||

|

|

|

|

SIGNATURE OF APPLICANT |

|

DATE (YYMMDD) |

|

|

|

|

|

This form is currently applicable to the States of New Jersey, New York, and Oregon - AND is not to be used to change State of legal residence.

INSTRUCTIONS

The explanatory material below should help you determine if you qualify for exemption from State income tax withholding under this test. If you are unsure of your particular State law provisions for exemption from withholding, you should write your State taxing authority.

Residents of applicable states who enter military service and are assigned to duty outside those States do not change residence because of such assignments. They remain residents of those States for tax purposes unless they fulfill all three of the following conditions:

1.They maintain no place of abode in their State of legal residence during the taxable year,

2.They do maintain a place of abode outside that State for the entire taxable year, and

3.They spend no more than 30 days in that State during the taxable year.

The following are not considered places of abode under condition 2:

a.An abode maintained while on temporary duty or while attending a specialized training school away from your permanent duty station. A member who is otherwise considered to maintain a place of abode outside his or her State of legal residence does not lose the place of abode solely because of performance of duty at another location if such place of abode is still maintained by the member.

b.Quarters occupied by a barracks, on shipboard, or in bachelor officer quarters at your permanent duty station. This restriction applies only to New Jersey and New York residents. If your status under condition 2 is unclear, you should consult your legal assistance officer before completing the form.

If the spouse and family of a married individual in military service continue to reside in the State of legal residence, their abode is considered to be an abode maintained by the service member. Condition 1 would therefore not be met.

Effective date of exemption election. Withholding of State income tax will stop the month after the month in which the certificate is filed. Retroactive adjustments will not be made.

DD Form |

Adobe Professional 7.0 |

|

Designed using Perform Pro, WHS/DIOR, Dec 94 |

Document Specifics

| Fact Name | Description |

|---|---|

| Legal Authority | The State Income Tax Exemption Test Certificate is governed by 5 USC 5516, 5517, and Executive Order (EO) 9397 from November 1943. |

| Principal Purpose | The form is used to stop withholding state income taxes from pay by demonstrating exemption eligibility for the tax year specified. |

| Routine Uses | Information provided will join the active duty pay system records and may be shared with state tax authorities among other routine users. |

| Voluntary Disclosure | Completion and Social Security Number disclosure are voluntary but required for processing to ensure accurate application of withholding exemptions. |

| Eligibility Criteria | Residents must not maintain a place of abode in their state of legal residence, must maintain an abode outside that state for the entire year, and spend no more than 30 days in their state of legal residence to qualify for exemption. |

Guide to Writing State Income Tax Exemption

Filling out the State Income Tax Exemption form is a crucial step for residents of certain states in the military who are stationed outside their state of legal residence and wish to be exempt from state income tax withholding for the specified tax year. This process involves a clear understanding of the eligibility criteria and providing accurate information to ensure that the exemption application is processed successfully. The steps outlined below will guide individuals through the completion of the form, ensuring they meet the necessary conditions and submit their application correctly. It is important to carefully review each section of the form and provide detailed, accurate information to avoid any delays or issues with the exemption application.

- Review the eligibility criteria under the section titled "INSTRUCTIONS" to ensure you meet the three conditions required for exemption from State income tax withholding.

- Type or print your full name (Last, First, Middle Initial) in the designated space on the form.

- Enter your Social Security Number (SSN) in the provided area. Remember, disclosure of your SSN, while voluntary, is crucial for avoiding the erroneous application of your withholding exemption to another member's account.

- Provide your military address, including the Street Address, City, State, and ZIP Code, in the corresponding section.

- Indicate the tax year for which you are seeking exemption from state income tax withholding.

- Specify your state of legal residence by filling in the appropriate field with the name of your home state.

- List the address of your place of abode outside your state of legal residence, including Street Address, City, State, and ZIP Code. Ensure that this address meets the criteria outlined in the instructions for maintaining a place of abode outside the state of legal residence.

- Certify your eligibility by reading the declaration that states you anticipate meeting the three conditions necessary to be exempt from withholding for the calendar year. If you agree and comply with these conditions, sign your name in the signature field provided.

- Date the form by entering the date in the format YYMMDD in the specified area next to your signature.

- Before submitting the form, double-check all entered information for accuracy and completeness to ensure that your exemption request is processed without delay.

- Submit the completed form to the finance officer as directed, ensuring it is filed in a timely manner to stop withholding of state income tax the month following the month in which the certificate is completed.

Upon successful submission of this form, withholding of state income tax will cease based on the effective date outlined in the instructions. It is critical for individuals to notify the finance officer immediately of any changes that may affect their withholding status, maintaining compliance with state and federal requirements for tax exemption. This form plays an integral role in managing state income tax obligations for military personnel ensuring they are aligned with their rights and responsibilities under the law.

Understanding State Income Tax Exemption

Frequently Asked Questions About State Income Tax Exemption Form

What is the purpose of the State Income Tax Exemption Test Certificate?

The primary purpose of this form is to allow applicable service members to stop the withholding of state income taxes from their pay for the specified tax year. It is used to provide a structured way for service members to claim exemption under certain conditions.Who needs to fill out this form?

This form is necessary for residents of New Jersey, New York, and Oregon who are in active military service and meet specific criteria for exemption from state income tax withholding.What information is required on this form?

To complete the form, a service member needs to provide their name, social security number, military address, tax year, state of legal residence, and address of place of abode outside their state of legal residence. A signature and date are also required to certify anticipation in meeting the exemption conditions.Is disclosing my Social Security Number mandatory?

While the disclosure of the Social Security Number (SSN) is stated as voluntary, the form indicates that without it, the exemption certificate may not be processed. This is to prevent the erroneous application of withholding exemptions.What are the conditions for exemption from state income tax withholding?

Service members must fulfill all three conditions: 1) Maintain no place of abode in their state of legal residence during the taxable year, 2) Maintain a place of abode outside that state for the entire taxable year, and 3) Spend no more than 30 days in that state during the taxable year.What does not count as a place of abode outside my state of legal residence?

There are specific exceptions to what is considered a place of abode, including temporary duty locations, specialized training schools, or military quarters such as barracks, ships, or bachelor officer quarters in the permanent duty station.How does my family's residence affect my exemption status?

If a service member's spouse and family continue to reside in the state of legal residence, their abode is considered to be maintained by the service member, potentially affecting the exemption status under condition 1.When does the exemption take effect?

The exemption from state income tax withholding becomes effective the month following the filing of the certificate. Retroactive adjustments are not provided for previously withheld taxes.Where can I get more information or assistance with this form?

Service members seeking further clarification or needing assistance with completing the form are advised to consult their legal assistance officer or write to their state's taxing authority for more details on specific state law provisions related to withholding exemptions.

Common mistakes

Filling out a State Income Tax Exemption form requires attention to detail. However, people commonly make mistakes that can lead to delays or incorrect tax withholdings. Here are some errors to avoid:

- Not providing the Social Security Number (SSN): Even though the form states that disclosing your SSN is voluntary, it's essential for the correct processing of your withholding exemption. Omitting this can lead to your form not being processed.

- Incorrectly typing the SSN: A mistake in entering your SSN can cause your exemption application to be applied to someone else's account.

- Failing to notify of address changes: It's crucial to update your military and abode addresses if they change during the tax year.

- Overlooking the signature and date: The form must be signed and dated to be valid. Forgetting to do so will result in it being returned or not processed.

- Ignoring condition specifics for maintaining abodes: Misunderstanding what constitutes a place of abode can lead to incorrectly claiming you meet exemption conditions.

- Not updating the finance officer of withholding status changes: Any change in your situation that affects your withholding status should be reported immediately.

- Using the form to attempt a change of State of legal residence: This form cannot be used for changing your State of legal residence.

- Misidentifying applicable states: Ensure your State is one of those listed as applicable (New Jersey, New York, and Oregon) before proceeding.

- Assuming automatic updates: Don't expect the form to update your information annually. You must refile if your exemption status continues beyond the current tax year.

Understanding and avoiding these common mistakes can streamline the process of claiming your state income tax exemption and ensure that your financial records are accurately maintained.

Documents used along the form

When dealing with the State Income Tax Exemption form, individuals often need to gather additional documents to fully support their exemption claim. These documents play a crucial role in ensuring the process runs smoothly, reinforcing one's exemption status with detailed evidence. Here's an overview of some common forms and documents that are frequently required alongside the State Income Tax Exemption form:

- Copy of Military Orders: This shows the individual's duty station and verifies military service requirements. It's essential for proving that the service member is stationed outside their state of legal residence.

- W-2 Form: This wage and tax statement is necessary for income verification. It provides a record of the income earned and taxes already paid to the state, which is crucial for processing the exemption form.

- Voter Registration: Used as proof of the state of legal residence, this document can help establish where the service member considers their permanent home to be.

- State Identification Card or Driver's License: Issued by the state of legal residence, these IDs serve as straightforward evidence of where the individual claims residency.

- Vehicle Registration: Similar to a state ID or driver's license, vehicle registration helps establish state residency by showing where the car is officially registered.

- Lease Agreement or Mortgage Documents: These are used to demonstrate the presence or absence of a place of abode within or outside the state of legal residence, which is relevant under the exemption conditions.

- Record of Rental Payments: For individuals renting a residence outside their state of legal residence, this provides proof of maintaining a domicile in another state for the entire taxable year.

In summary, when filing the State Income Tax Exemption form, it's imperative to have all your documentation in order. These additional documents not only support your claim for exemption but also ensure that your application is processed without delays or complications. By accurately demonstrating your situation through these forms and records, you can substantiate your eligibility for state income tax exemption under military service conditions.

Similar forms

The Federal Tax Withholding Form (W-4) is akin to the State Income Tax Exemption form in several key aspects. Both forms serve the primary purpose of instructing employers on the amount of taxes to withhold from an employee's paycheck, with the State form focusing on state income taxes and the W-4 on federal income taxes. Individuals provide personal information, including their social security number, to ensure accurate tax withholding. Disclosure on both forms is voluntary but necessary for those wishing to adjust their withholdings to suit their financial or personal situations.

Another document closely related to the State Income Tax Exemption form is the Voter Registration form. Although used for different purposes, both require personal identification details such as name and address, and they often necessitate proof of residency within a particular state or legal jurisdiction. These forms play crucial roles in civic duties and financial responsibilities, ensuring individuals are properly identified and accounted for in governmental systems.

The State Homestead Exemption Application also shares similarities with the State Income Tax Exemption form. Both are centered around state-specific regulations that can lead to financial relief for the applicant. While the homestead exemption can reduce property tax burdens by considering a portion of a home's value as non-taxable, the State Income Tax Exemption form focuses on reducing or eliminating the requirement for state income tax withholding based on certain criteria met by the filer.

The Change of Address Form (USPS Form 3575), while primarily for notifying the postal service of an address change, intersects with the State Income Tax Exemption form in its reliance on accurate personal and residency information. Updating address information ensures proper mail delivery and maintains the accuracy of records for state tax purposes, especially for individuals claiming tax exemption based on their residency status.

The Driver's License Application form, required for obtaining or renewing a driver's license in one's state of residence, parallels the State Income Tax Exemption form by necessitating proof of identity, residency, and legal status. Both forms are integral to validating an individual's eligibility for certain state-specific rights and privileges—driving in one case, and potential tax exemptions in the other.

The Non-Resident Tuition Exemption Request forms that many state colleges and universities use are conceptually similar to the State Income Tax Exemption form. These documents determine whether students qualify for lower tuition rates based on residency criteria. Like the tax exemption form, students must often provide evidence of their residency status, intent to maintain or change residency, and personal identification information to qualify for the benefit.

Finally, the Application for Absentee Ballot shares functionality with the State Income Tax Exemption form by requiring voters to declare their state of legal residence and personal identification details. This ensures that individuals vote in the correct jurisdiction and under the appropriate legal stipulations, much like how tax exemption forms ensure taxes are correctly withheld or not withheld based on state laws.

Dos and Don'ts

When navigating the process of filling out a State Income Tax Exemption form, it's crucial to proceed with care and attention to detail. To help guide you through this task, here are four essential dos and don'ts to keep in mind:

- Do carefully review the instructions provided on the form. Understanding the specific requirements and conditions set forth can significantly impact your eligibility for exemption.

- Do consult a legal assistance officer if you find any part of the form or its instructions unclear, especially regarding the maintenance of an abode outside your state of legal residence.

- Do disclose your Social Security Number (SSN) on the form. While the disclosure of your SSN is noted as voluntary, failing to provide it can result in the incorrect processing of your exemption status.

- Do notify the finance officer immediately if there are any changes in your circumstances that could affect your withholding status. Keeping your information up-to-date ensures that your tax exemption status is accurately maintained.

- Don't neglect to specify your State of Legal Residence accurately. Remember, this form is not intended to change your state of legal residence, but to affirm your tax exemption status based on it.

- Don't overlook the requirement to maintain a place of abode outside your state of legal residence throughout the taxable year. Failing to meet this condition can disqualify you from exemption.

- Don't fill out the form without confirming if your state of residence is among those specified (New Jersey, New York, and Oregon), as the exemption test is currently applicable only to these states.

- Don't hesitate to reach out to your state taxing authority if you're unsure about the state law provisions for exemption. Direct communication can provide clarity and prevent potential errors in your application.

The process of applying for a State Income Tax Exemption is pivotal for those who qualify, potentially offering significant savings. Ensuring that you accurately complete and submit this form not only helps in achieving compliance with tax laws but also in securing your financial wellbeing. As always, if there's uncertainty or need for clarification, seeking professional guidance is a wise decision.

Misconceptions

There are several misconceptions regarding the State Income Tax Exemption form that often lead to confusion among those looking to understand or potentially benefit from it. Addressing these misunderstandings is crucial for ensuring accurate compliance and making informed decisions related to state income tax obligations.

Misconception 1: Filing the form automatically exempts you from state income tax. In reality, eligibility for exemption depends on meeting specific conditions outlined in the form, such as not maintaining a place of abode in your state of legal residence and spending no more than 30 days in that state during the tax year.

Misconception 2: Disclosure of your Social Security Number (SSN) on the form is optional. While the form indicates that disclosure of SSN is voluntary, it clarifies that without it, the exemption certificate will not be processed due to the risk of erroneous application of withholding exemptions.

Misconception 3: The form can be used to change your state of legal residence. This document is specifically not for changing one’s state of legal residence but rather for certifying eligibility for state income tax withholding exemption under certain conditions.

Misconception 4: Any type of housing qualifies as a place of abode outside the state of legal residence. The form explicitly excludes certain types of housing, such as barracks or bachelor officer quarters at a permanent duty station, from being considered a place of abode for the purposes of this exemption.

Misconception 5: If you qualify and file the form, the exemption from state income tax withholding is retroactive. The withholding of state income tax stops the month after the certificate is filed, and no retroactive adjustments will be made.

Misconception 6: The exemption applies as soon as the form is submitted. The effect takes place the month following the filing of the form, not immediately upon submission.

Misconception 7: All military members stationed outside their state of legal residence qualify. Members must fulfill all the specified conditions to qualify for the exemption; simply being stationed outside the state does not automatically exempt one from state income tax withholding.

Misconception 8: The form applies to all states. It is currently applicable only to the states of New Jersey, New York, and Oregon, and residents of other states should consult their own state's tax regulations.

Understanding these misconceptions is vital for service members and their families to navigate the complexities of state income tax exemption accurately. It is always recommended to seek advice from a legal assistance officer or tax professional when there are uncertainties regarding state income tax obligations.

Key takeaways

Filing out the State Income Tax Exemption form is an important process for service members wishing to adjust their state income tax withholdings. Here are key takeaways to guide individuals through the completion and use of this form:

- Authority and Purpose: The form is authorized by 5 USC 5516, 5517, and Executive Order 9397, primarily for the purpose of ceasing state income tax withholdings for eligible service members.

- Voluntary Disclosure: Providing information on this form, including the Social Security Number (SSN), is voluntary but necessary for accurate processing and to avoid withholding errors.

- Identification: The SSN is crucial for positive identification and to prevent misapplication of withholding exemptions to incorrect accounts.

- State Residency: This form is applicable to residents of New Jersey, New York, and Oregon serving in the military and assigned duty outside their state of legal residence.

- Residency Conditions: To qualify for exemption, service members must not maintain an abode in their state of legal residence, must maintain an abode outside that state for the entire tax year, and spend no more than 30 days in their state of legal residence during the tax year.

- Definition of Abode: Temporary duty locations or specialized training schools are not considered a place of abode. Similarly, quarters provided by the military are not considered a place of abode for the purpose of this exemption.

- Family Consideration: If a service member's spouse and family continue to reside in the state of legal residence, that is considered as maintaining an abode in the state, impacting eligibility for exemption.

- No Retroactive Adjustments: It is important to note that withholding adjustments take effect the month following the filing of the certificate, with no retroactive changes to withholdings made.

- Consultation Advised: Those unsure of their exemption status, particularly with regard to maintaining an abode outside their state of legal residence, are advised to consult with a legal assistance officer.

- Immediate Notification Responsibility: Service members are responsible for promptly notifying their finance officer of any changes affecting their withholding status.

Understanding these key points ensures that service members can accurately complete the State Income Tax Exemption form, potentially reducing their tax liabilities responsibly and in compliance with legal provisions.

Popular PDF Documents

Ptax 401 - If a portion of the facility was retired or removed from use, relevant costs and dates must be identified in the PTAX-401.

Irs 10k Lutzdecrypt - Even casinos and gaming establishments, which often deal in large cash transactions, are subject to the reporting requirements of Form 8300.