Get Sss Payment Return Form

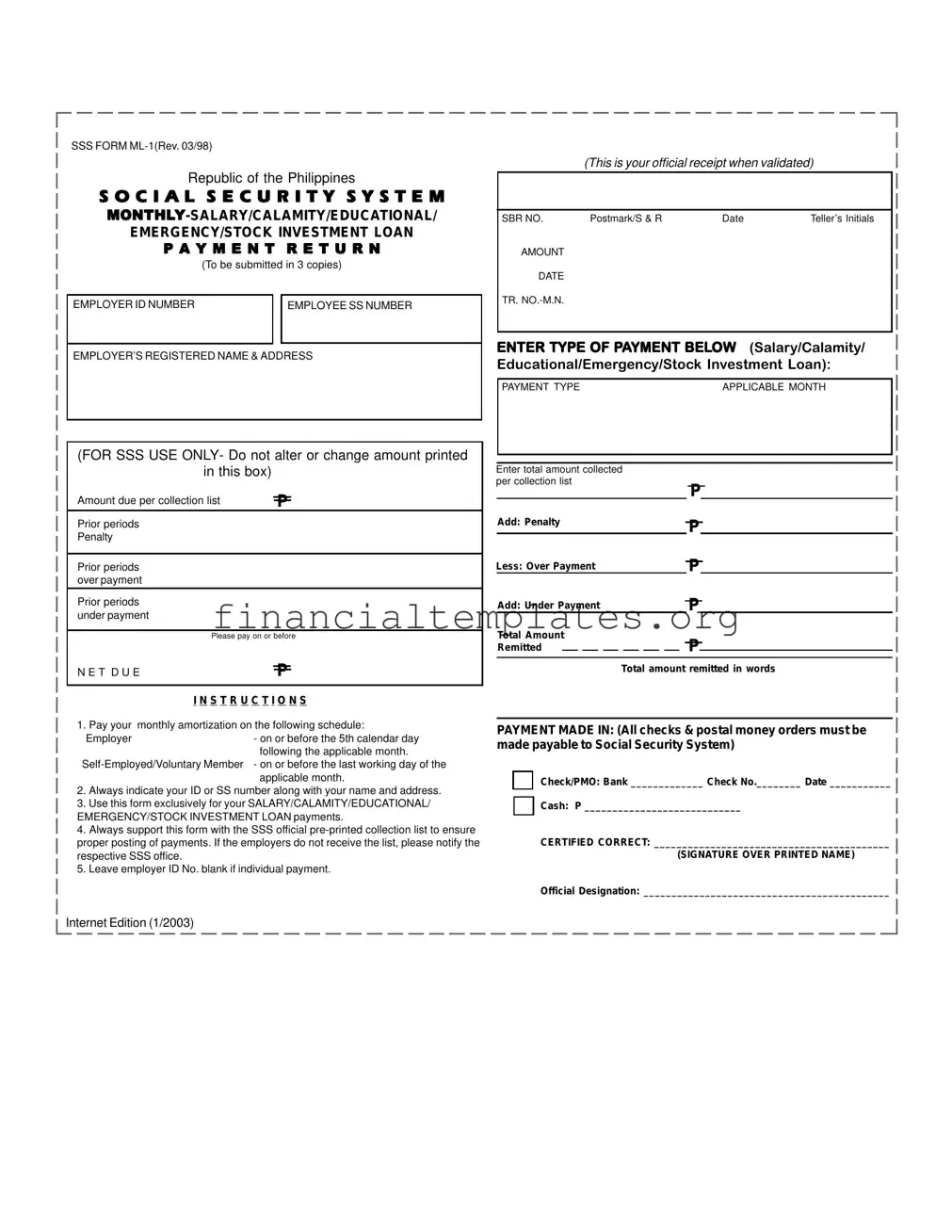

Navigating through government forms can often be a daunting task, especially when it comes to financial matters. The Social Security System in the Philippines offers various forms that are crucial for the smooth operation of its services, among which the SSS Payment Return form, designated as form ML-1, plays a pivotal role. This form is used by employers and individuals alike for the remittance of monthly amortizations on loans such as salary, calamity, educational, emergency, and stock investment loans. It requires submission in triplicate and details such as the employer's ID number, employee’s SS number, and the employer’s registered name and address are mandatory. Notably, the form also includes a section for the calculation of the payment amount, taking into account previous periods' overpayments or underpayments and penalties. It offers clear instructions on the payment schedule and emphasizes the importance of including identification numbers to ensure accurate processing. Moreover, it specifies the use of the SSS official pre-printed collection list to support the form for proper posting of payments. Payments can be made via check, postal money order, or cash, and the form must be completed with the payer's signature and official designation, highlighting its function as an official receipt upon validation. Understanding the SSS Payment Return form is essential for timely and correct loan payment remittances to the Social Security System, ensuring compliance and avoiding potential penalties.

Sss Payment Return Example

SSS FORM

Republic of the Philippines

S O C I A L S E C U R I T Y S Y S T E M

EMERGENCY/STOCK INVESTMENT LOAN

P A Y M E N T R E T U R N

(To be submitted in 3 copies)

EMPLOYER ID NUMBER |

|

EMPLOYEE SS NUMBER |

|

|

|

EMPLOYER’S REGISTERED NAME & ADDRESS

(FOR SSS USE ONLY- Do not alter or change amount printed in this box)

Amount due per collection list |

P |

Prior periods

Penalty

Prior periods over payment

Prior periods under payment

Please pay on or before

N E T D U EP

I N S T R U C T I O N S

(This is your official receipt when validated)

SBR NO. |

Postmark/S & R |

Date |

Teller’s Initials |

AMOUNT

DATE

TR.

ENTER TYPE OF PAYMENT BELOW (Salary/Calamity/

Educational/Emergency/Stock Investment Loan):

PAYMENT TYPE |

APPLICABLE MONTH |

Enter total amount collected |

|

|

|||||||||||||

per collection list |

P |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Add: Penalty |

|

|

|||||||||||||

P |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: Over Payment |

P |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add: Under Payment |

P |

|

|||||||||||||

Total Amount |

P |

|

|||||||||||||

Remitted |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||||||||

Total amount remitted in words

1. Pay your |

monthly amortization on the following schedule: |

|

Employer |

|

- on or before the 5th calendar day |

|

|

following the applicable month. |

- on or before the last working day of the |

||

|

|

applicable month. |

2.Always indicate your ID or SS number along with your name and address.

3.Use this form exclusively for your SALARY/CALAMITY/EDUCATIONAL/ EMERGENCY/STOCK INVESTMENT LOAN payments.

4.Always support this form with the SSS official

5.Leave employer ID No. blank if individual payment.

Internet Edition (1/2003)

PAYMENT MADE IN: (All checks & postal money orders must be made payable to Social Security System)

Check/PMO: Bank _____________ Check No.________ Date ___________

Cash: P ____________________________

CERTIFIED CORRECT: __________________________________________

(SIGNATURE OVER PRINTED NAME)

Official Designation: ____________________________________________

Document Specifics

| Fact Name | Description |

|---|---|

| Form Identification | SSS FORM ML-1 (Rev. 03/98) |

| Country of Origin | Republic of the Philippines |

| Form Purpose | For the payment of Monthly-Salary, Calamity, Educational, Emergency, and Stock Investment Loans |

| Submission Requirement | To be submitted in three copies |

| Payment Instructions for Employers | Employer payments due on or before the 5th calendar day following the applicable month |

| Payment Instructions for Self-Employed/Voluntary Members | Payments due on or before the last working day of the applicable month |

| Identification Necessity | Required to always indicate ID or SS number, along with name and address on the form |

| Supporting Document | Must be supported with SSS official pre-printed collection list for proper posting of payments |

| Payment Method | All checks and postal money orders must be made payable to Social Security System |

Guide to Writing Sss Payment Return

Filling out the SSS Payment Return form is an essential process for ensuring that loan payments, whether they are for salary, calamity, educational, emergency, or stock investment, are correctly recorded and processed by the Social Security System (SSS). This procedure aids in maintaining the accuracy of member records and the timely application of payments to the appropriate accounts. It's important to follow these steps methodically to ensure that your submission is complete and free of errors.

- Locate your Employer ID Number and Employee SS Number. These are crucial for accurately associating your payment with the correct accounts.

- Fill in the Employer’s Registered Name & Address section clearly and accurately. This information should match the details the SSS has on file.

- Observe the Amount due per collection list and other related fields such as Prior periods (Penalty, Over payment, Under payment). Do not fill these in as they are for SSS use only.

- Determine the correct Type of Payment (Salary/Calamity/Educational/Emergency/Stock Investment Loan) and the Applicable Month for which you are making the payment. Enter these details in the designated spaces.

- Calculate your payment amount. Start with the total amount collected per collection list. Then, add any penalty amounts, subtract any overpayments, add underpayments, and write down the Total Amount Remitted.

- Write the Total amount remitted in words to ensure there are no discrepancies between the numerical figure and the amount in words. This prevents processing errors.

- Select your Payment Made In method, noting whether it's via Check/PMO or Cash, along with the relevant details (Bank, Check No., Date, or Cash Amount).

- Sign your name under the CERTIFIED CORRECT section, print your name and indicate your Official Designation to validate the form.

Once you've completed these steps, you are ready to submit the form in accordance with the instructions provided by the Social Security System. This includes making copies and ensuring it reaches the SSS office in a timely manner, whether by mail or in person, depending on their submission guidelines. Following this detailed guide will assist in a smooth transaction, minimizing potential delays or complications with your loan payments.

Understanding Sss Payment Return

Frequently Asked Questions about the SSS Payment Return Form

- What is the SSS Payment Return Form?

The SSS Payment Return Form, identified as SSS FORM ML-1, is a document used by the Social Security System (SSS) in the Philippines. It is designed for the monthly payment of various loans such as Salary, Calamity, Educational, Emergency, and Stock Investment Loans. This form ensures that these payments are recorded and processed accurately. It is required to be submitted in three copies and serves as an official receipt when validated.

- Who needs to submit the SSS Payment Return Form?

Both employers and self-employed or voluntary members of the SSS are required to submit this form. Employers use it to report and remit loan repayments on behalf of their employees. Self-employed and voluntary members, on the other hand, must use this form to individually remit their loan repayments to the SSS.

- When is the SSS Payment Return Form due?

The submission deadlines for the SSS Payment Return Form vary based on the type of contributor. Employers are required to submit the form on or before the 5th calendar day following the applicable month. Self-Employed and Voluntary Members have until the last working day of the applicable month to submit their forms. Adhering to these deadlines helps avoid potential penalties for late payments.

- What important details must be included in the SSS Payment Return Form?

- Employer ID Number and Employee SS Number (for employer submissions).

- Employer’s registered name & address or individual member information.

- The type of loan payment (Salary, Calamity, Educational, Emergency, Stock Investment Loan).

- The applicable month for the payment.

- Total amount collected, including penalties, overpayments, or underpayments, if any.

It’s crucial to ensure that all sections of the form are completed accurately to prevent issues with loan repayment records.

- How can I ensure my payment is properly processed?

To ensure proper processing of your payment, always use this specific form for your SALARY/CALAMITY/EDUCATIONAL/EMERGENCY/STOCK INVESTMENT LOAN payments. Attach the SSS official pre-printed collection list to support this form. If you are an employer and do not receive the collection list, immediately notify the respective SSS office. Additionally, verify that all payments made by check or postal money order are payable to the Social Security System. Ensuring these steps can help prevent payment discrepancies and ensure your liabilities are accurately recorded.

Common mistakes

Filling out the SSS Payment Return form correctly is vital for ensuring that your payments are processed smoothly and accurately. However, there are common mistakes that many individuals make when completing this form. Recognizing and avoiding these errors can save time and prevent delays.

Not double-checking the Employer ID and Employee SS number: These identifiers are crucial for the proper allocation of your contributions. An incorrect number can lead to misposted payments or even the loss of contributions.

Omitting the Employer’s Registered Name & Address: This information helps to further ensure that payments are correctly applied, especially for employers managing multiple accounts.

Altering the pre-printed amounts: The section marked "For SSS use only" should not be changed by the filer. Alterations can cause discrepancies in your payment records.

Incorrectly entering the type of payment: Clearly indicating whether the payment is for a Salary, Calamity, Educational, Emergency, or Stock Investment Loan avoids confusion and ensures that funds go towards the proper account.

Failing to provide the total amount collected and the remitted amount in words: Both figures help in cross-verifying the sum you intend to pay, reducing the risk of underpayment or overpayment.

Missing the payment deadline: Payments made after the deadlines incur penalties which increase the total amount due. This mistake is common and unnecessarily costly.

Forgetting to sign and designate officially: An unsigned form or one without the official designation may be considered invalid, delaying the processing of your payment.

To avoid these errors, always review your completed SSS Payment Return form before submission. Ensure that:

- All required fields are filled accurately.

- Information is provided as instructed in the form.

- Supporting documents, if needed, are attached and correctly filled out.

Correct and careful form submission ensures that your payments are processed efficiently, keeping your contributions up-to-date and maintaining your eligibility for SSS benefits.

Documents used along the form

When preparing and submitting the SSS Payment Return form, it's crucial to understand that several other forms and documents often accompany this form to ensure comprehensive compliance and accurate record-keeping. These documents help in streamlining the process and ensuring that all necessary information is correctly captured and reported to the Social Security System (SSS). Below is a list of documents that are commonly used alongside the SSS Payment Return form.

- SSS Employment Report (Form R-1): This form is used by employers to report newly hired employees to the SSS. It ensures that all employees are properly documented and eligible for social security benefits.

- SSS Contribution Collection List (Form R-3): Accompanies the Payment Return form to detail the monthly contributions of each employee, ensuring accurate recording and posting of payments.

- SSS Loan Payment Form (Form ML-2): This is used specifically for the payment of loans taken by an employee from the SSS. It details the repayment amount, including any interest and penalties, if applicable.

- SSS Specimen Signature Card (Form L-501): Employers use this form to register authorized company representatives' signatures, facilitating the verification process for SSS transactions.

- SSS Maternity Notification Form: Required for female employees applying for maternity leave benefits. It notifies the SSS of an impending birth or miscarriage.

- SSS Sickness Notification Form: Used to notify the SSS of an employee's illness or injury that will lead to temporary inability to work and to claim sickness benefits.

- Annual Confirmation of Pensioners’ Form (ACOP): For retirees and pensioners, this form is used to confirm their current status with the SSS, ensuring continued receipt of benefits.

Together with the SSS Payment Return form, these documents form a comprehensive suite that employers need to manage and fulfill their obligations towards their employees' social security contributions and benefits. Proper completion and timely submission of these forms not only comply with regulatory requirements but also ensure that employees are adequately protected and can avail themselves of the benefits they are entitled to under the Social Security System.

Similar forms

The IRS Form 941, Employer's Quarterly Federal Tax Return, shares similarities with the SSS Payment Return form in that it is used by employers to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks. Just as the SSS Payment Return form requires details such as employer ID and amount due including adjustments for previous periods, Form 941 similarly asks for an employer’s identification number and details about the tax owed for the quarter, adjustments from prior periods, and calculates the total tax due or refundable.

The Employment Development Department (EDD) Form DE 9, Quarterly Contribution Return and Report of Wages, is another document akin to the SSS Payment Return form. It serves employers in reporting wages paid to employees and unemployment insurance taxes in certain states. Like the SSS form which is designed to ensure proper posting of loan payment contributions, the DE 9 form is crucial for accurate recording of employees' wages and contributions to state unemployment insurance funds, with specific fields for reporting adjustments and total amounts due for the period.

The Wage and Tax Statement, or Form W-2, similarly necessitates detailed reporting from employers about salaries paid and taxes withheld, akin to the SSS Payment Return form’s requirement to detail loan payments. Though the W-2 primarily focuses on annual reporting to employees for their income tax return filings, both forms emphasize accuracy in the details of payments made, whether for income or loan repayments, and require employer identification numbers and precise calculations of amounts due.

The Federal Unemployment Tax Act (FUTA) Tax Return, Form 940, also parallels the SSS Payment Return form in its objective to collate payments due for a specific period, albeit for unemployment taxes. Employers use Form 940 to report annual federal unemployment taxes, detailing previous adjustments and total due, similar to the process of reporting and adjusting for salary, calamity, educational, emergency, or stock investment loan payments in the SSS Payment Return form.

The Form 1099-MISC, Miscellaneous Income, shares a conceptual resemblance with the SSS Payment Return in the context of reporting specific types of payments. Although 1099-MISC is used by payers to report payments made in the course of a trade or business to others (not employees), it underscores the importance of accurate reporting and payment reconciliation, similar to the need for precise data input on the SSS Payment Return form for various loan repayments.

Dos and Don'ts

When completing the SSS Payment Return form, it's important to pay attention to both what you should and shouldn't do to ensure the process is smooth and error-free. Here are some guidelines to follow:

Things You Should Do:

Ensure that you pay your monthly amortization based on the specified schedule. Employers are required to make payments on or before the 5th calendar day following the applicable month, while Self-Employed and Voluntary Members should do so on or before the last working day of the month.

Always include your ID or SS number, along with your name and address, on the form to facilitate easy identification and avoid processing delays.

Use this form exclusively for the payment types it is designed for, namely SALARY, CALAMITY, EDUCATIONAL, EMERGENCY, and STOCK INVESTMENT LOAN payments.

Support your payment with the SSS official pre-printed collection list to ensure your payments are properly posted. If you have not received this list, you should notify the SSS office immediately.

Things You Shouldn't Do:

Don't make any alterations or changes in the box marked "FOR SSS USE ONLY." This area contains critical amounts that are pre-calculated and should remain unmodified.

Avoid leaving the employer ID No. field filled if you're making individual payments. This field should only be completed when the employer is making payments on behalf of their employees.

Do not use checks and postal money orders made payable to any party other than the Social Security System. Incorrectly addressed payments may not be processed, leading to potential delays or penalties.

Never sign the form without ensuring that all the information provided is accurate and complete. The signature over your printed name certifies that the details on the form are correct.

Misconceptions

Many people often misunderstand the various aspects of the Social Security System's (SSS) Payment Return form, specifically the ML-1 form used in the Philippines for various loan repayments. Here are six common misconceptions and the truths behind them:

- It's only for employers. While the form is mainly used by employers to remit contributions for salary, calamity, educational, emergency, and stock investment loans, self-employed and voluntary members also use it for their respective loan payments. The form caters to a broader audience than just employers.

- You can alter the amount due in the "For SSS Use Only" box. The information and amount specified in the "For SSS Use Only" box should never be altered or changed by the payer. This box contains crucial information that ensures the accurate processing of payments.

- Payment deadlines are the same for everyone. Payment deadlines vary depending on the payer's status. Employers must remit payments on or before the 5th calendar day following the applicable month, while self-employed and voluntary members have until the last working day of the applicable month.

- The ML-1 form can be used for any type of payment to the SSS. This specific form is designed exclusively for the payment of salary, calamity, educational, emergency, and stock investment loans. Other types of payments to the SSS require different forms and procedures.

- Supporting documents are not necessary if the form is filled correctly. Even if the ML-1 form is filled out correctly, it must always be supported with the official pre-printed collection list from SSS. This ensures that payments are properly posted and accounted for by the system.

- Leaving the employer ID number blank signifies an individual payment. For self-employed and voluntary members making individual payments, while it's true that the employer ID number section should be left blank, it's essential to include their SS number, name, and address to ensure that the payment is properly credited to their account.

Understanding these nuances can help individuals and employers navigate the complexities of loan repayment to the SSS more effectively, ensuring that payments are processed smoothly and without error.

Key takeaways

- It is crucial to adhere to the payment schedule specified in the form, with employers being required to pay on or before the 5th day following the applicable month, and self-employed or voluntary members needing to make their payments on or before the last working day of the month.

- Every payment transaction should include your identification or Social Security (SS) number along with your full name and address, to ensure accurate posting to your account.

- This form, identified as SSS Form ML-1, is dedicated solely to the payment of loans such as Salary, Calamity, Educational, Emergency, and Stock Investment Loans, ensuring specificity in the type of transactions being processed.

- The importance of supporting the SSS Payment Return form with the official pre-printed collection list provided by SSS cannot be overstressed, as it serves as a crucial document for correct payment posting. Employers who do not receive this list must inform their respective SSS office immediately.

- When submitting individual payments, the employer ID number should be left blank to signify that the payment is not being made by an employer but rather by an individual such as a self-employed or voluntary member.

Popular PDF Documents

Schedule M-3 1120 Instructions - Filing the M-3 is a step towards greater financial accountability and transparency in the corporate taxation process.

IRS 8960 - The 8960 form is a critical document for high-income earners subject to the 3.8% Net Investment Income Tax (NIIT).