Get Sss Loan Application Form

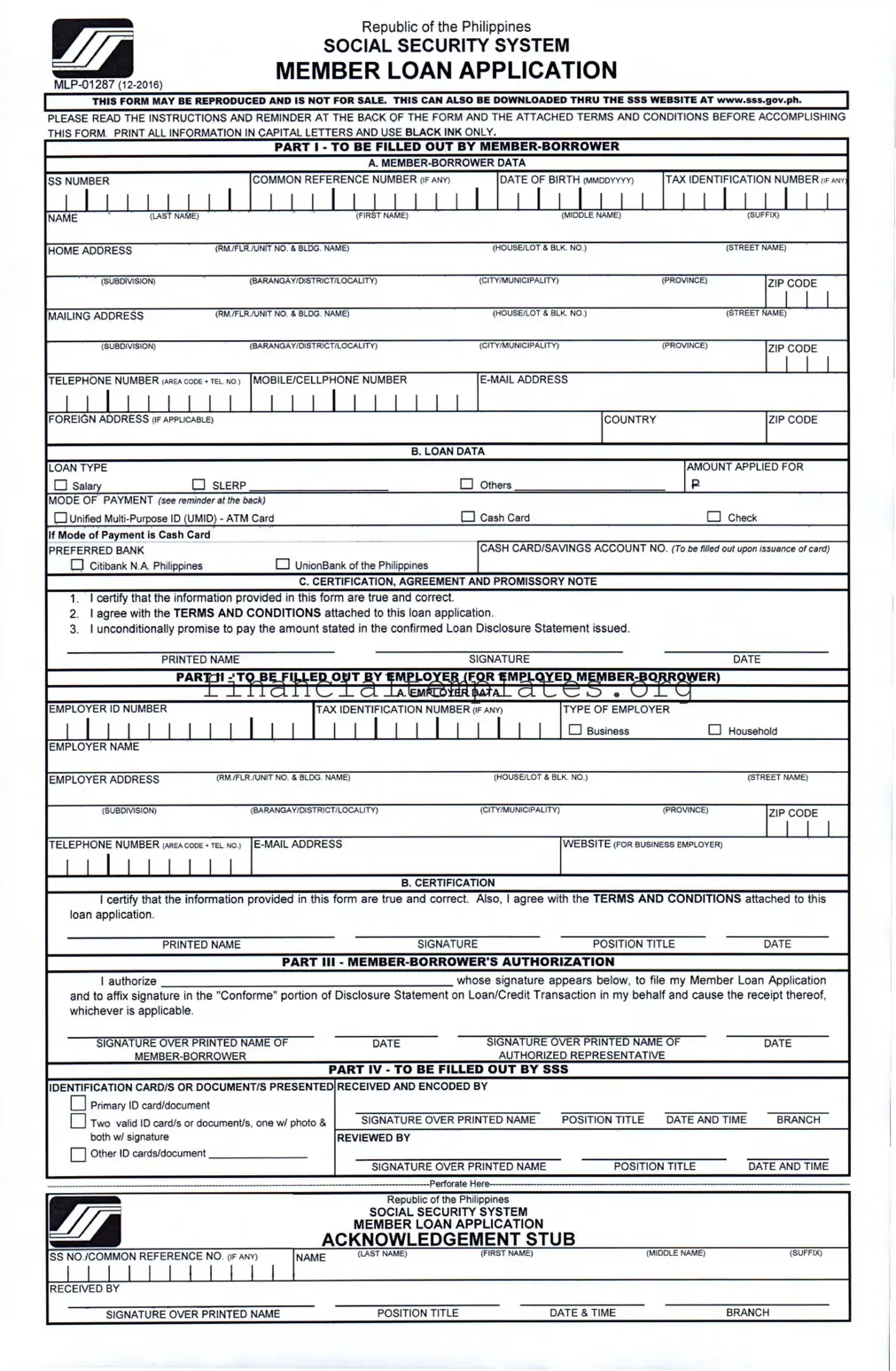

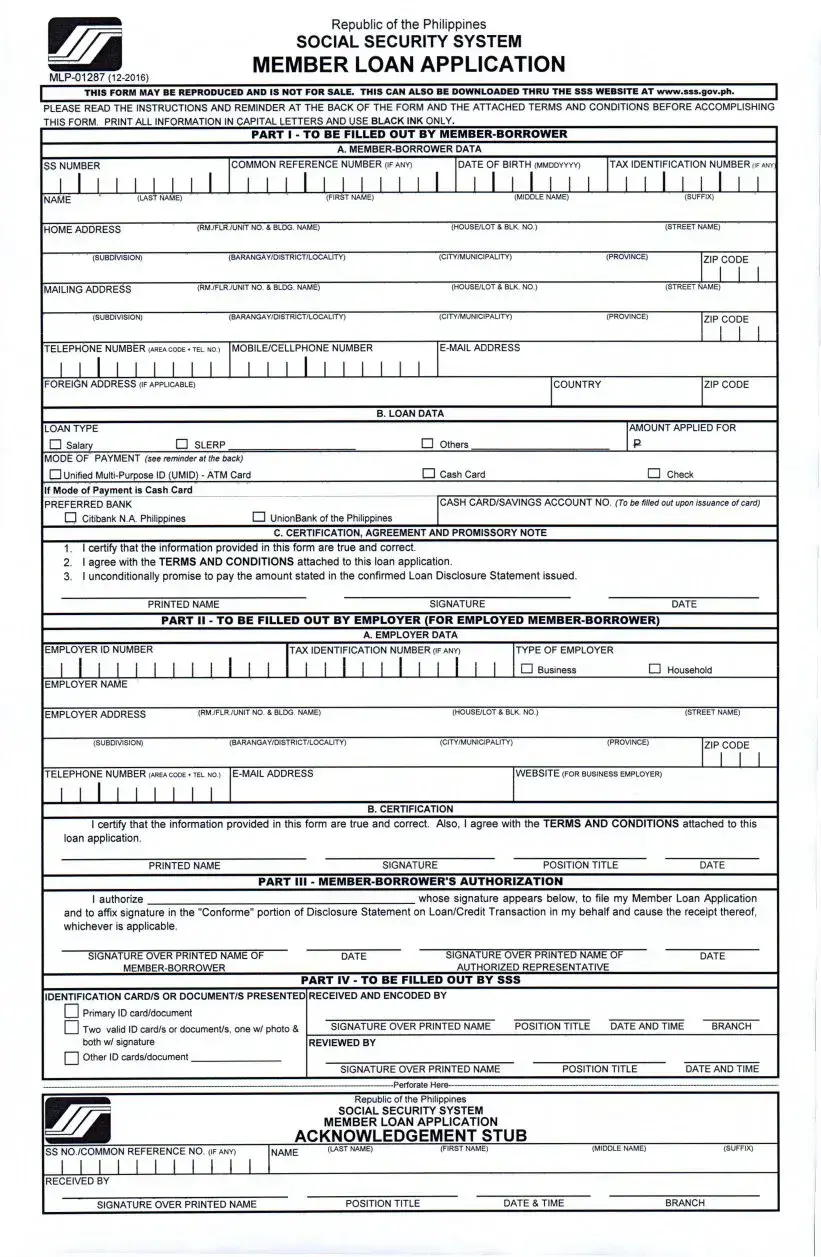

Navigating through the process of securing a loan from the Social Security System (SSS) in the Philippines involves a meticulous examination of the Member Loan Application form, MLP-01287 (12-2016). Designed for members to access financial assistance in times of need, the form encompasses vital sections ranging from personal data to loan specifics, alongside certifications and terms of agreement. Instructions are clear on the necessity for current, precise information filled out in black ink and capital letters, reflecting the importance of transparency and accuracy. Equally, the form sets forth options for loan repayment and underscores eligibility criteria for applicants, ensuring members understand their commitments. Notably, the emphasis on the truthfulness of supplied data underpins the legal and ethical foundations of the loan process. Clear guidance on the documentation required, both from the borrower and the employer, including identification and employment status, is provided, streamlining the process. Furthermore, the form makes evident the consequences of false information, stressing the gravity of honesty in the application process. With provisions for renewal and repayment terms, it encapsulates a comprehensive framework for member loans, catering to employed, self-employed, and voluntary members, thereby facilitating financial support with structured oversight.

Sss Loan Application Example

Republic of the Philippines

SOCIAL SECURITY SYSTEM

MEMBER LOAN APPLICATION

| |

T |

I |

F |

B |

REPRODUCED A |

I N |

|

|

SA . |

T |

I |

|

AL |

|

E DO NL |

|

|

T |

E S |

|

E I |

|

|

. . . . |

|

| |

|||||||

|

THIS FORM MAY BE REPRODUCED AND |

IS NOTT FOR |

SALE. |

THIS |

CAN ALSO BE DOWNLOADED |

THRU THE SSS WEBSITE AT www.sss.gov.ph. |

|

|

|||||||||||||||||||||||||

PLEASE READ THE INSTRUCTIONS AND REMINDER AT THE BACK OF THE FORM AND THE ATTACHED TERMS AND CONDITIONS BEFORE ACCOMPLISHING |

|||||||||||||||||||||||||||||||||

THIS FORM. PRINT ALL INFORMATION IN CAPITAL LETTERS AND USE BLACK INK ONLY. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

PART 1 - TO BE FILLED OUT BY |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

A. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

SS NUMBER |

|

|

|

|

COMMON REFERENCE NUMBER (ifany) |

|

L |

DATE OF BIRTH (MMDDYYYY) |

|

TAX IDENTIFICATION NUMBER(ifany: |

|||||||||||||||||||||||

1 1 1 1 Mill |

I |

I |

I |

I |

I |

I |

I |

I |

I |

I |

I |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

NAME |

|

|

(LAST NAME) |

|

|

|

|

|

|

(FIRST NAME) |

|

|

|

|

|

(MIDDLE NAME) |

|

|

|

|

|

|

(SUFFIX) |

|

|

||||||||

HOME ADDRESS |

|

|

(RM./flr./unit no. & bldg, name) |

|

|

|

|

|

|

|

(house/lot & blk. no.) |

|

|

|

|

|

(street name) |

|

|

||||||||||||||

|

|

(SUBDIVISION) |

|

|

(BARANGAY/DISTRICT/LOCALITY) |

|

|

|

|

|

(CITY/MUNICIPALITY) |

|

|

|

|

|

(PROVINCE) |

|

|

|

ZIP CODE |

|

|||||||||||

MAILING ADDRESS |

|

|

(RM./flr./unit no. & bldg, name) |

|

|

|

|

|

|

|

(house/lot & blk. no.) |

|

|

|

|

|

(street name) |

|

|

||||||||||||||

|

|

(SUBDIVISION) |

|

|

(BARANGAY/DISTRICT/LOCALITY) |

|

|

|

|

|

(CITY/MUNICIPALITY) |

|

|

|

|

|

(PROVINCE) |

|

|

|

ZIP CODE |

|

|||||||||||

TELEPHONE NUMBER (area code + tel. no.) |

MOBILE/CELLPHONE NUMBER |

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

1 |

1 |

1 |

1 |

1 1 1 |

1 |

1 |

I |

I |

I |

I |

I |

I |

I |

I |

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOREIGN ADDRESS (IF applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COUNTRY |

|

|

|

|

|

ZIP CODE |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. LOAN DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

LOAN TYPE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMOUNT APPLIED FOR |

|

|

||||||

|

Salary |

|

|

|

|

SLERP |

|

|

|

|

|

|

|

|

|

|

|

Others |

|

|

|

|

|

|

|

R |

|

|

|

|

|

|

|

MODE OF PAYMENT (see reminder at the back) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Unified |

|

|

|

|

|

|

|

|

|

O Cash Card |

|

|

|

|

|

|

|

O Check |

|

|

|

|||||||||||

If Mode of Payment is Cash Card |

|

|

|

|

|

|

|

|

|

|

|

|

CASH CARD/SAVINGS ACCOUNT NO. (To be filled out upon issuance of card) |

||||||||||||||||||||

PREFERRED BANK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Citibank N.A. Philippines |

|

|

O UnionBank of the Philippines |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

C. CERTIFICATION, AGREEMENT AND PROMISSORY NOTE

1.I certify that the information provided in this form are true and correct.

2.I agree with the TERMS AND CONDITIONS attached to this loan application.

3.I unconditionally promise to pay the amount stated in the confirmed Loan Disclosure Statement issued.

PRINTED NAMESIGNATUREDATE

PART II - TO BE FILLED OUT BY EMPLOYER (FOR EMPLOYED

A. EMPLOYER DATA

EMPLOYER ID NUMBER |

I I ILll |

TAX IDENTIFICATION NUMBER (if an>9 |

TYPE OF EMPLOYER |

|

|

|

||||

I I I I I I I |

I I |

I I I |

I I |

I I |

|

|

|

|

|

|

|

|

|

Lll |

Business |

|

O Household |

|

|

||

|

|

|

|

|

|

|

|

|

||

EMPLOYER NAME |

|

|

|

|

|

|

|

|

|

|

EMPLOYER ADDRESS |

(rm./flr./unit no. & bldg, name) |

|

|

(house/lot & blk. no.) |

|

(street name) |

|

|||

(SUBDIVISION) |

(BARANGAY/DISTRICT/LOCALITY) |

|

(CITY/MUNICIPALITY) |

|

(PROVINCE) |

ZIP |

CODE |

|

||

|

|

|

|

|

|

|

|

1 |

||

|

|

|

|

|

|

|

|

1 |

1 |

|

TELEPHONE NUMBER (area code ♦tel. no.) |

WEBSITE (FOR BUSINESS EMPLOYER) |

I I I I I I I I I

B. CERTIFICATION

I certify that the information provided in this form are true and correct. Also, I agree with the TERMS AND CONDITIONS attached to this loan application.

PRINTED NAME |

SIGNATURE |

POSITION TITLE |

DATE |

|

PART III - |

|

|

I authorize |

whose siqnature appears below, to file mv Member Loan Application |

||

and to affix signature in the "Conforme" portio 1 of Disclosure Statement on Loan/Credit Transaction in my behalf and cause the receipt thereof, whichever is applicable.

SIGNATURE OVER PRINTED NAME OF |

|

DATE |

SIGNATURE OVER PRINTED NAME OF |

|

DATE |

||

|

|

AUTHORIZED REPRESENTATIVE |

|

|

|||

|

|

PART IV - TO BE FILLED OUT BY SSS |

|

|

|

||

IDENTIFICATION CARD/S OR DOCUMENT/S PRESENTED RECEIVED AND ENCODED BY |

|

|

|

|

|||

ZJ Primary ID card/document |

|

|

|

|

|

|

|

H Two valid ID card/s or document/s, one w/ photo & |

SIGNATURE OVER PRINTED NAME |

POSITION TITLE |

DATE AND TIME |

BRANCH |

|||

both w/ signature |

|

REVIEWED BY |

|

|

|

|

|

2] Other ID cards/document |

|

|

|

|

|

|

|

|

|

SIGNATURE OVER PRINTED NAME |

POSITION TITLE |

|

DATE AND TIME |

||

_______________________________________________________________________________ Perforate Here- |

|

|

|

|

|||

|

|

Republic of the Philippines |

|

|

|

|

|

|

|

SOCIAL SECURITY SYSTEM |

|

|

|

|

|

|

|

MEMBER LOAN APPLICATION |

|

|

|

|

|

|

ACKNOWLEDGEMENT STUB |

|

|

|

|||

SS NO./COMMON REFERENCE NO. (if any) |

NAME |

(^ST NAME) |

(FIRST NAME) |

|

(MIDDLE NAME) |

|

(SUFFIX) |

RECEIVED BY |

|

|

|

|

|

|

|

SIGNATURE OVER PRINTED NAME |

|

POSITION TITLE |

|

DATE & TIME |

|

BRANCH |

|

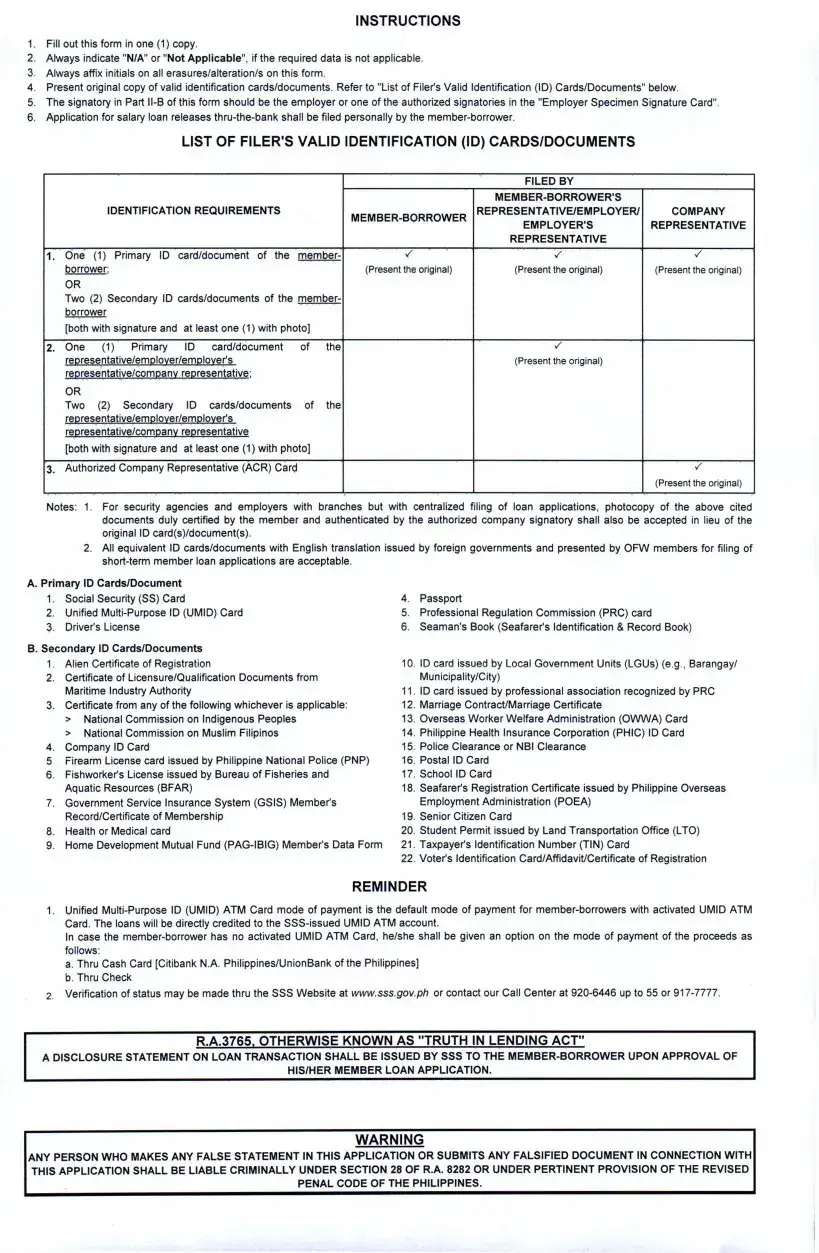

INSTRUCTIONS

1.Fill out this form in one (1) copy.

2.Always indicate "N/A" or "Not Applicable", if the required data is not applicable.

3.Always affix initials on all erasures/alteration/s on this form.

4.Present original copy of valid identification cards/documents. Refer to "List of Filer's Valid Identification (ID) Cards/Documents" below.

5.The signatory in Part

6.Application for salary loan releases

LIST OF FILER’S VALID IDENTIFICATION (ID) CARDS/DOCUMENTS

|

|

|

FILED BY |

|

|

IDENTIFICATION REQUIREMENTS |

|

|

|

|

REPRESENTATIVE/EMPLOYER/ |

COMPANY |

||

|

|

|

EMPLOYER’S |

REPRESENTATIVE |

|

|

|

REPRESENTATIVE |

|

1. |

One (1) Primary ID card/document of the member- |

Z |

Z |

Z |

|

borrower: |

(Present the original) |

(Present the original) |

(Present the original) |

|

OR |

|

|

|

|

Two (2) Secondary ID cards/documents of the member- |

|

|

|

|

borrower |

|

|

|

|

[both with signature and at least one (1) with photo] |

|

|

|

2. |

One (1) Primary ID card/document of the |

|

Z |

|

|

reoresentative/emolover/emolover's |

|

(Present the original) |

|

|

reoresentative/comoanv representative: |

|

|

|

|

OR |

|

|

|

|

Two (2) Secondary ID cards/documents of the |

|

|

|

|

representative/emplover/emplover's |

|

|

|

|

representative/companv representative |

|

|

|

|

[both with signature and at least one (1) with photo] |

|

|

|

3. |

Authorized Company Representative (ACR) Card |

|

|

Z |

|

|

|

|

(Present the original) |

Notes: 1. For security agencies and employers with branches but with centralized filing of loan applications, photocopy of the above cited documents duly certified by the member and authenticated by the authorized company signatory shall also be accepted in lieu of the original ID card(s)/document(s).

2.All equivalent ID cards/documents with English translation issued by foreign governments and presented by OFW members for filing of

A. Primary ID Cards/Document

1.Social Security (SS) Card

2.Unified

3.Driver's License

B. Secondary ID Cards/Documents

1.Alien Certificate of Registration

2.Certificate of Licensure/Qualification Documents from Maritime Industry Authority

3.Certificate from any of the following whichever is applicable:

>National Commission on Indigenous Peoples

>National Commission on Muslim Filipinos

4.Company ID Card

5 Firearm License card issued by Philippine National Police (PNP)

6.Fishworker's License issued by Bureau of Fisheries and Aquatic Resources (BFAR)

7.Government Service Insurance System (GSIS) Member's Record/Certificate of Membership

8.Health or Medical card

9.Home Development Mutual Fund

4.Passport

5.Professional Regulation Commission (PRC) card

6.Seaman's Book (Seafarer's Identification & Record Book)

10.ID card issued by Local Government Units (LGUs) (e.g., Barangay/ Municipality/City)

11.ID card issued by professional association recognized by PRC

12.Marriage Contract/Marriage Certificate

13.Overseas Worker Welfare Administration (OWWA) Card

14.Philippine Health Insurance Corporation (PHIC) ID Card

15.Police Clearance or NBI Clearance

16.Postal ID Card

17.School ID Card

18.Seafarer's Registration Certificate issued by Philippine Overseas Employment Administration (POEA)

19.Senior Citizen Card

20.Student Permit issued by Land Transportation Office (LTO)

21.Taxpayer's Identification Number (TIN) Card

22.Voter's Identification Card/Affidavit/Certificate of Registration

REMINDER

1.Unified

In case the

a.Thru Cash Card [Citibank N.A. Philippines/UnionBank of the Philippines]

b.Thru Check

2.Verification of status may be made thru the SSS Website at www.sss.gov.ph or contact our Call Center at

R.A.3765, OTHERWISE KNOWN AS "TRUTH IN LENDING ACT"

A DISCLOSURE STATEMENT ON LOAN TRANSACTION SHALL BE ISSUED BY SSS TO THE

HIS/HER MEMBER LOAN APPLICATION.

WARNING

ANY PERSON WHO MAKES ANY FALSE STATEMENT IN THIS APPLICATION OR SUBMITS ANY FALSIFIED DOCUMENT IN CONNECTION WITH THIS APPLICATION SHALL BE LIABLE CRIMINALLY UNDER SECTION 28 OF R.A. 8282 OR UNDER PERTINENT PROVISION OF THE REVISED PENAL CODE OF THE PHILIPPINES.

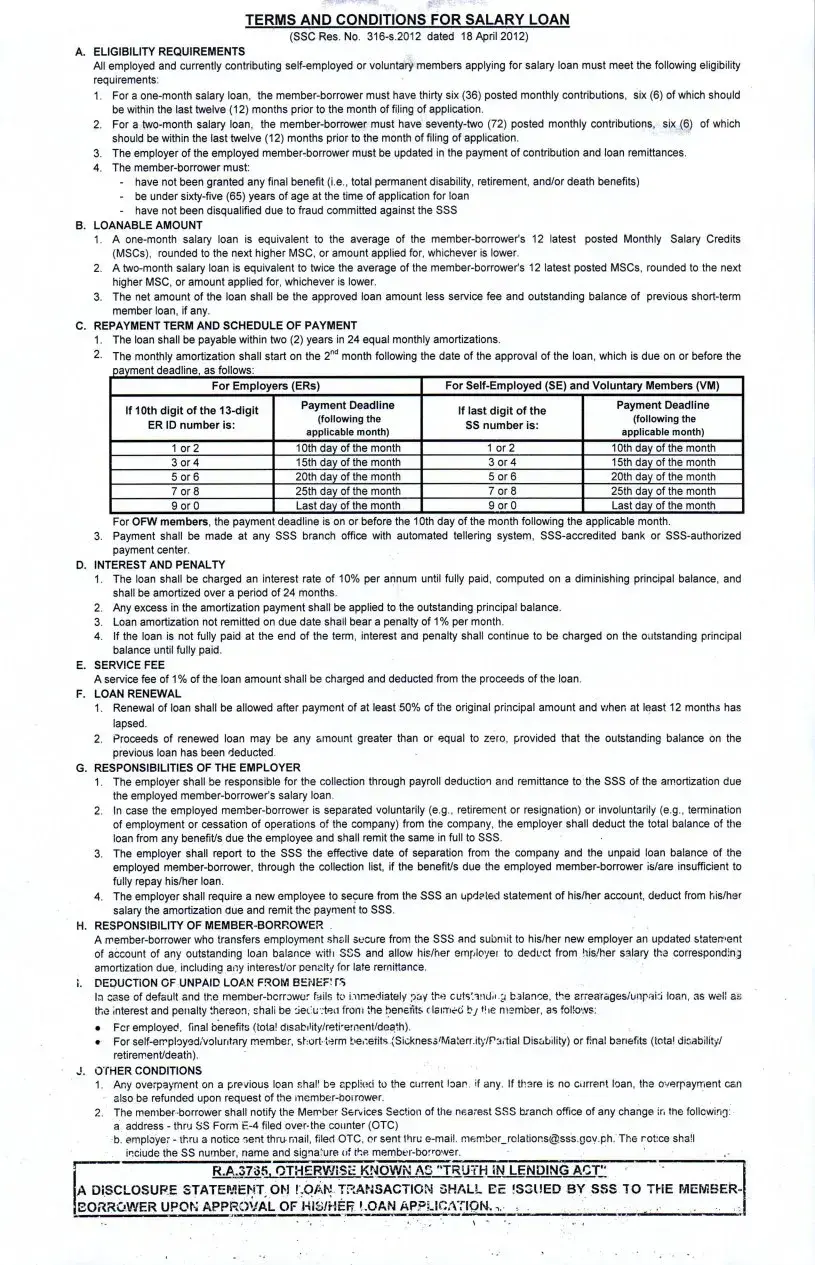

TERMS AND CONDITIONS FOR SALARY LOAN

(SSCRes. No.

A.ELIGIBILITY REQUIREMENTS

All employed and currently contributing

1.For a

2.For a

3.The employer of the employed

4.The

-have not been granted any final benefit (i.e., total permanent disability, retirement, and/or death benefits)

-be under

-have not been disqualified due to fraud committed against the SSS

B.LOANABLE AMOUNT

1.A

2.A

3.The net amount of the loan shall be the approved loan amount less service fee and outstanding balance of previous

C.REPAYMENT TERM AND SCHEDULE OF PAYMENT

1.The loan shall be payable within two (2) years in 24 equal monthly amortizations.

2.The monthly amortization shall start on the 2nd month following the date of the approval of the loan, which is due on or before the payment deadline, as follows:

|

For Employers (ERs) |

For |

||

|

If 10th digit of the |

Payment Deadline |

If last digit of the |

Payment Deadline |

|

(following the |

(following the |

||

|

ER ID number is: |

SS number is: |

||

|

applicable month) |

applicable month) |

||

|

|

|

||

|

1 or 2 |

10th day of the month |

1 or 2 |

10th day of the month |

|

3 or 4 |

15th day of the month |

3 or 4 |

15th day of the month |

: |

5 or 6 |

20th day of the month |

5 or 6 |

20th day of the month |

|

7 or 8 |

25th day of the month |

7 or 8 |

25th day of the month |

|

9 or 0 |

Last day of the month |

9 or 0 |

Last day of the month |

For OFW members, the payment deadline is on or before the 10th day of the month following the applicable month.

3.Payment shall be made at any SSS branch office with automated tellering system,

D.INTERESTAND PENALTY

1.The loan shall be charged an interest rate of 10% per annum until fully paid, computed on a diminishing principal balance, and shall be amortized over a period of 24 months.

2.Any excess in the amortization payment shall be applied to the outstanding principal balance.

3.Loan amortization not remitted on due date shall bear a penalty of 1% per month.

4.If the loan is not fully paid at the end of the term, interest and penalty shall continue to be charged on the outstanding principal balance until fully paid.

E.SERVICE FEE

A service fee of 1% of the loan amount shall be charged and deducted from the proceeds of the loan.

F.LOAN RENEWAL

1.Renewal of loan shall be allowed after payment of at least 50% of the original principal amount and when at least 12 months has lapsed.

2.Proceeds of renewed loan may be any amount greater than or equal to zero, provided that the outstanding balance on the previous loan has been deducted.

G.RESPONSIBILITIES OF THE EMPLOYER

1.The employer shall be responsible for the collection through payroll deduction and remittance to the SSS of the amortization due the employed

2.In case the employed

3.The employer shall report to the SSS the effective date of separation from the company and the unpaid loan balance of the employed

4.The employer shall require a new employee to secure from the SSS an updated statement of his/her account, deduct from his/her salary the amortization due and remit the payment to SSS.

H.RESPONSIBILITY OF MEMBER BORROWER

A

i. DEDUCTION OF UNPAID LOAN FROM BENER PS

In case of default and the

•Fcr employed, final benefits (tola! disabiHty/retrernent/dea*h).

•For

J.OTHER CONDITIONS

1.Any overpayment on a previous loan shall be applied to the current loan, if any. If there is no current loan, the overpayment can also be refunded upon request of the

2.The

b. employer - thru a notice sent thru mail, filed OTC, or sent thru

“ |

R.AJ3735, OTHERWISE KNOWN AS R1J:rH7N~LENDINGACT,: ” ' |

A DISCLOSURE STATEMENT ON LOAN TRANSACTION SHALL EE ’S3UED BY SSS TO THE MEMBER

BORROWER UPON APPROVAL OF HIS/HER LOAN APPLICATION, n. t |

. |

Document Specifics

| Fact Name | Description |

|---|---|

| Form Title | Member Loan Application |

| Form Number | MLP-01287 |

| Revision Date | December 2016 |

| Reproduction Permission | This form may be reproduced and is not for sale. It can also be downloaded through the SSS website at www.sss.gov.ph. |

| Submission Requirement | Applicants must fill out the form with all information in capital letters using black ink only. |

| Eligibility for Application | Applicants must be employed, currently contributing self-employed, or voluntary members with the required number of posted monthly contributions. |

| Governing Law for Disclosure | R.A. 3765, otherwise known as the "Truth in Lending Act", requires a disclosure statement on loan transactions to be issued by SSS to the member-borrower upon approval of his/her loan application. |

Guide to Writing Sss Loan Application

Filling out the Social Security System (SSS) Member Loan Application form is a significant step for members who need financial assistance. The process requires attention to detail to ensure all sections are correctly completed, as this will affect the processing of your loan application. Your application starts with providing personal and employment information, selecting the loan type and amount, and ending with the certification and agreement. Properly completing this form ensures a smoother transaction with the SSS.

- Before starting, ensure you have a black ink pen and your details ready to provide accurate information.

- In PART 1, under "MEMBER-BORROWER DATA," start by writing your SSS number and, if applicable, your Common Reference Number.

- Enter your date of birth in the format (MMDDYYYY), and if you have one, your Tax Identification Number.

- Fill in your name, starting with your last name, first name, middle name, and suffix if applicable.

- Provide your home address in full, including room/unit number, building name, house/lot and block number, street name, subdivision, barangay/district/locality, city/municipality, province, and zip code.

- If your mailing address differs from your home address, complete the section for "MAILING ADDRESS" with the same level of detail.

- Enter your telephone number, including the area code, mobile/cellphone number, and email address.

- If you have a foreign address, provide the details in the allocated space.

- Under "LOAN DATA," specify the type of loan you're applying for by checking the appropriate box and state the amount applied for.

- Choose your mode of payment and, if applicable, fill in your cash card/savings account number.

- In the "CERTIFICATION, AGREEMENT AND PROMISSORY NOTE" section, read the statements and sign your name, print your name, and date the document to confirm your agreement.

- PART II should be completed by your employer if you're an employed member-borrower. This includes your employer's details, their certification, and agreement to the terms and conditions.

- PART III involves your authorization for someone else to file your loan application if necessary. Sign and print your name as the member-borrower and have your authorized representative do the same.

- Finally, in PART IV, ensure that the SSS officer fills out the identification card/document section during your submission.

After submitting your loan application, the SSS will review it based on their eligibility criteria and terms. You should expect a response, which will include a loan disclosure statement if your application is approved, detailing the terms of your loan. Regularly check your account for updates and be prepared to fulfill any additional requirements or clarifications the SSS may request.

Understanding Sss Loan Application

-

Who is eligible for an SSS loan application?

Employed, self-employed, and voluntary members of the SSS who are actively contributing to the system may apply for a salary loan. Specific eligibility criteria include having posted at least thirty-six (36) monthly contributions for a one-month salary loan and seventy-two (72) contributions for a two-month salary loan. Six (6) of these contributions must be within the last twelve (12) months prior to the month of filing the application. The employer of the employed member-borrower should be updated in their contributions and loan remittances. Also, applicants must not have been granted any final benefit (total permanent disability, retirement, and death benefits) and should be under sixty-five (65) years of age at the time of application.

-

What is the maximum amount I can borrow?

The loanable amount for a one-month salary loan is equivalent to the average of the member's twelve (12) latest posted Monthly Salary Credits (MSCs), rounded to the next higher MSC, or the amount applied for, whichever is lower. For a two-month salary loan, it is twice the average of the member-borrower's twelve (12) latest posted MSCs, rounded to the next higher MSC, or the amount applied for, whichever is lower. A 1% service fee will be deducted upfront.

-

How do I repay the loan, and what is the term?

The loan is repayable within two (2) years in 24 equal monthly amortizations. The first payment is due on the second month following the loan approval. Payments are made to any SSS branch with automated tellering systems, accredited banks, or authorized payment centers. Employers are responsible for collecting and remitting amortizations for employed members.

-

What are the interest and penalties for the loan?

Loans are subject to an annual interest rate of 10%, computed on the diminishing principal balance. This interest rate is amortized over 24 months. Failure to remit the monthly amortization on time will result in a penalty of 1% per month. Unpaid loans at the end of the term will continue to accrue interest and penalties until fully paid.

-

How can I apply for a loan?

To apply for a loan, fill out the Member Loan Application form (MLP-01287) with all required information in capital letters and using black ink. This form can be downloaded from the SSS website. Ensure to read all instructions and attached Terms and Conditions before submitting the form. Alongside the loan application form, present a valid ID as required.

-

What documents are required for a loan application?

Applicants need to present at least one primary ID card/document or two secondary ID cards/documents, both with a signature and at least one with a photo. For employed members, the employer needs to accomplish part of the form and also adhere to document requirements.

-

Can I renew my loan, and when?

Loan renewal is allowed after paying off at least 50% of the original principal amount and when at least 12 months have passed since the loan was granted. The amount for the new loan will be based on qualifications at the time of renewal, less any outstanding balance from the previous loan.

-

What happens if I cannot pay the loan?

If the loan is not repaid, any outstanding balance, interest, and penalties may be deducted from future benefits claimed by the member (e.g., total disability, retirement, death benefits for employed members, and similar short-term benefits for self-employed or voluntary members).

Common mistakes

-

Not printing all information in capital letters. The form instructions clearly specify that all information should be printed in capital letters. Failing to do so can cause misunderstandings or processing delays.

-

Using ink colors other than black. The form must be filled out using black ink only. Using other colors can cause issues during document scanning and processing.

-

Leaving fields blank instead of indicating "N/A" or "Not Applicable". When certain sections of the form do not apply, it is important to indicate this properly to avoid any assumptions of oversight or incomplete information.

-

Not affixing initials on erasures or alterations. It is crucial to initial any changes made on the form to verify the authenticity of the modifications and to maintain the integrity of the provided information.

-

Omitting the employer's certification in Part II for employed members. This section verifies the employment status and the employer's acknowledgment of the loan application, which is vital for the loan's processing.

-

Failure to provide the correct mode of payment. Applicants need to choose their preferred mode of payment accurately according to the options provided, ensuring there are no delays in receiving the loan amount.

-

Neglecting to sign the certification, agreement, and promissory note section. This part of the form is a binding agreement regarding the terms of the loan, and leaving it unsigned could nullify the application.

-

Forgetting to include required identification documents. Proper identification is essential for verifying the member-borrower's identity and eligibility for the loan application process.

-

Not reviewing the terms and conditions attached to the loan application. Understanding these terms is crucial for ensuring compliance with the loan requirements and repayment obligations.

-

Failing to verify the status of the loan application through the SSS website or contact center. Regular follow-up can help in addressing any concerns or errors in the application promptly.

Documents used along the form

Applying for a loan through the Social Security System (SSS) entails a list of required forms and documents that go beyond the initial Member Loan Application form. These additional documents ensure that your application is processed efficiently, adhering to both regulatory requirements and internal assessments. Understanding these supplementary requirements will ensure a smoother application process.

- Proof of Income: Critical for assessing your loan repayment capability. For employed members, this may include the latest one to two months' payslip or Income Tax Return (ITR). Self-employed individuals or voluntary members might need to submit financial statements or ITR.

- Valid Identification Cards (IDs): At least one primary ID or two secondary IDs are required to verify your identity. These could include your Social Security (SS) card, UMID Card, Driver's License, Passport, or PRC card.

- Employer Certification: Employed members must have their employer complete part of the loan application to confirm employment and dedication to remit contributions and loan repayments.

- Bank Account Information: For members who opt for loan proceeds to be credited to a bank account, the recent bank statement or passbook might be required to validate the account under the member's name.

- Authorization Letter: If a representative is filing the loan application on your behalf, an authorization letter along with the representative’s ID and your ID is needed for verification.

- Collateral Documents (if applicable): For loans that may require collateral, relevant documents like land titles, vehicle registration, or similar, must be provided.

Whether you're aiming to secure a loan for immediate financial needs or planning for future investments, being prepared with the right documents is key. Remember, the completeness and accuracy of your documents can significantly impact the processing time and outcome of your loan application. Always check with the latest SSS guidelines or consult directly with an SSS representative to ensure you have the most current information.

Similar forms

One document similar to the SSS Loan Application form is a mortgage application form. Both forms collect extensive personal and financial information from the applicant to assess eligibility for a loan. They include sections for personal data, financial data, and employment information. Moreover, both require agreement to terms and conditions and involve a certification process where the applicant confirms the truthfulness of the information provided.

Another document that bears resemblance to the SSS Loan Application form is a credit card application. Both require the applicant to fill out personal information, financial details, and employment history. They also include an agreement section where applicants must acknowledge and accept the terms and conditions related to the application. In addition, both applications often result in the issuance of a physical card or document upon approval.

A car loan application also shares similarities with the SSS Loan Application form. Both applications require detailed personal information, financial information, and an assessment of the applicant's ability to repay the loan. They include sections for the applicant's declaration of income, existing debts, and employment details. Additionally, both forms require applicants to agree to specific terms, conditions, and repayment schedules.

Student loan applications are akin to the SSS Loan Application in terms of collecting personal data, educational information, and financial status, to evaluate the applicant's loan eligibility and repayment capacity. Both forms engage in a thorough vetting process, including the requirement for the applicant to agree to terms regarding loan repayment, interest rates, and conditions of use.

A personal loan application form shares commonalities with the SSS Loan Application as it collects comprehensive personal and financial information to assess the borrower's creditworthiness. Both require details about the applicant's income, existing debts, and employment. Plus, they have sections where applicants must accept the lending terms and conditions explicitly.

Business loan applications are similar in that they require detailed information about the business's financial state, ownership details, and the purpose of the loan—much like how the SSS Loan Application requires personal financial information and loan purpose details. Both forms also typically entail a review of terms and conditions and involve agreements that outline the borrower's responsibilities.

The Federal Student Aid (FAFSA) application, while primarily for educational purposes, shares parallel aspects with the SSS Loan Application regarding the collection of personal and financial information to determine eligibility for financial aid. Both documents are comprehensive in gathering data necessary for making informed decisions on the applicant's qualification for financial support.

Lastly, a payday loan application resembles the SSS Loan Application form as it often requires less detailed personal and financial information but still includes essential data collection for assessing short-term loan eligibility. Both forms also necessitate the borrower's agreement to repayment terms and conditions, emphasizing the borrower's understanding and commitment to fulfill the loan obligations.

Dos and Don'ts

Filling out the SSS Loan Application form is an important step towards securing your loan, but it can be tricky if you're not careful. Here are nine dos and don'ts to guide you through the process, ensuring a smoother experience.

- Do read all the instructions and terms and conditions on the form thoroughly before filling it out. Understanding these details helps avoid mistakes that could delay your application.

- Don't use any type of pen other than a black ink pen. This might seem minor but using the right pen ensures your application is legible and processed without hitches.

- Do print all your information in CAPITAL LETTERS. This enhances readability and reduces the chance of errors during processing.

- Don't leave any fields blank. If a section doesn't apply to you, mark it with "N/A" to indicate "Not Applicable." This shows you didn't overlook the section.

- Do double-check your personal information for accuracy before submitting, especially your SS number, name, and contact details. Accurate information speeds up the verification process.

- Don't make erasures or alterations on the form without initialing them. Doing so could raise questions about the authenticity of the information provided.

- Do ensure your preferred mode of payment is clearly indicated. This helps in processing your loan in the manner most convenient for you.

- Don't forget to sign and date the form. An unsigned form is considered incomplete and could delay processing.

- Do keep a copy of the form for your records. Having your own copy is useful for future reference or in case any questions arise after submission.

By following these guidelines, you're more likely to enjoy a straightforward and efficient application process. Remember, the key is in the details and clarity of the information you provide.

Misconceptions

When applying for a loan through the Social Security System (SSS), applicants might come across various misconceptions that can lead to confusion or incorrect expectations about the process. Addressing these misconceptions is crucial for a smooth loan application experience. Here are four common misunderstandings:

- Needing a high credit score to be eligible: Many believe that a high credit score is a prerequisite for securing an SSS loan. However, the SSS does not check credit scores for loan eligibility. Instead, it requires that the member-borrower must have a certain number of posted monthly contributions and must be currently employed or a currently contributing self-employed or voluntary member.

- Employment is not a factor: Some applicants think their employment status does not influence their loan application. On the contrary, employment status is crucial since part of the eligibility criteria includes being currently employed or being a currently contributing self-employed or voluntary member. Additionally, for employed member-borrowers, the employer must be updated in the payment of contributions and loan remittances.

- The loan amount is arbitrary: Another common misconception is that the loan amount applied for can be any arbitrary figure. In reality, the loan amount is based on the member-borrower's 12 latest posted Monthly Salary Credits (MSCs), rounded to the next higher MSC, or amount applied for, whichever is lower. This ensures the loan amount is within the paying capacity of the member.

- Instant approval and disbursement: Applicants often expect their loan to be approved and disbursed instantly or within a few days. The process, however, involves verification of eligibility, compliance with the required number of contributions, and employer certification among others. Loan approval and disbursement time can vary, and applicants should allow for processing time.

Understanding the actual requirements and processes of SSS loan applications can greatly simplify what might initially seem to be a daunting task. Clearing up these misconceptions not only helps in setting the right expectations but also ensures that applicants are better prepared with the necessary information and documents when they apply.

Key takeaways

Filling out the Social Security System (SSS) Loan Application form is an important step for members seeking financial assistance. Here are seven key takeaways to ensure a smooth and correct process:

- Ensure all personal information is filled out in capital letters and use black ink. This includes your SSS number, date of birth, and full name as well as your contact information and address.

- Choose wisely between the loan types available - whether it's a salary loan, SLERP, or others, and clearly state the amount applied for.

- For mode of payment, members with an activated UMID ATM Card have it as the default option. Alternatively, options such as through cash card or check are available, emphasizing the flexibility in loan disbursement methods.

- Complete the certification, agreement, and promissory note section carefully. By signing, you certify the correctness of the provided information, agree to the terms and conditions, and commit to repay the loan as stated.

- Employed members need to have the employer part of the form filled out. This is crucial to validate employment details and ensure agreement with the loan's terms and conditions.

- Identification documents are necessary to process your loan. Ensure to present a valid ID as specified in the instructions to avoid any delays or issues in your loan application.

- Remember to read and understand the terms and conditions attached to the SSS Loan Application. These include eligibility requirements, loanable amount, repayment terms, penalties, and responsibilities both as an employer and a member-borrower.

By keeping these key points in mind, members can navigate the SSS Loan Application process more effectively, leading to a smoother transaction and ensuring compliance with all requirements.

Popular PDF Documents

How to Get Power of Attorney in Nebraska - Eases the burden of tax compliance on the principal by entrusting responsibilities to a capable and authorized agent.

Nj St-50 - The ST-50 worksheet may be reproduced, allowing businesses to practice or prepare multiple versions before final submission.

Tax Forms 2023 - Reports payment credits from estimated payments, prior year overpayments, and withholding.