Get Sc Tax Form

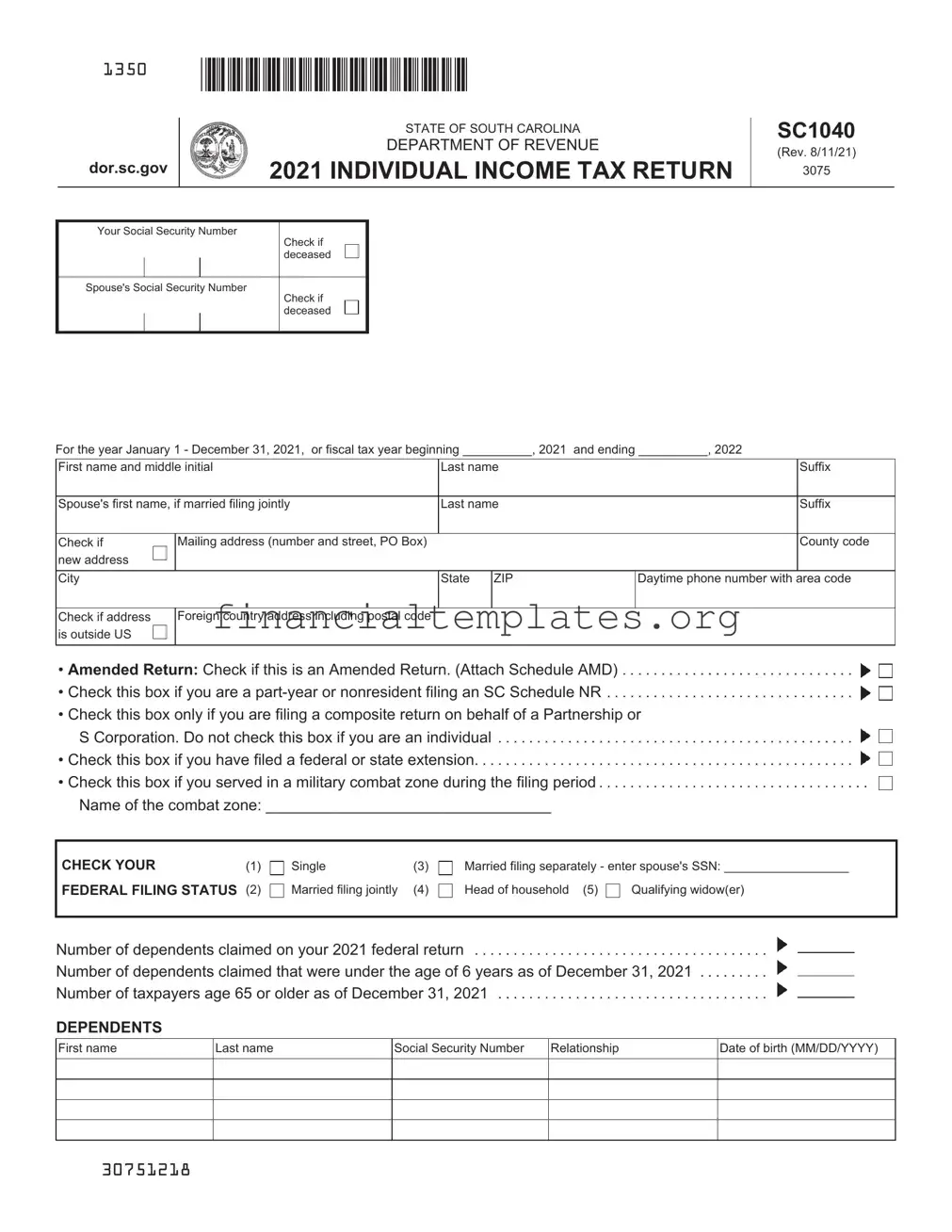

The State of South Carolina Individual Income Tax Return, represented by form SC1040 for the tax year 2020, is a comprehensive document designed by the Department of Revenue to simplify the tax filing process for residents, part-year residents, and non-residents of South Carolina. This form, updated on October 14, 2020, serves as the primary vehicle through which individuals report their annual income, claim allowable deductions and credits, and calculate the tax owed to the state or the refund due from the state. Key sections of the SC1040 form include spaces for taxpayers to enter personal information, check specific conditions such as amendments, non-residency, or military combat zone service, and detail income, adjustments, deductions, and credits based on federal taxable income and state-specific guidelines. Furthermore, the form provides directives for reporting tax withheld, estimated tax payments, and other refundable credits, culminating in the determination of the taxpayer's net obligation to the state or expected refund. The meticulous design of the SC1040 aims to address the diverse scenarios South Carolina taxpayers may encounter, offering specific instructions for additions and subtractions to federal taxable income, tax calculations for various types of income, and the eligibility criteria for a range of credits, underscoring the state's effort to ensure clarity and accuracy in the tax filing process.

Sc Tax Example

1350

dor.sc.gov

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

2021 INDIVIDUAL INCOME TAX RETURN

SC1040

(Rev. 8/11/21)

3075

Your Social Security Number

Check if deceased

Spouse's Social Security Number

Check if deceased

For the year January 1 - December 31, 2021, |

or fiscal tax year beginning __________, 2021 |

and ending __________, 2022 |

|||||

|

|

|

|

|

|

|

|

First name and middle initial |

|

Last name |

|

|

Suffix |

||

|

|

|

|

|

|

|

|

Spouse's first name, if married filing jointly |

|

Last name |

|

|

Suffix |

||

|

|

|

|

|

|

|

|

Check if |

Mailing address (number and street, PO Box) |

|

|

|

County code |

||

new address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

ZIP |

|

Daytime phone number with area code |

|

|

|

|

|

|

|

|

|

Check if address |

Foreign country address including postal code |

|

|

|

|

||

is outside US |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• Amended Return: Check if this is an Amended Return. (Attach Schedule AMD) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

• Check this box if you are a

• Check this box only if you are filing a composite return on behalf of a Partnership or

S Corporation. Do not check this box if you are an individual . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

• Check this box if you have filed a federal or state extension. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

• Check this box if you served in a military combat zone during the filing period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Name of the combat zone: _________________________________

CHECK YOUR |

(1) |

FEDERAL FILING STATUS (2)

Single |

(3) |

Married filing jointly |

(4) |

Married filing separately - enter spouse's SSN: __________________

Head of household (5) |

Qualifying widow(er) |

Number of dependents claimed on your 2021 federal return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Number of dependents claimed that were under the age of 6 years as of December 31, 2021 . . . . . . . . .

Number of dependents claimed that were under the age of 6 years as of December 31, 2021 . . . . . . . . .

Number of taxpayers age 65 or older as of December 31, 2021 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Number of taxpayers age 65 or older as of December 31, 2021 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

DEPENDENTS

First name

Last name

Social Security Number |

Relationship |

|

|

Date of birth (MM/DD/YYYY)

30751218

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 2 of 3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your SSN _____________ |

|

2021 |

|

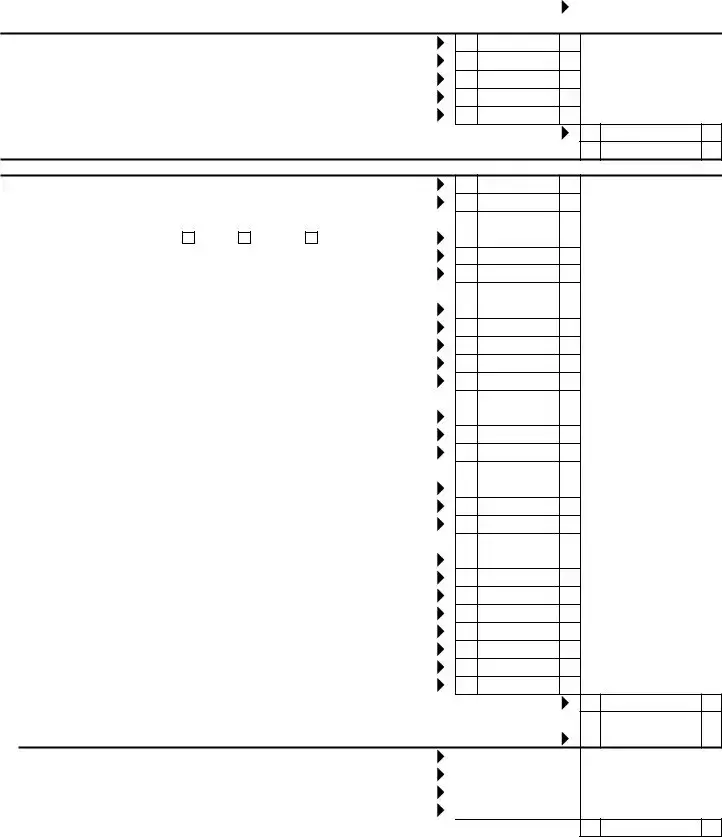

INCOME AND ADJUSTMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Enter federal taxable income from your federal form. If zero or less, enter zero here |

|

Dollars |

|

|||||||||||||||||||||||||||||||

Nonresident filers: complete Schedule NR and enter total from line 48 on line 5 below |

1 |

|

00 |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDITIONS TO FEDERAL TAXABLE INCOME |

|

|

|||

a |

State tax addback, if itemizing on federal return (see instructions) |

a |

00 |

||

b |

b |

00 |

|||

c |

Expenses related to National Guard and Military Reserve Income |

c |

00 |

||

d |

Interest income on obligations of states and political subdivisions other than South Carolina |

d |

00 |

||

e Other additions to income (attach explanation - see instructions) |

e |

00 |

|||

2 Total additions (add line a through line e) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

2 |

||

3 Add line 1 and line 2 and enter the total here |

. . . . . . . . . . . . . . . |

. . 3 |

|||

SUBTRACTIONS FROM FEDERAL TAXABLE INCOME |

|

|

|||

f |

State tax refund, if included on your federal return |

f |

00 |

||

g |

Total and permanent disability retirement income, if taxed on your federal return |

g |

00 |

||

h |

|

|

|||

|

Check type of income/gain: |

Rental |

Business Other ___________ |

h |

00 |

i |

44% of net capital gains held for more than one year |

i |

00 |

||

j |

Volunteer deductions (see instructions) Type: _____________________ |

j |

00 |

||

k |

Contributions to the SC College Investment Program (Future Scholar) |

|

|

||

|

or the SC Tuition Prepayment Program . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

k |

00 |

|

l |

Active Trade or Business Income deduction (see instructions) |

l |

00 |

||

m Interest income from obligations of the US government |

m |

00 |

|||

n Certain nontaxable National Guard or Reserve pay |

n |

00 |

|||

o Social Security and/or railroad retirement, if taxed on your federal return . . |

o |

00 |

|||

p Retirement Deduction (see instructions) |

|

|

|

||

|

00 |

||||

|

00 |

||||

|

00 |

||||

|

Military Retirement Deduction (see instructions) |

|

|

||

|

00 |

||||

|

00 |

||||

|

00 |

||||

qAge 65 and older deduction (see instructions)

|

Taxpayer (date of birth: _____________) |

00 |

||

|

Spouse (date of birth: _____________) |

00 |

||

r |

Negative amount of federal taxable income |

r |

00 |

|

s |

Subsistence allowance (multiply ______ days by $8) |

s |

00 |

|

t |

Dependents under the age of 6 years on December 31 of the tax year . . . . |

t |

00 |

|

u |

Consumer Protection Services |

u |

00 |

|

v |

Other subtractions (see instructions) |

v |

00 |

|

w South Carolina Dependent Exemption (see instructions) |

w |

00 |

||

4 Total subtractions (add line f through line w) |

. . . . . . . . . . . . . . |

4 < |

||

5Residents: subtract line 4 from line 3 and enter the difference. Nonresidents: enter amount from Schedule NR,

|

line 48. If less than zero, enter zero here. This is your SOUTH CAROLINA INCOME SUBJECT TO TAX |

5 |

|||

6 |

TAX on your South Carolina Income Subject to Tax (see SC1040TT) |

|

|

00 |

|

6 |

|

|

|||

|

TAX on Lump Sum Distribution (attach SC4972) |

|

|

|

|

7 |

7 |

|

00 |

|

|

|

TAX on Active Trade or Business Income (attach |

|

|

|

|

8 |

8 |

|

00 |

|

|

|

TAX on excess withdrawals from Catastrophe Savings Accounts |

|

|

|

|

9 |

9 |

|

00 |

|

|

10 |

Add line 6 through line 9 and enter the total here. This is your TOTAL SOUTH CAROLINA TAX . . . . |

. 10. . |

|||

00

00

00>

00

00

30752216

|

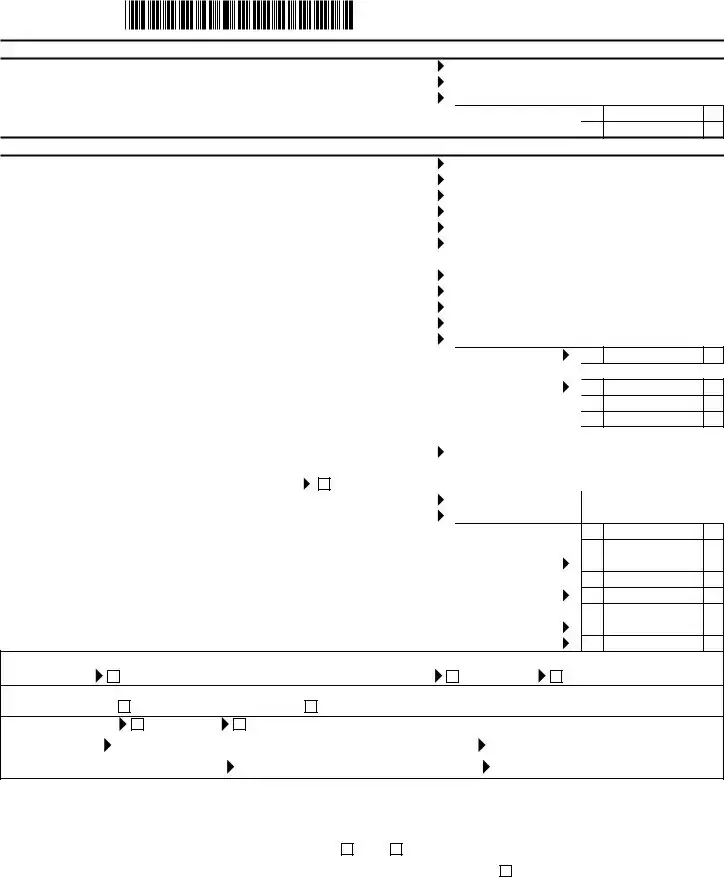

Page 3 of 3 |

Your SSN _____________ |

2021 |

11 |

. . . . . . . . . . . . . . .Child and Dependent Care (see instructions) |

. . . . . . . . . . . |

11 |

|

00 |

|

|

12 |

Two Wage Earner Credit (see instructions) |

|

|

|

|

|

|

. . . . . . . . . . . |

12 |

|

00 |

|

|||

13 |

Other nonrefundable credits. Attach SC1040TC and other state returns |

|

|

|

|

||

13 |

|

00 |

|

||||

14 |

. . .Total nonrefundable credits (add line 11 through line 13) |

. . . . . . . . . . . . . . . |

. . . . |

. . . . . . . . . . . . |

. . |

14 |

|

15 |

Subtract line 14 from line 10 and enter the difference. If less than zero, enter zero here |

. . |

15 |

||||

PAYMENTS AND REFUNDABLE CREDITS |

|

|

|

|

|

||

|

SC income tax withheld (attach |

|

|

|

|

|

|

16 |

. . . . . . . . . . . |

16 |

|

00 |

|

||

17 |

2021 Estimated Tax payments |

|

|

|

|

|

|

. . . . . . . . . . . |

17 |

|

00 |

|

|||

18 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . .Amount paid with extension |

. . . . . . . . . . . |

18 |

|

00 |

|

|

19 |

. . . . . . . . . . . . . . . . . . . . . . . . . .Nonresident sale of real estate |

. . . . . . . . . . . |

19 |

|

00 |

|

|

20 |

. . . . . . . . . . . . . . . . . . . . . .Other SC withholding (attach 1099) |

. . . . . . . . . . . |

20 |

|

00 |

|

|

21 |

. . . . . . . . . . . . . . . . . . . . . . . . . .Tuition tax credit (attach |

. . . . . . . . . . . |

21 |

|

00 |

|

|

22 |

Other refundable credits: |

|

|

|

|

|

|

|

22a Anhydrous Ammonia (attach |

|

|

|

|

||

|

. . . . . . . . . . . |

22a |

|

00 |

|

||

|

22b |

Milk Credit (attach |

|

|

|

|

|

|

. . . . . . . . . . . |

22b |

|

00 |

|

||

|

22c |

Classroom Teacher Expenses (attach |

|

|

|

|

|

|

. . . . . . . . . . . |

22c |

|

00 |

|

||

|

22d |

Parental Refundable Credit (attach |

|

|

|

|

|

|

. . . . . . . . . . . |

22d |

|

00 |

|

||

|

22e |

Motor Fuel Income Tax Credit (attach |

|

|

|

|

|

|

. . . . . . . . . . . |

22e |

|

00 |

|

||

|

. . . . .Total refundable credits (add line 22a through line 22e) |

. . . . . . . . . . . . . . . |

. . . . |

. . . . . . . . . . . |

|

22 |

|

|

AMENDED RETURN: Use Schedule AMD for line 23 calculation. |

|

|

|

|

||

23 Add line 16 through line 22 and enter the total here |

These are your TOTAL PAYMENTS |

|

|||||

|

23 |

||||||

24 |

If line 23 is larger than line 15, subtract line 15 from line 23 and enter the overpayment |

24 |

|||||

25 |

If line 15 is larger than line 23, subtract line 23 from line 15 and enter the amount due |

25 |

|||||

|

|

|

|

|

|

|

|

AMENDED RETURN: Enter the amount from line 24 on line 30. Enter the amount from line 25 on line 31.

00

00

00

00

00

00

26 |

USE TAX due on online, |

26 |

|

00 |

|

|

|

|

|

|

|

|

Use Tax is based on your county's Sales Tax rate. See instructions for more information. |

|

|

||

|

If you certify that no Use Tax is due, check here . . . . |

|

|

|

|

|

Amount of line 24 to be credited to your 2022 Estimated Tax |

|

|

|

|

27 |

27 |

|

00 |

|

|

28 |

Total Contributions for |

|

|

|

|

28 |

|

00 |

|

||

29 |

Add line 26 through line 28 and enter the total here |

|

|

|

|

. . . . |

. . . . . . . . . . . . |

29. . |

|||

30 |

If line 29 is larger than line 24, go to line 31. Otherwise, subtract line 29 from line 24 and enter the |

|

|

||

|

amount to be refunded to you (line 35 check box entry is required) |

. . . . |

. . . REFUND |

30 |

|

31Add line 25 and line 29. If line 29 is larger than line 24, subtract line 24 from line 29, enter the total. This is your tax due 31

32 |

Late filing and/or late payment: Penalties___________ Interest __________ |

Enter total here |

32 |

33 |

Penalty for Underpayment of Estimated Tax (attach SC2210) |

|

|

|

Enter exception code from instructions here if applicable ______ |

. . . . . . . . . . . . . |

33 |

34 |

Add line 31 through line 33 and enter your balance due (select payment option on line 36) |

BALANCE DUE |

34 |

|

REFUND OPTIONS Getting a refund? Direct deposit is fast, accurate, and secure! |

|

|

35 Select one: |

Direct Deposit (line 37 required) (for US accounts only) |

Debit Card |

Paper Check |

PAYMENT OPTIONS Have a balance due? Pay electronically! It's quick and easy!

36 |

Select one: |

MyDORWAY (pay at dor.sc.gov/pay) |

ACH Debit (enter your US bank information on line 37) |

|

|

||||||

37 |

Type of Account: |

Checking |

Savings |

|

|

|

|

|

|

|

|

|

Routing |

|

|

Must be 9 digits. The first two numbers |

Bank Account |

|

|

|

|

||

|

|

|

|

|

|

|

|||||

|

Number (RTN) |

|

|

of the RTN must be 01 through 32. |

Number (BAN) |

|

|

|

|

||

|

|

|

|

|

|

|

|||||

|

For payments only: |

Withdrawal Date |

|

|

Withdrawal Amount |

|

00 |

|

|||

00

00

00

00

00

00

I declare that this return and all attachments are true, correct, and complete to the best of my knowledge. If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has any knowledge.

Your signature |

|

Date |

|

Spouse's signature (if married filing jointly, BOTH must sign) |

|

|

|

|

|

|

|

I authorize the Director of the SCDOR or delegate to discuss this return, |

Yes |

No |

Preparer's printed name |

||

attachments, and related tax matters with the preparer. |

|

|

|

|

|

Paid |

Preparer |

Date |

|

Check if self- |

PTIN |

Preparer's |

signature |

|

|

employed |

|

|

|

|

|

||

Use |

Firm name (or yours if self- |

|

|

|

FEIN |

Only |

employed), address, ZIP |

|

|

|

Phone |

MAIL TO:

REFUNDS OR ZERO TAX: SC1040 Processing Center, PO Box 101100, Columbia, SC

BALANCE DUE: Taxable Processing Center, PO Box 101105, Columbia, SC

30753214

Document Specifics

| Fact Name | Description |

|---|---|

| Form Title and Version | SC1040 Individual Income Tax Return 2020, Rev. 10/14/20 |

| Governing Entity | South Carolina Department of Revenue |

| Eligibility | Residents, part-year residents, or nonresidents who have earned income in South Carolina within the tax year |

| Key Features | Options to file amended returns, checks for military combat zone service, various deductions including for those 65 and older, and SC-specific credits |

| Governing Law | Subject to the laws of the State of South Carolina |

| Submission Methods | Mail or electronic filing through SC Department of Revenue's official website |

Guide to Writing Sc Tax

Before starting to fill out the South Carolina Individual Income Tax Return Form SC1040, it is essential to gather all required documents, including your federal income tax return, W-2 forms, and any other relevant income statements. This form is used to report your income to the South Carolina Department of Revenue for the tax year 2020. The process can seem complex, but breaking it down into step-by-step instructions will simplify it.

- Enter your Social Security Number and, if applicable, your spouse's Social Security Number in the designated areas. If either party is deceased, check the appropriate box.

- Fill out the section for the fiscal tax year, starting and ending dates if you don't file on a calendar year basis.

- Provide your first name, middle initial, and last name. Do the same for your spouse if you are married and filing jointly, including any suffixes.

- Check the appropriate box if it is a new address and enter your mailing address, including the number and street or PO Box, county code, city, state, and ZIP. If the address is outside the U.S., include the foreign country address and postal code.

- Indicate if this is an Amended Return by checking the box and attaching Schedule AMD.

- For part-year or nonresident filings, check the corresponding box and attach an SC Schedule NR.

- If filing on behalf of a Partnership or S Corporation, check the box for a composite return but don't check if you are an individual filer.

- Indicate if you have filed a federal or state extension.

- If you served in a military combat zone during the filing period, check the box and write the name of the combat zone.

- Select your filing status from the options provided and enter the number of dependents as claimed on your federal return.

- Fill in your dependents' information, including first name, last name, Social Security Number, relationship to you, and date of birth.

- Enter your federal taxable income from your federal form on the designated line. If it's zero or less, enter zero.

- Add any additions to the federal taxable income as outlined in the form. This includes state tax addbacks, out-of-state losses, and other additions requiring explanations and relevant form attachments.

- Calculate and enter subtractions from federal taxable income, such as state tax refund, disability retirement income, and out-of-state income wherever applicable.

- Fill in the South Carolina income subject to tax, determining the amount based on whether you are a resident or nonresident.

- Calculate the tax on your South Carolina income subject to tax using the SC1040TT table and any other specified tax calculations for specific situations.

- Enter information about non-refundable and refundable credits from the relevant sections of the form and attach necessary schedules as instructed.

- If necessary, calculate use tax due for online, mail-order, or out-of-state purchases, and enter the information.

- Choose your refund option, if applicable, and provide banking information for direct deposit.

- Review the penalties and interest section if you are filing or paying late. Attach form SC2210 for underpayment of estimated tax if necessary.

- Sign and date the form. If you are married and filing jointly, both spouses must sign. If someone else prepared the form, they must also provide their information.

- Mail your completed form to the appropriate address, depending on whether you have a balance due or are expecting a refund or if your tax due is zero.

Following these instructions will help ensure your South Carolina Individual Income Tax Return is filled out correctly. Be sure to double-check all entries and attachments to avoid delays or problems with your return. If you're unsure about any part of the process, consider seeking assistance from a tax professional.

Understanding Sc Tax

What is the SC1040 tax form used for?

The SC1040 is the form used for filing individual income tax returns in South Carolina. It's designed to report income, calculate taxes owed, and determine the refund or additional taxes due for the state of South Carolina.

Who needs to file an SC1040 form?

Residents, part-year residents, and nonresidents who have earned income in South Carolina during the tax year need to file the SC1040 form. This requirement applies whether you're filing singly, jointly, or separately if you are married.

What are some key sections of the SC1040 form?

- Identification Information: Includes Social Security Numbers and addresses.

- Federal Filing Status: Matches your filing status on your federal return.

- Income and Adjustments: Reports income and adjustments to income specific to South Carolina.

- Subtractions: Deductions specific to South Carolina tax law.

- Tax Computation: Determines the amount of state tax owed.

- Credits and Payments: Details tax credits and any payments already made.

Can I amend a previously filed SC1040 form?

Yes, if you need to make changes after your original SC1040 form has been filed, you can file an amended return using the same form but checking the box labeled "Amended Return" and attaching Schedule AMD.

What should nonresidents note when filling out the SC1040?

Nonresidents should check the appropriate box indicating their nonresident status and complete the SC Schedule NR. This schedule helps calculate the portion of income subject to South Carolina tax.

How can military servicemembers file the SC1040?

Servicemembers who served in a combat zone during the filing period have specific boxes to check on the SC1040 form. They may also be eligible for certain tax benefits, such as exclusions for combat pay.

What are some of the deductions and credits available on the SC1040?

South Carolina offers various deductions and tax credits including, but not limited to, deductions for retirement income, a deduction for taxpayers over 65, credits for child and dependent care expenses, and credits for education savings account contributions.

How do I file the SC1040 and what are the deadlines?

The SC1040 can be filed electronically through South Carolina's online services or mailed to the appropriate address. The filing deadline typically falls on April 15th, but if you file a federal extension, you automatically receive a state extension. However, taxes owed are still due by the original deadline to avoid interest and penalties.

Common mistakes

Filling out tax forms can often be complex, and making errors is not uncommon. Here are ten common mistakes to avoid when completing the South Carolina Individual Income Tax Return (SC1040).

One frequent oversight is not providing complete Social Security numbers for oneself and, if filing jointly, for one's spouse. This critical piece of information is essential for processing the return.

Another common error involves the filling status section. Taxpayers sometimes check the wrong status or fill it out inaccurately. Each status affects taxation differently, so it's important to choose correctly.

Incorrectly reporting dependents, including missing or inaccurate Social Security numbers, names, or relationships can lead to processing delays or errors in tax calculations.

For those filing an amended return, forgetting to attach the Schedule AMD can result in the amendment not being processed correctly.

Failing to include income from all sources or not correctly calculating additions and subtractions to federal taxable income can lead to a misrepresentation of your tax obligations.

Overlooking potential deductions and credits, such as those for child and dependent care or education credits, is a mistake that can lead to overpayment of taxes.

Not adjusting the federal taxable income for state-specific additions and subtractions can result in inaccurate state taxable income and potentially higher or lower tax due.

Incorrectly calculating or forgetting to include the tax on lump sum distributions, if applicable, can affect the accuracy of the tax calculation.

Forgetting to sign the tax return or, if filing jointly, both spouses not signing can result in the return being considered incomplete and not processed until corrected.

Not choosing or improperly filling out the direct deposit information can delay the refund process or result in the refund being issued by paper check instead of directly deposited into your bank account.

Avoiding these common errors can make the process of filling out your SC1040 tax return smoother and can help ensure that your return is processed accurately and efficiently.

Documents used along the form

Filing your South Carolina Individual Income Tax Return, using form SC1040, is just one step in the tax filing process. To ensure a comprehensive and compliant filing, several other documents and forms are commonly required. These documents cater to diverse income sources, deductions, and specific taxpayer situations. Understanding each form's purpose can significantly simplify your tax preparation efforts.

- W-2 Forms: These are essential for taxpayers who have been employed and have received wages during the tax year. The W-2 form reports your annual wages and the amount of taxes withheld from your paycheck.

- Schedule NR: For part-year residents or nonresidents, this schedule is necessary to determine the portion of income subject to South Carolina taxes.

- Form 1099: This series of forms reports various types of income other than wages, salaries, and tips. For example, 1099-INT for interest earned, 1099-DIV for dividends received, and 1099-MISC for independent contractor income.

- SC Schedule AMD: If amendments are needed for a previously filed SC1040 form, Schedule AMD is used to detail those changes and corrections.

- SC1040TC: This form is used to claim various non-refundable credits that a taxpayer may be eligible for, beyond the standard deductions and exemptions.

- I-319 Tuition Tax Credit: Eligible taxpayers can use this form to claim a credit for tuition paid to South Carolina educational institutions.

- I-335: Active Trade or Business Income Deduction form is for individuals who have income from an active trade or business, including sole proprietorships, partnerships, and S corporations.

- SC4972: For calculating tax on lump-sum distributions, this form is used to ensure fair taxation on these potentially large, one-time incomes.

- SC2210: This is the form for taxpayers who must calculate penalties for underpayment of estimated tax throughout the tax year.

- Schedule CR: For claiming credit for taxes paid to another state, this schedule ensures taxpayers aren't taxed twice on the same income.

While this list covers many of the forms and documents commonly needed alongside the SC Tax form SC1040, each taxpayer's situation is unique. It's crucial to review all applicable tax laws and requirements or consult with a tax professional. Accurate and complete filing helps taxpayers avoid delays in processing and potential penalties, ensuring peace of mind as the tax deadline approaches.

Similar forms

The Federal 1040 Income Tax Return is remarkably similar to the SC 1040 form, especially in its primary function of reporting annual income, tax deductions, and tax credits to calculate taxes owed or refunds due to the taxpayer. Both forms require taxpayers to report wages, salaries, interest earned, dividends, and various other types of income. They also allow for deductions and credits that reduce taxable income, such as educational expenses, earned income credit, and child tax credits. The structure of both forms facilitates a step-by-step calculation to determine the taxpayer's final tax liability or refund due.

The W-2 form, issued by employers, is integral to the tax filing process and closely relates to the SC 1040 form. It provides vital information about the taxpayer's wages and taxes withheld throughout the year. This form's data is essential for accurately completing the SC 1040, particularly in determining the amount of income tax already paid and identifying any potential refund or additional tax owing. The connectivity between these documents underscores the importance of accurate and comprehensive reporting of wage information.

Form 1099 is another document closely linked to the SC 1040 form. Various 1099 forms report different types of income, such as interest, dividends, government payments, and income from freelance work. Like the W-2, the 1099 forms provide information necessary for completing the SC 1040 accurately, ensuring that all taxable income is reported. This comprehensive accounting allows taxpayers to pay the correct amount of taxes, reflecting non-wage earnings.

The Schedule NR, specifically designed for part-year residents or nonresidents, complements the SC 1040 form. It requires detailed income information, similar to the main tax form but focuses on income sourced from within the state for those not residing in South Carolina the entire tax year. This schedule helps determine the portion of income subject to state taxes, ensuring fair taxation based on residency status and preventing double taxation of income.

Form W-4 is closely related to the SC 1040 in its role in adjusting tax withholding levels. While not directly linked in their use, the information from the W-4 influences the data entered on the W-2, which then impacts the SC 1040. By appropriately filling out the W-4, taxpayers can ensure that their employers withhold the correct amount of taxes, potentially affecting the final calculation on their state tax return and the size of their refund or amount owed.

Schedule AMD is used for amending previously filed tax returns and works directly with the SC 1040 when corrections or updates to a taxpayer's income, deductions, or credits are necessary. This schedule requires a detailed explanation of the changes, just as the federal 1040X form does for amendments to the federal return. This ensures that taxpayers can accurately rectify their tax responsibilities with the state.

Form SC1040TT, the tax table for the SC 1040, is crucial for calculating the taxpayer's final tax liability based on their taxable income. This document mirrors the role of tax tables and tax rate schedules at the federal level, providing a method to determine the amount of tax owed to the state. It simplifies the tax calculation process, ensuring taxpayers apply the correct tax rates to their income levels.

Form I-335, the Active Trade or Business Income Tax Form, interacts with the SC 1040 by offering a specific deduction for income derived from active trade or business operations within South Carolina. This form takes into account particular types of business income, influencing the overall taxable income reported on the SC 1040. It serves to lower taxable income for qualifying taxpayers, much like specific business deductions do on the federal return.

The Estimated Tax Payment vouchers are preparatory documents for taxpayers who anticipate owing taxes when filing their SC 1040 form. They facilitate the payment of estimated taxes throughout the year, closely emulating the purpose of the federal 1040-ES vouchers. These payments impact the total tax calculation on the annual return, ensuring taxpayers can manage their tax burden progressively throughout the year.

Lastly, the Use Tax declaration on the SC 1040 form parallels the concept of self-reporting use taxes on purchases made out-of-state, similar to declarations made on forms in other states where use tax applies. This entry allows taxpayers to comply with state tax laws on purchases that were not subject to sales tax at the time of sale, demonstrating the varied ways state and local tax policies interact with individual tax responsibilities.

Dos and Don'ts

When completing the South Carolina (SC) Tax Form SC1040 for the year 2020, it’s important to follow specific dos and don’ts to ensure the process is smooth and free from errors. Below are some key pointers to keep in mind:

- Do:

- Check your filing status carefully and make sure it matches what you have filed on your federal return.

- Ensure that all Social Security Numbers are correctly entered, including those for dependents.

- Report all income accurately, including adjustments to Federal Taxable Income as specified in the SC Tax Form instructions.

- Take advantage of any deductions and credits you are eligible for, such as the SC College Investment Program Contributions or Retirement Deduction.

- Keep a copy of the completed tax form and all related documentation for your records.

- Use the correct schedule (e.g., Schedule NR for part-year or nonresident filers) where applicable.

- Double-check your calculations to prevent errors that could delay processing.

- File before the deadline to avoid possible penalties and interest for late filing.

- Don’t:

- Forget to sign and date your tax return; if filing jointly, both spouses must sign.

- Omit any relevant income or deductions, as this could result in discrepancies and possible audits.

- Assume that the rules haven’t changed; always refer to the latest instructions or tax laws.

- Ignore requests for additional information from the Department of Revenue, as failing to respond can result in processing delays.

- Miss out on checking applicable boxes for amended returns, military combat zone presence, or part-year/nonresident status, as this can affect your tax calculation.

- Neglect to include direct deposit information if you expect a refund and prefer this method of payment.

- Use incorrect postage if mailing your return, and always send it to the correct address based on whether you are expecting a refund or owe a balance.

- Rely solely on pre-filled forms without verifying that all information remains accurate and up to date.

By following these guidelines, filing your SC Tax Form can be a straightforward process that ensures timely and accurate processing of your state income tax return.

Misconceptions

When it comes to filing state tax returns, misconceptions can lead to errors that potentially affect the outcome of your tax liabilities and refunds. Particularly for the State of South Carolina Individual Income Tax Return, commonly known as the SC1040 form, some misunderstandings frequently arise. Addressing these misconceptions is essential for accurate tax reporting and compliance.

Misconception #1: Filing an Amended Return Is Only Necessary for Major Mistakes. Many taxpayers believe that small errors or omissions on their original SC1040 form do not necessitate filing an amended return (Schedule AMD). However, the South Carolina Department of Revenue encourages filing an amended return for any inaccuracies to ensure that your tax responsibilities are fully accurate, regardless of the mistake's perceived size.

Misconception #2: Nonresidents Cannot Claim Deductions. There's a common misunderstanding that nonresidents who earn income from South Carolina sources are ineligible for deductions on their SC1040 form. This is not the case. Nonresidents can claim various subtractions and deductions, particularly if they relate to income earned within the state, by completing the additional SC Schedule NR.

Misconception #3: Part-Year Residents Must File as Either a Resident or Nonresident for the Entire Year. South Carolina actually allows part-year residents to file their taxes reflecting the portion of the year they were residents. Taxpayers don't have to choose between filing solely as a resident or nonresident for the whole year, which helps ensure taxes are accurately assessed based on residency status throughout the year.

Misconception #4: Military Pay Is Fully Taxable on the SC1040. While military pay is subject to federal tax, South Carolina offers deductions for certain types of military income, such as combat pay or pay received while serving in a designated combat zone. Moreover, taxpayers with military retirement income may be eligible for significant deductions, highlighting the importance of not overlooking these potential tax advantages.

Understanding these nuances helps ensure that the SC1040 tax form is filled out correctly, maximising potential benefits while minimising errors. It's always recommended to consult the latest tax instructions from the South Carolina Department of Revenue or a tax professional for tailored advice and the most accurate information.

Key takeaways

Filling out your South Carolina (SC) Tax Form can seem daunting, but understanding its key aspects can simplify the process considerably. Here are several takeaways to guide you through it:

- Begin with ensuring your personal information is correct. This includes your Social Security Number, your spouse’s Social Security Number if filing jointly, and your mailing address.

- Choosing the right filing status is crucial. Your options include Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er).

- Report your income accurately. Start with your federal taxable income and make the necessary adjustments, according to the SC form instructions, to determine your South Carolina income subject to tax.

- Don't overlook deductions and credits. These can include deductions for retirement income, disability income, or even contributions to the SC College Investment Program. Credits might cover childcare, education, or energy efficiency investments.

- If you've made estimated tax payments or had South Carolina income tax withheld, don’t forget to include these amounts. They could significantly reduce your tax due or increase your refund.

- Amended returns require extra attention. If you need to correct your filing, check the box indicating it's an amended return and attach Schedule AMD.

- For those who qualify, special considerations include options for military personnel, part-year or nonresident filings, and various sectors eligible for specific deductions or credits.

- Finally, consider your refund or payment options carefully. You can choose direct deposit for refunds, which is faster and more secure than waiting for a paper check.

Remember, deadlines matter. Filing and paying on time helps avoid penalties and interest. Always check the SC Department of Revenue's website for the most current forms and instructions. When in doubt, seeking help from a tax professional can ensure your SC Tax Form is completed accurately.

Popular PDF Documents

Form 706 - It’s a comprehensive document accounting for deductions like debts, funeral expenses, and charitable contributions against the estate.

What Is 990 Tax Form - Includes questions designed to ascertain whether a nonprofit adheres to the public support test over a five-year period.