Get San Diego Exemption Tax Form

Understanding how the San Diego Exemption Tax form operates is essential for federal government employees who find themselves staying in the city for official business. Designed to exempt these individuals from the Transient Occupancy Tax (TOT) that typically applies to short-term lodging, this form requires thorough completion to ensure compliance and eligibility for exemption. It mandates the provision of detailed personal and employment information, including name, title, work telephone number, and the federal government entity serving as the employer. Additionally, it prompts for the employer's address, the purpose of stay, dates and location of the event if applicable, along with hotel details where the stay occurred. Importantly, the form includes a section for supervisor details, reinforcing the need for validation of the business nature of the stay. A declaration under penalty of perjury confirms the accuracy of the information and the official business purpose of the stay. Furthermore, a clause highlights the individual's responsibility for the TOT on any days not related to official business, showcasing the balance San Diego aims to maintain between offering necessary exemptions and ensuring the tax's integrity. Verification by the hotel or motel operator acts as a final check, underscoring the importance of cooperation between government employees, their agencies, and lodging establishments in adhering to the city's tax laws.

San Diego Exemption Tax Example

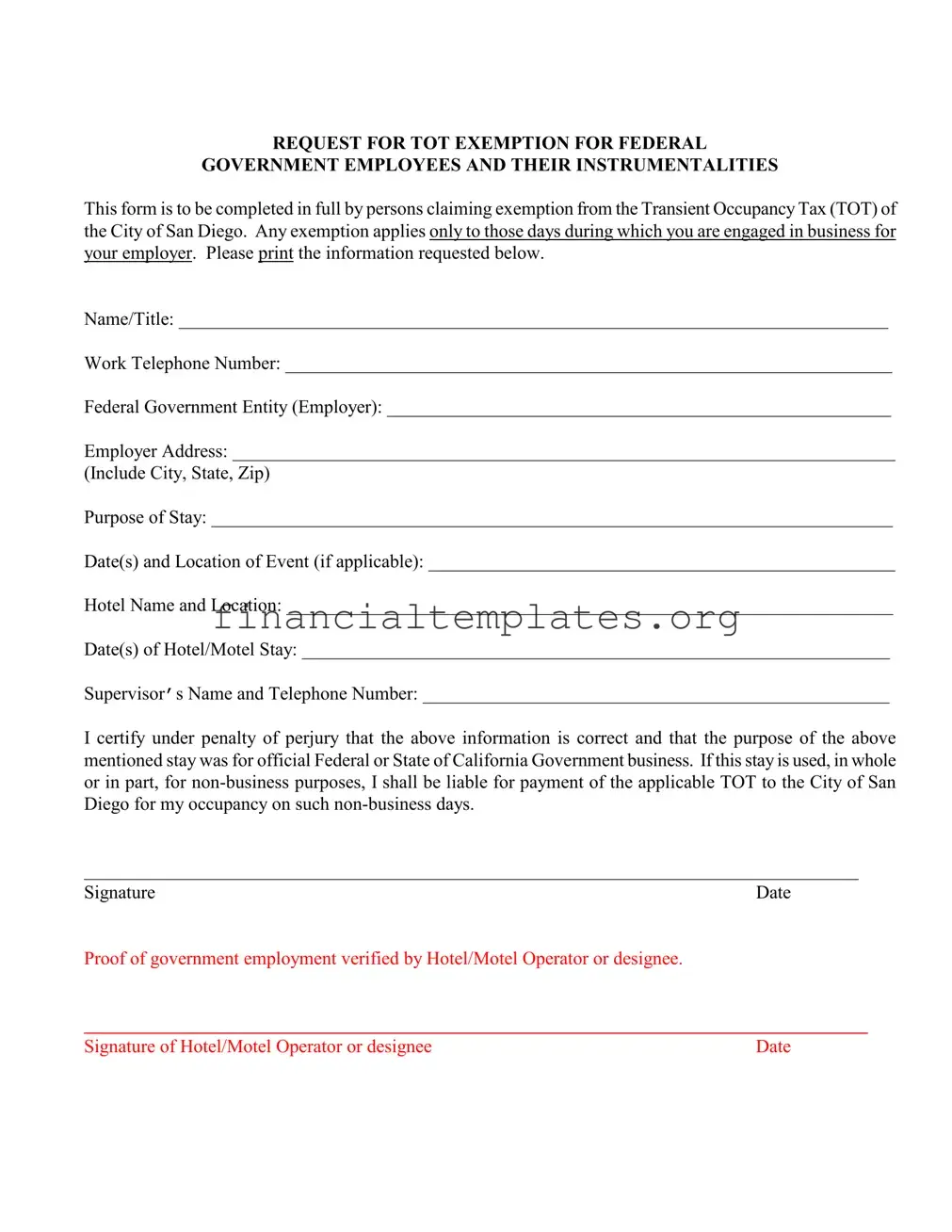

REQUEST FOR TOT EXEMPTION FOR FEDERAL

GOVERNMENT EMPLOYEES AND THEIR INSTRUMENTALITIES

This form is to be completed in full by persons claiming exemption from the Transient OccupancyTax (TOT) of the City of San Diego. Any exemption applies only to those days during which you are engaged in business for your employer. Please print the information requested below.

Name/Title: ____________________________________________________________________________

Work Telephone Number: _________________________________________________________________

Federal Government Entity (Employer): ______________________________________________________

Employer Address: _______________________________________________________________________

(Include City, State, Zip)

Purpose of Stay: _________________________________________________________________________

Date(s) and Location of Event (if applicable): __________________________________________________

Hotel Name and Location: _________________________________________________________________

Date(s) of Hotel/Motel Stay: _______________________________________________________________

Supervisor’s Name and Telephone Number: __________________________________________________

I certify under penalty of perjury that the above information is correct and that the purpose of the above mentioned stay was for official Federal or State of California Government business. If this stayis used, in whole or in part, for

___________________________________________________________________________________

Signature |

Date |

Proof of government employment verified by Hotel/Motel Operator or designee.

Signature of Hotel/Motel Operator or designee |

Date |

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Purpose | This form is used by federal government employees to claim exemption from the City of San Diego's Transient Occupancy Tax (TOT) for official business stays. |

| Eligibility | Exemption applies only for days when the federal government employee is engaged in official business for their employer. |

| Verification Requirement | Proof of government employment must be verified by the Hotel/Motel Operator or their designee. |

| Governing Law | The exemption is governed by the municipal laws of the City of San Diego relating to the collection of Transient Occupancy Taxes. |

Guide to Writing San Diego Exemption Tax

The San Diego Exemption Tax form is a vital document for federal government employees seeking an exemption from the Transient Occupancy Tax (TOT) during their business-related stays in the city. This tax, often colloquially known as a "hotel tax", is charged to travelers who rent accommodations in a hotel, motel, or similar lodging for less than 30 days. Eligibility for the exemption is strictly limited to those days which are officially dedicated to governmental duties. The form, while straightforward, requires precise information to validate the exemption claim. Following the steps below carefully will ensure that the form is correctly filled out, which is crucial for a smooth and successful submission.

- Print your full name and title in the space provided, ensuring clarity and legibility to avoid any misunderstandings or processing delays.

- Enter your work telephone number, including area code, to facilitate easy communication in case there are any questions regarding your exemption request.

- Specify the federal government entity or employer you are representing. This information helps authenticate your claim for a tax exemption.

- Provide the complete address of your federal government employer, including the city, state, and ZIP code. Accuracy here is important for verification purposes.

- Describe the purpose of your stay. This should directly relate to your official duties or the event you are attending on behalf of your federal employer. Specify details to avoid any ambiguity.

- Include the date(s) and location of the event you are attending, if applicable. If there's a specific conference, meeting, or duty, this information could be crucial for your exemption.

- Fill in the hotel name and location where you are requesting the exemption. Remember, the exemption applies only to the hotel stay that is directly connected to your federal government business.

- Detail the date(s) of your hotel or motel stay. Matching these dates with your business engagement in the city is key to ensuring the exemption is applied correctly.

- Provide your supervisor’s name and telephone number. This serves as a reference and may be used to verify the legitimacy of your trip and entitlement to the exemption.

- Finally, sign and date the form, affirming under penalty of perjury that the information you've provided is accurate and truthful. Remember, intentionally providing false information could lead to significant legal consequences.

- The signature of the Hotel/Motel Operator or designee is also required. This step is usually completed by the establishment where the accommodation is booked, confirming they have verified your government employment status.

Once you've carefully filled out each step of the form, review your entries to ensure all information is correct and complete. This form serves as essential documentation to claim your tax exemption, so accuracy is paramount. Following these steps and providing thorough, precise information will facilitate a hassle-free processing of your exemption from the Transient Occupancy Tax during your official business in San Diego.

Understanding San Diego Exemption Tax

Frequently Asked Questions about the San Diego Exemption Tax Form

- What is the purpose of the San Diego Exemption Tax form?

This form is designed for federal government employees and their instrumentalities seeking exemption from the Transient Occupancy Tax (TOT) in the City of San Diego. It validates your stay is for official government business, allowing exemption from the TOT for the duration of business-related occupancy.

- Who is eligible to fill out the San Diego Exemption Tax form?

Federal government employees or individuals working for federal agencies and instrumentalities who are on official business in San Diego are eligible. The exemption applies specifically to those days spent conducting official duties.

- What information is required to complete the form?

- Name/Title of the employee

- Work Telephone Number

- Federal Government Entity (Employer)

- Employer Address, including city, state, and zip code

- Purpose of Stay

- Date(s) and Location of Event (if relevant)

- Hotel Name and Location

- Date(s) of Hotel/Motel Stay

- Supervisor’s Name and Telephone Number

All this information must be provided accurately for the form to be considered valid.

- How does one submit proof of government employment?

Verification of government employment is conducted by the hotel or motel operator, or their designee, who must sign the form confirming the employee's status. This typically requires showing a government ID or other proof of employment at check-in.

- What happens if part of the stay is for non-business purposes?

If any part of the stay is used for non-business purposes, the individual is responsible for paying the applicable Transient Occupancy Tax to the City of San Diego for those days. Honest disclosure of the purpose of stay is crucial.

- Is there a penalty for providing incorrect information?

Yes, the form is submitted under penalty of perjury. Providing false information intentionally is a serious offense and could lead to legal repercussions, including being liable for unpaid taxes and penalties.

- When should the San Diego Exemption Tax form be completed?

It should be filled out and submitted at the time of booking or upon arrival at the hotel or motel, prior to the start of the stay. This ensures that the exemption is applied correctly for the duration of the governmental business activity.

- Where can one find the San Diego Exemption Tax form?

The form can be obtained from the City of San Diego's official website, or directly from the hotel or motel at which the government employee will be staying. It's advisable to check in advance with the accommodation provider regarding availability of the form.

Common mistakes

Not fully completing the form, which includes skipping sections that may seem irrelevant but are required for processing the exemption. Every field must be filled out to ensure that the request is properly evaluated.

Failure to print the information as requested on the form. Handwritten submissions can lead to misinterpretations or errors in processing the application.

Forgetting to include the supervisor’s name and telephone number, a critical oversight as this information is often used for verification purposes.

Incorrectly stating the purpose of stay, or being too vague about the official government business, which can lead to doubts about the eligibility for tax exemption.

Entering incomplete or wrong dates for the hotel/motel stay or the event, if applicable. Accurate dates are crucial for determining the period for which the exemption is valid.

Not specifying the federal government entity or employer in sufficient detail. This information is essential to confirm that the exemption request is legitimate.

Providing an inaccurate or incomplete employer address. Including the full address, including city, state, and zip, is necessary for proper identification and processing.

Omitting the name and location of the hotel or motel, which is key to verifying the claim for exemption as it establishes where the government business was conducted.

Failing to certify the information under penalty of perjury, or not understanding the implications of this certification. This is a legal assurance that the information provided is truthful and accurate.

Not securing the signature of the hotel/motel operator or designee, or not verifying proof of government employment. This step is crucial for the exemption to be granted, as it is part of the required documentation.

Common mistakes can often lead to delays in processing or even denial of tax exemption requests. Attention to detail and thoroughness are vital when completing the San Diego Exemption Tax form to ensure a smooth and quick review process. Applicants should carefully review their completed forms for accuracy and completeness before submission.

- It is advisable to double-check all entered information against official documents to avoid discrepancies.

- Making sure that the form is legible will help prevent unnecessary back-and-forth communication for clarification.

- Understanding that the exemption only applies to business days and accurately reporting any personal days is essential for compliance and avoiding possible repayment obligations.

Documents used along the form

Filling out the San Diego Exemption Tax form is an important step for federal government employees seeking exemption from the Transient Occupancy Tax (TOT) during their business stay in the city. However, this form doesn't exist in isolation. To ensure a smooth and compliant tax exemption process, a few other documents are typically used alongside it. Understanding these documents can help simplify the procedure and avoid any potential hiccups.

- Government Identification Badge or Card: This serves as proof of employment with a federal government entity. It’s typically required for verification purposes by the hotel or motel operator.

- Official Travel Orders: These orders or a travel authorization letter indicate the necessity of travel for government business. They outline the details of the trip, including its purpose and duration, providing a clear link to the requirement for a TOT exemption.

- Hotel Booking Confirmation: This document confirms the arrangements made with the hotel or motel and includes details such as the name of the guest, the dates of the stay, and the room rate. It's frequently referenced to ensure that the exemption is applied correctly to the relevant days of official business travel.

- Expense Report or Reimbursement Form: For government employees, documenting the trip costs and seeking reimbursement is a common procedure. This form is often required to be filled out after the stay, and having proof of TOT exemption can be necessary to ensure accurate reimbursement for lodging expenses without including the exempted taxes.

- Proof of Payment or Hotel Invoice: After the stay, a detailed hotel invoice showing that the bill has been settled (and indicating that the TOT was exempted, where applicable) is important for record-keeping. This document can also be crucial for auditing purposes or future reference.

Together with the San Diego Exemption Tax form, these documents form a comprehensive set that ensures federal government employees can claim and verify their TOT exemption correctly. Each piece of documentation plays a specific role in the process, from establishing eligibility to providing proof of compliance. Familiarizing oneself with these documents can lead to a seamless experience when travelling on official business in San Diego.

Similar forms

The San Diego Exemption Tax form shares similarities with the IRS Form W-9, "Request for Taxpayer Identification Number and Certification." Both forms require the individual to provide personal information, such as name and address, and to sign a certification under penalty of perjury regarding the accuracy of the information provided. While the San Diego form is used for claiming a tax exemption on hotel stays for government business, the IRS Form W-9 is typically used to certify one's tax identification number (TIN) for income reporting purposes. Both forms play a crucial role in ensuring compliance with tax laws and regulations.

Similar to the San Francisco Hotel Tax Exemption Certificate, the San Diego Exemption Tax form is used by individuals seeking exemption from local occupancy taxes. Both forms cater to certain groups of travelers - in San Francisco's case, often employees of exempted organizations or government employees, similar to the San Diego form’s focus on federal government employees. Each form requires information about the stay, including dates and hotel details, alongside a declaration that the stay is for official business. These documents ensure that eligible individuals can avoid taxes that do not apply to them due to their specific circumstances or employment.

The Government Administrative Rate Supplement (GARS) Payment Form also bears resemblance to the San Diego Exemption Tax form. GARS is generally used by federal employees traveling on official business to pay for hotel expenses at a government rate. Like the San Diego form, it requires the traveler to certify their status and the purpose of their travel. Both forms facilitate governmental employees in conducting official duties while ensuring accommodations are correctly billed and exempted from certain charges where applicable.

Another document sharing commonality with the San Diego Exemption Tax form is the New York State Tax Exemption Certificate (ST-129). This form is used by New York State employees, or other eligible parties, to claim exemption from state and local sales taxes on lodging within New York. Both forms necessitate the individual to certify their eligibility for the exemption based on employment and purpose of stay. They serve a similar purpose in helping employees avoid unnecessary taxes while traveling for official business, demonstrating how various jurisdictions have mechanisms for such exemptions.

The Employee Business Expense Reimbursement Form, commonly used within many organizations, also parallels the San Diego Exemption Tax form in purpose and function. Though not a tax form per se, it requires employees to detail business-related expenses during travel for reimbursement, including lodging. The necessity for employees to substantiate the business nature of their expenses, often with oversight such as supervisor approval or additional documentation, mirrors the certification process of the San Diego form. Both ensure accountability and proper use of funds, whether for tax exemption or reimbursement purposes.

Dos and Don'ts

When it comes to filling out the San Diego Exemption Tax form for federal government employees seeking exemption from the Transient Occupancy Tax (TOT), it is important to follow specific guidelines to ensure the process is smooth and your application is successful. Below is a list of dos and don'ts to help guide you through the process:

Do:- Read the instructions carefully before you begin filling out the form to ensure you understand all the requirements.

- Print clearly and legibly, ensuring that all your information is easy to read and understand.

- Provide accurate and complete information for each section, including your full name, title, work telephone number, and federal government entity or employer.

- Include the full address of your employer, making sure to add the city, state, and zip code.

- Detail the specific purpose of your stay, including dates and location of the event if applicable.

- Keep a record of the hotel name and location, as well as your date(s) of stay, to provide clear and consistent information.

- Verify your signature and ensure you sign the statement certifying that your stay was for official government business.

- Obtain a signature from the hotel or motel operator, or their designee, as proof of your government employment.

- Retain a copy of the completed form for your records.

- Contact the appropriate San Diego city department if you have questions or need clarification on the exemption process.

- Rush through filling out the form without understanding each requirement.

- Leave any sections blank; provide a response for each requirement to avoid processing delays.

- Provide misleading or false information, as this could lead to penalties or denial of the exemption.

- Forget to get the necessary signatures both from yourself and the hotel/motel operator to verify the exemption claim.

- Dismiss the importance of the certification statement; understand that by signing, you are declaring under penalty of perjury that your information is correct and the stay was for official business.

- Ignore dates or details related to your stay, as these are crucial for proving eligibility for tax exemption.

- Assume the exemption applies to personal days; remember, the exemption only covers days spent engaged in official business for your employer.

- Avoid contacting city officials for help or clarification, as they can provide valuable guidance and reduce errors.

- Fail to check the City of San Diego's official website for updated forms or information on the exemption process.

- Discard your copy of the form once submitted; keeping a record is important for future reference or in the event of a dispute.

Misconceptions

When it comes to requesting an exemption from the Transient Occupancy Tax (TOT) in San Diego for federal government employees, there are several misconceptions that can lead to confusion and errors in filing. Let's clear up some common misunderstandings:

- Only military personnel are eligible. This is incorrect. The exemption applies to all federal government employees, including civilian employees, as long as they are on official business.

- Exemption is automatic for government employees. This is not the case. Eligible individuals must submit a San Diego Exemption Tax Form and provide the necessary documentation and information to qualify.

- Any hotel stay is covered. The exemption only applies to those days spent engaging in business for your employer. Personal days or vacation time taken in conjunction with business travel are not exempt.

- Exemption applies to all taxes associated with the hotel stay. The exemption specifically applies to the Transient Occupancy Tax. Other fees or taxes charged by the hotel may not be covered.

- A verbal declaration to the hotel staff is enough. A formal request and certification under penalty of perjury is required through the San Diego Exemption Tax Form. A verbal declaration will not suffice.

- The form is only for state of California employees. The form clearly specifies that it is for federal government employees, though it does mention "Federal or State of California Government business" in the certification statement. It's mainly intended for federal employees, but clarifies that state government business conducted in San Diego is relevant.

- There is no need to prove employment status. Proof of government employment is a must and needs to be verified by the hotel or motel operator or their designee, contrary to what some might believe.

- The form can be filled out after the stay. To ensure proper exemption, the form should ideally be completed and submitted at the time of check-in or as part of the reservation process, not after the stay has concluded.

- Any hotel in San Diego is familiar with the form. Not all hotels may be familiar with the specific process for claiming a TOT exemption. It is advisable for federal employees to contact the hotel in advance to ensure the process goes smoothly.

Understanding the accurate requirements and process for claiming a TOT exemption in San Diego is crucial for federal government employees traveling on official business. Clearing up these misconceptions ensures a smoother process for both the employees and the hotels involved.

Key takeaways

Filing the San Diego Exemption Tax form correctly is crucial for federal government employees to ensure they are exempt from paying the Transient Occupancy Tax (TOT) during official business stays. Here are key takeaways to ensure the process is done accurately:

- Eligibility: The exemption applies strictly to federal government employees and their instrumentalities, affirming that only those who are on official business can benefit from this exemption.

- Complete the form in full: It’s important to provide all requested details without leaving any section incomplete. Ensure you clearly print your name, title, work telephone number, and all other required information.

- Purpose of Stay: Clearly articulate the reason for your stay, specifying that it is for official government business. Ambiguity might delay or invalidate your exemption request.

- Proof of Official Business: Your submission must include the dates and location of the event or business that necessitates your stay, as this serves as proof that your travel is for work-related purposes.

- Hotel Information: Include specific details about the hotel or motel, such as name and location, as well as the dates of your stay. This information will be used to verify your exemption claim.

- Supervisor's Verification: The form requires your supervisor’s name and telephone number. This is a measure to ensure that your claim can be verified directly with your government entity.

- Signatures Are Mandatory: Your signature, along with the date, is required to certify that the information provided is accurate. Furthermore, the hotel or motel operator, or their designee, must also sign the form, verifying proof of your government employment.

- Liability on Non-business Days: If any part of your stay is used for non-business purposes, you are responsible for paying the TOT for those days. This ensures that the tax exemption is strictly applied to official business activities only.

Remember, filing this form accurately and providing thorough documentation are the best ways to ensure your exemption is processed smoothly. It’s a straightforward process designed to benefit those serving in the public sector, allowing them to focus on the important work at hand.

Popular PDF Documents

How to Get Power of Attorney in Oregon - Ensuring that this form is properly executed and filed is key to its validity and the ability to enforce the powers granted.

Power of Attorney 2848 - Accuracy in the information provided on the IL-2848 form protects against potential legal or financial repercussions.