Get Sample Profit Loss For Taxi Form

Understanding the financials of a taxi business, whether operated by the owner or contracted to a driver, is crucial for maintaining profitability and ensuring sustainable operations. The Sample Profit & Loss Statement for Taxi Business simplifies this process by breaking down earnings and expenses into digestible components. For owner-driven and contracted driver models, it categorizes earnings from taxi fares and tips, as well as proceeds from the sale of fixed assets, into operating and non-operating income. Additionally, it meticulously itemizes expenses ranging from fuel and maintenance to bank charges and interest on loans. Moreover, it addresses depreciation of taxis and the financial implications of personal use, aligning with specific decrees for accurate tax preparation. The statement's thorough approach extends to calculating net profit before tax by subtracting total expenses from total income. Furthermore, it includes a sample balance sheet, providing a snapshot of the taxi business's financial health by detailing assets, liabilities, and equity at year-end. This comprehensive form serves not only as a record-keeping tool but also as an insightful resource for audit and strategy, aiding owners and contractors in navigating the financial complexities of the taxi industry.

Sample Profit Loss For Taxi Example

SAMPLE PROFIT & LOSS STATEMENT

OF TAXI BUSINESS ( TAXI'S DRIVEN BY OWNER)

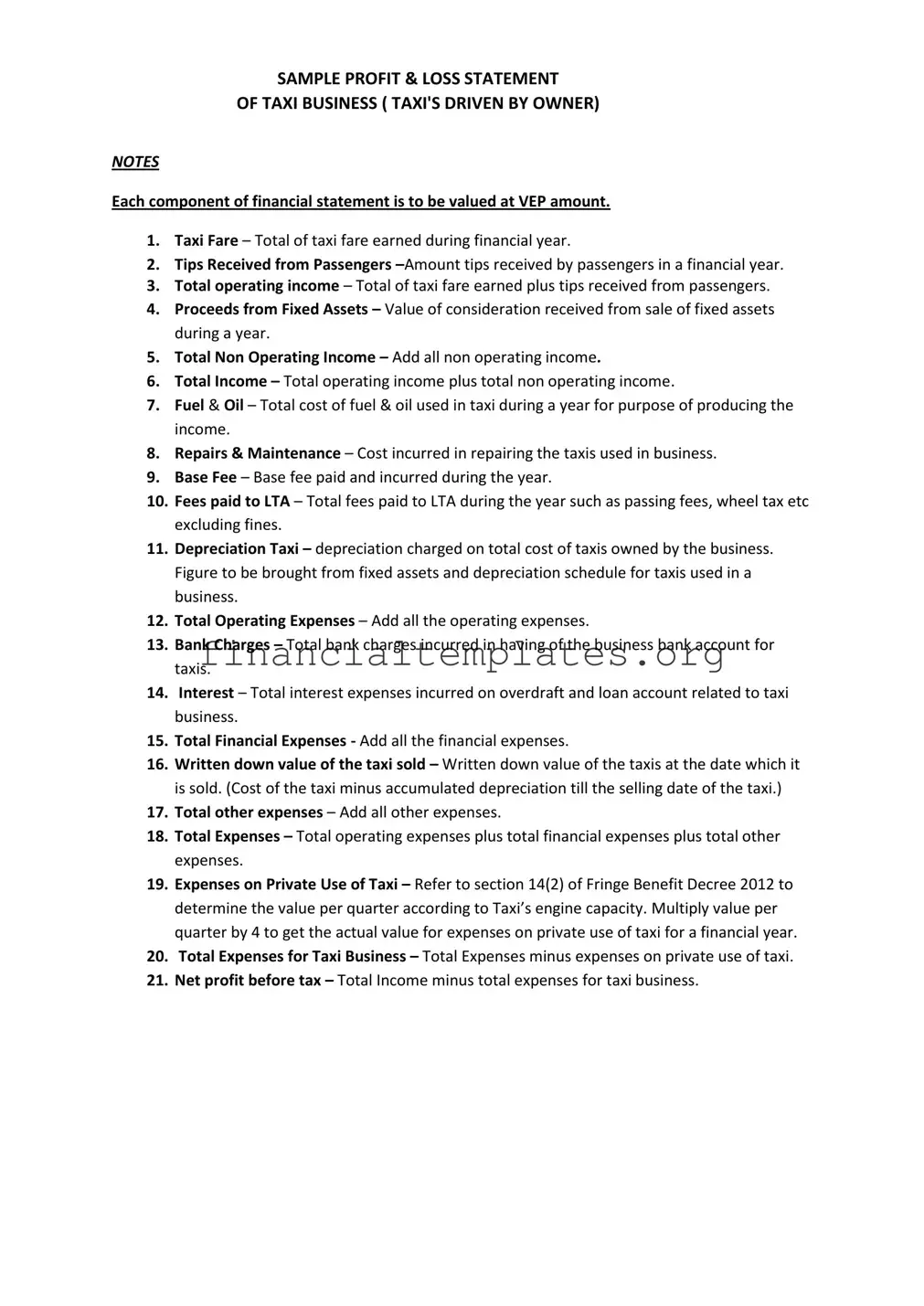

NOTES

Each component of financial statement is to be valued at VEP amount.

1.Taxi Fare – Total of taxi fare earned during financial year.

2.Tips Received from Passengers

3.Total operating income – Total of taxi fare earned plus tips received from passengers.

4.Proceeds from Fixed Assets – Value of consideration received from sale of fixed assets during a year.

5.Total Non Operating Income – Add all non operating income.

6.Total Income – Total operating income plus total non operating income.

7.Fuel & Oil – Total cost of fuel & oil used in taxi during a year for purpose of producing the income.

8.Repairs & Maintenance – Cost incurred in repairing the taxis used in business.

9.Base Fee – Base fee paid and incurred during the year.

10.Fees paid to LTA – Total fees paid to LTA during the year such as passing fees, wheel tax etc excluding fines.

11.Depreciation Taxi – depreciation charged on total cost of taxis owned by the business. Figure to be brought from fixed assets and depreciation schedule for taxis used in a business.

12.Total Operating Expenses – Add all the operating expenses.

13.Bank Charges – Total bank charges incurred in having of the business bank account for taxis.

14.Interest – Total interest expenses incurred on overdraft and loan account related to taxi business.

15.Total Financial Expenses - Add all the financial expenses.

16.Written down value of the taxi sold – Written down value of the taxis at the date which it is sold. (Cost of the taxi minus accumulated depreciation till the selling date of the taxi.)

17.Total other expenses – Add all other expenses.

18.Total Expenses – Total operating expenses plus total financial expenses plus total other expenses.

19.Expenses on Private Use of Taxi – Refer to section 14(2) of Fringe Benefit Decree 2012 to

dete i e the value pe ua te acco di g to Ta i’s e gi e capacit . Multiply value per quarter by 4 to get the actual value for expenses on private use of taxi for a financial year.

20.Total Expenses for Taxi Business – Total Expenses minus expenses on private use of taxi.

21.Net profit before tax – Total Income minus total expenses for taxi business.

SAMPLE PROFIT & LOSS STATEMENT

OF TAXI BUSINESS (CONTRACTED TO DRIVER)

NOTES

Each component of financial statement is to be valued at VEP amount.

1.Taxi Income – Total taxi income received from drivers during the financial year.

2.Proceeds from Fixed Assets – Value of consideration received from sale of fixed assets during a year.

3.Total Non Operating Income – Add all non operating income.

4.Total Income – Total operating income plus total non operating income.

5.Repairs & Maintenance – Cost incurred in repairing the taxi used in business.

6.Base Fee – Base fee paid and incurred during the year.

7.Fees paid to LTA – Total fees paid to LTA during the year such as passing fees etc excluding fines.

8.Depreciation Taxi – depreciation charged on total cost of taxis owned by the business. Figure to be brought from fixed assets and depreciation schedule for taxis used in a business.

9.Total Operating Expenses – Add all the operating expenses.

10.Bank Charges – Total bank charges incurred in having of the business bank account for taxis.

11.Interest – Total interest expenses incurred on overdraft and loan account related to taxi business.

12.Total Financial Expenses - Add all the financial expenses.

13.Written down value of the taxi sold – Written down value of the taxis at the date which it is sold. (Cost of the taxi minus accumulated depreciation till the selling date of the taxi.)

14.Total other expenses – Add all other expenses.

15.Total Expenses – Total operating expenses plus total financial expenses plus total other expenses.

16.Expenses on Private Use of Taxi – Refer to section 14(2) of Fringe Benefit Decree 2012 to

dete i e the value pe ua te acco di g to Ta i’s e gi e capacit . Multipl value pe

quarter by 4 to get the actual value for expenses on private use of taxi for a financial year.

17.Total Expenses for Taxi Business – Total Expenses minus expenses on private use of taxi.

18.Net profit before tax – Total Income minus total expenses for taxi business.

SAMPLE BALANCE SHEET

OF TAXI BUSINESS

NOTES

Each component of financial statement is to be valued at VEP amount.

1.Cash at Bank - This closing bank balance of a year from the bank reconciliation or bank statement which is ending balance as at 31st December.

2.Cash on Hands - Ending balance, as at 31 December of cash held on hand.

3.Debtors – Amount of money owed to your business by individual or organisation as at end of current financial year.

4.Insurance in advance – Amount of insurance expenses paid in advance for taxi insurance before it has been incurred.

5.Total Current Assets - Add all current assets.

6.Taxi

7.Accumulated Depreciation - Total depreciation on taxis from date of acquisition till year end date.

8.Cost of taxis less accumulated depreciation on taxis (Written down Value).

9.Land – Historical cost of land owned by you or your business.

10.Building – Value of building owned by you for personal use.

11.Accumulated Depreciation - Total depreciation on building from date of acquisition till year end date.

12.Value of building less accumulated depreciation on building (Written down Value).

13.Motor Vehicle – Value of all motor vehicles owned you for personal use valued at purchase price.

14.Accumulated Depreciation - Total depreciation on motor vehicle from date of acquisition till year end date.

15.Purchase price of motor vehicle less accumulated depreciation on motor vehicle (Written down Value).

16.Total Fixed Assets – Total of written down value of all assets plus value of land.

17.Total Assets – Current assets plus fixed assets.

18.Creditors – Total amount of money owed by you or your business to individuals (including friends and relatives) and organization which can be paid within 12 months period.

19.Total Current Liabilities - Total amount of all current liabilities.

20.Loan payable – Amount of loan is to be paid as at end of the year either payable to financial institution or any other party (including friends and relatives).

21.Taxi loan payable – Amount of loan to be paid for taxi as at end of the year either payable to financial institution or any other party (including friends and relatives).

22.Total Long Term Liabilities – Add all long term liabilities.

23.Total Liabilities – Total current liabilities plus total long term liabilities.

24.Net Assets – Total assets minus total liabilities.

25.Beginning Capital – Amount of capital at the start of this financial year (closing capital of last financial year).

26.Net Profit after income tax – Net profit of the current year after income tax has been subjected to it.

27.Beginning capital plus net profit after income tax.

28.Drawings – Total value of cash taken by owner from the business for personal use during the year.

29.Closing Equity – Beginning capital plus net profit after income tax minus drawings.

Document Specifics

| Fact Name | Detail |

|---|---|

| Valuation Currency | Each financial statement component is valued in VEP amount. |

| Income Sources | Taxi fare earned and tips from passengers constitute primary income. |

| Total Operating Income | Sum of taxi fare earned and tips received from passengers. |

| Non-Operating Income | Includes proceeds from sale of fixed assets and other non-operational income. |

| Operating Expenses | Fuel, oil, repairs, maintenance, and various fees (excluding fines). |

| Financial Expenses | Bank charges, interest on loans or overdrafts related to taxi business. |

| Depreciation | Depreciation on taxis, calculated from fixed assets schedule. |

| Net Profit Before Tax | Determined by subtracting total business expenses from total income. |

Guide to Writing Sample Profit Loss For Taxi

Filling out a Sample Profit Loss For Taxi form requires a systematic approach to ensure that every financial aspect of the taxi business is accurately reported. This process involves listing all forms of income and expenses to determine the net profit or loss for the financial period. Let’s break this task down into clear, actionable steps.

- Start by calculating the Total Taxi Fare earned during the financial year, including any tips received from passengers. This will provide the basis for your Total Operating Income.

- Add any Proceeds from Fixed Assets, which is essentially the income from the sale of any business assets within the year.

- Sum the total of the non-operating income to determine the Total Non-Operating Income.

- Combine Total Operating Income and Total Non-Operating Income for the Total Income.

- Log all expenses related to fuel, oil, repairs, and maintenance for the taxi. Do not forget to include base fees and fees paid to regulatory authorities like the LTA (Land Transport Authority), excluding any fines.

- Calculate the depreciation on taxis, which can be retrieved from the fixed assets and depreciation schedule, and add it to the operating expenses.

- Sum up bank charges and interest expenses to find the Total Financial Expenses.

- For the taxi sold during the year, note the Written Down Value, which is the initial cost minus depreciation up to the selling date.

- Aggregate the Total Operating Expenses, Total Financial Expenses, and any other expenses to find the Total Expenses.

- To calculate the Expenses on Private Use of Taxi, refer to the relevant section of the Fringe Benefit Decree and apply the formula provided, multiplying the quarterly value by four to get the annual figure.

- Subtract the Expenses on Private Use of Taxi from the Total Expenses to determine the Total Expenses for Taxi Business.

- Finally, ascertain the Net Profit before Tax by subtracting Total Expenses for Taxi Business from Total Income. Enter this value to complete the form.

After completing these steps, you have accurately reported the financial performance of the taxi business for the year. This information will not only give you insight into the health of the business but also is crucial for tax reporting purposes. Ensuring accuracy in this document will aid in making informed decisions about future business operations and strategies.

Understanding Sample Profit Loss For Taxi

What items are included in the Total Income for a taxi business?

Total Income for a taxi business consists of several components. Primarily, it includes the taxi fare earned and tips received from passengers. Additionally, any proceeds from the sale of fixed assets form part of the total non-operating income. Summing up both the operating income (fare and tips) and non-operating income gives the Total Income figure.

How are Total Expenses calculated in the profit and loss statement?

Total Expenses encompass operating expenses, financial expenses, and other miscellaneous expenses. Operating expenses cover fuel, oil, repairs, maintenance, base fees, and LTA fees among others, including depreciation of taxis. Financial expenses include bank charges and interest incurred on loans related to the taxi business. If any expenses arise from other activities not directly related to day-to-day operations, they are also added. Additionally, expenses incurred from the private use of taxis must be considered. The sum of operating, financial, and other expenses, adjusted for private use, gives the total expenses.

Can you explain how the Net Profit Before Tax is determined for a taxi business operated by the owner?

To determine the Net Profit Before Tax for an owner-operated taxi business, you start by calculating Total Income, which includes all earnings from taxi fares and tips, plus any non-operating income. From this figure, subtract Total Expenses, which are the sum of operating, financial, and other expenses necessary to run the business, adjusted for any personal use of taxis. The difference between Total Income and Total Expenses for the business yields the Net Profit Before Tax.

What is the significance of the "Expenses on Private Use of Taxi" section and how is it calculated?

The "Expenses on Private Use of Taxi" section quantifies the cost attributed to the personal use of a business-owned taxi. This ensures that the profit and loss statement accurately reflects expenses purely related to business operations. It's calculated according to the Fringe Benefit Decree 2012, which provides a formula based on the taxi's engine capacity. The value per quarter is multiplied by 4 to derive the annual expense figure. This adjustment is crucial for separating personal benefits from business expenses, thereby ensuring the clarity of the business's financial health.

Common mistakes

Filling out a Sample Profit & Loss Statement for a Taxi Business requires attention to detail and an understanding of your financial activities throughout the year. Common mistakes can lead to inaccuracies that may affect the overall picture of your business's financial health. To help ensure accuracy, let's explore nine common mistakes people often make when completing their Profit & Loss Statement.

- Not separating personal and business expenses: Mixing personal expenses with business expenses can lead to an inaccurate representation of the business's finances.

- Incorrectly calculating total income: Forgetting to include certain sources of income such as tips or non-operating income can understate the business's earnings.

- Omitting expenses: Failing to account for all operating, financial, and other expenses can artificially inflate the net profit.

- Misclassifying expenses: Placing an expense in the wrong category can distort the analysis of where the business money goes.

- Overlooking depreciation: Neglecting to include depreciation of taxis and other assets can lead to an overestimation of the business's value and net profit.

- Incorrect calculation of net profit: Errors in subtracting total expenses from total income can result in an inaccurately reported net profit.

- Not accounting for private use of taxi: Failing to deduct expenses related to the private use of the taxi can overstate the expenses attributable to the business.

- Calculation errors in the expenses section: Arithmetic mistakes when adding up total expenses, operating expenses, or financial expenses can distort the actual cost of running the business.

- Forgetting to update the financial statement for asset sales: Not adjusting the value of assets or including the proceeds from sold assets can misrepresent the financial state of the business.

To ensure the accuracy of your Profit & Loss Statement, it's crucial to carefully review each section, double-check calculations, and ensure all business activities over the financial year are correctly reflected. This careful approach not only provides a clearer picture of the business's financial health but also assists in making informed decisions for future growth and stability.

Documents used along the form

When managing a taxi business, alongside the Sample Profit & Loss Statement, several other forms and documents are pivotal for comprehensive financial tracking and legal compliance. These documents collectively ensure that the financial health of the business is well-monitored and reported accurately for various purposes including tax filing, loan applications, and strategic planning.

- Balance Sheet: This document provides a snapshot of the business's financial condition at a specific point in time. It lists the assets, liabilities, and equity of the taxi business to show its net worth.

- Vehicle Expense Log: This record keeps track of all costs related to the business's taxis, including fuel, maintenance, and repairs. It’s crucial for calculating the operational expenses of the fleet.

- Loan Amortization Schedules: For any loans taken out for the purchase of taxis or business operation, this document outlines the payment schedule, interest rates, and balance reduction over time.

- Fixed Asset Register: This provides detailed information on the fixed assets owned by the business, such as taxis, equipment, and buildings, including purchase dates, values, and depreciation.

- Income Tax Returns: Completed annually, this form reports the income, expenses, and taxable profit of the taxi business. It is essential for compliance with tax regulations.

- Cash Flow Statement: This financial statement tracks the inflow and outflow of cash within the business. It helps in understanding the liquidity and financial stability of the taxi operation.

- Employee Records: For businesses that employ drivers or other staff, maintaining accurate and up-to-date employment records is essential. This includes contracts, wage information, and work schedules.

Together, these documents create a comprehensive financial framework for the taxi business, allowing business owners and stakeholders to make informed decisions. Careful management of these records contributes to the sustainability and growth of the business, ensuring legal compliance and financial health.

Similar forms

The Sample Profit and Loss (P&L) Statement for a Taxi Business driven by the owner shares similarities with the P&L Statement of a Taxi Business contracted to a driver. Both documents outline the total income derived from the business, including specific incomes such as taxi fare or income received from drivers. They also detail the expenses related to operating the business, like fuel, repairs, and maintenance costs, and both differentiate operating from non-operating income. Where they diverge is in the source of their primary income—owner-driven taxis count fare and tips, whereas contracted operations record income from drivers.

Similarly, a P&L Statement for a Restaurant Business can be likened to the taxi business's P&L due to its structure of reporting income and expenses. A restaurant's P&L would list revenue from food and beverage sales in place of taxi fare, while still itemizing common costs like utilities and wages, comparable to fuel and maintenance in the taxi P&L. Both documents aim to calculate net profit by subtracting total expenses from total income, providing a clear picture of the business's financial performance.

A General Small Business P&L Statement is another document bearing resemblance to the Sample Profit and Loss for Taxi form. It typically includes revenue from sales or services provided, cost of goods sold (COGS), gross profit, and operating expenses—parallel to the taxi P&L's structure of income and expenses. Although the sources of revenue and specific line items may differ, the purpose remains to showcase the company’s financial health over a specified period.

The Cash Flow Statement, while focusing more on the movement of cash in and out of a business, shares an underlying similarity with the Sample Profit and Loss for Taxi document. Both are crucial for understanding the financial status of a business, but while the P&L focuses on profit and losses during a period, the Cash Flow Statement highlights liquidity by showing how well the company generates cash to meet its debt obligations and fund its operating expenses.

Balance Sheets, although fundamentally different in purpose, can complement the information found in a P&L Statement. The Sample Balance Sheet of a Taxi Business, for instance, lists assets, liabilities, and equity at a specific point in time, offering a snapshot of what the company owns and owes. When used alongside the P&L, it provides a fuller picture of the business’s financial health, combining profitability with solvency and liquidity.

The Break-even Analysis Document shares a strategic similarity with the Sample Profit and Loss for Taxi form by determining the point at which a business’s revenues will equal its costs. While a P&L statement shows if and how much the business has profited or lost over a period, a break-even analysis calculates what is needed in sales volume to cover fixed and variable expenses, serving as a performance target.

A Budget Forecast or Projection closely relates to a P&L statement by planning future income and expenses, aiming to predict the company's financial performance. Unlike a P&L, which records actual results, a budget is predictive, setting financial targets for the business to achieve, essentially guiding financial planning and decision-making processes.

The Inventory Management Report, while more specific in focus, complements the information in a P&L statement for retail or product-based businesses like a taxi service that might sell merchandise or taxi-related products. It tracks product quantities and sales, directly influencing the COGS and ultimately the net profit margin presented in the P&L statement.

The Expense Report, detailing all costs incurred by a business during a period, focuses solely on the expense side of a P&L statement. For taxi businesses, this could include fuel, repairs, and maintenance expenses. Though not encompassing revenue, understanding expenses in detail via such reports is crucial for effective financial management and profitability analysis.

Finally, the Tax Returns for Businesses, while a legal document filed with the government, outline income, expenses, and the net profit—figures also presented in a P&L statement. The tax return’s profit figure must align with what's reported in the P&L, underscoring the importance of accurate financial reporting in both documents for legal and operational reasons.

Dos and Don'ts

When filling out the Sample Profit & Loss Statement for a Taxi business, it's essential to approach the task with attention to detail and accuracy. Below are six dos and don'ts that can guide you through the process effectively:

Do:- Verify all figures: Ensure that every financial amount entered, from taxi fare to expenses on private use of the taxi, matches your records accurately.

- Maintain consistency in valuation: Use the VEP (Valued Economic Price) amount consistently across the document for every financial statement component.

- Include all sources of income: Remember to report every type of income, including taxi fares, tips received from passengers, and proceeds from the sale of fixed assets.

- Accurately calculate depreciation: Utilize the depreciation schedule for taxis to report the correct depreciation amount for your taxi business assets.

- Deduct expenses for private use correctly: Apply the guidelines from the Fringe Benefit Decree 2012 to determine the value of expenses on private use of the taxi accurately.

- Check for mathematical accuracy: After listing all incomes and expenses, recheck the calculations to ensure that the net profit before tax is correctly computed.

- Estimate figures: Avoid guessing or rounding off numbers. Use exact amounts for every entry, from fuel costs to fees paid to LTA.

- Overlook any expenses: Every cost associated with the business, including bank charges and interest on loans, should be accurately reported.

- Mix personal finances with business: Keep personal expenses separate and only report costs directly associated with operating the taxi business.

- Forget to report the sale of assets: If any taxi or other fixed assets are sold during the year, ensure to include the proceeds and the written down value of the asset.

- Ignore bank charges and interest expenses: Accurately record all financial expenses related to the business to ensure a correct assessment of net profit.

- Misuse the depreciation schedule: Ensure the depreciation amount reflects the actual decrease in value of the taxis, as per the provided schedule.

Misconceptions

Understanding the nuances of a Sample Profit & Loss Statement for a taxi business can sometimes lead to misconceptions, especially when distinguishing between two different operational models: one where the taxi is driven by the owner and another where it is contracted to a driver. Let's address some common misconceptions.

Profit equals total income: A common mistake is confusing total income with net profit. Total income includes taxi fares, tips, and non-operating income. However, net profit is what remains after deducting operating expenses, financial expenses, and other expenses from the total income. This is a crucial distinction for accurately assessing the financial health of a taxi business.

Fuel & oil costs are negligible: Some might underestimate the cost of fuel and oil, considering them insignificant compared to other expenses. In reality, these are substantial ongoing expenses that significantly affect the net profit, especially when the taxi is heavily used.

Depreciation is just a technicality: Depreciation of the taxi (or taxis) reflects the wear and tear on the vehicle. It's a real expense that impacts the value of the business's assets and, consequently, its financial performance. Ignoring depreciation can lead to an overestimated value of the business's assets.

All tips go straight to profit: While tips do increase the total income, it's not accurate to consider them pure profit. Operating and other expenses still need to be covered from the total income, which includes tips. Tips can boost the overall profitability but don't directly translate to net profit.

Expenses on private use of taxi are irrelevant: The personal use of a business taxi incurs expenses that must be factored out from the business expenses to gain an accurate understanding of the business's profitability. These are not just informal deductions but adjustments that affect the calculation of net profit before tax.

Interest and bank charges are minor details: Financial expenses, including interest on loans and bank charges, can significantly impact net profit. Treating these expenses as afterthoughts or minor details can lead to a misrepresentation of the business's financial situation, particularly in cases where the taxi business is heavily leveraged.

By addressing these misconceptions, stakeholders can have a clearer understanding of the financial mechanisms at play within a taxi business, enabling more informed decision-making and financial planning.

Key takeaways

Understanding the Sample Profit & Loss (P&L) Statement for a Taxi Business is crucial for effective financial management and ensuring the longevity of the business. Here are four key takeaways to guide you through filling out and utilizing this form:

Comprehensive Income Tracking: The Sample P&L Statement demands detailed tracking of both operating income (like taxi fares and tips) and non-operating income (such as proceeds from the sale of fixed assets). This approach offers a holistic view of where the business's income is originating from, emphasizing the importance of not just the core business activities but also ancillary income streams.

Explicit Expense Breakdown: A significant feature of the Sample P&L Statement is its breakdown of expenses into operating, financial, and other expenses. Including specific costs like fuel, maintenance, and bank charges ensures that every penny spent in running the business is accounted for. This detailed expense tracking is pivotal for identifying potential areas for cost reduction.

Depreciation and Asset Management: The Sample P&L Statement underlines the necessity of accounting for depreciation, particularly concerning taxis and other fixed assets. By documenting the depreciation and written down value of assets like taxis, the statement provides insights into asset performance and aids in strategic decision-making about asset renewal or disposal.

Attention to Regulatory Compliance: Incorporating sections like the Expenses on Private Use of Taxi, as delineated by the Fringe Benefit Decree, highlights the necessity of aligning business practices with regulatory requirements. This not only aids in accurate financial reporting but also safeguards the business from potential legal and tax-related repercussions.

Thoroughly engaging with each section of the Sample Profit & Loss Statement empowers taxi business owners to maintain a comprehensive grasp on their financial performance, facilitating informed strategic planning and operational adjustments. Accurate and diligent completion of this document is not just a regulatory necessity but a critical component of effective business management.

Popular PDF Documents

How to Pay Form 4549 Online - A formal adjustment notice from the IRS detailing corrections to your federal income tax return.

Pslf Employment Certification Form - Loan releases are made directly to the educational institution, simplifying the process for beneficiaries.

2024 Fica Wage Limit - For anyone navigating the complexities of paying extra Medicare taxes, the IRS 8959 form is a critical tool.