Get Salvation Army Tax Receipt Form

Supporting charitable organizations like The Salvation Army not only allows individuals to contribute to meaningful causes but also provides an opportunity to benefit from tax deductions. The Salvation Army Tax Receipt form is a crucial document for donors who wish to claim their contributions on their tax returns. This carefully structured form includes sections for specifying the type of donation—whether it's a one-time gift, a monthly donation, or a tribute made in memory or honor of someone. It gathers essential donor information such as name, address, and contact details, ensuring that contributions are properly acknowledged and recorded. Moreover, the form outlines various donation amounts and payment methods, including checks and major credit cards, with spaces for the donor's signature and credit card information to verify the transaction. Notably, it emphasizes that donations of $10.00 or more automatically qualify for a tax receipt, underscoring the financial implications of giving. Additionally, for those choosing to donate in someone's honor or memory, the form accommodates the inclusion of an acknowledgment card, allowing for a personal touch in the donation process. The form also reassures donors about the privacy and security of their information, highlighting The Salvation Army's commitment to respecting donor privacy and ensuring that personal details are not misused.

Salvation Army Tax Receipt Example

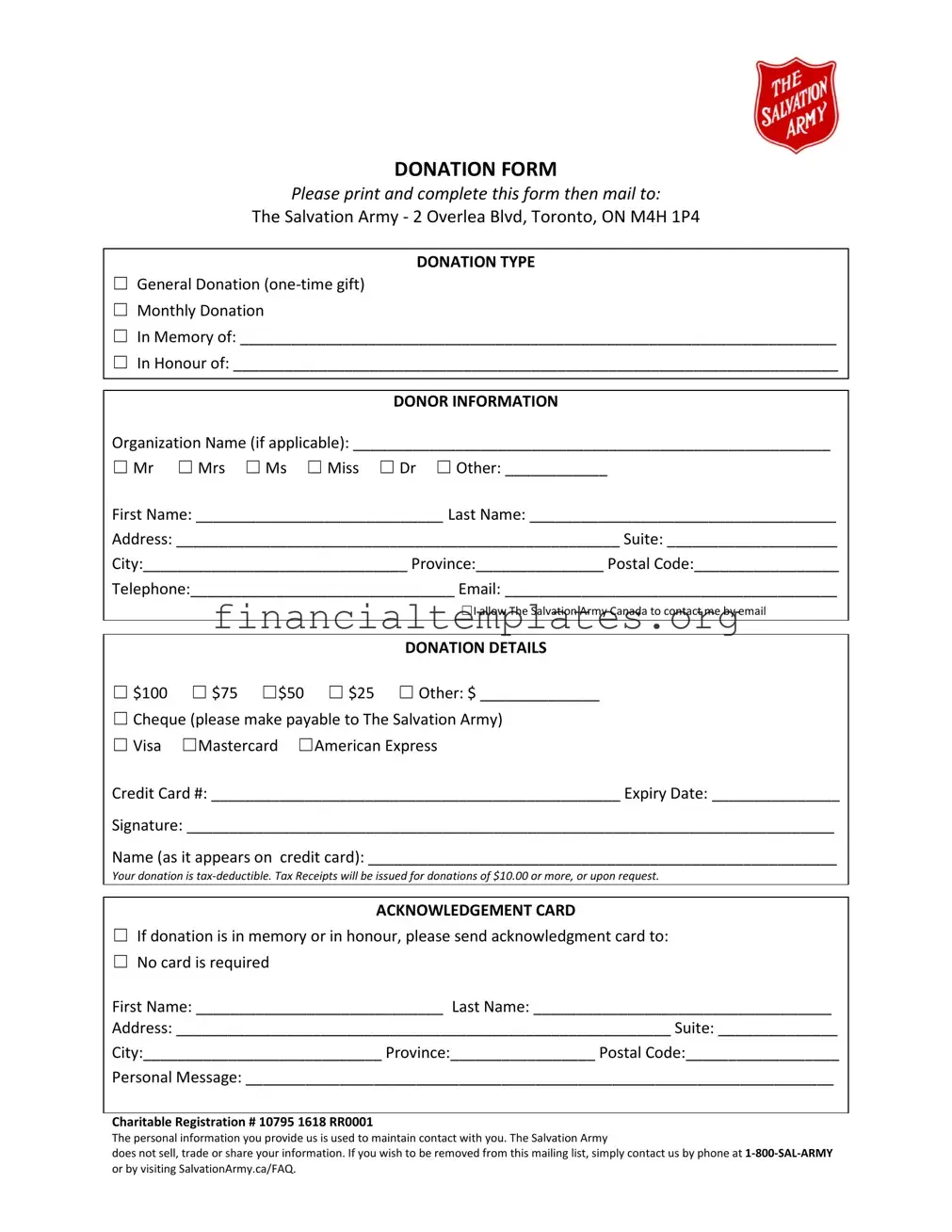

DONATION FORM

Please print and complete this form then mail to:

The Salvation Army - 2 Overlea Blvd, Toronto, ON M4H 1P4

DONATION TYPE

☐General Donation

☐Monthly Donation

☐In Memory of: ______________________________________________________________________

☐In Honour of: _______________________________________________________________________

DONOR INFORMATION

Organization Name (if applicable): ________________________________________________________

☐ Mr ☐ Mrs ☐ Ms ☐ Miss ☐ Dr ☐ Other: ____________

First Name: _____________________________ Last Name: ____________________________________

Address: ____________________________________________________ Suite: ____________________

City:_______________________________ Province:_______________ Postal Code:_________________

Telephone:_______________________________ Email: _______________________________________

☐I allow The Salvation Army Canada to contact me by email

DONATION DETAILS

☐ $100 ☐ $75 ☐$50 ☐ $25 ☐ Other: $ ______________

☐Cheque (please make payable to The Salvation Army)

☐Visa ☐Mastercard ☐American Express

Credit Card #: ________________________________________________ Expiry Date: _______________

Signature: ____________________________________________________________________________

Name (as it appears on credit card): _______________________________________________________

Your donation is

ACKNOWLEDGEMENT CARD

☐If donation is in memory or in honour, please send acknowledgment card to:

☐No card is required

First Name: _____________________________ Last Name: ___________________________________

Address: __________________________________________________________ Suite: ______________

City:____________________________ Province:_________________ Postal Code:__________________

Personal Message: _____________________________________________________________________

Charitable Registration # 10795 1618 RR0001

The personal information you provide us is used to maintain contact with you. The Salvation Army

does not sell, trade or share your information. If you wish to be removed from this mailing list, simply contact us by phone at

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used for making donations to The Salvation Army, allowing for various types of contributions such as general, monthly, or in memory/honour of someone. |

| Submission Address | Completed forms must be mailed to The Salvation Army at 2 Overlea Blvd, Toronto, ON M4H 1P4. |

| Donor Information | Donors are required to provide personal information including name, address, telephone number, and email, with an option to allow contact via email by The Salvation Army Canada. |

| Donation Details | Donors can select from preset donation amounts or write in a different amount, and choose between various payment methods including check and credit card. |

| Tax Deductions | Donations are tax-deductible in Canada, with tax receipts issued for donations of $10.00 or more, or upon request. |

| Acknowledgement Card | If the donation is in memory or in honour of someone, donors have the option to have an acknowledgement card sent, specifying recipient details and a personal message. |

| Privacy Policy | The personal information provided by donors is used for contact purposes only, with a strict policy against selling, trading, or sharing this information. |

Guide to Writing Salvation Army Tax Receipt

Filling out the Salvation Army Tax Receipt form is an important step for ensuring you receive credit for your charitable donation. This action not only supports a good cause but also potentially aids in your annual tax preparation. By completing this form, you provide necessary details about your donation and how you wish it to be acknowledged. Here's a simple guide to properly filling out the form. Remember, it's important to print clearly to avoid any misinterpretations of your information.

- Choose the type of donation you're making by checking the appropriate box: General Donation (one-time gift), Monthly Donation, In Memory of, or In Honour of. If the last two options are selected, write the name of the person to be remembered or honored.

- If donating on behalf of an organization, provide the Organization Name.

- Select the title that best describes you (Mr, Mrs, Ms, Miss, Dr, or Other) and fill in the "Other" blank if applicable.

- Enter your First Name and Last Name.

- Write down your Address, including the Suite number if applicable, City, Province, and Postal Code.

- Provide your Telephone number and Email address. Check the box if you agree to allow The Salvation Army Canada to contact you by email.

- Under DONATION DETAILS, select the amount you wish to donate. If choosing "Other," specify the amount.

- Indicate the payment method: Cheque (with the cheque made payable to The Salvation Army), Visa, Mastercard, or American Express. If paying by credit card, fill in the Card Number, Expiry Date, and Signature.

- Fill in the Name as it appears on the credit card.

- For donations made in memory or in honor, decide if you want an acknowledgment card sent. If so, provide the recipient's name, address, suite number (if applicable), city, province, postal code, and a personal message. If no card is required, check the corresponding box.

Once you've completed all these steps, ensure that every detail is correct to the best of your knowledge. Reviewing your form for accuracy is crucial to ensure your donation is processed smoothly and to pave the way for your tax receipt issuance for donations of $10.00 or more, or upon request. Finally, mail the completed form to The Salvation Army at the provided address. Your contribution goes a long way in supporting the missions and programs of The Salvation Army. Thank you for your generosity.

Understanding Salvation Army Tax Receipt

Frequently Asked Questions about the Salvation Army Tax Receipt Form

- How do I get a tax receipt for my donation to the Salvation Army?

- Can I make a donation in memory or in honour of someone and still receive a tax receipt?

- What payment methods are accepted for donations that qualify for a tax receipt?

- How will my personal information be used, and is it secure?

- Is it possible to allow The Salvation Army to contact me by email regarding future donations or communications?

- What should I do if I want to make a donation but not receive an acknowledgment card?

- Where can I find the Charitable Registration number of The Salvation Army for my records?

To receive a tax receipt for your donation, ensure that your donation is $10.00 or more, as tax receipts are issued for donations of this amount or higher upon request. Complete the donation form with all the required donor information and donation details. Once completed, mail it to The Salvation Army at 2 Overlea Blvd, Toronto, ON M4H 1P4. Remember, to be eligible for a tax receipt, your donation must be properly documented and mailed to the mentioned address.

Yes, you can make a donation in memory or in honour of someone and still be eligible for a tax receipt. On the donation form, select the appropriate option and provide the necessary information regarding the individual you are honoring. As long as your donation is $10.00 or more, or you request a receipt, you will receive a tax receipt for your donation.

The Salvation Army accepts several payment methods for donations that qualify for a tax receipt, including checks (made payable to The Salvation Army), Visa, MasterCard, and American Express. Ensure you provide all necessary credit card details on the donation form if you choose to donate using a credit card.

The personal information you provide on the donation form is used to maintain contact with you and to process your donation. The Salvation Army assures that it does not sell, trade, or share your information with any third party. Your information is kept secure and used solely for the purposes of your relationship with The Salvation Army. If you ever wish to be removed from their mailing list, you can contact them directly by phone or through their website.

Yes, it is possible. On the donation form, there's an option you can check to allow The Salvation Army Canada to contact you by email for future donations or communications. Checking this box means you agree to receive updates and information via email from The Salvation Army.

If you're making a donation in memory or in honour of someone and do not wish to receive an acknowledgment card, simply select the 'No card is required' option on the donation form. This option ensures that your donation is processed without sending an acknowledgment card to anyone.

The Charitable Registration number of The Salvation Army is 10795 1618 RR0001. This number is provided on the donation form and is necessary for your records, especially when claiming your donation on your tax return.

Common mistakes

When filling out the Salvation Army Tax Receipt form, people often make mistakes that can affect the processing and acknowledgment of their generous donations. Here are four common pitfalls to avoid:

Not specifying the donation type: The form offers several options for the type of donation (e.g., General Donation, Monthly Donation, In Memory of, In Honour of). Failing to check the appropriate box can lead to confusion about the donor's intentions and how the funds should be allocated.

Incomplete donor information: The donor's details, including name, address, and contact information, are crucial for issuing tax receipts and maintaining communication. Skipping any of this information might result in the inability to properly acknowledge or tax-deduct the donation.

Incorrect donation details: When indicating the donation amount, some forget to check the box corresponding to their chosen amount or to specify an amount if selecting "Other." Additionally, errors in the payment method details, particularly with credit card information, can obstruct the donation process.

Overlooking the acknowledgment card section: For those donating in memory or in honor of someone, the form provides an option to send an acknowledgment card. Not filling out this section completely, especially when requesting a card, could mean missing the chance to properly honor the person in whose name the donation was given.

By paying close attention to these areas, donors can ensure their contributions are processed smoothly and that their intentions are clearly communicated, making their generous support as impactful as possible.

Documents used along the form

When supporting The Salvation Army or any charitable organization, individuals often utilize various forms and documents to ensure that their contributions are recorded accurately and comply with legal requirements. The Salvation Army Tax Receipt form is a critical document for donors who wish to claim their donation as a deduction on their tax return. Alongside the Salvation Army Tax Receipt, there are several other important documents and forms that are frequently used by donors and the organization. Understanding the purpose and use of these documents can provide clarity and enhance the donation process.

- Gift-in-Kind Donation Form: This document is used when donating items or services rather than cash. It helps in determining the value of the donated goods for tax purposes.

- Volunteer Hours Log: Volunteers may keep track of their hours spent working with the organization. Some jurisdictions allow volunteers to claim tax deductions for their service time.

- Planned Giving Documentation: For those looking to leave a legacy through bequests or estate gifts, this documentation outlines the planned contribution and its intended use.

- Corporate Sponsorship Agreement: Businesses that support The Salvation Army through financial or in-kind donations use this form to set the terms and acknowledgments of their sponsorship.

- Event Sponsorship Form: When sponsoring special events organized by The Salvation Army, this form details the specifics of the contribution and any reciprocal benefits.

- Direct Deposit Authorization Form: For regular donors, this form sets up automatic transfers from a bank account for hassle-free monthly donations.

- Change of Information Form: Used to update donor contact information or preferences, ensuring ongoing communication remains seamless.

- Privacy Consent Form: This form outlines how personal data is managed and gives the donor control over what information is shared and how it is used.

In summary, while the Salvation Army Tax Receipt form is essential for those seeking tax deductions for their donations, various other documents play pivotal roles in the donation lifecycle. These documents help in planning and recording donations, ensuring legal compliance, and maintaining a transparent and trustworthy relationship between donors and charitable organizations. Whether contributing time, resources, or funds, having knowledge of and access to these forms can facilitate a smoother and more rewarding giving experience.

Similar forms

One similar document to the Salvation Army Tax Receipt form is the Goodwill Donation Tax Receipt form. Both forms serve a similar purpose by allowing donors to record their donations to a charity, making those donations eligible for a tax deduction. Each form requires donors to provide personal information such as name, address, and contact details, and details about the donation itself, including the amount and type of donation. These forms both emphasize the importance of documentation for tax purposes and ensure that supporters can claim their contributions during tax season.

The Charitable Donation Acknowledgement Letter is another document that shares similarities with the Salvation Army Tax Receipt form. This letter serves as proof of a donation to a charitable organization and includes vital information for tax deduction purposes, much like the Salvation Army form. It typically contains the donor's name, the amount donated, and a statement confirming that no goods or services were provided in exchange for the contribution. Both documents play a crucial role in the tax documentation process for charitable contributions.

A Tax Deductible Donation Receipt is also akin to the Salvation Army Tax Receipt form. This receipt is specifically designed to acknowledge donations that qualify for tax deductions. Similar to the Salvation Army form, this receipt includes detailed information about the donation, such as the donor's name, the date of the donation, and the amount. Both forms ensure donors have the necessary documentation to support their claims when filing taxes and provide transparency and accountability for the donation process.

The Nonprofit Gift Acknowledgement Letter shares similarities with the Salvation Army's tax receipt form through its structure and purpose. This document serves as a formal acknowledgment from a nonprofit to a donor, detailing the gift made and its impact. Like the Salvation Army form, it includes donor information, the donation's specifics, and often a thank-you message, reinforcing the value of the contribution. Both documents foster a positive relationship between charities and their supporters while facilitating the tax deduction process.

Lastly, the IRS Charitable Contribution Deduction Receipt resembles the Salvation Army Tax Receipt form in its function and requirements. Specifically designed to comply with IRS guidelines, this receipt includes comprehensive details about the donation, such as the donor’s information, amount, and date of contribution, similar to what is required by the Salvation Army form. This formal acknowledgment ensures donors can confidently claim their donations during tax season, highlighting the form's significance in the charitable donation ecosystem.

Dos and Don'ts

When preparing to submit a Salvation Army Tax Receipt form, it's essential to take careful steps to ensure the accuracy and completeness of your donation information. Here are four key practices to follow, along with four practices to avoid, ensuring your contribution is processed efficiently and qualifies for a tax deduction.

Things You Should Do- Thoroughly Review the Donation Options: Make a clear decision whether your contribution is a one-time gift, a monthly donation, or made in memory or honour of someone. Selecting the correct option ensures your donation is allocated according to your wishes.

- Fill in All Required Donor Information: Provide complete and accurate information including your name, address, telephone number, and email. This information is crucial not only for tax receipt issuance but also for the Salvation Army to maintain contact and express gratitude.

- Specify Your Donation Amount Clearly: If selecting "Other" for the donation amount, write the exact figure you intend to donate. Precise amounts help in ensuring that your tax receipt reflects the actual donation made.

- Sign the Form: Ensure that you sign the form, especially if you are making a donation using a credit card. Your signature is necessary for authorization and serves as a confirmation of the details provided on the form.

- Leave Sections Blank: Avoid skipping any required sections, particularly those related to donor information and donation details. Incomplete forms may delay the processing of your donation and the issuance of your tax receipt.

- Use Informal Communication: When specifying a personal message for an acknowledgment card, maintain a respectful and appropriate tone. Remember, this message will be shared with others to acknowledge your donation.

- Forget to Check Your Contact Permissions: If you wish to receive updates or further communication from The Salvation Army, ensure you've indicated your consent by ticking the appropriate box. Respect for your communication preferences is taken very seriously.

- Misplace the Charitable Registration Number: For your records and tax preparation purposes, take note of The Salvation Army's Charitable Registration Number provided on the form. This number is essential for claiming your donation on your tax return.

Following these guidelines will not only simplify the process but also enhance the effectiveness of your generous contribution. Remember, every donation is a step towards making a significant impact, and ensuring your documentation is accurately completed is key to supporting this journey.

Misconceptions

Only Monetary Contributions Qualify for a Tax Receipt: A common misconception is that the Salvation Army issues tax receipts only for monetary donations. However, the Salvation Army also provides tax receipts for qualifying non-monetary donations, such as goods or property, based on their assessed value.

Tax Receipts Are Automatically Issued for All Donations: Many believe that tax receipts are automatically issued for all donations made to the Salvation Army. In reality, tax receipts are issued for donations of $10.00 or more or upon request, as explicitly stated in the donation form instructions.

Any Amount Is Eligible for a Tax Receipt: It's often assumed that donations of any amount are eligible for a tax receipt. However, the Salvation Army's policy states that only donations of $10.00 or more qualify for a tax receipt, unless a specific request is made.

Donor Information Is Optional: The requirement of donor information might be seen as optional by some. Yet, for tax receipt issuance and donor acknowledgment purposes, this information is essential and must be accurately provided.

Email Consent Applies to All Correspondence: There's a misconception that allowing the Salvation Army to contact by email applies universally to all types of correspondence. This consent primarily relates to updates and information sharing, not necessarily impacting the receipt of the tax receipt or other transactional documents.

Credit Card Payments Do Not Require a Signature: Contrary to what some might think, credit card donations do require a handwritten signature on the donation form. This is a security measure and a standard procedure for processing such payments accurately and safely.

The Personal Message Section Affects the Tax Receipt: Some may wrongly assume that the personal message included in a donation 'in memory of' or 'in honour of' someone alters the processing or content of the tax receipt. The personal message is used solely for acknowledgment cards and does not impact the tax receipt.

All Donations Are Publicly Acknowledged: A common belief is that all donations receive public acknowledgment. The truth is, donor privacy is respected, and public acknowledgment only occurs if the donor explicitly agrees to it. The primary purpose of gathering donor details is for processing the donation and issuing the tax receipt.

Donor Information Is Shared With Third Parties: It's wrongly assumed that the Salvation Army shares or sells donor information to third parties. The Salvation Army explicitly states that it does not sell, trade, or share personal information, maintaining donor privacy and confidentiality.

Requesting Removal from Mailing Lists Invalidates Donation Acknowledgements: Some believe that asking to be removed from the Salvation Army's mailing list could affect the acknowledgment of their donations or the issuance of their tax receipts. Donors can choose to not receive further communications without impacting the acknowledgment process or their eligibility for a tax receipt.

Key takeaways

Filling out and using the Salvation Army Tax Receipt form correctly is crucial for ensuring that your charitable contributions are documented appropriately and can be claimed for tax purposes. Here are key takeaways to help donors navigate this process:

- Donation Options: The form accommodates various types of donations, including general one-time gifts, monthly donations, and tributes in memory or honor of someone. This flexibility allows donors to contribute in a manner that best aligns with their giving preferences.

- Donor Information is Mandatory: To complete the form properly, personal information including name, address, telephone number, and email is required. This ensures that the donation can be matched correctly to the donor for tax receipt purposes.

- Communication Preferences: Donors have the option to allow or disallow future communication via email from The Salvation Army Canada. This ensures donors have control over their contact preferences.

- Donation Amounts: The form provides preset donation amounts but also allows donors to specify other amounts, ensuring flexibility in the donation amounts. Every donation, regardless of the size, is significant.

- Payment Methods: It accepts various payment methods, including cheque and major credit cards like Visa, Mastercard, and American Express. This variety ensures convenience for the donor.

- Tax-deductibility: Donations of $10.00 or more are tax-deductible, and tax receipts will be issued for such donations or upon request if the donation is below this threshold. It's important for donors to note this to ensure they meet the criteria for tax deduction eligibility.

- Privacy of Information: Donor's personal information is securely handled and not shared beyond the organization. This commitment to privacy helps build trust between the donor and The Salvation Army.

Understanding these key aspects of the Salvation Army Tax Receipt form ensures that donors can contribute effectively and receive the appropriate documentation for their charitable actions, ultimately supporting the underlying mission of the Salvation Army while ensuring compliance with tax requirements.