Get Sales Tax Certificate Form

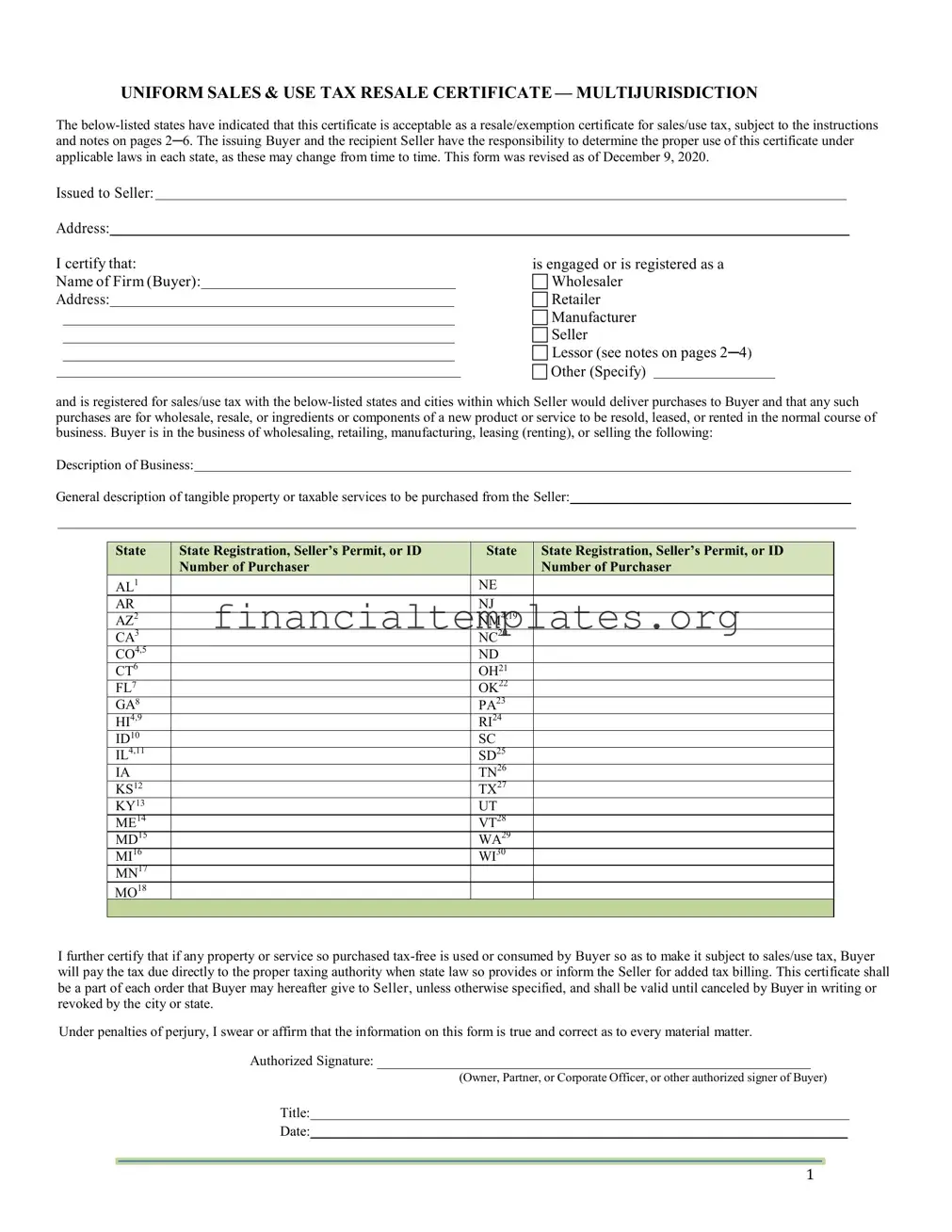

The Uniform Sales & Use Tax Resale Certificate—Multijurisdiction holds significance for businesses engaged in buying and selling goods across various states, allowing them to navigate the complexities of sales and use tax exemptions. Updated as recently as December 9, 2020, this form facilitates a streamlined process for purchasers who buy goods intending to resell, lease, or use them as components in new products to certify their eligibility for tax exemption in multiple jurisdictions. The document outlines the responsibility of both the issuing buyer and the recipient seller to ensure the certificate's proper use under the laws, which may vary or change over time, of each applicable state. It includes critical details such as the business type of the purchaser, a description of the business, and the general type of tangible property or taxable services to be bought. Moreover, the form requires state-specific registration or permit numbers to validate the buyer's claims, underscoring the necessity for accurate and up-to-date information to avoid legal pitfalls or the revocation of exemption privileges. Misuse of this certificate, as mentioned, can lead to penalties including fines or imprisonment, indicating the legal importance of its correct application. Through comprehensive instructions and notes, the certificate also guides on how and when it should be used or revoked, providing clarity on its application in different states and for varying business transactions.

Sales Tax Certificate Example

UNIFORM SALES & USE TAX RESALE CERTIFICATE — MULTIJURISDICTION

The

Issued to Seller:

Address:

I certify that: |

|

|

is engaged or is registered as a |

||||

Name of Firm (Buyer): |

|

|

|

Wholesaler |

|||

Address: |

|

|

Retailer |

||||

|

|

|

|

|

|

Manufacturer |

|

|

|

|

|

|

|

Seller |

|

|

|

|

|

|

|

Lessor (see notes on pages 2─4) |

|

|

|

|

|

|

|

Other (Specify) |

|

and is registered for sales/use tax with the

Description of Business:

General description of tangible property or taxable services to be purchased from the Seller:

State |

State Registration, Seller’s Permit, or ID |

State |

State Registration, Seller’s Permit, or ID |

|

Number of Purchaser |

|

Number of Purchaser |

AL1 |

|

NE |

|

AR |

|

NJ |

|

AZ2 |

|

NM4,19 |

|

CA3 |

|

NC20 |

|

CO4,5 |

|

ND |

|

CT6 |

|

OH21 |

|

FL7 |

|

OK22 |

|

GA8 |

|

PA23 |

|

HI4,9 |

|

RI24 |

|

ID10 |

|

SC |

|

IL4,11 |

|

SD25 |

|

IA |

|

TN26 |

|

KS12 |

|

TX27 |

|

KY13 |

|

UT |

|

ME14 |

|

VT28 |

|

MD15 |

|

WA29 |

|

MI16 |

|

WI30 |

|

MN17 |

|

|

|

MO18 |

|

|

|

|

|

|

|

I further certify that if any property or service so purchased

Under penalties of perjury, I swear or affirm that the information on this form is true and correct as to every material matter.

Authorized Signature:

(Owner, Partner, or Corporate Officer, or other authorized signer of Buyer)

Title:

Date:

1

INSTRUCTIONS

In order to comply with state and local sales tax law requirements, the Seller must have in its files a properly completed exemption certificate from all of its customers (Buyers) who claim a sales/use tax exemption. If the Seller does not have this certificate, it is obliged to collect the tax for the state in which the property or service is delivered.

Generally, a Buyer must be registered as a retailer for sales/use tax in states where the Buyer has sales/use tax nexus. The sales/use tax registration number(s) should be entered on this certificate. A Buyer has sales/use tax nexus in a state if the Buyer has physical presence in that state or has made sufficient sales to customers in that state to have sales/use tax economic nexus. The threshold of sales activity needed to establish sales/use tax economic nexus may differ by state. If the Buyer is entitled to claim a resale sales tax exemption or exclusion, the Buyer should complete the certificate and send it to the Seller at the time of purchase or as soon thereafter as possible. If the Buyer purchases tax free for a reason other than resale, ingredient or component exemption, the Buyer cannot use this form and must provide to the Seller the proper state exemption certificate for that specific exemption.

Caution:

Misuse of this certificate by Buyer, Seller, lessor, lessee, or the representative thereof may be punishable by fine, imprisonment or loss of right to issue or accept a certificate in some states or cities.

Notes:

1.Alabama: Each retailer shall be responsible for determining the validity of a purchaser’s claim for exemption.

2.Arizona: This certificate may be used only when making purchases of tangible personal property for resale in the ordinary

course of business, and not for any other statutory deduction or exemption. It is valid as a resale certificate only if it contains the purchaser’s name, address, signature, and Arizona transaction privilege tax (or other state sales tax) license number, as required by Arizona Revised Statutes §

3.California: a) This certificate is not valid as an exemption certificate. Its use is limited to use as a resale certificate subject to the provisions of Title 18, California Code of Regulations, Section 1668 (Sales and Use Tax Regulation 1668, Resale Certificate).

b)By use of this certificate, the purchaser certifies that the property is purchased for resale in the regular course of business in the form of tangible personal property, which includes property incorporated as an ingredient or component of an item manufactured for resale in the regular course of business.

c)When the applicable tax would be sales tax, it is the Seller who owes that tax unless the Seller takes a timely and valid resale certificate in good faith.

d)A valid resale certificate is effective until the issuer revokes the certificate.

4.Colorado, Hawaii, Illinois, and New Mexico: these states do not permit the use of this certificate to claim a resale exemption for the purchase of a taxable service for resale.

5.Colorado: Sellers should review 1 Code Colo. Regs.

6.Connecticut: This certificate is not valid as an exemption certificate. Its use is limited to use as a resale certificate subject to Conn. Gen. State

7.Florida: Allows the Multistate Tax Commission’s Uniform Sales and Use Tax Resale Certificate – Multijurisdiction for

Florida Department of Revenue at floridarevenue.com/taxes/certificates, or by calling

2

8.Georgia: a)The purchaser’s

purchaser is located outside Georgia, does not have nexus with Georgia, and the tangible personal property is delivered by drop shipment to the purchaser’s customer located in Georgia.

b)The certificate relieves the seller from the burden of proof on sales for resale if the seller acquires from the purchaser a properly completed certificate, taken in good faith, from a purchaser who:

(i)Is engaged in the business of selling tangible personal property;

(ii)Has a valid sales tax registration number at the time of purchase and has listed his or her sales tax number on the certificate; and

(iii)At the time of purchasing the tangible personal property, the seller has no reason to believe that the purchaser does not intend to resell it in his or her regular course of business.

9.Hawaii: Allows this certificate to be used by the seller to claim a lower general excise tax rate or no general excise tax, rather than the buyer claiming an exemption. The no tax situation occurs when the purchaser of imported goods certifies to the seller, who originally imported the goods into Hawaii, that the purchaser will resell the imported goods at wholesale. If the lower rate or

10.Idaho: This certificate may be used only when making purchases of tangible personal property for resale in the ordinary course of business, and not for any other statutory deduction or exemption. It is valid as a resale certificate only if it complies with Rule 128 of the Idaho Administrative Rules for Sales Tax (IDAPA 35.01.02.128).

11.Illinois: Use of this certificate in Illinois is subject to the provisions of 86 Ill. Adm. Code Ch.I, Sec. 130.1405 (Seller’s Responsibility to Obtain Certificates of Resale and Requirements for Certificates of Resale). Illinois does not have an exemption for sales of property for subsequent lease or rental, except as follows: (i) a motor vehicle that is used for automobile renting subject to the Automobile Renting Occupation and Use tax Act (35 ILCS

The registration number to be supplied next to Illinois on page 1 of this certificate must be the Illinois registration or resale number; no other state’s registration number is acceptable.

“Good faith” is not the standard of care to be exercised by a retailer in Illinois. A retailer in Illinois is not required to determine whether the purchaser actually intends to resell the item. Instead, a retailer must confirm that the purchaser has a valid registration or resale number at the time of purchase. If a purchaser fails to provide a certificate of resale at the time of sale in Illinois, the seller must charge the purchaser tax.

While there is no statutory requirement that blanket certificates of resale be renewed at certain intervals, blanket certificates should be updated periodically, and no less frequently than every three years.

12.Kansas: Purchaser must enter a valid Kansas Registration Number issued by the Kansas Department of Revenue. Exemption certificates must be obtained from the purchaser at the time of the sale, but no later than 90 days subsequent to the date of sale. This resale certificate may only be used as a resale exemption certificate or ingredient or component part exemption certificate. This resale certificate may not be used by contractors to purchase materials without sales tax. This resale certificate may not be used by Manufacturing Companies to purchase machinery and equipment without sales tax. See Kansas Certificate

13.Kentucky: a) Kentucky does not permit the use of this certificate to claim a resale exclusion for the purchase of admissions.

3

b)This certificate is not valid as an exemption certificate. Its use is limited to use as a resale certificate subject to the provisions of Kentucky Revised Statute 139.270.

c)The use of this certificate by the purchaser constitutes the issuance of a blanket certificate in accordance with Kentucky Administrative Regulation 103 KAR 31:111.

14.Maine: This state does not have an exemption for sales of property for subsequent lease or rental. This certificate is not valid for

use by manufacturers purchasing tangible personal property that becomes an ingredient or component part of a product manufactured by the manufacturer. Please use Maine’s Industrial Users Exemption Certificate

15.Maryland: This certificate is not valid as an exemption certificate. Itsuseislimitedtouseasaresalecertificatesubjecttotheprovisionsof MdTax–

organization. Exemption certifications issued to religious organizations consist of 8 digits, the first two of which are always

“29”. Maryland salesandusetaxregistration numbers, exemptions, and direct pay numbers may be verified on the website of the Comptroller of the Treasury at www.marylandtaxes.gov.

16.Michigan: Blanket certificates are effective for a period of four years unless a lesser period is mutually agreed to and stated on this certificate. A seller who receives and maintains a record of a properly completed certificate is not generally liable for sales or use tax on the transaction, even if a purchaser improperly claims an exemption. There are certain limited situations in which a seller can be liable for the tax, such as those involving fraud on the part of the seller. For more information, see revenue Administrative Bulletin (RAB)

17.Minnesota: Purchaser’s Minnesota tax identification number should be inserted into the row labeled “MN” in the state chart on page 1. If purchaser does not have a Minnesota tax

identification number, the following are acceptable:

Purchaser’s tax identification number issued by a state other than Minnesota and the

name of the state;

Purchaser’s federal Employer identification Number;

The number of Purchaser’s valid state

identification number, along with the state of issue.

Purchaser must identify purchaser’s type of business using Minnesota’s business

system. Check the correct box near the top of page 1. If you check the box labeled

“Other,” provide the appropriate Minnesota business code in the space following the “Other” check box. You can find a list of Minnesota business codes on the Min nesota

exemption certificate (Form ST3).

Purchaser must update the certificate data, as necessary, if this certificate is to be used as a blanket exemption certificate for continuing future purchases.

Note that Minnesota allows this certificate to be used to claim a resale exemption only. It does not permit this certificate to be used to claim any other type of exemption. To claim an exemption other than resale, use the Minnesota exemption certificate (Form ST3) or the Streamlined Sales Tax Governing Board exemption certificate (Form F0003).

18. |

Missouri: |

a) Purchasers who improperly purchase property or services |

|

|

pay the tax, interest, additions to tax, or penalty. |

b)Even if property is delivered outside Missouri, facts and circumstances may subject it to Missouri tax, contrary to the second sentence of the first paragraph of the above instructions.

19.New Mexico: For transactions occurring on or after July 1, 1998, New Mexico will accept this certificate in lieu of a New Mexico nontaxable transaction certificate and as evidence of the deductibility of a sale of tangible personal property provided:

a)this certificate was not issued by the State of New Mexico;

b)the buyer is not required to be registered in New Mexico; and

c)the buyer is purchasing tangible personal property for resale or incorporation as an ingredient or component of a manufactured product.

20.North Carolina: This certificate is not valid as an exemption certificate if signed by a person such as a contractor who intends to use the property. Its use is subject to G.S.

4

21. Ohio: a) The buyer must specify which one of the reasons for exemption on the certificate applies. This may be done by circling or underlining the appropriate reason or writing it on the form above the state registration section. Failure to specify the exemption reason will, on audit, result in disallowance of the certificate.

b)If no certificate is provided or obtained from the buyer at the time of the sale or within ninety days after the date on which such sale is consummated, it shall be presumed that the tax applies.

22.Oklahoma: Oklahoma would allow this certificate in lieu of a copy of the purchaser’s sales tax permit as one of the elements of “properly completed documents” which is one of the three requirements which must be met prior to the vendor being relieved of liability. The other two requirements are that the vendor must have the certificate in his possession within ninety (90) days

subsequent to the date of sale and must accept the documentation in good faith. The specific documentation required under OAC

Absent strict compliance with these requirements, Oklahoma holds a seller liable for sales tax due on sales where the claimed exemption is found to be invalid, for whatever reason, unless the Tax Commission determines that purchaser should be pursued for collection of the tax resulting from improper presentation of a certificate.

23.Pennsylvania: This certificate is not valid as an exemption certificate. It is valid as a resale certificate subjecttotheprovisions

of 61PACode §32.3. The buyer should enter their

24.Rhode Island: Rhode Island allows this certificate to be used to claim a resale exemption only when the item will be resold in the same form. It does not permit this certificate to be used to claim any other type of exemption.

25.South Dakota: Services which are purchased by a service provider and delivered to a current customer in conjunction with the services contracted to be provided to the customer are claimed to be for resale. Receipts from the sale of a service for resale by the purchaser are not subject to sales tax if the purchaser furnishes a resale certificate which the seller accepts in good faith. In order for the transaction to be a sale for resale, the following conditions must be present:

(a)The service is purchased for or on behalf of a current customer;

(b)The purchaser of the service does not use the service in any manner; and

(c)The service is delivered or resold to the customer without any alteration or change.

26.Tennessee:

Any tangible personal property or other taxable item or service purchased without the payment of tax upon this resale certificate that is used or consumed in any manner by the buyer, or is given away, must be reported and the tax paid directly to the Tennessee Department of Revenue.

27.Texas: Items purchased for resale must be for resale within the geographical limits of the United States, its territories, and possessions.

28.Vermont: The reseller must be registered to collect Vermont sales tax. Vermont allows this certificate to be used to claim a resale exemption for goods only, not component parts to a service. It is not to be used by contractors. Vermont’s manufacturing exemption is limited to property consumed in the manufacturing process, used directly and exclusively in the manufacturing process, or packaging or shipping materials for use by a manufacturer or wholesale distributor. Any other uses and the use for any other exemptions is not permitted.

While there is no statutory requirement that blanket certificates of resale be renewed at certain intervals, blanket certificates should be updated periodically, and no less frequently than every three years.

29.Washington: Buyer acknowledges that in addition to the amount of tax due, the misuse of this form may result in interest and penalties being imposed by law.

30.Wisconsin: Allows this certificate to be used to claim a resale exemption only. It does not permit this certificate to be used to claim any other type of exemption.

5

Frequently Asked Questions

Uniform Sales and Use Tax Certificate – Multijurisdictional

•To whom do I give this certificate?

•Can I register for multiple states simultaneously?

•I have received this certificate from my customer. What do I do with it?

•Am I the Buyer or the Seller?

•What is the purpose of this certificate?

•How do I fill out the certificate?

•What information goes on the line next to each state abbreviation?

•What if I don’t have an ID number for any (or some) state(s)?

•Who should use this certificate?

•Can I use this certificate?

•Which states accept the certificate?

•I am based in, buying from, or selling into Maine. Can I use this certificate?

•I am a drop shipper. Can I use this certificate?

•Do I have to fill this certificate out for every purchase?

•Can this certificate be used as a blanket certificate?

•Who determines whether this certificate will be accepted?

•I have been asked to accept this certificate. How do I know whether I should accept it?

•Is there a more recent version of this certificate?

•To whom should I talk to for more information?

To whom do I give this certificate?

If you are purchasing goods for resale, you will give this certificate to your vendor, so that your vendor will not charge you sales tax.

If you are selling goods for resale, and you have received this certificate from your buyer, you will keep the certificate on file.

Can I register for multiple states simultaneously?

A buyer must be registered as a retailer for sales/use tax in states where the buyer has sales/use tax nexus in a state.

Registration in each state must be done separately with that state. See the state tax agency’s website. The Federal

Tax Administrators (FTA) maintains a centralized list of links to state agency websites:

I have received this certificate from my customer. What do I do with it?

Once you have examined the certificate and you have accepted it, you will keep it on file as prescribed by applicable state laws. The relevant state will generally be the state where you are located, or the state where the sales transaction took place.

Am I the Buyer or the Seller?

If you are purchasing goods for resale, you are the Buyer. If you are selling goods to a buyer who is purchasing them for resale, you are the Seller.

6

What is the purpose of this certificate?

This certificate is to be used as supporting documentation that the Seller should not collect sales tax because the good or service sold to the Buyer, is exempt from the tax as a sale for resale or as an ingredient or component of a product manufactured by the Buyer and to be resold.

How do I fill out the certificate?

The individual filling out the certificate is referred to as the Buyer. The first two lines, “Issued to Seller” an “Address”, should be filled in with the name and address of the Seller. The rest of the information refers to the Buyer (name and address of Buyer, business engaged in, description of business, property or services to be purchased). The line next to each state abbreviation should be filled out with the relevant state ID number.

What information goes on the line next to each state abbreviation?

The line next to each state abbreviation should be filled in with the relevant state ID number. This will be the sales/use tax registration or resale authorization number issued by the state (see next FAQ for an exception). For example, on the line next to AL, provide the sales/use tax registration number issued by Alabama. The relevant registration number may be given various names in the different states. Some of the terms for this number are State Registration or Seller’s Permit Number. Regardless of the name, this will be a number that has been issued by the state to the Buyer (see next FAQ for an exception). This number is generally associated with the reseller’s authority to collect and remit sales/use tax.

What if I don’t have a registration number for any (or some) state(s)?

The states vary in their rules regarding requirements for a reseller exemption or exclusion. Some states require that the reseller (Buyer) be registered to collect sales tax in the state where the reseller makes its purchase. Other states will accept the certificate if the registration number is provided for some other state (such as the resident state of the Buyer). You should check with the relevant state to determine whether you meet the requirements of that state.

Who should use this resale certificate?

A Buyer who is registered in one of the states listed on the resale certificate may be able to use this certificate to make purchases of tangible property or taxable services that are for resale

Can I use this resale certificate?

The states vary in their rules for use of this resale certificate. You should check with the relevant state to determine whether you can use this resale certificate for purchases from sellers registered in that state. The footnotes to the certificate provide some guidance; however, the Multistate Tax Commission cannot guarantee that any state will accept this certificate. States may change their policies without informing the Multistate Tax Commission.

Which states accept the certificate?

States listed on the certificate accepted this certificate as of December 1, 2020. States may change their policies for acceptance of the certificate without notifying the Multistate Tax Commission. You may check with the relevant state to determine the current status of the state’s acceptance policy. See next FAQ.

I am based in, buying from, or selling into Maine. Can I use this certificate?

Please contact Maine Revenue Services.

I am a drop shipper. Can I use this certificate?

If you are the Buyer and your Seller ships directly to your customers, you may be able to use this certificate because you are a reseller. However, your Seller may be unwilling to accept this certificate if you are not

7

registered to collect sales tax in the state(s) where your customers are located.

If you are the Seller, and you have nexus with the state(s) into which you are shipping to your Buyer’s customers, you may be required by such state(s) to remit sales tax on those sales if your Buyer is not registered to collect sales tax.

Do I have to fill this resale certificate out for every purchase?

In many cases, this certificate can be used as a blanket certificate, so that you will only need to fill it out once for each of your Sellers. Some states require periodic replacement with a renewed certificate (see notes on certificate).

Can this resale certificate be used as a blanket certificate?

In many states this certificate can be used as a blanket certificate. You should verify this with the applicable state. A blanket certificate is one that can be kept on file for multiple transactions between a specific Buyer and specific Seller.

Who determines whether this resale certificate will be accepted?

The Seller will determine whether it will accept the certificate from the Buyer. The applicable state will determine whether a certificate is acceptable for the purpose of demonstrating that sales tax was properly exempted. The applicable state will generally be the state where the Seller is located or has nexus or the state where the sales transaction took place, or where the Buyer is located. The Multistate Tax Commission does not determine whether this certificate will be accepted either by the Seller or the applicable state.

I have been asked to accept this resale certificate. How do I know whether I should accept it?

You should contact your state revenue department if you are not familiar with the policies regarding acceptance of resale certificates.

In order for the certificate to be accepted in good faith by the Seller, Seller must exercise care that the property or service being sold is of a type normally sold wholesale, resold, leased, rented or incorporated as an ingredient or component of a product manufactured by Buyer and then resold in the usual course of its business. A Seller failing to exercise care could be held liable for the sales tax due in some states.

Is there a more recent version of this certificate?

No. The most recent version is posted on our website (revised as of December 9, 2020). You may have seen a version that has been modified in an unauthorized manner. You should not use any version other than the one available on our website.

Whom should I talk to for more information?

For information regarding whether the certificate will be accepted in the applicable state, you should contact the revenue department of that state. The Multistate Tax Commission’s Member States webpage has links to revenue department websites.

8

Document Specifics

| Fact number | Fact detail |

|---|---|

| 1 | This form was revised as of December 9, 2020. |

| 2 | It is acceptable as a resale/exemption certificate in multiple jurisdictions, subject to varying state laws. |

| 3 | Both the buyer's and seller's responsibility to determine correct use under applicable state laws. |

| 4 | May be used for purchases for resale, or as ingredients or components of a new product or service. |

| 5 | To comply with state and local sales tax laws, a properly completed certificate must be provided to the seller. |

| 6 | Buyers must be registered for sales/use tax in states where they have a sales/use tax nexus. |

| 7 | Misuse of this certificate may result in punishment, including fine or imprisonment. |

| 8 | Blanket certificates should be updated periodically, at least every three years in some states. |

| 9 | Specific provisions apply for certain states regarding the use and acceptance of this certificate. |

Guide to Writing Sales Tax Certificate

To accurately complete a Uniform Sales & Use Tax Resale Certificate - Multijurisdiction, the focus should be on providing precise and verifiable information, ensuring that your business correctly leverages the benefits while adhering to state-specific regulations. This process involves checking the applicable boxes that align with your business's nature, filling in business details diligently, and specifying the states where you have a tax nexus. Below is a step-by-step guide designed to make your submission process smooth and compliant with the regulations.

- Start with the section labeled "Issued to Seller", where you should insert the seller's full legal name and address, ensuring accuracy to avoid processing delays.

- In the "Name of Firm (Buyer)" field, enter the legal name of your business as it is registered with the involved states.

- Identify the nature of your business by ticking the appropriate box(es) that best describe your business operation: Wholesaler, Retailer, Manufacturer, Seller, Lessor, or specify under "Other" if none of the listed categories suits your business model.

- Input your business address just underneath the section where you've identified your business type. Be thorough and include all relevant address details such as street name, number, city, state, and ZIP code.

- Complete the "Description of Business" by providing a brief but comprehensive explanation of what your business does, focusing on the main activities related to the items being purchased for resale.

- Under "General description of tangible property or taxable services to be purchased from the Seller," detail the types of goods or services you intend to buy. This helps in establishing the purpose of purchase as for resale.

- Proceed to the section requiring the State Registration, Seller’s Permit, or ID Number of Purchaser. For each state listed, fill in your registration or permit number if applicable. This part is crucial for validating the form across multiple jurisdictions.

- Review the instructions and notes on pages 2 through 6 carefully to understand the extent of your responsibilities and the conditions under which the certificate can be used in each state listed.

- At the bottom of the form, the "Authorized Signature" section must be completed with the signature of an owner, partner, corporate officer, or another authorized signer of the Buyer. Print the name, title, and date alongside the signature to validate the document.

Upon completion, ensure that a copy of the certificate is kept for your records and send the original to the seller before making your tax-exempt purchase. It's essential to remember that this document must be filled out accurately and in good faith. The misuse of this certificate could lead to penalties, fines, or imprisonment, as noted in the cautions and legal reminders outlined within the form. Additionally, remain vigilant about changes in sales/use tax laws in the jurisdictions where you operate, as laws and requirements can change, impacting how the certificate should be used in future transactions.

Understanding Sales Tax Certificate

What is a Uniform Sales & Use Tax Resale Certificate - Multijurisdiction?

A Uniform Sales & Use Tax Resale Certificate - Multijurisdiction is a form accepted by multiple states that allows sellers to purchase goods tax-free, provided they are purchased for resale in the normal course of business. This certificate covers various types of businesses including wholesalers, retailers, manufacturers, lessors, and others, ensuring that each transaction complies with the sales and use tax laws of the involved states. It is the buyer's and seller's responsibility to determine the appropriate use of this certificate under the laws of each state.

Who needs to fill out this form?

Any business purchasing goods for resale, manufacturing, leasing, or as components of new products, intending to sell, lease, or rent in their normal course of business, must fill out this form. The form requires specific information, including the business's name, the nature of their operations, and their sales/use tax registration numbers for each state where they operate. This form serves as evidence that the purchase is for resale and thus exempt from sales tax.

How does a business qualify to use this certificate?

To qualify for using the Uniform Sales & Use Tax Resale Certificate, a business must be registered to collect sales/use tax in the states where it has a taxable presence or nexus. Physical presence or significant sales activity in a state could establish such nexus. The business must also be engaged in activities that include selling tangible personal property or specified services that can be resold in the course of business. Upon providing this certificate to the seller, it absolves the seller from the obligation to collect sales tax on behalf of the state, assuming the certificate is filled out completely and in good faith.

Can this certificate be used for services?

The certificate usually applies to tangible personal property intended for resale. However, in certain jurisdictions like Colorado, Hawaii, Illinois, and New Mexico, this certificate cannot be used to claim a resale exemption for the purchase of a taxable service for resale. Always check specific state guidelines because the applicability of this certificate for services can vary based on local tax laws and regulations.

What are the consequences of misusing this certificate?

Misuse of the Uniform Sales & Use Tax Resale Certificate can result in significant penalties, including fines, imprisonment, or the loss of the right to issue or accept a certificate in some states or cities. Misuse includes using the certificate to buy goods tax-free that are not for resale, or not following through with paying sales/use tax on items consumed by the business that do not qualify for exemption under this certificate.

How long is the certificate valid?

The validity of the Uniform Sales & Use Tax Resale Certificate continues until it is cancelled in writing by the buyer or revoked by the city or state. However, it is a good practice to periodically review and renew the certificates as needed to ensure compliance with the latest tax laws and to maintain accurate and updated information with the sellers.

Common mistakes

Filling out the Uniform Sales & Use Tax Resale Certificate can be tricky, and making mistakes can lead to unnecessary headaches for both buyers and sellers. Here are 10 common mistakes people make when completing this form:

- Not providing complete information about the buyer and seller: It's crucial to fill in all required fields, including the full names and addresses of both parties.

- Failure to specify the type of business: The form requires the buyer to indicate whether they are a wholesaler, retailer, manufacturer, lessor, or other. Omitting this information can invalidate the certificate.

- Incorrect or missing state registration numbers: Buyers must include their sales/use tax registration numbers for each state listed on the form. Using incorrect numbers or failing to provide them can lead to the rejection of the certificate.

- Not describing the business purpose: The certificate asks for a description of the business and the general description of tangible property or taxable services to be purchased. Leaving this section blank or being too vague can create issues.

- Using the certificate for ineligible products or services: Some states do not allow the use of this certificate for the purchase of taxable services for resale. Misapplying the certificate for such purchases can lead to penalties.

- Assuming the certificate covers all transactions: The form must be part of each order between the buyer and seller unless otherwise specified. Assuming it covers all future transactions without proper specification can lead to disputes.

- Not updating or renewing the certificate: While the certificate is valid until canceled or revoked, changes in business operations or state laws may require an updated certificate.

- Signing the certificate without proper authority: The certificate must be signed by an owner, partner, corporate officer, or another authorized signer of the buyer. Unauthorized signatures can make the certificate invalid.

- Failing to specify the reason for exemption: In states like Ohio, the buyer must specify the reason for exemption right on the certificate. Not doing so can lead to the disallowance of the certificate upon audit.

- Misuse of the certificate: Using the certificate for personal purchases or for items not intended for resale can result in fines, imprisonment, or the loss of the right to issue or accept a certificate.

By paying close attention to these common mistakes, buyers and sellers can ensure their transactions are smooth and comply with applicable sales and use tax laws.

Documents used along the form

When businesses engage in transactions that involve the resale of goods and services, they often require various forms and documents besides the Uniform Sales & Use Tax Resale Certificate. These documents help in complying with tax laws, verifying business operations, or establishing the terms of a sale or service. Understanding these documents can assist businesses in maintaining proper records and ensuring transactions are conducted smoothly and in accordance with the law.

- Business License: This document serves as official permission to operate a business within a specific jurisdiction. It verifies the legal standing and compliance of a business with local regulations and is often required when applying for a sales tax certificate.

- Seller’s Permit: Similar to the Sales Tax Certificate, a Seller’s Permit authorizes a business to sell goods and services while collecting sales tax. This permit is crucial for businesses that sell taxable goods and services at the retail or wholesale level.

- EIN Confirmation Letter (CP 575): Issued by the IRS, this document confirms a business's Employer Identification Number (EIN). This number is needed for tax administration and is often required when opening a business bank account or applying for business licenses.

- Certificate of Authority: Needed when a business operates outside the state of its original incorporation, this document grants permission to do business in a non-domestic state while ensuring compliance with its tax laws and regulations.

- Franchise Tax Board Certificate of Account Status: This certificate, relevant for businesses in certain states, verifies that a business is in good standing with the state’s Franchise Tax Board by meeting all tax obligations, including the payment of franchise taxes.

- Reseller Agreement: A contract between a seller and a buyer that outlines the terms under which the buyer can resell the seller’s products. This document is vital for clarifying the conditions of resale, including pricing, territory, and how sales tax is handled.

Collectively, the utilization of these documents, along with a Sales Tax Certificate, ensures that businesses operate within legal parameters, maintain proper tax reporting, and establish clear agreements between sellers and buyers. Being familiar with these documents can significantly aid businesses in navigating the complexities of sales transactions and tax obligations efficiently.

Similar forms

The Sales Tax Certificate form closely mirrors the Employer Identification Number (EIN) application in essence. Both serve as crucial identifiers for businesses within government systems, facilitating tax-related processes and compliance. While the Sales Tax Certificate is specific to sales and use tax, authorizing businesses to collect tax on sales or to purchase items tax-free for resale, the EIN application identifies a business entity for federal tax purposes. This similarity underscores how each document supports the operational and regulatory requirements of businesses, ensuring that they meet their tax obligations accurately.

Comparable to the Sales Tax Certificate, a Resale Certificate also aims at tax exemption for goods intended for resale. Retailers use Resale Certificates to buy products without paying sales tax if the items are to be sold in their business operations. The core resemblance lies in their role in documenting the intent to resell goods, thereby preventing double taxation – initially when the good is purchased for resale, and subsequently when the final consumer buys the product. Both certificates, thus, facilitate tax-free transactions between businesses, under the condition that the purchased goods are ultimately sold to end consumers.

A Business License shares commonalities with the Sales Tax Certificate, as both are foundational to the legal operation of businesses. While a Business License grants permission to operate within a certain locality or jurisdiction, the Sales Tax Certificate specifically relates to tax collection and exemption activities. Each document ensures businesses comply with local, state, and federal regulations, making them legally accountable for their activities. They represent two sides of the operational compliance coin: permission to operate and permission to engage in specific tax-related transactions.

The Certificate of Authority is akin to the Sales Tax Certificate in that both are critical for businesses to lawfully engage in activities within state boundaries. Businesses obtain a Certificate of Authority to legally conduct business outside of the state where they were originally established, ensuring compliance with foreign state regulations. Similarly, the Sales Tax Certificate allows entities to handle sales tax appropriately, adhering to each state’s tax laws. Both certificates thus facilitate cross-border business operations, albeit on different fronts – general business activities versus tax-specific undertakings.

An Exemption Certificate is similar to the Sales Tax Certificate, particularly when the latter is used to purchase items without paying sales tax due to intent for resale. Exemption Certificates cover a broad range of tax exemptions, including but not limited to goods for resale, allowing businesses or individuals to bypass certain taxes under specified conditions. The common thread is the strategic use of these documents to legally avoid tax payments on eligible transactions, with the responsibility to adhere to applicable laws and conditions fully resting on the certificate holder.

The Vendor’s License and the Sales Tax Certificate intersect in their roles within sales and taxation processes. A Vendor’s License typically permits businesses to sell goods or services, often including the responsibility to collect sales taxes. Similarly, the Sales Tax Certificate addresses the collection, remittance, and exemption of sales tax. Both documents enable businesses to partake in commerce legally while ensuring the correct handling and transfer of sales taxes to the appropriate authorities, embodying the link between commerce facilitation and tax regulation.

Lastly, the Use Tax Certificate bears resemblance to the Sales Tax Certificate due to its focus on tax treatment regarding the consumption, use, or storage of goods. While the Sales Tax Certificate often touches on resale and tax exemption for purchases, a Use Tax Certificate may come into play for items bought without sales tax – for instance, through interstate commerce – and subsequently used within a state that levies a use tax. Both certificates are pivotal in delineating the tax obligations related to the acquisition and final consumption of goods, ensuring businesses correctly apply sales and use tax laws.

Dos and Don'ts

When filling out the Uniform Sales & Use Tax Resale Certificate form, it's important to handle the process carefully to ensure compliance with the tax laws of each relevant state. The guidelines below can help you successfully complete the form while avoiding common pitfalls.

Do's:

- Ensure Accuracy: Double-check the information provided, especially the business name, address, and state sales/use tax registration numbers. These must accurately reflect your current business registration details.

- Specify the Type of Business: Clearly indicate the nature of your business (wholesaler, retailer, manufacturer, etc.) as this determines the eligibility for tax exemptions under different jurisdictions.

- Keep It Updated: Regularly review and update the certificate as needed, especially if there are changes in your business or the states where you have tax nexus. Some states require renewal or updating of certificates periodically.

- Provide a Detailed Description: Include a comprehensive description of the tangible personal property or taxable services to be purchased tax-free. This helps in validating the certificate's proper use.

Don'ts:

- Use It Improperly: Avoid using the certificate for purchases that are not for resale, or for personal use, as misuse can lead to penalties, fines, or imprisonment in some jurisdictions.

- Delay Submission: Do not wait too long to submit the certificate to the seller. It's best practice to provide it at the time of purchase or as soon thereafter as possible to comply with various states' laws.

- Omit the Signature: Failing to sign the certificate renders it invalid. Ensure it is signed by an owner, partner, corporate officer, or another authorized individual of the buyer’s firm.

- Ignore State-Specific Requirements: Each state has its own rules regarding sales/use tax nexus and what qualifies for a resale exemption. Neglecting these can lead to the certificate being rejected or the transaction being subject to tax.

Filling out the Sales Tax Certificate form correctly is crucial for compliance with state tax laws. Being thorough and precise helps avoid complications and ensures that your business operates smoothly within legal tax guidelines.

Misconceptions

Understanding the Sales Tax Certificate form can sometimes be confusing. There are several common misconceptions about how it works and what it allows a business to do. Let's clear up some of these misunderstandings:

Every business can use this form for exemption on all purchases. In reality, the form is specifically designed for businesses purchasing goods for resale, ingredients or components of a new product, or a service to be resold. It's not a blanket exemption for all purchases a business might make.

Once you fill out the form, you never have to do it again. While it's true that this form can act as a blanket certificate in many cases, it is the buyer's responsibility to cancel or update the certificate in writing or if it's revoked by the city or state. Additionally, the conditions under which the form is valid may change, requiring new certification.

The form automatically exempts a business from sales tax in all states. Although the form is a Multijurisdictional certificate, it's crucial to understand that each state has specific rules and uses for the certificate. Not all states may accept this certificate as valid, and some states have specific requirements or additional documents that must be used instead.

Filling out the form is all that’s required to ensure exemption. Completing the form is a key step, but it must be properly executed and accepted in good faith by the seller. Misuse of the certificate by either party can result in penalties, including fines or imprisonment. Proper documentation and adherence to state laws are crucial.

This certificate allows for the purchase of any services tax-free for resale. The use of this certificate to claim a resale exemption for services is explicitly not permitted in several states listed in the instructions. Each state may have different rules regarding what constitutes a taxable service and how those services can be resold.

Any misuse of the certificate has negligible consequences. On the contrary, misuse of the Sales Tax Certificate form can lead to severe consequences including fines, imprisonment, and the loss of the right to issue or accept a certificate. Both buyers and sellers must understand the appropriate use and requirements of this certificate to avoid legal trouble.

It's important for both buyers and sellers to fully understand and comply with the specific regulations of each state regarding the use of the Sales Tax Certificate form to ensure a smooth and legal transaction process.

Key takeaways

Understanding the Sales Tax Certificate form is essential for businesses engaged in purchasing goods for resale, leasing, or manufacturing purposes. It's designed to help companies navigate through sales and use tax exemptions across various jurisdictions. Here are four key takeaways to keep in mind:

- Each state has specific guidelines about the acceptability of this certificate for sales/use tax exemption. Businesses must familiarize themselves with the rules governing the use of this form in each state where they operate to ensure compliance and avoid penalties.

- The form requires detailed information about the buyer, including the type of business (e.g., wholesaler, retailer, manufacturer), description of goods or services purchased, and registration numbers for states in which the buyer is registered to collect sales/use tax. Completeness and accuracy of this information are crucial for the form's validity.

- Certification by the buyer is critical. By signing the certificate, the buyer affirms that the goods or services purchased are for resale, leasing, or as components in manufacturing and agrees to pay sales/use tax directly to the state if the goods are used in a manner that makes them taxable. Misuse of the certificate may result in fines, imprisonment, or loss of the right to issue or accept the certificate in some states.

- The form also emphasizes the importance of the seller obtaining and maintaining a properly completed certificate. Failure to do so may leave the seller liable for any unpaid sales/use tax. Sellers should verify the validity of the buyer's claims and maintain updated records of all certificates.

Adherence to the guidelines outlined in the Sales Tax Certificate form ensures that businesses can effectively manage their sales/use tax obligations and capitalize on exemptions for which they are eligible. Both buyers and sellers play critical roles in complying with tax laws, reducing the risk of fines or legal issues stemming from misuse of the certificate.

Popular PDF Documents

Broward Tax Collector Plantation - Facilitates economic development initiatives by ensuring that businesses are properly accounted for and taxed according to city ordinances.

Proof of Payment Letter - An integral part of maintaining an organized and updated account profile within Loyola Plans' systems.

What Does 1040 Mean - Professional tax preparers should provide their contact info for follow-ups on the return.