Get Rut 75 Tax Form

When people acquire an aircraft or watercraft through non-traditional methods such as gifts, donations, transfers, or non-retail purchases, navigating the tax obligations can seem daunting. The Form RUT-75, Aircraft/Watercraft Use Tax Transaction Return, is a crucial document for individuals in Illinois in such situations. This form applies to a wide range of aircraft, from airplanes and helicopters to gliders and seaplanes, as well as several classes of watercraft, including personal watercraft like jet skis. However, it's important to note that canoes and kayaks are exempt from this requirement. The form is not necessary if the purchase is from an Illinois dealer or leasing company because different forms cater to those transactions. Understanding when and how to file Form RUT-75 is essential, as it must be done within 30 days of the acquisition or entry of the item into Illinois. Helpfully, the state provides avenues for assistance through its website or direct phone support for those uncertain about the process. The form details required include purchaser information, specifics about the item acquired, and tax calculation based on the purchase price or fair market value, with provisions for exemptions under certain conditions. Penalties for late filing or payment emphasize the importance of adherence to deadlines and accuracy in submitting this form. For many, this form is a gateway to exploring the skies or cruising the waters legally and without tax-related concerns.

Rut 75 Tax Example

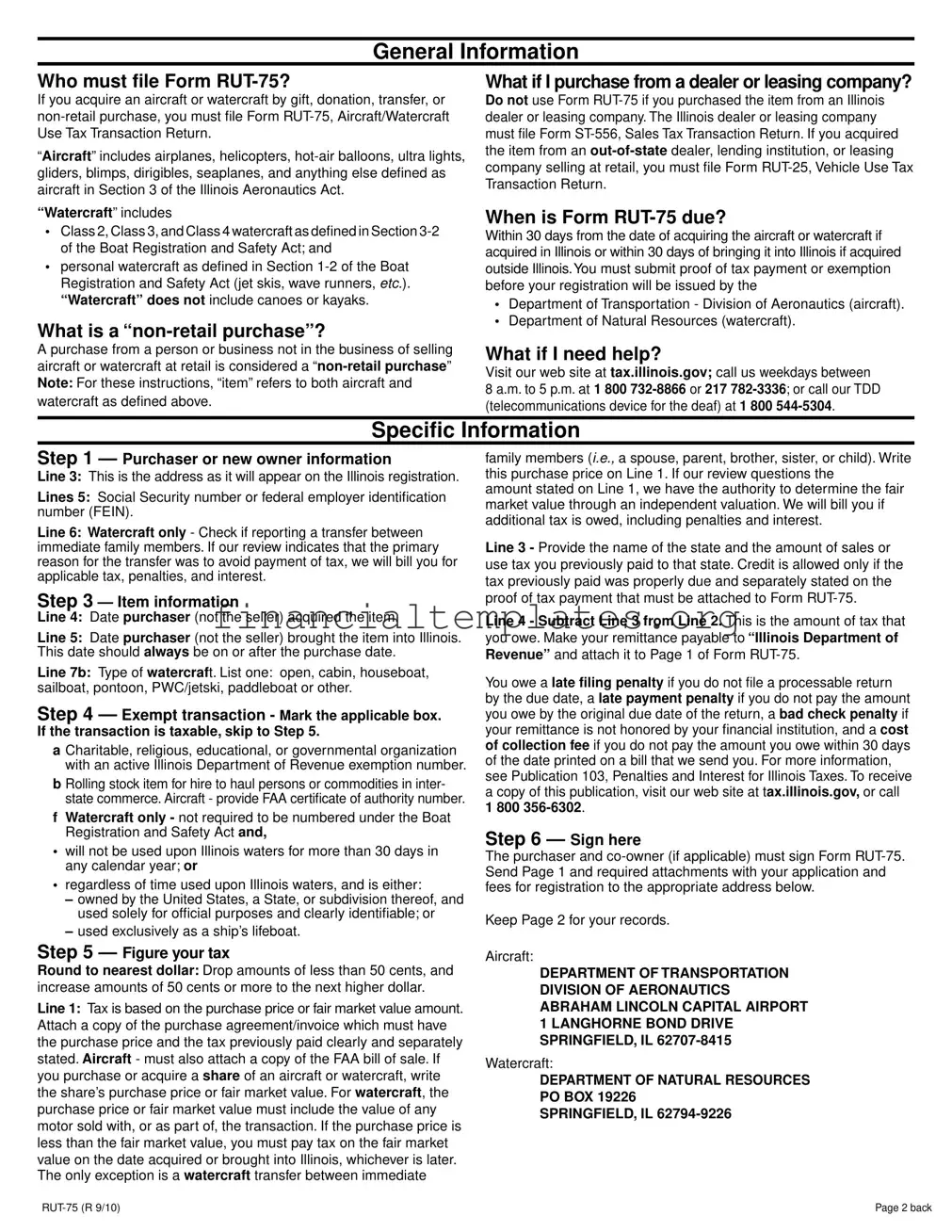

General Information

Who must file Form

If you acquire an aircraft or watercraft by gift, donation, transfer, or

“Aircraft” includes airplanes, helicopters,

“Watercraft” includes

•Class 2, Class 3, and Class 4 watercraft as defined in Section

•personal watercraft as defined in Section

What is a

A purchase from a person or business not in the business of selling aircraft or watercraft at retail is considered a

What if I purchase from a dealer or leasing company?

Do not use Form

When is Form

Within 30 days from the date of acquiring the aircraft or watercraft if acquired in Illinois or within 30 days of bringing it into Illinois if acquired outside Illinois. You must submit proof of tax payment or exemption before your registration will be issued by the

•Department of Transportation - Division of Aeronautics (aircraft).

•Department of Natural Resources (watercraft).

What if I need help?

Visit our web site at tax.illinois.gov; call us weekdays between

8 a.m. to 5 p.m. at 1 800

Specific Information

Step 1 — Purchaser or new owner information

Line 3: This is the address as it will appear on the Illinois registration.

Lines 5: Social Security number or federal employer identification number (FEIN).

Line 6: Watercraft only - Check if reporting a transfer between immediate family members. If our review indicates that the primary reason for the transfer was to avoid payment of tax, we will bill you for applicable tax, penalties, and interest.

Step 3 — Item information

Line 4: Date purchaser (not the seller) acquired the item.

Line 5: Date purchaser (not the seller) brought the item into Illinois. This date should always be on or after the purchase date.

Line 7b: Type of watercraft. List one: open, cabin, houseboat, sailboat, pontoon, PWC/jetski, paddleboat or other.

Step 4 — Exempt transaction - Mark the applicable box. If the transaction is taxable, skip to Step 5.

a Charitable, religious, educational, or governmental organization with an active Illinois Department of Revenue exemption number.

b Rolling stock item for hire to haul persons or commodities in inter- state commerce. Aircraft - provide FAA certificate of authority number.

fWatercraft only - not required to be numbered under the Boat Registration and Safety Act and,

•will not be used upon Illinois waters for more than 30 days in any calendar year; or

•regardless of time used upon Illinois waters, and is either:

–owned by the United States, a State, or subdivision thereof, and used solely for official purposes and clearly identifiable; or

–used exclusively as a ship’s lifeboat.

Step 5 — Figure your tax

Round to nearest dollar: Drop amounts of less than 50 cents, and increase amounts of 50 cents or more to the next higher dollar.

Line 1: Tax is based on the purchase price or fair market value amount. Attach a copy of the purchase agreement/invoice which must have the purchase price and the tax previously paid clearly and separately stated. Aircraft - must also attach a copy of the FAA bill of sale. If you purchase or acquire a share of an aircraft or watercraft, write the share’s purchase price or fair market value. For watercraft, the purchase price or fair market value must include the value of any motor sold with, or as part of, the transaction. If the purchase price is less than the fair market value, you must pay tax on the fair market value on the date acquired or brought into Illinois, whichever is later. The only exception is a watercraft transfer between immediate

family members (I.E., a spouse, parent, brother, sister, or child). Write this purchase price on Line 1. If our review questions the

amount stated on Line 1, we have the authority to determine the fair market value through an independent valuation. We will bill you if additional tax is owed, including penalties and interest.

Line 3 - Provide the name of the state and the amount of sales or use tax you previously paid to that state. Credit is allowed only if the tax previously paid was properly due and separately stated on the proof of tax payment that must be attached to Form

Line 4 - Subtract Line 3 from Line 2. This is the amount of tax that

you owe. Make your remittance payable to “Illinois Department of Revenue” and attach it to Page 1 of Form

You owe a late filing penalty if you do not file a processable return by the due date, a late payment penalty if you do not pay the amount you owe by the original due date of the return, a bad check penalty if your remittance is not honored by your financial institution, and a cost of collection fee if you do not pay the amount you owe within 30 days of the date printed on a bill that we send you. For more information, see Publication 103, Penalties and Interest for Illinois Taxes. To receive a copy of this publication, visit our web site at tax.illinois.gov, or call 1 800

Step 6 — Sign here

The purchaser and

Keep Page 2 for your records.

Aircraft:

DEPARTMENT OF TRANSPORTATION DIVISION OF AERONAUTICS ABRAHAM LINCOLN CAPITAL AIRPORT 1 LANGHORNE BOND DRIVE SPRINGFIELD, IL

Watercraft:

DEPARTMENT OF NATURAL RESOURCES

PO BOX 19226

SPRINGFIELD, IL

Page 2 back |

Document Specifics

| Fact | Description |

|---|---|

| Purpose of Form RUT-75 | This form must be filed if an aircraft or watercraft is acquired by gift, donation, transfer, or non-retail purchase. |

| Definition of "non-retail purchase" | A non-retail purchase refers to buying from an individual or business that isn't in the business of selling aircraft or watercraft at retail. |

| Due Date | The form must be filed within 30 days from acquiring the aircraft or watercraft if acquired in Illinois or brought into Illinois. |

| Governing Laws | The Illinois Aeronautics Act and Boat Registration and Safety Act govern what constitutes as an aircraft and watercraft for this form. |

Guide to Writing Rut 75 Tax

Filing Form RUT-75 is essential for individuals who acquire an aircraft or watercraft through non-retail purchases, such as gifts, donations, or transfers within Illinois or from outside the state. This form helps in reporting the use tax transaction for the item acquired. Understanding the correct way to fill out this form is crucial for timely compliance with state tax obligations and for avoiding potential penalties. Follow these step-by-step instructions to ensure accurate submission of your RUT-75 form.

- Purchaser or New Owner Information:

- Line 3: Enter the address that will be listed on the Illinois registration.

- Line 5: Provide the Social Security number or Federal Employer Identification Number (FEIN).

- Line 6: For watercraft only - Check the box if you are reporting a transfer between immediate family members. Note the potential for tax, penalties, and interest if the transfer is deemed tax-avoidant.

- Item Information:

- Line 4: Enter the date when the purchaser, not the seller, acquired the item.

- Line 5: Enter the date the purchaser brought the item into Illinois, which must be the same or after the purchase date.

- Line 7b: Specify the type of watercraft, choosing from the options provided (e.g., open, cabin, houseboat).

- Exempt Transaction: Mark the applicable box if the transaction is exempt. If taxable, proceed to the next step.

- Choose the exemption category that best applies to your situation, following the form's guidance.

- Figure Your Tax:

- Line 1: State the tax based on the purchase price or fair market value. Attach the necessary documentation as specified.

- Line 3: Indicate the name of the state and the amount of sales or use tax previously paid to that state. Attach proof of tax payment.

- Line 4: Calculate the tax owed by subtracting Line 3 from Line 2.

- Sign the Form: The purchaser and co-owner (if applicable) must sign the Form RUT-75.

- Send Page 1 along with required attachments, the application, and the registration fees to the appropriate address, depending on whether you have an aircraft or a watercraft. Keep Page 2 for your records.

- For Aircraft: Send to the Department of Transportation Division of Aeronautics at the provided address.

- For Watercraft: Send to the Department of Natural Resources at the specified address.

Be aware that failure to correctly file Form RUT-75 by the due date may result in late filing penalties, late payment penalties, bad check penalties, and a cost of collection fee. For more detailed information regarding penalties and to ensure compliance with all requirements, it's recommended to review Publication 103, Penalties and Interest for Illinois Taxes or visit the Illinois Department of Revenue’s website.

Understanding Rut 75 Tax

-

Who is required to file Form RUT-75?

Form RUT-75 must be filed by individuals who acquire an aircraft or watercraft through a method other than a retail purchase. This includes acquisitions by gift, donation, transfer, or if the purchase was made from a private seller or a business that does not sell aircraft or watercraft at retail. Relevant vehicles include various types of aircraft, Class 2 to Class 4 watercraft, and personal watercraft like jet skis and wave runners, excluding canoes and kayaks.

-

What qualifies as a "non-retail purchase"?

A "non-retail purchase" refers to buying an item from a seller who is not engaged in selling those items as their usual business. This could be purchasing from an individual or a business that does not primarily sell aircraft or watercraft.

-

What if my purchase is from a dealer or leasing company?

If the item was purchased from an Illinois dealer or leasing company, Form RUT-75 should not be used. Instead, the dealer or leasing company is responsible for filing Form ST-556, Sales Tax Transaction Return. For purchases made from out-of-state dealers, lending institutions, or leasing companies at retail, Form RUT-25, Vehicle Use Tax Transaction Return must be filed.

-

What is the deadline for filing Form RUT-75?

The form must be filed within 30 days from the date the aircraft or watercraft was acquired if the transaction occurred in Illinois. If the item was purchased outside of Illinois and then brought into the state, the form should be submitted within 30 days of its arrival in Illinois.

-

What if I need assistance with the form?

For help with Form RUT-75, you can visit the official website at tax.illinois.gov, call between 8 a.m. to 5 p.m. on weekdays at 1 800 732-8866 or 217 782-3336, or use the TDD service at 1 800 544-5304 if you are hearing impaired.

-

How do I determine the tax owed on my purchase?

Tax should be calculated based on the purchase price or the fair market value of the aircraft or watercraft, whichever is applicable. The purchase price includes any motor sold with, or as part of, the watercraft. If the purchase price is under the fair market value or if the transaction was between immediate family members, the tax is based on the fair market value as of the date acquired or brought into Illinois. It's essential to attach proof of the purchase price, any tax already paid, and, for aircraft, a copy of the FAA bill of sale. If discrepancies arise, the state may independently determine the fair market value and adjust the tax owed accordingly.

-

What penalties exist for late filing or payment?

Late filings incur penalties, as do late payments after the original due date of the return. If your payment is returned by your bank, a bad check penalty will be applied. Failure to pay the tax owed within 30 days of receiving a bill could also lead to additional collection fees. Further details on penalties and interest can be found in Publication 103, Penalties and Interest for Illinois Taxes, available on the tax.illinois.gov website.

Common mistakes

Filling out the Rut 75 Tax form can be tricky. Here are four common mistakes people make:

Not Understanding Who Must File: Many people get confused about whether they need to file Form RUT-75. It’s crucial to understand that this form is required if you’ve acquired an aircraft or watercraft through a non-retail purchase, such as a gift, donation, transfer, or any purchase from someone not in the business of selling these items at retail. This includes a wide variety of aircrafts and watercrafts, excluding only canoes and kayaks. If the purchase or acquisition came from an Illinois dealer or leasing company, then Form ST-556 is the correct form to use, not RUT-75.

Omitting Required Identifiers: A common oversight is not providing the Social Security number or federal employer identification number (FEIN) in the designated area. This detail is crucial for the processing of the form, and leaving it blank can cause delays or even rejection of the submission.

Miscalculating the Tax: It’s easy to make mistakes in calculating the tax due. Remember, the tax should be based on the purchase price or fair market value of the aircraft or watercraft, including any motor sold with or as part of the transaction. If the purchase price is less than fair market value, you’re required to pay tax on the fair market value at the date acquired or brought into Illinois. Another common error is forgetting to subtract the amount of sales or use tax previously paid to another state from the amount owed, leading to overpayment.

Missing Signatures and Attachments: A critical but often overlooked part of the process is the requirement for the purchaser and, if applicable, co-owner to sign Form RUT-75. Additionally, failing to attach necessary documents, such as a copy of the purchase agreement/invoice, FAA bill of sale for aircraft, or proof of sales or use tax paid to another state, can result in processing delays or the need to refile.

Understanding and meticulously following the guidelines provided in the Rut 75 Tax form will smooth the path to compliance. Attention to detail and ensuring all necessary documents are included will help avoid these common pitfalls.

Documents used along the form

When managing the acquisition of an aircraft or watercraft, several documents must be prepared alongside the Rut 75 Tax Form to ensure compliance and proper registration. Accurate preparation and submission of these various forms and documents safeguard against legal and financial complications, streamlining the process of owning and operating aircraft and watercraft.

- Bill of Sale: A crucial document detailing the sale, including the purchase price, the seller, and the buyer's information. For aircraft, an FAA bill of sale is required, which serves as proof of the transaction and is necessary for the tax calculation on the Rut 75 form.

- Proof of Tax Payment or Exemption: Documentation showing that sales or use tax has been paid, or that the transaction is exempt from tax, must accompany the Rut 75. This could include receipts or official letters of exemption.

- Registration Application: Following tax submission, an application for the registration with the Department of Transportation for aircraft or the Department of Natural Resources for watercraft must be completed.

- FAA Certificate of Authority (for Aircraft): If the aircraft is used for hire to haul persons or commodities in interstate commerce, an FAA Certificate of Authority number must be provided, highlighting the aircraft's commercial use status.

- Purchase Agreement/Invoice: This document outlines the terms of the sale, including the price and any taxes previously paid. It serves as a basis for tax calculation on the Rut 75 tax form.

- Form ST-556 (Sales Tax Transaction Return): Required for purchases made through Illinois dealers or leasing companies. This form is not needed if the Rut 75 is being filed but is pertinent for dealer transactions.

- Form RUT-25 (Vehicle Use Tax Transaction Return): Necessary for items acquired from out-of-state dealers, lending institutions, or leasing companies, where a different tax calculation might be applicable.

- Ownership Transfer Documentation: For watercraft only, if reporting a transfer between immediate family members, documentation proving the relationship and the transfer reason may be needed to validate tax exemption claims.

Understanding and assembling the various documents that accompany the Rut 75 Tax Form can be a daunting task. However, each document plays a specific role in establishing legality and ownership, ensuring compliance with state regulations, and securing tax obligations. Proper attention to these details not only facilitates the smooth transition of ownership but also establishes a solid foundation for responsible and enjoyable aircraft or watercraft operation.

Similar forms

The Form ST-556, Sales Tax Transaction Return, bears a resemblance to the Form RUT-75 in its primary function, which is to collect sales tax on specific transactions. Both forms are used in Illinois for reporting and paying tax but differ in the items they cover; Form ST-556 is specifically for transactions involving vehicles sold by Illinois dealers or leasing companies, contrasting with Form RUT-75's focus on private sales of aircraft and watercraft.

Form RUT-25, Vehicle Use Tax Transaction Return, is similar to Form RUT-75 as both concern the taxation of transportation assets brought into Illinois. Where RUT-75 is utilized for aircraft and watercraft acquired through non-retail sales, RUT-25 is required for vehicles purchased from out-of-state dealers. Each form ensures tax compliance for different types of property entering Illinois.

The Form RUT-50, Vehicle Use Tax Transaction Return for Private Party Vehicle Sales, also aligns closely with RUT-75, with the major difference being its application to private vehicle sales. While RUT-75 captures tax on non-retail acquisitions of aircraft and watercraft, RUT-50 does the same for vehicles purchased in private sales, ensuring that these transactions are taxed accordingly.

Another document, the Form RV-F1400301, Application for Tennessee Certificate of Title and Registration, while not an Illinois form, serves a parallel purpose for Tennessee residents, closely matching the process outlined in RUT-75 for Illinois. This form is necessary when registering a new or used vehicle, boat, or aircraft in Tennessee, highlighting the universal requirement across states to report and tax vehicle, watercraft, and aircraft acquisitions.

The Sales and Use Tax Return forms, commonly found across various states, share fundamental similarities with Form RUT-75, focusing on the declaration and payment of sales and use taxes. Though broader in scope, these forms, like RUT-75, aim to capture tax on transactions that fall outside of typical retail sales, including those involving aircraft and watercraft.

California's Form BOE-401-A2, Sales and Use Tax Return, resembles RUT-75 in its intent to collect taxes on goods purchased or transferred within its jurisdiction. Despite their geographical differences, both forms require taxpayers to report purchases of high-value items, like aircraft and watercraft, ensuring compliance with state tax laws.

New York's Form ST-121, Exempt Use Certificate, has parallels with the exempt transaction section of RUT-75, allowing for tax exemptions under specific conditions. Both documents recognize that certain transactions, including those involving aircraft and watercraft, can qualify for tax exemptions based on their use or the status of the purchaser.

The Form 8849, Claim for Refund of Excise Taxes, by the IRS, although focused on excise taxes at the federal level, shares a similar foundational purpose with RUT-75: to ensure proper tax treatment of specific types of property, including vehicles, aircraft, and watercraft. Form 8849 allows taxpayers to claim refunds on previously paid taxes, just as RUT-75 enables individuals to report and pay the correct use tax.

Lastly, Florida's Form DR-15, Sales and Use Tax Return, is akin to RUT-75 in its goal to manage the state's taxation of goods and services, including transactions involving watercraft and aircraft. This form, like RUT-75, plays a crucial role in the state's revenue system by requiring disclosure and payment of taxes due on a wide range of purchases.

Dos and Don'ts

When filling out the RUT-75 Tax Form, it’s important to pay attention to detail and follow instructions closely to avoid penalties or processing delays. Here’s a helpful guide to what you should and shouldn’t do:

- Do ensure that you actually need to use Form RUT-75. It's specifically for aircraft or watercraft acquired by gift, donation, transfer, or non-retail purchase.

- Don't use this form if you acquired the aircraft or watercraft from an Illinois dealer or leasing company. Different forms apply in those cases.

- Do fill out the purchaser or new owner information accurately, including the Social Security number or federal employer identification number (FEIN) as applicable.

- Don't delay in submitting the form. It's due within 30 days from the date of acquiring the aircraft or watercraft if acquired in Illinois, or within 30 days of bringing it into Illinois if acquired outside Illinois.

- Do attach a copy of the purchase agreement/invoice, which must clearly state the purchase price and the tax previously paid. For aircraft, also attach a copy of the FAA bill of sale.

- Don't guess or undervalue the item’s purchase price or fair market value. If found to be lower than actual, this could lead to additional tax, penalties, and interest.

- Do report any applicable tax exemptions in Step 4 of the form accurately. Check if the transaction qualifies for any of the listed exemptions.

- Don't forget to include the name of the state and the amount of sales or use tax you previously paid to that state if claiming a credit.

- Do sign the form. The purchaser and co-owner (if applicable) must sign Form RUT-75 for it to be processed.

By following these dos and don'ts, you can ensure a smoother experience with your RUT-75 Tax Form submission. If you need assistance or have questions, don't hesitate to visit the provided tax website or contact the Illinois Department of Revenue directly.

Misconceptions

Understanding the nuances of tax forms can sometimes be confusing. When it comes to Form RUT-75, Aircraft/Watercraft Use Tax Transaction Return, there are several misconceptions. It's vital to clear these up to ensure compliance and avoid unnecessary penalties.

Only watercraft purchases require Form RUT-75: A common misunderstanding is that Form RUT-75 is meant exclusively for watercraft. However, it is also required for aircraft acquisitions, including airplanes, helicopters, and even hot-air balloons. This broad spectrum reveals the form's applicability beyond just water-based transactions.

Form RUT-75 is for dealer purchases: This form is not to be used if you purchased the item from an Illinois dealer or leasing company. Those transactions are covered by Form ST-556. Form RUT-75 is for non-retail purchases, such as those from private sellers or when the item is gifted or donated.

Purchases from out-of-state dealers are exempt: Even if you buy from an out-of-state dealer, you must file a different form (RUT-25) if the dealer sells at retail. No exemption applies simply because the seller is located outside of Illinois.

All watercraft are included: Not all watercraft fall under Form RUT-75. Specifically, canoes and kayaks are exempt. The form covers a wider range of watercraft, including jet skis and sailboats, but it's essential to recognize these exceptions.

Immediate family transfers are always tax-exempt: A transfer between immediate family members is closely scrutinized. If the primary intent behind the transfer is deemed to be tax avoidance, the involved parties will be billed for the applicable taxes, along with penalties and interest.

Tax is always based on purchase price: While the purchase price is often the basis for tax calculation, the fair market value comes into play if it is higher than the purchase price or if the transaction involves an immediate family transfer. The Department of Revenue has the authority to assess fair market value independently.

Proof of previously paid tax is unnecessary: On the contrary, providing evidence of previously paid sales or use tax to another state is crucial. This information allows for a credit against the Illinois tax owed, but only if the tax was properly due and clearly stated on the documentation attached to Form RUT-75.

There's no penalty for late filing if tax is paid: Late filing penalties apply regardless of whether the tax owed has been paid on time. Additional penalties exist for late payments, dishonored checks, and failure to pay amounts due within 30 days of a billing notice.

Digital submission is available: As of the last update, forms and payments must be mailed to the appropriate department, either the Department of Transportation Division of Aeronautics for aircraft or the Department of Natural Resources for watercraft. This underscores the importance of ensuring all paper documentation is complete, accurate, and timely sent.

Correctly understanding and applying the requirements for Form RUT-75 can help avoid misunderstandings and ensure that tax obligations related to aircraft and watercraft transactions are met in full compliance with Illinois law.

Key takeaways

Understanding the requirements and processes surrounding the RUT-75 Tax Form is essential for individuals who acquire an aircraft or watercraft through non-retail transactions. Here are four key points to keep in mind:

- The RUT-75 form is specifically designed for the reporting and payment of use tax on aircraft and watercraft acquired by gift, donation, transfer, or non-retail purchase. The form applies to a wide range of aircraft, including airplanes, helicopters, and gliders, as well as certain classes of watercraft like jet skis but excludes canoes and kayaks. This specificity ensures that the appropriate tax obligations are met for these types of transactions.

- If the aircraft or watercraft is purchased from a licensed dealer or leasing company in Illinois, the RUT-75 form should not be used. Instead, transactions involving Illinois dealers or leasing companies necessitate the filing of Form ST-556. Similarly, purchases from out-of-state dealers that sell at retail require the submission of Form RUT-25. This delineation ensures that tax responsibilities are catered to the source and nature of the transaction.

- Timeliness in filing the RUT-75 form is crucial, with a deadline set at within 30 days from the date of acquisition if the purchase is made in Illinois, or within 30 days of bringing the aircraft or watercraft into Illinois if purchased out-of-state. Late submissions may result in penalties, interest charges, and delays in registration. For prompt and compliant processing, attaching proof of tax payment or exemption is required when submitting the form for registration purposes.

- The calculation of tax owed is based upon the purchase price or fair market value of the aircraft or watercraft, a critical distinction that can impact the amount of tax payable. In cases where the transaction involves immediate family members, special considerations apply, potentially altering the tax implications of the transfer. Moreover, the form allows for the deduction of any sales or use tax already paid to another state from the tax owed, preventing double taxation.

By carefully following these guidelines, individuals can ensure compliance with Illinois tax laws when acquiring aircraft or watercraft through non-retail transactions, thereby avoiding potential penalties, ensuring the correct tax amount is paid, and facilitating a smoother registration process.

Popular PDF Documents

What Is Power of Attorney California - It reassures taxpayers that their tax affairs are handled according to their wishes.

House Tax Form - Avoid common mistakes businesses make when filling out the tangible personal property tax return in Broward County.