Get Rushmore Loan Management Services Form

Dealing with financial hardship requires clarity and assistance, and the Rushmore Loan Management Services form provides a structured approach for borrowers seeking a modification of their loan terms. This comprehensive form demands detailed information from borrowers to expedite the modification review process effectively. Required documents include a complete Borrower Assistance Application, recent paystubs, bank statements, federal tax returns, and, if applicable, Homeowners’ Association Statements, alongside IRS Form 4506T for a thorough financial scrutiny. For non-borrowers contributing towards mortgage payments, detailed income proof and authorization for credit checks are mandated. Self-employed individuals must provide additional documentation, such as profit and loss statements, to ensure an accurate assessment of their financial stance. Those with rental properties, fixed or variable income, or those undergoing a divorce or legal separation face specific documentation requirements as well. The application also entails disclosures regarding the borrower's intentions towards the property, current living situation, and any pertinent legal or counseling representation. Furthermore, the form specifies clear instructions for submitting the required documents and provides contact information for additional support, underscoring Rushmore's commitment to facilitating borrowers in distress. This procedure aligns with the regulatory guidelines aiming to protect both the lender and borrower’s interests while ensuring a fair review process for those facing financial difficulties.

Rushmore Loan Management Services Example

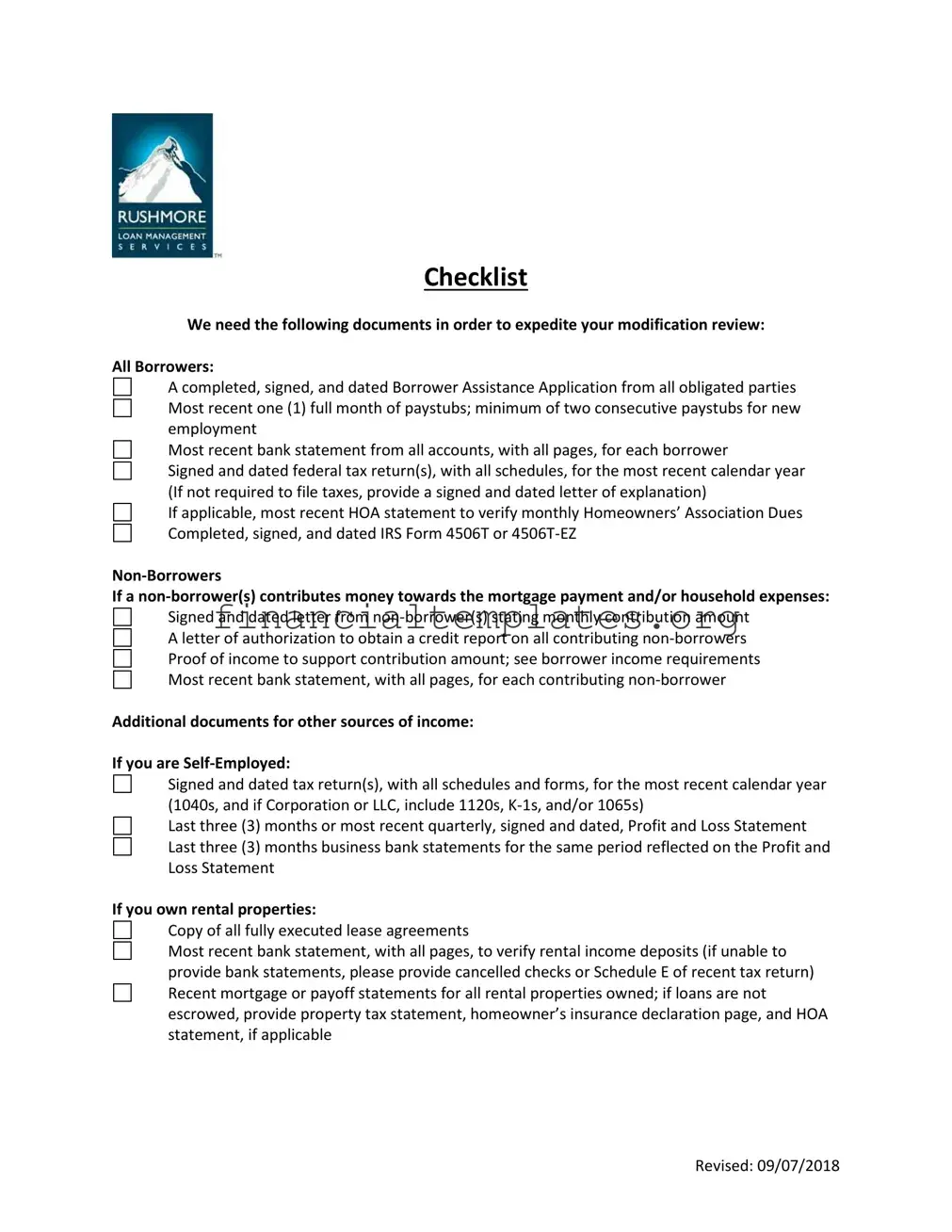

Checklist

We need the following documents in order to expedite your modification review:

All Borrowers:

A completed, signed, and dated Borrower Assistance Application from all obligated parties Most recent one (1) full month of paystubs; minimum of two consecutive paystubs for new employment

Most recent bank statement from all accounts, with all pages, for each borrower

Signed and dated federal tax return(s), with all schedules, for the most recent calendar year (If not required to file taxes, provide a signed and dated letter of explanation)

If applicable, most recent HOA statement to verify monthly Homeowners’ Association Dues Completed, signed, and dated IRS Form 4506T or

If a

Signed and dated letter from

Additional documents for other sources of income:

If you are

Signed and dated tax return(s), with all schedules and forms, for the most recent calendar year (1040s, and if Corporation or LLC, include 1120s,

Last three (3) months or most recent quarterly, signed and dated, Profit and Loss Statement Last three (3) months business bank statements for the same period reflected on the Profit and Loss Statement

If you own rental properties:

Copy of all fully executed lease agreements

Most recent bank statement, with all pages, to verify rental income deposits (if unable to provide bank statements, please provide cancelled checks or Schedule E of recent tax return) Recent mortgage or payoff statements for all rental properties owned; if loans are not escrowed, provide property tax statement, homeowner’s insurance declaration page, and HOA statement, if applicable

Revised: 09/07/2018

If you receive Fixed Income (e.g. SSI, pension, long term disability, alimony, child support)

Award letter or benefit statement showing the amount, frequency, and duration of pay Most recent bank statement, with all pages, to verify deposits

If you receive Variable Income (e.g. seasonal income, school employees):

Evidence of the frequency and duration of pay, and documentation to support income received (e.g. Employment Contract, Letter of Explanation from Employer, along with paystubs and/or bank statements for the months worked)

In cases where a divorce or legal separation has occurred:

A copy of a divorce decree or legal separation filed/acknowledged with the Court A copy of a recorded Quit Claim Deed or Warranty Deed filed with the County

If your loan is not currently escrowed for property tax and/or hazard insurance:

A copy of the most recent property tax statement and/or hazard insurance declaration page

If you are reapplying due to a change in your circumstances:

A signed and dated letter of explanation and supporting documentation to outline your change in circumstance.

*Note: Any expenses disclosed must be validated with supporting documents (e.g. Alimony, Child Support, Liens, and Judgments)

If you have any questions or concerns regarding this checklist, please contact our office toll free at

Revised: 09/07/2018

This completed Borrower Assistance Application and all required documentation must be sent to one of the following locations:

Mail: Attn: Loss Mitigation

Rushmore Loan Management Services LLC

15480 Laguna Canyon Road

Irvine, CA 92618

Secure Fax:

Questions: Call us at

F 6:00 am PST to 6:00 PST.

BORROWER ASSISTANCE APPLICATION

If you are experiencing a temporary or

options. You must disclose information about (1) your intentions to either keep or transition out of the property; (2) the property’s status; (3) bankruptcy; and (4) your credit counseling agency or

representative, if any.

You must disclose information about your income, expenses and assets. This application also lists the required income documentation that you must submit in support of your request for assistance. You must also complete the Hardship Affidavit in which you disclose the nature of your hardship. The Hardship Affidavit informs you of the required documentation that you must submit in support of your hardship claim.

When you sign and date this application you will make certain certifications, representations and agreements, including certifying that the information you provide in the application is accurate and truthful and that the identified hardship has contributed to your need for mortgage relief.

This application requires a completed and signed IRS Form

Loan Number: ______________________ (found on your monthly mortgage statement)

I want to: |

Keep the property |

Vacate the property |

Sell the property |

Undecided |

||||

If you wish to keep the property, for how long? ______________________ |

|

|||||||

The property is currently: |

My primary residence |

A second home |

|

|

||||

|

|

An investment property |

|

|

|

|

||

The property is currently: |

Owner occupied |

Renter occupied |

Vacant |

|

||||

|

|

|

|

1 |

|

|

|

|

CONTACT INFORMATION

Borrower |

|

|

|

|

|

Borrower Name: _____________________ |

||

|

|

|

SSN _______________ DOB __________ |

SSN _____________ |

DOB __________ |

|

|

|

Home Phone # ( ) |

Home Phone # ( ) |

|

Best time to call: |

Best time to call: |

|

|

|

|

Cell/Mobile Phone # ( ) |

Cell/Mobile Phone # ( |

) |

Best time to call: |

Best time to call: |

|

|

|

|

Email: ____________________________ |

Email: ____________________________ |

|

|

|

|

My primary language is Spanish. This information will be used to assign you a

Mailing Address: _________________________________________________________

Property Address (if the same as mailing address, just write “same”)

Have you contacted a credit counseling agency? Yes |

No |

|

If “Yes”, provide counselor contact information: |

|

|

Agency Name: _________________ |

Counselor Name: ___________________ |

|

|

Counselor Phone #: _________________ |

|

|

Counselor email: ____________________ |

|

Rushmore may contact this agency about my Loan. Yes No

Do you have a lawyer or other representative we should contact about this application? Yes No

If “Yes”, provide contact information:

Law Firm Name (if any): _________________ Representative Name: _____________

Phone #: _______________________

Email: _________________________

Rushmore should only contact this representative about my Loan. |

Yes |

No |

|

|

|

2 |

|

|

PROPERTY INFORMATION

Estimated Market Value of the property: $ _________________________________

Is the property listed for sale? |

Yes |

No |

If “Yes”, what was the listing date? _____________ |

||||

|

|

|

|

|

|||

Have you received an offer on the property? |

Yes |

No |

|

|

|||

Date of Offer: _____________ |

|

Amount of Offer: $ ______________ |

|||||

Agent’s Name: _____________ |

|

Agent’s phone #: ______________ |

|||||

For Sale by Owner |

Yes |

No |

|

|

|

|

|

|

|

|

|||||

Do you have condominium or homeowner association (HOA) fees? |

Yes |

No |

|||||

Total monthly amount: $ ______________ |

|

|

|

|

|||

Name and Address that fees are paid to: ________________________________________

______________________________________________________________________

Who pays the real estate tax bill on the property? |

I/We do |

|

Servicer does |

||||

Are the taxes current? |

Yes |

No |

|

|

|

|

|

|

|

|

|||||

Who pays the homeowners insurance policy on the property? |

I/We do |

Servicer does |

|||||

Is the policy current? |

Yes |

No |

Name of Insurance Company: _________________ |

||||

|

|

|

Insurance Company Phone #: _________________ |

||||

|

|

|

|||||

Are there any liens/other mortgages or judgments on the property? |

Yes |

No |

|||||

If “Yes”, provide : |

|

|

|

|

|

|

|

Lien holder/Servicer name: ___________________ |

Phone #: ________________ |

||||||

Balance Amount: $ ________________ |

Monthly payment amount: $ ________________ |

||||||

Lien holder/Servicer name: ___________________ |

Phone #: ________________ |

||||||

Balance Amount: $ ________________ |

Monthly payment amount: $ ________________ |

||||||

Lien holder/Servicer name: ___________________ |

Phone #: ________________ |

||||||

Balance Amount: $ ________________ |

Monthly payment amount: $ ________________ |

||||||

MORTGAGE INFORMATION

Has the mortgage on your property ever had a Home Affordable Modification Program (HAMP) trial period plan or permanent modification? Yes No

Has the mortgage on any other property that you or any

modification? Yes |

No |

|

|

|

3 |

BORROWER INFORMATION

Have you or the |

Yes |

|

No |

|

|

||

Chapter 7 |

Chapter 11 |

|

Chapter 12 |

|

Chapter 13 |

||

Has the bankruptcy been discharged? |

Yes |

No |

Bankruptcy Case No. : |

|

|||

Has/Was the mortgage on the property been reaffirmed? |

Yes |

No |

Don’t know |

||||

If you have or will receive a discharge from a bankruptcy and the mortgage was not reaffirmed in the case, we will only exercise our rights against the property and are not attempting any act to collect the discharged debt from you personally. Your decision to discuss workout options with us is strictly voluntary. You are not obligated to pursue any workout option discussed with us. At your request, we will immediately terminate any such discussions should you no longer wish to purse these options to retain your property.

SERVICE MEMBERS

Is any borrower an active duty service member? Yes No

If “Yes”, has any borrower been deployed away from his/her primary residence or received a

permanent Change of Station order? |

Yes |

No |

Is any borrower the surviving spouse of a deceased service member who was on active duty at the

time of death? Yes |

No |

EMPLOYMENT INFORMATION

Borrower

Company Name: ______________________________ Start Date: ________________

Job Title: _______________________

Company Name: ______________________________ Start Date: ________________

Job Title: _______________________

4

OTHER PROPERTY FOR WHICH ASSISTANCE IS REQUESTED

Complete this section ONLY if you are requesting mortgage assistance for a property that is not your principal residence.

I am requesting mortgage assistance with a rental property that is not your principal residence:

Yes |

No |

|

|

|

|

I am requesting mortgage assistance with a second or seasonal home: |

Yes |

No |

|||

If “Yes” to either, I want to: |

Keep the property |

Sell the property |

|

|

|

Property Address: _____________________________________________ Loan Number: __________

Do you have a second mortgage on the property? |

Yes |

No |

|

|

If “Yes”: Servicer Name: __________________________________________ |

||||

Loan Number: __________ |

|

|

|

|

Do you have condo or Homeowner’s association (HOA) fee? |

Yes |

No |

|

|

If “Yes”: Monthly Fee: _______________ Are HOA fees current? |

Yes |

No |

||

Name and address fees are paid to: ____________________________________________

Does your mortgage payment include taxes and insurance? |

Yes |

No |

|

If “NO”: Are taxes and insurance paid and current? |

Yes |

No |

|

Annual Homeowner’s Insurance: ____________________ Annual Property Taxes: ___________________

Vacant and available for rent

Occupied by a tenant as their principal residence

Other: _______________________________________________________

If rental property is occupied by a tenant:

Term/Lease of Occupancy (MM/DD/YYYY - MMMM/DD/YYYY): ______________________________

Gross Monthly Rent: $ ________________________________

If rental property is vacant, describe efforts to rent property:

______________________________________________________________________________________________

If applicable, describe relationship and duration of

Is the property for sale? |

Yes No |

|

If “Yes”, Listing Agent Name: ____________________________________________ |

|

|

Listing Agent Phone #: _________________________________________________ |

|

|

Listing Date: ___________________________ Have you received purchase offer? Yes |

No |

|

Amount of Offer: $ _________________________________________ Closing Date:_________________

5

RENTAL PROPERTY CERTIFICATION

You must complete this certification if you are requesting mortgage assistance with respect to a rental property.

By checking this box and initialing below, I am requesting a mortgage modification under MHA with respect to the rental property described in this section and I hereby certify under penalty of perjury that each of the following statements is true and correct with respect to that property:

1.1 intend to rent the property to a tenant or tenants for at least five years following the effective date of my mortgage modification. I understand that the servicer, the U.S. Department of Treasury, or their respective agents may ask me to provide evidence of my intention to rent the property during such time. I further understand that such evidence must show that I used reasonable efforts to rent the property to a tenant or tenants on a year- round basis, if the property is or becomes vacant during such

Note: The term “reasonable efforts” includes, without limitation, advertising the property for rent in local newspaper, websites, or other commonly used forms of written or electronic media, and/or engaging a real estate or other professional to assist in renting the property, in either case, at or below market rent.

2.The property is not my secondary residence and I do not intent to use the property as a secondary residence for at least five years following the effective date of my mortgage modification. I understand that if I do use the property as a secondary residence during such

Note: The Term “secondary residence” includes, without limitation, a second home, vacation home or other type of residence that I personally use or occupy on a

3.I do not own more than five (5)

Notwithstanding the residence, or permit my legal dependent, parent or grandparent to occupy it as their principal residence with no rent charged or collected, none of which will be considered to be inconsistent with the certifications made herein.

This certificate is effective on the earlier of the date listed below or the date the RMA is received by you servicer.

Initials: _______ |

_______________________ |

____________ |

|

Borrower |

Date |

Initials: _______ |

_______________________ |

____________ |

|

Date |

|

|

6 |

|

|

FINANCIAL INFORMATION |

|

|

|

|

|

|

|

|

Borrower Monthly Income |

|

Borrower Assets |

|

|

Gross Wages |

$ |

Checking Account |

$ |

|

|

|

|

|

|

Overtime |

$ |

Checking Account |

$ |

|

|

|

|

|

|

Child support/Alimony* |

$ |

Savings/Money Market |

$ |

|

$ |

Stocks/Bonds/CDs |

$ |

|

|

|

|

|

|

|

Taxable SS Benefits or Other |

|

Expected Assets (e.g., inheritance, |

|

|

Monthly Income (e.g., Annuities |

$ |

$ |

|

|

or Retirement Plans, etc.) |

|

tax, returns, etc.) |

|

|

|

|

|

|

|

|

|

|

|

|

Tips, Commissions, Bonus and |

$ |

Total Amount in Additional |

$ |

|

Assets (e.g. trusts) |

|

|||

|

|

|

||

Rents Received |

$ |

Other Real Estate Owned |

$ |

|

(estimated value) |

|

|||

|

|

|

|

|

|

|

|

|

|

Unemployment Income |

$ |

Retirement |

$ |

|

|

|

|

|

|

Food stamps/Welfare |

$ |

Other Cash on Hand |

$ |

|

Other |

$ |

Other |

$ |

|

|

|

|

||

Gross Wages |

$ |

Checking Account |

$ |

|

Overtime |

$ |

Checking Account |

$ |

|

|

|

|

|

|

Child support/Alimony* |

$ |

Savings/Money Market |

$ |

|

|

|

|

|

|

$ |

Stocks/Bonds/CDs |

$ |

|

|

Taxable SS Benefits or Other |

|

Expected assets (e.g., inheritance, |

|

|

Monthly Income (e.g., Annuities |

$ |

$ |

|

|

or Retirement Plans, etc.) |

|

tax, returns, etc.) |

|

|

|

|

|

|

|

|

|

|

|

|

Tips, Commissions, Bonus and |

$ |

Total Amount in Additional |

$ |

|

Assets (e.g. trusts) |

|

|||

|

|

|

||

|

|

|

|

|

Rents Received |

$ |

Other Real Estate Owned |

$ |

|

(estimated value) |

|

|||

|

|

|

|

|

Unemployment Income |

$ |

Retirement |

$ |

|

|

|

|

|

|

Food Stamps/Welfare |

$ |

Other Cash on Hand |

$ |

|

|

|

|

|

|

Other |

$ |

Other |

$ |

|

*Child Support, alimony, separation maintenance need not be disclosed if you do not want it considered in support of your Loan payments.

Monthly Household Expenses

First Mortgage |

$ |

Electric |

$ |

|

|

|

|

|

|

Second Mortgage |

$ |

Gas |

$ |

|

Homeowner’s Insurance* |

$ |

Trash |

$ |

|

Property Taxes |

$ |

Cable |

$ |

|

|

|

|

|

|

HOA/Condo Fees/Property |

$ |

Cell phone |

$ |

|

Maintenance |

||||

|

|

|

||

Student Loan (if not deferred) |

$ |

Food |

$ |

|

Car Payment |

$ |

Clothing |

$ |

|

|

|

|

|

|

Credit Cards/Other Installment |

|

Out of Pocket Medical/Dental |

|

|

Loans (minimum monthly |

$ |

$ |

||

Expenses |

||||

payment) |

|

|

||

|

|

|

||

Car Expense/Gas |

$ |

Life Insurance |

$ |

|

Alimony/Child Support Payments |

$ |

Mortgage Payments on Other |

$ |

|

Properties |

||||

|

|

|

||

|

|

|

|

|

Other |

$ |

Other |

$ |

|

|

|

|

|

If you want Rushmore to consider

7

REQUIRED INCOME DOCUMENTATION

Please refer to the Checklist included in this package

Any income documentation that you submit as part of your Borrower Assistance Application should be dated within 90 days of the time documentation is received by Rushmore.

Additional documentation may be required if income not supported.

HARDSHIP AFFIDAVIT

I (We) are having difficulty or expect to have difficulty making monthly mortgage payments because of the reason(s) set forth below. Please check the primary reason and submit the required documentation demonstrating your primary hardship.

If your Hardship Is: |

|

Then the required documentation is: |

|

|

|

Unemployment |

|

Please state dates of unemployment |

|

(e.g. MM/DD/YYYY to MM/DD/YYYY): |

|

|

|

|

|

|

____/____/______ to ____/____/______ |

|

|

____/____/______ to ____/____/______ |

|

|

|

Reduction in Income: a hardship that has |

|

Provide a written description of your |

caused a decrease in your income due to |

|

circumstances on the attached hardship letter. |

circumstances beyond your control (e.g., |

|

|

reduction in overtime or regular working hours, |

|

|

reduction in base pay). |

|

|

|

|

|

Increase in Housing Expenses: a hardship that |

|

Provide a written description of your |

has caused an increase in your housing expense |

|

circumstances below or on the attached hardship |

due to circumstances beyond your control. |

|

letter: |

|

|

|

|

8 |

|

Document Specifics

| Fact | Detail |

|---|---|

| Document Purpose | To expedite the modification review process for borrowers experiencing hardship. |

| Borrower Requirements | Borrowers must provide a complete, signed, and dated Borrower Assistance Application along with specific financial documentation. |

| Income Verification | Documentation such as recent paystubs, tax returns, and bank statements are required to verify income. |

| Non-Borrower Contributions | If non-borrowers contribute to the mortgage or household expenses, a signed letter stating the contribution amount and proof of income are needed. |

| Self-Employment Documents | Self-employed individuals must provide tax returns, Profit and Loss Statements, and business bank statements. |

| Rental Property Income | For rental income verification, lease agreements and bank statements or cancelled checks are required. |

| Variable Income Documentation | Documentation to support the amount, frequency, and duration of variable income is necessary. |

| Legal and Property Documents | Documents such as divorce decrees, property deeds, and tax or insurance statements may be required depending on the borrower's situation. |

| Contact Information | Rushmore Loan Management Services can be reached for questions via phone or mail, with specific hours of operation provided. |

Guide to Writing Rushmore Loan Management Services

Preparing and submitting the Rushmore Loan Management Services form involves a detailed process aimed at collecting comprehensive information about your financial situation, property details, and any hardships you are facing that require assistance. The form is designed to evaluate your eligibility for modification or other types of mortgage assistance. It is crucial to provide accurate and complete information to expedite the review process. Make sure to gather all required documentation before beginning to fill out the form to ensure a smooth submission process.

- Start by noting your Loan Number, which can be found on your monthly mortgage statement.

- Indicate your intention by selecting whether you want to Keep, Vacate, Sell the property or if you are Undecided.

- If you wish to keep the property, specify for how long.

- Identify the property's current status, whether it is your primary residence, a second home, or an investment property and its occupancy status.

- Provide detailed contact information for both the borrower and co-borrower, including names, social security numbers, dates of birth, phone numbers, the best times to call, and email addresses.

- If the primary language is Spanish, indicate it to ensure a Spanish-speaking representative is assigned to your case.

- Enter both the mailing and property addresses. If they are the same, write "same" for the property address.

- Answer whether you have contacted a credit counseling agency and provide the agency's contact information if applicable.

- Fill out the property information section, including estimated market value, listing information if applicable, HOA fees, real estate tax, and homeowners insurance details.

- Disclose any liens, other mortgages, or judgments on the property.

- Complete the mortgage information section, providing details about any previous Home Affordable Modification Program (HAMP) involvement.

- Ensure all obligated parties complete, sign, and date the Borrower Assistance Application.

- Gather and attach the required documents as listed in the checklist, ensuring completeness and accuracy.

- Collect and include any additional documentation relevant to your income, such as pay stubs, bank statements, federal tax returns, and any other income-related paperwork.

- For non-borrowers contributing towards mortgage payments, include a signed and dated letter from the contributing non-borrowers stating the monthly contribution amount along with their proof of income and bank statements.

- Complete, sign, and date the IRS Form 4506T or 4506T-EZ.

- If experiencing a hardship, fill out the Hardship Affidavit section, disclosing the nature of your hardship.

- Complete and sign the Dodd-Frank Certification.

- If applicable, fill out the Non-Borrower Contribution form.

- Review the entire application to ensure all sections are completed accurately.

- Send the completed Borrower Assistance Application and all required documentation to one of the specified locations by mail or secure fax. Alternatively, if you have questions, contact the office using the provided phone numbers during the specified hours.

By following these detailed steps, you will have fully completed and submitted the Rushmore Loan Management Services form. This step is critical in the process of seeking modification or other mortgage assistance. Providing complete and accurate information, along with all required documentation, will help expedite your review and improve the chances of a favorable outcome.

Understanding Rushmore Loan Management Services

-

What documents do I need to submit for a modification review with Rushmore Loan Management Services?

To expedite your modification review, Rushmore Loan Management Services requires the following documents: a completed, signed, and dated Borrower Assistance Application from all obligated borrowers; the most recent one month of paystubs or two consecutive paystubs if you have new employment; all bank statements from the most recent month for each borrower; signed and dated federal tax returns from the most recent calendar year, or a letter of explanation if not required to file taxes; the most recent HOA statement if applicable; a completed, signed, and dated IRS Form 4506T or 4506T-EZ. For non-borrowers contributing towards the mortgage, a signed letter from them stating their monthly contribution amount, a letter of authorization for a credit report, proof of their income, and their most recent bank statement are required. Additional documents may include tax returns and profit and loss statements for self-employed individuals, lease agreements and bank statements for rental property income, and various documents verifying fixed or variable income sources.

-

How do I contact Rushmore Loan Management Services if I have questions about the form or my application?

If you have any questions or concerns regarding the form or your modification review application, you can contact Rushmore Loan Management Services toll-free at 1-888-504-7300. Their office hours are Monday through Thursday from 6:00am to 7:00pm, and Friday from 6:00am to 6:00pm Pacific Time. These representatives can assist with inquiries and provide further guidance on your application process.

-

Where do I send my completed Borrower Assistance Application and required documents?

Your completed Borrower Assistance Application, along with all required documentation, can be sent to Rushmore Loan Management Services LLC by mail or secure fax. For mail submissions, address them to: Attn: Loss Mitigation, 15480 Laguna Canyon Road, Irvine, CA 92618. If you prefer to fax the documents, the secure fax number is 949-341-2238. Ensure all pages of each document are included to avoid delays in the review process.

-

What should I do if my financial circumstances have changed and I need to reapply for assistance?

If your financial situation has changed since you initially applied for mortgage assistance, you need to submit a new application detailing your change in circumstances. Along with a new Borrower Assistance Application, include a signed and dated letter of explanation that outlines your changed situation. It is also important to provide any relevant supporting documents that can verify your current financial status. This may include, but is not limited to, updated pay stubs, bank statements, or other evidence of income or expenses that were not previously considered.

-

If I'm not required to file taxes, what documentation should I provide instead?

If you are not required to file taxes, Rushmore Loan Management Services requests that you provide a signed and dated letter of explanation. This letter should clarify why you are not required to submit federal tax returns and, if possible, include any supporting documents that affirm your financial status or income sources. This could be in the form of benefit statements for fixed incomes, such as SSI, pension, long-term disability, or any other relevant financial information that verifies your income and ability to contribute towards the mortgage.

Common mistakes

When completing the Rushmore Loan Management Services form, individuals often make errors that can delay the processing of their application. To ensure a smoother procedure, paying attention to the following mistakes is crucial:

- Incorrectly completed or unsigned Borrower Assistance Application: It's imperative that all obligated parties fill out, sign, and date the application. An incomplete or unsigned application can result in unnecessary delays.

- Insufficient documentation of income: Submitting less than the required number of pay stubs or not providing proof of other income sources as specified can hinder the review process. For new employment, a minimum of two consecutive paystubs is mandatory.

- Omitting pages from bank statements or tax returns: Every page of the required bank statements and tax returns must be submitted. Leaving out pages, even if they seem unimportant, can lead to a request for additional documentation.

- Failure to provide documentation for all accounts and properties: Neglecting to include statements for all bank accounts or documentation related to rental properties and other assets can cause your application to be considered incomplete.

- Not supplying documentation for non-borrower contributions: If a non-borrower is contributing to mortgage payments or household expenses, their signed letter stating this, along with proof of their income and a recent bank statement, are necessary for a thorough review.

Avoiding these common mistakes can significantly improve the processing time and outcome of your modification review with Rushmore Loan Management Services. Proper documentation and thoroughness are your allies in securing the assistance you need.

Documents used along the form

When preparing to submit a Borrower Assistance Application to Rushmore Loan Management Services, individuals may be required to gather various documents and forms in addition to the core application itself. The goal of these documents is to provide a full picture of the borrower's financial situation, enabling a more efficient review process. Below are four additional forms and documents typically requested alongside the Borrower Assistance Application:

- Hardship Affidavit: This document details the specific circumstances that have led the borrower to seek mortgage assistance. By describing the nature and timing of the hardship, this affidavit supports the application and clarifies the need for loan modification or other relief options.

- Dodd-Frank Certification: In response to the Dodd-Frank Wall Street Reform and Consumer Protection Act, this certification is needed to attest that the borrower has not been convicted of any crimes involving real estate or mortgage transactions within the past ten years. It's a legal requirement intended to prevent fraud.

- IRS Form 4506-T or 4506T-EZ: This form is utilized to request a transcript of the borrower's tax return directly from the IRS. Lenders use it to verify income information provided in the loan modification application, ensuring that the financial data is accurate and up to date.

- Non-Borrower Contribution Form: If individuals not listed on the mortgage are contributing to the household income or mortgage payments, this form documents their contributions. It includes the non-borrower's personal information, the nature of their relationship to the borrower, and the amount they contribute monthly.

In addition to these documents, applicants may be asked for further proof of income, assets, or expenses to fully assess their financial situation. By gathering and submitting all required information promptly, borrowers can expect a more streamlined review process. It's essential to contact Rushmore Loan Management Services directly with any questions or for clarification on specific documentation needs. The key is to provide a comprehensive and accurate financial overview to assist the service provider in determining the most suitable form of assistance.

Similar forms

The Rushmore Loan Management Services form shares similarities with the Uniform Residential Loan Application (URLA). Both forms require detailed personal and financial information from the borrower intended for mortgage-related services. The URLA, much like the Rushmore form, necessitates data on income, employment, assets, and liabilities to assess the borrower's creditworthiness and eligibility for loan assistance or modification. Each form also asks about the property in question, including its use and status, to determine the appropriate loan product or relief service.

Another document similar to the Rushmore form is the Loss Mitigation Application commonly utilized by servicers to evaluate a borrower's eligibility for alternatives to foreclosure. This application, like the Rushmore form, typically requests information regarding the borrower's financial hardship, current income, monthly expenses, and other debts. Both applications require supporting documentation, such as recent pay stubs, bank statements, and tax returns, to verify the information provided by the borrower and facilitate the review process.

The IRS Form 4506-T, Request for Transcript of Tax Return, also bears similarity to the Rushmore Loan Management Services form in that both are used in the loan modification and mortgage assistance process. The 4506-T form allows lenders to access the borrower’s tax return information directly from the IRS, ensuring the accuracy of the borrower's reported income and tax-related information. Rushmore's form requires a signed and dated 4506-T or 4506T-EZ to verify the borrower’s income through their federal tax returns, highlighting the importance of tax information in assessing borrowers' financial situations.

The Dodd-Frank Certification is another document that aligns with the Rushmore form’s purpose. This certification is required under the Dodd-Frank Wall Street Reform and Consumer Protection Act for borrowers seeking assistance or modification of their mortgage loan. It is similar to the Hardship Affidavit included in the Rushmore documentation, where the borrower must describe their financial hardship and affirm their request for assistance. Both documents are crucial for the evaluation process, allowing lenders to determine the appropriateness of modifying the loan terms based on the borrower’s circumstances.

Finally, the Non-Borrower Contribution form shares aspects with the Rushmore Loan Management Services form, particularly for those cases where household income from non-borrowers contributes to the mortgage or household expenses. This form, like the specific section in the Rushmore document, collects information on the contribution amount and source of income from individuals not obligated on the mortgage loan. It underlines the significance of considering the entire household income in determining the borrower's ability to afford mortgage payments, especially when modifications or assistance is being considered.

Dos and Don'ts

When completing the Rushmore Loan Management Services form, it is crucial to adhere to a set of guidelines to ensure the application process is smooth and successful. The following list includes things you should and shouldn't do:

- Do gather all the necessary documents before you start filling out the application. This includes pay stubs, bank statements, federal tax returns, and any other required financial documents.

- Do ensure that every obligated party completes, signs, and dates the Borrower Assistance Application. Omitting a signature can delay the processing of your application.

- Do provide detailed and accurate information about your income, assets, and expenses. Accuracy is crucial for a fair assessment of your situation.

- Do check that you have included all pages of your bank statements and tax returns. Missing pages can result in a request for additional documentation, delaying the process.

- Don't leave any sections blank. If a question does not apply to you, it is better to write "N/A" than to leave it empty.

- Don't underestimate the importance of the hardship affidavit. Make sure to explain the nature of your hardship clearly and concisely, and back it up with the necessary documentation.

- Don't send in incomplete documentation. Review the checklist provided in the form instructions carefully to ensure that you have included everything required.

- Don't hesitate to contact Rushmore Loan Management Services for clarification if you have any questions or concerns. It's better to ask than to submit incorrect information.

By following these guidelines, applicants can increase the likelihood of a smooth and successful application process. Remember, the goal is to present your financial situation accurately to obtain the assistance you need.

Misconceptions

There are several misconceptions about the Rushmore Loan Management Services form and its requirements. Clarifying these misunderstandings can help borrowers navigate the process more smoothly and ensure they provide all the necessary documentation for their application.

Misconception 1: Only borrowers are required to submit documentation.

This is incorrect. Both borrowers and non-borrowers who contribute to mortgage payments or household expenses are required to provide specific documentation, including proof of income and bank statements.

Misconception 2: Single month's bank statement or paystub is sufficient.

In reality, the form specifies that borrowers must submit the most recent full month of paystubs and, for self-employed individuals, the last three months or the most recent quarterly profit and loss statement.

Misconception 3: Tax returns are not essential if taxes are not filed.

Contrary to this belief, if a borrower was not required to file taxes, they must provide a signed and dated letter explaining the situation.

Misconception 4: Documentation of expenses is not necessary.

Any disclosed expenses must be validated with supporting documents. This detail is crucial for assessing the borrower's financial situation accurately.

Misconception 5: Hardship details are optional on the application.

The application requires a completed Hardship Affidavit, where borrowers must specify the nature of their hardship and support their claims with proper documentation.

Misconception 6: Rental income does not need verification.

For those owning rental properties, it's mandatory to verify rental income through bank statements that reflect deposits or provide alternative evidence like cancelled checks.

Misconception 7: A credit report authorization is not needed for non-borrowers who contribute financially.

Actually, a letter of authorization to obtain a credit report for all contributing non-borrowers is required to assess their financial contributions accurately.

Misconception 8: Communication preferences do not influence the application process.

The form allows borrowers to indicate if they prefer communication in Spanish, which facilitates assigning a Spanish-speaking representative to assist them.

Understanding the specific requirements of the Rushmore Loan Management Services form can help applicants submit their documentation correctly, facilitating a smoother modification review process.

Key takeaways

When seeking mortgage assistance through the Rushmore Loan Management Services, understanding the checklist and requirements is crucial for a successful application process. Here are key takeaways to ensure you are well-prepared.

- Every borrower must fill out, sign, and date the Borrower Assistance Application. This includes all parties obligated on the loan.

- Income verification is a must. Provide the most recent one full month of paystubs, or two consecutive paystubs if newly employed.

- All accounts' most recent bank statements, ensuring every page is included, are required for each borrower.

- Submission of signed and dated federal tax returns from the most recent year, including all schedules, is necessary. If taxes were not filed, a signed and dated explanatory letter is required.

- For those with properties governed by a Homeowners’ Association, the most recent HOA statement is needed to verify monthly dues.

- The IRS Form 4506T or 4506T-EZ must be completed, signed, and dated for tax verification purposes.

- Non-borrowers contributing towards the mortgage or household expenses need to provide a signed and dated letter stating their monthly contribution, along with proof of income and a recent bank statement.

- Various sources of income, including self-employed, rental properties, fixed income, and variable income, have specific documentation requirements outlined in the application checklist.

It is also important to note, if circumstances have changed requiring a reappraisal of your application, a detailed letter of explanation along with relevant supporting documents must be provided.

Should there be any questions or concerns while filling out the application or gathering documents, Rushmore Loan Management Services offers a toll-free number available Monday through Thursday from 6:00 am to 7:00 pm, and Friday from 6:00 am to 6:00 pm Pacific Time to assist applicants.

Filing your Borrower Assistance Application accurately and providing all the required documentation can expedite the review process. Remember to mail or fax the completed application to the addresses provided by Rushmore Loan Management Services, ensuring all information is current and accurate to facilitate a smooth evaluation process.

Popular PDF Documents

Nebraska Resale Certificate - Energy sources and mobility enhancing equipment have specific forms for exemption claims.

IRS Schedule D 1040 or 1040-SR - It's vital for tracking the tax implications of buying and selling investments throughout the year.

Claiming Tax Back at the Airport - Streamlines the process of applying for a refund on travel taxes paid, with clear instructions for both the passenger and the carrier.