Get Rev 1706 Tax Form

Navigating through the complexities of closing or altering a business operation in Pennsylvania requires careful attention to various tax obligations and licenses. The Rev 1706 Tax Form, known formally as the Business/Account Cancellation Form, serves as a pivotal document for business owners who find themselves in this position. This form is designed to facilitate the process of officially informing the Pennsylvania Department of Revenue about significant changes, including the discontinuation, sale, or cessation of operations. Covering a wide array of areas, it addresses the cancellation of state and local sales tax licenses, employer withholding taxes, Public Transportation Assistance Fund taxes and fees, vehicle rental taxes, and tobacco products licenses. Each section demands specific information about the business, such as its legal name, Taxpayer Identification Number (FEIN for businesses or SSN for sole proprietors), and the reason for the cancellation – be it due to the cessation of taxable sales, the closure or sale of the business, or other reasons. Additionally, the form requires an affirmation section to be completed, ensuring that all provided information is correct to the best of the submitter's knowledge, under the penalty of law for unsworn falsification to authorities. With detailed instructions included, the form guides users through each step of the cancellation process to ensure that all necessary information is accurately conveyed, thereby assisting business owners in closing chapters or shifting directions with compliance and peace of mind.

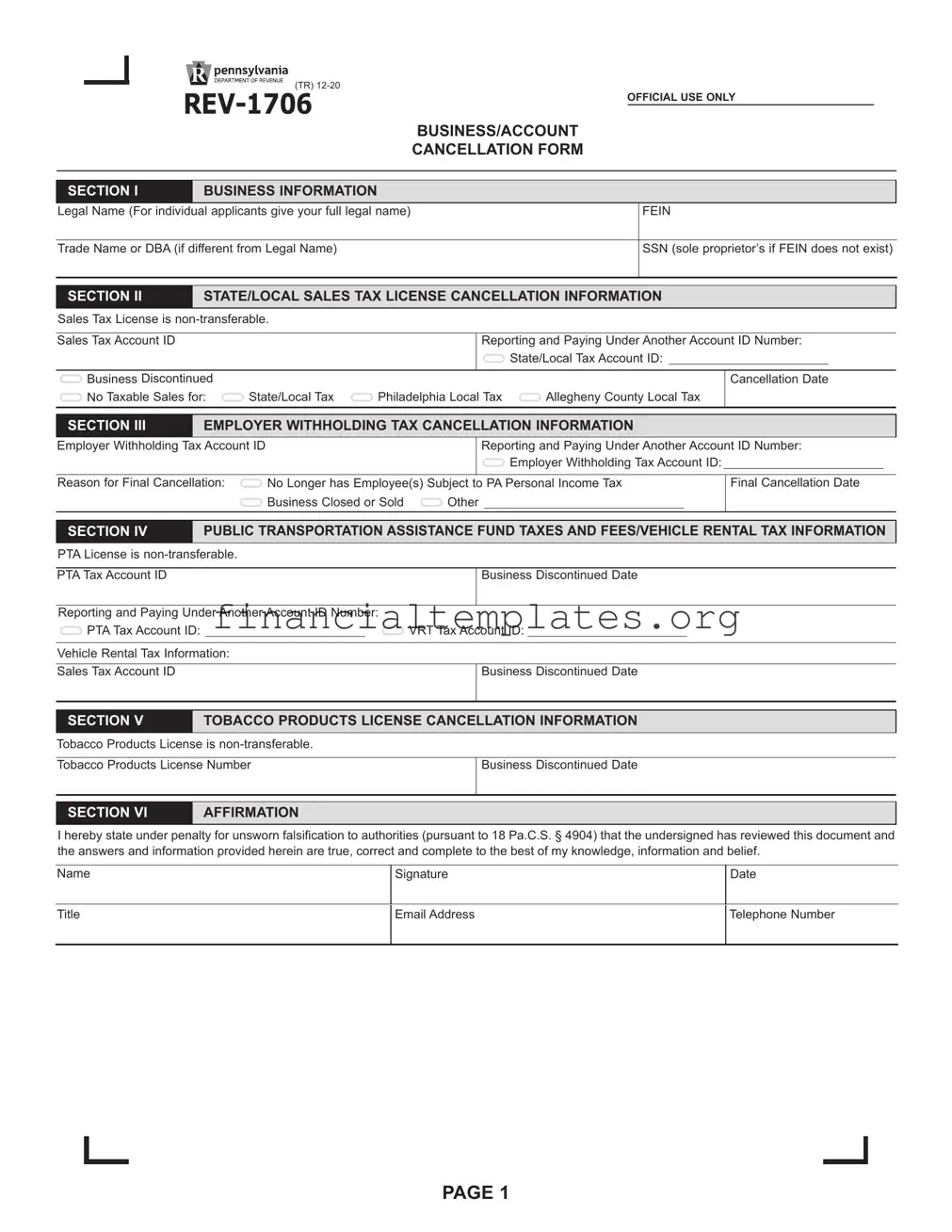

Rev 1706 Tax Example

(TR)

OFFICIAL USE ONLY

BUSINESS/ACCOUNT

CANCELLATION FORM

SECTION I

BUSINESS INFORMATION

Legal Name (For individual applicants give your full legal name)

FEIN

Trade Name or DBA (if different from Legal Name)

SSN (sole proprietor’s if FEIN does not exist)

SECTION II

STATE/LOCAL SALES TAX LICENSE CANCELLATION INFORMATION

Sales Tax License is

Sales Tax Account ID

Reporting and Paying Under Another Account ID Number:  State/Local Tax Account ID:

State/Local Tax Account ID:

Business Discontinued |

|

|

|

No Taxable Sales for: |

State/Local Tax |

Philadelphia Local Tax |

Allegheny County Local Tax |

Cancellation Date

SECTION III

EMPLOYER WITHHOLDING TAX CANCELLATION INFORMATION

Employer Withholding Tax Account ID

Reporting and Paying Under Another Account ID Number:  Employer Withholding Tax Account ID:

Employer Withholding Tax Account ID:

Reason for Final Cancellation:

No Longer has Employee(s) Subject to PA Personal Income Tax |

|

Business Closed or Sold |

Other |

Final Cancellation Date

SECTION IV

PUBLIC TRANSPORTATION ASSISTANCE FUND TAXES AND FEES/VEHICLE RENTAL TAX INFORMATION

PTA License is

PTA Tax Account ID |

Business Discontinued Date |

|

|

Reporting and Paying Under Another Account ID Number:  PTA Tax Account ID:

PTA Tax Account ID:

VRT Tax Account ID:

Vehicle Rental Tax Information:

Sales Tax Account ID |

Business Discontinued Date |

|

|

SECTION V

TOBACCO PRODUCTS LICENSE CANCELLATION INFORMATION

Tobacco Products License is

Tobacco Products License Number |

Business Discontinued Date |

|

|

SECTION VI

AFFIRMATION

I hereby state under penalty for unsworn falsification to authorities (pursuant to 18 Pa.C.S. § 4904) that the undersigned has reviewed this document and the answers and information provided herein are true, correct and complete to the best of my knowledge, information and belief.

Name

Signature

Date

Title

Email Address

Telephone Number

PAGE 1

INSTRUCTIONS FOR

BUSINESS/ACCOUNT CANCELLATION FORM

This form must be completed if the business was discontin- ued, sold or ceased operations in Pennsylvania.

SECTION IV

PUBLIC TRANSPORTATION ASSISTANCE FUND TAXES AND FEES/VEHICLE RENTAL TAX INFORMATION

If the business no longer has sales, rentals or leases sub- ject to PTA/VRT taxes and fees, or the sales tax license was cancelled, indicate

LINE INSTRUCTIONS

SECTION II

STATE/LOCAL SALES TAX LICENSE CANCELLATION INFORMATION

PENNSYLVANIA

Complete this section to cancel a state sales tax license when a business:

●Was discontinued, sold or ceased operations in Pennsylvania;

●No longer makes taxable sales, rentals or leases;

●No longer provides taxable services in Pennsylvania; or

●Reports and pays under another Account ID Number.

LOCAL

Complete this section to advise the department that a business:

●Was discontinued, sold or ceased operations in Pennsylvania;

●No longer makes sales, rentals or leases, or provides taxable sales or services subject to local sales tax;

●No longer reports use tax on property used or services provided within Philadelphia or Allegheny County on which no local sales tax was paid; or

●Reports and pays under another Account ID Number.

SECTION V

TOBACCO PRODUCTS LICENSE CANCELLATION INFORMATION

If cigarettes are no longer sold or if the sales tax license was cancelled, complete this information and indicate the date the business ceased selling cigarettes.

SECTION VI

AFFIRMATION

Sign and date the form. Include a daytime telephone num- ber, title and email.

Fax or Email the completed form to:

Fax:

Email:

REGISTRATION METHOD

To register, complete the Pennsylvania Online Business Entity Registration

SECTION III

EMPLOYER WITHHOLDING TAX CANCELLATION

INFORMATION

If the business was sold, closed or no longer has employee(s) subject to PA personal income tax, complete this section. Provide the reason for the cancellation and the required cancellation dates on this form. If the EIN is changed by the Internal Revenue Service, a new registration

www.revenue.pa.gov |

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The REV-1706 form is used for businesses discontinuing operations in Pennsylvania or changing account information related to sales/use tax, employer withholding tax, Public Transportation Assistance taxes and fees, vehicle rental tax, and Tobacco Products licenses. |

| Non-Transferability | Sales Tax License, PTA License, and Tobacco Products License mentioned in the form are non-transferable, meaning they cannot be passed from one business entity to another. |

| Affirmation Requirement | The form must be signed under penalty for unsworn falsification to authorities, affirming that the information provided is true, correct, and complete. |

| Account ID Specification | When cancelling any licenses or accounts, accurate Account ID Numbers corresponding to each tax or license type must be provided. |

| Registration Method for New Accounts | New registrations must be completed through the Pennsylvania Online Business Entity Registration (PA-100) for any changes in existing businesses, including changes mandated by the IRS. |

| Electronic Submission Options | For users of e-TIDES, the state's electronic tax information and data exchange system, account changes can be made directly online, offering a streamlined method for updating business information. |

Guide to Writing Rev 1706 Tax

Filling out the REV-1706 Tax Form is an essential step for businesses that are discontinuing operations, selling, or ceasing their activities in Pennsylvania. This process ensures that the company's obligations toward state and local taxes, employer withholding taxes, and other specific licenses (like those for public transportation assistance or tobacco products) are properly closed or transferred. Navigating through this form might seem daunting, but by breaking it down into manageable steps, businesses can ensure compliance with state requirements, avoid potential penalties, and take a significant step toward finalizing their business affairs. Here are the detailed steps to guide you through completing the REV-1706 Business/Account Cancellation Form correctly.

- Collect all necessary business information: This includes the legal name of the business, Federal Employer Identification Number (FEIN), if available, or the Social Security Number (SSN) for sole proprietors, and any trade names or DBAs (Doing Business As).

- Complete Section I - Business Information: Fill in your business's legal name, FEIN, trade name or DBA, and SSN if a sole proprietor and FEIN is not available.

- Address the specifics of state and local sales tax license cancellation in Section II: If you are discontinuing or have sold the business, you will need to provide the sales tax account ID, and check the appropriate boxes that apply to your situation, such as “Business Discontinued” or “No Taxable Sales for” specific local taxes.

- Fill in the Employer Withholding Tax Cancellation Information in Section III: Indicate your Employer Withholding Tax Account ID, select a reason for the final cancellation from the provided options, such as “No Longer has Employee(s) Subject to PA Personal Income Tax, Business Closed or Sold, or Other”, and specify the final cancellation date.

- Detail the Public Transportation Assistance Fund Taxes and Fees/Vehicle Rental Tax Information in Section IV: This section requires the PTA Tax Account ID, possible new Account ID Number if reporting under another, and business discontinuation dates.

- Provide Tobacco Products License Cancellation Information in Section V: If you had a tobacco products license, indicate the license number and the date when the business stopped selling cigarettes.

- Complete the Affirmation in Section VI: Sign and date the form, providing a print name, title, email address, and telephone number to verify the accuracy and truthfulness of the information submitted.

- Submit the completed form: Fax or email the form to the department using the provided fax number: 717-787-3708 or email address: RA-BTFTREGISFAX@PA.GOV.

By following these steps carefully, businesses can effectively communicate their closure or change in operational status to the Pennsylvania Department of Revenue. This not only helps in wrapping up the business's tax affairs but also in paving the way for a smoother transition for businesses moving forward with new endeavors or closing down

.Understanding Rev 1706 Tax

What is the purpose of the REV-1706 Tax Form?

The REV-1706 Tax Form serves as a Business/Account Cancellation Form. It is used by businesses in Pennsylvania that have been discontinued, sold, or ceased operations within the state. The form allows businesses to officially cancel their state/local sales/use tax, employer withholding tax, Public Transportation Assistance Fund taxes and fees, vehicle rental tax, and Tobacco Products licenses.

How can changes to account information be made without the REV-1706 Form?

For businesses that prefer an online solution, changes to account information can be directly made on the Department of Revenue’s e-TIDES platform, utilizing the “Enterprise maintenance” function. This online method provides an alternate route without the need to fill out and submit the REV-1706 Form.

Is the Sales Tax License transferable between businesses?

No, the Sales Tax License, along with the Public Transportation Assistance Fund taxes and fees (PTA), Vehicle Rental Tax (VRT), and Tobacco Products License, are non-transferable. This means that these licenses cannot be transferred from one business entity to another in the event of a sale, merger, or ownership change.

What should be done if a business no longer makes taxable sales or if its tax account ID changes?

If a business discontinues making taxable sales, sells, or ceases operations, or if it begins reporting and paying taxes under a new account ID number, the appropriate sections of the REV-1706 Form must be completed. This includes detailing the transition and providing cancellation dates where necessary for accurate records and compliance.

How can a business cancel its Tobacco Products License?

To cancel a Tobacco Products License, a business must fill out the REV-1706 Form, indicating the date when it stopped selling tobacco products. This is essential for companies that have discontinued the sale of cigarettes or are closing their operations entirely.

What are the requirements for the affirmation section in the REV-1706 Form?

In the affirmation section of the REV-1706 Form, the individual completing the form must declare that all provided information and answers are true, correct, and complete to the best of their knowledge. This section requires a signature, date, title of the signer, and the inclusion of contact information such as an email address and telephone number. It is crucial as it holds the individual accountable under penalty for unsworn falsification to authorities.

How should the completed REV-1706 Form be submitted?

Once filled out, the completed REV-1706 Form can be submitted either by faxing it to 717-787-3708 or by emailing it to the designated email address provided on the form, RA-BTFTREGISFAX@PA.GOV. This allows for convenient submission depending on the preference or capabilities of the business completing the form.

Common mistakes

Filling out the REV-1706 Tax Form is a crucial step for businesses ceasing operations or undergoing significant changes in Pennsylvania. However, it's not uncommon for mistakes to happen during this process. Understanding these pitfalls can help ensure your submission is accurate and compliant. Here are seven common errors to avoid:

-

Incorrect or Incomplete Legal Name: The full legal name is critical for individual applicants. A mismatch or omission can lead to processing delays or the rejection of the form.

-

Failure to Specify Account ID Numbers for All Relevant Taxes: When the form is used to cancel multiple taxes, each corresponding Account ID Number must be precisely entered. Overlooking or inaccurately filling in these details can complicate the cancellation process.

-

Omitting the Cancellation Date: For every tax type being cancelled, a specific cancellation date is required. Neglecting to provide this date may result in confusion or assume the business is still active for tax purposes.

-

Forgetting to Specify the Reason for Employer Withholding Tax Cancellation: This section must clearly state why the cancelation is occurring, whether due to business closure, sale, or absence of employees subject to PA personal income tax. Ambiguity here can lead to unnecessary follow-up inquiries.

-

Not Using the Most Current Form Version: Utilizing an outdated version of the form can result in an incorrect submission, as it may lack recent updates or requirement changes.

-

Failure to Sign the Affirmation Section: The omission of a signature, date, and necessary contact information in the Affirmation section invalidates the form. This demonstrates compliance and accountability, affirming that the provided information is accurate to the best of the submitter's knowledge.

-

Incorrectly Reporting or Not Reporting Transfer of Sales Tax License: It is essential to understand that sales tax licenses are non-transferable. If a business is discontinued or sold, this form must clearly state that fact, and any attempt to transfer the license without properly notifying through this form can create legal complications.

Each of these mistakes can lead to delays, additional paperwork, or even legal issues. By taking the time to review and double-check each section of the REV-1706, businesses can navigate the closing or transition process more smoothly, ensuring that all tax obligations are correctly concluded.

Documents used along the form

Handling business affairs often requires more than just completing the REV-1706 Tax Form. Several other forms and documents may be necessary to ensure compliance with various tax and legal obligations. Below is a list of documents often used in conjunction with the REV-1706 Tax Form, each serving a specific purpose in the broader context of managing a business's responsibilities.

- PA-100 Form: This is the Pennsylvania Enterprise Registration Form used to register a new business or update information for an existing business with the Pennsylvania Department of Revenue and the Department of Labor & Industry. It covers sales tax, employer withholding, and unemployment compensation among other tax responsibilities.

- Form W-9: Request for Taxpayer Identification Number and Certification is often required when setting up accounts with new vendors or contracting with independent contractors, ensuring the correct reporting of taxes to the IRS.

- Form 1099-MISC: Used to report payments made in the course of a trade or business to others who are not employees. This form is crucial for businesses that have discontinued operations and need to report final payments made to contractors.

- Articles of Dissolution: This document is filed with the state by businesses that are ending operations permanently, signaling the legal end of the entity according to state law.

- Sales and Use Tax Exemption Certificate: Businesses that purchase goods for resale can use this form to buy items tax-free, provided the items are sold later under the sales tax license of the business. It would be relevant when closing a business to ensure all final purchases are properly documented.

- Employee's Withholding Allowance Certificate (W-4): This form is used to determine the correct amount of tax withholding for employees. It's relevant for businesses that are concluding operations and need to ensure final payroll compliance.

- IRS Form 940: This is the Employer’s Annual Federal Unemployment (FUTA) Tax Return, necessary for businesses to finalize their federal unemployment tax responsibilities for the year the business ends operations or discontinues employing staff.

- IRS Form 941: Employers use this quarterly federal tax return to report income taxes, social security tax, or Medicare tax withheld from employee's paychecks, and to pay the employer's portion of social security or Medicare tax.

- Change of Address Form (8822): This IRS form should be filed if the business is moving as part of the discontinuation process to ensure all final tax documents and correspondence are sent to the correct address.

Each document plays a vital role in wrapping up a business's fiscal and legal affairs properly. Whether it's ensuring that all taxes are correctly reported and paid, or that the business is legally dissolved in its state, these forms help protect the interests of the business owner, the employees, and the tax authorities involved. Proper completion and filing of these forms will support a smooth transition as business operations come to a close.

Similar forms

The IRS Form 8822-B is quite similar to the Rev 1706 Tax Form, specifically in its function for updating business information with a tax authority. While the Rev 1706 form is used to notify the Pennsylvania Department of Revenue about changes such as business closure or cessation of operations, IRS Form 8822-B serves a broader purpose by allowing businesses across the United States to inform the Internal Revenue Service of changes to their mailing address or business location. Both forms are critical for maintaining accurate records and ensuring that tax-related communications are correctly directed.

Another document akin to the Rev 1706 Tax Form is the state-specific Sales and Use Tax Cancellation or Change of Account form that many states offer for businesses operating within their jurisdictions. These forms, similar to Section II of the Rev 1706, are used by businesses to cancel their sales tax permits when they discontinue sales, cease operations, or change their business structure in a way that affects their sales tax liabilities. Importantly, they facilitate the smooth transition of sales tax responsibilities and help prevent accidental tax evasion by ensuring that state tax agencies have up-to-date information on businesses.

The Employer’s Quarterly Federal Tax Return, or IRS Form 941, shares similarities with Section III of the Rev 1706 regarding the reporting of employee-related taxes. Though the IRS Form 941 is used to report payroll taxes on a quarterly basis and is not a cancellation document, it aligns with the Rev 1706 in its focus on employment tax obligations. When a business closes or stops employing workers, understanding the interplay between finalizing IRS Form 941 filings and completing Section III of the Rev 1706 can be crucial for properly ending a business’s tax responsibilities.

The Business License Cancellation forms found in various states parallel the Rev 1706's Sections IV and V, which deal with the cancellation of licenses for the Public Transportation Assistance Fund Taxes, Vehicle Rental Tax, and Tobacco Products. Similar to the Rev 1706, these forms are used when a business ceases operations or no longer requires specific licenses for its operations. The primary purpose is to officially notify the licensing authority that the business will no longer engage in activities requiring those licenses, thus avoiding unnecessary licensing fees or taxes.

Lastly, the State Department of Health’s Permit to Operate Cancellation forms, though not directly tax-related, resemble the Rev 1706 in their procedural nature for businesses ending specific types of operations. Just as a business might need to cancel its Tobacco Products License through the Rev 1706, health-related business operations might also require the formal cancellation of health permits when they cease operations that affect public health. This ensures that state records accurately reflect the current status of businesses and permits, helping to maintain public health and safety.

Dos and Don'ts

When completing the Rev 1706 Tax Form, there are certain practices to keep in mind to ensure accuracy and compliance. Below is a list of dos and don'ts that can serve as a guide:

Do:

Provide your full legal name as it appears in official documents to avoid discrepancies.

Enter the correct Federal Employer Identification Number (FEIN) or Social Security Number (SSN) to ensure your business is properly identified.

Clearly indicate if you are reporting and paying under another Account ID Number, to link all relevant accounts and avoid confusion.

Specify the exact date of business discontinuation, sale, or cessation of operations in Pennsylvania, for accurate records and processing.

Check all the sections relevant to your business activities (e.g., sales tax, employee withholding, etc.) to ensure all necessary cancellations are processed.

Provide a valid email address and telephone number to facilitate communication regarding your form.

Don't:

Transfer the sales tax license to another business entity, as it is non-transferable.

Leave sections incomplete if they are applicable to your business activities, as this could lead to delays or errors in processing.

Forget to sign and date the form, as this affirmation section is required to verify the information provided.

Ignore the requirement to register a new PA-100 if your EIN has been changed by the IRS, to ensure your business information is up to date.

Omit the cancellation date for any tax accounts being discontinued, as these dates are crucial for record-keeping.

Dismiss the advice to use e-TIDES for users who can update their accounts online, as it might streamline the process.

Adhering to these guidelines will help in the smooth processing of your Rev 1706 Tax Form. Remember to consult with a tax professional if you have questions or concerns about your specific situation.

Misconceptions

Misconceptions about the REV-1706 Tax Form are prevalent, often leading to confusion or errors when attempting to complete it. Understanding these misconceptions can help ensure the process is managed correctly and efficiently.

- Only for Businesses Physically Closing: A common misconception is that the REV-1706 form is solely for businesses that are physically closing their doors. However, this form also applies to businesses that have been discontinued, sold, or ceased operations in Pennsylvania in any capacity, not just those shuttering their physical premises. This includes situations where operations continue but under a different business model or structure that doesn't require the previously held licenses.

- One Form Fits All Situations: Another misunderstanding is believing that the REV-1706 is a universal form for all types of cancellations and notices to the Pennsylvania Department of Revenue. While the REV-1706 is comprehensive, it specifically addresses the cancellation of business/accounts related to state/local sales/use tax, employer withholding tax, Public Transportation Assistance Fund taxes and fees, vehicle rental tax, and Tobacco Products licenses. Other types of tax or license cancellations may require different forms or procedures.

- Physical Submission Only: Some may think that the REV-1706 form must be submitted physically either via mail or in person. This is not the case. The form can be faxed or emailed to the appropriate department contacts, providing a more convenient and quicker option for submission. Additionally, those using the e-TIDES system for managing their taxes can make necessary changes directly through the online portal, streamlining the process further.

- Transferring Licenses: There's a misconception that licenses associated with the REV-1706, such as the sales tax or tobacco products license, can be transferred to a new owner or another business entity as part of a sale or restructuring. The form explicitly states that these licenses are non-transferable. The cancellation of the license is necessary when a business changes hands, and the new owner must apply for their license under their name or their business entity.

Correcting these misconceptions helps in navigating the complexities of Pennsylvania's tax system, ensuring businesses comply with state regulations while making informed decisions about their operations.

Key takeaways

Understanding how to properly fill out and use the REV-1706 Tax Form is crucial for businesses aiming to cancel licenses or accounts when discontinuing operations, selling, or ceasing operations in Pennsylvania. Here are key takeaways to guide you through this process:

- The REV-1706 form is designed for the cancellation of various tax-related licenses and accounts, including state/local sales/use tax, employer withholding tax, public transportation assistance fund taxes and fees, vehicle rental tax, and tobacco products licenses.

- It's important to accurately complete the Business Information section with your legal name, FEIN, and any trade name or DBA you operate under. This ensures that the correct business entity is identified for license cancellation.

- For state/local sales tax license cancellation, you must provide specific information about your Sales Tax Account ID and the reason for cancellation, such as business discontinuation or no longer making taxable sales.

- If cancelling an employer withholding tax account, it's necessary to include details regarding the Employer Withholding Tax Account ID and the reason for the final cancellation, like the business closing or no longer having employees subject to PA personal income tax.

- The form also requires specific information for the cancellation of specialty taxes, such as Public Transportation Assistance Fund taxes and Tobacco Products licenses, including account IDs and the business discontinuation date.

- Finally, the affirmation section must be signed and dated to confirm that the provided information is accurate and complete. This section is a legal declaration of the truth and completeness of the form's content.

Completing the REV-1706 form accurately and thoroughly is a step towards ensuring compliance with Pennsylvania's tax laws during significant business transitions. Remember to provide detailed and accurate information for each relevant section and to sign the affirmation to validate the form. For additional guidance or clarification, consulting with a tax professional or utilizing resources available on the Pennsylvania Department of Revenue's website can be helpful.

Popular PDF Documents

Pslf Employment Certification Form - The financial support covers both degree and vocational/technical courses, with specific maximum amounts provided.

IRS 8960 - Awareness of updates and changes to IRS 8960 and relevant tax provisions is critical for compliance and tax strategy.

City of Owensboro - Details minimum license fee payments to ensure businesses meet their baseline fiscal responsibilities.