Get Request For Irs W 2 Form

In navigating the intricacies of tax documentation, the Request for IRS Form W‐2 stands out for its critical role in ensuring employees can accurately file their taxes. Particularly relevant for those who have either never received their W‐2, misplaced it, or found it destroyed, this form enables individuals to request a reprint or reissue of their W‐2 Tax Form for specific tax years, ranging widely from 2008 to 2014. Given its importance, the process includes a meticulous step of indicating the reason for the request, ensuring clarity in intent. Equally vital is the decision on how the form should be delivered, offering options from mailing to a specified address, physical pick-up at the Administrative Services Building, or receiving it through a secure email link, accommodating different preferences and needs. To support the administrative cost associated with reissuing these forms, a processing fee of $10 for each year requested is mandatory, with payment options being diverse, including credit card, cash, money order, or check, thereby adding a layer of financial transaction to the process. This comprehensive approach, encapsulated in the form’s design, underscores the balance between accessibility for the employee and the administrative rigor required to manage such requests, illustrating the form's pivotal role in tax administration and individual compliance.

Request For Irs W 2 Example

|

|

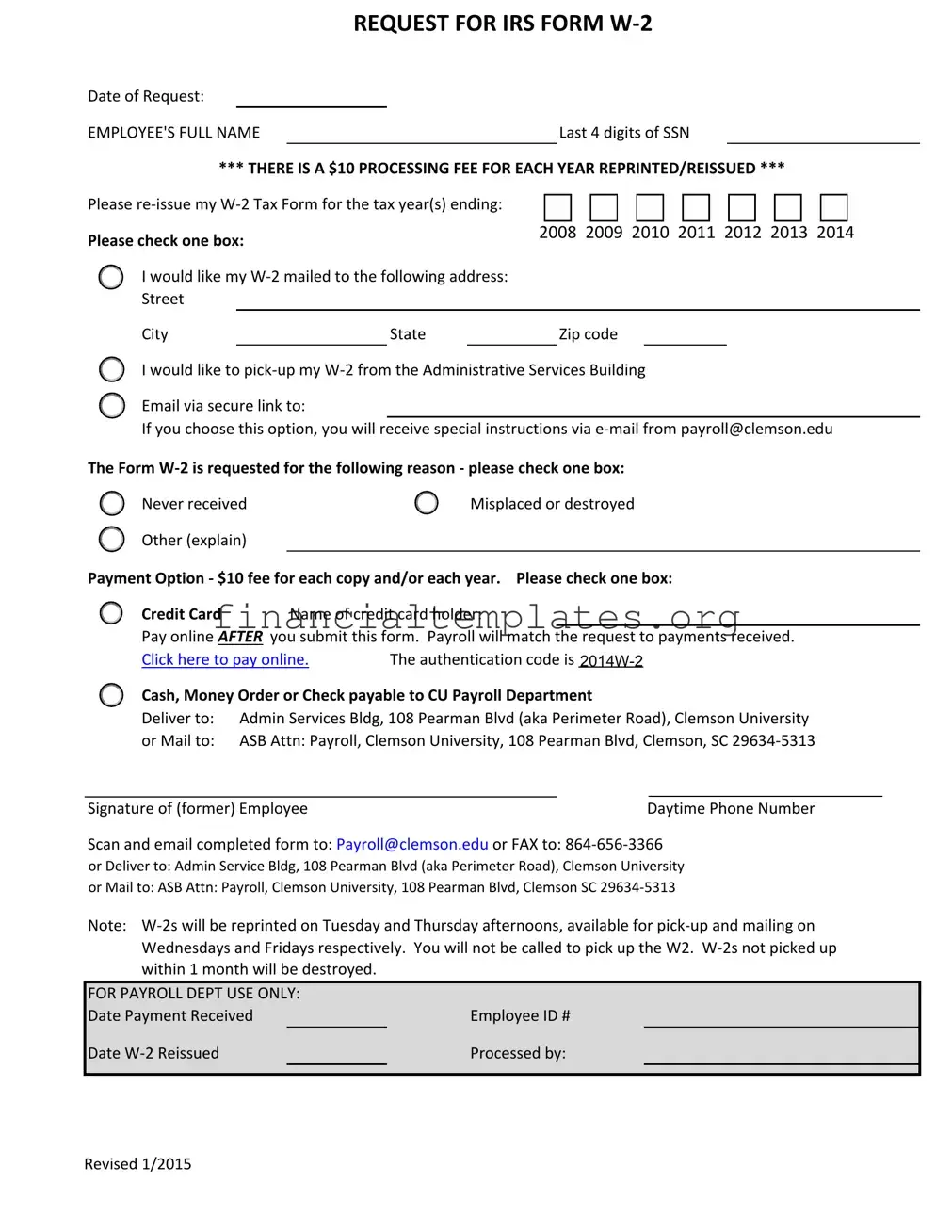

REQUEST FOR IRS FORM W‐2 |

||

Date of Request: |

|

|

|

|

EMPLOYEE'S FULL NAME |

|

|

Last 4 digits of SSN |

|

*** THERE IS A $10 PROCESSING FEE FOR EACH YEAR REPRINTED/REISSUED ***

Please re‐issue my W‐2 Tax Form for the tax year(s) ending:

Please check one box: |

|

|

2008 2009 2010 2011 2012 2013 2014 |

||||

|

|

|

|

|

|

||

I would like my W‐2 mailed to the following address: |

|

|

|

|

|||

Street |

|

|

|

|

|

|

|

City |

State |

|

Zip code |

||||

|

|

|

|

|

|

|

|

I would like to pick‐up my W‐2 from the Administrative Services Building

Email via secure link to:

If you choose this option, you will receive special instructions via e‐mail from payroll@clemson.edu

The Form W‐2 is requested for the following reason ‐ please check one box:

Never received |

Misplaced or destroyed |

|||||

Other (explain) |

|

|

|

|

||

|

|

|

|

|

||

Payment Option ‐ $10 fee for each copy and/or each year. Please check one box: |

||||||

Credit Card |

|

Name of credit card holder: |

|

|||

Pay online AFTER you submit this form. Payroll will match the request to payments received. |

||||||

Click here to pay online. |

The authentication code is |

|||||

Cash, Money Order or Check payable to CU Payroll Department |

||||||

Deliver to: |

Admin Services Bldg, 108 Pearman Blvd (aka Perimeter Road), Clemson University |

|||||

or Mail to: |

ASB Attn: Payroll, Clemson University, 108 Pearman Blvd, Clemson, SC 29634‐5313 |

|||||

|

|

|

|

_ |

|

|

|

|

|

|

|

|

|

Signature of (former) Employee |

|

Daytime Phone Number |

||||

Scan and email completed form to: Payroll@clemson.edu or FAX to: 864‐656‐3366

or DeliverA to: Admin Service Bldg, 108 Pearman Blvd (aka Perimeter Road), Clemson University

or Mail to: ASB Attn: Payroll, Clemson University, 108 Pearman Blvd, Clemson SC

Note: W‐2s will be reprinted on Tuesday and Thursday afternoons, available for pick‐up and mailing on Wednesdays and Fridays respectively. You will not be called to pick up the W2. W‐2s not picked up within 1 month will be destroyed.

FOR PAYROLL DEPT USE ONLY:

Date Payment Received

Date W‐2 Reissued

Revised 1/2015

Document Specifics

| Fact Name | Fact Detail |

|---|---|

| Form Purpose | Allows for the request of a reissued IRS Form W-2. |

| Processing Fee | A $10 processing fee is charged for each year's W-2 form reprinted/reissued. |

| Request Options | Options to receive the W-2 include mail, pickup, or via a secure email link. |

| Reasons for Request | Reason options include never received, misplaced, destroyed, or other with an explanation required. |

| Payment Methods | Payment can be made via credit card, cash, money order, or check. |

| Online Payment | Online payment requires submission of the form first, followed by online payment with payroll matching the request to payments. |

| Signature Requirement | Submission requires the signature of the (former) employee requesting the W-2 form. |

| Contact Information & Delivery Mode | The form provides details for email, fax, and mail submission, including where to send payment and where the W-2 form can be picked up. |

Guide to Writing Request For Irs W 2

After completing the Request for IRS Form W-2, there are specific steps to follow to ensure the process goes smoothly. This form is essential for anyone needing a duplicate of their W-2 form due to not receiving it, misplacement, or it being destroyed. The process involves selecting the tax year(s) for the W-2 form(s) you're requesting, choosing a delivery method, and providing a reason for the request. Additionally, a $10 processing fee is required for each year's W-2 form requested. Following the correct steps will help expedite the receipt of your W-2 form.

- Enter your Employee ID # at the top of the form.

- Fill in the Date of Request.

- Provide your EMPLOYEE'S FULL NAME, including the last 4 digits of your Social Security Number (SSN).

- Select the tax year(s) for which you need the W-2 form reissued by checking the appropriate box(es).

- Choose how you'd like to receive your W-2: by mail—filling out your address, picking it up from the Administrative Services Building, or receiving it via a secure link by email. If choosing email, write down your email address.

- Indicate the reason for requesting the form by checking the appropriate box: never received, misplaced/destroyed, or other (providing an explanation if you select "other").

- Select your payment option for the processing fee: paying online with a credit card or using cash, a money order, or a check. If paying by credit card, note the name of the cardholder, then pay online as instructed after submitting the form. If using another payment method, deliver or mail your payment to the specified address.

- Add your signature and a daytime phone number at the bottom of the form.

- Lastly, submit the completed form along with your payment. You can scan and email it to Payroll@clemson.edu, fax it, deliver it in person, or mail it to the provided addresses.

After submission, W-2s are reprinted on Tuesday and Thursday afternoons and are ready for pick-up or mailing on the following Wednesdays and Fridays. It is important to note that you will not receive a call to pick up the W-2. Any forms not collected within one month will be destroyed. This process ensures the secure and timely delivery of your requested W-2 form.

Understanding Request For Irs W 2

What is a Request for IRS Form W-2?

The Request for IRS Form W-2 is a document used by employees to request a reprint or reissue of their W-2 tax form for a specific tax year(s). This might be necessary if the original form was never received, misplaced, or destroyed.Is there a fee for requesting a reissued W-2 form?

Yes, there is a $10 processing fee for each year's W-2 form that is reprinted or reissued.How can the payment for the reissued W-2 form be made?

Payment options include credit card, cash, money order, or check payable to the CU Payroll Department. For credit card payments, pay online after submitting the request form, and payroll will match the payment to the received request.How can I submit my request for a reissued W-2 form?

The completed request form can be submitted via email (by scanning and emailing to Payroll@clemson.edu), fax (to 864‐656‐3366), delivery in person to the Admin Services Building at 108 Pearman Blvd, Clemson University, or by mail to the same address, directed to 'ASB Attn: Payroll'.When are reprinted W-2 forms available for pick-up or mailing?

W-2 forms are reprinted on Tuesday and Thursday afternoons and are available for pick-up and mailing on Wednesdays and Fridays, respectively. Note that recipients will not be called to pick up their W-2 form.What happens to unclaimed W-2 forms?

Unclaimed W-2 forms not picked up within one month from the date of reprinting will be destroyed.Can I have my reissued W-2 form mailed to me?

Yes. When filling out the request form, you can opt to have the W-2 form mailed to a specified address by ticking the appropriate box and providing the mailing details.Is it possible to receive the W-2 form via email?

Yes, there's an option to receive the W-2 form through a secure link via email. Select this option on the request form and follow the special instructions sent from payroll@clemson.edu for downloading the form securely.What should I do if I have multiple tax years of W-2 forms to request?

If requesting reissues for multiple tax years, indicate each year clearly on the request form and note that the $10 fee applies to each copy and/or each year requested.What information is required to complete the W-2 request form?

To complete the request form, you'll need your employee ID number, the last four digits of your SSN, full name, the specific tax year(s) of the W-2 form(s) being requested, reason for the request, chosen delivery method, payment information, and your signature along with a daytime phone number.

Common mistakes

When filling out the Request for IRS Form W-2, individuals often make mistakes that could delay or complicate the process. Recognizing and avoiding these errors can ensure a smoother transaction. Here are ten common mistakes:

- Not including the last 4 digits of the Social Security Number (SSN). This unique identifier is crucial for processing the request efficiently.

- Failing to specify the tax year(s) for the W-2 reissue. Without the specified year(s), payroll cannot process the request correctly.

- Overlooking the option checked for receiving the W-2. Whether it's by mail, pick-up, or a secure email link, indicating the preferred method is mandatory.

- Incorrectly entering the mailing address or email. This mistake can lead to the W-2 being sent to the wrong location or not being received at all.

- Forgetting to select the reason for the request. Understanding why a reissue is needed helps in prioritizing and managing the requests more effectively.

- Omitting the payment option for the reissue fee. The form stipulates a $10 fee per copy or tax year, which must be addressed for processing to proceed.

- Leaving the signature section blank. A signature is required to authenticate the request and confirm the information provided.

- Ignoring the payment instructions after selecting the payment option. If opting to pay online, one must follow through with the online payment after submitting the form.

- Not providing a daytime phone number. This contact information is essential if the payroll department needs to clarify or follow up on any details.

- Delay in submitting the request. Timing is critical, especially during tax season. Late submissions can lead to further delays in receiving the necessary documentation.

Avoiding these mistakes not only facilitates a smoother process but also ensures that individuals receive their documentation in a timely manner, thereby avoiding potential penalties for late tax filings.

Documents used along the form

When an individual requests a reprint or reissue of their Form W-2 due to reasons like never receiving the original, misplacing, or having it destroyed, it is often not the only form needed to address their tax situation or to fulfill compliance requirements. Alongside the Request for IRS Form W-2, there are several other forms and documents that might be useful or necessary to facilitate the process. Understanding these documents can provide a more comprehensive approach to handling one’s financial and tax responsibilities.

- Form 1040: The U.S. Individual Income Tax Return is the standard federal income tax form used to report an individual's gross income. It is often necessary to refer to or amend a previously submitted Form 1040 when dealing with issues related to the W-2 form.

- Form 4506-T: Request for Transcript of Tax Return. This form allows taxpayers to request past tax transcripts that can be crucial for verifying income in the absence of W-2 forms.

- Form 4868: Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. If an individual is awaiting a reissued W-2, they may need to file this form to extend their tax filing deadline.

- Form 8822: Change of Address. If the need for a reissued W-2 stems from a change of address, this form should be filed with the IRS to ensure all future tax documents are sent to the correct location.

- Social Security Administration (SSA) Earnings Statement: For verifying earnings and taxes paid into Social Security and Medicare, which could also be affected by inaccuracies or missing W-2 forms.

- State Tax Withholding Forms: Depending on the state, there might be additional state-specific tax withholding forms that need to be adjusted or reviewed in light of receiving a new or corrected W-2.

- Direct Deposit Forms: If payroll errors led to the need for a W-2 reissue, reviewing and updating direct deposit information with one's employer might be necessary.

- Personal Identification Documents: In situations where identity verification is required to process the W-2 reissue, providing documents like a driver’s license or passport might be necessary.

Accompanying the Request for IRS Form W-2 with the relevant forms and documents as listed above can often streamline the process of rectifying issues related to one's employment taxes and income reporting. Being prepared with the right paperwork can alleviate potential stress and complications, ensuring that individuals remain compliant with tax regulations while safeguarding their financial well-being.

Similar forms

The Request for IRS Form 1099 is similar to the Request for IRS W-2 form because both involve requests for tax documents related to income reporting. The 1099 form is often requested by independent contractors or freelancers who need to report their earnings, just as employees request the W-2 form to report wages earned from an employer. Both forms are crucial for accurately completing an individual's tax return and may require a fee for reissuing if lost or destroyed.

The IRS Form 4506, Request for Copy of Tax Return, is another document similar to the Request for IRS W-2 form. This form is used when individuals need to request a copy of a previously filed tax return, which might include attached W-2s. Like the W-2 request, there is typically a fee associated with retrieving these documents. Both are important for individuals who need documentation for loans, legal matters, or personal records.

The SSA-7004, Request for Social Security Earnings Information, bears similarity to the W-2 request form in that it is used to obtain past earnings information. However, the information provided by the Social Security Administration includes a complete history of earnings according to Social Security’s records, which could be used for verifying income in situations where W-2 forms are missing. Both processes require the individual to provide personal details and the specific years for which information is needed.

The Change of Address Form (IRS Form 8822) is indirectly related to the W-2 request process. When individuals move, they need to update their address with the IRS to ensure they receive their W-2 and other tax-related documents. If this step is neglected, it could lead to the necessity of requesting a reissued W-2, highlighting the interconnectedness of these administrative tasks in managing one's tax documents effectively.

The Request for Employment Information (CMS-L564) is used in conjunction with Medicare registration and is somewhat similar to the W-2 request. This form is filled out to verify health insurance coverage through an employer, which requires income information that could be supported by W-2 forms. Both documents are essential for verifying employment and income details, albeit for different purposes.

The Employment Verification Letter, though not a standard IRS form like the W-2, serves a related purpose by confirming an individual's employment status and income. This letter might be requested by lenders, landlords, or government agencies. In cases where a W-2 is unavailable, an employer-generated employment verification letter might suffice, thus sharing a common goal with the Request for IRS W-2 form—to certify an individual’s income.

Lastly, the IRS Form 4852, Substitute for Form W-2, Wage and Tax Statement, is a direct alternative to the W-2 form. If an employer cannot provide a W-2 or if there is a delay, taxpayers can use Form 4852 as a substitute to complete their tax return, estimating their wages and taxes withheld as accurately as possible. This similarity lies in their shared purpose of ensuring that an individual can report their earnings and taxes to the IRS, even in situations where the original documents are unavailable.

Dos and Don'ts

When requesting a reprint of your IRS Form W-2, it's important to proceed with both accuracy and completeness to ensure a smooth processing. Below are ten guidelines divided into what you should and shouldn't do when filling out the Request for IRS Form W-2. These suggestions aim to facilitate the process, helping both you and the payroll department achieve a successful transaction.

What You Should Do:- Verify your personal information: Double-check your Employee ID, full name, and the last four digits of your Social Security Number (SSN) to ensure they match your employment records.

- Specify the tax year(s): Clearly indicate the tax year(s) for which you are requesting a W-2 reprint. Check the appropriate box(es).

- Choose your delivery method: Decide whether you want the W-2 mailed to a specific address, picked up, or emailed via a secure link, and then select the corresponding option.

- Provide a clear reason for the request: Check the box next to the reason you're requesting a reprint, such as never received, misplaced, or destroyed.

- Include payment information: Acknowledge the $10 processing fee per copy/year and choose your payment option, ensuring to complete any associated steps such as paying online if that option is chosen.

- Leave sections incomplete: Do not skip any sections or leave blanks. Incomplete forms may result in processing delays or the request being denied.

- Sign without reviewing: Avoid signing the form before you have checked all the information for accuracy. Once signed, it's an affirmation that all the details are correct.

- Forget to check the payment process: Do not submit the form without understanding the payment process. Know whether you need to pay online, by check, or another method, and follow through.

- Ignore instructions for secure email transmission: If choosing to email the form, ensure that you're following any provided instructions for secure transmission to protect your personal information.

- Omit contact information: Ensure you provide a daytime phone number or email where you can be reached in case there are questions or issues with your request.

By adhering to these guidelines, you will aid the payroll department in processing your W-2 reprint request efficiently and accurately, preventing unnecessary complications and ensuring that you receive your document in a timely manner.

Misconceptions

There are several common misconceptions about the process of requesting a reissued IRS Form W-2, which can cause confusion and unnecessary worry for employees and former employees. Understanding the actual facts can simplify the process and set the correct expectations.

Only current employees can request a reissued W-2. Both current and former employees have the right to request a reissued W-2 form. The form specifically provides a section for the signature of a (former) employee, indicating that past employees are eligible to make this request.

The process is free of charge. There is a processing fee of $10 for each year’s W-2 form that is reprinted or reissued. This fee covers the administrative costs involved in reissuing the form.

You can only have your W-2 mailed to you. The form allows for multiple delivery options, including mailing to a specified address, picking the form up from the Administrative Services Building, or receiving it via a secure email link. This flexibility ensures that the individual can choose the most convenient option for them.

W-2 forms can be reprinted at any time upon request. The form indicates that W-2s will be reprinted on specific days of the week (Tuesday and Thursday afternoons), with availability for pick-up and mailing on subsequent days (Wednesdays and Fridays, respectively). This schedule is likely in place to manage workload and ensure efficiency in the payroll department.

There is no deadline to pick up a reissued W-2. W-2 forms not picked up within one month will be destroyed to protect sensitive information. It’s important to follow up and ensure the collection of your document within this timeframe.

Email is not a secure method to receive your W-2. The form mentions the option to email the W-2 via a secure link. This means that appropriate security measures are in place to protect the individual’s private information during transmission.

Payment must be submitted with the request form. The form states that payment for the reissued W-2 should be made online after submitting the request, not at the time of the request. The payroll department will then match the request to the payments received, ensuring that the process is tracked accurately.

Any method of payment is acceptable. The request form specifies acceptable payment options, including credit card, cash, money order, or check made payable to the CU Payroll Department. This clarity helps individuals prepare the payment correctly, ensuring a smooth process.

The reason for the W-2 request is irrelevant. The form requires individuals to check a box indicating the reason for their request, such as the W-2 being never received, misplaced, or destroyed. This information likely helps the payroll department assess and improve their processes for issuing and distributing W-2 forms.

Understanding these points clarifies the process and sets correct expectations for individuals who need to request a reissue of their W-2 form. It's crucial to read and follow the instructions carefully to avoid delays and ensure the protection of sensitive information.

Key takeaways

Filling out and using the Request for IRS Form W-2 requires understanding a few key elements to ensure the process is completed accurately and efficiently. Here are some important takeaways:

- There is a mandatory processing fee of $10 for each tax year's W-2 form that you request to be reprinted or reissued.

- When requesting a W-2 form, you must identify the specific tax year(s) for which you need the form.

- The form allows for different delivery options, including mail to a specified address, pick-up from the Administrative Services Building, or delivery via a secure email link.

- To receive the form via email, special instructions will be provided by the payroll department after choosing this option.

- The reason for requesting the W-2 must be indicated, such as the form never being received, it being misplaced or destroyed, or other reasons which should be explained if selected.

- Payment options for the processing fee include credit card (with instructions to pay online after submitting the form), or cash, money order, or check payable to the CU Payroll Department.

- Accurate contact information, including the requester's signature and daytime phone number, is necessary to process the request.

- Form submissions can be completed through various methods: emailing the payroll department, faxing, delivering in person, or mailing to the designated address.

- Reprinted W-2 forms are available for pick-up and mailing on specific days, and unclaimed W-2s will be destroyed after one month.

This summary provides a comprehensive overview of the steps and requirements involved in requesting a reprint or reissuance of an IRS Form W-2 through this particular process.

Popular PDF Documents

Us Sales Tax Exemption - The Texas Real Estate Commission's approval of this form attests to its compliance and suitability for real estate transactions.

IRS 943 - This IRS form helps maintain transparency between agricultural employers, their employees, and the federal tax system.

Irs 8948 - It helps to bridge the gap between traditional paper filing and modern e-file approaches, accommodating various taxpayer and preparer needs.