Get Refunding Travel Tax Form

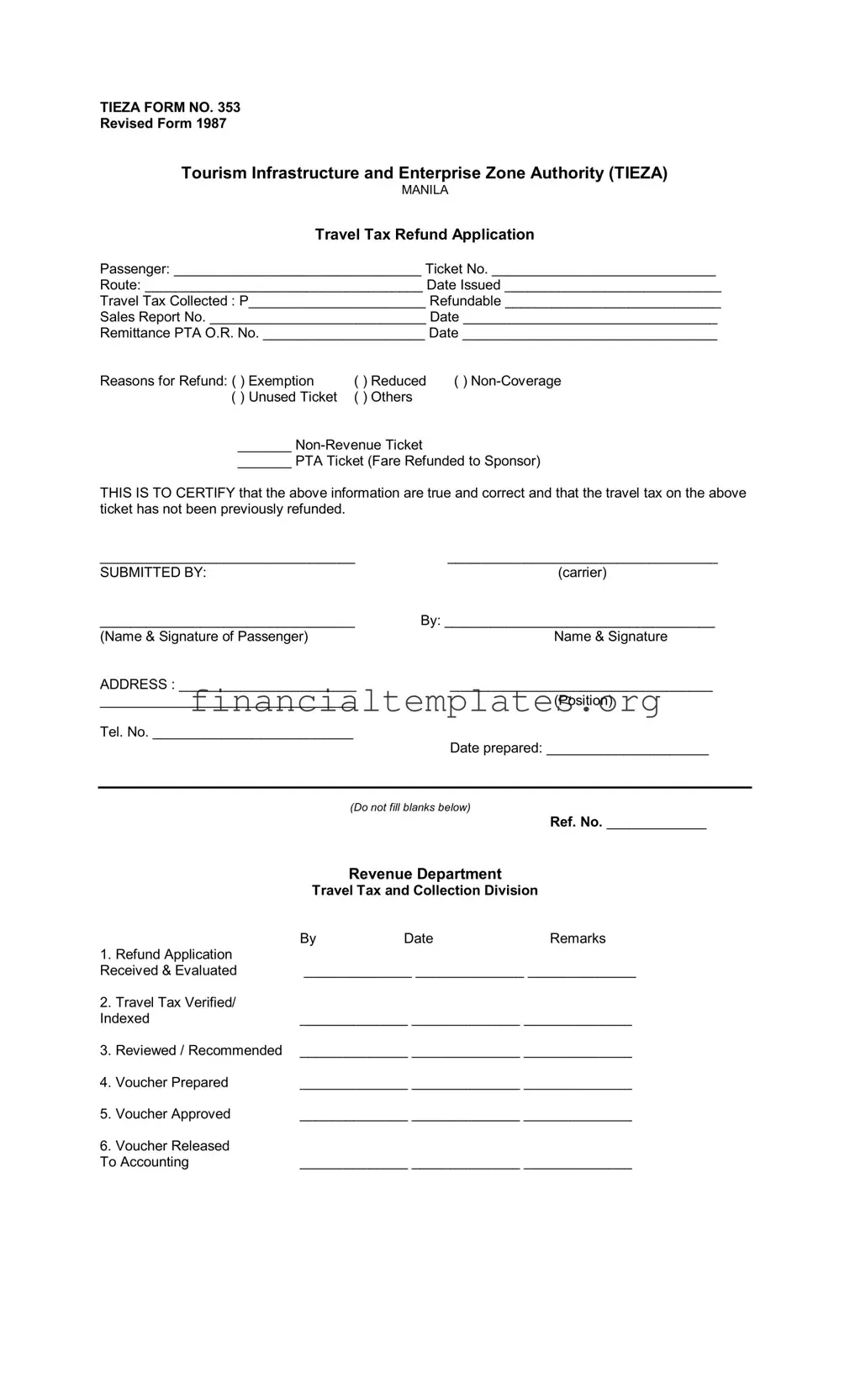

Embarking on international travel unfolds a myriad of expenses, among which travel taxes often represent a noticeable share. It's not uncommon for passengers to find themselves in situations where they might qualify for a refund of these taxes, a process facilitated by the Refunding Travel Tax Form. Specifically known as TIEZA Form No. 353, this document originated in 1987 under the purview of the Tourism Infrastructure and Enterprise Zone Authority (TIEZA) in Manila. Designed to streamline the refund application process, the form meticulously records essential details such as the passenger's name, ticket number, travel route, and the amount of travel tax collected. It caters to various refund scenarios—ranging from exemptions and reductions to cases involving non-coverage, unused tickets, and other particular circumstances. Additionally, the form also specifies the type of ticket involved, notably distinguishing between non-revenue and PTA tickets where the fare has been refunded to the sponsor. What underpins the utility of this document is not just the facilitation of refunds but also its role in ensuring the accuracy and integrity of the application process by requiring confirmation that the information provided is true and correct and that no previous refunds have been issued for the same tax. This procedural aspect is crucial, reflecting a commitment to precision and fairness in the administration of travel tax refunds.

Refunding Travel Tax Example

TIEZA FORM NO. 353

Revised Form 1987

Tourism Infrastructure and Enterprise Zone Authority (TIEZA)

MANILA

Travel Tax Refund Application

Passenger: ________________________________ Ticket No. _____________________________

Route: ____________________________________ Date Issued ____________________________

Travel Tax Collected : P_______________________ Refundable ____________________________

Sales Report No. ____________________________ Date _________________________________

Remittance PTA O.R. No. _____________________ Date _________________________________

Reasons for Refund: ( ) Exemption |

( ) Reduced |

( ) |

( ) Unused Ticket |

( ) Others |

|

_______

_______ PTA Ticket (Fare Refunded to Sponsor)

THIS IS TO CERTIFY that the above information are true and correct and that the travel tax on the above ticket has not been previously refunded.

_________________________________ |

___________________________________ |

SUBMITTED BY: |

(carrier) |

_________________________________ |

By: ___________________________________ |

(Name & Signature of Passenger) |

Name & Signature |

ADDRESS : _______________________ |

__________________________________ |

_________________________________ |

(Position) |

Tel. No. __________________________

Date prepared: _____________________

(DO NOT FILL BLANKS BELOW)

Ref. No. _____________

Revenue Department

Travel Tax and Collection Division

|

|

By |

Date |

Remarks |

1. |

Refund Application |

|

|

|

Received & Evaluated |

______________ ______________ ______________ |

|||

2. |

Travel Tax Verified/ |

|

|

|

Indexed |

______________ ______________ ______________ |

|||

3. |

Reviewed / Recommended |

______________ ______________ ______________ |

||

4. |

Voucher Prepared |

______________ ______________ ______________ |

||

5. |

Voucher Approved |

______________ ______________ ______________ |

||

6. |

Voucher Released |

|

|

|

To Accounting |

______________ ______________ ______________ |

|||

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Identification | TIEZA FORM NO. 353, Revised Form 1987 |

| Authority | Tourism Infrastructure and Enterprise Zone Authority (TIEZA), Manila |

| Purpose | Travel Tax Refund Application |

| Key Fields | Passenger Name, Ticket Number, Route, Date Issued, Travel Tax Collected, Refundable Amount, Sales Report Number, Remittance PTA OR Number |

| Refund Reasons | Exemption, Reduced Rate, Non-Coverage, Unused Ticket, Others (Specify: Non-Revenue Ticket, PTA Ticket with Fare Refunded to Sponsor) |

| Certification Requirement | Confirmation that the information provided is true and correct, and the travel tax has not been previously refunded |

| Submission | Form must be submitted by the carrier on behalf of the passenger |

| Processing Steps | Application Received & Evaluated, Travel Tax Verified/Indexed, Reviewed/Recommended, Voucher Prepared, Voucher Approved, Voucher Released To Accounting |

| Relevant Contact Information | Name, Signature & Address of the Passenger; Position and Telephone Number of the person preparing the form |

Guide to Writing Refunding Travel Tax

Filling out the Refunding Travel Tax form is a straightforward process that allows passengers to request a refund of their travel tax under specific conditions such as exemptions, reductions, non-coverage, unused tickets, and other reasons. To ensure a smooth and successful submission, it's crucial to complete the form accurately and provide all the necessary information. The following steps will guide you through each part of the form, helping to clarify what details are needed and where to place them.

- Start by entering the passenger's name in the designated space. This should match the name on the travel documents.

- Fill in the Ticket No. Ensure this number is accurate as it's critical for verifying the travel tax paid.

- Specify the route taken during travel. This includes the departure and arrival points.

- Provide the Date Issued for the ticket. This information is usually found on the ticket itself.

- Enter the amount of Travel Tax Collected in Philippine pesos (P). You must know the exact amount paid.

- Indicate the refundable amount, if known. This may require calculation based on your reason for a refund.

- Fill in the Sales Report No. and its corresponding Date. This information can be obtained from the carrier or ticket issuer.

- Document the Remittance PTA O.R. No. (Official Receipt Number) and its Date, which are crucial for tracking the payment.

- Select your Reason(s) for Refund by ticking the appropriate box. If choosing "Others," specify the reason in the space provided.

- Complete the certification section with the passenger's signature and date to affirm that the information given is true and the travel tax has not been previously refunded.

- Fill in the Address and Tel. No. fields with current and reachable contact information.

- Lastly, the form requests the Name, Position, and Date prepared by the carrier's representative who submitted the form. Ensure this section is completed by the relevant official.

Upon completing the form with accurate and truthful details, your request for a travel tax refund will undergo a series of evaluations and verifications as indicated in the sections not to be filled by the applicant. The process involves receiving and evaluating the application, verifying the travel tax paid, and a series of reviews before the voucher preparation and approval. While waiting, keep a copy of the submitted form and any correspondence for your records.

Understanding Refunding Travel Tax

-

Who is eligible to apply for a Travel Tax refund?

Eligibility for a Travel Tax refund varies, but typically, passengers who fall under specific categories such as those who have unused tickets, those who qualify for exemption or reduced rates, or tickets that were not covered by the travel tax initially, can apply. Additionally, situations involving non-revenue tickets or PTA tickets where the fare has been refunded to the sponsor, also qualify for a refund. It's essential that the applicant certifies that the travel tax for the ticket in question has not been previously refunded.

-

What information do I need to provide for my Travel Tax refund application?

For a successful Travel Tax refund application, the following information is required: the passenger's name, ticket number, route, date the ticket was issued, the amount of travel tax collected, sales report number, remittance PTA O.R. number, reason for refund, and the certification that the tax on the ticket has not been previously refunded. Additionally, the submission must include the name, signature, address, position, and telephone number of the applicant.

-

How do I submit my Travel Tax refund application?

Submission procedures for the Travel Tax refund application may vary, but generally, applications should be submitted to the Tourism Infrastructure and Enterprise Zone Authority (TIEZA) or designated offices. It involves filling out the TIEZA Form No. 353, attaching necessary documentation (such as original tickets, official receipts, etc.), and ensuring all sections, especially those regarding personal information and reason for refund, are completed accurately. Notably, carriers (airlines or ticketing offices) might also facilitate the refund process on behalf of passengers.

-

What happens after I submit my Travel Tax refund application?

Upon submission, the Travel Tax refund application undergoes a series of evaluations and verifications, outlined in the form's lower section. First, the application is received and evaluated, followed by the verification and indexing of the travel tax. Then, it's reviewed and recommended for approval. A voucher is prepared, approved, and subsequently released to accounting for processing. Each step has an allocated space for dates and remarks, allowing for tracking the application's progress. However, the time frame for these steps can vary, so it's advised to check with TIEZA or the relevant office for specific details.

Common mistakes

Filling out the Refunding Travel Tax form requires careful attention to detail. Mistakes can delay or even prevent a successful refund. Here are four common errors:

- Incorrect or Incomplete Passenger Information: The name, ticket number, and route are often filled out incorrectly or left blank. Each piece of information should mirror what is found on the travel ticket and identification documents.

- Failure to Specify the Reason for the Refund Accurately: The form provides options such as Exemption, Reduced, Non-Coverage, Unused Ticket, and Others. Applicants frequently check the wrong reason or forget to specify under "Others," leading to processing delays.

- Incorrect Travel Tax Amounts: Both the collected and refundable amounts must match the official records. Mismatches happen when applicants guess these figures instead of verifying them against their travel documents or receipts.

- Omitting Signature and Date: The form requires signatures from the passenger and, if applicable, the carrier's representative. A common oversight is neglecting to sign the form or include the date, which is necessary to validate the refund request.

Avoiding these mistakes requires a detailed review of the form before submission. Double-checking the information against travel documents and ensuring that all required fields are completed can significantly increase the likelihood of a successful refund. Remember, accuracy is key in this process.

Documents used along the form

When processing a Refunding Travel Tax form, several other documents might become necessary to ensure a smooth and fully compliant process. These documents not only support your application but also provide necessary proof and details that might be required by the Tourism Infrastructure and Enterprise Zone Authority (TIEZA) or related entities. Understanding these documents will make the refund process more efficient and straightforward.

- Original Boarding Pass - This serves as proof that you actually traveled or, in cases of refunds, did not travel on the specific journey for which the travel tax was initially paid.

- Flight Itinerary - Outlines your travel route and dates. It is used to verify your claim, especially if your reason for a refund is related to flight changes or cancellations.

- Proof of Payment - A receipt or transaction document showing that the travel tax was paid. This is crucial for any refund process to confirm that the fee in question has indeed been collected.

- Government-issued ID - Used to verify the identity of the person applying for the refund. It ensures that the refund is made to the correct individual, especially in cases where the refund is not processed immediately.

- Exemption or Reduced Tax Eligibility Proof - If the refund is being claimed on the basis of exemption or eligibility for reduced tax, relevant documents proving this status will be needed, such as certifications or official letters.

- Unused Ticket Notification - In instances where a ticket was never used, a document from the airline or booking agency confirming this can support your refund request.

- Non-Revenue Ticket Documentation - If the refund is for a non-revenue ticket (complimentary or award ticket), documentation validating such status of the ticket is needed.

- PTA Ticket Proof - For tickets where the fare was refunded to a sponsor (PTA tickets), evidence of this transaction may be required to process the travel tax refund.

- Letter of Authorization - If someone else is submitting the refund application on your behalf, a letter authorizing them to do so will be required, along with their valid government-issued ID.

Gathering these documents beforehand can facilitate a smoother processing of the travel tax refund application. It's also a good practice to keep copies of all submissions for your records. Understanding and preparing the required documentation can streamline your interactions with agencies and ensure that your refund is processed in a timely manner without unnecessary delays.

Similar forms

A Travel Tax Refund Application, such as the one described, shares similarities with a Tax Return Document, primarily in the aspect of requesting a financial reimbursement or adjustment from a government authority. In both cases, the individual or entity is required to provide specific details about the transaction, including amounts paid and personal identification information. Additionally, the reason for the claim—whether it be an exemption, overpayment, or other qualifying circumstances—plays a crucial role in the processing of the document. This structured approach ensures proper verification and validation by the concerned authority.

Another comparable document is the Insurance Claim Form. This form is used when an individual seeks compensation for losses covered by an insurance policy. Similar to the Travel Tax Refund Application, it requires the claimant to fill in personal details, policy numbers, and the circumstances leading to the claim. Both forms undergo a review process where the provided information is verified and the validity of the claim is assessed before any reimbursement is processed. The meticulous documentation and detailing mirror the procedural integrity found in both processes.

The Rebate Claim Form, often used in retail or sales promotions, also parallels the Travel Tax Refund Application. Customers fill out these forms to request a partial refund after purchasing a product or service that offers a rebate. Like the travel tax form, the rebate claim requires purchasers to provide purchase details, including dates, amounts, and reasons for eligibility. This process ensures that rebates are issued correctly and to the deserving parties, employing a systematic verification similar to that of travel tax refunds.

The Scholarship Application Form is another document that exhibits similarities to the Travel Tax Refund Application. Applicants must provide personal information, educational details, and reasons for eligibility, akin to how travelers submit their details for a tax refund. Although the purpose differs, both forms serve as requests for financial adjustments based on specific criteria and are subject to evaluation and approval by the respective authority. The emphasis on accurate and thorough information submission is paramount in both instances.

Lastly, the Expense Reimbursement Form used by employees to claim work-related expenses is reflective of the procedures outlined in the Travel Tax Refund Application. Employees must document the nature of the expense, provide receipts, and detail the amounts for which they seek reimbursement. This process closely mirrors the necessity for travelers to outline their travel details, tax amounts, and reasons for refund eligibility. Both forms facilitate a financial adjustment process based on predefined conditions and necessitate comprehensive scrutiny to ensure the legitimacy of the claim.

Dos and Don'ts

When completing the Refunding Travel Tax form, there are specific actions you should take to ensure the process is smooth and error-free. Equally, there are actions you should avoid to prevent any complications with your application. Here’s a guide to help you navigate the process effectively.

Do:

- Ensure all the personal information you provide, such as your name, address, and ticket number, is accurate and matches the details on your travel documents.

- Clearly state the reason for the refund. You must check the appropriate box such as Exemption, Reduced, Non-Coverage, Unused Ticket, or specify another reason in the space provided.

- Include accurate financial information, including the amount of travel tax collected and the amount you believe is refundable.

- Sign the form personally. Your signature is a necessary confirmation that the information provided is true and correct.

- Attach any required documentation that supports your reason for a refund, such as proof of exemption or a copy of your unused ticket.

- Contact the Tourism Infrastructure and Enterprise Zone Authority (TIEZA) directly if you have any questions or require assistance with filling out the form.

Don't:

- Leave any required fields blank. If a section does not apply to you, clearly mark it as "N/A" for not applicable.

- Submit the form without reviewing it for completeness and accuracy. Errors or omissions can delay processing.

- Attempt to request a refund for travel tax that has already been refunded or was not paid in the first place.

- Forget to include your contact information, especially your telephone number, which may be needed for any follow-up questions.

- Use outdated forms. Always verify that you are using the most current version of the form, which is available from TIEZA.

- Submit the form to unauthorized agents or third parties. Always submit directly to the authorized offices or through official channels specified by TIEZA.

Misconceptions

Understanding the process for refunding travel tax often leads to confusion, bred from misunderstandings about certain aspects of the form and process. Let's clarify nine common misconceptions to facilitate a smoother experience for travelers.

It's Complicated to Apply for a Refund: Many believe that applying for a travel tax refund is complex and time-consuming. However, the TIEZA form NO. 353 is straightforward, requiring only pertinent information like the passenger's name, ticket number, and reason for the refund.

Refunds Are Rarely Approved: There's a misconception that refund requests are seldom approved. In reality, if the criteria for exemptions, reductions, non-coverage, unused tickets, or any other valid reason are met, refunds are processed accordingly.

Requests Must Be Submitted In Person: While personal submission might be an option, it is not the only way to apply for a refund. Alternatives, such as mail or electronic submission, might be available, depending on the most current procedures set by TIEZA.

All Travel Taxes Are Refundable: Some travelers assume that all travel taxes are subject to refunds. However, eligibility for a refund depends on specific reasons such as exemptions, reductions, or non-coverage, as outlined in the application form.

Refunds Are Immediate: A common misconception is that refunds are processed immediately. The reality is that each application undergoes evaluation, verification, and review before approval, as indicated in the steps listed on the form itself.

Unused Tickets Are Automatically Refunded: Another false belief is that the travel tax for unused tickets is automatically refunded. Travelers need to apply for the refund, citing an unused ticket as the reason for the request.

Airlines Submit Refund Applications on Behalf of Passengers: While some might think airlines will handle their refund applications, it is the passenger's responsibility to submit the form, either directly or through a designated representative.

Only the Original Ticket is Needed for a Refund: Apart from the ticket, the application form requires additional details, such as the sales report number and the remittance PTA O.R. number, to process a refund.

Everyone Qualifies for a Refund: Eligibility for a refund is based on specific criteria, such as exemptions and non-coverage. Not every traveler or situation qualifies for a refund of the travel tax.

Correcting these misconceptions can ease the refund application process, making it less daunting for travelers who are entitled to reclaim their travel tax under the rules set by the Tourism Infrastructure and Enterprise Zone Authority (TIEZA).

Key takeaways

Filling out and using the Refunding Travel Tax form requires attention to detail and a clear understanding of the eligibility for refund. Here are key takeaways for those considering applying for a travel tax refund:

- Ensure all personal details are accurately filled out, including the passenger name, ticket number, route, and the date the ticket was issued. This information is essential for the processing of your application.

- Clearly indicate the amount of travel tax collected and the amount deemed refundable. Misinformation may lead to delays or denial of the refund.

- Include the relevant sales report number and the remittance PTA O.R. number along with their respective dates. These details validate your claim and are crucial for referencing your payment.

- Select the appropriate reason for your refund request. Options include exemption, reduced rate, non-coverage, unused ticket, and others. Be prepared to provide supporting documentation or further explanation if you select "others."

- Verify that the information provided is true and correct. The certification by the passenger and submission by the carrier are declarations of the accuracy of the submitted information.

- Do not omit any contact information, such as the address and telephone number. This allows the Tourism Infrastructure and Enterprise Zone Authority (TIEZA) to contact you if further information is needed or to notify you of the decision regarding your application.

- The bottom section of the form, detailing the steps from receipt and evaluation of the application to the voucher release, is for official use only and provides insight into the processing stages of your application.

- Patience is necessary as the refund process involves several steps, including application receipt, evaluation, and verification of the travel tax, followed by review, recommendation, voucher preparation, approval, and release. These steps are meticulously undertaken to ensure the accuracy and validity of refund claims.

Understanding these key aspects can substantially simplify the process of applying for a travel tax refund and help manage expectations regarding the time frame for processing and receiving the refund.

Popular PDF Documents

Pa Department of Revenue Tax Clearance - If the business engaged in activities that required PA personal income tax withholding from employee wages, specifics must be disclosed.

How Long Does an Eviction Take - A judicial order that enforces the eviction of tenants who haven't adhered to rent agreements.