Get Real Estate Tax Deduction Form

In recent times, the task of organizing and taking full advantage of tax-deductible business expenses has become more crucial for realtors nationwide. Responding to a significant demand for clarity and assistance in this area, Daszkal Bolton LLP developed the Realtors' Tax Deduction Worksheet, following a particularly well-received tax tip article. This comprehensive tool aims to guide real estate professionals through the maze of allowable deductions, ensuring they capitalize on every potential saving. It meticulously outlines a broad spectrum of expenses, from advertising to office supplies, essential for operating a successful real estate business. To qualify for a deduction, an expense must be both 'ordinary and necessary'; this is a fundamental requirement that realtors must meet. Additionally, the worksheet advises on handling expenses not eligible for deduction, such as those reimbursable or already reimbursed. Designed with the realtor's financial well-being in mind, this worksheet not only assists in organizing deductible expenses but also underscores the emphasis on adhering to tax regulations and guidelines. Should realtors have inquiries or seek detailed advice on specific issues, the worksheet encourages direct contact with Jeff Bolton, CPA, offering a personalized support system to navigate real estate tax complexities.

Real Estate Tax Deduction Example

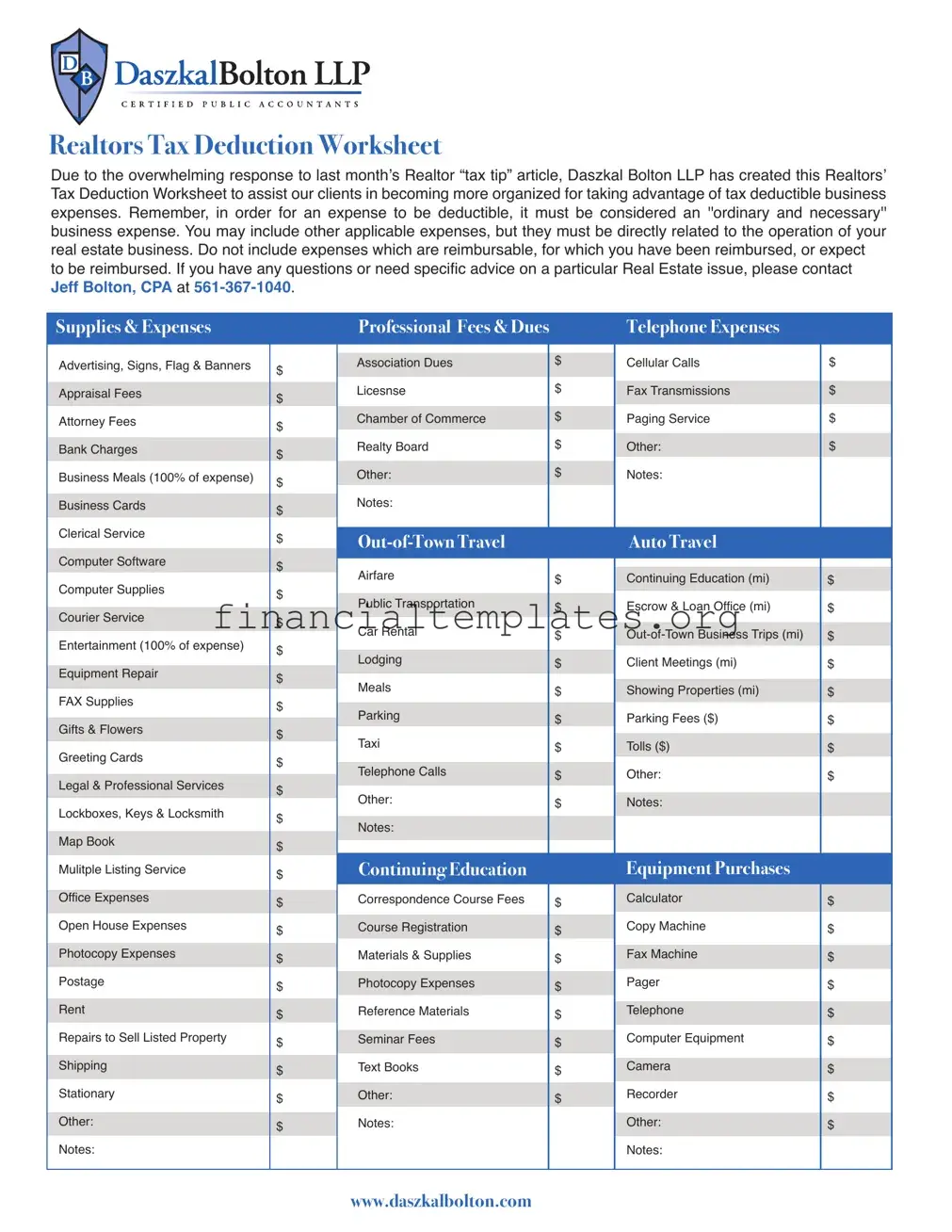

Realtors Tax Deduction Worksheet

Due to the overwhelming response to last month’s Realtor “tax tip” article, Daszkal Bolton LLP has created this Realtors’ Tax Deduction Worksheet to assist our clients in becoming more organized for taking advantage of tax deductible business expenses. Remember, in order for an expense to be deductible, it must be considered an ''ordinary and necessary'' business expense. You may include other applicable expenses, but they must be directly related to the operation of your real estate business. Do not include expenses which are reimbursable, for which you have been reimbursed, or expect to be reimbursed. If you have any questions or need specific advice on a particular Real Estate issue, please contact JEFF BOLTON, CPA at

Supplies & Expenses

Advertising, Signs, Flag & Banners Appraisal Fees

Attorney Fees

Bank Charges

Business Meals (100% of expense) Business Cards

Clerical Service

Computer Software

Computer Supplies Courier Service Entertainment (100% of expense) Equipment Repair

FAX Supplies

Gifts & Flowers

Greeting Cards

Legal & Professional Services

Lockboxes, Keys & Locksmith

Map Book

Mulitple Listing Service

Office Expenses

Open House Expenses

Photocopy Expenses

Postage

Rent

Repairs to Sell Listed Property

Shipping

Stationary

Other:

Notes:

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

Professional Fees & Dues

Association Dues |

$ |

|

|

Licesnse |

$ |

|

|

Chamber of Commerce |

$ |

Realty Board |

$ |

|

|

Other: |

$ |

Notes: |

|

|

|

|

|

Airfare |

$ |

|

|

|

|

Public Transportation |

$ |

|

|

Car Rental |

$ |

|

|

|

|

Lodging |

$ |

|

|

Meals |

$ |

|

|

|

|

Parking |

$ |

Taxi |

$ |

|

|

|

|

Telephone Calls |

$ |

|

|

Other: |

$ |

|

|

|

|

Notes: |

|

|

|

|

|

Continuing Education |

|

Correspondence Course Fees |

$ |

|

|

|

|

Course Registration |

$ |

Materials & Supplies |

$ |

|

|

|

|

Photocopy Expenses |

$ |

|

|

Reference Materials |

$ |

|

|

|

|

Seminar Fees |

$ |

|

|

Text Books |

$ |

|

|

|

|

Other: |

$ |

Notes: |

|

|

|

Telephone Expenses

Cellular Calls

Fax Transmissions

Paging Service

Other:

Notes:

Auto Travel

Continuing Education (mi)

Escrow & Loan Office (mi)

Client Meetings (mi)

Showing Properties (mi)

Parking Fees ($)

Tolls ($)

Other:

Notes:

Equipment Purchases

Calculator

Copy Machine

Fax Machine

Pager

Telephone

Computer Equipment

Camera

Recorder

Other:

Notes:

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

www.daszkalbolton.com

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of the Worksheet | This Realtors’ Tax Deduction Worksheet is designed to help realtors organize and take advantage of tax deductible business expenses. |

| Criteria for Deductibility | Expenses must be ordinary and necessary, directly related to the operation of the real estate business, and not reimbursable to be deductible. |

| Direct Contact for Advice | For specific advice on real estate tax issues, JEFF BOLTON, CPA at Daszkal Bolton LLP, is available at 561-367-1040. |

| Categories of Deductible Expenses | Expenses include advertising, legal fees, office costs, professional dues, travel, continuing education, telephone, auto travel, and equipment purchases. |

| Specific Deductible Items | The form lists specific deductible items such as business meals, computer software, and equipment repairs among others. |

| Exclusion from Deduction | Expenses that are reimbursable, have been reimbursed, or are expected to be reimbursed cannot be deducted. |

| Governing Law | The worksheet operates under the tax laws governing business expenses and deductions in the United States. |

Guide to Writing Real Estate Tax Deduction

Once it's time to manage your expenses as a realtor, the Real Estate Tax Deduction form becomes an invaluable tool. This form helps ensure you're taking full advantage of tax deductions related to your real estate business. All expenses listed must be ordinary and necessary, directly connected to your business operations, and not reimbursable. Properly completing this form can not only keep you organized but also potentially lower your tax liabilities. Before diving in, it may be beneficial to consult with a CPA or tax professional if you have specific concerns or need detailed advice. Below are straightforward steps to fill out the Real Estate Tax Deduction form confidently.

- Start by reviewing all categories on the worksheet to familiarize yourself with the types of expenses covered.

- Under Supplies & Expenses, input the dollar amount next to each applicable expense. If an expense is not listed, add it under "Other" with the corresponding amount.

- In the Professional Fees & Dues section, record any membership dues or license fees that relate to your real estate business.

- For Out-of-Town Travel, list all costs incurred during business trips, including transportation, lodging, meals, and other related expenses.

- Under Continuing Education, input fees for courses, seminars, and materials that maintain or improve your professional knowledge.

- Complete the Telephone Expenses section with costs related to cellular calls, fax transmissions, and any paging service fees.

- In the Auto Travel category, record miles traveled for business purposes like client meetings, property showings, and out-of-town trips. Also, list parking fees and tolls where applicable.

- For Equipment Purchases, document the cost of any significant assets bought during the period, such as computers, cameras, or office equipment.

- Go through the worksheet again to ensure all relevant expenses have been recorded accurately and completely.

- Sum up the totals for each section and double-check your calculations.

- If necessary, make notes next to any entries that require clarification or where you anticipate needing to provide additional documentation.

- Save a copy of the completed form for your records and prepare to share it with your tax preparer or incorporate it into your tax return.

With this form thoroughly filled out, you've taken a significant step towards optimizing your tax situation. This detailed approach to tracking and documenting your real estate business expenses ensures you're well-prepared for tax season. Remember, maintaining regular updates throughout the year can ease the process even further, making tax time less daunting.

Understanding Real Estate Tax Deduction

This FAQ section provides insights into commonly asked questions regarding the Real Estate Tax Deduction form, facilitating a deeper understanding of how realtors can optimize their tax deductible business expenses.

What expenses can be considered deductible for real estate professionals?

To qualify as deductible, expenses must be deemed "ordinary and necessary" for conducting real estate business. These include advertising, office supplies, professional fees, travel expenses related to business, continuing education, telephone expenses, and automobile travel related to business operations.

Are meals and entertainment expenses fully deductible?

Yes, unlike many professions where there are limitations, for real estate professionals, 100% of business meals and entertainment expenses are deductible, provided they are directly related to the business operations and not reimbursable.

Can I deduct the cost of equipment purchases?

Yes, purchases of equipment necessary for your real estate business, such as computers, cameras, phones, and other office equipment, are deductible. This is to ensure that real estate professionals have the necessary tools to conduct their business efficiently.

What is considered an "ordinary and necessary" business expense?

An "ordinary" expense is one that is common and accepted in the real estate industry, while a "necessary" expense is deemed appropriate for conducting real estate business. Both criteria must be met for an expense to be deductible.

How do I handle expenses that are reimbursable or have been reimbursed?

Any expenses that are reimbursable, or for which you have already been reimbursed, should not be included in your deductions. Only out-of-pocket expenses directly related to your business operations are deductible.

Are there limits on the deductibility of certain expenses?

Yes, while most expenses directly related to the operation of your real estate business are fully deductible, there are limits, such as those pertaining to gifts and luxury entertainment. It is important to check current tax laws for specifics as these can change.

Can travel expenses be deducted?

Travel expenses directly related to your real estate business, including airfare, lodging, car rental, and meals during travel, are deductible. However, the primary purpose of the travel must be business-oriented.

What educational expenses are deductible?

Continuing education that maintains or improves your real estate skills, including course registration fees, materials, and related travel, is deductible. This enables real estate professionals to stay current in their field while benefiting from tax deductions.

How do auto travel expenses relate to deductions?

Auto expenses incurred while performing business activities, such as showing properties or attending client meetings, are deductible. This includes mileage, parking fees, and tolls, but accurate records must be kept to support these deductions.

What advice is available for those needing help with Real Estate tax issues?

For specific advice or questions regarding real estate tax issues, consulting with a tax professional or CPA, such as Jeff Bolton, is recommended. They can provide tailored advice to ensure you maximize your deductions while complying with tax law.

Common mistakes

When filling out the Real Estate Tax Deduction form, people often make mistakes that can affect their tax returns. Here's a look at some common errors:

- Not verifying eligibility for deductions: Before listing any expense, it's crucial to ensure that it qualifies as an "ordinary and necessary" business expense related to real estate activities.

- Omitting expenses that are not reimbursable: Some individuals forget to exclude expenses that have been reimbursed or are expected to be reimbursed, which is essential for an accurate deduction claim.

- Incorrect categorization of expenses: It's common to mislabel expenses or place them under incorrect categories, which can lead to discrepancies in the reported amounts.

- Overlooking deductible items: Often, realtors miss out on including all deductible items, such as small office supplies or minor advertising costs, which can add up.

- Failing to maintain receipts and records: Proper documentation for all claimed expenses is critical, yet many fail to keep organized records, leading to challenges if audited.

- Forgetting to include out-of-town travel expenses: Expenses related to out-of-town business trips can be considerable but are frequently overlooked or incorrectly calculated.

- Miscalculating auto travel costs: Accurately tracking mileage for various business activities is essential, yet errors in logging these figures or applying the correct rates are common.

- Misinterpreting deductions for meals and entertainment: Understanding what constitutes a 100% deductible expense under this category can be complex, and errors often occur.

Ensuring accuracy and completeness when filling out the Real Estate Tax Deduction form can significantly impact a real estate professional's financial health. Paying close attention to detail and consulting with a tax professional when unsure can help avoid these common pitfalls.

Documents used along the form

When managing real estate taxes, the Realtors Tax Deduction Worksheet serves as a crucial tool for professionals in the real estate industry, helping to organize and maximize deductible business expenses. Alongside this worksheet, there are multiple forms and documents that real estate professionals might use to ensure a thorough and accurate accounting of their business operations and expenses. Each of these documents plays a vital role in capturing the breadth of a realtor's financial activities.

- Mortgage Interest Statement (Form 1098): This form details the amount of mortgage interest paid during the year, often a significant deduction for real estate professionals.

- Home Office Deduction Form (Form 8829): For realtors who use a portion of their home for business, this form calculates the deduction for home office use, encompassing utilities, mortgage interest, insurance, and repairs.

- Vehicle Expense Log: This document tracks mileage and vehicle expenses related to business activities, essential for claiming the auto travel deduction.

- Income Statement: A comprehensive report detailing the realtor's income sources. It's crucial for organizing revenue streams and ensuring accurate tax calculations.

- Receipts for Business Expenses: Maintaining receipts for supplies, marketing, meals, and other business expenses is critical for supporting deductions claimed on the tax return.

- Depreciation Schedules: If the realtor owns office space or equipment, depreciation schedules track the value reduction of these assets over time and determine the deductible amount.

- Property Tax Statements: These statements provide proof of property taxes paid, which are directly deductible on real estate professionals' tax returns.

- Closing Statements (HUD-1): For realtors involved in the purchase or sale of property, the closing statement details transaction costs, some of which may be tax-deductible.

To ensure the most favorable tax outcome, real estate professionals should carefully manage and document their business expenses and operations using these related forms and documents. Effectively leveraging these resources can significantly impact a realtor’s annual tax liabilities, highlighting the importance of maintaining accurate and comprehensive financial records throughout the year.

Similar forms

The Home Office Deduction form is similar to the Real Estate Tax Deduction form as it assists individuals in organizing expenses that can be deducted for tax purposes. Like the Real Estate Tax Deduction form, which outlines specific expenses related to conducting real estate business, the Home Office Deduction form focuses on expenses incurred from maintaining a home office. These expenses include home-related costs apportioned to the dedicated office space, such as rent, utilities, and repairs, showing a close parallel in purpose and detailed categorization of deductible expenses.

Similarly, the Vehicle Expense log is akin to the Real Estate Tax Deduction form, which encompasses auto travel and its associated expenditures. The Vehicle Expense log is specifically designed to track costs related to the use of a car for business purposes, including mileage, gas, maintenance, and tolls. This reflects the Auto Travel section on the Real Estate Tax Deduction form, aiming to help individuals accurately document and claim work-related vehicle expenses for tax deductions.

The Employee Business Expense Worksheet also bears resemblance to the Real Estate Tax Deduction form. It's designed for employees to itemize and track various work-related expenses that are not reimbursed by their employer. Similar to sections of the Real Estate Tax Deduction form that include business meals, travel, and supplies, the Employee Business Expense Worksheet provides a structured format for reporting necessary costs incurred in the course of performing job duties, reinforcing the notion of organizing deductible business expenses.

The Charitable Donations Tracking form, while focused on charitable contributions, shares a common goal with the Real Estate Tax Deduction form: maximizing tax deductions. The Charitable Donations form helps individuals document their donations to eligible organizations, similar to how the Real Estate form organizes business expenses. Though the nature of deductions differ—one for business expenses and the other for charitable contributions—they both serve the purpose of ensuring individuals accurately report and maximize their tax deductions.

The Schedule C Profit and Loss from Business form is closely related to the Realtors’ Tax Deduction Worksheet, as both are pivotal for individuals who are self-employed or own a business. The Schedule C form is used to report the income and expenses related to the operation of a business, paralleling the Real Estate form’s focus on organizing deductible business expenses. Both forms are essential tools for entrepreneurs to detail their operational costs and potential deductions.

Last, the Investment Interest Expense form is analogous to the Real Estate Tax Deduction form in its documentation of expenses for tax deduction purposes. This form is aimed at investors, allowing them to deduct interest paid on loans used to buy investment property. Similar to real estate professionals tracking their business-related expenses, investors use this form to reduce taxable income through interest deductions, highlighting their mutual objective of tax efficiency.

Dos and Don'ts

When it comes to navigating your taxes, especially with the Real Estate Tax Deduction form, being methodical and informed can save you time and ensure you take full advantage of your deductions. Here are eight essential do's and don’ts to guide you through the process:

- Do ensure that every expense you list is classified as an "ordinary and necessary" business expense. This means the expense is common and accepted in the real estate industry and is helpful and appropriate for your business.

- Don’t include expenses that are reimbursable or for which you have already been reimbursed. This is crucial, as claiming these can lead to discrepancies and potential audits.

- Do keep meticulous records of all your expenses throughout the year, including receipts, bank statements, and invoices. This documentation will be invaluable if you ever need to substantiate your deductions to the IRS.

- Don’t estimate or "guess" expenses. Accurate and precise numbers are crucial to compliant tax filing. Estimates can raise flags with the IRS, leading to unnecessary audits or reviews.

- Do include a wide variety of expenses that relate directly to the operation of your real estate business, like advertising, business meals, computer software, and professional fees. Diversifying deductible expenses can significantly reduce taxable income.

- Don’t forget to deduct mileage for business travel. The IRS allows deductions for miles driven for business purposes, which can add up, especially for real estate professionals who travel to show properties or meet clients.

- Do review the IRS guidelines on real estate deductions annually. Tax laws can change, and staying informed ensures you don’t miss out on new deductions or mistakenly include disallowed expenses.

- Don’t hesitate to seek professional advice if you have questions or need clarification on specific deductions. A certified public accountant (CPA) or tax professional familiar with real estate can provide invaluable guidance.

Approaching your Real Estate Tax Deduction form with these practices will not only streamline your tax filing process but also maximize your deductions, ultimately benefiting your financial wellbeing. Proper preparation and knowledge are your best tools in navigating real estate taxes efficiently and effectively.

Misconceptions

When it comes to the realm of taxes, particularly those pertaining to real estate professionals, misinformation is as abundant as the paperwork. The Real Estate Tax Deduction Form, a crucial tool for realtors aiming to maximize their tax deductions, is often subject to misunderstandings. Let's clarify some common misconceptions to ensure these professionals can fully capitalize on their deductions.

Misconception 1: All business-related expenses are deductible. While a wide range of expenses is indeed tax-deductible, they must specifically be "ordinary and necessary" for conducting real estate business. This means that personal expenses or those only tangentially related to the operation of your real estate business cannot be deducted.

Misconception 2: Expenses for business meals and entertainment are fully deductible. It is easy to assume that any dining or entertainment cost incurred in the pursuit of business can be fully deducted. However, these expenses are subject to limitations and must be directly related to or associated with the operation of your business to qualify for deductions.

Misconception 3: Home office expenses are straightforward to deduct. The deduction of home office expenses is laden with specific conditions. The space must be used regularly and exclusively for business, and it must be the principal place of your business.

Misconception 4: Mileage is deductible at a standard rate for all types of vehicles. While the IRS does provide a standard mileage rate for business use of a car, variations can apply based on the type and usage of the vehicle. It is crucial to accurately track and record the business use of your vehicle to substantiate your deductions.

Misconception 5: Realtors can deduct clothing expenses. Clothing expenses can only be deducted if the clothing is not suitable for everyday wear and is a requirement for your work. The typical business attire does not qualify for deductions, even if it is purchased exclusively for business use.

Misconception 6: All types of gifts given in the course of business are deductible. While giving gifts can be a part of building and maintaining relationships in real estate, the IRS caps the deduction for business gifts to $25 per person per year. This limit is often overlooked, leading to mistaken assumptions about the deductibility of more expensive gifts.

Misconception 7: Deductions for education and training are unlimited. Investing in one's education and skill development is crucial; however, the IRS imposes limits on what can be deducted. For an educational expense to be deductible, it must either maintain or improve your existing skills or be required by law or your employer. Personal development courses or those that qualify you for a new profession are not deductible.

Understanding the nuances of the Real Estate Tax Deduction Form can substantially aid realtors in optimizing their tax deductions. However, given the complexities of tax law, consulting with a tax professional, such as a CPA, is advised to ensure full compliance and maximization of benefits.

Key takeaways

Filling out the Real Estate Tax Deduction form correctly can significantly benefit realtors by maximizing their eligible business expense deductions. Here are key takeaways to ensure that the process is smooth and beneficial:

- Understand the meaning of "ordinary and necessary": Expenses must meet this criterion to be deductible. This includes costs that are common and accepted in the real estate business, as well as helpful and appropriate for your business operations.

- Organize your expenses: Categorize your business expenses, such as advertising, supplies, professional fees, and travel costs, to streamline the deduction process.

- Exclude reimbursable expenses: Only include expenses for which you have not been reimbursed and do not expect to be reimbursed. Including these can lead to discrepancies and potential audit issues.

- Document everything: Keeping organized records of all business-related expenses throughout the year can make filling out the tax deduction form easier and more accurate.

- Deductible meals and entertainment: Understand that specific rules apply, such as the ability to deduct 100% of business meals under certain conditions, which is a change from previous tax years.

- Professional fees are deductible: Costs associated with legal and professional services specifically related to your real estate business can be included.

- Travel expenses count: Costs related to out-of-town travel, including airfare, lodging, and meals, can be deductible if they are directly related to the real estate business.

- Keep up with continuing education: Expenses for education that maintains or improves your real estate skills, including courses, materials, and associated travel, are deductible.

- Invest in necessary equipment: Purchases of equipment necessary for your business, such as computers, software, and cameras, can also be deducted.

To make the most out of your deductible expenses and navigate the complexities of real estate taxation, consider consulting with a tax professional like JEFF BOLTON, CPA, or a reputable tax advisor familiar with real estate business operations.

Popular PDF Documents

2024 Ev Rebate - For the credit to apply, the vehicle must be placed in service during the tax year in which you're claiming the credit.

Does Wisconsin Have Sales Tax - Farmers can claim exemptions on containers for transporting and storing agricultural produce, reflecting the tailored approach to supporting farming operations.