Blank Stock Purchase Agreement Form

Embarking on the journey of buying or selling shares in a company can be both an exciting and daunting endeavor. Central to this process is the Stock Purchase Agreement (SPA), a critical document that outlines the terms and conditions of the transaction. This meticulously crafted form serves as the blueprint for the entire deal, detailing everything from the number of shares being traded to the price per share, alongside any representations and warranties made by both parties. Additionally, it encompasses the rights and obligations of the buyer and seller, ensuring a clear understanding and expectations from both ends. Understanding the intricacies of the SPA is essential for anyone looking to navigate the waters of equity transactions successfully. From due diligence requirements to confidentiality clauses and conditions precedent to closing, the agreement lays the foundation for a smooth and transparent exchange, safeguarding the interests of all involved parties and paving the way for a successful transfer of ownership.

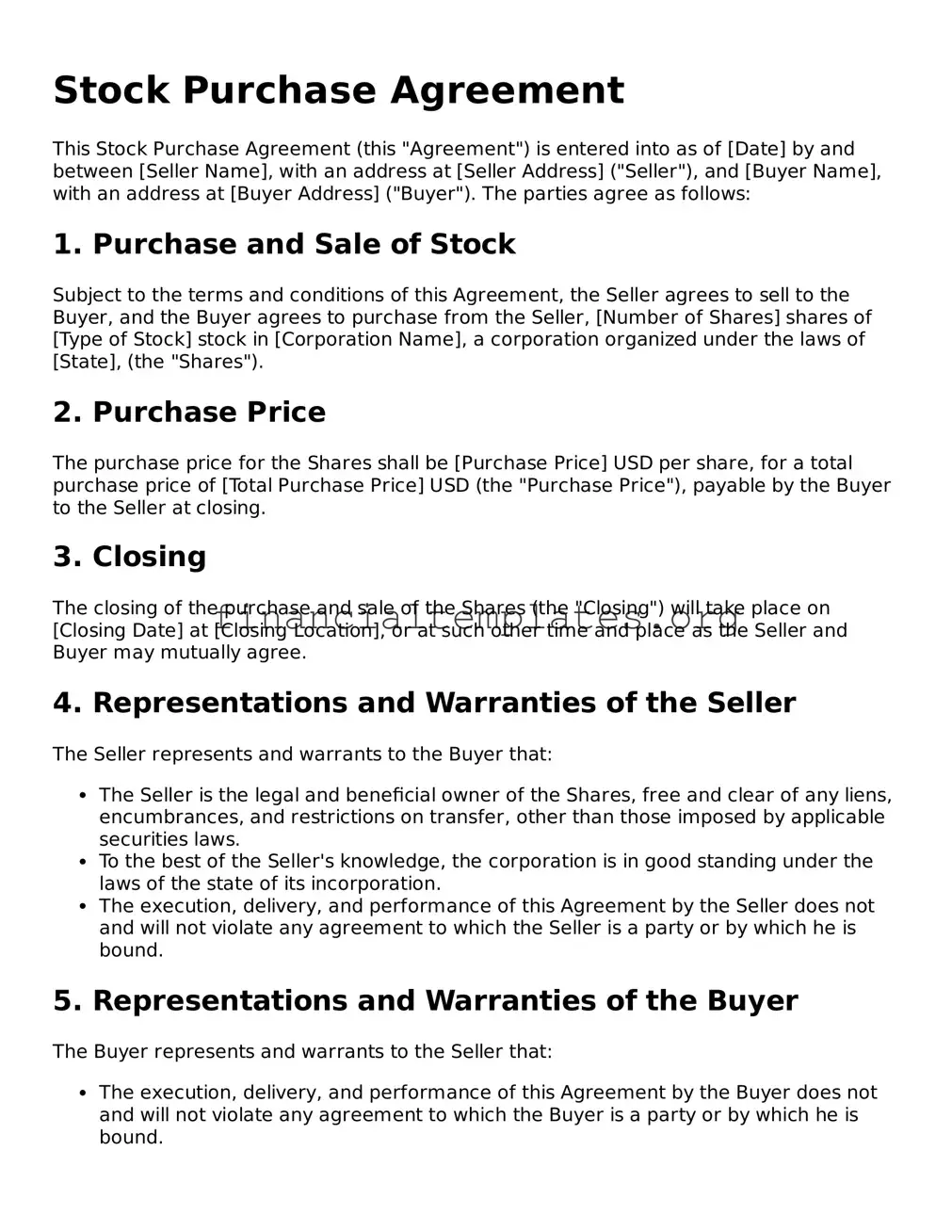

Stock Purchase Agreement Example

Stock Purchase Agreement

This Stock Purchase Agreement (this "Agreement") is entered into as of [Date] by and between [Seller Name], with an address at [Seller Address] ("Seller"), and [Buyer Name], with an address at [Buyer Address] ("Buyer"). The parties agree as follows:

1. Purchase and Sale of Stock

Subject to the terms and conditions of this Agreement, the Seller agrees to sell to the Buyer, and the Buyer agrees to purchase from the Seller, [Number of Shares] shares of [Type of Stock] stock in [Corporation Name], a corporation organized under the laws of [State], (the "Shares").

2. Purchase Price

The purchase price for the Shares shall be [Purchase Price] USD per share, for a total purchase price of [Total Purchase Price] USD (the "Purchase Price"), payable by the Buyer to the Seller at closing.

3. Closing

The closing of the purchase and sale of the Shares (the "Closing") will take place on [Closing Date] at [Closing Location], or at such other time and place as the Seller and Buyer may mutually agree.

4. Representations and Warranties of the Seller

The Seller represents and warrants to the Buyer that:

- The Seller is the legal and beneficial owner of the Shares, free and clear of any liens, encumbrances, and restrictions on transfer, other than those imposed by applicable securities laws.

- To the best of the Seller's knowledge, the corporation is in good standing under the laws of the state of its incorporation.

- The execution, delivery, and performance of this Agreement by the Seller does not and will not violate any agreement to which the Seller is a party or by which he is bound.

5. Representations and Warranties of the Buyer

The Buyer represents and warrants to the Seller that:

- The execution, delivery, and performance of this Agreement by the Buyer does not and will not violate any agreement to which the Buyer is a party or by which he is bound.

- The Buyer is purchasing the Shares for investment for his own account, and not with a view to, or for resale in connection with, any distribution or public offering of the Shares within the meaning of any applicable securities laws.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of [Governing Law State], without regard to its conflict of law principles.

7. Entire Agreement

This Agreement constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior agreements and understandings, both oral and written, between the parties with respect to the subject matter hereof.

8. Amendment

This Agreement may be amended only by a written agreement executed by both parties.

9. Notices

All notices required or permitted under this Agreement shall be in writing and shall be deemed effectively given upon delivery by hand, by certified mail, return receipt requested, or by overnight courier, to the addresses set forth at the beginning of this Agreement, or to such other addresses as the parties may later designate in writing.

10. Counterparts

This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the parties hereto have executed this Stock Purchase Agreement as of the date first above written.

Seller Signature: _____________________ Date: _______________

Buyer Signature: _____________________ Date: _______________

PDF Properties

| Fact | Description |

|---|---|

| 1. Core Purpose | A Stock Purchase Agreement (SPA) is used to transfer ownership of shares from a seller to a buyer, outlining the terms and conditions of the sale. |

| 2. Key Elements | An SPA typically includes critical details such as the number of shares being sold, the price per share, representations and warranties, and any conditions precedent to the closing of the transaction. |

| 3. Governing Law | SPAs are governed by the state laws where the transaction takes place or as agreed upon by the parties. This includes securities law and general contract law of the specified jurisdiction. |

| 4. Importance of Due Diligence | Conducting due diligence before finalizing an SPA ensures that buyers understand the exact nature and value of the shares they are purchasing and Sellers are abreast of any pre-existing conditions that could affect the transaction. |

| 5. Amendment and Termination | The agreement can be amended or terminated only by the mutual consent of all parties involved, unless provisions for unilateral amendment or termination are explicitly included in the agreement. |

Guide to Writing Stock Purchase Agreement

Filling out a Stock Purchase Agreement form is a crucial step in the process of buying or selling shares of a company. This legal document ensures that the terms of the transaction are clearly outlined and agreed upon by both parties, which helps to prevent misunderstandings and potential disputes in the future. It's important to fill out this form carefully and accurately, paying close attention to detail. Following a step-by-step guide can simplify the process, making it easier for all involved parties to complete the agreement efficiently.

- Begin by gathering all necessary information about the buyer and seller, including full legal names, addresses, and contact information. This ensures that the agreement is drafted between the correct parties.

- Specify the number of shares to be purchased, along with their type and class. It's essential to be precise to avoid any confusion regarding the equity being transferred.

- Detail the purchase price per share and the total purchase price for all shares. This information should be clear, with no ambiguity regarding the payment amounts.

- Outline any representations and warranties made by the seller to the buyer regarding the condition of the company and the shares at the time of sale. This section is crucial for transparency and trust.

- Include any conditions precedent to the sale, specifying actions that must be taken or events that must occur before the transaction can be finalized. This could include obtaining approvals from relevant authorities or the completion of certain tasks.

- Describe the procedure for closing the transaction, including the date, location, and any documents that must be exchanged. It's important for both parties to agree on these details to ensure a smooth closing process.

- Specify any post-closing agreements, such as non-competition or confidentiality clauses. These are important for protecting both the buyer's and the seller's interests after the transaction is completed.

- Have a section for signatures where both the buyer and the seller, along with their respective legal representatives, can sign to acknowledge and agree to the terms of the agreement. It’s vital that this section not be overlooked, as the signatures make the document legally binding.

Once the Stock Purchase Agreement form is filled out completely and accurately, the next step involves a careful review by both parties and their legal advisors. This review is crucial to ensure that all the details are correct and that there are no misunderstandings about the terms of the agreement. After this review, any necessary adjustments can be made. When both parties are satisfied with the document, they can proceed to the signing and execution phase, thus formalizing the agreement. It's essential for the buyer and seller to keep copies of the signed agreement for their records and to refer to the document if any issues arise in the future.

Understanding Stock Purchase Agreement

-

What is a Stock Purchase Agreement?

A Stock Purchase Agreement (SPA) is a legal document that outlines the terms and conditions under which shares of a company are sold and bought. The agreement details the number of shares being purchased, the price per share, and the rights and obligations of both the buyer and the seller. It serves as a binding contract that ensures the interests of both parties are protected during the transaction.

-

Who needs a Stock Purchase Agreement?

Any individual or entity planning to buy or sell shares in a company should use a Stock Purchase Agreement. This includes small business owners, private investors, or shareholders in a corporation looking to sell their stake to another party. It's crucial for ensuring a clear, legally-binding understanding of the sale's terms.

-

What key elements are included in a Stock Purchase Agreement?

Identification of Parties: Names and details of the buyer and seller.

Shares Information: Number of shares being bought, along with their class and price per share.

Payment Terms: How, when, and where the payment will be made.

Representations and Warranties: Statements by both parties about the status of the shares and the company.

Covenants: Actions both parties agree to take before and after the transaction.

Conditions Precedent: Conditions that must be met before the transaction can occur.

Closing and Delivery: Instructions for the exchange of shares and payment.

-

How does a Stock Purchase Agreement protect the buyer?

The agreement safeguards the buyer by specifying the exact number of shares being purchased and at what price, ensuring they receive what they are paying for. It also includes representations and warranties from the seller about the company’s financial status and any potential liabilities. This helps the buyer make an informed decision and provides legal recourse in case of misinformation or fraud.

-

How does a Stock Purchase Agreement protect the seller?

For the seller, the agreement provides a clear record of the sale, including payment terms, which helps prevent disputes over agreed terms. It also specifies any conditions that release the seller from further obligations once the shares are transferred. This protects the seller from future claims or liabilities relating to the period after the sale.

-

Can a Stock Purchase Agreement be modified?

Yes, a Stock Purchase Agreement can be modified if both the buyer and seller agree to the changes. Any modifications should be made in writing and signed by both parties, ensuring the changes are legally binding. It's important to address any amendments as soon as new terms are agreed upon to avoid misunderstandings or disputes.

Common mistakes

Not reviewing the entire document thoroughly. Sometimes, sections are overlooked, leading to a misunderstanding of the obligations, rights, or even the purchase price.

Incorrectly identifying the parties involved. It's vital to use full legal names and ensure they're spelled correctly. This mistake could lead to confusion about who is legally bound by the agreement.

Failing to specify payment terms clearly. Payment terms need to be outlined in detail, including the amount, currency, and schedule. Ambiguity here can lead to disputes later on.

Overlooking the representations and warranties. Both buyers and sellers make certain assurances in a Stock Purchase Agreement. Skimming over these can leave parties unaware of important commitments they're making.

Ignoring closing conditions. Specific conditions must be met before the transaction can be completed. If these aren't clearly understood or are overlooked, it can delay or even derail the purchase.

Neglecting the Confidentiality clause. This section protects sensitive information shared during the negotiation. Failure to comply can have legal consequences.

Forgetting to check for the entire agreement clause. This clause states that the written agreement contains all terms of the deal, making any prior agreements or discussions irrelevant unless they are included in the document. Not considering this can lead to misunderstandings about the agreement's scope.

When filling out a Stock Purchase Agreement form, paying close attention to these areas can save a lot of time and prevent potential legal issues down the line. Always make sure to:

Read and understand every part of the agreement.

Ensure accurate representation of all parties and terms.

Consult a legal professional if anything is unclear.

To navigate these agreements successfully, meticulous attention to detail and a clear understanding of the document are essential. By avoiding these common mistakes, parties can ensure a smoother transaction process.

Documents used along the form

In the world of business transactions, especially those involving the buying and selling of stock, the Stock Purchase Agreement (SPA) stands out as a cornerstone document. However, navigating through such dealings requires more than just the SPA. A constellation of additional documents and forms plays a crucial role in ensuring every aspect of the transaction is thoroughly documented, legal requirements are met, and both parties' interests are protected. The following list highlights other significant documents often used alongside the Stock Purchase Agreement.

- Letter of Intent (LOI): This document signifies the buyer's intention to purchase and outlines the preliminary terms between the buyer and seller, serving as a precursor to the SPA.

- Confidentiality Agreement: Protects sensitive information that the parties share with each other during negotiations and due diligence.

- Due Diligence Checklist: A comprehensive list used by the buyer to assess the financial, legal, and operational aspects of the company being acquired.

- Disclosure Schedules: These provide detailed exceptions to the representations and warranties made by the seller in the SPA, outlining specific risks the buyer is assuming.

- Employment Agreement(s): New or amended employment contracts for key executives or employees of the company being acquired, effective upon closing.

- Non-Compete Agreement: Prevents the seller from directly competing with the business being sold for a specified period after the sale.

- Escrow Agreement: Holds a portion of the purchase price in escrow to protect the buyer against potential breaches of the SPA or to ensure certain conditions are met post-closing.

- Amendments to the Articles of Incorporation: Required if the sale involves changes in the company's structure or an increase in authorized stock to facilitate the transaction.

- Legal Opinion: Prepared by legal counsel, it confirms that the transaction complies with applicable laws and that the issuing company is in good standing.

- Closing Checklist: Ensures all necessary steps have been taken and documents are in place for the successful closing of the transaction.

When properly utilized, these documents complement the Stock Purchase Agreement by filling in its broad strokes with the necessary details and legal protections. By carefully drafting and reviewing these ancillary documents, parties can better manage their risks, comply with legal requirements, and pave the way for a smooth transaction. It's crucial for both buyers and sellers to understand not just the SPA, but also the broader spectrum of documents that support and facilitate these complex transactions.

Similar forms

The Asset Purchase Agreement shares similarities with the Stock Purchase Agreement by being a foundational document in the process of buying or selling a company's assets, rather than its stock. This distinction is crucial because, unlike the Stock Purchase Agreement, the purchaser in an Asset Purchase Agreement acquires specific assets (and possibly assumes certain liabilities), rather than obtaining a company's shares. This results in a transaction more tailored to the buyer's needs, allowing them to avoid inheriting unnecessary or undesirable assets and liabilities.

Another document closely related to the Stock Purchase Agreement is the Shareholder Agreement. Both documents govern the rights and obligations of shareholders but serve different purposes in the context of a company's lifecycle. While the Stock Purchase Agreement facilitates the transfer of stock ownership between a buyer and a seller, the Shareholder Agreement regulates the ongoing relationships and operations among all shareholders of a corporation. The Shareholder Agreement might include, for example, provisions for the resolution of disputes among shareholders, or rules for the sale and transfer of shares within the company.

The Merger Agreement is akin to the Stock Purchase Agreement, as both are instrumental in the consolidation and acquisition processes of companies. Whereas the Stock Purchase Agreement deals with the acquisition of a company through the purchase of its stock, the Merger Agreement combines two or more entities into one. The latter often entails a more complex structuring of the deal, requiring thorough due diligence and negotiation to ensure that the merged entity operates effectively post-transaction.

Similarly, the Letter of Intent (LOI) shares a common ground with the Stock Purchase Agreement, existing as a precursor in the negotiation phase of business transactions. This preliminary document outlines the basic terms of the deal, serving as a foundation for the detailed and legally binding Stock Purchase Agreement. Although not always binding in its entirety, the LOI signifies a serious commitment from both parties to move forward under agreed-upon terms, acting as a roadmap to the final agreement.

Finally, the Confidentiality Agreement (also known as a Non-Disclosure Agreement or NDA) complements the Stock Purchase Agreement in safeguarding the sensitive information exchanged during the negotiation and due diligence process. Before the parties agree to the final terms outlined in the Stock Purchase Agreement, they may share proprietary or confidential information with each other. The Confidentiality Agreement ensures that this information remains protected, preventing its misuse or disclosure, and establishing a trust foundation critical for the successful completion of the transaction.

Dos and Don'ts

When it comes to filling out a Stock Purchase Agreement form, accuracy and attention to detail are key. Here's a list of what you should and shouldn't do to ensure a smooth process:

Do:- Read the entire form carefully before filling it out to understand all the requirements and provisions.

- Use black ink or type the information if possible to ensure legibility.

- Check for any restrictions or clauses that could affect the purchase, such as right of first refusal or drag-along rights.

- Consult with a financial advisor or attorney if you have questions or need clarification on any terms.

- Ensure all parties’ information is complete and accurate, including names, addresses, and the number of shares being purchased.

- Review the agreement thoroughly before signing to confirm that all terms and conditions are correctly stated and agreed upon.

- Skip any sections or fields; if a section doesn't apply, mark it as “N/A” instead of leaving it blank.

- Use pencil or any erasable medium that could lead to alterations or question the document's integrity.

- Ignore the fine print or any attached schedules and exhibits that form an integral part of the agreement.

- Forget to obtain all necessary signatures, including those of any co-buyers or guarantors involved in the purchase.

- Assume anything without written confirmation; verbal agreements or understandings should be included in the document.

- Delay reviewing the signed agreement and keeping a copy for your records immediately after all parties have signed.

Misconceptions

In the realm of buying and selling stakes in companies, the Stock Purchase Agreement (SPA) plays a critical role. It outlines the terms and conditions under which shares of a company are sold by one party to another. However, several misconceptions surround this legal document. These misconceptions not only mislead participants but can also result in unfavorable outcomes for both buyers and sellers.

All SPAs are identical: One common misunderstanding is that all Stock Purchase Agreements follow a uniform template without variation. Although SPAs share common elements such as identification of parties, quantity of shares, and price per share, they are highly customizable. Different transactions may require specific representations, warranties, and conditions based on the complexity of the deal, the nature of the business being acquired, and regulatory requirements.

SPAs are only necessary for large transactions: Another misconception is that only large or complex transactions require an SPA. In reality, any transfer of company stock benefits from having a formal agreement in place, regardless of the size of the transaction. An SPA provides a clear framework and legal protection for both parties involved in the transfer, even in what might seem like a straightforward or small-scale deal.

Legal representation is not necessary for drafting an SPA: Some individuals believe that they can prepare an SPA without the assistance of a legal professional. While it is possible to draft this document without a lawyer, it is not advisable. Lawyers can help navigate the complexities of securities laws and ensure that the agreement meets all legal requirements and adequately protects the client's interests.

Verbal agreements suffice before signing the SPA: Relying solely on verbal agreements before the formal signing of an SPA is risky. Without a written agreement, misunderstandings related to the terms of the deal are more likely to occur. A signed SPA ensures that all parties have a clear understanding of their rights and obligations.

An SPA is only about the price of the shares: While the price of shares is a critical component of an SPA, it encompasses much more. The agreement also details the terms of payment, representations and warranties, covenants, conditions to closing, and procedures for resolving disputes. Overlooking these elements can lead to unexpected liabilities and obligations.

The SPA is the final step in the transaction process: It is a misconception that once the SPA is signed, the transaction is complete. In practice, the signing of the SPA marks the agreement on terms but is often followed by a period during which certain conditions must be met before the transaction can close. This might include obtaining necessary approvals, completing due diligence, or fulfilling other closing conditions outlined in the agreement.

Key takeaways

When preparing to fill out and use the Stock Purchase Agreement form, it is important to pay attention to several key aspects to ensure the process goes smoothly and your interests are well protected. By understanding these takeaways, you can navigate the complexities of stock transactions with more confidence and clarity.

- Accurate Information is Crucial: Ensure all data entered in the Stock Purchase Agreement is accurate, including names, addresses, and the number of shares being bought or sold. Mistakes can lead to disputes or legal issues down the line.

- Understand the Terms: Familiarize yourself with the terms of the agreement, such as the purchase price, payment method, and any conditions precedent to closing the transaction. Knowing these details can help prevent misunderstandings between the buyer and seller.

- Due Diligence is Key: Before signing, conduct due diligence to ensure that the stock, and the company issuing it, are in good standing and that there are no hidden problems or liabilities. This step can protect buyers from unwanted surprises.

- Legal Requirements Must be Met: Comply with all legal requirements related to the sale of stock, including securities laws and regulations. Failure to do so can result in penalties for both parties.

- Seek Professional Advice: Consider consulting with a legal or financial professional before completing the Stock Purchase Agreement. Their expertise can provide valuable guidance and help you avoid potential pitfalls.

By keeping these key takeaways in mind, you can navigate the process of filling out and using the Stock Purchase Agreement form with greater assurance and contribute to a successful transaction.

Other Types of Stock Purchase Agreement Templates:

Buyer Cancellation of Purchase Agreement Form - A practical solution for addressing changes in circumstances that affect the ability to complete a property purchase.

Purchase Agreement Addendum - This document serves to legally protect the interests of all parties, ensuring that everyone is on the same page about the transaction’s details.