Blank Real Estate Purchase Agreement Form

When stepping into the world of homeownership or property investment, one crucial document stands out: the Real Estate Purchase Agreement form. This form is the blueprint of the transaction, detailing the agreement between buyer and seller over the sale of a property. Within its pages lie the terms of the sale, including the purchase price, the closing date, and any conditions or contingencies that must be met before the deal can close. It serves as a legally binding contract, meaning once it's signed, both parties are legally obligated to fulfill their part of the deal. Understanding this form is pivotal, as it encapsulates everything from the earnest money deposit details, which secure the agreement, to specifics about who pays for what in terms of closing costs and inspections. It's a roadmap that guides both the buyer and seller through the legal landscape of transferring property ownership, making it an indispensable tool in real estate transactions.

Real Estate Purchase Agreement Document Subtypes

Real Estate Purchase Agreement Example

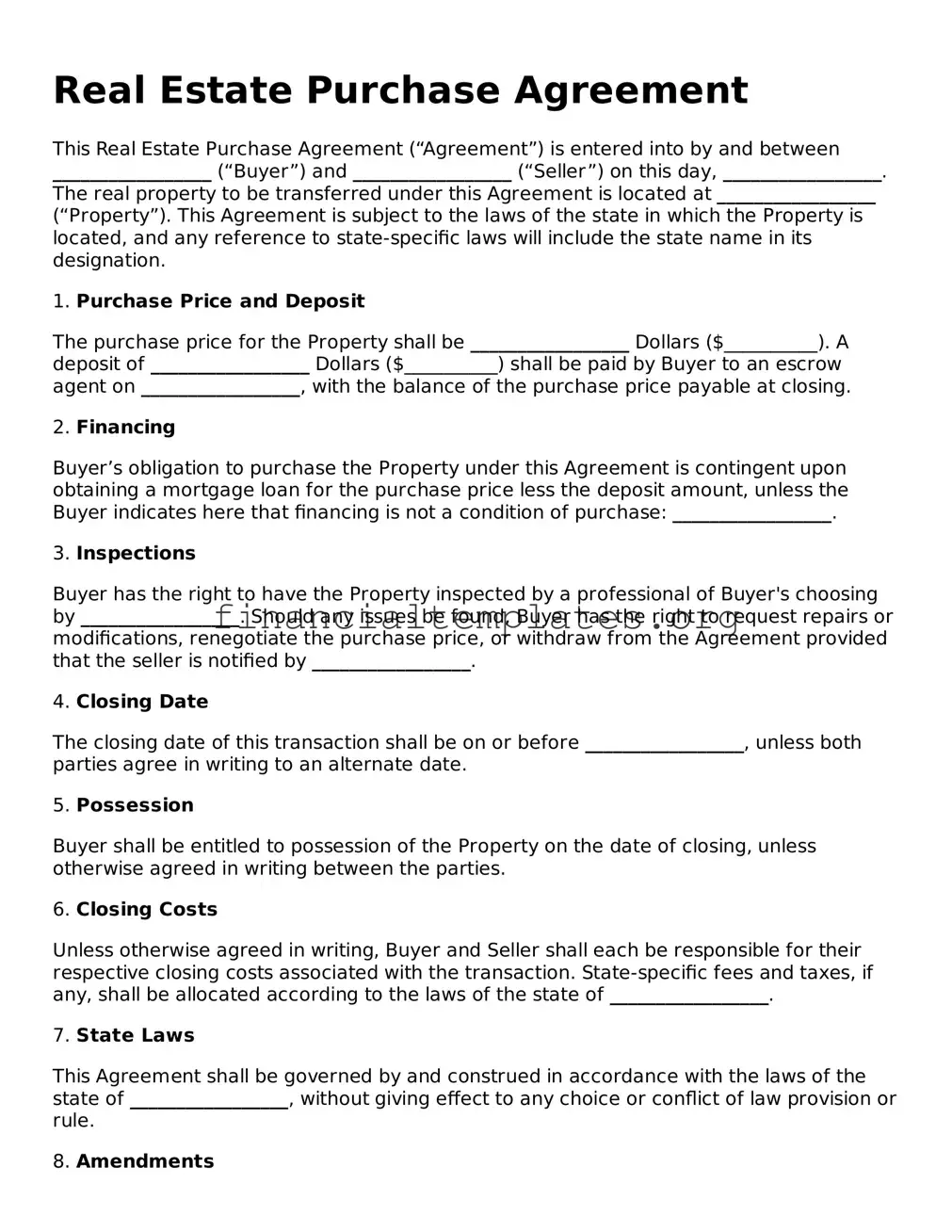

Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is entered into by and between _________________ (“Buyer”) and _________________ (“Seller”) on this day, _________________. The real property to be transferred under this Agreement is located at _________________ (“Property”). This Agreement is subject to the laws of the state in which the Property is located, and any reference to state-specific laws will include the state name in its designation.

1. Purchase Price and Deposit

The purchase price for the Property shall be _________________ Dollars ($__________). A deposit of _________________ Dollars ($__________) shall be paid by Buyer to an escrow agent on _________________, with the balance of the purchase price payable at closing.

2. Financing

Buyer’s obligation to purchase the Property under this Agreement is contingent upon obtaining a mortgage loan for the purchase price less the deposit amount, unless the Buyer indicates here that financing is not a condition of purchase: _________________.

3. Inspections

Buyer has the right to have the Property inspected by a professional of Buyer's choosing by _________________. Should any issues be found, Buyer has the right to request repairs or modifications, renegotiate the purchase price, or withdraw from the Agreement provided that the seller is notified by _________________.

4. Closing Date

The closing date of this transaction shall be on or before _________________, unless both parties agree in writing to an alternate date.

5. Possession

Buyer shall be entitled to possession of the Property on the date of closing, unless otherwise agreed in writing between the parties.

6. Closing Costs

Unless otherwise agreed in writing, Buyer and Seller shall each be responsible for their respective closing costs associated with the transaction. State-specific fees and taxes, if any, shall be allocated according to the laws of the state of _________________.

7. State Laws

This Agreement shall be governed by and construed in accordance with the laws of the state of _________________, without giving effect to any choice or conflict of law provision or rule.

8. Amendments

Any amendments or modifications to this Agreement must be made in writing and signed by both Buyer and Seller.

9. Acceptance

The undersigned Buyer and Seller acknowledge they have fully read, understood, and accepted all terms and conditions of this Real Estate Purchase Agreement.

Buyer’s Signature: _____________________ Date: _____________________

Seller’s Signature: _____________________ Date: _____________________

PDF Properties

| Fact Number | Fact Detail |

|---|---|

| 1 | The Real Estate Purchase Agreement is a legally binding contract between the buyer and seller for the purchase and sale of real estate. |

| 2 | This agreement outlines the terms and conditions of the sale, including the purchase price, financing conditions, inspections, and closing date. |

| 3 | State-specific forms must comply with the governing laws of the state where the property is located. |

| 4 | Common provisions include dispute resolution mechanisms and clauses on who bears the risk of loss if the property is damaged before closing. |

| 5 | Contingencies, such as financing, sale of the buyer's current home, and satisfactory home inspections, may be included to protect both parties. |

| 6 | Earnest money deposits are typically required as part of the agreement, demonstrating the buyer's commitment to the transaction. |

| 7 | Closing costs and who is responsible for paying them (buyer or seller) are specified within the contract. |

| 8 | The agreement specifies the date by which the offer must be accepted by the seller, and what happens if the offer is rejected. |

| 9 | Amendments or addenda to the agreement may be made if both parties agree to changes after the initial signing. |

Guide to Writing Real Estate Purchase Agreement

Filling out a Real Estate Purchase Agreement form is a critical step in the process of buying or selling property. This document outlines the terms and conditions of the sale, ensuring that both parties are clear on the agreement. It serves as a binding contract once signed, setting the stage for a smooth transaction. The following steps are designed to guide you through this process, ensuring that all necessary information is accurately captured to protect the interests of both the buyer and seller.

- Start by entering the date of the agreement at the top of the form.

- Fill in the full legal names of both the buyer and the seller in the designated sections.

- Specify the address and the legal description of the property being sold. This information can usually be found in the property's current deed.

- Enter the purchase price agreed upon by both parties. Also, include the terms of the payment, such as down payment amount, financing details, and if there are any contingencies such as the sale being subject to the buyer obtaining financing.

- List any personal property that will be included in the sale. This can range from appliances to furniture, as long as it's explicitly agreed upon.

- Detail the closing date and location where the final transaction will take place.

- Outline any inspections or investigations that the buyer has the right to conduct before the closing, including the timeframe for these to be completed.

- Specify any contingencies that must be met for the sale to proceed. This can include things like the buyer selling their current home, the property passing a home inspection, or the buyer obtaining adequate financing.

- Agree on who will pay for specific closing costs, such as title insurance, escrow fees, transfer taxes, and agent commissions. Typically, these costs are shared between the buyer and seller but can be negotiated.

- Sign and date the form at the bottom. Both the buyer and the seller must sign to make the agreement legally binding.

Once the Real Estate Purchase Agreement form has been fully completed and signed by both parties, it will guide the rest of the transaction towards completion. The next steps include finalizing financing, conducting necessary inspections, and preparing for the closing day when the transaction is officially completed. Both the buyer and seller should keep a copy of the signed agreement for their records.

Understanding Real Estate Purchase Agreement

-

What is a Real Estate Purchase Agreement?

A Real Estate Purchase Agreement is a legally binding document between a buyer and seller outlining the terms of a real estate transaction. It includes details such as the purchase price, property description, closing date, and any contingencies that must be met before the deal is finalized. This agreement serves as a roadmap for the transaction, ensuring that both parties understand their obligations and the steps needed to complete the sale.

-

Why is a Real Estate Purchase Agreement important?

This agreement is crucial because it legally binds the buyer and seller to the sale, providing a clear framework of what is expected from each party. It helps to prevent misunderstandings and disputes by detailing the transaction's specifics, such as the agreed-upon price, the condition of the property, and any items to be included or excluded from the sale. Moreover, it outlines the recourse each party has if the other fails to meet their obligations, ensuring a level of protection for both sides.

-

What should be included in a Real Estate Purchase Agreement?

- Identification of the parties involved

- Description of the property

- Purchase price and terms of sale

- Details of the earnest money deposit

- Contingencies such as financing, inspections, and appraisal

- Closing date and possession details

- Signatures of both parties

Each component plays a vital role in clarifying the transaction's terms and ensuring the agreement is enforceable.

-

Can a Real Estate Purchase Agreement be modified?

Yes, but any changes to the agreement must be made in writing and signed by both the buyer and seller. Modifications can include adjustments to the purchase price, closing date, or the resolution of issues discovered during a home inspection. These amendments are usually documented in a separate addendum to the original agreement. It's essential for both parties to carefully review and agree upon any changes to ensure mutual understanding and agreement.

-

What happens if a party breaches the Real Estate Purchase Agreement?

If a party fails to fulfill their obligations under the agreement, it is considered a breach. Depending on the terms of the agreement and state laws, the non-breaching party may have several recourses, such as seeking specific performance, which compels the breaching party to complete the sale, or pursuing damages for financial losses incurred. Alternatively, the agreement may allow the non-breaching party to terminate the agreement and potentially recover their earnest money deposit. It's crucial for both parties to understand the consequences of breaching the agreement before entering into it.

-

Is legal representation necessary when entering into a Real Estate Purchase Agreement?

While it's not mandatory, having legal representation is highly recommended. Real estate transactions can be complex, and a lawyer can provide valuable guidance, ensuring that the agreement complies with state laws and fully protects your interests. They can also assist in negotiating terms, addressing any issues that arise, and navigating the closing process. Ultimately, the small investment in hiring a lawyer can provide significant peace of mind and prevent costly mistakes.

Common mistakes

-

One common mistake people make is neglecting to review the entire document thoroughly. Every detail in a Real Estate Purchase Agreement is significant, and overlooking any section can lead to misunderstandings or legal issues down the road. It's important to ensure that all information is correct and that you fully understand the terms before signing.

-

Not accurately describing the property is another error that can have serious implications. The legal description of the property, including its address, lot number, and any applicable legal boundaries, must be precise. Misidentifications can lead to disputes about what was actually intended to be bought or sold.

-

Failing to specify the fixtures and fittings that are included or excluded from the sale can result in conflicts between buyer and seller. Items such as light fixtures, window treatments, and appliances should be clearly listed if they are to remain or be removed from the property upon sale.

-

Another oversight is not agreeing on a closing date or misunderstanding the terms related to the closing. The agreement should clearly state when the transaction will be completed, and any conditions that must be met by both buyer and seller before this can happen.

-

Ignoring the need for a professional inspection condition can be a grave mistake. Buyers should always protect themselves by insisting on a condition that the sale is contingent upon a satisfactory report from a qualified home inspector. This ensures the property is in the expected condition.

-

Miscalculating the costs associated with the purchase, such as taxes, fees, and other closing costs, is a common error. These expenses can add up significantly and should be factored into the total cost of purchasing the property to avoid surprises.

-

Omitting contingency clauses for financing or selling a current home can put buyers in a vulnerable position. Such clauses allow the buyer to back out of the deal without penalty under specific conditions, such as not being able to secure a mortgage or sell their existing home.

-

Underestimating the importance of the timeline for fulfilling or waiving contingencies can lead to the forfeiture of earnest money or, worse, legal action. It's crucial to strictly adhere to the deadlines specified for inspections, mortgage approval, and other conditions.

-

Finally, failing to consult with a real estate attorney before finalizing the agreement is a mistake that can result in overlooking potential legal issues. An attorney can provide valuable advice and ensure that the agreement protects the client's interests.

Documents used along the form

When navigating the purchase of a property, a Real Estate Purchase Agreement is a fundamental document delineating the terms of sale between buyer and seller. However, this agreement does not stand alone in the transaction process. Several other forms and documents commonly accompany the Real Estate Purchase Agreement, each serving a specific purpose to ensure a thorough and legally sound transaction. Understanding these documents is crucial for buyers, sellers, and all parties involved in a real estate transaction.

- Title Insurance Commitment: Before the property changes hands, it's essential to guarantee that the title is clear of any claims or liens that could affect ownership. The Title Insurance Commitment provides a detailed report of the property's title status and outlines the conditions under which the insurer agrees to provide title insurance to protect the buyer against future claims.

- Disclosure Forms: Sellers are often required to complete certain disclosure forms that inform the buyer about the condition and history of the property. These disclosures can include but are not limited to environmental hazards, the presence of lead-based paint, and details of any major repairs or insurance claims previously made on the property.

- Loan Documents: Buyers financing their purchase through a mortgage will need to provide several loan documents. These may encompass pre-approval letters, loan agreements, and mortgage disclosures. These documents detail the terms of the loan, including the interest rate, repayment schedule, and conditions of the mortgage.

- Home Inspection Report: Although not always a requirement, most buyers opt for a professional home inspection before finalizing a purchase. The Home Inspection Report outlines the condition of the property, including structural, electrical, and plumbing systems, and may highlight areas in need of repair or concern.

Together with the Real Estate Purchase Agreement, these documents play vital roles in the real estate transaction. They ensure transparency, protect the interests of all parties involved, and facilitate a smoother transition of property ownership. Knowledge and proper management of these documents contribute to informed decision-making and a successful real estate purchase.

Similar forms

A Real Estate Purchase Agreement form is critically important in the sale and purchase of property, serving as a legally binding contract between buyer and seller detailing the terms of the property transfer. This document is not alone in its significance during legal and financial transactions. Various other documents share similarities in function and structure, each integral to their respective processes.

Firstly, the Bill of Sale is a close cousin to the Real Estate Purchase Agreement. While a Bill of Sale typically pertains to the transfer of personal property such as vehicles or office equipment, it, like the Real Estate Purchase Agreement, outlines the specifics of a transaction between a buyer and seller. Both documents solidify an agreement, marking the change of ownership of an asset.

Lease Agreements share a foundational similarity to Real Estate Purchase Agreements in that they govern the terms under which property is rented rather than owned. Lease Agreements detail the obligations and rights of landlords and tenants, much like how Real Estate Purchase Agreements delineate the responsibilities of buyers and sellers in a property sale.

Loan Agreements, while focused on the lending and repayment of money, parallel Real Estate Purchase Agreements in their formalization of terms between parties. Where Real Estate Purchase Agreements establish the conditions of a property sale, Loan Agreements specify the details of loan amounts, interest rates, and repayment schedules.

Another document with similarities is the Land Contract. This agreement differs as it pertains to seller financing of property purchases but shares the characteristic of detailing the terms under which property is transferred, albeit with the seller also acting as the lender.

The Deed of Trust, used in some states in place of a mortgage, is an instrument that secures a loan on real property. It is similar to a Real Estate Purchase Agreement as it is imperative in the transfer of interest in real property, though it specifically relates to securing a loan with the property as collateral.

Title Insurance Policies, though not agreements between buyer and seller, are fundamentally related to the assurance of clear title in a real estate transaction, a concern at the heart of Real Estate Purchase Agreements. They protect against losses from defects in title, ensuring the buyer's ownership rights.

Escrow Agreements represent the neutral third-party handling of funds, documents, and instructions necessary for completing property transactions. Their role in ensuring the proper transfer of property and funds before closing mirrors the function of a Real Estate Purchase Agreement in establishing the conditions for such transfers.

Finally, the Property Disclosure Statement, while not an agreement, is traditionally part of the documentation in real estate transactions. It requires the seller to disclose known property issues, similar to how a Real Estate Purchase Agreement might detail property conditions and other terms affecting the sale.

Each of these documents, in its own right, plays a pivotal role in legal and financial transactions, ensuring clarity, legality, and fairness for all parties involved. Understanding their purposes and how they complement a Real Estate Purchase Agreement can provide invaluable insight into property transactions and beyond.

Dos and Don'ts

When entering into the exciting world of real estate transactions, the Real Estate Purchase Agreement form plays a pivotal role. This legal document outlines the terms and conditions of the sale and purchase of property, acting as a binding agreement between the buyer and seller. Handling this form with care is essential, and there are specific dos and don'ts that can help navigate this process smoothly.

Things You Should Do

Review all the details carefully. Ensure that every piece of information on the form is accurate, including property addresses, legal descriptions, sale price, and terms of the sale.

Consult with a professional. It's always wise to have a real estate attorney or a knowledgeable agent review the agreement before you sign. They can spot issues you might miss.

Understand all the terms and conditions. Make sure you fully comprehend the obligations, rights, and contingencies outlined in the agreement.

Keep a signed copy. Once all parties have signed the agreement, make sure to secure a copy for your records.

Things You Shouldn't Do

Don't rush through the process. Take your time to thoroughly review and understand each section of the agreement before signing.

Avoid making verbal agreements. All agreements and negotiations should be documented in writing within the purchase agreement to be legally binding.

Don't skip over contingencies. These are crucial as they provide conditions under which you can back out of the deal without penalty, such as failing an inspection.

Never leave blanks on the form. If a section doesn't apply, mark it as N/A. Unfilled sections can lead to misunderstandings or manipulation of the agreement later.

Misconceptions

When it comes to buying or selling property, a Real Estate Purchase Agreement is a critical document that outlines the terms and conditions of the sale. However, there are several misconceptions about this form that can lead to confusion and misunderstandings. Below is a list of ten common misconceptions and the truths behind them.

All Real Estate Purchase Agreements are the same: This is not true. While many agreements may appear similar, each state has specific requirements, and the terms can vary significantly depending on the property type and the agreement between the buyer and seller.

Verbal agreements are as good as written ones: In real estate transactions, verbal agreements are not binding. Law requires that all agreements pertaining to the sale of property be in writing to be enforceable.

You can back out of a Real Estate Purchase Agreement anytime: Once signed by both parties, these agreements are legally binding. Backing out without a contractual reason may result in financial penalties or legal action.

The Real Estate Purchase Agreement is only about the sale price: The agreement covers numerous terms besides the sale price, including contingencies, closing date, and obligations of both parties.

Home inspections are optional: While the agreement may not mandate a home inspection, it is advisable to have one. Inspections can uncover potential issues that may impact the buyer’s decision or negotiation leverage.

Sellers must fix all issues found during the home inspection: This is incorrect. The agreement may allow negotiations for repairs or adjustments to the sale price instead. In some cases, sellers may refuse to make any changes, giving the buyer the choice to continue with the purchase or back out, depending on the agreement's contingencies.

The seller always pays the real estate agent’s commission: While this is common practice, it is not a rule. The agreement stipulates who is responsible for the commission, and it’s possible for the buyer to agree to cover this cost.

Real Estate Purchase Agreements favor the seller: The agreements are meant to protect both parties. Buyers and sellers should negotiate terms that meet their needs and protect their interests.

You don’t need a lawyer to review your Real Estate Purchase Agreement: While not always legally required, having a lawyer review your agreement can prevent misunderstandings and ensure that your rights are protected.

Signing the agreement locks you into a fixed closing date: Closing dates can be subject to change if both parties agree. Delays can occur due to financing issues, inspection findings, or title problems that may require an amendment to the original agreement.

Understanding these misconceptions can make the real estate transaction process smoother and more transparent for everyone involved. Always seek professional advice when dealing with Real Estate Purchase Agreements.

Key takeaways

Navigating the intricate path of a real estate transaction can be complex, but a well-crafted Real Estate Purchase Agreement (REPA) serves as a vital roadmap. This document not only outlines the sale's terms and conditions but also safeguards the interests of both parties involved. Here are five key takeaways to consider when filling out and using a REPA.

- Detail is Key: Every aspect of the sale, from the purchase price to contingencies, must be meticulously detailed in the agreement. This precision ensures clarity and prevents potential disputes by covering all bases of the sale transaction.

- Legal Compliance: Real estate laws vary by state and sometimes by local jurisdiction. Ensuring that the REPA complies with these laws is critical to its enforceability and the smooth progression of the real estate transaction.

- Contingencies Matter: Contingencies, such as those for financing, inspections, and appraisals, protect both the buyer and seller. They provide a legal way to back out of the deal if certain conditions aren't met, so understanding and defining these conditions is crucial.

- Clear Titles: A REPA should require a clear title, meaning the property is free from liens, disputes, and other encumbrances. This ensures the buyer gains full ownership rights upon closing.

- Signature Requirements: For a REPA to be legally binding, it must be signed by all parties involved in the transaction. This may include not only the buyer and seller but also their legal representatives if applicable. Electronic signatures are often permitted and can expedite the process.

Ultimately, a Real Estate Purchase Agreement is a binding contract that demands careful attention and understanding. Both parties should thoroughly review every line of the agreement, potentially with the assistance of legal counsel, to ensure a fair and lawful transaction. By keeping these key takeaways in mind, participants can pave the way for a smoother and more secure real estate deal.

Popular Documents

Health Insurance Marketplace Statement - As a key document for tax preparation, the 1095-A contains information about your health insurance premiums and subsidies throughout the year.

Should I Claim for Homeowners' Property Tax Exemption - Specially designed, the PTAX-343-A serves as a direct link between medical validation of disability and legal tax benefits, emphasizing the form's critical role.

Irs Live Chat - Through Form 911, taxpayers can articulate the distress and challenges caused by their unresolved tax issues, seeking expedited assistance.