Get Rc4031 Tax Refund Form

The Rc4031 Tax Refund form serves as an essential document for non-resident visitors to Canada wishing to reclaim the Goods and Services Tax/Harmonized Sales Tax (GST/HST) they paid during their stay. This form facilitates the process for individuals who have spent over CAN$200 before taxes on short-term accommodation and goods, thereby offering a financial reprieve in acknowledgment of the substantial contributions tourists make to the Canadian economy. To be eligible for the refund, applicants need to provide original receipts—photocopies and payment card slips are not acceptable—to vouch for their expenditures, while ensuring they meet the set criteria outlined in detail on the form and supplementary pamphlets like RC4031, "Tax Refund for Visitors to Canada." Furthermore, it's crucial for claimants to understand that provincial sales taxes are not included in this refund, emphasizing the federal focus of the GST/HST recovery process. Interestingly, the form also offers options for those who have purchased significant goods or partaken in travel tours, providing specific provisions for these situations. Completion and submission of the Rc4031 form are paramount for initiating the refund process, which is exclusively conducted through mailed paper applications, reflecting the Canada Revenue Agency’s (CRA) efforts to manage these claims efficiently while also underscoring the importance of adhering to all requirements to facilitate a smooth and successful refund claim.

Rc4031 Tax Refund Example

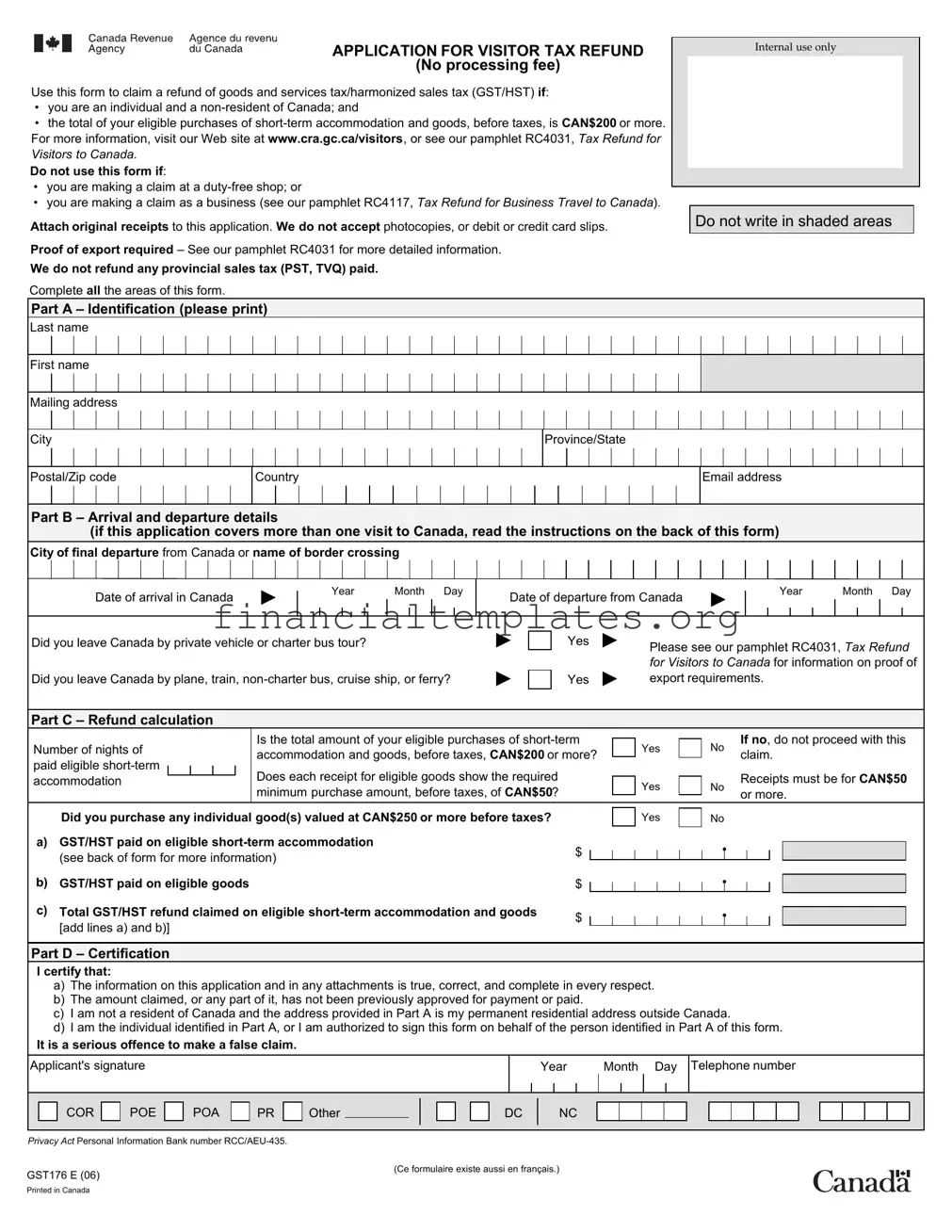

APPLICATION FOR VISITOR TAX REFUND

(No processing fee)

Use this form to claim a refund of goods and services tax/harmonized sales tax (GST/HST) if:

•you are an individual and a

•the total of your eligible purchases of

Do not use this form if:

•you are making a claim at a

•you are making a claim as a business (see our pamphlet RC4117, Tax Refund for Business Travel to Canada).

Attach original receipts to this application. We do not accept photocopies, or debit or credit card slips.

Proof of export required – See our pamphlet RC4031 for more detailed information.

We do not refund any provincial sales tax (PST, TVQ) paid.

Complete all the areas of this form.

Internal use only

Do not write in shaded areas

Part A – Identification (please print)

Last name

First name

Mailing address

City

Province/State

Postal/Zip code

Country

Email address

Part B – Arrival and departure details

(if this application covers more than one visit to Canada, read the instructions on the back of this form)

City of final departure from Canada or name of border crossing

Date of arrival in Canada

Year |

Month Day |

Date of departure from Canada |

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

Month Day |

Did you leave Canada by private vehicle or charter bus tour?

Did you leave Canada by plane, train,

Yes |

|

Please see our pamphlet RC4031, Tax Refund |

|

||

|

|

|

|

|

for Visitors to Canada for information on proof of |

Yes |

|

export requirements. |

|

Part C – Refund calculation

Number of nights of |

Is the total amount of your eligible purchases of |

|

Yes |

|

No |

If no, do not proceed with this |

|||||||||||

|

|

||||||||||||||||

paid eligible |

|

|

|

|

accommodation and goods, before taxes, CAN$200 or more? |

|

|

|

|

|

claim. |

||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

Does each receipt for eligible goods show the required |

|

|

|

|

|

|

|

Receipts must be for CAN$50 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

accommodation |

|

|

|

Yes |

|

No |

|||||||||||

|

|

|

|

|

minimum purchase amount, before taxes, of CAN$50? |

|

|

|

|

or more. |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Did you purchase any individual good(s) valued at CAN$250 or more before taxes? |

|

|

|

Yes |

|

No |

|

|

|

|

|

||||||

a) GST/HST paid on eligible |

$ |

|

|

|

|

|

• |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||||||||

(see back of form for more information) |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

• |

|

|

|

|

|

||||||

b) GST/HST paid on eligible goods |

|

$ |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

c) Total GST/HST refund claimed on eligible |

$ |

|

|

|

|

|

• |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||||||||

[add lines a) and b)] |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part D – Certification |

|

|

|

|

|

|

|

I certify that: |

|

|

|

|

|

|

|

a) The information on this application and in any attachments is true, correct, and complete in every respect. |

|||||||

b) The amount claimed, or any part of it, has not been previously approved for payment or paid. |

|

||||||

c) I am not a resident of Canada and the address provided in Part A is my permanent residential address outside Canada. |

|||||||

d) I am the individual identified in Part A, or I am authorized to sign this form on behalf of the person identified in Part A of this form. |

|||||||

It is a serious offence to make a false claim. |

|

|

|

|

|||

Applicant's signature |

|

|

|

|

Year |

Month Day Telephone number |

|

COR |

POE |

POA |

PR |

Other |

DC |

NC |

|

Privacy Act Personal Information Bank number

GST176 E (06)

Printed in Canada

(Ce formulaire existe aussi en français.)

General Information

Visitors to Canada

Use this form if you are a

Include original receipts with your application. We do not accept photocopies or debit or credit card slips. It will take about four to six weeks to process your application.

Note

We do not return the receipts that are sent in with your refund application.

If you are claiming the GST/HST you paid on eligible goods and your first departure flight does not leave from one of the eight international airports, you have to provide alternate forms of proof of export. The international airports are listed on page12 of our pamphlet RC4031, Tax Refund for Visitors to Canada. For proof of export information, see our pamphlet RC4031, or visit our Web site at www.cra.gc.ca/visitors.

If your refund claim covers multiple visits to Canada, enter the earliest arrival date, the latest departure date, and the place of your final departure from Canada on the front of this form. Also attach a list of your various arrival and departure dates, including each place of departure from Canada. If your claim includes eligible goods from various visits, proof of export for the goods is needed from each departure place.

Eligible travel tour packages

If your tour package included eligible

Quick calculation option for GST/HST paid on eligible

You can use a quick method to calculate the amount of your GST/HST refund, rather than adding up the actual amount you paid. See page 5 of our pamphlet RC4031, Tax Refund for Visitors to Canada, for more information.

The only method of payment by the Canada Revenue Agency is by cheque.

Mail this refund application to:

Visitor Rebate Program

Summerside Tax Centre

Canada Revenue Agency

Suite 104, 275 Pope Road

Summerside PE C1N 6C6

CANADA

Internal use only

Document Specifics

| Fact | Detail |

|---|---|

| 1. Eligibility | For non-resident individuals of Canada who have spent CAN$200 or more on eligible purchases of short-term accommodation and goods before taxes. |

| 2. Exclusion | Cannot be used for claims at duty-free shops or by businesses. |

| 3. Receipt Requirement | Original receipts must be attached; photocopies, debit, or credit card slips are not accepted. |

| 4. Proof of Export | Essential for processing the refund; detailed information available in the RC4031 pamphlet. |

| 5. Provincial Sales Tax (PST) Refund | Provincial sales taxes (PST, TVQ) paid are not eligible for a refund. |

Guide to Writing Rc4031 Tax Refund

Filling out the RC4031 Tax Refund form is an important step for non-resident visitors to Canada seeking a refund on the goods and services tax/harmonized sales tax (GST/HST) paid on eligible purchases and short-term accommodation during their stay. This process, detailed below, involves providing personal information, details of the visit(s) to Canada, calculation of the refund amount, and certification of the information provided. To ensure a smooth and successful claim, it's essential to thoroughly complete each section of the form and attach all original receipts, as photocopies or debit/credit card slips are not accepted. The instructions outlined aim to assist applicants in accurately completing the form, thereby facilitating a timely processing of their refund claim.

- Part A – Identification:

- Print your last name, first name, mailing address, city, province/state, postal/zip code, country, and email address in the spaces provided.

- Part B – Arrival and departure details:

- For multiple visits, refer to the back of the form for additional instructions.

- Enter the city of your final departure from Canada or the name of the border crossing.

- Fill in the date of your arrival in Canada and the date of your departure, including year, month, and day.

- Indicate whether you left Canada by private vehicle or charter bus tour, and if you left by plane, train, non-charter bus, cruise ship, or ferry.

- Part C – Refund calculation:

- Answer 'Yes' or 'No' to determine if you meet the criteria for a tax refund claim based on the amount and types of purchases.

- For eligible short-term accommodation, input the GST/HST paid.

- For eligible goods, enter the GST/HST paid.

- Calculate and enter the total GST/HST refund claimed by adding lines a) and b).

- Part D – Certification:

- Read the certification statements carefully.

- Sign and date the form, and provide your telephone number.

Upon completion, ensure that all original receipts are attached to the form and mail it to the Visitor Rebate Program at the Summerside Tax Centre of the Canada Revenue Agency. Remember, the processing time for your application may take four to six weeks, and any provincial sales tax paid is not refundable through this program. By following these instructions closely, you can successfully submit your application and look forward to receiving your tax refund.

Understanding Rc4031 Tax Refund

Who is eligible to use the RC4031 Tax Refund form?

To be eligible to use the RC4031 form for a tax refund, individuals must meet two key criteria. First, they must be non-residents of Canada. Second, they need to have made eligible purchases totaling CAN$200 or more before taxes, which can include short-term accommodation and goods. It's important to note that this form is specifically intended for individual claims and should not be used by businesses or for claims made at duty-free shops.

What types of taxes are refundable with the RC4031 form?

The RC4031 form allows individuals to claim a refund for the goods and services tax/harmonized sales tax (GST/HST) paid on eligible purchases. These purchases include short-term accommodations and goods, assuming they meet the minimum purchase requirements. However, it's crucial to understand that provincial sales tax (PST) or Quebec sales tax (TVQ) are not refundable through this process.

What documentation is required to submit a claim using the RC4031 form?

When submitting a claim using the RC4031 form, individuals must include original receipts for their eligible purchases. Photocopies, debit, or credit card slips are not accepted as valid proof of purchase. Additionally, proof of export is required for eligible goods. This detailed information ensures the Canada Revenue Agency can accurately assess and process each tax refund claim.

How long does it take to process a claim made with the RC4031 form, and how are refunds issued?

Claims made with the RC4031 form typically take four to six weeks to process. This timeframe allows the Canada Revenue Agency (CRA) to thoroughly review the application and accompanying documentation. It's important for claimants to note that the only method of payment for refunds from the CRA is by cheque, ensuring a secure transfer of funds back to the individual.

Can the RC4031 form be used for multiple visits to Canada?

Yes, the RC4031 form accommodates claims that cover multiple visits to Canada. Applicants should enter the earliest arrival date and the latest departure date on the form. Additionally, they must attach a list that includes all arrival and departure dates, as well as the place of final departure from Canada. If the claim includes eligible goods from various visits, proof of export must be provided for goods from each departure location. This ensures that all eligible purchases are appropriately documented and considered for the tax refund.

Common mistakes

Filling out the RC4031 Tax Refund form can be a straightforward process, but errors can creep in if you're not careful. Here are eight common mistakes that can delay or even derail your claim for a GST/HST refund as a non-resident visitor to Canada.

- Not meeting the minimum purchase requirement: A crucial detail is that your eligible purchases of short-term accommodation and goods, before taxes, must total CAN$200 or more. Overlooking this detail can lead to an outright rejection of your application.

- Forgetting to include original receipts: The form requires that you attach original receipts for your purchases and proof of export. Some applicants mistakenly submit photocopies or debit/credit card slips, which are not accepted.

- Misunderstanding eligible goods: It is important to understand what qualifies as eligible goods and accommodation. Trying to claim a refund on ineligible items can result in part of your claim being denied.

- Incorrect claim amounts: All too often, applicants either overestimate or underestimate the GST/HST paid on eligible purchases. It is vital to carefully calculate the correct amounts to ensure a successful refund claim.

- Omitting proof of export: For goods, you must prove that they were exported from Canada. Failure to include this proof can lead to disqualification of your refund on those goods.

- Failing to complete every section of the form: Leaving sections incomplete can result in processing delays. Make sure every required area is filled out accurately.

- Applying after the deadline: Your refund application must be received within one year after the day the tax on the eligible short-term accommodation became payable, and within one year after the day you exported the eligible goods. Late applications are not considered.

- Ignoring the quick calculation option: If you're claiming for short-term accommodation or a tour package, the quick calculation option can simplify your application. Overlooking this option, if it's applicable, could mean you miss out on a simpler calculation method.

In conclusion, filling out the RC4031 form accurately can smooth the path to receiving your GST/HST refund. Paying attention to the details, including the dos and don'ts mentioned above, ensures that your application will be processed efficiently and correctly. Familiarizing yourself with the eligibility requirements and ensuring you have all necessary documents on hand before you begin your application can save you time and effort in the long run.

Documents used along the form

Completing the RC4031 Tax Refund form is a significant step for non-resident visitors in Canada to reclaim the goods and services tax/harmonized sales tax (GST/HST) on their purchases. However, this form often necessitates the accompaniment of additional documents and forms to ensure a successful and smooth processing of the tax refund claim. Understanding these complementary documents can greatly enhance the efficiency of your refund request.

- Original purchase receipts: These serve as the fundamental proof of your eligible purchases. Remember, only original receipts are accepted – photocopies or debit/credit card slips will not suffice. Each receipt must clearly show a minimum purchase amount of CAN$50 before taxes.

- Proof of export: This document is necessary to validate that the goods purchased were indeed taken out of Canada. Proof of export is especially critical if your departure flight was not from one of the eight designated international airports where such proof can be more straightforwardly obtained.

- Documentation of short-term accommodation: If part of your refund claim includes GST/HST paid on short-term lodging, you'll need to provide documents such as hotel bills or rental agreements that clearly show the amount of GST/HST paid.

- Travel itinerary: For claims that cover multiple visits to Canada, a detailed travel itinerary is required. This should list various arrival and departure dates, including places of departure from Canada, to corroborate the claim of goods exportation following each visit.

- RC4117 Tax Refund for Business Travel to Canada pamphlet: Although not applicable to all, individuals making a claim related to business travel will need to consult this pamphlet. It outlines the distinct process and requirements for business-related GST/HST refund claims.

Collecting and preparing these documents in conjunction with the RC4031 form is pivotal for the timely processing of your tax refund. Each document plays a critical role in validating your claim, from proving the eligibility of your purchases to substantiating the exportation of goods out of Canada. Paying meticulous attention to these requirements will pave the way for a successful refund application. For further guidance, the Canada Revenue Agency's website offers comprehensive information and assistance for visitors looking to claim their GST/HST refund.

Similar forms

The Form 1040NR, U.S. Nonresident Alien Income Tax Return, shares similarities with the RC4031 Tax Refund form, as both are designed for non-residents to navigate tax obligations. In the U.S., Form 1040NR allows non-resident aliens to report income made in the U.S. In contrast, the RC4031 is for non-residents of Canada seeking GST/HST refunds on eligible goods and services. Both forms require detailed personal and financial information to process a tax-related claim.

The VAT Refund for Tourists scheme operated by many countries, including countries in the European Union, aligns closely with Canada's tax refund form RC4031. Tourists can reclaim the Value-Added Tax (VAT) paid on purchases made during their visit. Like the RC4031, visitors must keep original receipts and submit a claim to receive a refund. Both systems aim to encourage tourism by offering financial incentives back on purchases made during the visit.

The U.S. Sales Tax Refund, available to international visitors in certain states, serves a similar purpose to the RC4031 form. Tourists can claim a refund for sales tax paid on purchases within the U.S. However, the process and eligibility criteria vary by state. Like Canada’s GST/HST rebate for visitors, this encourages spending by offering rebates on taxes paid, enhancing the tourist experience.

Australia’s Tourist Refund Scheme (TRS) allows visitors and Australian residents to claim a refund of the Goods and Services Tax (GST) and Wine Equalisation Tax (WET) on goods purchased in Australia and taken out of the country. The scheme, akin to Canada's RC4031, requires travelers to present receipts and the goods for inspection. Both initiatives support the recovery of taxes for tourists, promoting shopping among international visitors.

The New Zealand GST Refund Scheme for tourists operates on principles similar to those of the RC4031 form. Visitors to New Zealand can claim a refund of the Goods and Services Tax (GST) for larger purchases that they are taking out of the country. The emphasis on original receipts and proof of export mirrors the requirements of Canada’s visitor tax refund, aiming to make shopping more attractive to tourists by offering a tax rebate.

Japan’s Consumption Tax Refund procedure allows tourists to reclaim the consumption tax on eligible purchases made during their stay. Similar to Canada's RC4031 form, visitors need to keep their receipts and apply for a refund before leaving Japan. Both programs encourage spending by overseas visitors through tax incentives, enhancing the overall attractiveness of the country as a shopping destination.

The UK VAT Refund scheme for non-EU visitors is another parallel to the RC4031 form. Eligible tourists can claim back the Value Added Tax (VAT) on purchases made during their visit when they take the goods out of the country. Though the UK’s scheme has undergone changes post-Brexit, the premise of providing a tax rebate to enhance the shopping experience for tourists remains aligned with Canada’s GST/HST refund for visitors.

Singapore’s Electronic Tourist Refund Scheme (eTRS) simplifies the process for tourists to claim a refund on the Goods and Services Tax (GST) for purchases made during their visit. Like the RC4031 form, the eTRS demands that tourists retain their receipts and submit a claim before leaving. Both seek to streamline tax refund processes for international visitors, leveraging technology to enhance convenience.

South Korea’s Tax Refund for Foreign Tourists scheme provides a pathway for tourists to reclaim the Value Added Tax (VAT) or Goods and Services Tax (GST) paid on purchases during their visit. Comparable to the RC4031 form, the procedure involves retaining receipts and presenting them along with the goods at designated refund points. Both programs are designed to stimulate retail spending by international visitors through tax rebates.

The Malaysia Tourist Refund Scheme (TRS) offers international tourists the opportunity to claim a refund on the Goods and Services Tax (GST) for items purchased and taken out of Malaysia. Similar to the RC4031, tourists need to follow specific guidelines, including presenting original receipts and goods for inspection to qualify for a refund. Both schemes facilitate an enjoyable shopping experience for tourists by offering financial incentives.

Dos and Don'ts

Filling out the RC4031 Tax Refund form correctly is crucial to ensure a smooth and successful claim process for your goods and services tax/harmonized sales tax (GST/HST) refund as a non-resident visitor to Canada. Here are seven essential dos and don'ts to keep in mind:

- Do ensure you meet the eligibility criteria before starting your application. This includes being a non-resident of Canada and having made eligible purchases totaling CAN$200 or more before taxes.

- Do include original receipts with your application. Copies, debit, or credit card slips are not accepted.

- Do complete all sections of the form fully and accurately. Incomplete information can delay processing.

- Do check for the specific requirements regarding proof of export, especially if your eligible goods and short-term accommodation fall under different criteria.

- Do sign and date the form. An unsigned form will not be processed.

- Don't include claims for goods or services that aren't eligible under the RC4031 guidelines. Provincial sales tax (PST, TVQ) is not refundable through this program.

- Don't send in your application without ensuring that each receipt shows a minimum purchase amount of CAN$50 or more, before taxes. This is a requirement for the refund to be processed.

By following these guidelines, you can streamline your application process and avoid common pitfalls that could delay your refund. Remember, the Canada Revenue Agency (CRA) requires your application to be submitted within one year after the taxable purchase or exportation of goods. Ensure your documents are in order, and when in doubt, refer to the detailed information provided in the RC4031 pamphlet or the CRA website.

Misconceptions

When it comes to navigating tax documents, the Application for Visitor Tax Refund, commonly referred to by its form number RC4031, can be particularly tricky due to misunderstandings that often circulate. Let’s tackle some of these misconceptions to help clear the air.

- "I can use the RC4031 form even if I am a Canadian resident." Unfortunately, this is a misconception. The RC4031 form is specifically designed for individuals who are non-residents of Canada. Its purpose is to claim a refund of goods and services tax/harmonized sales tax (GST/HST) on eligible purchases, including short-term accommodations, made while visiting Canada.

- "Photocopies of receipts are fine for submitting with my application." This is not correct. The Canada Revenue Agency (CRA) requires original receipts to be attached to the application. Photocopies, debit, or credit card slips are not accepted as valid proof of purchase.

- "I can claim a refund for any purchases made during my stay." This is another common misunderstanding. To be eligible for a refund, your total purchases of short-term accommodation and goods, before taxes, must amount to CAN$200 or more. Furthermore, each receipt for eligible goods must show a minimum purchase amount, before taxes, of CAN$50.

- "The RC4031 form allows me to claim a refund on provincial sales tax (PST, TVQ)." This is not accurate. The form only applies to the refund of goods and services tax/harmonized sales tax (GST/HST). Any provincial sales tax paid is not eligible for a refund through this application.

- "Once I submit my application, I’ll get my receipts back." Unfortunately, this is not the case. It's important to note that original receipts submitted with your refund application will not be returned. This emphasizes the importance of making and keeping copies for your records before sending the originals to the CRA.

Navigating the refund process with the RC4031 form doesn't have to be complicated. By understanding these key points and clarifying common misconceptions, individuals can more effectively manage their expectations and submissions, ensuring a smoother refund process.

Key takeaways

When filling out the Rc4031 Tax Refund form for visitors to Canada, it's important to understand the eligible criteria and how to accurately complete the form. Here are key takeaways to guide you through the process:

- Eligibility hinges on being a non-resident of Canada and making eligible purchases of short-term accommodation and goods amounting to CAN$200 or more prior to taxes.

- The form cannot be used for claims made at duty-free shops or for business-related refunds.

- Original receipts are mandatory for the application; photocopies, debit, or credit card slips are not accepted.

- Proof of export is required for the goods claimed; consult the RC4031 pamphlet for detailed instructions on this requirement.

- Provincial sales tax (PST, TVQ) is not refundable via this form.

- All sections of the form must be filled out thoroughly to ensure processing.

- The application must be submitted within one year after the tax on the eligible short-term accommodation was due and within one year after exporting the claimed goods.

- Include the earliest arrival and latest departure date if covering multiple visits to Canada, additionally listing all pertinent arrival and departure dates if applicable.

- For eligible travel tour packages, you can claim up to half of the GST/HST paid on the package, with a quick calculation option available for convenience.

- The Canada Revenue Agency (CRA) only provides refunds through cheques, and all applications should be mailed to the Summerside Tax Centre.

It's crucial to review all instructions and conditions detailed in the RC4031, Tax Refund for Visitors to Canada pamphlet to ensure compliance and accuracy when seeking a GST/HST refund for goods and services consumed during your visit. Processing times can take about four to six weeks, so applicants should plan accordingly.

Popular PDF Documents

Non Profit Donation Receipt Example - Ensures a secure donation process with required fields for credit card details and donor signature, adhering to standard financial practices.

Tax Affidavit Form - It's a public record that contributes to the transparency of property transactions within the state.