Get Raffle Tax Return Form

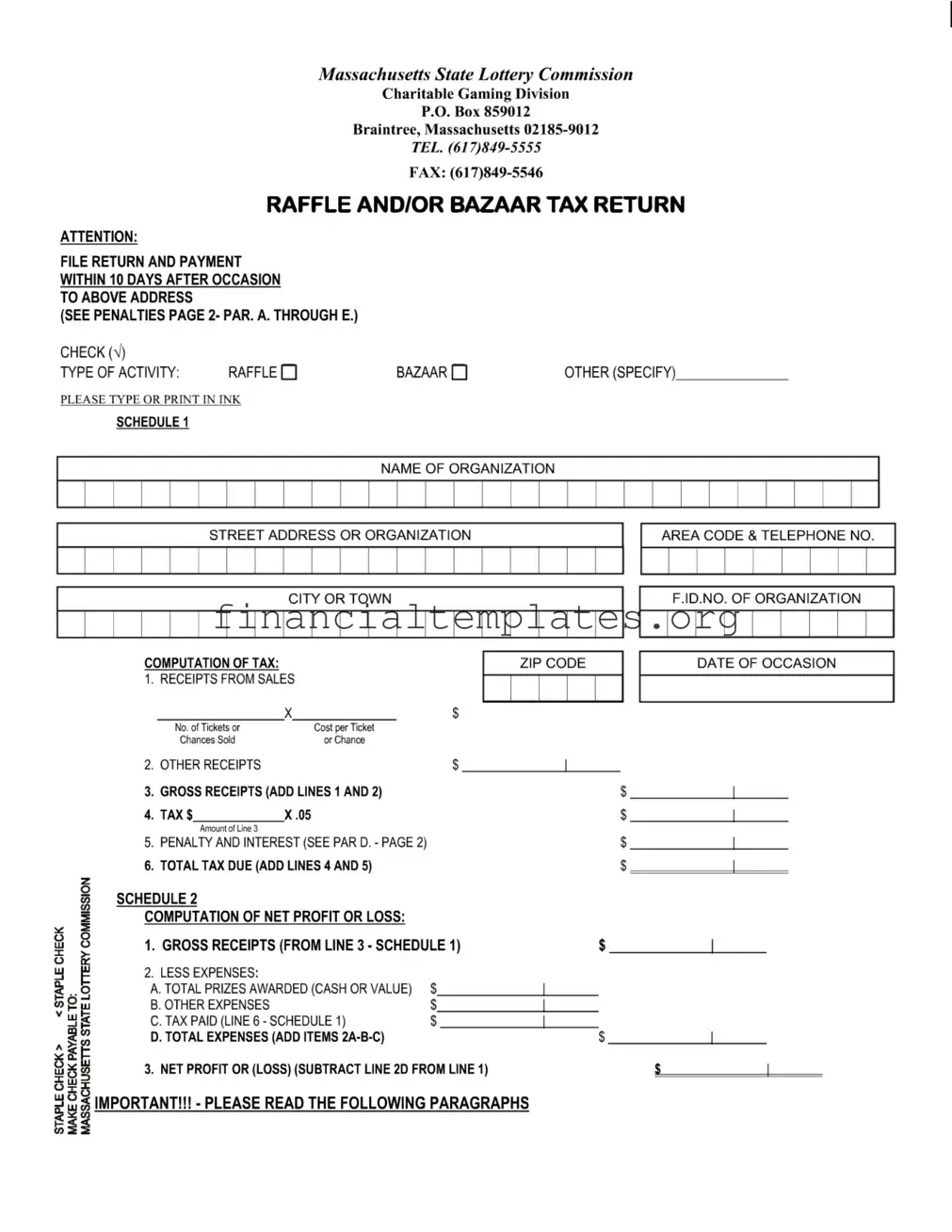

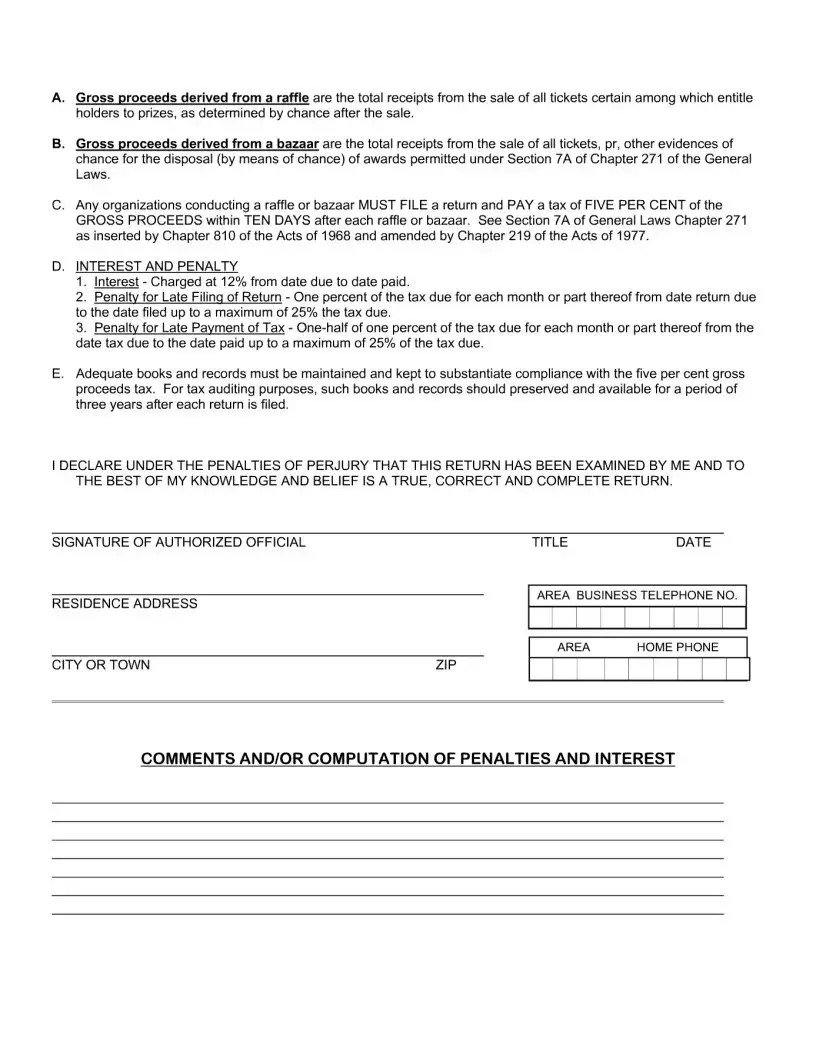

Organizations that run raffles and bazaars in Massachusetts must navigate the complexities of compliance, including the important requirement of submitting a Raffle Tax Return form to the Massachusetts State Lottery Commission's Charitable Gaming Division. This requirement underscores the state’s efforts to ensure that charitable gaming activities are conducted within a regulated framework, emphasizing accountability and fairness. Within 10 days following the event, organizations must file their return and remit payment, incorporating details such as type of activity, tickets sold, gross receipts, and the calculated tax, which is set at five percent of the gross proceeds. Additionally, the form outlines the calculation for net profit or loss, taking into account prizes awarded, other expenses, and the tax paid. The imposition of interest and penalties for late filing or payment underscores the importance of adherence to the stipulated timeline. Furthermore, the maintenance of adequate records for a minimum of three years post-filing serves as a vital component for tax auditing purposes, ensuring organizations can substantiate their compliance with the tax obligations. To certify the accuracy and completeness of the information provided, an authorized official must declare the return under the penalties of perjury, highlighting the seriousness with which the state views these submissions.

Raffle Tax Return Example

Document Specifics

| Fact | Detail |

|---|---|

| Form Purpose | This raffle tax return is used to report and pay taxes due on the gross proceeds from raffles held by any organization, as required by the Massachusetts State Lottery Commission, Charitable Gaming Division. |

| Submission Deadline | Organizations must file the return and make payment within 10 days after the raffle or bazaar event. |

| Tax Rate | A tax of five percent (5%) is applied to the gross proceeds derived from the raffle or bazaar. |

| Governing Law | The requirement for this tax return is established under Section 7A of Chapter 271 of the General Laws of Massachusetts, as amended by Chapter 810 of the Acts of 1968 and further by Chapter 219 of the Acts of 1977. |

Guide to Writing Raffle Tax Return

Filing a Raffle Tax Return form is crucial for organizations conducting a raffle in Massachusetts. This ensures compliance with state tax regulations and helps in maintaining the legality of the fundraising activity. The tax is calculated as five percent of the gross proceeds, and the form, along with the payment, must be submitted within ten days following the event. Below is a simplified guide to assist you in completing this form accurately.

- Prepare all necessary documentation: Gather all records of ticket sales and other receipts related to the raffle or bazaar. This information will be crucial for accurately filling out the form.

- Complete the header information: Begin by providing the name of your organization, its street address, and contact information, including the area code and telephone number.

- Indicate the type of activity: Check the box next to "Raffle" to specify the nature of your event.

- Fill in Schedule 1 details:

- Enter the number of tickets or chances sold and the cost per ticket.

- Report any other receipts related to the event.

- Calculate the gross receipts by adding the total from ticket sales and other receipts.

- Compute the tax by applying five percent to the gross receipts amount.

- Refer to paragraph D on page 2 to determine if any penalty and interest apply, and calculate accordingly.

- Add the tax and any penalty and interest to find the total tax due.

- Complete Schedule 2 for Net Profit or Loss:

- Transfer the gross receipts total from Schedule 1.

- List all expenses, including total prizes awarded, other expenses, and the tax paid.

- Subtract the total expenses from the gross receipts to find the net profit or loss.

- Verification: Read the declarations paragraph carefully, ensuring that all information provided on the form is accurate and true.

- Sign and Date the form: The form must be signed by an authorized official of the organization. Include the signatory’s residence address, city or town, title, and both business and home telephone numbers.

- Address for submission: Attach a check for the total tax due, if applicable, and mail the completed form to the Massachusetts State Lottery Commission, Charitable Gaming Division, at the specified P.O. Box address in Braintree, Massachusetts. Make sure the payment is stapled to the form where indicated.

Remember, filing this form accurately and on time is not just about fulfilling a legal requirement; it also reflects your organization's commitment to transparency and responsible financial management. Keep a copy of the completed form and all related documentation for your records, maintaining them for a period of three years, as these may be required for tax auditing purposes.

Understanding Raffle Tax Return

What is the purpose of the Raffle Tax Return form?

The Raffle Tax Return form is used by organizations to report the gross proceeds from raffles or bazaars and pay the required tax. This form ensures organizations conducting these activities comply with Massachusetts state law, which mandates a tax of five percent on the gross proceeds.

Who needs to file a Raffle Tax Return form?

Any organization that conducts a raffle or bazaar in Massachusetts must file a Raffle Tax Return form. This requirement is in place to ensure transparency and accountability in charitable gaming activities and to contribute to public funds through taxation.

When is the Raffle Tax Return form due?

The form and the payment are due within 10 days following the raffle or bazaar event. Filing and payment beyond this period could lead to penalties and interest charges.

What information is required on the Raffle Tax Return form?

Organizations must provide detailed information on the form, including the type of activity (raffle or bazaar), name and address of the organization, gross receipts from ticket sales, tax amount calculated at five percent of gross receipts, and any penalties and interest if applicable. Additionally, details regarding the prizes awarded, other expenses, and the net profit or loss from the activity must be included.

How is the tax calculated on the Raffle Tax Return form?

The tax is calculated at five percent of the gross receipts, which include the total amount collected from ticket sales and any other receipts related to the raffle or bazaar. Organizations need to report these amounts accurately to calculate the tax due properly.

What penalties apply for late filing or payment?

Late filing incurs a penalty of one percent of the tax due for each month or part of a month from the due date until the return is filed, up to a maximum of 25%. Similarly, late payment of tax results in a penalty of one-half of one percent of the tax due for each month or part thereof from the due date until payment is made, also capped at 25%.

How important is it to keep records related to the Raffle Tax Return?

Keeping detailed and accurate records is critical. Records substantiate the amounts reported on the tax return and must be maintained for three years after filing. These records are crucial for tax auditing purposes to verify compliance with the tax requirements.

What happens if the information provided on the Raffle Tax Return form is incorrect or incomplete?

Submitting a return with incorrect or incomplete information could lead to additional tax assessments, penalties, and interest. The authorized official signs the form under the penalties of perjury, affirming that the information is true, correct, and complete to the best of their knowledge. Therefore, ensuring the accuracy and completeness of the information provided is of utmost importance.

Common mistakes

When completing the Raffle Tax Return form, individuals and organizations often encounter several common errors. Addressing these mistakes ensures timely processing and compliance with the Massachusetts State Lottery Commission Charitable Gaming Division's requirements.

- Failing to attach the check securely. The check should be stapled securely to the form as indicated by the "STAPLE CHECK" instruction, to prevent loss or misplacement.

- Omitting details about the type of activity. It is crucial to check the appropriate activity type box (Raffle, Bazaar, or other) for accurate processing.

- Inaccurate information. Ensuring that the organization's name, street address, and telephone numbers are correctly entered and legible prevents processing delays.

- Incorrect calculation of gross receipts. Gross receipts must include the total from ticket sales and other sources accurately, as outlined in Schedule 1, lines 1 and 2.

- Errors in the tax calculation. The tax is 5% of the gross receipts. Mistakes in its computation affect the total tax due reflected on line 6, Schedule 1.

- Not listing the expenses accurately. Schedule 2 requires careful documentation of prizes awarded, other expenses, and tax paid to accurately reflect the net profit or loss.

- Overlooking the penalty and interest. If applicable, penalty and interest due to late filing or payment must be documented as per the instructions on the form and the related penalties section.

- Failing to sign the form. The return is not valid unless signed by an authorized official, declaring the information as true and accurate under the penalties of perjury.

- Neglecting the declaration's completeness and correctness. It is the responsibility of the filing individual to ensure the form is thoroughly reviewed and all information provided is correct to the best of their knowledge.

By addressing these common mistakes, organizations can help ensure their Raffle Tax Return forms are processed efficiently and comply with all requirements set forth by the Massachusetts State Lottery Commission Charitable Gaming Division. Keeping adequate records, as mentioned, aids in this process and prepares organizations for potential auditing.

Documents used along the form

Organizations involved in conducting raffles or bazaars must navigate through various documentation requirements, one of which includes filing a Raffle Tax Return form. This form is crucial for reporting gross proceeds and ensuring compliance with tax obligations. Alongside the Raffle Tax Return, there are several other forms and documents that are commonly used to ensure a comprehensive approach to compliance and record-keeping. Understanding these additional requirements can help organizations maintain transparency and adhere to legal standards.

- Application for Registration: Before hosting a raffle or bazaar, organizations may need to submit an application to register with the appropriate state or local authorities. This document usually requires details about the organization, the type of event, and the intended use of proceeds, ensuring that the event is legally recognized and permitted.

- Prize Winner Information Form: This form records the details of prize winners, such as names, contact information, and the value of prizes awarded. It helps in maintaining a transparent record of the distribution of prizes and assists in reporting to tax authorities if necessary.

- Financial Statement of the Event: Following the conclusion of the raffle or bazaar, organizations are often required to prepare a detailed financial statement. This document outlines the total income generated, expenses incurred, and net profit or loss. It serves as a comprehensive record for tax purposes and organizational audit trails.

- Annual Summary Report: Some jurisdictions may require an annual summary report aggregating the outcomes of all charitable gaming activities throughout the year. This report typically includes information on the number of events held, total gross receipts, expenses, and net proceeds, providing oversight authorities with an overview of the organization’s charitable gaming activities.

Together with the Raffle Tax Return form, these documents form a critical framework for organizations to follow, ensuring compliance with legal obligations and promoting transparent and responsible conduct of raffle and bazaar events. Proper documentation and adherence to regulatory requirements are essential for the legitimacy and success of such charitable endeavors.

Similar forms

The Raffle Tax Return form shares similarities with the Sales Tax Return commonly utilized by businesses to report sales revenue and taxes collected on behalf of the state. Both require accurate disclosure of gross receipts and applicable taxes due. The Sales Tax Return also mandates the reporting of total sales, taxable sales, and the tax rate applied, paralleling the Raffle Tax Return’s requirement to detail gross receipts from ticket sales and the imposition of a tax rate on those gross proceeds.

Comparable to the Federal Income Tax Return, the Raffle Tax Return necessitates a detailed accounting of revenue (in this case, from raffle ticket sales) and allowable deductions (such as prizes awarded and other expenses). Both forms calculate a taxable income base to determine the tax owed or refund due, and they underscore the legal requirement to report and remit taxes to government authorities accurately and timely.

The Non-Profit Organization Annual Return, specifically those pertaining to tax-exempt entities, bears resemblance to the Raffle Tax Return in that both require disclosure of gross receipts and expenses related to specific fundraising activities. They both serve to ensure compliance with tax regulations regarding the generation and use of funds derived from public support, although tax-exempt organizations' returns focus more on proving adherence to conditions for maintaining tax-exempt status.

The Raffle Tax Return and the Gambling Winnings Tax Return share similarities as both involve the declaration of income derived from games of chance. However, while the Raffle Tax Return is focused on the organization's earnings and paid taxes from hosting a raffle, the Gambling Winnings Tax Return concerns individual taxpayers reporting their winnings to the IRS. Both highlight the need for accurate reporting of earnings from gambling or similar activities to the relevant tax authorities.

Similar to the Employer's Quarterly Federal Tax Return, the Raffle Tax Return requires periodic filing and details payments applicable within a specific timeframe. Both forms are structured to ensure the entity's compliance with its tax obligations, calculating taxes owed or contributions made over the quarter or, in the case of the Raffle Tax Return, after each raffle event. This parallels the process of reporting employment taxes on wages paid to employees.

The Excise Tax Return, which businesses use to report and pay taxes on specific goods, services, and activities, also parallels the Raffle Tax Return. Both involve declaring gross receipts and calculating a tax based on those receipts. While excise taxes often apply to specific items like gasoline, alcohol, or tobacco, the Raffle Tax Return focuses on the gross proceeds from charitable gaming activities.

The Estate Tax Return, like the Raffle Tax Return, includes a computation of net profit or loss after deducting allowable expenses. For the Estate Tax Return, this involves reporting the value of an estate’s gross assets and subtracting liabilities to calculate the taxable estate. Although the contexts are quite different—one pertains to gambling proceeds and the other to estate assets—the underlying principle of determining a tax base after allowable deductions is consistent across both.

The Property Tax Return, which property owners file to report the value of real estate for tax purposes, shares the concept of tax compliance and reporting with the Raffle Tax Return. Each form requires the declaration of particular values that are subject to taxation—property value in one and gross proceeds from raffles in the other. Both seek to ensure accurate taxation based on declared values.

Lastly, the Corporate Income Tax Return and the Raffle Tax Return share the commonality of reporting an entity's income and calculating taxes owed to government authorities. Both require detailing gross receipts and deducting allowable expenses to arrive at a taxable income. While the entities and nature of income might differ, the fundamental requirement to report and appropriately tax income is a shared feature.

The Gift Tax Return, requiring the reporting of transfers of wealth as gifts, juxtaposes with the Raffle Tax Return through their mutual need to report transactions subject to taxation. Though the Raffle Tax Return deals with the outcomes of charitable gaming and the Gift Tax Return focuses on the taxation of gifts exceeding annual exclusions, they both encapsulate the broader theme of tax responsibility and compliance.

Dos and Don'ts

When you're preparing to fill out your Raffle Tax Return form, it's important to pay close attention to detail and follow regulations closely. Here's a helpful list of dos and don'ts that can guide you through the process:

- Do ensure that all information is typed or written in ink to maintain the clarity and legibility of your entries.

- Do staple your check to the form in the designated area, as this helps prevent payment from getting lost or separated from your return.

- Do verify the type of activity box is correctly marked, indicating whether it's a raffle, bazaar, or another type of event.

- Do thoroughly review the instructions on both the form and accompanying pages to accurately calculate taxes, penalties, and interest, if applicable.

- Do include gross receipts from the sale of all tickets when calculating your tax due, ensuring nothing is mistakenly omitted.

- Do maintain and keep adequate books and records to substantiate compliance, as these must be available for auditing purposes for three years.

- Don't delay filing your return and making payment; both must be done within 10 days after the raffle or bazaar to avoid penalties.

- Don't overlook the calculation of net profit or loss in Schedule 2, as this provides a clear picture of the event's financial outcome.

- Don't forget to sign and date the return, declaring under penalties of perjury that the information is accurate to the best of your knowledge.

- Don't ignore penalties and interest requirements. If your filing or payment is late, accurately calculate any additional amounts owed to avoid further issues.

Adhering to these guidelines will help ensure your Raffle Tax Return form is filled out accurately and submitted on time, helping to keep your event compliant with Massachusetts regulations.

Misconceptions

When navigating the complexities of filing a Raffle Tax Return, organizations often stumble over common misconceptions. Clarifying these misunderstandings can streamline the process, ensuring compliance with regulations and avoiding unnecessary penalties.

All organizations are exempt from raffle taxes. It's a common myth that nonprofit and charitable organizations don't need to pay taxes on raffle proceeds. In reality, the law requires that a tax of five percent of the gross proceeds be paid by any organization conducting a raffle or bazaar, regardless of its tax-exempt status.

The due date is flexible. The belief that the filing deadline can be extended upon request is incorrect. Organizations must file the return and make payment within ten days after the event. Late submissions are subject to penalties and interest charges.

Gross receipts only include ticket sales. This is a misunderstanding. Gross receipts encompass both ticket sales and other receipts related to the raffle, significantly affecting the tax calculation.

Prize costs are deductible from gross proceeds. While expenses and prize costs are reported, they do not reduce the amount of gross proceeds subject to the five percent tax. Taxes are calculated based on total receipts before expenses.

Filing is only necessary for large raffles. There's a misconception that small-scale raffles or bazaars are not subject to the filing requirement. However, any organization conducting a raffle or bazaar, regardless of size, must file a return and pay the applicable tax.

Penalties are negligible. Some organizations might underestimate the consequences of late filing or payment, not realizing penalties can accumulate up to 25% of the tax due. This can represent a significant financial burden.

Interest is waived for first-time filers. First-time filing does not exempt an organization from interest charges on overdue payments. Interest is charged at 12% from the due date to the payment date, with no exceptions for newcomers.

Recordkeeping is optional. A serious misunderstanding is that keeping records of the raffle or bazaar is at the organization's discretion. Adequate records must be maintained for three years to substantiate compliance with the tax requirement, crucial for audit purposes.

Dispel these misconceptions to ensure a smooth Raffle Tax Return filing process. Proper understanding and adherence to the rules can save organizations from unnecessary financial strain and legal complications.

Key takeaways

Filling out and using the Raffle Tax Return form is an essential task for organizations conducting raffles in Massachusetts. This form ensures compliance with state tax obligations. Here are six key takeaways for organizations to consider:

- The form must be filed with the Massachusetts State Lottery Commission Charitable Gaming Division within 10 days following the conclusion of the raffle event. Failure to meet this deadline can result in penalties.

- Organizations are required to pay a tax equal to five percent of the gross proceeds derived from the raffle. The definition of gross proceeds includes the total receipts from the sale of all tickets or chances sold.

- Interest and penalties are applied to late filings and payments. Interest is charged at a rate of 12% from the due date to the payment date, and penalties for late filing or payment can reach up to 25% of the tax due.

- It is crucial for organizations to maintain adequate books and records to substantiate their compliance with the five percent gross proceeds tax. These records should be kept for a period of three years after each return is filed, facilitating potential tax audits.

- The tax return form requires detailed information, including the number of tickets sold, the cost per ticket, gross receipts, and the computation of net profit or loss after expenses. Organizations should prepare this information in advance to ensure accurate reporting.

- The form must be signed by an authorized official of the organization, declaring under penalty of perjury that the return is true, correct, and complete. This emphasizes the importance of careful and accurate completion of the form.

Understanding and adhering to these guidelines will help organizations fulfill their tax obligations promptly and correctly, avoiding unnecessary penalties and ensuring that their raffle activities comply with Massachusetts laws.

Popular PDF Documents

Form 8949 Exception Reporting Statement - The IRS 8919 is a pathway for workers to assert their rights and correct misunderstandings or abuses regarding their employment status.

Zanesville City Tax - Addressing whether a business withholds taxes for employees residing in Zanesville ensures fairness in tax collection.