Get Qualified Dividends Tax Worksheet Form

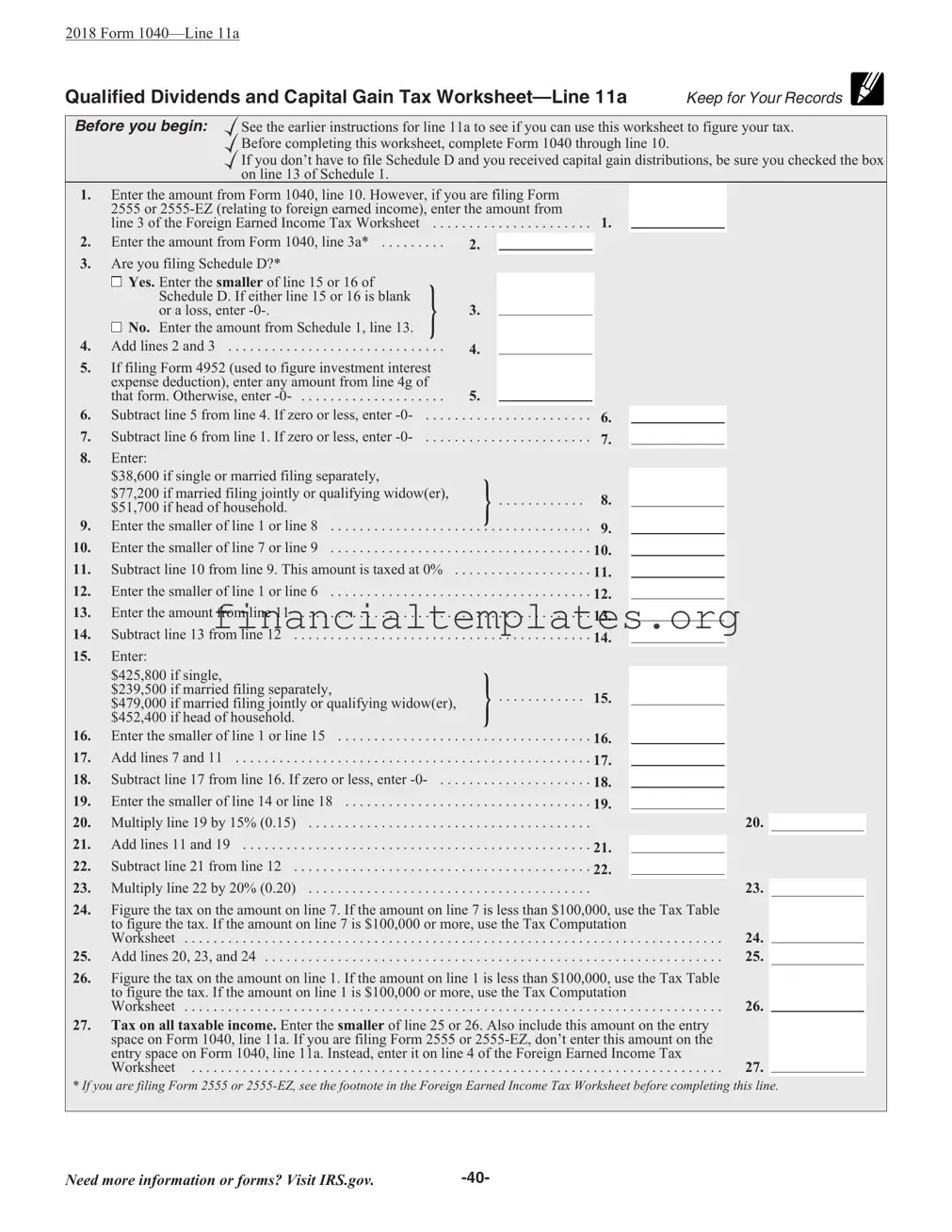

Understanding the nuances of tax forms is essential for ensuring that individuals pay the correct amount of taxes and utilize available benefits to reduce their tax liability. The Qualified Dividends and Capital Gain Tax Worksheet, found in the 2018 Form 1040—Line 11a instructions, serves as an important tool for taxpayers who receive qualified dividends or capital gains distributions. This worksheet aids in determining the tax on this type of income, potentially at lower rates than ordinary income. To use this worksheet effectively, taxpayers must first complete Form 1040 up to line 10 and examine if Schedule D applies to their situation. This is crucial for those not required to file Schedule D but who have received capital gain distributions, as ensuring the correct box on Line 13 of Schedule 1 is checked is a fundamental step. Requirements such as entering amounts from Form 1040, making adjustments based on foreign earned income (if applicable), and navigating through specific lines that involve calculations related to investment interest expense, standard deductions, and applicable tax brackets underscore the worksheet’s complexity. Additionally, understanding how to integrate the results with the Tax Table or Tax Computation Worksheet to figure out the ultimate tax liability demonstrates the interconnectivity of various tax forms and instructions. This worksheet not only facilitates a more accurate tax calculation but also exemplifies the critical nature of following detailed instructions and the potential financial impacts of qualified dividends and capital gains in the broader context of individual tax responsibilities.

Qualified Dividends Tax Worksheet Example

2018 Form

Qualified Dividends and Capital Gain Tax |

Keep for Your Records |

|

Before you begin: |

See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. |

|

|

Before completing this worksheet, complete Form 1040 through line 10. |

|

|

If you don’t have to file Schedule D and you received capital gain distributions, be sure you checked the box |

|

|

on line 13 of Schedule 1. |

|

1.Enter the amount from Form 1040, line 10. However, if you are filing Form 2555 or

line 3 of the Foreign Earned Income Tax Worksheet |

. .1 |

|||||

. . . . . . . . .Enter the amount from Form 1040, line 3a* |

2. |

|

|

|

|

|

|

|

|

|

|

|

|

Are you filing Schedule D?*

Yes. Enter the smaller of line 15 or 16 of Schedule D. If either line 15 or 16 is blank or a loss, enter

No. Enter the amount from Schedule 1, line 13. Add lines 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

No. Enter the amount from Schedule 1, line 13. Add lines 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4.

|

If filing Form 4952 (used to figure investment interest |

|

|

|

|

|

|

|

|

|

|

|

|

expense deduction), enter any amount from line 4g of |

5. |

|

|

|

|

|

|

|

|

|

|

6. |

that form. Otherwise, enter |

|

|

|

|

|

|

|

|

|

|

|

Subtract line 5 from line 4. If zero or less, enter |

. .6. |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||||

7. |

.Subtract line 6 from line 1. If zero or less, enter |

. . . . . . . . . . . . . . .. .7. |

|

|

|

|

|

|

||||

8. |

Enter: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

$38,600 if single or married filing separately, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$77,200 if married filing jointly or qualifying widow(er), |

8. |

|

|

|

|

|

|

||||

|

$51,700 if head of household. |

|

|

|

|

|

|

|||||

9. |

Enter the smaller of line 1 or line 8 |

. . . . . . . . . . . . . . . . . 9. |

|

|

|

|

|

|

||||

10. |

.Enter the smaller of line 7 or line 9 |

. . . . . . . . . . . . . . . . . 10. |

|

|

|

|

|

|

||||

11. |

.Subtract line 10 from line 9. This amount is taxed at 0% . |

. . . . . . . . . . . . . . . . . 11. |

|

|

|

|

|

|

||||

12. |

.Enter the smaller of line 1 or line 6 |

. . . . . . . . . . . . . . . . . 12. |

|

|

|

|

|

|

||||

13. |

.Enter the amount from line 11 |

. . . . . . . . . . . . . . .. .13. |

|

|

|

|

|

|

||||

14. |

Subtract line 13 from line 12 |

. .14. |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|||||||

15. |

Enter: |

|

|

|

|

|

|

|

|

|

|

|

|

$425,800 if single, |

|

|

|

|

|

|

|

|

|

|

|

|

$239,500 if married filing separately, |

|

|

. . . . . . . . . . . . |

15. |

|

|

|

|

|

|

|

|

$479,000 if married filing jointly or qualifying widow(er), |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||

16. |

$452,400 if head of household. |

|

|

|

|

|

|

|

|

|

|

|

Enter the smaller of line 1 or line 15 |

. . . . . . . . . . . . . . . . . 16. |

|

|

|

|

|

|

|||||

17. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Add lines 7 and 11 |

. . . . . . . . . . . . . . . . . 17. |

|

|

|

|

|

|

||||

18. |

.Subtract line 17 from line 16. If zero or less, enter |

. . . . . . . . . . . . . . . . . 18. |

|

|

|

|

|

|

||||

19. |

.Enter the smaller of line 14 or line 18 |

. . . . . . . . . . . . . . .. .19. |

|

|

|

|

|

|

||||

20. |

Multiply line 19 by 15% (0.15) |

|

|

|

|

20. |

|

|

|

|

||

|

|

|

|

|||||||||

21. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Add lines 11 and 19 |

. . . . . . . . . . . . . . . . . 21. |

|

|

|

|

|

|

||||

22. |

.Subtract line 21 from line 12 |

. . . . . . . . . . . . . . .. .22. |

|

|

|

|

|

|

||||

23. |

Multiply line 22 by 20% (0.20) |

|

|

|

|

23. |

|

|

|

|

||

|

|

|

|

|

||||||||

24. |

Figure the tax on the amount on line 7. If the amount on line 7 is less than $100,000, use the Tax Table |

|

|

|

|

|

||||||

|

to figure the tax. If the amount on line 7 is $100,000 or more, use the Tax Computation |

|

|

|

|

|||||||

|

Worksheet |

. .24 |

|

|||||||||

25. |

Add lines 20, 23, and 24 |

25. |

|

|

|

|

||||||

|

|

|

||||||||||

26. |

Figure the tax on the amount on line 1. If the amount on line 1 is less than $100,000, use the Tax Table |

|||||||||||

|

to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation |

|||||||||||

|

Worksheet |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26. |

|

|

|

|||||||

27.Tax on all taxable income. Enter the smaller of line 25 or 26. Also include this amount on the entry space on Form 1040, line 11a. If you are filing Form 2555 or

Worksheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27.

* If you are filing Form 2555 or

Need more information or forms? Visit IRS.gov. |

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of the Worksheet | This worksheet is designed to help individuals calculate the tax on qualified dividends and capital gains as required on Line 11a of the 2018 Form 1040. |

| Who Should Use It | It is intended for taxpayers who do not have to file Schedule D and have received capital gain distributions, ensuring they checked the box on line 13 of Schedule 1. |

| Prerequisites | Before completing this worksheet, taxpayers must complete Form 1040 through line 10. If filing Form 2555 or 2555-EZ related to foreign earned income, special instructions apply. |

| Special Considerations | The worksheet includes specific income thresholds and different treatment for taxpayers based on filing status, such as single, married filing jointly, or head of household, impacting the calculation of taxes on qualified dividends and capital gains. |

Guide to Writing Qualified Dividends Tax Worksheet

Filling out the Qualified Dividends and Capital Gain Tax Worksheet is a necessary step for taxpayers who receive qualified dividends or have capital gains that may be taxed at lower rates than their regular tax rates. This worksheet helps calculate the tax on income from these sources in a way that potentially lowers your overall tax liability. To accurately complete this worksheet, you must first complete Form 1040 through line 10. The following steps guide you through filling out the Qualified Dividends and Capital Gain Tax Worksheet correctly.

- Enter the amount from Form 1040, line 10. If you are filing Form 2555 or 2555-EZ related to foreign earned income, instead enter the amount from line 3 of the Foreign Earned Income Tax Worksheet.

- Enter the amount from Form 1040, line 3a.

- If you are filing Schedule D, enter the smaller of line 15 or 16 from Schedule D. If either line 15 or 16 is blank or shows a loss, enter "-0-". If not filing Schedule D, enter the amount from Schedule 1, line 13.

- Add lines 2 and 3.

- If you are filing Form 4952, enter the amount from line 4g of that form. Otherwise, enter "-0-".

- Subtract line 5 from line 4. If the result is zero or less, enter "-0-".

- Subtract line 6 from line 1. Again, if this results in zero or less, enter "-0-".

- For line 8, enter $38,600 if single or married filing separately, $77,200 if married filing jointly or qualifying widow(er), or $51,700 if head of household.

- Enter the smaller of line 1 or line 8.

- Enter the smaller of line 7 or line 9.

- Subtract line 10 from line 9. This amount is taxed at 0%.

- Enter the smaller of line 1 or line 6.

- Enter the amount from line 11.

- Subtract line 13 from line 12.

- According to filing status, enter $425,800 if single, $239,500 if married filing separately, $479,000 if married filing jointly or qualifying widow(er), $452,400 if head of household.

- Enter the smaller of line 1 or line 15.

- Add lines 7 and 11.

- Subtract line 17 from line 16. If zero or less, write "-0-".

- Enter the smaller of line 14 or line 18.

- Multiply line 19 by 15% (0.15).

- Add lines 11 and 19.

- Subtract line 21 from line 12.

- Multiply line 22 by 20% (0.20).

- Figure the tax on the amount on line 7 using the Tax Table or Tax Computation Worksheet as applicable.

- Add lines 20, 23, and 24.

- Figure the tax on the amount on line 1 using the Tax Table or Tax Computation Worksheet as needed.

- Enter the smaller of line 25 or 26. Include this amount on Form 1040, line 11a. If filing Form 2555 or 2555-EZ, enter it on line 4 of the Foreign Earned Income Tax Worksheet instead.

Upon completing these steps, you will have accurately calculated the tax on your qualified dividends and capital gains. Make sure to review each step carefully and confirm the correctness of your entries to ensure the accuracy of your tax calculations.

Understanding Qualified Dividends Tax Worksheet

Who needs to use the Qualified Dividends and Capital Gain Tax Worksheet?

Individuals who received qualified dividends or capital gain distributions in the tax year and are not required to file Schedule D for their capital gains and losses need to use this worksheet. This is particularly relevant for those completing Form 1040 and have such income types.

What is the purpose of this worksheet?

The primary goal is to help taxpayers accurately calculate the tax on their income that includes qualified dividends and/or capital gains at the preferential tax rates these income types are eligible for, rather than the standard income tax rates.

Is this worksheet required if I am filing Schedule D?

Yes, if you are filing Schedule D and have qualified dividends, you may still need to use this worksheet. It assists in determining the smaller of the amounts on line 15 or 16 of Schedule D or calculating the tax due considering the preferential rates for qualified dividends and capital gain distributions.

What if I have foreign earned income?

If you are reporting foreign earned income using Form 2555 or 2555-EZ, you should refer to the Foreign Earned Income Tax Worksheet for instructions before completing certain lines of this worksheet regarding your income amounts.

How do I begin the worksheet?

You should first complete Form 1040 through line 10 before starting this worksheet. Ensure all relevant income, adjustments, and deductions are accurately reported up to that point.

What are the income thresholds mentioned in the worksheet?

The worksheet outlines specific income thresholds that help determine the tax rate applicable to your qualified dividends and capital gains. These thresholds vary based on your filing status, such as single, married filing jointly, married filing separately, or head of household.

How do I calculate the tax on my qualified dividends and capital gains?

Follow the step-by-step instructions on the worksheet. You will need to enter amounts from your Form 1040 and potentially Schedule 1 or Schedule D, perform several calculations to adjust your taxable income, and apply the correct tax rates based on your income levels to determine the tax due on your qualified dividends and capital gains.

What do I do with the final amount calculated on the worksheet?

The final figure calculated, which represents the tax on your total taxable income including qualified dividends and capital gains, should be reported on your Form 1040, Line 11a. If filing Form 2555 or 2555-EZ, follow the specific instructions for reporting this tax amount.

Where can I find more information or assistance?

For further details or clarification on how to use the Qualified Dividends and Capital Gain Tax Worksheet or other tax forms, visiting the IRS website at IRS.gov is recommended. It offers a comprehensive range of resources and tools to assist taxpayers.

Common mistakes

When filling out the Qualified Dividends and Capital Gain Tax Worksheet, people often encounter a few common errors. Understanding these mistakes can help ensure the process is done accurately, leading to correct tax calculations.

Incorrect Entry from Form 1040: The initial step requires entering the amount from Form 1040, line 10. However, for those filing Form 2555 or 2555-EZ related to foreign earned income, it's crucial to use the amount from line 3 of the Foreign Earned Income Tax Worksheet instead. This step is frequently overlooked, resulting in an incorrect starting point for the calculations.

Not Checking the Schedule D Box: If you don’t have to file Schedule D but received capital gain distributions, it's essential to check the box on line 13 of Schedule 1. This step is often missed and can lead to inaccuracies in how income is reported and taxed.

Overlooking Form 4952 for Investment Interest Expense: For those who need to figure their investment interest expense deduction using Form 4952, failing to enter any amount from line 4g of that form into the worksheet is a common mistake. This omission can affect the subtraction in subsequent steps.

Misunderstanding Taxable Income Parameters: When entering the taxable income amounts, especially on lines 8 (about filing status and income thresholds) and 15 (regarding higher income thresholds), there's often confusion. These figures guide which portions of income are taxed at specific rates. Incorrect entries here can lead to miscalculation of taxes owed.

Failing to Properly Calculate the 0% Rate: Line 11, which helps determine the amount taxed at 0%, is another area prone to errors. Subtracting line 10 from line 9 correctly is vital for ensuring that this advantageous rate is accurately applied to qualifying dividends and capital gains.

Each step in the worksheet plays a crucial role in determining your tax liability related to qualified dividends and capital gains. Careful attention to detail and a thorough review of each line can help avoid these common mistakes.

Documents used along the form

The process of preparing taxes can be complex, especially when dealing with investments and dividends. The Qualified Dividends Tax Worksheet is a crucial tool for many taxpayers, particularly those with income from investments that qualify for more favorable tax treatment. This worksheet is not used in isolation. Alongside it, there are several forms and documents that taxpayers frequently need in order to accurately calculate their taxes and report their income.

- Form 1040: The U.S. Individual Income Tax Return is the starting point for personal tax filing. It collects information about the taxpayer's income, deductions, and credits to determine their tax liability or refund.

- Schedule D (Form 1040): Used to report capital gains and losses from the sale of assets. This schedule is essential for individuals who have profits or losses from investments that must be factored into their tax calculations.

- Schedule 1 (Form 1040): Additional Income and Adjustments to Income. This form encompasses additional income streams not entered directly on Form 1040, such as capital gains distributions not reported on Schedule D, making it pertinent for diversified income sources.

- Form 4952: Used for calculating the investment interest expense deduction. For taxpayers with significant investments, this form helps determine how much of their investment interest is deductible, which can reduce taxable income.

- Form 2555 or 2555-EZ: Pertains to Foreign Earned Income. For taxpayers living abroad or receiving income from foreign sources, these forms allow the exclusion of a portion of their foreign earnings from U.S. taxes, influencing the calculation on the Qualified Dividends Tax Worksheet.

Together, these forms and documents encompass a wide range of financial situations, from domestic to international, and from salary-based income to complex investment portfolios. The Qualified Dividends Tax Worksheet operates within this ecosystem, helping ensure that taxpayers receive the correct tax treatment for their qualified dividends within the broader context of their entire tax situation. Understanding and utilizing the relevant forms correctly can lead to significant tax savings and ensure compliance with tax laws.

Similar forms

The Form 1040—Line 11a is closely related to the Schedule D (Form 1040), Capital Gains and Losses document. Both are integral for taxpayers who need to report capital gains or losses from investments or the sale of property. While the Qualified Dividends and Capital Gain Tax Worksheet directly calculates the tax on qualified dividends and capital gains at preferential rates, Schedule D categorizes these transactions and determines the overall gain or loss to be reported on Form 1040. The interaction between these forms ensures accurate tax calculation on investment income.

Similarly, the Schedule 1 (Form 1040), Additional Income and Adjustments to Income, shares a connection with the Qualified Dividends and Capital Gain Tax Worksheet. Schedule 1 is used to report income or adjustments not listed on the main Form 1040, such as capital gain distributions that don't require filing Schedule D. It provides a summary of additional income streams that directly affect the computation on the Qualified Dividends and Capital Gain Tax Worksheet, specifically in determining the correct taxable income amount.

The Foreign Earned Income Tax Worksheet is designed for taxpayers who claim the foreign earned income exclusion or the foreign housing deduction (Form 2555 or 2555-EZ). This worksheet adjusts the taxpayer's income to account for these exclusions before calculating tax using the Qualified Dividends and Capital Gain Tax Worksheet. It highlights the necessity of adjusting gross income to accurately reflect taxable income from domestic sources, ensuring that the preferential tax rates are applied correctly.

Form 4952, Investment Interest Expense Deduction, also interacts with the Qualified Dividends and Capital Gain Tax Worksheet. If taxpayers have investment interest expenses, Form 4952 is used to calculate the deductible amount. This deductible amount can adjust the income on the Qualified Dividends and Capital Gain Tax Worksheet, directly affecting the tax calculations related to investment income, and ensuring that taxpayers benefit from all applicable deductions.

The Tax Table and the Tax Computation Worksheet provide the mechanisms for calculating the tax due on taxable income. Depending on the taxpayer's taxable income level, either the Tax Table or the Tax Computation Worksheet is used to determine the final tax liability on ordinary income. In contrast, the Qualified Dividends and Capital Gain Tax Worksheet specifically deals with calculating tax on qualified dividends and capital gains at the lower tax rates, integrating the outcomes from the Tax Table or Tax Computation Worksheet for comprehensive tax computation.

Form 2555 or 2555-EZ, Foreign Earned Income, directly impacts the figures used in the Qualified Dividends and Capital Gain Tax Worksheet. These forms allow for the exclusion of foreign earned income from taxable income, necessitating adjustments to the income figures used in the Qualified Dividends and Capital Gain Tax Worksheet. This ensures that only appropriately taxed income is considered, highlighting the interplay between foreign income treatment and domestic tax calculations.

The Alternative Minimum Tax (AMT) Worksheet is another document that shares objectives with the Qualified Dividends and Capital Gain Tax Worksheet. While the AMT Worksheet is used to ensure that taxpayers pay at least a minimum amount of tax, it requires input from capital gains and dividends as well. This connection underscores the comprehensive approach to tax calculation, ensuring that preferential tax treatments do not overly reduce tax liabilities under the AMT rules.

The Child Tax Credit Worksheet is important for taxpayers claiming the child tax credit. Though primarily focused on determining the allowable credit based on dependents, this worksheet indirectly relates to the Qualified Dividends and Capital Gain Tax Worksheet through its influence on the overall tax liability. It exemplifies how various credits and deductions work together with income calculations to determine the final tax due.

Lastly, the Earned Income Credit (EIC) Worksheet is utilized to calculate the earned income tax credit, which is designed for low- to moderate-income working individuals and families. While focusing on earned income, the calculation of adjusted gross income in this worksheet considers the tax implications of capital gains and dividends reported through the Qualified Dividends and Capital Gain Tax Worksheet. This interconnection ensures that tax benefits are accurately applied across different income sources, reflecting the holistic approach to individual tax assessment.

Dos and Don'ts

When it comes to filing your taxes, the Qualified Dividends Tax Worksheet can be an important tool to ensure you're taxed accurately for any qualified dividends or capital gains. Here are some do's and don'ts that can help guide you through the process effectively.

Do:

- Ensure you're eligible to use the worksheet by reading the instructions for Form 1040, line 11a carefully.

- Complete Form 1040 through line 10 before you start the worksheet to have all necessary information ready.

- Check the box on line 13 of Schedule 1 if you received capital gain distributions and are not filing Schedule D.

- Accurately enter the amount from Form 1040, line 10, or the foreign earned income amount if filing Form 2555 or 2555-EZ.

- Consult the instructions for Schedule D if filing, to determine the correct amounts to enter from lines 15 or 16 of that form.

- Include any investment interest expense deductions by referring to Form 4952, line 4g if applicable.

- Use the correct figures for your filing status as provided in the worksheet for lines 8 and 15 to calculate your tax correctly.

Don't:

- Attempt to use the worksheet without first completing the necessary prerequisites on Form 1040 and other related forms.

- Guess or estimate figures. Ensure all numbers entered on the worksheet are accurate and supported by documentation.

- Overlook the specific instructions for filers of Form 2555 or 2555-EZ, as this can significantly impact the accuracy of your tax calculations.

By carefully following these guidelines, you can navigate the complexities of the Qualified Dividends Tax Worksheet more smoothly, ensuring your tax calculations are both accurate and beneficial to your financial situation. Always remember, if you're unsure about any part of the process, consulting a tax professional or the IRS for guidance is a wise decision.

Misconceptions

Understanding taxes can be complex, and when it comes to filing taxes, there are many forms and worksheets that can lead to confusion. One such document is the Qualified Dividends and Capital Gain Tax Worksheet, which often is surrounded by misconceptions. Let’s clarify some of these misunderstandings:

It’s only for people with significant investments. Many think this worksheet is only for those with large portfolios. In truth, anyone who receives qualified dividends or capital gains should review this form to see if it might offer tax advantages.

You need to itemize deductions to use it. This worksheet does not require itemizing deductions. It's designed to calculate tax liabilities on capital gains and qualified dividends, unrelated to the standard or itemized deductions.

It’s too complicated for the average taxpayer. While it may look daunting, the instructions provided by the IRS guide taxpayers through the process. It’s a step-by-step calculation that most taxpayers can follow with patience.

You must have a financial advisor to complete it correctly. Although having a financial advisor can be helpful, it's not a requirement for completing this worksheet. The IRS instructions and resources are enough for most people to complete it on their own.

It doesn’t affect many taxpayers. Actually, with the rise of investment platforms and more people investing outside of retirement accounts, this worksheet is relevant to a growing number of taxpayers.

Qualified dividends are taxed the same as regular income. A common misunderstanding is that all dividends are taxed at the same rate as regular income. However, qualified dividends are taxed at the capital gains rate, which can be lower.

If you fill out Schedule D, you don’t need this worksheet. In fact, even if you fill out Schedule D due to capital gains or losses, you may still need this worksheet to correctly calculate the tax on qualified dividends and capital gains.

The worksheet itself calculates all your taxes. The worksheet is specifically for calculating taxes on qualified dividends and capital gains, not for calculating your entire tax liability.

Filing electronically means you don't need to understand this form. Even when filing electronically, understanding the steps your tax software takes, including how it uses this worksheet, is important for ensuring your taxes are filed correctly.

It’s irrelevant if you’re filing Form 2555 or 2555-EZ. Taxpayers with foreign earned income might think this worksheet doesn't apply to them. However, you may still need to complete it as part of your tax calculations, with specific instructions for those forms noted within the worksheet.

Clearing up these misconceptions can make tax season less stressful and help ensure you’re not missing out on potential tax benefits related to your investments.

Key takeaways

Understanding how to fill out the Qualified Dividends Tax Worksheet is paramount for those looking to optimize their tax returns. Here are six key takeaways that can assist anyone going through this process:

- Eligibility Check: Before diving into the worksheet, confirm your eligibility. This involves reviewing instructions for Form 1040, line 11a, to ensure this worksheet applies to your tax situation.

- Form 1040 Prerequisite: Completion of Form 1040 through line 10 is a necessary step before using the Qualified Dividends Tax Worksheet. This foundational step provides the numbers needed for accurate worksheet completion.

- Schedule D Consideration: The necessity of filing Schedule D plays a critical role in the worksheet process. The answer dictates which numbers from Schedule D or Schedule 1 are used, impacting the calculation.

- Investment Interest Adjustment: If filing Form 4952, which pertains to the investment interest expense deduction, adjustments on the worksheet must be made to account for this. Those not filing Form 4952 will enter "-0-" at this step.

- Income Thresholds: Understanding the income thresholds that apply based on your filing status is crucial. These thresholds affect the calculation of tax on qualified dividends and capital gains, which in turn influences the tax owed.

- Tax Calculation Details: The worksheet provides a detailed process for calculating the tax owed on qualified dividends and capital gains. This includes deductions, tax rate applications, and adjustments based on total income and filing status.

Completing the Qualified Dividends Tax Worksheet correctly is vital for ensuring that taxpayers do not overpay or underpay their taxes. Attention to detail and a clear understanding of one's own tax situation are key components of this process. By following the guidelines and having a strong grasp of the applicable rules, filers can navigate the complexities of tax calculations with confidence.

Popular PDF Documents

Tax Form 1040 - It’s the go-to form for claiming a host of additional tax credits, including those related to investments or retirement.

Form 1040 Vs 1040a - Empowers taxpayers to elect for direct deposit, simplifying the refund process and ensuring timely access to funds.

Deed Tax - Identify the type of deed or trust document used in the transaction, such as a warranty deed or quit claim deed.