Get Qms Loan Application Form

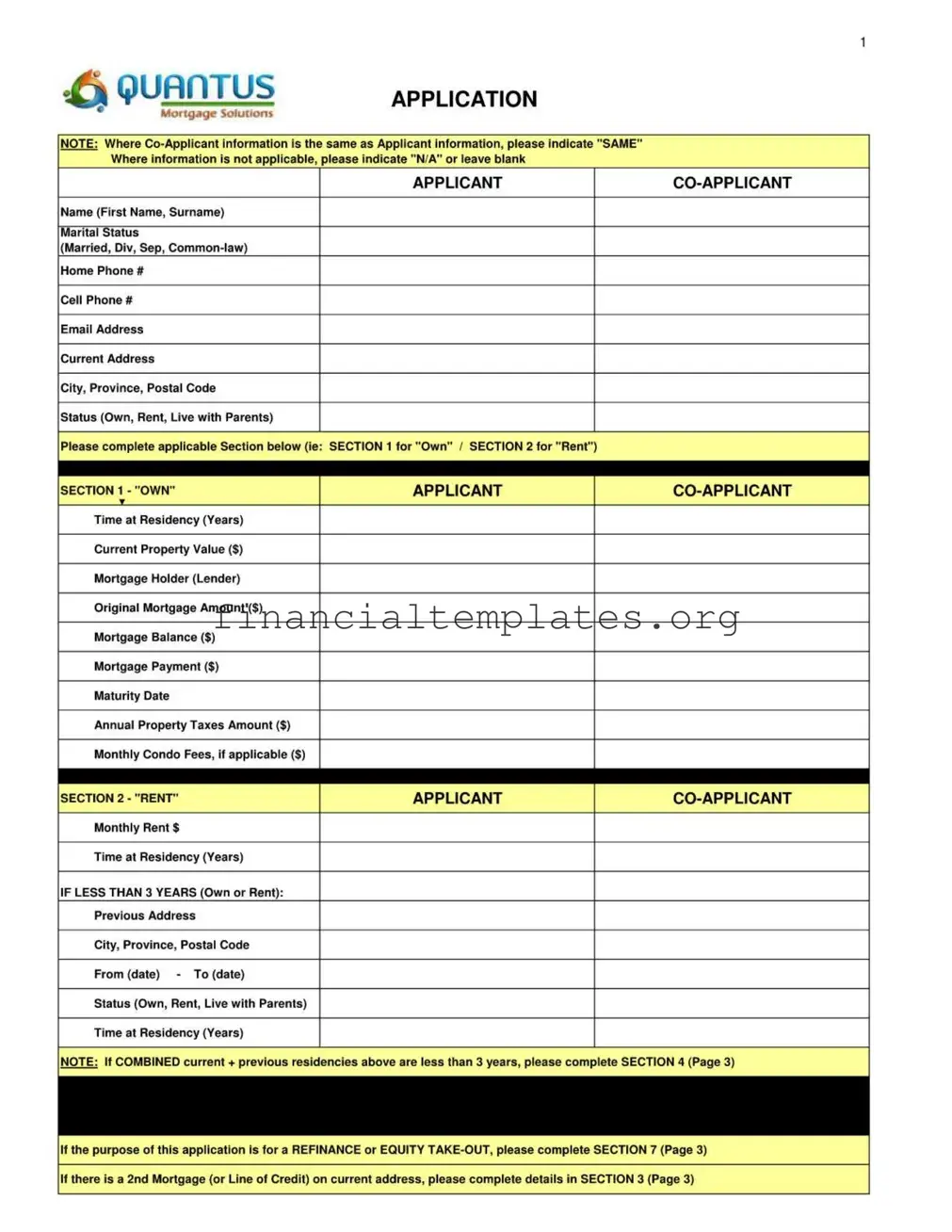

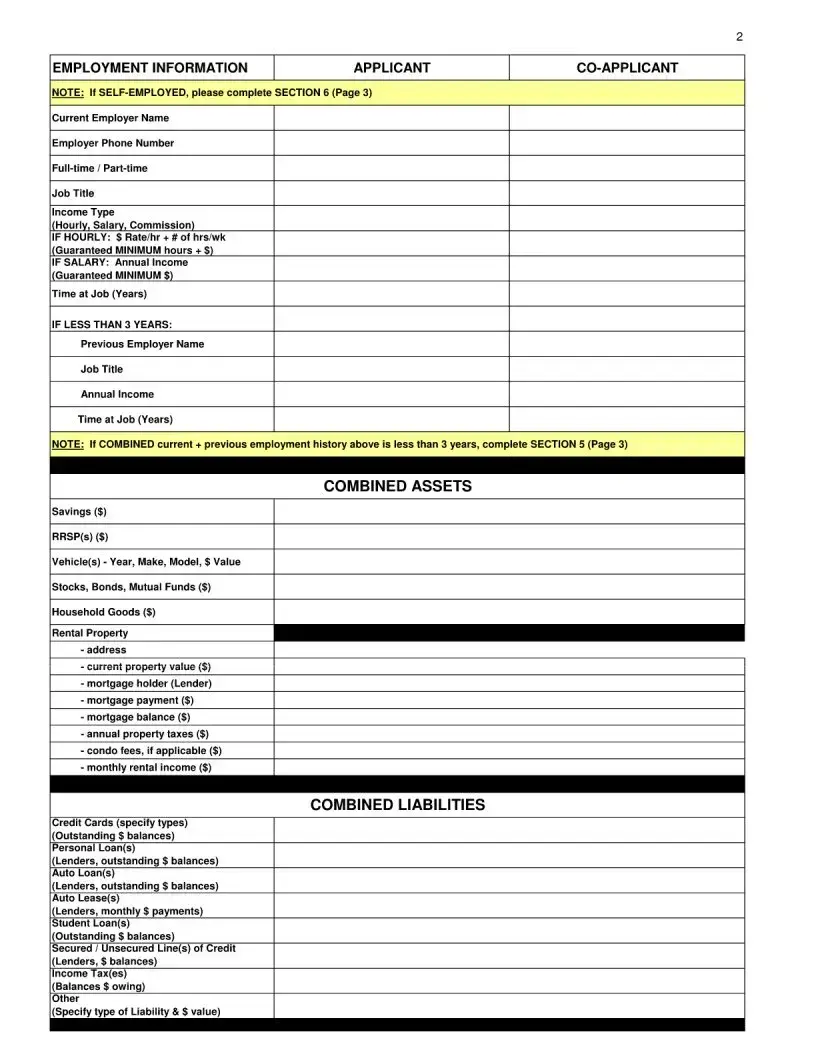

The QMS Loan Application form is an essential document for individuals seeking mortgage solutions through Quantus Mortgage Solutions. It meticulously gathers personal, employment, and financial information from applicants to facilitate the loan approval process. Applicants are required to provide detailed data, including names, marital status, contact information, and current living arrangements. For those who own their homes, information on property value, mortgage details, and related expenses is required, while renters must disclose their rent amount and duration at their current residence. Additionally, the form asks for employment history, including current and previous employers, to assess the applicant's income stability and financial health. Assets and liabilities are thoroughly scrutinized, with sections dedicated to listing savings, investments, debts, and other financial obligations. This comprehensive approach ensures a holistic view of an applicant’s financial standing, guiding the decision-making process for loan approval. Important components also include declarations regarding additional property details for refinancing or equity take-outs, and explicit consent for credit checks and sharing of personal information with relevant parties. Through this, Quantus Mortgage Solutions ensures that all necessary data is collected efficiently, maintaining transparency and security in handling applicants' information.

Qms Loan Application Example

Document Specifics

| Fact | Detail |

|---|---|

| Form Purpose | The Quantus Mortgage Solutions Loan Application form is used to collect information necessary to evaluate an applicant's eligibility for mortgage financing. |

| Applicant and Co-Applicant Information | Applicants must provide detailed personal information including marital status, contact information, and current living situation. If the co-applicant's information mirrors the applicant's, "SAME" can be indicated. |

| Residential History | Applicants are required to detail their current and previous addresses, alongside the duration of residency, to account for at least the previous three years. |

| Employment and Income | Details on the applicant and co-applicant's current and past employment, income type, and employment duration must be provided, including for those who are self-employed. |

| Financial Information | The form solicits comprehensive financial information ranging from assets and liabilities to details on mortgages and other loans to evaluate the financial standing of the applicant. |

| Governing Law(s) | The form, while utilized for gathering pertinent financial and personal details for mortgage application processing, adheres to laws and regulations that protect the confidentiality and integrity of personal information. Specific state laws related to lending and personal data protection may apply based on the applicant's location. |

Guide to Writing Qms Loan Application

Filling out the QMS Loan Application form is an important step towards securing your mortgage financing. This detailed form requires you to supply comprehensive information about your identity, residency, employment, financial assets, and liabilities. Ensuring accuracy and completeness when providing this information will facilitate a smoother evaluation process. Here are the steps to guide you through completing the form:

- Start with the section titled "APPLICANT CO-APPLICANT". Enter the full names, marital status, contact numbers, and email addresses of both the applicant and co-applicant.

- For "Current Address" and subsequent fields (City, Province, Postal Code, Status), fill in the current living situation. If the co-applicant's information is the same, simply write "SAME".

- Choose either SECTION 1 for homeowners or SECTION 2 for renters. Complete the subsection with details regarding your residency, mortgage or rent information. Remember, if applicable, note "N/A" or leave blank spaces for questions that do not pertain to your situation.

- If you've resided at your current location for less than three years, proceed to fill in your previous address details under the appropriate header.

- Under "EMPLOYMENT INFORMATION", input current and previous employment details for both the applicant and co-applicant. This includes job titles, income, and duration of employment.

- In the section marked "COMBINED ASSETS", list all assets including savings, property, vehicles, investments, and any additional assets you possess.

- Following the assets, you'll see "COMBINED LIABILITIES". Here, document all debts and financial obligations such as loans, credit card debts, and mortgages apart from the primary residence.

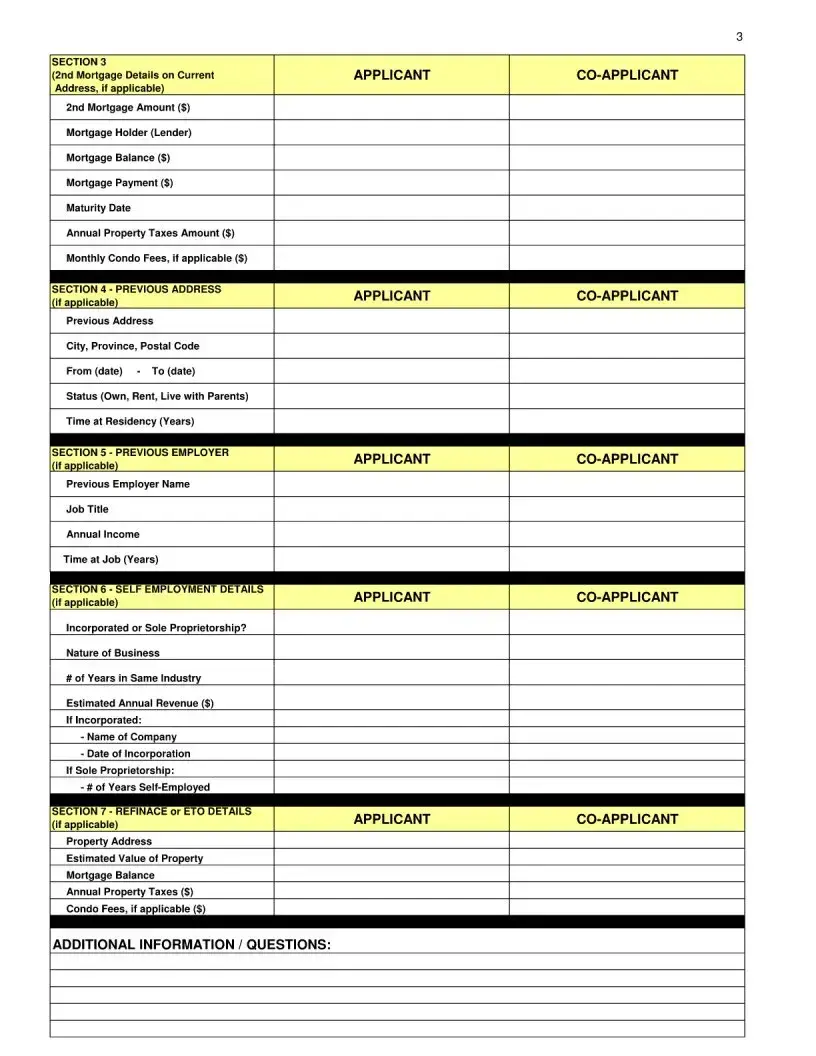

- If there's a second mortgage on the current address or if the application is for a refinance or equity take-out, fill out the additional sections indicated on the form for these specifics.

- Should be self-employed, provide detailed information in the designated section concerning the nature of your business and financial aspects.

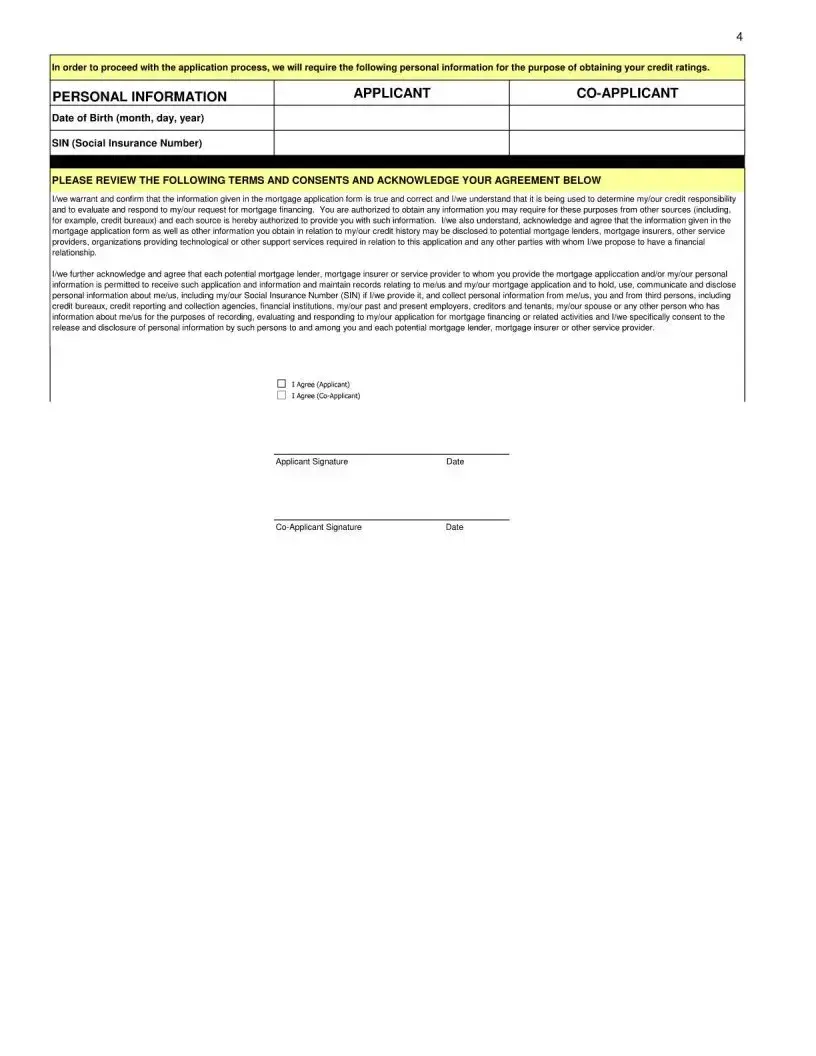

- Lastly, the "PERSONAL INFORMATION" section is where you'll input sensitive information like your date of birth and Social Insurance Number for both the applicant and co-applicant.

- Review the terms and consents carefully at the bottom of the form. Only if you agree to these terms, check the "I Agree" boxes and provide signatures and dates for both the applicant and co-applicant.

After completing the application form with careful attention to detail, submit it as per the instructions provided on the form or by the loan officer. The information submitted will be reviewed to assess your mortgage application. As each section captures crucial details about your financial history and current status, providing accurate and complete responses will significantly contribute to a positive outcome.

Understanding Qms Loan Application

Frequently Asked Questions about the QMS Loan Application Form

-

What should I do if the co-applicant's information is the same as the applicant's?

If the co-applicant's information mirrors that of the applicant, please simply write "SAME" in the co-applicant field. This instruction ensures clarity and efficiency in processing the application.

-

How should I indicate information that doesn't apply to me?

For any sections or details in the application that are not applicable to your situation, mark them as "N/A" or leave the space blank. This will let the evaluators know that the particular piece of information is not relevant to your loan application.

-

What should I do if my current and/or previous residency is less than three years?

If the sum of your current residency and any previous residencies within the last three years does not add up to a total of three years, it's required to complete SECTION 4 on Page 3 of the application. This section is designed to provide a more comprehensive view of your residence history.

-

What employment information is required if I am self-employed?

Self-employed applicants need to complete SECTION 6 on Page 3. This section asks for specifics about your business, including if it's incorporated or a sole proprietorship, the nature of the business, and the number of years you've been in the industry, among other details. This information helps in accurately assessing your loan application.

-

When is SECTION 7 necessary, and what does it entail?

SECTION 7 is specifically for applicants seeking to refinance or take equity out of their property. It requires details about the property address, its estimated value, current mortgage balance, annual property taxes, and any applicable condo fees. This section is critical in evaluating the feasibility and terms of refinancing or equity take-out proposals.

Common mistakes

Filling out a mortgage application can be a complex process. It’s crucial to pay close attention to detail to avoid common mistakes that could potentially delay or derail your application. Below are five common mistakes people make when they complete the QMS (Quantus Mortgage Solutions) Loan Application form:

-

Not indicating "SAME" where co-applicant information matches applicant information. Many applicants fail to note when the co-applicant's details are identical to the applicant's. This oversight can lead to unnecessary duplication of effort and confusion in processing the application.

-

Omitting "N/A" or leaving sections blank where information is not applicable. It's important to indicate clearly when certain information does not apply to you. Failing to do so can lead to assumptions that you simply missed a section, potentially causing delays as the lender seeks clarification.

-

Incomplete employment history information. Many applicants do not provide sufficient details about their employment, especially if they have been in their current position for less than three years. Completing sections related to previous employment fully is crucial for a thorough review of your financial stability.

-

Incorrectly detailing assets and liabilities. A common error is inaccurately reporting assets and liabilities or omitting information. This step is vital for lenders to understand your financial situation fully. Make sure all fields are accurate, including the types of liabilities and the specifics of your assets.

-

Not providing complete previous address details, if applicable. If your combined current and previous residencies are less than three years, completing the section on previous addresses is mandatory. Many applicants overlook this requirement, which is essential for a complete background check.

It’s essential to approach your loan application meticulously, ensuring that all information provided is accurate and complete. Avoiding these common mistakes can smooth the process, leading to a quicker and more favorable outcome.

Documents used along the form

When applying for a mortgage through the QMS Loan Application, several additional forms and documents are typically required to process and evaluate your application effectively. These documents play crucial roles in assessing your financial health, verifying your identity, and ensuring the accuracy of the information provided. A clear understanding of each document and its purpose can significantly smooth the application journey.

- Proof of Income: This includes recent pay stubs, tax returns, and W-2 forms from the past two years for employed applicants. It helps lenders assess your earnings stability and capacity to make mortgage payments.

- Credit Report Authorization: A signed document that permits lenders to request your credit history from credit bureaus. It's vital for evaluating your creditworthiness and interest rates.

- Proof of Identity: A government-issued photo ID, such as a driver's license or passport, is required to confirm your identity and prevent fraud.

- Bank Statements: Statements from the last two to three months are needed to verify your savings, regular income, and cash flow.

- Investment Account Statements: Documents showing the value of your investment accounts, including stocks, bonds, and mutual funds, contribute to determining your financial assets.

- Property Appraisal: A report that estimates the market value of the property you wish to purchase or refinance. It ensures the loan amount does not exceed the property's worth.

- Title Insurance: A policy that protects the lender and buyer from potential ownership disputes or property damage issues. It's essential for safeguarding the investment.

- Homeowners Insurance: Proof of insurance is mandatory to cover possible damages to the property. Lenders require it before you can close on a home loan.

- Previous Address Verification: If you've moved within the last three years, documentation or utility bills showing your former address can help corroborate your residence history.

Each document serves a specific function in the mortgage application process, from verifying the applicant's identity and financial status to protecting the interests of both the lender and the borrower. Accurately compiling and submitting these documents alongside your QMS Loan Application form will help ensure a smoother and more efficient approval process.

Similar forms

The Uniform Residential Loan Application plays a similar role to the Qms Loan Application form, as both are comprehensive forms utilized by individuals seeking to secure financing for real estate purchases. The Uniform Residential Loan Application collects detailed personal and financial information from applicants, similar to how the Qms form outlines applicant and co-applicant details, current and previous residence information, employment details, and financial liabilities and assets to assess creditworthiness.

A Business Loan Application shares similarities with the Qms Loan Application form by requiring detailed information about the applicant's financial standing, though it focuses on businesses rather than individuals. Like the Qms form, a Business Loan Application gathers data on the entity's financial health, income, liabilities, and assets, in addition to detailed information about the business owners and the nature of the business, to determine eligibility for a loan.

Credit Card Application forms bear resemblance to the Qms Loan Application form in their need for personal and financial information to evaluate credit history and risk. Both applications ask for current and previous addresses, income sources, employment status, and financial obligations. However, credit card applications typically require less extensive information about real estate holdings or previous residencies.

An Auto Loan Application, while intended for financing a vehicle purchase, similarly collects detailed personal, employment, and financial information from applicants to assess their creditworthiness. It closely mirrors the structure of the Qms Loan Application form by requesting details on income, assets such as vehicles (make, model, value), and liabilities, including existing auto loans or leases.

Mortgage Refinance Applications align closely with the refinancing section of the Qms Loan Application form. Both require detailed information about the property in question, including its value, existing mortgage details, and the objectives of refinancing, whether for equity take-out or to secure a better interest rate, demonstrating their focus on evaluating the equity and financial stability of the borrower.

The Rental Application process is analogous to the Qms Loan Application form's section on current and previous residencies. Applicants for rental properties must provide their rental history, income verification, and sometimes their credit score, similar to how loan applicants must disclose their housing status, income, and financial information to support their loan application.

Student Loan Applications, like the Qms form, assess the applicant's financial situation and potential for repayment. They gather data on educational expenses, income, employment, and financial assets and liabilities. Both applications aim to establish the creditworthiness and financial responsibility of the applicant to ensure the ability to repay the borrowed amount.

The Self-Employment Loan Application parallels sections of the Qms Loan Application form pertinent to self-employed individuals, requiring detailed information about the business, including nature, income, and years in operation. This specialized loan application focuses on evaluating the stability and profitability of self-employed applicants' business ventures to determine loan eligibility.

Dos and Don'ts

When engaging with the Qms Loan Application form, it's crucial to approach the process with both accuracy and honesty to ensure a smooth assessment by the lender. Below are some essential guidelines to follow, highlighting actions to embrace and those to avoid.

Do's for Filling Out the Qms Loan Application Form

- Review all sections carefully before starting, to understand which parts are relevant to your situation. This preliminary step can save time and reduce errors.

- Provide accurate information for each question. Being truthful and precise in your responses is fundamental for a legitimate evaluation of your application.

- Use "SAME" where Co-Applicant's Information matches Applicant's, as instructed. This ensures clarity and prevents unnecessary repetition.

- Indicate "N/A" or leave blank for questions that do not apply to your situation, in line with the form's instructions.

- Double-check for completeness and accuracy before submission. Overlooking this step could lead to unnecessary delays or even the rejection of your application.

Don'ts for Filling Out the Qms Loan Application Form

- Avoid guessing on financial details, such as your income or monthly expenses. Inaccuracies in these areas can significantly impact the evaluation of your loan application.

- Do not skip sections that apply to your circumstances. Failing to complete relevant sections can result in an incomplete application, requiring further clarification.

- Refrain from withholding financial information, like outstanding debts or liabilities. Transparency is crucial for a fair assessment of your financing capabilities.

- Avoid using informal or vague language in your responses. The seriousness of the application process necessitates clear and formal communication.

- Do not forget to review the terms and consents at the end of the form. Understanding and agreeing to these terms is essential for the processing of your application.

Adhering to these guidelines can significantly influence the success of your loan application. Every detail matters in conveying your financial situation, aspirations, and reliability as a borrower. A well-prepared application not only reflects your commitment but can also expedite the lending decision, bringing you one step closer to achieving your financial goals.

Misconceptions

There are several misconceptions regarding the QMS Loan Application form that often confuse or mislead applicants during the mortgage application process. Understanding these misconceptions is vital for prospective borrowers to ensure they fill out their applications accurately and completely. Here are nine common misunderstandings:

Applicants believe they must have a co-applicant to apply: While the form provides space for co-applicant information, this does not mean it's mandatory to have one. Individuals can apply on their own.

Leaving sections blank when not applicable is acceptable: Instead of leaving them blank, applicants should mark these sections as "N/A" or "SAME" where the instruction indicates, to avoid the appearance of overlooked information.

"Current Address" section only requires the address information if the applicant is renting: Irrespective of the housing status (owning, renting, or living with parents), all applicants must provide current living arrangement details.

The belief that employment details are only necessary for the primary applicant: Both the applicant and co-applicant must provide their employment information, even if one of them is not currently employed.

Only annual income needs to be disclosed: Applicants need to provide comprehensive income details, including the type (hourly, salary, commission) and, if applicable, the rate/hours or annual value.

The misconception that previous address details are optional: If the combined current and previous residencies are less than 3 years, it is mandatory to fill out the previous address details.

Applicants often assume they don't need to disclose liabilities like student or auto loans if they're not currently in debt: All liabilities, including credit card balances, student loans, auto loans, etc., must be disclosed.

The form is solely for purchasing a new property: The QMS Loan Application also accommodates applications for refinancing and equity take-out, which is a detail often overlooked.

Personal information like the Social Insurance Number (SIN) is optional: While privacy concerns may make applicants hesitant to provide their SIN, this information significantly aids in the credit assessment process, although the application can still be processed without it.

Understanding these aspects of the QMS Loan Application form can simplify the process for applicants and enhance the accuracy of the information provided to lenders. It’s important for applicants to read the instructions carefully and provide detailed, accurate information in every section applicable to their situation.

Key takeaways

Filling out the Qms Loan Application form is a critical step towards securing a mortgage that suits your financial situation. Here are some key takeaways to guide you through the process:

- Accuracy is paramount. Ensure that all information provided on the form is true and correct. Incorrect or misleading information could adversely affect your mortgage application and your credit responsibility evaluation.

- Complete coverage of your financial background is necessary. The form requests detailed personal, residential, employment, and financial information, including assets and liabilities. If your history in any of these areas is less than three years, additional sections of the application must be filled out to provide a comprehensive view.

- Disclosure consent is required. By signing the application, you authorize the release of your information to mortgage lenders, mortgage insurers, and other relevant parties. This allows them to obtain, hold, use, and disclose personal and credit information as necessary for evaluating your mortgage application.

- Special sections for diverse scenarios. The form includes specific sections for applicants who are refinancing, have a second mortgage or line of credit, are self-employed, or have changed residences or employment within the last three years. This ensures that the application can be tailored to fit a wide range of financial situations and needs.

It's important to approach the application process with care, ensuring that all information is filled out comprehensively and truthfully. If there are any areas that do not apply to your situation, marking them as "N/A" or leaving them blank is acceptable. This careful attention to detail will aid in the smooth processing of your application.