Get Purple Heart Tax Receipt Form

Generosity towards those who have served in the military is a noble trait, and the Purple Heart Foundation, Inc. (PHF) provides a platform for such contributions through the facilitation of donations. Donors who give to PHF can use the Purple Heart Tax Receipt form to document their contributions, whether they are dropping off appliances, electronics, clothing, or an assortment of other household goods at specified locations or arranging for pick-up. Located in Annandale, Virginia, and functioning with a clear mission to benefit not only veterans but also the environment by minimizing waste, the PHF assures donors that their contributions are making a meaningful difference. As they part with items ranging from computers and clothing to large furniture and bedding, donors have the responsibility to declare the value of their goods—a crucial step since these values will directly influence their income tax deductions. Acknowledging that no goods or services were exchanged for these donations is an essential part of the process, underscoring the charity's integrity and the donation's philanthropic nature. Operating under a tax-exempt status and with a distinct Tax ID, the foundation underscores the importance of compliance with legal requisites. Furthermore, the partnership with Unique Thrift Store allows the foundation to convert donated goods into financial support for veterans' programs, ensuring that the act of giving extends beyond the immediate transaction into long-lasting support for veterans. Disclosures about how donated items are utilized reinforce transparency, ensuring donors understand that their contributions are sold in bulk, rather than directly benefiting needy veterans through the distribution of goods.

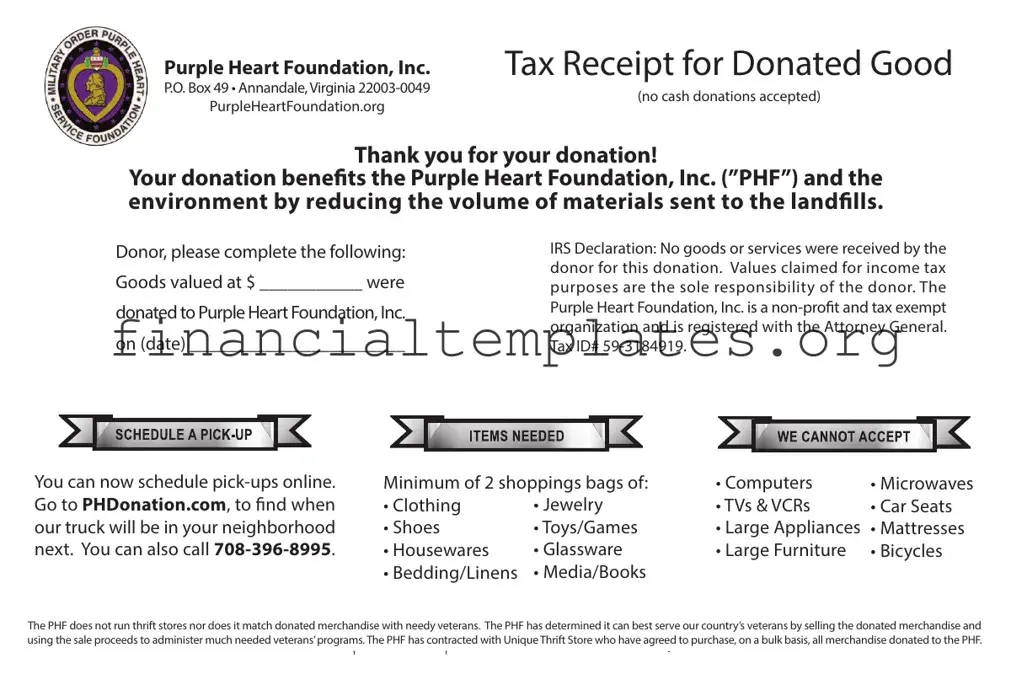

Purple Heart Tax Receipt Example

Purple Heart Foundation, Inc. |

Tax Receipt for Donated Good |

|

P.O. Box 49 • Annandale, Virginia |

(no cash donations accepted) |

|

PurpleHeartFoundation.org |

||

|

Thank you for your donation!

Your donation beneurple Heart Foundation, Inc. (”PHF”) and the environment by reducing the volume of materials sent to the land.

Donor, please complete the following:

Goods valued at $ ___________ were

donated to Purple Heart Foundation, Inc.

on (date) _______________________

IRS Declaration: No goods or services were received by the donor for this donation. Values claimed for income tax purposes are the sole responsibility of the donor. The Purple Heart Foundation, Inc. is a

You can now schedule |

Minimum of 2 shoppings bags of: |

• Computers |

• Microwaves |

|

Go to PHDonation.com, to |

• Clothing |

• Jewelry |

• TVs & VCRs |

• Car Seats |

our truck will be in your neighborhood |

• Shoes |

• Toys/Games |

• Large Appliances |

• Mattresses |

next. You can also call |

• Housewares |

• Glassware |

• Large Furniture |

• Bicycles |

|

• Bedding/Linens |

• Media/Books |

|

|

The PHF does not run thrift stores nor does it match donated merchandise with needy veterans. The PHF has determined it can best serve our country’s veterans by selling the donated merchandise and using the sale proceeds to administer much needed veterans’programs. The PHF has contracted with Unique Thrift Store who have agreed to purchase, on a bulk basis, all merchandise donated to the PHF.

Document Specifics

| Fact Name | Description |

|---|---|

| Organization Name | Purple Heart Foundation, Inc. (PHF) |

| Mailing Address | P.O. Box 49, Annandale, Virginia 22003-0049 |

| Cash Donations | No cash donations are accepted. |

| Website | PurpleHeartFoundation.org |

| Donation Effect | Benefits the PHF and the environment by reducing materials sent to landfill. |

| IRS Declaration | No goods or services were received by the donor in exchange for the donation. Value claims for tax purposes are the donor's responsibility. |

| Tax Status and ID | Non-profit exempt organization, Tax ID# 59-3184919. |

| Accepted Donations | Includes computers, clothing, large appliances etc. The PHF sells these to Unique Thrift Store in bulk for funding veterans' programs. |

Guide to Writing Purple Heart Tax Receipt

After making a generous donation to the Purple Heart Foundation, the next step is to fill out the Tax Receipt form. This step is crucial for tracking your donation and ensuring you can claim it on your taxes correctly. Here is a simple, step-by-step guide to complete the Purple Heart Tax Receipt form:

- Start by locating the section titled "Donor, please complete the following:".

- In the space provided, enter the total value of the goods you donated. Remember, it's crucial to be honest and accurate in your assessment.

- Next, specify the date of donation in the space provided. Ensure the date is accurate and formatted correctly.

- Read the IRS Declaration section carefully. This confirms that you received no goods or services in exchange for your donation, which is a requirement for tax-deductible contributions.

- Take note of the Tax ID# 59-3184919 for the Purple Heart Foundation, Inc., as this will be needed for your tax records.

- Consider scheduling a pickup for future donations by visiting PHDonation.com or calling 708-396-8995. This step is optional but can be convenient for frequent donors.

- Lastly, keep a copy of the completed form for your records. It will serve as documentation for your charitable contribution when you file your taxes.

Once you've filled out the form, you've taken an important step in ensuring your generous contributions are acknowledged and properly recorded. Not only do you get the benefit of a potential tax deduction, but you also gain the satisfaction of supporting veterans through the Purple Heart Foundation. Remember, every donation makes a difference, and your support is highly valued.

Understanding Purple Heart Tax Receipt

What types of goods can I donate to the Purple Heart Foundation, and how can I arrange for a donation pick-up?

You can donate a wide array of items including computers, microwaves, clothing, jewelry, TVs, VCRs, car seats, shoes, toys/games, large appliances, mattresses, housewares, glassware, large furniture, bicycles, bedding/linens, and media/books. To arrange for a pick-up of donated goods, you have two convenient options: you can schedule it directly online at PHDonation.com, or if you prefer to arrange by phone, you can call 708-396-8995. Remember, a minimum of 2 shopping bags worth of items is required for the pick-up service to be available in your neighborhood.

How should I determine the value of my donated goods for income tax purposes?

The Purple Heart Foundation, Inc. (PHF) highlights that the determination and declaration of the value of donated goods for income tax purposes is the sole responsibility of the donor. It's important for donors to accurately value their donated items, as this value is used when claiming tax deductions. Donors are encouraged to consult with tax professionals or use available IRS guidelines to make an accurate assessment of their donation's value.

Will I receive any goods or services in return for my donation?

According to the tax receipt provided by the Purple Heart Foundation, Inc. (PHF), no goods or services will be received by the donor in exchange for their donation. This declaration is important for tax deduction purposes, indicating that the full value of your donation can potentially be deducted as per IRS regulations, emphasizing the purely charitable nature of the contribution.

Is the Purple Heart Foundation a recognized non-profit, and what is their Tax ID?

Yes, the Purple Heart Foundation, Inc. is recognized as a non-profit organization and is duly registered with the Attorney General. It operates under the Tax ID# 59-3184919. This official recognition underscores the legitimacy of the PHF and assures donors that their contributions are going to a recognized charitable organization, which is crucial for trust and transparency, as well as for the tax-deductibility of donations.

What happens to the goods I donate to the Purple Heart Foundation?

The Purple Heart Foundation has a clear policy regarding the merchandise that generous donors like you provide: it does not run thrift stores nor directly match donated merchandise with needy veterans. Instead, the foundation has opted for a model where donated goods are sold, and the sales proceeds are used to fund much-needed programs for veterans. This approach allows the PHF to efficiently manage donations and maximize the benefit to veterans by focusing on funding programs that provide direct assistance. The PHF has partnered with Unique Thrift Store, which agrees to purchase the donated merchandise on a bulk basis, ensuring a streamlined process for turning your donations into vital support for veterans' programs.

Common mistakes

When filling out the Purple Heart Tax Receipt form, it is important to avoid common mistakes to ensure the donations are processed efficiently and effectively benefit the Purple Heart Foundation, Inc. (PHF) and its vital programs for veterans. Here are four frequent errors:

Incorrect Valuation of Donated Goods: Donors often estimate the value of their donated goods inaccurately. It's essential to assess the fair market value of the items at the time of donation, as this value is the responsibility of the donor and is used for income tax purposes.

Failure to Properly Document the Donation Date: Not specifying the exact date of donation can lead to discrepancies. It is crucial for record-keeping and tax deduction purposes to accurately fill in the date when the goods were donated to PHF.

Omitting the IRS Declaration Confirmation: The form includes a declaration that no goods or services were received in exchange for the donation. Overlooking this declaration can raise questions during tax audits, as it is a key component in verifying the donation's eligibility for tax deductions.

Notifying PHF Improperly for Pickup: Given that PHF provides a convenient online scheduling option for pick-ups and has specified contact information for this purpose, failing to properly notify or schedule with PHF can result in donations not being picked up or processed in a timely manner.

In addition to these common mistakes, here are some considerations to ensure a smooth donation process:

Ensure that the goods being donated match the types of items PHF is able to accept, such as computers, clothing, and large furniture, among others listed on the form.

Remember, PHF does not accept cash donations via this form. Donations of non-monetary items are the focus of this form.

Keep a copy of the completed tax receipt form for your records. This can be helpful when preparing year-end taxes and in case of any queries from the IRS regarding the donation.

Consider the environmental benefits of your donation, which aids in reducing the volume of materials sent to the landfill, in addition to supporting the veterans through PHF's programs.

Documents used along the form

When donating to organizations like the Purple Heart Foundation, Inc., donors may encounter a variety of forms and documents in addition to the Purple Heart Tax Receipt form. Understanding these documents can make the donation process smoother and ensure compliance with legal and tax requirements. Here is a list of documents often used alongside the Purple Heart Tax Receipt form, each with a brief description:

- Donation Acknowledgment Letter: This letter serves as proof of the donation made and details the nature of the donation (non-cash items). It complements the tax receipt by acknowledging the receipt of the donated goods.

- Itemized Donation List: When donating multiple items, an itemized list detailing each item's condition and fair market value can be necessary for tax purposes.

- Form 8283: For non-cash donations exceeding $500, the IRS requires donors to fill out Form 8283, Noncash Charitable Contributions, and include it with their tax return.

- Appraisal Summary: For donations valued over $5,000, an appraisal summary performed by a qualified appraiser must be attached to the tax return.

- IRS Publication 526: This publication provides guidelines and instructions for charitable contributions, including how to determine the deduction value of donated goods.

- IRS Publication 561: To assist donors in determining the value of donated property, IRS Publication 561 outlines how fair market value should be assessed.

- Records of Donation Pickups: If the charity provides pickup services for donated goods, receipts or email confirmations of these pickups should be kept as part of the donor's records.

- Charitable Organization’s Qualification Letter: A document from the IRS certifying the charity’s tax-exempt status is crucial for ensuring that one's donation is tax-deductible.

- Bank or Credit Card Statements: Though not directly related to non-cash donations, these statements can serve as additional proof of donation if they record related expenses, such as travel costs to the donation site.

- Gift Aid Declaration Form: For donors in the UK, this form enables charities to claim back 25p every time £1 is donated, increasing the value of the donation at no extra cost to the donor.

Collectively, these documents support the donation process, ensuring donors can properly claim tax deductions and organizations can comply with legal requirements. By maintaining a comprehensive record of donations and related documents, both parties can facilitate a transparent and efficient donation process, ultimately benefiting the charitable cause at hand.

Similar forms

The Goodwill Donation Receipt is comparable to the Purple Heart Tax Receipt form in its purpose and structure. Both documents serve as a confirmation for individuals who donate items, underscoring that no cash donations are accepted and providing specific guidelines on what types of items can be donated. Each receipt outlines that the donor did not receive any goods or services in exchange for their donation, emphasizing the charitable nature of the contribution. The receipts also remind donors that determining the value of donated items for tax deduction purposes is their responsibility, ensuring compliance with IRS regulations.

Similarly, the Salvation Army Donation Receipt functions as a record for donors, much like the Purple Heart Tax Receipt form. It acknowledges the donation of goods to a nonprofit organization and specifies that the contribution will support the organization’s mission. Both documents include crucial details such as the date of donation and a declaration that no goods or services were received in return. The Salvation Army Receipt also provides a Tax ID number and informs donors about the tax-deductible nature of their donation, mirroring the essential elements found in the Purple Heart Tax Receipt.

The Habitat for Humanity Donation Receipt shares several similarities with the Purple Heart Tax Receipt, particularly in the way both receipts document charitable contributions of physical items, excluding cash. They provide a structured format for documenting the description and value of the donated goods, necessary for taxpayer records and potential tax deductions. Both acknowledge the nonprofit status of the recipient organization and include a Tax ID number, aiding donors in confirming the legitimacy of their contributions for tax purposes.

The St. Vincent de Paul Donation Receipt is another document that bears resemblance to the Purple Heart Tax Receipt. Both serve to acknowledge the receipt of goods donated to their respective charitable organizations, without providing any goods or services to the donor in return. These receipts are crucial for donors who wish to claim their donations as tax deductions, as they include reminders that the valuation of donated items is the donor’s responsibility. Each receipt also explicitly mentions the charitable or nonprofit status of the organization, reinforcing the tax-exempt nature of the donation.

Finally, the Tax-Deductible Donation Receipt, commonly issued by a range of nonprofit organizations, parallels the Purple Heart Tax Receipt in its function and content. This type of receipt is designed to provide donors with proof of their non-cash contributions for tax purposes. Like the Purple Heart Receipt, it includes a disclaimer that no goods or services were provided in exchange for the donation, an assertion of the organization’s nonprofit status, and a reminder that the donor is responsible for determining the value of their donated goods. The inclusion of the organization’s Tax ID number is also a common feature, facilitating the donors’ tax reporting process.

Dos and Don'ts

When filling out the Purple Heart Tax Receipt form for your generous donation, closely following the guidelines will ensure that your donation process is smooth and that you can properly claim your donation on your tax return. Here’s what you should and shouldn’t do:

Do:

- Accurately estimate the value of the goods you have donated. Remember, the IRS requires this valuation to reflect the item's fair market value.

- Record the date of donation carefully. This information is crucial for both your records and for the Purple Heart Foundation, Inc. (PHF).

- Retain a copy of the tax receipt for your records. This documentation will be important if you itemize deductions on your tax return.

- Ensure that you list all the items donated. Keeping a detailed record helps in maintaining transparency and integrity in the donation process.

- Check that you have not received any goods or services in return for your donation. This declaration is essential for the receipt to be valid for tax purposes.

Don't:

- Attempt to donate cash using this form. The PHF explicitly states that it does not accept cash donations through this channel.

- Forget to schedule a pickup for your donation if it includes large items or requires assistance. Using the provided contacts facilitates an easy donation process.

- Overlook the list of items that PHF accepts. Donating items that are not on their accepted list may cause inconvenience and additional costs for the foundation.

- Misrepresent the value of donated goods. It's important to be honest and accurate in your valuation for ethical reasons and compliance with IRS guidelines.

- Assume the tax receipt automatically qualifies you for a tax deduction. Eligibility for deductions depends on various factors, including your adherence to IRS rules and the accuracy of your tax return.

Misconceptions

Many people hold misconceptions about the tax implications and procedures for donating goods to organizations like the Purple Heart Foundation, Inc. (PHF). It's important to clarify these misunderstandings to ensure donors are both informed and confident in their charitable contributions.

Misconception 1: Cash donations can be included on the Purple Heart Tax Receipt form.

This is incorrect. The form clearly states that no cash donations are accepted. Donors should not expect to use this receipt form for cash contributions, as the PHF focuses on goods rather than monetary donations for their funding.

Misconception 2: The value stated by the donor for donated goods is automatically accepted by the IRS.

The form emphasizes that the values claimed for income tax purposes are the sole responsibility of the donor. This means the IRS requires donors to accurately assess the value of their donations, and it reserves the right to challenge these assessments if they are not reasonable or well-documented.

Misconception 3: Donated goods are distributed directly to veterans in need.

A common assumption is that donated goods, such as clothing or appliances, are given directly to veterans. However, the form explains that the PHF does not match donated items with needy veterans. Instead, it sells the donations to fund programs for veterans, a key point donors should understand.

Misconception 4: Donors receive goods or services in exchange for their donation.

The IRS Declaration on the form makes it clear that no goods or services are provided in return for donations. This declaration is important for tax purposes, as the benefit to the donor must be purely the satisfaction of contributing to a good cause, without receiving any tangible benefit in return.

Misconception 5: The value of donated goods does not need to be substantiated for tax purposes.

While the form allows donors to state the value of their donated goods, it’s a misunderstanding to think this value does not need to be substantiated. For tax deduction purposes, donors need to keep records of how they determined the value of their contributions, especially if the total value of the donation exceeds certain IRS thresholds.

Understanding these aspects is crucial for donors who wish to support the Purple Heart Foundation, Inc., ensuring that their contributions are both meaningful and in compliance with tax regulations. Donations of goods, when properly documented and understood, can significantly support the valuable programs administered by the foundation for veterans.

Key takeaways

Filling out and using the Purple Heart Tax Receipt form involves several key steps and considerations that donors should be aware of to ensure their donations are accurately documented and beneficial for tax purposes. Below are ten key takeaways from the process:

- Supports a Noble Cause: Donations made using the Purple Heart Tax Receipt form benefit the Purple Heart Foundation, Inc. (PHF), aiding both veterans and the environment.

- Non-Cash Donations: The form explicitly states that cash donations are not accepted. Donors are encouraged to donate goods instead.

- Document Goods' Value: Donors are required to state the monetary value of the goods donated on the form.

- IRS Declaration: It's noted on the form that no goods or services were received in exchange for the donation, and donors are responsible for claiming the value of their donation for tax purposes.

- Tax-Exempt Status: The PHF is a tax-exempt organization, a factor that could benefit donors during tax filings.

- Tax ID Provided: The tax identification number for the PHF, 59-3184919, is provided for donor records.

- Online Scheduling for Pick-Ups: Donors can schedule pick-ups of their donated goods online, facilitating the donation process.

- Specific Goods Accepted: The form lists specific types of goods the PHF accepts, including electronics, clothing, and furniture, among others.

- Merchandise Use: It is clarified that donated merchandise is sold to Unique Thrift Store on a bulk basis, with proceeds going toward veterans’ programs run by the PHF.

- No Direct Distribution: The PHF does not directly distribute donated goods to needy veterans but instead focuses on using the proceeds from sold goods to support veteran programs.

By understanding these key points, donors can efficiently support the Purple Heart Foundation's commendable efforts to assist veterans while also ensuring they properly document their donations for tax purposes.

Popular PDF Documents

Colorado Department of Revenue Denver Co 80261 - It lays the groundwork for a trusted relationship between the taxpayer and their chosen representative for tax affairs.

Irs Form 3911 Instructions - Designed to assist in the recovery of lost or missing payments issued by the U.S. Treasury.