Get Ptax 401 Form

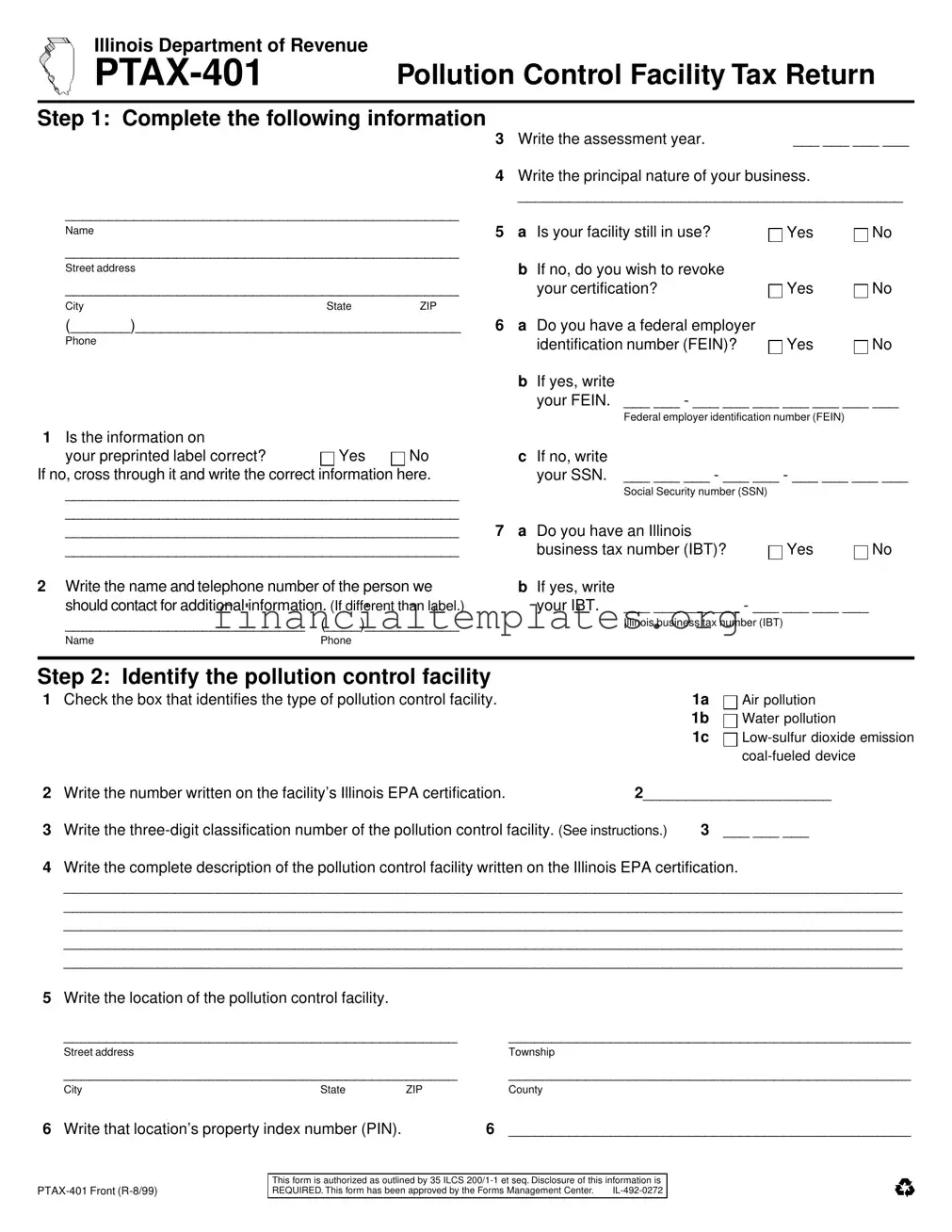

The Illinois Department of Revenue's PTAX-401 form plays a crucial role in the environmental and fiscal responsibilities of businesses operating pollution control facilities within the state. This document is specifically designed for the taxation of pollution control facilities, encompassing a range of equipment dedicated to minimizing environmental impact, including those for air and water pollution, and low-sulfur dioxide emission coal-fueled devices. The form requires detailed information, such as the assessment year, the principal nature of the business, facility usage status, and identification numbers like the Federal Employer Identification Number (FEIN) and Illinois Business Tax number (IBT). Moreover, it guides owners through identifying the type of pollution control facility, certification details by the Illinois EPA, and a comprehensive description of the facility’s location and operational specifics. Completing the assessment information entails disclosing the date the facility was placed into use, estimating its remaining useful life, and calculating the original and current costs of the certified portions of the facility, including any additions, improvements, retirements, or removals up to the current assessment year. The form also probes into the economic benefits of the facility, asking whether its operation contributes to byproduct production or cost reduction. The final steps involve updating any changes in the use of the facility, additional costs within the assessed year, and an affirmation of the accuracy of the information provided. Mailed to the Local Government Services Bureau, this form ensures compliance and contributes to the state's environmental management efforts, making it a pivotal document for business owners and state authorities alike.

Ptax 401 Example

Illinois Department of Revenue |

|

|

|

|

|

|

|

Pollution Control Facility Tax Return |

|||||

Step 1: Complete the following information |

|

|

|

|

||

|

|

|

3 |

Write the assessment year. |

___ ___ ___ ___ |

|

|

|

|

4 Write the principal nature of your business. |

|

||

|

|

|

|

_____________________________________________ |

||

______________________________________________ |

|

|

|

|

||

Name |

|

|

5 |

a Is your facility still in use? |

Yes |

No |

______________________________________________ |

|

|

|

|

||

Street address |

|

|

|

b If no, do you wish to revoke |

|

|

______________________________________________ |

|

your certification? |

Yes |

No |

||

City |

State |

ZIP |

|

|

|

|

(_______)______________________________________ |

6 |

a Do you have a federal employer |

|

|

||

Phone |

|

|

|

identification number (FEIN)? |

Yes |

No |

|

|

|

|

|||

|

|

|

|

|

b If yes, write |

|

|

|

|

|

|

|

|

|

your FEIN. |

___ ___ - ___ ___ ___ ___ ___ ___ ___ |

|||

|

|

|

|

|

|

Federal employer identification number (FEIN) |

|

||

1 |

Is the information on |

|

|

|

|

|

|

|

|

|

your preprinted label correct? |

Yes |

No |

|

c If no, write |

|

|

|

|

If no, cross through it and write the correct information here. |

|

your SSN. |

___ ___ ___ - ___ ___ - ___ ___ ___ ___ |

||||||

|

______________________________________________ |

|

|

Social Security number (SSN) |

|

||||

|

______________________________________________ |

|

|

|

|

|

|

||

|

______________________________________________ |

7 |

a Do you have an Illinois |

|

|

||||

|

______________________________________________ |

|

business tax number (IBT)? |

Yes |

No |

||||

2 |

Write the name and telephone number of the person we |

|

b If yes, write |

|

|

|

|

||

|

should contact for additional information. (If different than label.) |

|

your IBT. |

___ ___ ___ ___ - ___ ___ ___ ___ |

|

||||

|

____________________________ (____)___________ |

|

|

Illinois business tax number (IBT) |

|

||||

|

Name |

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Step 2: Identify the pollution control facility |

|

|

|

|

|

|

|||

1 Check the box that identifies the type of pollution control facility. |

|

|

1a |

Air pollution |

|

||||

|

|

|

|

|

|

|

1b |

Water pollution |

|

|

|

|

|

|

|

|

1c |

||

|

|

|

|

|

|

|

|

|

|

2 Write the number written on the facility’s Illinois EPA certification. |

|

2______________________ |

|

||||||

3 |

Write the |

3 ___ ___ ___ |

|

||||||

4Write the complete description of the pollution control facility written on the Illinois EPA certification.

__________________________________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

5Write the location of the pollution control facility.

______________________________________________ |

_______________________________________________ |

||

Street address |

|

|

Township |

______________________________________________ |

_______________________________________________ |

||

City |

State |

ZIP |

County |

6 Write that location’s property index number (PIN). |

|

6 _______________________________________________ |

|

This form is authorized as outlined by 35 ILCS

REQUIRED. This form has been approved by the Forms Management Center. |

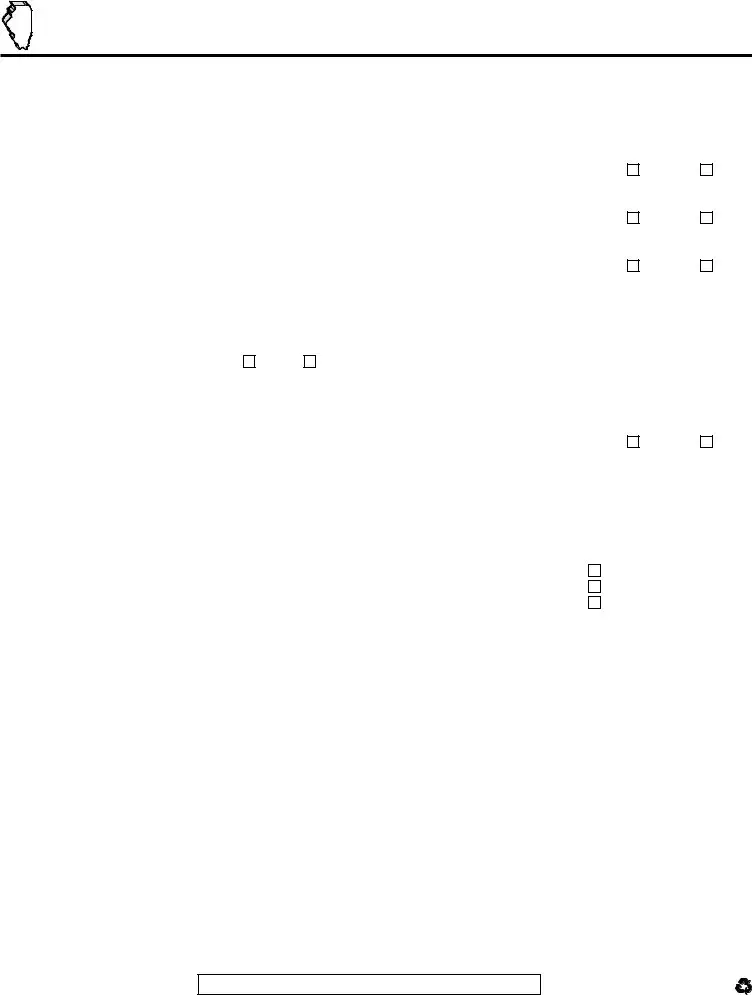

Step 3: Complete the assessment information

1 |

Write the month and year that the facility was placed into use. |

1 |

___ ___ /___ ___ ___ ___ |

|

|

|

|

Month |

Year |

2 |

Write the estimated remaining useful life of the facility. (See instructions.) |

2 |

________________ years |

|

3 |

Write the original cost of the certified portion of the facility as of the date placed into use. |

3 |

$ ____________________ |

|

4If any portion of the facility was assessed as personal property before January 1, 1979,

write the original cost of the certified portion of the facility as of January 1, 1978. |

4 |

$ ____________________ |

5 Subtract Line 4 from Line 3. |

5 |

$ ____________________ |

6Write the total original cost of all additions and improvements made to the certified portion

of the facility from the date placed into use through January 1 of this assessment year. |

6 |

$ ____________________ |

7 Add Lines 5 and 6. |

7 |

$ ____________________ |

8Write the total original cost of all certified portions of the facility that have been retired

|

or removed from use through January 1 of this assessment year. |

8 |

$ |

____________________ |

9 |

Subtract Line 8 from Line 7. |

9 |

$ |

____________________ |

10 |

Write the net earnings attributable to the certified portion of the facility. |

10 |

$ |

____________________ |

11 Does the operation of the facility produce a byproduct that can be commercially sold? |

11 |

If you answered yes, please explain: _________________________________________ |

|

12Does the operation of the facility result in increased production or reduced production cost? 12 If you answered yes, please explain: _________________________________________

Yes

Yes

No

No

Step 4: Complete the following information

1Have there been any changes in the use of the facility within the previous assessment year? 1 If you answered yes, please explain: _________________________________________

2a Have there been any additions or improvements made to the certified portion

of the facility within the previous assessment year? |

2a |

If you answered yes, complete the following. |

|

b Write the original cost of the addition or improvement. |

2b |

c Write the date placed into use. |

2c |

d Check the classification of the addition or improvement. |

2d |

Describe the addition or improvement: _____________________________________ |

|

3a Has any part of the certified portion of the facility been retired or removed from use

within the previous assessment year? |

3a |

If you answered yes, complete the following. |

|

b Write the original cost of the retired or removed portion. |

3b |

c Write the date retired or removed from use. |

3c |

YesNo

YesNo

$___________________

___ ___/___ ___ ___ ___

Month Year

Real Personal

YesNo

$___________________

___ ___/___ ___ ___ ___

Month Year

Step 5: Sign below

I state that, to the best of my knowledge, the information contained in this return is true, correct, and complete.

___________________________________________/____/____ ___________________________________________________

Pollution control facility owner’s or authorized representative’s signature |

Date |

Print the pollution control facility owner’s or authorized representative’s name and title |

|

|

|

Mail this return to:

Local Government Services Bureau, Illinois Department of Revenue, P.O. Box 19033, Springfield, IL

Document Specifics

| Fact | Detail |

|---|---|

| Purpose | The PTAX-401 form is used for the Pollution Control Facility Tax Return in Illinois. |

| Requirement | Filling out this form is required under the law 35 ILCS 200/1-1 et seq for pollution control facilities. |

| Content | It collects detailed information about the pollution control facility, including type, EPA certification, original cost, and assessment information. |

| Filing Address | Completed forms are mailed to the Local Government Services Bureau, Illinois Department of Revenue, P.O. Box 19033, Springfield, IL 62794-9033. |

Guide to Writing Ptax 401

Filling out the PTAX-401 form is a straightforward process, aimed at reporting specifics about pollution control facilities for tax purposes. This task is required to ensure that all relevant assessment information, including details about the pollution control facility's nature, use, and financial aspects, are accurately captured and reported to the Illinois Department of Revenue. The steps below guide you through each part of the form to help streamline the process, ensuring compliance and accuracy in your filing.

- Start by completing your assessment year in the designated space, ensuring the year reflects the period being reported.

- Indicate the principal nature of your business, succinctly describing the main activities or services provided.

- If applicable, confirm your facility’s current operational status (in use or not) and whether you wish to revoke your certification.

- Provide the federal employer identification number (FEIN) or social security number (SSN) if a FEIN is not applicable.

- For those with an Illinois business tax number (IBT), it should be included; if not, simply indicate the absence of one.

- Check the box that best identifies the type of pollution control facility you are reporting (e.g., air pollution, water pollution, etc.).

- Enter the Illinois EPA certification number and the three-digit classification number of your facility, adhering to the provided instructions for the correct format.

- Describe the pollution control facility as per the Illinois EPA certification and provide its location, including street address, city, state, and ZIP code.

- Complete the assessment information by stating the month and year the facility was first used, its estimated remaining useful life, and various financial amounts including the original and adjusted costs of the certified portions of the facility.

- Detail any changes in the use of the facility within the previous assessment year, including any additions, improvements, retirements, or removals of parts of the facility.

- Finally, certify the form by signing and dating the bottom section. Print the name and title of the pollution control facility owner or the authorized representative.

After carefully reviewing the completed form to ensure all information is accurate and comprehensive, mail it to the address provided: Local Government Services Bureau, Illinois Department of Revenue, P.O. Box 19033, Springfield, IL 62794-9033. This submission will conclude your current reporting responsibilities for the PTAX-401 form.

Understanding Ptax 401

The PTAX-401 form is a crucial document for businesses operating pollution control facilities in Illinois. Here are some frequently asked questions about the form:

What is the PTAX-401 form used for?

The PTAX-401 form serves as a pollution control facility tax return. It is used by the Illinois Department of Revenue to assess the property tax of pollution control facilities based on information such as their use, cost, and impact on pollution reduction. This form ensures that these facilities are taxed appropriately according to the Illinois Compiled Statutes (35 ILCS 200/1-1 et seq.), recognizing the investments businesses make in reducing environmental impacts.

Who needs to file the PTAX-401 form?

Any business operating a certified pollution control facility in Illinois is required to file this form. Types of facilities include those designed for air and water pollution control, low-sulfur dioxide emission coal-fueled devices among others. Certification by the Illinois Environmental Protection Agency (EPA) is a prerequisite for filing.

What information is required on the PTAX-401 form?

Businesses must provide detailed information about the pollution control facility, including the type of facility, its location, Illinois EPA certification number, and classification number. Additionally, the original cost, additions or improvements, and any retired portions of the facility must be reported. The form also asks about the facility's impact, such as whether it produces a commercially viable byproduct or affects production costs.

When is the PTAX-401 form due?

The filing deadline for the PTAX-401 form is typically tied to the assessment year in question. It's important for businesses to check with the Illinois Department of Revenue or their local tax assessor’s office for specific due dates to avoid penalties for late filings. Generally, the form should be submitted by the end of the fiscal year for which the taxes are being assessed.

Where should the PTAX-401 form be submitted?

Completed PTAX-401 forms should be mailed to the Local Government Services Bureau of the Illinois Department of Revenue. The specific address for submission is provided on the form itself: P.O. Box 19033, Springfield, IL 62794-9033. It is important to ensure that the form is fully completed and signed by the pollution control facility owner or an authorized representative before mailing.

Common mistakes

Filling out the PTAX-401 form, a critical document for the Illinois Department of Revenue concerning Pollution Control Facility Tax Returns, often involves intricate details that can be easily overlooked. Here are five common mistakes typically made:

Incorrect or incomplete assessment year entry: The assessment year must be accurately filled out with the correct four-digit year. Misunderstanding the assessment period can lead to incorrect tax calculations or form rejection.

Misidentifying the pollution control facility type: Selecting the wrong checkbox or leaving this section incomplete can cause significant delays. Each facility, whether it’s for air, water pollution, or a low-sulfur dioxide emission coal-fueled device, has unique tax implications and benefits that are assessed accordingly.

Failure to accurately report the original cost and improvements: The original cost of the facility, as well as any additions or improvements made, needs to be meticulously documented. This includes subtracting retired or removed portions of the facility to ensure the tax basis is accurately represented.

Neglecting to detail the commercial viability of byproducts: If the facility’s operations produce a commercially viable byproduct, this must be clearly stated along with an explanation. An omission or vague response can affect the tax advantages potentially available.

Incorrectly handling changes within the assessment year: Any changes to the use of the facility, as well as additions or improvements made during the previous assessment year, must be adequately reported, including costs and dates of implementation. Leaving these sections incomplete or providing inaccurate information can lead to discrepancies and potential audits.

Not verifying the preprinted label information: If the preprinted label contains outdated or incorrect information, it is crucial to cross it out and provide the current details. Overlooking this step may result in processing delays or miscommunication with the Department of Revenue.

Forgetting to include contact details for further information: Providing a clear point of contact, different from the preprinted label if necessary, ensures that any queries related to the tax return can be promptly addressed, facilitating smoother processing.

Omitting the signature of the owner or authorized representative: The declaration at the end of the form that confirms the truthfulness and accuracy of the provided information must be signed. An unsigned form is not considered valid and will not be processed.

Leaving the facility’s location and PIN undefined: Precisely describing the location of the pollution control facility and providing the Property Index Number (PIN) is essential for tax assessment purposes. Inaccuracies or omissions in this area can lead to incorrect tax evaluations.

Overlooking the need to specify the facility’s impact on production: The sections asking whether the facility’s operation has resulted in increased production or reduced production cost are critical for understanding the facility’s efficiency and economic impact, which influences the taxation process.

Documents used along the form

When dealing with the PTAX-401 form, specifically for pollution control facilities in Illinois, it is essential to have a comprehensive understanding of the multiple forms and documents often required alongside it. Each of these forms plays a critical role in ensuring that all necessary details are accounted for and that the process is completed correctly and efficiently.

- PTAX-300: This form is used for Real Estate Transfer Declarations. It gives details about the property being transferred, which might be necessary if the pollution control facility changes ownership.

- IL-941: Illinois Quarterly Withholding Income Tax Return. Companies operating pollution control facilities must report and pay taxes on wages paid to employees. This form is crucial for compliance with state tax obligations.

- Form IL-1040: Individual Income Tax Return. Owners of pollution control facilities who are individuals must file this form to report their income, adjustments, and credits to the state of Illinois.

- Form RUT-50: Private Party Vehicle Tax Transaction. If acquiring vehicles for use at the facility, this form is used to report and pay sales tax to the Illinois Department of Revenue.

- ST-1: Sales and Use Tax Return. Facilities that sell goods as part of their operation must file this form to report sales made and use tax collected from customers.

- Form IL-1023-C: Composite Income and Replacement Tax Return. This is for entities that are taxed as pass-through entities. It allows them to file a composite return on behalf of non-resident members.

- Form IL-501: Payment Coupon and Instructions for Employers. This form is used to make required monthly or quarterly withholding tax payments to the Illinois Department of Revenue.

- Form IL-1065: Partnership Replacement Tax Return, for pollution control facilities owned by partnerships. It details income, deductions, and credits related to the operation of the facility.

- PTAX-203: A Property Transaction Report, which must be filed for certain real estate transactions involving pollution control facilities, providing the state with information on these transactions.

These documents ensure that businesses operating pollution control facilities in Illinois stay compliant with various regulatory and tax requirements. Gathering and preparing these forms can be time-consuming but is crucial for the efficient and lawful operation of the facility. Being attentive to the details in these forms helps avoid potential legal issues and contributes to the overall success of the business.

Similar forms

The PTAX-401 form, associated with the Illinois Department of Revenue, shares similarities with numerous other tax documents designed to capture specific facets of business and property-related activities. First, consider the IRS Schedule C form, which is utilized by sole proprietors to report income or loss from a business. Similar to the PTAX-401, the Schedule C asks for detailed business information, including the principal business activity, gross income, and expenses. Both forms require the business owner's FEIN or SSN, underscoring the need for taxpayer identification in tracking and managing financial operations tied to tax obligations.

Another document bearing resemblance is the Form 4562, used for depreciation and amortization. This form, like the PTAX-401, requires detailed information about property and equipment, including the cost, date of service, and usage purpose. Businesses use Form 4562 to report on the depreciation of assets, an area that overlaps with the PTAX-401’s focus on pollution control facilities' operational costs and depreciation rates.

The IRS Form 8824, pertaining to Liked-Kind Exchanges, also shares common ground with the PTAX-401. Form 8824 is used when a taxpayer exchanges property used in a trade or business for another property of like kind. This exchange necessitates detailed reporting on the nature of the property, similar to how the PTAX-401 mandates descriptions of pollution control facilities and their usage. Both forms emphasize the importance of detailed asset descriptions in the context of tax reporting.

Form 4797, Sale of Business Property, is another document with similarities to the PTAX-401. This form is necessary for reporting the sale or exchange of property used in a business, much like the PTAX-401 requires specifics about the installation, operational status, and financial implications of pollution control facilities. Both forms delve into the financial ramifications of asset status changes, highlighting gains or losses that impact tax calculations.

The EPA's Toxic Release Inventory (TRI) Form R serves a different but complementary purpose to the PTAX-401. While the TRI Form R focuses on the environmental reporting of toxic chemical releases, the PTAX-401 addresses the taxation aspects of facilities controlling such pollution. Both forms necessitate detailed information about the business and its operations, tying financial implications to environmental stewardship.

Finally, a counterpart at the state level, the Illinois Business Income Tax Return (Form IL-1120), aligns with the PTAX-401 in its aim to gather business financials within Illinois. While the IL-1120 captures broader income, deductions, and tax credits, the PTAX-401 zeroes in on the specifics regarding pollution control facilities, illustrating a targeted approach within the larger framework of state tax obligations. Both forms play critical roles in fulfilling fiscal responsibilities, tailored to specific aspects of business operations.

Dos and Don'ts

When filling out the PTAX-401 form for the Illinois Department of Revenue, there are several do's and don'ts you should keep in mind to ensure the process is completed accurately and efficiently. This guidance can help navigate the complexities of the form, related to pollution control facility tax returns.

Do:- Ensure all preprinted information is correct. If there are any inaccuracies, cross out the incorrect details and write the correct information clearly.

- Write the assessment year carefully, ensuring it reflects the correct year for which the tax return is being filed.

- Provide a specific description of the pollution control facility as written on the Illinois EPA certification. This ensures clarity regarding the nature of the facility being reported.

- Include the location of the pollution control facility accurately, not forgetting to add the street address, city, state, ZIP, and county. Including the property index number (PIN) where applicable further enhances the specificity of the information provided.

- Detail the estimated remaining useful life of the facility as well as the original cost of the certified portion of the facility, facilitating an accurate assessment.

- Describe any changes in the use of the facility within the previous assessment year, including additions or improvements. This provides a current view of the facility’s status and valuation.

- Sign the form as the pollution control facility owner or an authorized representative, indicating the accuracy and completeness of the information provided to the best of your knowledge.

- Leave sections blank. If a question does not apply or the answer is “None”, explicitly state this rather than leaving the space empty. This avoids any presumptions of oversight or incomplete information.

- Forget to write the three-digit classification number of the pollution control facility. This classification is essential for tax purposes and must be retrieved from the accompanying instructions.

- Overlook detailing any byproducts that can be commercially sold or if the operation of the facility results in increased production or reduced production costs. These details can significantly impact the assessment.

- Omit the date the facility or any additions or improvements were placed into use. This information is crucial for determining the applicable assessment year.

- Provide estimates or rounded figures where exact numbers are required, especially regarding costs and dates. Precision is key to an accurate tax return.

- Send the form without reviewing it for completeness and accuracy. A double-check can prevent errors that might delay processing.

- Mail the return to an outdated address. Always verify the current mailing address for the Local Government Services Bureau to ensure the form is received and processed.

By following these recommended practices, individuals can confidently complete the PTAX-401 form, enhancing the efficiency of the process and contributing to accurate tax documentation for pollution control facilities in Illinois.

Misconceptions

When dealing with the PTAX-401 form, also known as the Pollution Control Facility Tax Return in Illinois, there are several common misconceptions that can lead to confusion and errors. Clearing up these misunderstandings is crucial for ensuring accurate filing and compliance with state requirements.

- Misconception 1: The PTAX-401 form is only for large corporations.

- Misconception 2: Only air and water pollution control facilities need to file this form.

- Misconception 3: The assessment year and the fiscal year are the same.

- Misconception 4: Reporting the original cost details is optional.

- Misconception 5: If a facility is no longer in use, the PTAX-401 form doesn't need to be filed.

- Misconception 6: The PTAX-401 form doesn't account for retired facilities.

- Misconception 7: Federal Employer Identification Number (FEIN) or Social Security number (SSN) details are optional.

- Misconception 8: Byproducts and operational efficiencies do not need to be disclosed.

This assumption is incorrect. The form is relevant for any entity, regardless of size, that operates a certified pollution control facility in Illinois. This encompasses a broad spectrum of businesses, not solely large corporations.

While air and water pollution controls are common, the PTAX-401 form also covers facilities dealing with other forms of pollution control, including low-sulfur dioxide emission coal-fueled devices. It's important to recognize the form's applicability to a variety of pollution control facilities.

The assessment year referred to in the PTAX-401 form is not necessarily aligned with a company's fiscal year. Understanding this distinction helps avoid confusion when completing the form regarding the relevant period for reporting.

One crucial aspect of the PTAX-401 is accurately reporting the original cost of the certified portion of the facility and any subsequent additions or improvements. These figures are not optional but required for determining the facility's assessed value.

Even if a facility is not currently in operation, if it was used at any point during the assessment year, it must be reported. Additionally, if wishing to revoke certification, this intention must be indicated on the form.

This form requires information on all certified portions of the facility, including those that have been retired or removed from use. This element is crucial for adjusting the overall value and tax implications of the pollution control facility.

Providing either a FEIN or an SSN, depending on the entity's status, is mandatory for identification and processing purposes. These details are essential for the Illinois Department of Revenue's records.

The PTAX-401 form specifically asks about byproducts that can be commercially sold and whether the operation results in increased production or reduced costs. These factors can significantly affect the facility's tax implications and must be reported accurately.

Understanding these misconceptions and correcting any misapprehensions can ensure proper compliance and avoid potential issues with the Illinois Department of Revenue. It's vital for businesses to approach the PTAX-401 form with a clear and accurate understanding of its requirements.

Key takeaways

Filling out the PTAX-401 form, essential for reporting on pollution control facilities in Illinois, requires precision and a comprehensive understanding of the facility's operations. Below are key takeaways designed to guide users through this process effectively:

- The PTAX-401 form applies to various types of pollution control facilities, including air pollution, water pollution, and low-sulfur dioxide emission coal-fueled devices. It's critical to correctly identify the type of facility right at the beginning of the form.

- Accurate and current information is crucial. If the pre-printed label contains outdated or incorrect details, it's important to correct this information directly on the form to ensure the Illinois Department of Revenue has the latest data.

- The form requires detailed descriptions of the pollution control facility, including the assessment year, the nature of the business, and specific details about the facility's operation, like the Illinois EPA certification number and classification number.

- Understanding the financial aspects of the facility is necessary for completing the PTAX-401. Information such as the original cost, any additions or improvements, and the estimated remaining useful life of the facility are required for a comprehensive assessment.

- Operational changes, including additions, improvements, retirements, or changes in the use of the facility within the assessment year, must be accurately reported. This includes detailing any byproducts that can be commercially sold and whether the facility's operation results in increased production or reduced production costs.

- The declaration section at the end of the form is a testament to the accuracy and completeness of the information provided. It must be signed by the pollution control facility owner or an authorized representative, affirming the truthfulness and accuracy of all data included in the form.

Understanding the complexities and requirements of the PTAX-401 form is pivotal for compliant and efficient reporting to the Illinois Department of Revenue. By focusing on accurate data, financial specifics, and operational changes, facilities can ensure they meet all necessary reporting obligations.

Popular PDF Documents

Beethoven Lives Upstairs Answer Key - Unveils the interaction between Beethoven and Schindler, marking an important relationship in the composer's life.

Form 593 Instructions - The use of Form 593-V is a straightforward way for sellers to manage their tax responsibilities associated with the withholding on the transfer of property.

Cab Bill Format in Word - A user-friendly format for documenting travel details and expenses incurred during a taxi ride from Washington Dulles Airport.