Get Ptax 343 R Form

Navigating the PTAX-343-R form is a crucial step for individuals seeking to maintain their Disabled Persons’ Homestead Exemption (DPHE). This vital form, which must be filed annually with the Chief County Assessment Officer (CCAO), serves as the backbone for verifying eligibility to continue enjoying a significant reduction in property tax. The meticulous process outlined in the form ensures that those who are genuinely eligible do not face the termination of their exemption due to procedural oversights. By providing details such as property ownership, residence status, and evidence of disability, applicants reaffirm their claim to the exemption set forth by Illinois law. The form not only assists in the administrative verification but also guides applicants through the process of documenting any changes in their disability status, thereby safeguarding their benefits. This comprehensive mechanism, embodied in the PTAX-343-R, underscores the importance of annual reassessment to both the state and the beneficiaries, ensuring that the support reaches those who need it most. Alongside, the form serves as a reminder of the ongoing commitment required from applicants, including the attention to filing deadlines and the potential need for additional documentation, thereby promoting a rigorous but fair assessment process.

Ptax 343 R Example

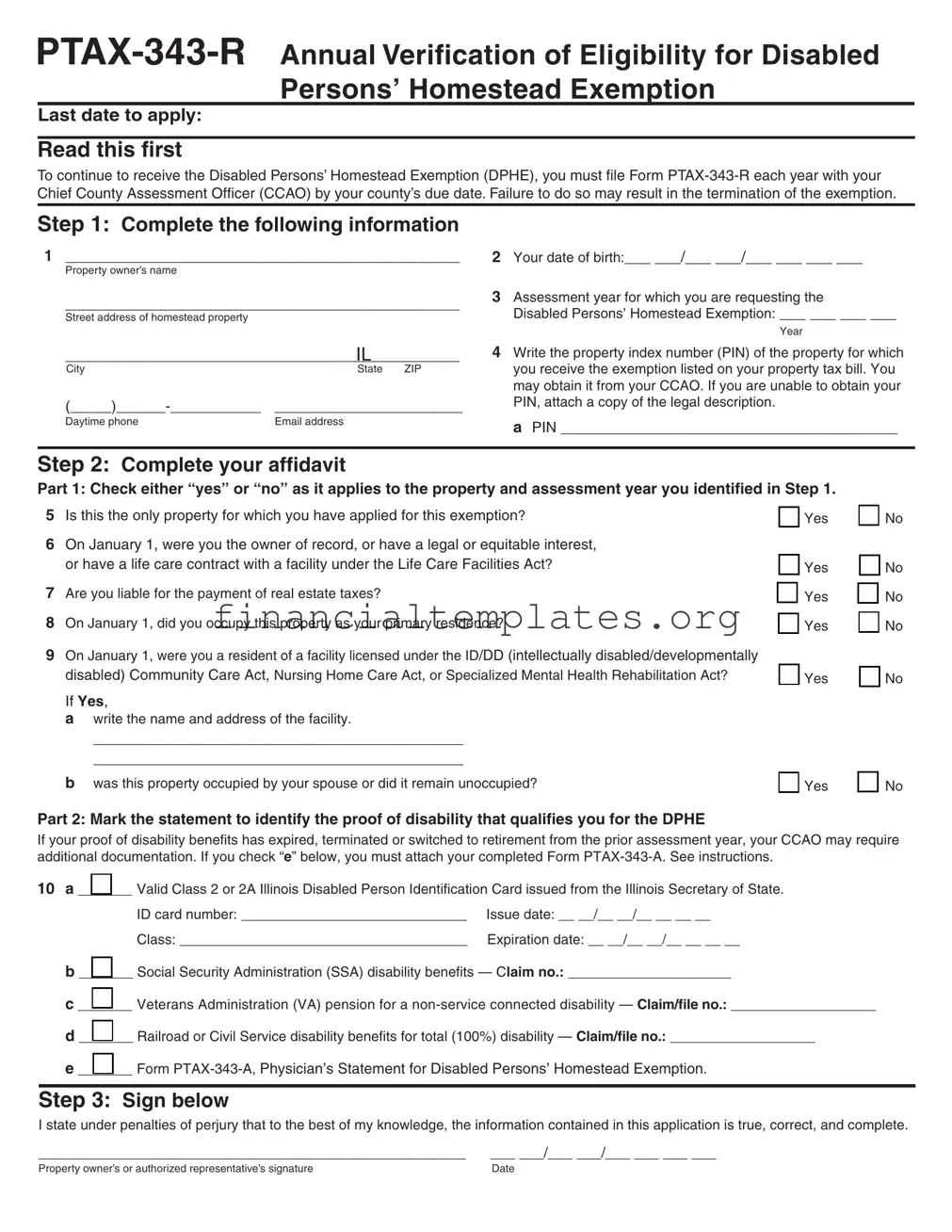

Last date to apply:

Read this first

To continue to receive the Disabled Persons’ Homestead Exemption (DPHE), you must file Form

Step 1: Complete the following information

1________________________________________________

Property owner’s name

________________________________________________

Street address of homestead property

2Your date of birth:___ ___/___ ___/___ ___ ___ ___

3Assessment year for which you are requesting the

Disabled Persons’ Homestead Exemption: ___ ___ ___ ___

Year

|

IL |

City |

State ZIP |

Daytime phone |

Email address |

4Write the property index number (PIN) of the property for which you receive the exemption listed on your property tax bill. You may obtain it from your CCAO. If you are unable to obtain your PIN, attach a copy of the legal description.

a PIN _________________________________________

Step 2: Complete your affidavit

Part 1: Check either “yes” or “no” as it applies to the property and assessment year you identified in Step 1.

5 Is this the only property for which you have applied for this exemption? |

|

Yes |

6On January 1, were you the owner of record, or have a legal or equitable interest,

|

or have a life care contract with a facility under the Life Care Facilities Act? |

|

Yes |

|

7 |

Are you liable for the payment of real estate taxes? |

|

|

Yes |

|

|

|||

8 |

|

|

|

|

On January 1, did you occupy this property as your primary residence? |

|

Yes |

||

9On January 1, were you a resident of a facility licensed under the ID/DD (intellectually disabled/developmentally

disabled) Community Care Act, Nursing Home Care Act, or Specialized Mental Health Rehabilitation Act? |

|

Yes |

If Yes,

awrite the name and address of the facility.

_____________________________________________

_____________________________________________

b was this property occupied by your spouse or did it remain unoccupied? |

|

Yes |

No

No

No

No

No

No

No

No

Part 2: Mark the statement to identify the proof of disability that qualifies you for the DPHE

If your proof of disability benefits has expired, terminated or switched to retirement from the prior assessment year, your CCAO may require additional documentation. If you check “e” below, you must attach your completed Form

10a _______ Valid Class 2 or 2A Illinois Disabled Person Identification Card issued from the Illinois Secretary of State.

ID card number: _____________________________ |

Issue date: __ __/__ __/__ __ __ __ |

Class: _____________________________________ |

Expiration date: __ __/__ __/__ __ __ __ |

b _______ Social Security Administration (SSA) disability benefits — Claim no.: _____________________

c _______ Veterans Administration (VA) pension for a

d _______ Railroad or Civil Service disability benefits for total (100%) disability — Claim/file no.: ___________________

e _______ Form

Step 3: Sign below

I state under penalties of perjury that to the best of my knowledge, the information contained in this application is true, correct, and complete.

____________________________________________________ ___ ___/___ ___/___ ___ ___ ___

Property owner’s or authorized representative’s signature |

Date |

Form

What is the Disabled Persons’ Homestead Exemption?

The Disabled Persons’ Homestead Exemption (DPHE) (35 ILCS

Who is eligible?

To qualify for the DPHE you must

•be disabled or have become disabled during the assessment year (i.e., cannot participate in any “substantial gainful activity by reason of a medically determinable physical or mental impairment” which will result in the person’s death or that will last for at least 12 continuous months),

•own or have a legal or equitable interest in the property on which a

•be liable for the payment of the property taxes.

If you previously received the DPHE and now reside in a facility licensed under the ID/DD (intellectually disabled/developmentally disabled) Community Care Act, Nursing Home Care Act, or Spe- cialized Mental Health Rehabilitation Act, you are still eligible to receive the DPHE provided your property

•is occupied by your spouse; or

•remains unoccupied during the assessment year.

If you are a resident of a cooperative apartment building or life care facility as defined under Section 2 of the Life Care Facilities Act (210 ILCS 40/1 et. seq.) you are still eligible to receive the DPHE provided you occupy the property as your primary residence and you are

•liable by contract with the owner(s) of record for the payment of the apportioned property taxes on the property; and

•an owner of record of a legal or equitable interest in the cooperative apartment building. Leasehold interest does not qualify for this exemption.

2Proof of Social Security Administration disability benefits which includes an award letter, verification letter or annual Cost of Living Adjustment (COLA) letter (only COLA Form

Forms

3Proof of Veterans Administration disability benefits which includes an award letter or verification letter indicating you are receiving a pension for a

4Proof of Railroad or Civil Service disability benefits which includes an award letter or verification letter of total (100%) disability.

When will I receive my exemption?

The year you apply (renew) for this exemption is referred to as the assessment year. The County Board of Review while in session for the assessment year has the final authority to grant your exemp- tion. If your exemption is granted, it will be applied to the property tax bill paid the year following the assessment year.

When and where must I file Form

To continue to receive this exemption, you must file

Form

File or mail your completed Form

Madison County, CCAO

157 N Main St Room 229 |

|

|

____________________________________________________ |

||

Mailing address |

|

|

Edwardsville |

IL |

62025 |

City |

|

ZIP |

618 |

692 |

6270 |

If you have any questions, call:

What documentation is required?

Your Chief County Assessment Officer (CCAO) may request you to provide documentation as proof of your disability to continue to qualify for the DPHE. You must provide documentation if your proof of disability has changed or expired from the prior year, including Social Security Administration’s disability benefits that switched over to retirement benefits. The proof of disability must be for the assessment year shown on Line 3 of this application.

If you are unable to provide any of the items listed below as proof of your disability, you must resubmit Form PTAX

1A Class 2 Illinois Disabled Person Identification Card from the Illinois Secretary of State’s Office. Class 2 or Class 2A qualifies for this exemption. Class 1 or 1A does not qualify.

Can I designate another person to receive a property tax delinquency notice for my property?

Yes. Contact your CCAO for information on how to designate an- other person to receive a duplicate of a property tax delinquency notice for your property.

Are there other homestead exemptions available for disabled persons or disabled veterans?

Yes. However, only one of the following disabled homestead exemp- tions may be claimed on your property for a single assessment year

•Disabled Veterans’ Homestead Exemption

•Disabled Persons’ Homestead Exemption

•Disabled Veterans’ Standard Homestead Exemption

|

|

|

|

Official use. Do not write in this space. |

|

||

Date received:___ ___/___ ___/___ ___ ___ ___ |

|

|

Board of review action date: ___ ___/___ ___/___ ___ ___ ___ |

||||

Verify Proof of Disability: |

1 |

2 |

3 |

4 |

Approved |

Denied |

|

Expiration date:___ ___/___ ___/___ ___ ___ ___ |

|

|

Reason for denial ________________________________________ |

||||

Comments:______________________________________________ |

_______________________________________________________ |

||||||

_______________________________________________________ |

_______________________________________________________ |

||||||

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | Annual Verification of Eligibility for Disabled Persons’ Homestead Exemption (DPHE) |

| Form Number | PTAX-343-R |

| Applicable Law | 35 ILCS 200/15-168 |

| Exemption Benefit | $2,000 reduction in the equalized assessed value (EAV) of the property |

| Eligibility Criteria | Must be disabled, own or have an interest in the property, and be liable for payment of property taxes |

| Application Deadline | Varies by county, must be filed annually with the Chief County Assessment Officer (CCAO) |

| Required Documentation | Evidence of disability, property ownership, and residency, among others |

| Failure to File | May result in termination of the exemption |

Guide to Writing Ptax 343 R

Filling out the PTAX-343-R form is a critical step for continuing to benefit from the Disabled Persons’ Homestead Exemption in the state of Illinois. This annual verification ensures that individuals who are eligible can enjoy a reduction in their property's equalized assessed value, thus lowering their property tax burden. Below, you'll find straightforward instructions on how to complete this form accurately. It's important to submit this form by the due date for your county to maintain your exemption. Failure to do so could lead to its termination, so take care to follow these steps closely.

- Complete the following information:

- Enter the "Property owner’s name" as registered.

- Fill in the "Street address of homestead property," including city, state, and ZIP code.

- Provide "Your date of birth" in the designated format MM/DD/YYYY.

- Indicate the "Assessment year" for which you're requesting the exemption, by entering the four-digit year.

- Write down the "property index number (PIN)" found on your property tax bill or attach a copy of the legal description if the PIN is unavailable.

- Include a daytime phone number and an email address for contact.

- Complete your affidavit:

- Answer "yes" or "no" to questions regarding ownership, liability for property taxes, primary residence status as of January 1, and if you were a resident of a licensed facility on January 1.

- If applicable, write the name and address of the facility.

- Indicate if the property was occupied by your spouse or remained unoccupied.

- Mark the statement that identifies the proof of disability:

- Select the appropriate identifier (a through e) for your proof of disability—this may include a valid Illinois Disabled Person Identification Card, Social Security Administration benefits, Veterans Administration pension, Railroad or Civil Service disability benefits, or a completed Form PTAX-343-A (Physician’s Statement).

- Provide necessary identification numbers and issue/expiration dates where required.

- Sign and date the form to affirm that the information provided is true, correct, and complete to the best of your knowledge, under penalties of perjury.

Upon completion, submit the form to the Chief County Assessment Office for your county by the provided due date. Assistance and specific due dates can be obtained by contacting your local CCAO. Remember to include any required documentation as proof of disability, especially if there has been any change from the previous year. Filing this form annually is essential to maintain your exemption and continue receiving property tax relief.

Understanding Ptax 343 R

What is the Disabled Persons' Homestead Exemption?

The Disabled Persons' Homestead Exemption (DPHE) provides a reduction in the equalized assessed value (EAV) of the primary residence of a disabled person by $2,000 annually. This exemption aims to lower the property tax burden on disabled individuals who are liable for paying property taxes on their homes.

Who is eligible for the DPHE?

To be eligible for the DPHE, an individual must meet the following conditions: they must be disabled or have become disabled during the assessment year, must own or hold a legal or equitable interest in the property used as their primary residence as of January 1 of the assessment year, and must be liable for the payment of property taxes on the residence. Eligibility is also extended to residents of facilities licensed under specific acts if the property is occupied by the spouse of the disabled person or remains unoccupied.

What documentation is required to apply for the DPHE?

Applicants must provide proof of disability, which could be a Class 2 Illinois Disabled Person Identification Card, documentation of Social Security Administration disability benefits, Veterans Administration non-service connected disability pension, Railroad or Civil Service disability benefits, or a completed Form PTAX-343-A, Physician’s Statement for Disabled Persons’ Homestead Exemption. If the proof of disability has changed or expired, additional documentation may be required by the Chief County Assessment Officer (CCAO).

When and where must I file Form PTAX-343-R?

The PTAX-343-R form must be filed annually with your county’s CCAO to continue receiving the DPHE. It is crucial to file by the county’s due date to avoid termination of the exemption. The filing location and contact information for assistance are provided by the local CCAO’s office.

What happens if I do not file the PTAX-343-R form or fail to provide the required documentation?

Failure to file Form PTAX-343-R or provide the necessary documentation by the due date may result in the termination of the DPHE. It's important to adhere to the filing deadlines and requirements specified by your CCAO.

Can I designate someone else to receive a property tax delinquency notice for my property?

Yes, you can designate another person to receive a duplicate of the property tax delinquency notice for your property. This can be arranged through your CCAO by providing the necessary information and authorization. This is beneficial for ensuring that important tax notices are attended to promptly, especially if the property owner has difficulty managing their affairs due to their disability.

Are there other homestead exemptions available for disabled persons or disabled veterans?

Yes, disabled individuals or disabled veterans may qualify for other types of homestead exemptions, such as the Disabled Veterans’ Homestead Exemption or the Disabled Veterans’ Standard Homestead Exemption. However, only one of these exemptions may be claimed on a property for a single assessment year. It's advised to review each exemption’s eligibility requirements to determine the most beneficial option.

Common mistakes

When applying for the Disabled Persons’ Homestead Exemption using the PTAX-343-R form, it's crucial to be attentive and thorough. Avoiding common mistakes can streamline the process and help ensure your exemption is processed without delays. Here are some key mistakes to avoid:

Not verifying the property index number (PIN) beforehand and entering it incorrectly or omitting it. The PIN is essential for identifying your property in the tax records.

Failing to confirm the assessment year for which the exemption is requested. This should match the current submission year unless specific circumstances dictate otherwise.

Incorrectly stating your occupancy status as of January 1. Your eligibility might depend on whether the property was your primary residence on this date.

Omitting the name and address of the facility if you were a resident of a licensed care facility on January 1. This information is crucial for verifying your eligibility under certain conditions.

Neglecting to mark the correct source of proof for disability. The form offers multiple options, and selecting the right one is critical for validating your exemption claim.

Forgetting to sign and date the form, which is a declaration under penalty of perjury that the information provided is accurate and complete.

Assuming previous documentation submitted in past years suffices. Proof of disability and other documentation may need to be updated annually.

Overlooking the need to attach additional required forms, such as the PTAX-343-A, if certain conditions apply.

Not checking with the Chief County Assessment Officer (CCAO) for any specific county-required documentation or guidelines, as these can vary and impact the filing process.

Avoiding these errors can greatly assist in the smooth processing of your Disabled Persons’ Homestead Exemption. Attention to detail and careful review of all requirements can help secure the benefits you are eligible for.

Documents used along the form

When applying for the Disabled Persons’ Homestead Exemption with the PTAX-343-R form, it's not uncommon to encounter a few additional forms and documents that you might need to gather or understand. These forms play a crucial role in ensuring that your application is complete and adheres to the requirements set forth. Here, we'll demystify what these accompanying documents are and offer a brief explanation for each.

- PTAX-343-A, Physician’s Statement for Disabled Persons’ Homestead Exemption: This form is crucial for verifying your eligibility for the exemption based on your disability status. A physician must complete it to provide proof of your condition.

- Proof of Social Security Administration (SSA) Disability Benefits: This could include an award letter, verification letter, or annual Cost of Living Adjustment (COLA) letter, which serves as evidence of your disability benefits from the SSA.

- Proof of Veterans Administration (VA) Disability Benefits: For veterans, this refers to any documentation, like an award letter or verification letter, that confirms you're receiving a pension for a non-service connected disability.

- Proof of Railroad or Civil Service Disability Benefits: Similar to the VA benefits' proof, this entails providing an award letter or verification letter that shows you're receiving total (100%) disability benefits from either the Railroad or Civil Service.

- Property Tax Bill: While not a form per se, your property tax bill is needed to indicate the Property Index Number (PIN) and confirm your liability for paying property taxes on the residence for which you're claiming the exemption.

- Legal Description of the Property: If obtaining your PIN is problematic, a legal description of the property can also serve as an alternative form of identification for your exemption application.

- Document Proving Ownership or Legal Interest: This could be a deed or a life care contract with a facility under the Life Care Facilities Act, proving you're the owner or have a contractual interest in the property you occupy.

While applying for the Disabled Persons’ Homestead Exemption, remember that each piece of documentation enables the Chief County Assessment Officer (CCAO) to assess your eligibility accurately. Gathering these documents beforehand can streamline your application process, ensuring a smoother path toward receiving your deserved benefits.

Similar forms

The Form PTAX-343-R, which serves as an annual verification for the Disabled Persons’ Homestead Exemption, shares similarities with other documents aimed at confirming eligibility for various exemptions or benefits. One such document is the homestead exemption application used in other states, which homeowners must submit to qualify for a reduction in their property taxes. Although the specific requirements can vary by state, the core purpose of establishing a homeowner’s eligibility for tax relief based on their residency status or personal circumstances, such as disability, mirrors that of the PTAX-343-R, emphasizing the need for regular submissions to maintain the exemption.

Another document resembling the PTAX-343-R is the application for a property tax freeze for senior citizens. This form also requires annual submission in certain jurisdictions and asks applicants to verify their age, income, and status as the property's primary resident. Like the PTAX-343-R, it is designed to provide financial relief to a specific group by reducing the property tax burden, though it targets senior citizens based on age and income rather than individuals with disabilities.

The Veterans’ Disability Exemption form, which veterans with disabilities must fill out to receive property tax exemptions, also parallels the PTAX-343-R. Both documents require evidence of the applicant's status—disability in the case of PTAX-343-R and military service-related disability for the veterans’ exemption. Applicants must provide proper documentation annually or as required to prove their continued eligibility for the benefit, highlighting the importance of sustaining support for those with recognized needs.

The Social Security Disability Insurance (SSDI) benefits application process shares similarities with the PTAX-343-R form in terms of demonstrating eligibility based on a disability. Applicants for SSDI must provide extensive documentation proving their disability and how it affects their ability to work, much like how PTAX-343-R applicants must demonstrate eligibility for the homestead exemption due to their disability status.

Applications for reduced fare or paratransit services for persons with disabilities offered by public transit authorities also echo the PTAX-343-R form's purpose and process. These forms typically require yearly submission along with proof of disability, paralleling the annual verification necessity of the PTAX-343-R to ensure the individual still qualifies for the exemption based on their disability.

The Low-Income Housing Tax Credit (LIHTC) application requires individuals to verify their income annually to maintain eligibility for affordable housing. While focused on income rather than disability, this process mirrors the PTAX-343-R’s yearly verification requirement, ensuring that only those who meet specific criteria benefit from the program designed to aid them.

Lastly, the application for the Supplemental Nutrition Assistance Program (SNAP) shares commonalities with the PTAX-343-R in terms of needing to regularly establish eligibility. SNAP applicants must periodically provide updates on their income and household situation, similar to how recipients of the Disabled Persons’ Homestead Exemption must annually verify their eligibility through the PTAX-343-R, reinforcing the ongoing nature of such support programs.

Each of these documents, while tailored to different exemptions, benefits, or services, fundamentally serves a similar purpose to the PTAX-343-R form. They require individuals to provide current information to confirm their continued eligibility for a specific benefit, reflecting a broad principle across various forms of assistance: maintaining accurate and up-to-date records to ensure that aid reaches those who genuinely qualify.

Dos and Don'ts

When preparing to fill out the PTAX-343-R form for the Disabled Persons’ Homestead Exemption, it is important to follow guidelines that can ensure the process is smooth and successful. Here are some recommended dos and don'ts:

Dos:

- Verify all personal information, including the property owner's name, address, and identification details, for accuracy before submission to avoid any processing delays.

- Consult and adhere to the specific due date provided by your county to submit the form to your Chief County Assessment Officer (CCAO), ensuring that you do not miss the deadline.

- Attach the necessary proof of disability as required. This documentation could vary from a Class 2 Illinois Disabled Person Identification Card to proof of Social Security Administration disability benefits, among others stated on the form.

- Double-check that all sections of the form relevant to your circumstances are correctly filled out, including whether the property is your primary residence and if it was occupied by your spouse or remained unoccupied as of January 1.

- Ensure your signature and the date are included on the form to certify the accuracy and completeness of the information under penalties of perjury.

Don'ts:

- Do not leave required fields blank. Incomplete applications may result in delays or denial of your exemption.

- Avoid submitting the form without the required proof of disability. Failure to attach the necessary documentation will likely result in the rejection of your application.

- Do not overlook the significance of submitting the form each year. Failing to reapply annually may result in the termination of your exemption.

- Refrain from providing inaccurate information. Misrepresentation can lead to serious consequences, including legal action.

- Do not hesitate to contact your CCAO for clarification or assistance if you encounter any difficulties in understanding the form or if you need help determining the necessary documentation.

Misconceptions

Understanding the PTAX-343-R form and the Disabled Persons' Homestead Exemption (DPHE) is vital for homeowners seeking to benefit from this relief program. However, there are common misconceptions that need to be clarified to ensure eligible individuals can smoothly apply for and continue to receive their exemption. Here are six misconceptions explained:

- You only need to file PTAX-343-R once. This is incorrect. For continued benefit, it is mandatory to file the PTAX-343-R form annually with your Chief County Assessment Officer (CCAO) by the county’s specified due date. Failing to file annually may result in the loss of the exemption.

- Any form of disability qualifies for the DPHE. Not every disability qualifies for the DPHE. Eligibility is based on being unable to engage in substantial gainful activity due to a medically determinable physical or mental impairment, which can either result in death or is expected to last for a continuous period of not less than 12 months.

- The exemption is automatically applied every year. The exemption is not automatic; homeowners need to actively file the PTAX-343-R form yearly. The assessment year you apply or renew your exemption determines when the benefit will reflect on your property tax bill — typically, it's applied to the bill paid the year following the assessment year.

- Proof of disability from any year is sufficient. Your proof of disability must be relevant to the assessment year mentioned on line 3 of your application. If your proof has expired, terminated, or if you have switched to retirement benefits, additional or updated documentation will be required by your CCAO.

- Only the property owner can file the form. If necessary, an authorized representative can complete and sign the PTAX-343-R form on behalf of the property owner. This flexibility ensures that those who might be unable to file personally due to their condition can still benefit from the exemption.

- Any disabled person residing in a facility is ineligible. Residents of licensed ID/DD, Nursing Home Care, or Specialized Mental Health Rehabilitation facilities can still qualify for the DPHE. The key criteria are that the property must remain the primary residence of the disabled person; it should be occupied by their spouse, or it must remain unoccupied during the assessment year.

Addressing these misconceptions is crucial to ensuring that eligible disabled persons can avail themselves of the DPHE without unnecessary hurdles. Always consult with your Chief County Assessment Officer for the most accurate and personalized advice regarding your situation.

Key takeaways

Filling out the PTAX-343-R form accurately is crucial for disabled persons seeking to maintain their Homestead Exemption. This document is key to ensuring the continuation of a valuable property tax benefit. Here are some key takeaways to guide you through this process:

- The PTAX-343-R form must be submitted annually to your Chief County Assessment Officer (CCAO) by the county’s stipulated deadline. Failure to submit this form on time can lead to the termination of the Disabled Persons’ Homestead Exemption (DPHE).

- When completing the form, it's essential to include your property index number (PIN), which can be found on your property tax bill or obtained from your CCAO. If you cannot find your PIN, attaching a copy of the legal description of your property is necessary.

- Proof of disability is a critical component of maintaining your exemption. Acceptable proofs include a Class 2 or 2A Illinois Disabled Person Identification Card, Social Security Administration disability benefits, Veterans Administration disability pension, or Railroad or Civil Service disability benefits.

- If your proof of disability has expired, been terminated, or if you have switched to retirement benefits since the previous assessment year, you may need to provide additional documentation to your CCAO.

- In cases where your disability status or proof changes, submitting Form PTAX-343-A, a Physician’s Statement for Disabled Persons’ Homestead Exemption, alongside the PTAX-343-R, becomes necessary. This form requires completion by a physician, and any associated costs are the applicant's responsibility.

- Eligibility for the DPHE demands that the applicant must own or have a legal or equitable interest in the property, occupy it as their primary residence as of January 1 of the assessment year, and be liable for the payment of property taxes.

- Residents of cooperative apartment buildings or life care facilities can still qualify for the DPHE, provided they meet certain criteria regarding their residence and tax liability.

- It's possible to designate another person to receive property tax delinquency notices for your property, which can be especially useful for individuals who may not be residing in their homes due to medical or other reasons.

- The PTAX-343-R form also elucidates that while multiple homestead exemptions exist for disabled persons or veterans, only one of these exemptions may be applied to a property in a single assessment year.

Understanding and adhering to these guidelines when completing the PTAX-343-R form ensures that eligible disabled persons can continue to benefit from the Disabled Persons’ Homestead Exemption without interruption.

Popular PDF Documents

Application for Car Loan - Incorporates safeguards such as the guarantee of lien perfection and vehicle checks to protect both lender and borrower interests.

Va Home Loan Checklist - A one-stop form for veterans to review and verify all pertinent information related to their VA loan application.

Are Credit Card Tips Taxed on Paycheck - For ease of use, the City of Bethlehem Tax Bureau provides a pre-addressed envelope with the form for sending it via mail.