Get Ptax 343 A Form

For individuals seeking the Disabled Persons’ Homestead Exemption (DPHE), a critical step involves proving one's disability status. This is where the PTAX-343-A form, titled 'Physician’s Statement for Disabled Persons’ Homestead Exemption,' comes into play. Designed to fulfill this requirement, the form necessitates completion by both the applicant and a licensed physician in Illinois. It serves as an alternate proof of disability for those who may not possess other acceptable documentation, such as a Class 2 Illinois Disabled Person Identification Card, Social Security Administration disability benefits, Veterans Administration disability benefits, or benefits from Railroad or Civil Service. The form details the specifics of the applicant's impairment, relying on the physician to certify the disability according to the Social Security Administration’s criteria. Besides personal and physician details, the form demands information on the nature and expected duration of the disability, along with an assessment of whether it impedes the applicant's ability to perform work as before. This documentation must be submitted to the Chief County Assessment Officer (CCAO) before the designated deadline for the DPHE application, imposing a responsibility on applicants to bear any associated physician costs. As this form bridges the gap for those lacking standard proof of disability, it underscores the intricacies of attaining the DPHE, highlighting the collaborative role of healthcare professionals and the stringent requirements set forth by authorities to ensure only eligible individuals benefit from this exemption.

Ptax 343 A Example

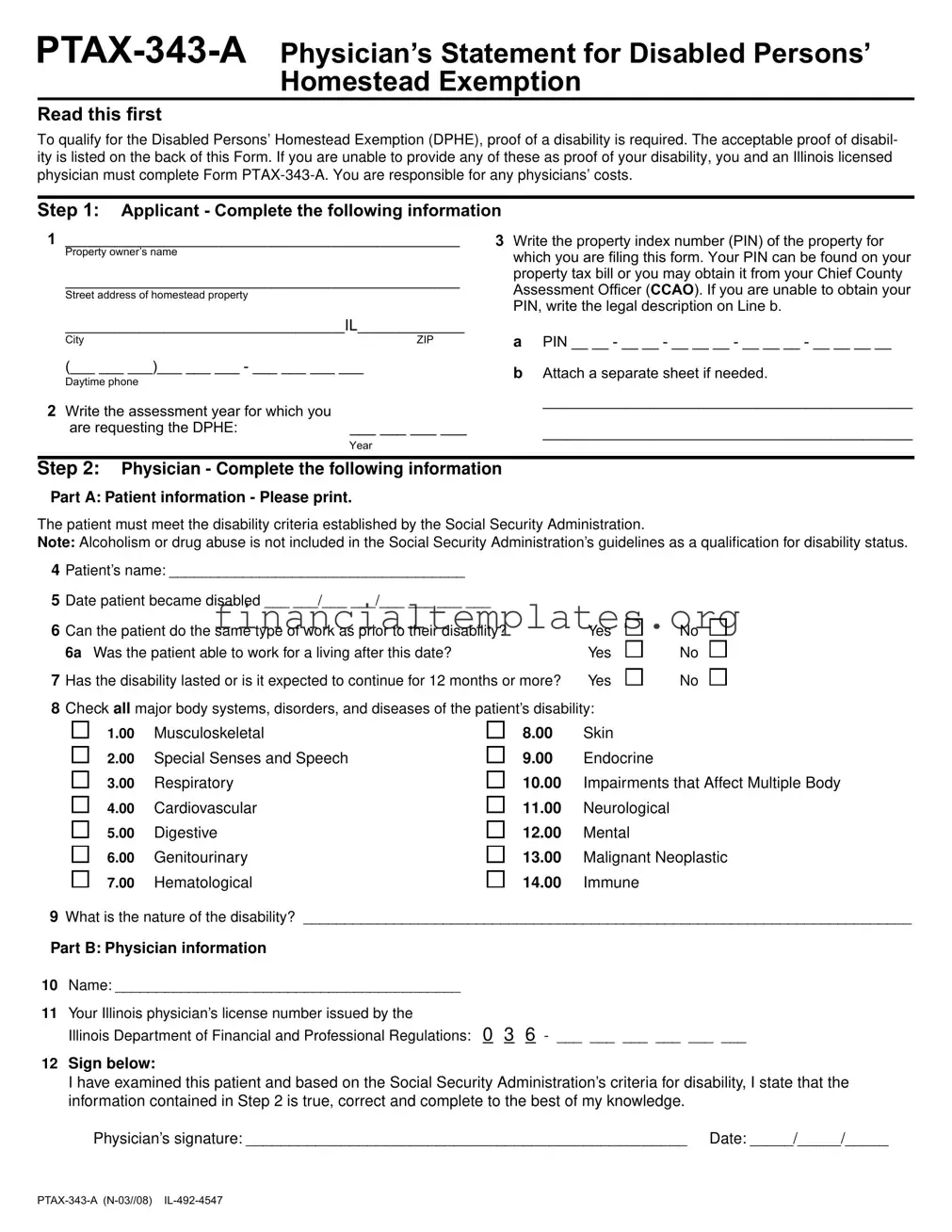

Read this first

To qualify for the Disabled Persons’ Homestead Exemption (DPHE), proof of a disability is required. The acceptable proof of disabil- ity is listed on the back of this Form. If you are unable to provide any of these as proof of your disability, you and an Illinois licensed physician must complete Form

Step 1: Applicant - Complete the following information

1________________________________________________

Property owner’s name

________________________________________________

Street address of homestead property

3Write the property index number (PIN) of the property for which you are fi ling this form. Your PIN can be found on your property tax bill or you may obtain it from your Chief County Assessment Officer (CCAO). If you are unable to obtain your PIN, write the legal description on Line b.

__________________________________IL_____________

City |

ZIP |

(___ ___ ___)___ ___ ___ - ___ ___ ___ ___

Daytime phone

2Write the assessment year for which you

are requesting the DPHE: |

___ ___ ___ ___ |

|

Year |

aPIN __ __ - __ __ - __ __ __ - __ __ __ - __ __ __ __

bAttach a separate sheet if needed.

_____________________________________________

_____________________________________________

Step 2: Physician - Complete the following information

Part A: Patient information - Please print.

The patient must meet the disability criteria established by the Social Security Administration.

Note: Alcoholism or drug abuse is not included in the Social Security Administration’s guidelines as a qualification for disability status.

4Patient’s name: ____________________________________

5Date patient became disabled ___ ___/___ ___/___ ___ ___ ___

6 |

Can the patient do the same type of work as prior to their disability? |

Yes |

|

6a Was the patient able to work for a living after this date? |

Yes |

7 |

Has the disability lasted or is it expected to continue for 12 months or more? |

Yes |

8Check all major body systems, disorders, and diseases of the patient’s disability:

No No

No

1.00Musculoskeletal

2.00Special Senses and Speech

3.00Respiratory

4.00Cardiovascular

5.00Digestive

6.00Genitourinary

7.00Hematological

8.00Skin

9.00Endocrine

10.00Impairments that Affect Multiple Body

11.00Neurological

12.00Mental

13.00Malignant Neoplastic

14.00Immune

9What is the nature of the disability? __________________________________________________________________________

Part B: Physician information

10Name: __________________________________________

11Your Illinois physician’s license number issued by the

Illinois Department of Financial and Professional Regulations: 0 3 6 - ___ ___ ___ ___ ___ ___

12Sign below:

I have examined this patient and based on the Social Security Administration’s criteria for disability, I state that the information contained in Step 2 is true, correct and complete to the best of my knowledge.

Physician’s signature: ___________________________________________________ Date: _____/_____/_____

General Information

To qualify for the Disabled Persons’ Homestead Exemption (DPHE), proof of a disability is required. The acceptable proof of disability is listed below. If you are unable to provide any of these as proof of your disability, you and an Illinois licensed physician must complete Form

You are responsible for any physicians’ costs.

What is considered proof of disability?

1A Class 2 Illinois Disabled Person Identification Card from the Illinois Secretary of State’s Office. Class 2 or Class 2A qualifies, Class 1 or 1A does not qualify.

2Proof of Social Security Administration (SSA) disability benefits which includes an award letter, verification letter or annual Cost of Living Adjustment (COLA) letter

(only Form

3Proof of Veterans Administration disability benefits which includes an award letter or verification letter indicating you are receiving a pension for a

4Proof of Railroad or Civil Service disability benefits which includes an award letter or verification letter of total (100%) disability.

When and where must I file this Form

You must fi le Form

File or mail your completed Form

_______________________________________ County, CCAO

____________________________________________________

Mailing address

|

IL |

City |

ZIP |

If you have any questions, please call:

Social Security Administration’s Listing of Impairments

The Listing of Impairments describes, for each major body system, impairments that are considered severe enough to prevent a person from doing any gainful activity. Most of the listed impairments are permanent or expected to result in death, or a specific state- ment of duration is made. For all others, the evidence must show that the impairment has lasted or is expected to last for a continuous period of at least 12 months. The criteria in the listing of impairments are applicable to evaluation of claims for disability benefits from the Social Security Administration (SSA). Visit SSA web site for more specific information.

1.00 |

Musculoskeletal System |

8.00 |

Skin Disorders |

2.00 |

Special Senses and Speech |

9.00 |

Endocrine System |

3.00 |

Respiratory System |

10.00 |

Impairments that Affect Multiple Body Systems |

4.00 |

Cardiovascular System |

11.00 |

Neurological |

5.00 |

Digestive System |

12.00 |

Mental Disorders |

6.00 |

Genitourinary System |

13.00 |

Malignant Neoplastic Diseases |

7.00 |

Hematological Disorders |

14.00 |

Immune System |

|

|

|

Offi cial use. Do not write in this space. |

|

|

Date received: ___ ___/___ ___/___ ___ ___ ___ |

DFPR license verifi ed: ___ ___/___ ___/___ ___ ___ ___ |

||||

Month |

Day |

Year |

Month |

Day |

Year |

|

|

|

|||

Comments:______________________________________________

_______________________________________________________

_______________________________________________________

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | The PTAX-343-A form is required for individuals seeking the Disabled Persons’ Homestead Exemption (DPHE) in Illinois when they cannot provide standard proof of disability. |

| 2 | Standard proof of disability includes a Class 2 Illinois Disabled Person Identification Card, Social Security Administration disability benefits, Veterans Administration disability benefits, or Railroad or Civil Service disability benefits. |

| 3 | This form needs to be completed collaboratively by the applicant and an Illinois licensed physician, affirming the applicant's disability based on Social Security Administration’s criteria. |

| 4 | The form outlines specific information about the disability including the nature of the disability and whether it affects the individual's ability to work. |

| 5 | Applicants are responsible for any costs associated with the physician’s completion of the form. |

| 6 | The completed PTAX-343-A form must be filed with the Chief County Assessment Officer (CCAO) of the applicant's county before the due date for the Disabled Persons’ Homestead Exemption (DPHE) application. |

Guide to Writing Ptax 343 A

To acquire the Disabled Persons’ Homestead Exemption (DPHE), demonstrating proof of disability is essential. However, if you're unable to procure any listed acceptable proofs of disability, filling out the Form PTAX-343-A is your next step, requiring a cooperative effort between you and an Illinois licensed physician. Keep in mind, any expense for the physician's services falls upon you. Here's a step-by-step guide on how to fill out this form correctly and efficiently.

- Applicant Section: Begin by filling in your personal information.

- Enter your full name as the property owner.

- Provide the street address, including the city and ZIP code, of the homestead property for which you are seeking the exemption.

- For the property index number (PIN), refer to your property tax bill or contact your Chief County Assessment Officer if you're unsure. If the PIN is unavailable, provide the legal property description instead.

- Note down the assessment year for which you're requesting the DPHE.

- Include your daytime phone number for any necessary communication.

- Physician Section: This part of the form must be completed by an Illinois licensed physician, who will verify your disability based on specific criteria.

- The physician should print the patient’s name clearly.

- The date you were determined disabled must be recorded.

- Answer whether you’re able to engage in any employment similar to what you did before your disability.

- Confirm if the disability is expected to last for at least 12 months or more.

- Select all applicable conditions from the list that relate to your disability.

- Describe the nature of the disability in detail.

- The physician must include their name and Illinois license number.

- Finally, the physician signs and dates the form, thereby certifying the accuracy of the provided information.

After adequately filling out the form, it’s necessary to submit it to your Chief County Assessment Officer (CCAO) before the deadline for the DPHE application in your county. The specific address where you should file this form can be found through your county's CCAO office. Should any queries or uncertainties arise during the process, don't hesitate to reach out to the provided contact number of your CCAO for guidance and assistance. Remember, timely and accurate completion and submission of the PTAX-343-A form are crucial steps in qualifying for the DPHE, helping you possibly reduce the tax burden on your homestead property as a disabled person in Illinois.

Understanding Ptax 343 A

What is the PTAX-343-A form, and who needs to complete it?

The PTAX-343-A form, known as the Physician’s Statement for Disabled Persons’ Homestead Exemption, is a crucial document for individuals seeking to qualify for the Disabled Persons’ Homestead Exemption (DPHE) in Illinois. This exemption aims to provide tax relief to disabled residents by reducing the taxable value of their homes, making their financial responsibilities lighter. To be eligible, proof of disability is required, and the form must be filled out by both the applicant and a licensed Illinois physician if the standard proofs of disability are not available. These standard proofs include identification cards, letters from the Social Security Administration, Veterans Administration benefits letters, and Railroad or Civil Service disability benefits. Individuals who cannot provide such documentation must then complete the PTAX-343-A form, bearing any associated physician's costs.

What constitutes acceptable proof of disability for the DPHE without needing the PTAX-343-A form?

Acceptable proofs of disability, bypassing the need for the PTAX-343-A form, include several specific documents: a Class 2 or Class 2A Illinois Disabled Person Identification Card from the Illinois Secretary of State’s Office (excluding Class 1 or 1A), an award letter or verification letter from the Social Security Administration regarding disability benefits, or similar documentation from the Veterans Administration or for Railroad or Civil Service total (100%) disability benefits. These documents serve as direct evidence of a recognized disability under state and federal guidelines, streamlining the qualification process for the exemption.

When and where do I need to file the PTAX-343-A form?

The submission of the PTAX-343-A form requires precise timing and an appropriate destination. It must be filed with your county's Chief County Assessment Officer (CCAO) before a specified due date for the Disabled Persons’ Homestead Exemption applications each year. Since deadlines can vary by county, reaching out to the local CCAO's office for specific dates and mailing instructions is advisable. Prompt submission ensures your application is considered for the current assessment year, potentially leading to significant property tax savings.

Who is responsible for the costs associated with the physician's completion of the form?

It is the applicant's responsibility to bear any costs incurred for the physician's services in completing the PTAX-343-A form. This includes consultations, examinations, and any related medical services required to determine the nature and extent of the disability in alignment with the form's requirements. Because this can lead to additional expenses, applicants should prepare in advance to meet this obligation, ensuring a smooth completion and submission process.

What kinds of disabilities are recognized for DPHE eligibility through form PTAX-343-A?

The disabilities recognized for DPHE eligibility encompass a broad range of conditions that significantly impair one's ability to perform work or everyday activities, as established by the Social Security Administration’s guidelines. Exclusions are specified for conditions such as alcoholism and drug abuse. The PTAX-343-A form explicitly asks the physician to identify the applicant's disability, selecting from categories including musculoskeletal disorders, respiratory conditions, cardiovascular illnesses, neurological disorders, mental disorders, and more. The fundamental criterion is that the disability must last or is expected to continue for at least 12 months, mirroring the rigorous standards used by the Social Security Administration to define disability.

Common mistakes

When completing the PTAX-343-A form for the Disabled Persons’ Homestead Exemption, individuals often make a variety of mistakes that can affect their application. Understanding these common errors can help ensure that the application process goes smoothly.

Not providing complete information in the applicant section, including the full name, street address of the homestead property, and particularly the property index number (PIN) or the legal description when the PIN is not available.

Failure to accurately write the assessment year for which the Disabled Persons’ Homestead Exemption is being requested, leading to potential delays in processing the exemption.

Omitting required details in the physician section, such as the physician's name, Illinois license number, or neglecting to have the physician’s signature on the form.

Overlooking the necessity to check the appropriate boxes indicating the major body systems, disorders, and diseases related to the patient’s disability, which is essential for validating the disability claim.

Incorrectly identifying the nature of the disability, or providing vague or insufficient descriptions which could result in the need for further clarification and possible delays.

Neglecting to attach additional necessary documents or sheets when more space is needed to explain the property details or to provide a comprehensive record of the disability.

It is also important to be aware of what is considered adequate proof of disability and the acceptable documents required for the application. Making sure to avoid these common mistakes can significantly streamline the application process.

Documents used along the form

When applying for the Disabled Persons’ Homestead Exemption (DPHE) with the PTAX-343-A Physician’s Statement, applicants often need to supplement their application with other forms and documents to ensure a successful submission. These additional forms not only support the primary application but also help in establishing the eligibility and authenticity of the applicant's claims for the exemption. The understanding of these documents facilitates a smoother application process for both applicants and reviewers.

- Illinois Disabled Person Identification Card - Issued by the Illinois Secretary of State’s Office, it serves as a qualifying proof of disability. Only Class 2 or Class 2A cards are accepted.

- Social Security Administration (SSA) Disability Benefits Proof - This includes an award letter, verification letter, or annual Cost of Living Adjustment (COLA) letter for those receiving SSA disability benefits.

- Veterans Administration Disability Benefits Proof - An award or verification letter indicating the applicant receives a pension for a non-service connected disability confirms eligibility for the DPHE.

- Railroad or Civil Service Disability Benefits Proof - An award letter or verification letter of total (100%) disability from either of these services is required for DPHE eligibility verification.

- Property Tax Bill or Legal Property Description - To establish property ownership, either a current property tax bill or a detailed legal description of the property must be provided.

- Proof of Residency - Documents such as utility bills or state-issued IDs verify the applicant's residency at the homestead property.

- Annual Cost of Living Adjustment (COLA) Letter - Specifically from the SSA, this document supports claims of ongoing disability benefits.

- Supplemental Security Income (SSI) Disability Benefits Letter - For applicants under the age of 65, a letter indicating SSI payments confirms financial assistance due to disability.

Understanding the necessity of each document listed above ensures applicants are well-prepared when submitting their PTAX-343-A form for the Disabled Persons’ Homestead Exemption. Applicants should gather and verify all relevant documents before submission to avoid delays or denial due to incomplete applications. Each supporting document plays a crucial role in exemplifying the applicant’s eligibility and need for the exemption, paving the way for a smoother and more efficient review process.

Similar forms

The Ptax 343 A form, designed for those seeking the Disabled Persons' Homestead Exemption, necessitates validation of disability through a physician's certification. This requirement mirrors the structure of the SSA-16 Form (Application for Social Security Disability Insurance). The SSA-16 form mandates applicants to provide thorough medical evidence of their disability, relying on professional healthcare evaluations to determine eligibility. Both documents underscore the necessity for official, medical validation of disability, though they serve different governmental benefits, illustrating a shared dependency on credible medical testimony to support claims of disability.

Similarly, the Veteran's Affairs (VA) Disability Compensation form demands extensive documentation and physician statements regarding the extent and nature of a veteran's service-connected disabilities. Much like the Ptax 343 A form, which solicits a detailed physician's statement to establish eligibility for a property tax exemption, the VA's approach underscores a rigorous vetting process, ensuring that benefits are accorded to individuals whose disabilities materially impact their lives. These forms collectively reflect an overarching system of checks and balances, aiming to match benefits with genuine need, substantiated by professional medical opinions.

Another related document is the Railroad Retirement Board (RRB) Disability Annuity Application, which requires applicants to furnish medical evidence and physician's statements similar to the Ptax 343 A form's requirements. Applicants must prove that they are physically or mentally unable to perform their occupational duties, with a focus on the impact of their condition over a projected time. Both the RRB application and the Ptax 343 A form share a common principle: leveraging detailed medical assessments to determine the eligibility of individuals for specific benefits, underlining the critical role of healthcare professionals in corroborating claims of disability.

The Federal Civil Service Disability Retirement application also shares similarities with the Ptax 343 A form. Federal employees seeking retirement due to disability must provide exhaustive medical documentation proving that a service-connected disability renders them unable to perform useful and efficient service in their current positions. Comparable to the Ptax 343 A form, this process necessitates a comprehensive medical evaluation and physician's statement, underscoring the importance of objective medical evidence in substantiating claims for disability-related benefits. Both documents reflect the stringent criteria individuals must meet to qualify for benefits aimed at alleviating hardships imposed by disabilities.

Dos and Don'ts

When preparing to fill out the PTAX-343-A form, which is a Physician's Statement for Disabled Persons' Homestead Exemption, there are several do's and don'ts to keep in mind. This form is crucial for individuals seeking to qualify for the Disabled Persons' Homestead Exemption (DPHE) and requires detailed information from both the applicant and an Illinois licensed physician. Here's a guide to help you through the process:

Do's:

Read all instructions carefully before starting to fill out the form. Understanding what is required can save you time and avoid mistakes.

Gather all necessary documents in advance, including any proof of disability if available. This might include a Class 2 Disabled Person Identification Card, Social Security Administration disability benefits evidence, Veterans Administration disability benefits proof, or Railroad or Civil Service disability benefits documentation.

Fill out each section completely. Leaving sections incomplete could lead to your application being delayed or rejected.

Check that the physician's details are accurate, including their Illinois physician’s license number. Incorrect or incomplete information in this section can lead to unnecessary delays.

Make sure the physician signs and dates the form. Without the physician’s signature, the form will not be processed.

Submit the form before your county's deadline for the Disabled Persons’ Homestead Exemption (DPHE). Late submissions might not be considered.

Don'ts:

Do not rush through the form without fully understanding each requirement. Mistakes can cause delays in your exemption application process.

Avoid guessing information. If you are unsure about any detail, it's better to verify it before including it on the form.

Do not overlook the necessity of including the property index number (PIN) or the legal description of your property, as these are crucial for identifying the homestead for which you're claiming the exemption.

Do not leave sections blank that require a response. If a question does not apply to you, writing "N/A" is more appropriate than leaving it empty.

Do not ignore the physician’s section. This part of the form is vital and needs to be filled out by a licensed Illinois physician. Ensure that the doctor understands the importance of their role in the process.

Avoid submitting the form without double-checking all entered information for accuracy and completeness. This includes checking for any spelling errors or inaccuracies in dates and numbers.

Following these guidelines can streamline the process of filing a PTAX-343-A form, helping you or your loved one obtain the Disabled Persons’ Homestead Exemption more efficiently. Always remember, attention to detail and early preparation are key to a successful application.

Misconceptions

When navigating the complexities of property tax exemptions for disabled persons, specifically through the use of the PTAX-343-A form, numerous misconceptions can lead to confusion and potential missteps. Understanding these misconceptions is paramount for accurately completing and submitting the PTAX-343-A to qualify for the Disabled Persons’ Homestead Exemption (DPHE). Below are nine common misunderstandings and the reality behind each.

Only physical disabilities qualify: It's a common belief that only physical disabilities are recognized for the DPHE. However, the PTAX-343-A form reflects broader criteria, including various major body systems and disorders that qualify, not limited strictly to physical impairments.

Physician certification is always needed: While the form requires a physician's certification, this step is only necessary if other forms of acceptable proof of disability, as outlined in the General Information section, are not available.

All disabilities listed in the SSA's Listing of Impairments are covered: Some assume any condition listed by the Social Security Administration (SSA) will qualify. Though the PTAX-343-A references SSA guidelines, disabilities related to alcoholism or drug abuse are explicitly excluded.

The form must be completed annually: The need for annual form submission isn't mentioned in the provided instructions. Filing requirements depend on the guidelines set by the Chief County Assessment Officer (CCAO) and any changes in the homeowner's disability status or other qualifying conditions.

There is a fee to file the form: While applicants are responsible for any physician's fees incurred for the form's completion, there is no mention of a filing fee directly associated with the PTAX-343-A itself.

Completing the form guarantees an exemption: Merely completing and submitting the form does not guarantee one will receive the exemption. The application must meet all criteria and documentation requirements as judged by the county's assessment office.

Any Illinois physician can sign the form: The physician completing the form must be licensed in Illinois and their license number is required. This ensures the verifying physician meets state-specific standards.

The exemption amount is fixed: Many believe the exemption provides a fixed discount on property taxes. However, the actual impact on an individual’s property tax bill can vary based on a number of factors including assessed property value and local tax rates.

Applicants must understand all medical terminology: Some applicants worry that they need to understand the detailed medical criteria listed under the SSA's Listing of Impairments. In reality, it is the physician’s responsibility to accurately identify and describe the applicable disability within the SSA's framework.

Navigating the eligibility and application process for the DPHE using the PTAX-343-A form requires a clear understanding of these misconceptions. By dispelling these misconceptions, applicants are better prepared to accurately complete and submit their application, thereby ensuring they receive the exemptions for which they are entitled.

Key takeaways

Filling out the PTAX-343-A form is an essential step for Illinois residents seeking to qualify for the Disabled Persons’ Homestead Exemption (DPHE). Here are some key takeaways to ensure the process is as straightforward as possible:

- The form is used when traditional proofs of disability are not available, requiring certification from an Illinois licensed physician.

- Applicants are responsible for any cost associated with obtaining the physician’s certification.

- It’s important for the property owner to provide accurate details about the homestead property, including the property index number (PIN), which can be found on the property tax bill or through the Chief County Assessment Officer (CCAO).

- The physician verifies the disability status based on criteria established by the Social Security Administration, explicitly excluding conditions like alcoholism and drug abuse.

- The form requires information about the patient's disability, including when the disability began, the nature of the disability, and whether the condition is expected to last for at least 12 months.

- Proof of disability can come in various forms, including a Class 2 Illinois Disabled Person Identification Card, Social Security Administration disability benefits, Veterans Administration disability benefits, or Railroad or Civil Service disability benefits.

- The completed form must be filed with the local Chief County Assessment Officer (CCAO) before the county’s due date for the Disabled Persons’ Homestead Exemption application to be considered.

- Contact information for the local CCAO office should be readily available for applicants who have questions or need assistance with their application.

Understanding these key points can help in successfully applying for the DPHE, providing much-needed relief for disabled homeowners.

Popular PDF Documents

Lower Property Taxes in Texas - A necessary step for lessees to maintain tax compliance regarding the classification of their leased vehicles.

Are Credit Card Tips Taxed on Paycheck - Credits for taxes paid to other jurisdictions are considered, preventing double taxation and reducing the taxpayer's liability in Bethlehem.