Get Ptax 342 R Form

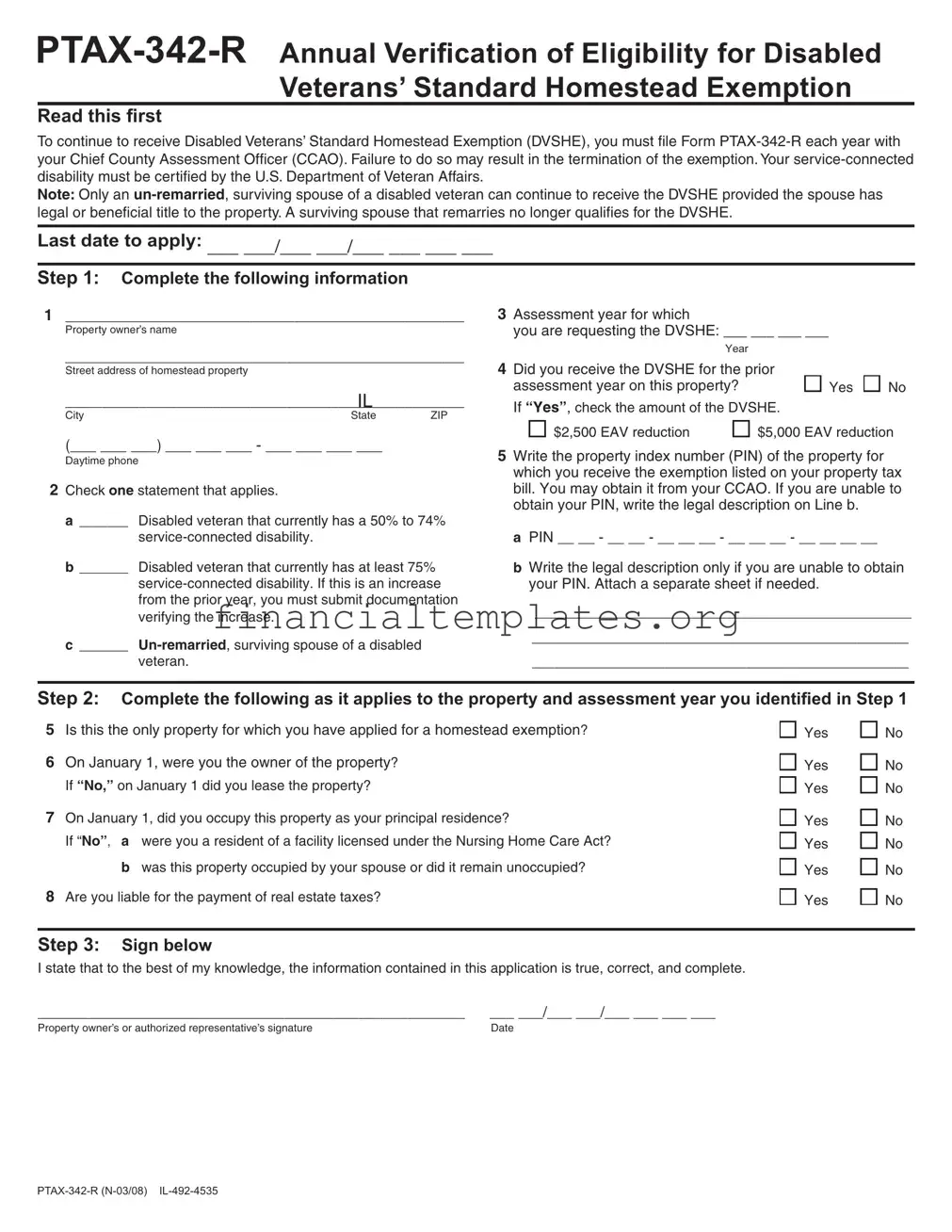

The PTAX-342-R form, officially titled Annual Verification of Eligibility for Disabled Veterans’ Standard Homestead Exemption, serves as a critical document for disabled veterans in Illinois seeking to maintain their Standard Homestead Exemption. This exemption offers a reduction in the equalized assessed value (EAV) of a primary residence, providing financial relief to those who have served and are living with disabilities as a result of their service. To continue receiving this benefit, eligible disabled veterans must submit the form annually to their Chief County Assessment Officer (CCAO), ensuring they meet the requirements set forth, including a service-connected disability certification by the U.S. Department of Veterans Affairs. Moreover, the form accommodates un-remarried surviving spouses of disabled veterans, allowing them to receive the exemption under certain conditions. Failure to comply with these annual submissions may lead to the termination of the exemption, underscoring the form's importance in the continuation of these much-needed benefits. Integrity in providing accurate and complete information when applying is emphasized, as is the necessity for timely submission, including any required documentation to support one’s eligibility, such as proof of disability and ownership or lease of the property in question.

Ptax 342 R Example

Read this irst

To continue to receive Disabled Veterans’ Standard Homestead Exemption (DVSHE), you must file Form

Note: Only an

Last date to apply: ___ ___/___ ___/___ ___ ___ ___

Step 1: Complete the following information

1______________________________________________________

Property owner’s name

______________________________________________________

Street address of homestead property

|

IL |

|

City |

State |

ZIP |

(___ ___ ___) ___ ___ ___ - ___ ___ ___ ___

Daytime phone

2Check one statement that applies.

a _______ Disabled veteran that currently has a 50% to 74%

b _______ Disabled veteran that currently has at least 75%

c _______

3Assessment year for which

you are requesting the DVSHE: ___ ___ ___ ___

Year |

|

|

4 Did you receive the DVSHE for the prior |

|

|

assessment year on this property? |

Yes |

No |

If “Yes”, check the amount of the DVSHE. |

|

|

$2,500 EAV reduction |

$5,000 EAV reduction |

5Write the property index number (PIN) of the property for which you receive the exemption listed on your property tax bill. You may obtain it from your CCAO. If you are unable to obtain your PIN, write the legal description on Line b.

a PIN __ __ - __ __ - __ __ __ - __ __ __ - __ __ __ __

bWrite the legal description only if you are unable to obtain your PIN. Attach a separate sheet if needed.

___________________________________________________

___________________________________________________

___________________________________________________

Step 2: Complete the following as it applies to the property and assessment year you identiied in Step 1

5Is this the only property for which you have applied for a homestead exemption?

6On January 1, were you the owner of the property? If “No,” on January 1 did you lease the property?

7On January 1, did you occupy this property as your principal residence?

If “No”, a were you a resident of a facility licensed under the Nursing Home Care Act?

bwas this property occupied by your spouse or did it remain unoccupied?

8Are you liable for the payment of real estate taxes?

Yes

Yes Yes

Yes

Yes

Yes

Yes

No

No No

No

No

No

No

Step 3: Sign below

I state that to the best of my knowledge, the information contained in this application is true, correct, and complete.

____________________________________________________ |

___ ___/___ ___/___ ___ ___ ___ |

Property owner’s or authorized representative’s signature |

Date |

Form

What is the Disabled Veterans’ Standard Homestead Exemption (DVSHE)?

The Disabled Veterans’ Standard Homestead Exemption (35 ILCS

Who is eligible?

To qualify for the DVSHE, the disabled veteran must

l be an Illinois resident who served as a member of the U.S. Armed Forces on active duty or state active duty, Illinois National Guard, or U.S. Reserve Forces, and not dishonorably discharged.

l have at least a 50%

l own and occupy the property as the primary residence on January 1 of the assessment year or lease and occupy a single family residence on January 1 of the assessment year and be liable for the payment of the property taxes to the county.

Note: The property’s total EAV must be less than $250,000 after subtracting any portion used for commercial purposes. “Commercial purposes” include any portion of the property rented for more than 6 months.

Is a surviving spouse eligible?

An

An

Form

Do I need to provide documentation?

The CCAO may request documentation to verify your eligibility. Doc- umentation may include a disability award or verification letter from

the U.S. Department of Veterans’ Affairs for the current assessment year with one of the following documents that is the original or a copy certified by the county recorder, recorder of deed’s, Illinois Department of Veterans’ Affairs, or the National Archives Record Center.

lForm DD 214 or separation of service from the War Department (military service prior to 1950); or

l Certification of Military Service Form.

When will I receive my exemption?

The year you apply for the DVSHE is referred to as the assessment year. The County Board of Review, while in session for the assess- ment year, has the final authority to grant your DVSHE. If granted, your DVSHE will be applied to the property tax bill paid the year following the assessment year.

When and where do I file my Form

To continue to receive this exemption on your residence, you must file Form

WILL

__________________________________________ County, CCAO

302 North Chicago Street, 2nd Floor |

|

______________________________________________________ |

|

Mailing address |

|

Joliet |

60432 |

_____________________________________ IL ______________ |

|

City |

ZIP |

740 |

________________4648 |

If you have any questions, call (_____815 )_____- |

|

Are there other homestead exemptions available for disabled persons or disabled veterans?

Yes. However, only one of the following disabled homestead exemp- tions may be claimed on your property for a single assessment year:

l Disabled Veterans’ Homestead Exemption - up to $70,000 reduction in assessed value for

l Disabled Persons’ Homestead Exemption - annual $2,000 reduction in property’s EAV (35 ILCS

l Disabled Veterans’ Standard Homestead Exemption - annual $2,500 or $5,000 reduction in property’s EAV (35 ILCS

|

Oficial use. Do not write in this space. |

||

Date received: ___ ___/___ ___/___ ___ ___ ___ |

Board of review action date: ___ ___/___ ___/___ ___ ___ ___ |

||

Verify proof of eligibility ____________________________ |

Approved |

||

|

|||

|

|

Denied |

|

Exemption amount |

|

Reason for denial____________________________________ |

|

$2,500 |

$5,000 |

||

______________________________________________________ |

|||

|

|

||

Assessment information |

|

Comments: _________________________________________ |

|

EAV of improvements |

$___________________ |

______________________________________________________ |

|

EAV of land |

$___________________ |

______________________________________________________ |

|

Total EAV of improvement/land |

$___________________ |

______________________________________________________ |

|

EAV commercial/rented property |

$___________________ |

______________________________________________________ |

|

Total EAV minus commercial/rented EAV $___________________ |

______________________________________________________ |

||

Note: An EAV of $250,000 or more, excluding commercial property or portion of the property rented for more than 6 months does not qualify for DVSHE.

Document Specifics

| Fact | Detail |

|---|---|

| Form Name | PTAX-342-R Annual Verification of Eligibility for Disabled Veterans’ Standard Homestead Exemption |

| Purpose | Used to continue receiving the Disabled Veterans’ Standard Homestead Exemption (DVSHE) by filing annually with the Chief County Assessment Officer (CCAO). |

| Failure to File | May result in the termination of the exemption. |

| Eligibility Certification | Service-connected disability must be certified by the U.S. Department of Veterans Affairs. |

| Surviving Spouse Eligibility | An un-remarried surviving spouse can continue receiving the DVSHE provided they have legal or beneficial title to the property. |

| Exemption Amounts | At least a 75% service-connected disability grants a $5,000 reduction, and a 50% to 74% disability grants a $2,500 reduction in property’s EAV. |

| Governing Law | The DVSHE is governed by the Illinois Compiled Statutes (35 ILCS 200/15-169). |

| Documentation Requirement | CCAO may request disability verification from the U.S. Department of Veterans’ Affairs alongside other documents such as Form DD 214 or Certification of Military Service Form for eligibility. |

Guide to Writing Ptax 342 R

Filling out the PTAX-342-R form is a crucial step for disabled veterans or their un-remarried surviving spouses in Illinois to continue receiving the Disabled Veterans’ Standard Homestead Exemption (DVSHE). This exemption can significantly reduce the equalized assessed value (EAV) of their primary residence, which translates to lower property taxes. It's essential to file this verification form annually with your Chief County Assessment Officer (CCAO) to maintain the exemption. Missing the deadline or failing to submit precise, complete information might result in losing this valuable exemption. Here is a straightforward, step-by-step guide on how to complete the PTAX-342-R form correctly.

- Property Owner’s Information: Start by writing the full name of the property owner and the address of the homestead property, including the city, state, and ZIP code. Also, provide a daytime phone number where you can be reached.

- Disability Status: Check the appropriate box that applies to the disabled veteran’s service-connected disability status.

- If the disabled veteran has a 50% to 74% service-connected disability, check box ‘a’.

- If the disability is at least 75%, check box ‘b’. Remember to attach documentation if this represents an increase from the prior year.

- For an un-remarried, surviving spouse of a disabled veteran, check box ‘c’.

- Specify the Assessment Year for which you are requesting the DVSHE by entering the year.

- Indicate whether you received the DVSHE for the prior assessment year on this property. If “Yes,” check the applicable amount of the DVSHE received, either $2,500 or $5,000 EAV reduction.

- Write the Property Index Number (PIN) of the property. If the PIN is not available, provide the legal description of the property. If necessary, attach a separate sheet for a complete legal description.

- Homestead Exemption Eligibility: Confirm whether this is the only property for which you have applied for a homestead exemption.

- Confirm ownership and occupancy details as of January 1.

- If you were not the owner on January 1, indicate if you leased the property.

- If you did not occupy the property as your principal residence, specify whether you resided in a licensed facility or if the property was occupied by your spouse or remained unoccupied.

- State whether you are liable for the payment of real estate taxes on the property in question.

- Complete the form by signing at the bottom. Provide your signature and the date to certify that the information supplied is accurate to the best of your knowledge.

The process of filing the PTAX-342-R form doesn't end with submission. After filing, your application will be reviewed by the county’s Board of Review. If approved, the exemption will be applied to your property tax bill the following year. It’s imperative to keep a copy of the completed form for your records and note the submission date. Should there be any discrepancies or if additional documentation is required, having your copy handy will make it easier to address these issues swiftly. Remember, maintaining open communication with your CCAO can also provide assistance throughout the process and for any questions you might have.

Understanding Ptax 342 R

What is the Disabled Veterans’ Standard Homestead Exemption (DVSHE)?

The Disabled Veterans’ Standard Homestead Exemption provides a reduction in the equalized assessed value (EAV) of a primary residence for disabled veterans. Depending on the level of service-connected disability as certified by the U.S. Department of Veterans’ Affairs, a veteran with at least a 75% disability is eligible for a $5,000 reduction in their property’s EAV, while a veteran with a 50% to 74% service-connected disability qualifies for a $2,500 reduction.

Who is eligible for the DVSHE?

To be eligible for the DVSHE, one must be an Illinois resident who served in the U.S. Armed Forces, National Guard, or Reserve Forces without a dishonorable discharge. The applicant must have a service-connected disability of at least 50%, own and occupy the property as their primary residence as of January 1 of the assessment year, or lease and occupy a single family residence and be liable for the property taxes. The total EAV of the property must be under $250,000 after deducting any commercial use portion.

Can a surviving spouse benefit from the DVSHE?

Yes, an un-remarried surviving spouse of a disabled veteran can continue to receive the DVSHE on their spouse's primary residence or transfer it to another primary residence if the original one is sold, provided the DVSHE had been granted previously. Surviving spouses must occupy the property and hold legal or beneficial title as of January 1 of the assessment year.

Is documentation required to apply for the DVSHE?

When applying for the DVSHE, the Chief County Assessment Officer (CCAO) may request documentation to verify eligibility. This documentation could include a disability award or verification letter from the U.S. Department of Veterans’ Affairs for the current year, along with Form DD 214, certification of military service, or similar documentation verifying the applicant's service and disability.

When and how do I receive my DVSHE application result?

The exemption application is processed for the assessment year in which it is applied for, and the County Board of Review has the final authority to grant the DVSHE during its session for that year. If approved, the exemption is applied to the property tax bill for the year following the assessment year.

Where and when should Form PTAX-342-R be filed?

Form PTAX-342-R, Annual Verification of Eligibility for Disabled Veterans’ Standard Homestead Exemption, must be filed each year with your CCAO to continue receiving the exemption. The deadline for filing and the contact information for the CCAO can be found on the form. You are encouraged to contact your CCAO for specific filing information and assistance.

Are there other homestead exemptions available for disabled persons or veterans?

Yes, other exemptions are available, but only one disabled homestead exemption may be claimed per property in a single assessment year. These include the Disabled Veterans’ Homestead Exemption for specially adapted housing, the Disabled Persons’ Homestead Exemption, and the Disabled Veterans’ Standard Homestead Exemption. Each has specific eligibility requirements and benefits.

Common mistakes

Filling out the PTAX-342-R form, which is crucial for claiming the Disabled Veterans' Standard Homestead Exemption, can be a straightforward process. However, certain mistakes can complicate or delay the benefits process. Here are ten common errors to avoid:

- Forgetting to file annually: The PTAX-342-R form must be filed every year to continue receiving the exemption. Failure to refile can lead to the loss of benefits.

- Incorrect property details: Entering wrong information like the property index number (PIN) or the legal description can lead to processing delays or rejections.

- Omitting documentation for increased disability: If there's an increase in your service-connected disability percentage, new documentation verifying the increase must accompany the form.

- Overlooking occupancy requirements: Veterans or their un-remarried surviving spouses must own and occupy the property as their primary residence as of January 1 of the assessment year.

- Misunderstanding eligibility for surviving spouses: An un-remarried surviving spouse is eligible, but if remarriage occurs, eligibility ceases. Also, transferring the exemption to a new primary residence requires additional documentation.

- Missing the submission deadline: Each year has a designated deadline for submission. Missing this deadline can result in missing out on the exemption for the year.

- Not checking the correct disability box: The form has specific boxes to check based on the percentage of service-connected disability. Checking the wrong box or forgetting to check a box can affect your exemption amount.

- Failing to update changes in property ownership or marital status: These changes impact eligibility and must be accurately reflected in the form.

- Incomplete sections or unanswered questions: Every question and section on the PTAX-342-R form is important for verifying eligibility and must be completed fully.

- Not signing or dating the form: An unsigned or undated form is considered incomplete and can result in the denial of the exemption.

By avoiding these mistakes, veterans and their families can ensure a smoother process in receiving the well-deserved Disabled Veterans’ Standard Homestead Exemption benefits.

Documents used along the form

Filing Form PTAX-342-R is an important step for disabled veterans seeking to obtain or continue to receive the Disabled Veterans’ Standard Homestead Exemption. To fully take advantage of this exemption, certain documents and forms may need to be prepared and submitted alongside PTAX-342-R. Understanding these documents can help ensure the process goes smoothly and effectively.

- DD Form 214 (Certificate of Release or Discharge from Active Duty): This form serves as evidence of a veteran's military service and discharge status, which is required for verification of eligibility.

- Disability Award Letter from the U.S. Department of Veterans Affairs: This letter provides proof of the service-connected disability rating, which determines the exemption amount.

- Marriage Certificate: For un-remarried surviving spouses applying for the exemption, the marriage certificate verifies the relationship to the deceased veteran.

- Death Certificate: This document is needed to confirm the veteran's death and is required when an un-remarried surviving spouse is applying for the exemption.

- Proof of Ownership: Legal documents such as a deed or title that demonstrate the applicant's ownership of the property.

- Property Tax Bill: Provides the Property Index Number (PIN) and other relevant details about the property for which the exemption is sought.

- PTAX-342, Application for Disabled Veterans’ Standard Homestead Exemption: For first-time applicants or when transferring the exemption to a new primary residence, this form initiates the process.

- Certification of Military Service: Needed if DD Form 214 is not available, this document certifies military service and is especially useful for service prior to 1950.

Each of these forms and documents plays a crucial role in ensuring that eligible veterans and their families can benefit from the Disabled Veterans’ Standard Homestead Exemption. It's essential to gather and prepare these documents carefully to support your application and secure the deserved exemptions. Getting these documents in order allows for a smoother verification process and helps prevent any unnecessary delays or challenges.

Similar forms

The PTAX-342-R form, which serves as the annual verification for continuing eligibility for the Disabled Veterans’ Standard Homestead Exemption in Illinois, shares similarities with several other documents designed to determine eligibility and benefits for tax exemptions, especially those targeting veterans and disabled individuals. Here, we explore eight comparable documents, shedding light on their purpose, requirements, and the audiences they serve.

Firstly, the PTAX-341, Application for Disabled Veterans' Homestead Exemption, closely resembles the PTAX-342-R. While the latter verifies ongoing eligibility, PTAX-341 is used initially to apply for the Disabled Veterans’ Homestead Exemption, requiring similar information such as service-connected disability certification by the U.S. Department of Veterans Affairs. Both forms seek to reduce property tax liabilities for disabled veterans, differing primarily in their application timing.

Secondly, the Senior Citizens Homestead Exemption application also mirrors the PTAX-342-R in function but serves a different demographic. Aimed at senior citizens over the age of 65 seeking property tax relief, this form assesses eligibility based on age, residence, and ownership, similar to how PTAX-342-R assesses eligibility based on disability and veteran status.

Another similar document is the Application for Homestead Exemption for Persons with Disabilities, which, like the PTAX-342-R, offers property tax relief but focuses on individuals with disabilities, regardless of veteran status. Applicants must prove their disability status alongside property ownership and occupancy, mirroring the requirements for disabled veterans but with a broader eligibility criteria.

The General Homestead Exemption application also shares similarities with the PTAX-342-R by offering property tax reductions to eligible homeowners. However, this exemption is more universally available, requiring only proof of residence and ownership, making it less specific than the disability or veteran-focused exemptions.

The Disabled Veterans’ Adapted Housing Exemption stands as another parallel form, designed specifically for veterans with disabilities requiring specially adapted housing. This document, while similar in intent to the PTAX-342-R, focuses on a narrower group of applicants, offering significant property tax relief tailored to their unique housing needs.

The Application for the Returning Veterans' Homestead Exemption echoes the PTAX-342-R by targeting veterans, granting a one-time tax relief for veterans returning from active duty. While it caters to a different phase in a veteran's life, it shares the core aim of providing financial relief through tax exemptions.

Moving to the Surviving Spouse Tax Abatement form, this document parallels the PTAX-342-R's provisions for un-remarried surviving spouses of disabled veterans. It extends property tax benefits to surviving spouses, acknowledging their shared sacrifice, and maintaining a connection through the eligibility criteria.

Lastly, the Home Improvement Exemption application, while not veteran-specific, offers tax relief for property improvements, reflecting the PTAX-342-R's spirit of reducing financial burdens on homeowners. This form encourages property enhancement by minimizing the tax impact of improvements, indirectly benefiting veterans and other homeowners alike.

In essence, these documents, although varied in their target beneficiaries and specific requirements, share a unifying purpose with the PTAX-342-R: to provide tax relief and recognize the contributions, needs, or circumstances of distinct groups within the community, from veterans and their families to seniors and individuals with disabilities.

Dos and Don'ts

When you're filling out the PTAX-342-R form, there are important steps to follow to ensure that your application is properly completed and submitted. Here's a list of things you should and shouldn't do:

Do:- Verify your eligibility annually. Remember, to keep receiving the Disabled Veterans’ Standard Homestead Exemption, you need to file this form each year with your Chief County Assessment Office.

- Provide accurate information. Make sure all the details you enter, such as your disability status and property information, are current and correct.

- Include required documentation. If there has been an increase in your service-connected disability percentage, attach the necessary documents verifying this change from the U.S. Department of Veterans’ Affairs.

- Sign and date the form. Before submission, ensure that the form is signed and dated, indicating that you attest to the accuracy of the information provided.

- Overlook the deadline. Be aware of the last date to apply and make sure your form is submitted on time to avoid losing your exemption.

- Leave sections incomplete. Fill out every applicable section of the form to avoid delays in processing. If a section does not apply to you, mark it as N/A (not applicable).

- Forget to check your eligibility status. Only veterans with a service-connected disability, or their un-remarried surviving spouses, qualify. Verify that you meet these criteria before applying.

- Assume automatic renewal. Remember, the exemption does not automatically renew. Filing this form each year is necessary to maintain your exemption status.

Misconceptions

There are several misconceptions regarding the PTAX-342-R form, commonly required for the continuation of the Disabled Veterans' Standard Homestead Exemption (DVSHE). Understanding these misconceptions can be crucial for eligible veterans and their families. Here's a closer examination to clarify these misconceptions:

Every Disabled Veteran Qualifies: Not every disabled veteran qualifies for the DVSHE. Eligibility requires the veteran to have at least a 50% service-connected disability, as certified by the U.S. Department of Veterans’ Affairs, and to own and occupy the property as their primary residence on January 1 of the assessment year.

Automatic Renewal: There's a common misconception that once you qualify for the DVSHE, you no longer need to reapply. However, veterans must file Form PTAX-342-R annually with their Chief County Assessment Officer (CCAO) to continue receiving the exemption. Failure to do so may result in the termination of the exemption.

Surviving Spouses Always Qualify: A surviving spouse of a disabled veteran can continue receiving the DVSHE provided they have not remarried and have legal or beneficial title to the property. If the surviving spouse remarries, they no longer qualify for the exemption.

No Documentation Needed: To apply for the DVSHE, eligible individuals must provide sufficient documentation to verify their eligibility. This documentation could include a disability award or verification letter from the U.S. Department of Veterans’ Affairs for the current assessment year.

Only Available to Veterans with a 100% Disability: This exemption is available to veterans with at least a 50% service-connected disability. Two levels of the exemption exist: a $2,500 reduction in property’s EAV for disabilities between 50% to 74%, and a $5,000 reduction for disabilities 75% and above.

Limits on Property Value: The property’s total equalized assessed value (EAV) must be less than $250,000 after subtracting any portion used for commercial purposes to qualify for the DVSHE. This detail often gets overlooked, leading to misconceptions about eligibility based on property value.

Exclusive to Single Family Homes: Eligibility is not limited to single-family homes. The qualifying veteran or their surviving spouse must own and occupy the property as their primary residence, regardless of the property type, as of January 1 of the assessment year.

No Deadline for Application: There is, in fact, a last date to apply each year, which varies. To ensure the continuation of the exemption, applicants should verify the exact deadline for submission of the PTAX-342-R form with their local CCAO.

Other Exemptions Make You Ineligible: While you cannot claim more than one disabled homestead exemption on your property for a single assessment year, eligibility for the DVSHE is not negated by eligibility for other exemptions. Veterans must choose the exemption that provides the greatest benefit for their situation.

Correcting these misconceptions is critical for ensuring that disabled veterans and their families can successfully navigate the process of applying for, and continuing to receive, the DVSHE. For further assistance and the most accurate filing information, contacting the local County Chief Assessment Officer's office is highly recommended.

Key takeaways

Filling out and submitting the PTAX-342-R form is essential for disabled veterans or their un-remarried surviving spouses to receive or continue receiving the Disabled Veterans’ Standard Homestead Exemption (DVSHE). This yearly process ensures that the significant property tax relief provided to those who have served our country is properly administered. Below are seven key takeaways regarding this important form:

- The PTAX-342-R form must be filed annually with the Chief County Assessment Officer (CCAO) to maintain the DVSHE. Without this crucial step, the exemption may be revoked, increasing the property tax burden.

- Eligibility for the DVSHE requires the veteran’s service-connected disability to be certified by the U.S. Department of Veterans Affairs. This ensures that only those with verified disabilities can benefit from this exemption.

- The exemption amount varies based on the degree of disability: Veterans with at least a 75% service-connected disability receive a $5,000 reduction in their property’s equalized assessed value (EAV), while those with a disability between 50% and 74% receive a $2,500 reduction.

- An un-remarried surviving spouse of a disabled veteran can qualify for the DVSHE, retaining this benefit as a form of continued support, provided they don’t remarry and maintain legal or beneficial title to the property.

- Documentation of the veteran’s disability status may be requested by the CCAO to verify eligibility. This could include a disability award or verification letter from the U.S. Department of Veterans’ Affairs, ensuring the process is based on accurate and current information.

- The form inquires about other homestead exemptions, emphasizing the rule that only one type of disabled exemption (Veteran or Person) can be claimed in a single assessment year. This helps to manage the various exemptions available and ensure they are distributed fairly.

- The deadline to file the PTAX-342-R is crucial and varies by county. Contacting your CCAO as soon as possible for filing information and assistance can help avoid any lapse in exemption status.

Understanding and completing the PTAX-342-R form accurately is vital for disabled veterans and their eligible surviving spouses. It's not just about receiving a tax benefit; it’s a recognition of the sacrifices made by veterans and a measure of support to them and their families. Should you have questions or need assistance, reaching out to your local Chief County Assessment Officer (CCAO) or a legal advisor familiar with veterans' benefits is a recommended course of action.

Popular PDF Documents

3,800 - Accurate completion of this form helps businesses avoid costly mistakes in tax credit claims.

IRS 4506-T - IRS Form 4506-T can be used to obtain not only the tax return transcript but also transcripts of 1099s and W-2s when available.