Get Ptax 340 Form

The PTAX-340 form, a vital document for senior citizens in Illinois aiming to maintain their financial stability, serves as the application and affidavit for the Senior Citizens Assessment Freeze Homestead Exemption for the tax year 2013. This exemption, designed to assist eligible senior citizens, enables the freezing of their property's equalized assessed value (EAV), acting as a safeguard against inflation-induced increases, although it does not halt potential tax bill upticks due to rising tax rates or home improvements. To qualify, applicants must be 65 or older within the year, demonstrate a household income of $55,000 or less, and meet specific ownership and residency criteria. The form mandates detailed personal, property, and comprehensive income information, covering a range of income types while allowing for certain deductions. Notably, the PTAX-340 underscores an inclusive approach by accounting for diverse living situations, including varying spousal residences and occupants of health facilities, ensuring broad accessibility. Seasoned with statutory deadlines and confidentiality assurances, it underscores the procedural seriousness and privacy respecting the applicants’ data. The form emerges as a crucial instrument for senior citizens seeking financial relief through tax exemptions, encapsulated by detailed instructions aimed at simplifying the complexity inherent in tax exemption applications.

Ptax 340 Example

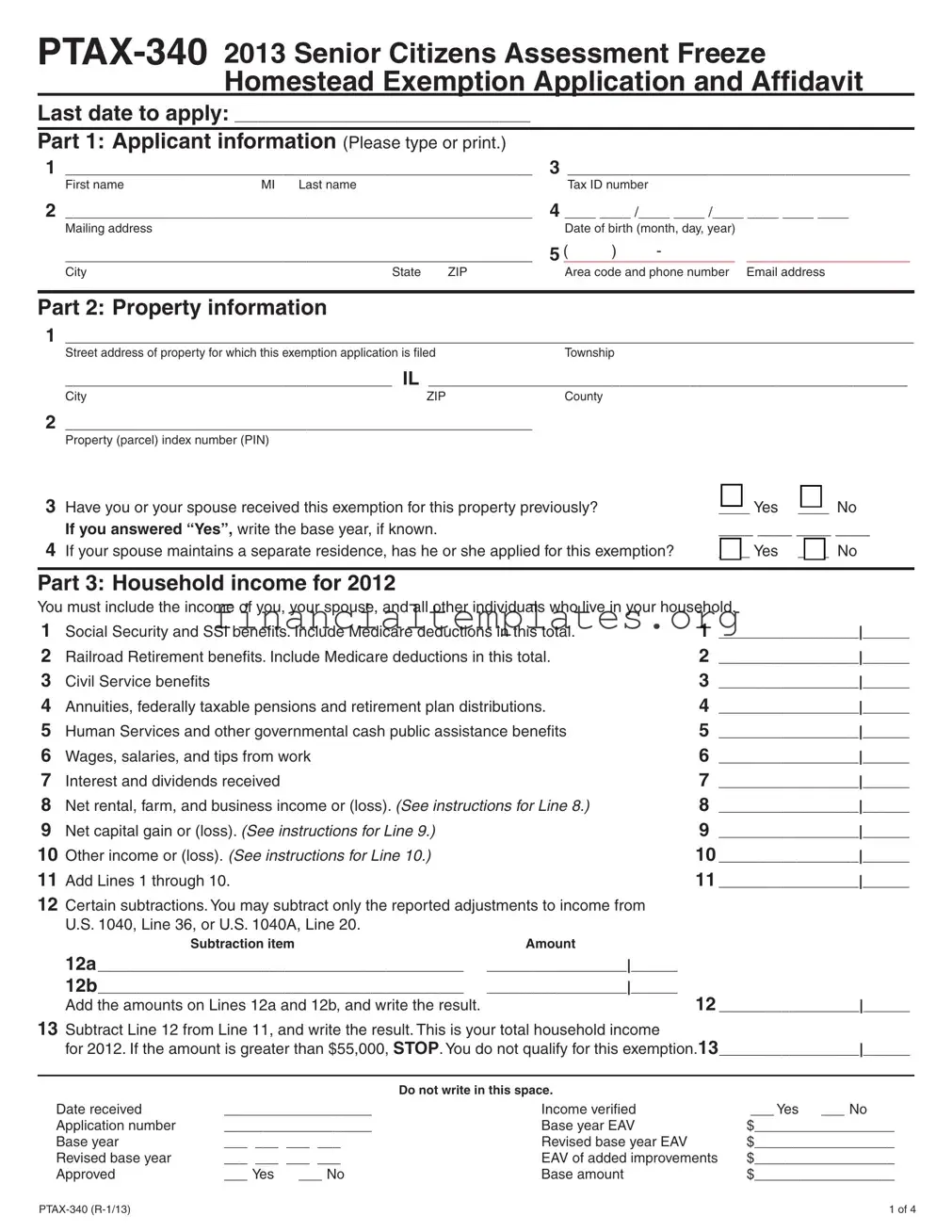

Last date to apply: ______________________________________

Part 1: Applicant information (Please type or print.)

1 |

____________________________________________________________ |

3 |

____________________________________________ |

||||||

|

First name |

MI |

Last name |

|

|

Tax ID number |

|

|

|

2 |

____________________________________________________________ |

4 |

____ ____ /____ ____ /____ ____ ____ ____ |

||||||

|

Mailing address |

|

|

|

|

Date of birth (month, day, year) |

|

||

|

____________________________________________________________ |

5 |

( |

) |

- |

_____________________ |

|||

|

______________________ |

||||||||

|

City |

|

State |

ZIP |

|

Area code and phone number |

Email address |

||

Part 2: Property information

1_____________________________________________________________________________________________________________

Street address of property for which this exemption application is filedTownship

__________________________________________ |

IL ______________________________________________________________ |

|

City |

ZIP |

County |

2____________________________________________________________

Property (parcel) index number (PIN)

Note: The PIN is shown on your property tax bill. You also may obtain it from your chief county assessment officer (CCAO). If you cannot obtain the PIN, attach a copy of the legal description.

3 |

Have you or your spouse received this exemption for this property previously? |

____ |

Yes |

|

____ |

|

No |

|

|

||||||||

|

If you answered “Yes”, write the base year, if known. |

____ ____ ____ ____ |

||||||

4 |

|

|

|

|

|

|

||

If your spouse maintains a separate residence, has he or she applied for this exemption? |

____ Yes |

|

____ |

No |

||||

|

|

|

|

|

|

|

|

|

Part 3: Household income for 2012

You must include the income of you, your spouse, and all other individuals who live in your household.

1 |

Social Security and SSI benefits. Include Medicare deductions in this total. |

1 |

__________________|______ |

2 |

Railroad Retirement benefits. Include Medicare deductions in this total. |

2 |

__________________|______ |

3 |

Civil Service benefits |

3 |

__________________|______ |

4 |

Annuities, federally taxable pensions and retirement plan distributions. |

4 |

__________________|______ |

5 |

Human Services and other governmental cash public assistance benefits |

5 |

__________________|______ |

6 |

Wages, salaries, and tips from work |

6 |

__________________|______ |

7 |

Interest and dividends received |

7 |

__________________|______ |

8 |

Net rental, farm, and business income or (loss). (See instructions for Line 8.) |

8 |

__________________|______ |

9 |

Net capital gain or (loss). (See instructions for Line 9.) |

9 |

__________________|______ |

10 |

Other income or (loss). (See instructions for Line 10.) |

10 __________________|______ |

|

11 |

Add Lines 1 through 10. |

11 __________________|______ |

|

12Certain subtractions. You may subtract only the reported adjustments to income from U.S. 1040, Line 36, or U.S. 1040A, Line 20.

Subtraction item |

Amount |

12a _______________________________________________ __________________|______ |

|

12b_______________________________________________ __________________|______ |

|

Add the amounts on Lines 12a and 12b, and write the result. |

12 __________________|______ |

13Subtract Line 12 from Line 11, and write the result. This is your total household income

for 2012. If the amount is greater than $55,000, STOP. You do not qualify for this exemption.13__________________|______

|

|

|

Do not write in this space. |

|

Date received |

___________________ |

Income verified |

___ Yes ___ No |

|

Application number |

___________________ |

Base year EAV |

$__________________ |

|

Base year |

___ ___ ___ ___ |

Revised base year EAV |

$__________________ |

|

Revised base year |

___ ___ ___ ___ |

EAV of added improvements |

$__________________ |

|

Approved |

___ Yes |

___ No |

Base amount |

$__________________ |

1 of 4 |

Part 4: Affidavit

Sworn under oath, I state the following:

1(Mark the statement that applies.)

On January 1, 2013, the property identified in Part 2, Line 1, was improved with a permanent structure a ____ that I used as my principal residence.

b ____ for which I received this exemption previously and is either unoccupied or used as my spouse’s principal residence. I am now a resident of a facility licensed under the Assisted Living and Shared Housing Act, Nursing Home Care Act, ID/DD (intellectually disabled/developmentally disabled) Community Care Act, or Specialized Mental Health Rehabili- tation Act.

_______________________________________ |

_________________________________________________ |

Name of facility |

Mailing address |

2(Mark the statement that applies.)

On January 1, 2013, I

a ____ was the owner of record of the property identified in Part 2, Line 1.

b ____ had a legal or equitable interest by a written instrument in the property listed in Part 2, Line 1.

c ____ had a leasehold interest in the property identified in Part 2, Line 1, that was used as a

3I am liable for paying real property taxes on the property identified in Part 2, Line 1.

Note: If I have not received this exemption for this property previously, I also met the eligibility requirements listed in Part 4, Lines 1, 2, and 3 for this property on January 1, 2012.

4(Mark the statement that applies.)

a ____ In 2013, I am, or will be, 65 years of age or older.

b ____ In 2013, my spouse, who died in 2013, would have been 65 years of age or older. (Complete the following information.)

_____________________________________________ |

__________________________________________________ |

Deceased spouse’s name |

Tax ID number |

____ ____ /____ ____ /____ ____ ____ ____ |

____ ____ /____ ____ /____ ____ ____ ____ |

Date of birth (month, day, year) |

Date of death (month, day, year) |

5The property identified in Part 2, Line 1, is the only property for which I am applying for a senior citizens assessment freeze homestead exemption for 2013.

6The amount reported in Part 3, Line 13, of this form includes the income of my spouse and all persons living in my household and the total household income for 2012 is $55,000 or less.

7On January 1, 2013, the following individuals also used the property identified in Part 2, Line 1, for their principal residence. My spouse is included if he or she used the property as his or her principal dwelling place on January 1, 2013. The total income of all individuals and my spouse (regardless of his or her principal residence) are included in Part 3. (Attach an ad- ditional sheet if necessary.)

a b

First and last name |

Tax ID number |

__________________________________________________ |

__________________________________________________ |

__________________________________________________ |

__________________________________________________ |

8 (Mark the statement that applies.) |

|

|

On January 1, 2013, I was |

|

|

a ____ single, widow(er), or divorced. |

b ____ married and living together. |

c ____ married, but not living together. |

My spouse’s name and address is _____________________________________________________________________________

First nameMILast name

_____________________________________________________________________________________________________________

Street Address |

City |

State |

ZIP |

Under penalties of perjury, I state that, to the best of my knowledge, the information contained in this affidavit is true, correct, and complete.

_______________________________________ ____ ____/____ ____/____ ____ ____ ____

Signature of applicantDate (month, day, year)

Subscribed and sworn to before me this

_______ day of ________________________________, 20_____. |

____________________________________________________ |

|

Notary public |

Note: The CCAO may conduct an audit to verify that the taxpayer is eligible to receive this exemption.

Mail your completed Form |

If you have any questions, please call: |

||

_________________Co. Chief County Assessment Officer |

(_________) |

— |

|

_______________________________________________________ |

Last date to apply ___ ___/___ ___/___ ___ ___ ___ |

||

Mailing address |

Month |

Day |

Year |

____________________________________IL _________________

City |

ZIP |

2 of 4 |

Form

What is the Senior Citizens Assessment Freeze Homestead Exemption (SCAFHE)?

The Senior Citizens Assessment Freeze Homestead Exemption (35 ILCS

Freezing your property’s EAV does not mean that your property taxes will not increase, however. Other factors also affect your tax bill. For example, your tax bill could increase if the tax rate, which is based on the amount of revenues taxing districts re- quest, increases. Your EAV and tax bill may also increase if you add improvements to your home. However, if your home’s EAV decreases in the future, you will benefit from any reduction.

Who is eligible?

The senior citizens assessment freeze homestead exemption quali- fications for the 2013 tax year (for the property taxes you will pay in 2014), are listed below.

•You will be 65 or older during 2013.

•Your total household income in 2012 was $55,000 or less.

•On January 1, 2012, and January 1, 2013, you

—used the property as your principal place of residence,

—owned the property, or had a legal or equitable interest in the property as evidenced by a written instrument, or had a leasehold interest in the property used as a

—were liable for the payment of property taxes.

You do not qualify for this exemption if your property is assessed under the mobile home privilege tax.

Surviving spouse — Even if you are not 65 or older during 2013, you are eligible for this exemption for 2013 (and possibly 2012) if your spouse died in 2013 and would have met all of the qualifica- tions.

Residents in a health facility — Even if you did not use the property as your principal place of residence on January 1, 2013, you qualify for this exemption if you are a resident of a facility licensed under the Assisted Living and Shared Housing Act, Nursing Home Care Act, ID/DD (intellectually disabled/develop- mentally disabled) Community Care Act, or Specialized Mental Health Rehabilitation Act and you meet all other requirements, have received this exemption previously, and your property is either unoccupied or is occupied by your spouse.

Residents of cooperatives — If you are a resident of a coop- erative apartment building or cooperative

What is a household?

A household includes you, your spouse, and all other per- sons who used your residence as a principal dwelling place on January 1, 2013.

What is included in household income?

Household income includes your income, your spouse’s income, and the income of all individuals living in the household. Examples of income that must be included in your household income are listed below. (For specific questions, see Part 3 on Page 4.)

•alimony or maintenance received

•annuities and other pensions

•Black Lung benefits

•business income

•capital gains

•cash assistance from the Illinois Department of Human Ser- vices and other governmental cash public assistance

•cash winnings from such sources as raffles and lotteries

•Civil Service benefits

•damages awarded in a lawsuit for nonphysical injury or sick- ness (for example, age discrimination or injury to reputation)

•dividends

•farm income

•Illinois Income Tax refund (only if you received Form

•interest

•interest received on life insurance policies

•long term care insurance (federally taxable portion only)

•lump sum Social Security payments

•miscellaneous income, such as from rummage sales, recy- cling aluminum, or baby sitting

•military retirement pay based on age or length of service

•monthly insurance benefits

•pension and IRA benefits (federally taxable portion only)

•Railroad Retirement benefits (including Medicare deductions)

•rental income

•Ilinois Cares Rx rebate (only if you took an itemized deduction for health insurance in the prior year on your federal income tax return)

•Social Security income (including Medicare deductions)

•Supplemental Security Income (SSI) benefits

•all unemployment compensation

•wages, salaries, and tips from work

•Workers’ Compensation Act income

•Workers’ Occupational Diseases Act income

What is not included in household income?

Some examples of income that are not included in household income are listed below. (For specific income questions, see Part 3 on Page 4.)

•cash gifts

•child support payments

•Circuit Breaker grants

•COBRA subsidy payments

•damages awarded in a lawsuit for a physical personal injury or sickness

•Energy Assistance payments

•federal income tax refunds

•IRA’s “rolled over” into other retirement accounts, unless “rolled over” into a Roth IRA

•lump sums from inheritances

•lump sums from insurance policies

•money borrowed against a life insurance policy or from any financial institution

• reverse mortgage payments

•spousal impoverishment payments

•stipends from Foster Parent and Foster Grandparent programs

•Veterans’ benefits

What if I have a net operating loss or capital loss carryover from a previous year?

You cannot include any carryover of net operating loss or capital loss from a previous year. You can include only a net operating loss or capital loss that occurred in 2012.

Will my information remain confidential?

All information received from your application is confidential and may be used only for official purposes.

When must I file?

File Form

Note: The CCAO may require additional documentation

(i.e., birth certificates, tax returns) to verify the information in this application.

What if I need additional assistance?

If you have questions about this form, please contact your CCAO, also known as the supervisor of assessments, or county assessor, at the address and phone number printed at the bottom of Page 2.

3 of 4 |

Form

Part 1: Applicant information

Lines 1 through 5 — Type or print the requested information.

Part 2: Property information

Lines 1 and 2 — Identify the property for which this applica- tion is filed.

Lines 3 and 4 — Answer the questions by marking an “X” next to your statement. If you answered “Yes” to the question on Line 3 and you know the base year, write it in the space provided.

Part 3: Household income for 2012

“Income” for this exemption means 2012 federal adjusted gross income, plus certain items subtracted from or not included in your federal adjusted gross income (320 ILCS 25/3.07). These in- clude

The amounts written on each line must include the 2012 income for you, your spouse, and all the other individuals living in the household.

Line 1 — Social Security and Supplemental Security Income (SSI) benefits

Write the total amount of retirement, disability, or survivor’s benefits (including Medicare deductions) the entire household received from the Social Security Administration (shown on Form

Note: The amount deducted for Medicare ($1,198.80 yearly or $99.90 per month, per person) is already included in the amount in box 3 of Form

Line 2 — Railroad Retirement benefits

Write the total amount of retirement, disability, or survivor’s bene- fits (including Medicare deductions) the entire household received under the Railroad Retirement Act (shown on Forms

Line 3 — Civil Service benefits

Write the total amount of retirement, disability, or survivor’s benefits the entire household received under any Civil Service retirement plan (shown on Form

Line 4 — Annuities and other retirement income

Write the total amount of income the entire household received as an annuity from any annuity, endowment, life insurance con- tract, or similar contract or agreement (shown on Form

Include only the federally taxable portion of pensions, IRAs, and IRAs converted to Roth IRAs (shown on U.S. 1040, Line 15b and 16b, or U.S. 1040A, Line 11b and 12b). IRA’s are not taxable when “rolled over,” unless “rolled over” into a Roth IRA.

Line 5 — Human Services and other governmental cash public assistance benefits

Write the total amount of Human Services and other governmen- tal cash public assistance benefits the entire household received. If the first two digits of any member’s Human Services case num- ber are the same as any of those in the following list, you must include the total amount of any of these benefits on Line 5.

01 |

aged |

04 and 06 temporary assistance to |

02 |

blind |

needy families (TANF) |

03 |

disabled |

07 general assistance |

To determine the total amount of the household benefits, multi- ply the monthly amount each person received by 12. You must adjust your figures accordingly if anyone in the household did not receive 12 equal checks during this period.

Food stamps, medical assistance, and Circuit Breaker benefits anyone in the household may have received are not considered income and should not be added to your total income.

Line 6 — Wages, salaries, and tips from work

Write the total amount of wages, salaries, and tips from work for every household member (shown in box 1 of Form

Line 7 — Interest and dividends received

Write the total amount of interest and dividends the entire house- hold received from all sources, including any government sources (shown on Forms

Line 8 — Net rental, farm, and business income or (loss)

Write the total amount of net income or loss from rental, farm, business sources, etc., the entire household received, as allowed on U.S. 1040, Lines 12, 17, and 18. You cannot use any net oper- ating loss (NOL) carryover in figuring income.

Line 9 — Net capital gain or (loss)

Write the total amount of taxable capital gain or loss the entire household received in 2012, as allowed on U.S. 1040, Lines 13 and 14, or U.S. 1040A, Line 10. You cannot use a net capital loss carryover in figuring income.

Line 10 — Other income or (loss)

Write the total amount of other income or loss not included in Lines 1 through 9, that is included in federal adjusted gross income, such as alimony received, unemployment compensation, taxes withheld from oil or gas well royalties. You cannot use any net operating loss (NOL) carryover in figuring income.

Line 11 — Add Lines 1 through 10.

Line 12 — Subtractions

You may subtract only the reported adjustments to income totaled on U.S. 1040, Line 36 or U.S. 1040A, Line 20. For example

• |

IRA deduction |

• Educator expenses |

• |

Archer MSA deduction |

• Tuition and fees |

• |

moving expenses |

• Domestic production |

• |

alimony or maintenance paid |

activities deduction |

• health savings account deduction

•student loan interest deduction

•jury duty pay you gave to your employer

•

•

•

•penalty on early withdrawal of savings

Line 13 — Total household income

Subtract Line 12 from Line 11. If this amount is greater than $55,000, you do not qualify for this exemption. See Page 3.

Part 4: Affidavit

Lines 1 through 4 — Mark the item that applies. Read the af- fidavit carefully. The statements must apply.

Line 7 — Write the names and tax identification numbers of the individuals, other than yourself, who used the property for their principal residence on January 1, 2013. Attach an additional sheet if necessary.

Line 8 — Follow the instructions on the form. If your spouse does not reside at this property, be sure to write his or her name and address.

Note: You must sign your Form

4 of 4 |

Document Specifics

| Fact Name | Fact Detail |

|---|---|

| Form Title | Senior Citizens Assessment Freeze Homestead Exemption Application and Affidavit (PTAX-340) |

| Application Purpose | Allows qualified senior citizens to freeze the equalized assessed value (EAV) of their home to limit increases due to inflation |

| Eligibility Criteria | Applicants must be 65 or older within the application year and have a household income of $55,000 or less |

| Key Components | Includes applicant information, property information, household income for the prior year, and an affidavit |

| Governing Law | 35 ILCS 200/15-172 (Illinois Compiled Statutes) |

| Confidentiality Assurance | Information provided in the application remains confidential and is used only for official purposes |

Guide to Writing Ptax 340

Filling out the PTAX-340 form is a crucial step for senior citizens aiming to secure a freeze on their home’s equalized assessed value (EAV), which could potentially limit increases in property taxes due to inflation. Careful attention to detail and thoroughness in completing each part of the form will ensure that all necessary information is accurately conveyed for eligibility consideration. Below is a straightforward guide designed to assist in the completion process.

- Part 1: Applicant information

- Lines 1 through 5: Provide your first name, middle initial, last name, mailing address, date of birth (month, day, year format), area code and phone number, and your email address. Be sure to also include your Tax ID number.

- Part 2: Property information

- Line 1: Enter the street address of the property for which this exemption application is filed, including the township, city, ZIP, and county.

- Line 2: Provide the property (parcel) index number (PIN). If unknown, attach a copy of the legal description of your property.

- Lines 3 and 4: Indicate whether you or your spouse have previously received this exemption for the property and if your spouse, maintaining a separate residence, has applied for this exemption.

- Part 3: Household income for 2012

- Lines 1 through 10: Accurately report all forms of income received by you, your spouse, and any other individuals living in your household during the year 2012, following the specific instructions for each line to include social security, benefits, wages, and other incomes or losses.

- Line 11: Add the amounts from Lines 1 through 10 to calculate total income.

- Line 12: If applicable, list certain subtractions from your income as specified, and add the amounts.

- Line 13: Subtract the total subtractions in Line 12 from the total income in Line 11 to find your total household income for 2012. Note, if greater than $55,000, stop; you do not qualify.

- Part 4: Affidavit

- Lines 1 through 4: Choose and mark the statement that applies to your situation regarding property usage, ownership, and eligibility requirements.

- Line 7: List names and tax identification numbers of others using the property as their principal residence as of January 1, 2013, if applicable.

- Line 8: Indicate your marital status and provide spouse’s information if living separately.

- Sign and date the affidavit in the presence of a notary public.

- Review the entire form to ensure accuracy and completeness before submission.

- Return the completed PTAX-340 form to the Chief County Assessment Officer (CCAO) at the mailing address provided on the form.

Once submitted, your application will undergo review to determine eligibility. Should additional documentation or clarification be required, the county assessor may reach out to you directly. It’s important to file within the specified deadline and ensure that all information is current and correct to avoid any delays or issues with your exemption request.

Understanding Ptax 340

FAQs about the PTAX-340 Form

What is the PTAX-340 form?

The PTAX-340 form, also known as the Senior Citizens Assessment Freeze Homestead Exemption Application and Affidavit, is a document used in the state of Illinois. It allows qualified senior citizens to freeze the equalized assessed value (EAV) of their property at the base year value. This is intended to help prevent or limit increases in property value due to inflation. While it may not necessarily reduce property taxes, it can prevent them from increasing due to a rise in property value.

Who is eligible to apply?

Eligibility for the Senior Citizens Assessment Freeze Homestead Exemption requires applicants to meet the following criteria for the tax year they are applying:

- Applicants must be 65 years of age or older.

- The total household income for the prior year must be $55,000 or less.

- On January 1 of the two years prior to the application year, the applicant must have used the property as their principal place of residence, owned the property or had a legal, equitable, or leasehold interest in it, and been liable for the payment of property taxes.

What constitutes household income?

Household income includes the combined total of the applicant's income, their spouse's income, and the income of all individuals living in the household. This encompasses a variety of income types such as wages, Social Security benefits, annuities, pensions, public assistance benefits, interest, dividends, net rental, farm and business income, capital gains, and any other income. Certain adjustments to income are also permitted to be subtracted as specified in the form instructions.

How and when should the PTAX-340 form be filed?

The PTAX-340 form should be completed and submitted to the Chief County Assessment Officer (CCAO) or county assessor's office. The deadline for submission varies, so it is crucial to refer to the specific due date printed on the form each year. Applicants are required to file the PTAX-340 form annually to continue receiving the exemption, and they should ensure the form is signed and notarized prior to submission. Additional documentation may be required by the CCAO to verify the information provided in the application.

Common mistakes

Failing to accurately report household income is a common mistake. It is crucial to include all sources of income for the applicant, their spouse, and anyone else living in the household as of January 1, 2013. This income includes wages, Social Security benefits, pensions, and any other money received. Exclusion or incorrect reporting of any portion can lead to application denial or future legal complications.

Another frequent error involves not properly identifying the property for which the exemption is sought. The form requires the property's street address, township, city, ZIP, and county in Illinois, along with the Property Index Number (PIN). The PIN is often overlooked or entered incorrectly, which could lead to processing delays or the rejection of the application.

Applicants sometimes incorrectly answer questions regarding previous receipt of this exemption or the occupancy status of the property. It's important to carefully read and accurately respond to whether the exemption was received before, and if the property is currently the principal residence of the applicant or their spouse. Incorrect answers can result in ineligibility.

Overlooking the need for detailed income reporting under Part 3 is a common oversight. Each type of income listed from Lines 1 through 10 must be meticulously calculated and reported, ensuring that Medicare deductions, if applicable, are included. Misreporting or omitting income details can significantly impact the assessment.

Confusion about what constitutes household income can lead to mistakes. Applicants must include all forms of income received by every household member, not just the primary applicant. This broader inclusion can be misunderstood, causing applicants to report only their income or exclude significant portions of the household's overall income.

Finally, a significant number of applicants forget to sign and date the affidavit section after completing the form, or they fail to get the affidavit notarized. This oversight, while seemingly minor, is crucial for the processing of the PTAX-340 form. Without a proper signature and notarization, the application cannot be legally processed, potentially disqualifying the applicant from receiving the exemption.

Documents used along the form

When filing the PTAX-340 form, which is a Senior Citizens Assessment Freeze Homestead Exemption Application and Affidavit, it's important to gather and complete additional forms and documents to ensure a comprehensive submission. Understanding these documents will facilitate a smooth application process.

- Form 1040 or 1040A: U.S. Individual Income Tax Return or (if applicable) the simplified version, required for detailing annual income. This form provides evidence of household income, an essential criterion for eligibility.

- Form 1099: Variants of this form report various types of income other than wages, such as dividends (1099-DIV), interest (1099-INT), government and public assistance payments, and distributions from pensions, annuities, retirement, or profit-sharing plans (1099-R).

- Form SSA-1099: Social Security Benefit Statement, showing the total amount of social security benefits received. This is crucial for applicants to report income accurately.

- Form RRB-1099: Issued by the Railroad Retirement Board, documenting the benefits received, similar to SSA-1099, for households with members having railroad retirement benefits.

- Form 1099-G: Certain Government Payments, which might include state tax refunds and unemployment compensation, necessary for completing household income data.

- Property Tax Bill: This document is necessary to provide the property index number (PIN) and to confirm the applicant's responsibility for the property taxes.

- Proof of Residence: Documents such as utility bills or driver's licenses help establish the property as the principal residence of the applicant.

- Legal Description of Property: If the PIN is not available, a legal description of the property is required. This can often be obtained from a deed or a property tax bill.

- Birth Certificate: Necessary to prove age eligibility, confirming the applicant is 65 years or older within the year of application.

- Proof of Ownership: A deed or other legal document is needed to establish the applicant's ownership or legal interest in the property.

Collecting and properly filling out these documents, in addition to the PTAX-340 form, is fundamental. They collectively establish eligibility for the Senior Citizens Assessment Freeze Homestead Exemption, making it imperatively beneficial for senior citizens seeking to freeze their property's equalized assessed value to mitigate the impact of real estate tax inflation. Taking care to prepare this documentation thoroughly ensures that applicants receive the exemptions for which they qualify.

Similar forms

The PTAX-340 form, utilized for senior citizens seeking a homestead exemption freeze, shares similarities with the Form 1040, U.S. Individual Income Tax Return. Just like the PTAX-340 requires detailed income information to determine eligibility for tax relief, the Form 1040 collects comprehensive income data to calculate the amount of tax owed or refund due to a taxpayer. Both forms require detailed reporting of various income sources, adjustments, and personal information, emphasizing financial transparency.

Another comparable document is the Schedule R (Form 1040), Credit for the Elderly or the Disabled. This form, like the PTAX-340, is designed specifically for senior citizens and others meeting certain criteria, aiming to provide financial relief. Both demand strict eligibility requirements, including age and income limits, and necessitate thorough documentation of income to ensure applicants qualify for the benefits they seek.

The HUD-1 Settlement Statement, though serving a different primary purpose in real estate transactions, bears resemblance to the PTAX-340 in its detailed itemization and emphasis on accuracy in financial dealings. While the HUD-1 outlines costs related to a property sale, the PTAX-340 scrutinizes homeowner's income and property details to qualify for a tax freeze, both ensuring correct financial representation.

The VA Form 26-1880, Request for Certificate of Eligibility for VA Home Loan Benefits, also parallels the PTAX-340. Both forms cater to specific groups - veterans for the VA form and senior citizens for the PTAX-340 - and require detailed personal information, property details, and, in the PTAX-340's case, income information, to verify eligibility for certain benefits.

The FAFSA (Free Application for Federal Student Aid) form, while focused on educational grants and loans rather than tax exemptions, shares commonalities with the PTAX-340 in its detailed financial scrutiny. Both documents require extensive financial information from applicants to determine eligibility for financial aid or tax relief, aiming to support individuals based on financial need.

The SSA-1099, Social Security Benefit Statement, though not an application form, relates closely to the PTAX-340 in the context of income reporting. Senior citizens applying for the homestead exemption freeze on the PTAX-340 often need to report their Social Security income, as demonstrated on the SSA-1099. Both documents play crucial roles in financial documentation for senior citizens, underscoring the importance of accurate income representation.

Dos and Don'ts

Filling out government forms can feel overwhelming, but when it comes to important documents like the PTAX-340 form, which is the Senior Citizens Assessment Freeze Homestead Exemption Application, attention to detail is crucial. This form offers a chance for eligible senior citizens to freeze the assessed value of their homes, potentially leading to savings on property taxes. Here are some do's and don'ts to keep in mind when completing this form:

- Do check the filing deadline – Make sure to file your application by the last date as indicated on the form to ensure your eligibility for the exemption.

- Don't forget to sign and date the form – An unsigned or undated form can lead to delays or even rejection of your application.

- Do type or print in black ink – This improves readability and helps in the accurate processing of your application.

- Don't omit your Tax ID number – This is essential for verifying your identity and tax records.

- Do include all necessary documentation – If your form asks for additional documents, like proof of income or age, make sure to attach them.

- Don't underestimate your income – Accurately report household income to prevent issues or discrepancies later. Remember, certain items not typically included in your taxable income must also be reported here.

- Do ask for help if you need it – If any part of the form is unclear, contact your Chief County Assessment Officer (CCAO) for assistance. It's better to get clarification than to make an incorrect assumption.

By following these guidelines, you can ensure a smoother process in applying for the Senior Citizens Assessment Freeze Homestead Exemption. Taking the time to fill out the PTAX-340 form accurately can lead to significant savings on your property taxes, making it well worth the effort.

Misconceptions

Understanding the complexities of the PTAX-340 form, also known as the Senior Citizens Assessment Freeze Homestead Exemption Application, can be challenging. Many applicants face misconceptions about the form and its requirements. Let's debunk some of these common misconceptions to help clarify the process.

Only income from employment counts towards the household income limit. This is incorrect. The form requires the inclusion of all household income, not just wages from employment. This includes Social Security benefits, pensions, annuities, and any other income received by household members.

The form is only for homeowners. While it's primarily designed for homeowners, residents of cooperative apartments or life-care facilities who are responsible for paying property taxes on their residence may also qualify and should apply.

If your income is slightly above the $55,000 threshold, you should not bother applying. This misconception could lead to eligible seniors missing out on benefits. Certain subtractions from your gross income are allowed, which might bring the total household income below the qualifying threshold.

Submission of the PTAX-340 once is enough for lifelong exemption. In reality, eligible senior citizens must reapply every year to continue receiving the exemption, ensuring their information and income levels still meet the criteria.

The form only benefits individuals with a fixed income. The PTAX-340 form is designed to help senior citizens freeze the assessed value of their property to limit increases due to inflation, benefiting all qualifying seniors regardless of whether their income is fixed or variable.

Improvements to your home always disqualify you from receiving the exemption. While adding improvements to your home can increase its assessed value and potentially your tax bill, it doesn't automatically disqualify you. The key factor is whether the overall equalized assessed value (EAV) of your property, as adjusted, remains within the program's guidelines.

Applicants need to provide their entire financial history. Applicants are only required to report their income and certain financial information for the previous year, not their entire financial history. This ensures the process remains as straightforward as possible.

The exemption eliminates your property tax bill. The exemption “freezes” the assessed value of your property, which can prevent or limit increases due to inflation. However, it doesn't eliminate the tax bill. Other factors, like tax rates and district revenue requests, can still cause your tax bill to change.

The same rules apply statewide. While the PTAX-340 form is used throughout Illinois, local implementation can vary. Applicants should contact their local County Chief Assessment Officer (CCAO) for specific details. Plus, since eligibility criteria may evolve, keeping in touch with local property tax authorities can provide up-to-date information.

Dispelling these misconceptions is essential for ensuring that all eligible senior citizens can benefit from the Senior Citizens Assessment Freeze Homestead Exemption. By providing accurate information and understanding the requirements, more seniors can take advantage of this opportunity to manage their property tax bills effectively.

Key takeaways

Filling out the PTAX-340 form correctly is crucial for senior citizens to ensure they receive the Senior Citizens Assessment Freeze Homestead Exemption. To assist in this process, here are nine key takeaways:

- Ensure the application is submitted by the due date listed at the bottom of Page 2 of the form to remain eligible for the exemption.

- Fill out Part 1 with your personal details thoroughly, including your tax ID number, mailing address, date of birth, phone number, and email address for future correspondence.

- In Part 2, accurate property information is necessary, including the street address, township, county, and the property index number (PIN), which is vital for identifying your property.

- Answer questions about previous exemptions and whether your spouse applies for this exemption separately if maintaining a distinct residence.

- Part 3 requires a detailed account of household income for 2012. This includes not just personal income but also the income of your spouse and others living in the household, covering a broad range of sources from Social Security benefits to net rental income.

- Remember, the total household income for 2012 must be $55,000 or less to qualify for the exemption.

- The affidavit section asks for confirmation regarding the property's use, your age, and your agreement that the property is the sole property for which you're applying for this exemption in 2013.

- Signatures and notarization are required at the bottom of the affidavit to validate the application. It's crucial that this section is completed fully and accurately.

- If necessary, contact the county's Chief County Assessment Officer (CCAO) for assistance or clarification. The form includes contact information for correspondence.

Keeping these points in mind while filling out the PTAX-340 can ease the process and help secure the valuable Senior Citizens Assessment Freeze Homestead Exemption.

Popular PDF Documents

Federal Form 2441 - Through Form 2441, the IRS accommodates a variety of care scenarios, from in-home nannies to external care facilities.

3520 Instructions - Provides peace of mind by entrusting tax duties to a responsible party.

433 B Oic - Filling out Form 433-A requires thorough documentation of financial status, including wages, investment income, and property values.