Get Ptax 300 R Form

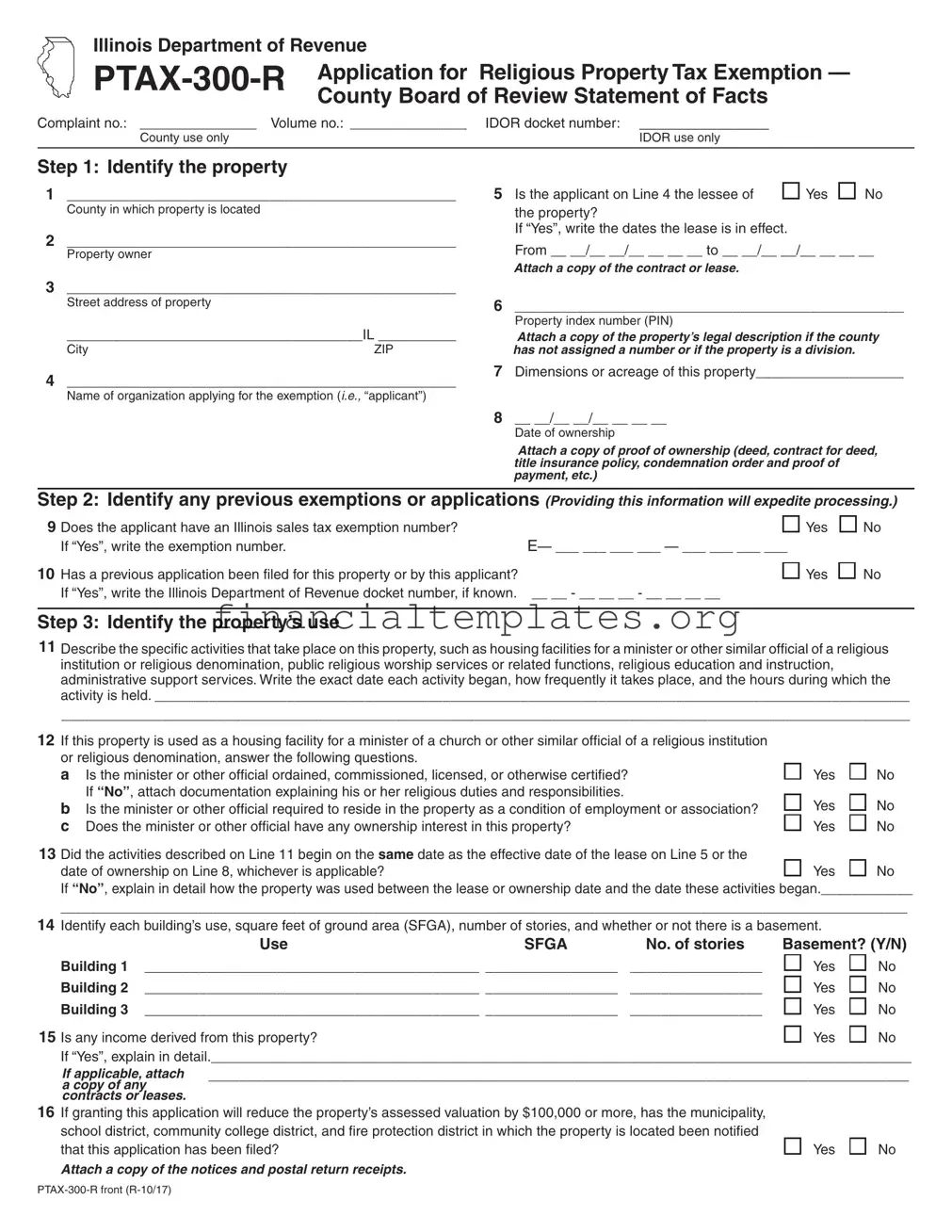

The Illinois Department of Revenue PTAX-300-R Application for Religious Property Tax Exemption is instrumental for religious organizations seeking property tax relief for their non-homestead properties. This detailed application form requires thorough information about the property in question, including a statement of facts, ownership details, and a comprehensive description of the property's use to establish its eligibility for exemption. Designed to streamline the exemption process, the form mandates the attachment of critical documents such as proof of ownership, pictures of the property, a notarized affidavit of use, and, if applicable, copies of any contracts or leases. It also guides applicants through identifying past exemptions or applications, the specific activities housed within the property, and income derived from it, which are all pivotal in determining the property’s exemption status. Significant emphasis is placed on notifying relevant taxing bodies in cases where the application’s approval may substantially reduce the property's assessed valuation, emphasizing the form's role in both facilitating exemptions and ensuring transparency and fairness in the tax assessment process. By meticulously outlining each step - from identification through to documentation and final submission to the county board of review - the PTAX-300-R form underpins the procedural integrity of applying for religious property tax exemptions in Illinois.

Ptax 300 R Example

Illinois Department of Revenue

|

Application for Religious Property Tax Exemption — |

|

||||

|

County Board of Review Statement of Facts |

|

|

|||

|

|

|

|

|||

Complaint no.: _______________ Volume no.: _______________ |

IDOR docket number: _______________ |

|

|

|||

|

County use only |

|

IDOR use only |

|

|

|

|

|

|

|

|

||

Step 1: Identify the property |

|

|

|

|

||

1 |

__________________________________________________ |

5 Is the applicant on Line 4 the lessee of |

Yes |

No |

||

|

County in which property is located |

|

the property? |

|

|

|

2 |

__________________________________________________ |

If “Yes”, write the dates the lease is in effect. |

|

|

||

From __ __/__ __/__ __ __ __ to __ __/__ __/__ __ __ __ |

||||||

|

Property owner |

|

||||

|

|

|

|

|

||

Attach a copy of the contract or lease.

3__________________________________________________

Street address of property |

|

6 |

__________________________________________________ |

|

|

|

Property index number (PIN) |

______________________________________IL __________ |

|

Attach a copy of the property’s legal description if the county |

|

City |

ZIP |

|

has not assigned a number or if the property is a division. |

4 __________________________________________________ |

7 |

Dimensions or acreage of this property___________________ |

|

|

|

||

Name of organization applying for the exemption (i.e., “applicant”) |

|

|

|

|

|

8 |

__ __/__ __/__ __ __ __ |

|

|

|

Date of ownership |

Attach a copy of proof of ownership (deed, contract for deed, title insurance policy, condemnation order and proof of payment, etc.)

Step 2: Identify any previous exemptions or applications (Providing this information will expedite processing.)

9 Does the applicant have an Illinois sales tax exemption number? |

|

If “Yes”, write the exemption number. |

E— ___ ___ ___ ___ — ___ ___ ___ ___ |

Yes

No

10Has a previous application been filed for this property or by this applicant?

If “Yes”, write the Illinois Department of Revenue docket number, if known. __ __ - __ __ __ - __ __ __ __

Yes

No

Step 3: Identify the property’s use

11Describe the specific activities that take place on this property, such as housing facilities for a minister or other similar official of a religious institution or religious denomination, public religious worship services or related functions, religious education and instruction, administrative support services. Write the exact date each activity began, how frequently it takes place, and the hours during which the activity is held.

_____________________________________________________________________________________________________________

12If this property is used as a housing facility for a minister of a church or other similar official of a religious institution or religious denomination, answer the following questions.

aIs the minister or other official ordained, commissioned, licensed, or otherwise certified? If “No”, attach documentation explaining his or her religious duties and responsibilities.

bIs the minister or other official required to reside in the property as a condition of employment or association? c Does the minister or other official have any ownership interest in this property?

Yes

Yes Yes

No

No No

13 Did the activities described on Line 11 begin on the same date as the effective date of the lease on Line 5 or the |

|

|

date of ownership on Line 8, whichever is applicable? |

Yes |

No |

If “No”, explain in detail how the property was used between the lease or ownership date and the date these activities began.____________

_______________________________________________________________________________________________________________

14Identify each building’s use, square feet of ground area (SFGA), number of stories, and whether or not there is a basement.

Use |

SFGA |

No. of stories |

Basement? (Y/N) |

Building 1 |

___________________________________________ _________________ |

_________________ |

Building 2 |

___________________________________________ _________________ |

_________________ |

Building 3 |

___________________________________________ _________________ |

_________________ |

Yes

Yes

Yes

No

No

No

15 Is any income derived from this property? |

Yes |

No |

If “Yes”, explain in detail.__________________________________________________________________________________________

__________________________________________________________________________________________

16If granting this application will reduce the property’s assessed valuation by $100,000 or more, has the municipality, school district, community college district, and fire protection district in which the property is located been notified that this application has been filed?

Attach a copy of the notices and postal return receipts.

Yes

No

Step 4: Attach documentation

The following documents must be attached:

•Proof of ownership (copy of the deed, contract for deed, title insurance policy, condemnation order and proof of payment, etc.)

•Picture of the property

•Notarized affidavit of use

•Copies of any contracts or leases on the property

The documents listed on Lines 18 through 23 may be attached to expedite processing. Mark an “X” next to any documents that are attached.

18 ___ Audited financial statements for the most recent year

19 ___ Copy of the applicant’s bylaws and complete certified recorded copy of Articles of Incorporation, including purpose clause and all amendments

20 ___ Copy of the notices to the municipality, school district, community college district, and fire protection district in which the property is located and postal return receipts if granting this application will reduce the property’s assessed valuation by $100,000 or more

21 ___ Plot plan of each building’s location on the property with each building and land area labeled with property index numbers and specific uses

22 ___ Copy of any Illinois Department of Revenue Exemption Certificate

23 ___ Other (list) ________________________________________

_________________________________________________

_________________________________________________

Step 5: Identify the person to contact regarding this application

24 ____________________________________________________ |

25 _____________________________________________________ |

||||||

Name of applicant’s representative |

|

Owner’s name (if the applicant is not the owner) |

|

||||

____________________________________________________ |

_____________________________________________________ |

||||||

Mailing address |

|

|

Mailing address |

|

|

||

____________________________________________________ |

_____________________________________________________ |

||||||

City |

|

State |

ZIP |

City |

|

State |

ZIP |

( |

) |

— |

|

( |

) |

— |

|

____________________________________________________ |

_____________________________________________________ |

||||||

Phone number |

|

|

Phone number |

|

|

||

Step 6: Signature

I, ______________________________________, _____________________________, say that I have read the foregoing application

Name |

Position |

and that all of the information is true and correct to the best of my knowledge and belief.

_______________________________________________________ __ __ / __ __ / __ __ __ __

Signature

County official use only. Do not write in this space

Step 7: County board of review statement of facts

1 |

Current assessment $__________________________________ |

For assessment year 2_____ |

2 |

Is this exemption application for a leasehold interest assessed to the applicant? |

|

|

If “Yes”, write the Illinois Department of Revenue docket number for the exempt fee interest to the owner, |

|

|

if known. ___ ___ — ___ ___ ___ — ___ ___ ___ ___ |

|

Yes

No

3 State all of the facts considered by the county board of review in recommending approval or denial of this exemption application.

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

4 County board of review recommendation

___ Full year exemption

___ Partial year exemption from ___ ___ / ___ ___ / ___ ___ ___ ___ to ___ ___ / ___ ___ / ___ ___ ___ ___

___ Partial exemption for the following described portion of the property: ___________________________________________________

__________________________________________________________________________________________________________

___ Deny exemption

5 Date of board’s action ___ ___ / ___ ___ / ___ ___ ___ ___

Step 8: County board of review certification

I certify this to be a correct statement of all facts arising in connection with proceedings on this exemption application.

_______________________________________________________ Mail to: OFFICE OF LOCAL GOVERNMENT SERVICES MC |

|

Signature of clerk of county board of review |

ILLINOIS DEPARTMENT OF REVENUE |

|

|

|

101 WEST JEFFERSON STREET |

|

SPRINGFIELD IL 62702 |

General Instructions for Form

When must Form

Complete Form

•For a federal/state agency exemption, complete Form PTAX-

•For any other

Which steps must the applicant complete?

The applicant must complete Steps 1 through 6. The county board of review must complete Steps 7 and 8.

Complete all lines and attach all required documents or the county board of review will not accept the incomplete exemption application. If there is not enough space on this form to answer a question fully, attach additional sheets. On the top of each ad- ditional sheet, identify the number of each question to which a response is being made.

Note: The Cook County Board of Review requires that their com- plaint form be filed in addition to Form

What must be attached to Form

The following documents must be attached to Form

•Proof of ownership (deed, contract for deed, title insurance policy, copy of the condemnation order and proof of payment, etc.)

•Picture of the property

•Notarized affidavit of use

•Copies of any contracts or leases on the property

To expedite processing, attach additional documents as specified in Step 4.

Must any taxing bodies be notified that an exemption application has been filed?

If granting this application will reduce the property’s assessed valuation by $100,000 or more, the municipality, school district, community college district, and fire protection district in which the property is located must be notified that this application has been filed.

How many forms must be filed if an exemption for multiple parcels is being sought?

File one application in both of the following situations:

•Multiple parcels acquired by the same deed — Form PTAX-

•A single parcel that was acquired by multiple deeds.

File a separate application for each parcel if multiple parcels were acquired by separate deeds, unless all four of the following conditions are met:

•The parcels are contiguous.

•All deeds were acquired before the year for which the exemp- tion is now being sought.

•Form

•Form

ing information, or characteristic (e.g., leases, photos, affida- vits of use) by parcel identifying number and deed.

Where is Form

File the completed Form

The county board of review considers exemption applications for the assessment year for which the board is in session only. It cannot consider an exemption for a previous or subsequent as- sessment year.

How is a property’s exempt status determined?

The following text is a brief outline of the procedures used to determine exempt status. For more information, see 35 ILCS

Step 1

Obtain Form

Step 2

The county board of review may hold a hearing to evaluate the ap- plication and supporting documents.

Step 3

The county board of review completes Steps 7 and 8 and recom- mends whether or not the exemption should be granted before forwarding Form

Step 4

The department assigns a docket number, reviews the facts regard- ing the application, and determines whether or not the exemption should be granted.

Note: In some instances, the department will request more information from the applicant, who has 30 days from the date of the department’s request to provide that information.

The department mails its decision to

•the applicant,

•any intervenors,

•the county clerk, and

•the clerk of the county board of review.

The department’s decision is final unless the applicant (or another party to the matter) requests a formal hearing.

How is a formal hearing requested if the applicant disagrees with the department’s decision?

Formal hearing requests must be made within 60 days after the date of the department’s decision. Mail requests for a formal hearing to the address provided on the exemption decision. The request will be forwarded to the Administrative Hearings Division.

Specific Instructions for Form

Step 1: Identify the property

Line 1 — Write the name of the county in which this property is located.

Line 2 — Write the property owner as shown on the deed or other proof of ownership.

Line 3 — Write the property’s street address.

Line 4 — Write the name of the organization applying for the exemption (i.e., “applicant”).

Line 5 — Check the box to indicate whether or not the applicant on Line 4 is the lessee of the property. If “Yes”, write the dates the lease is in effect. Attach a copy of the contract or lease.

Line 6 — Write the property index number. The chief county assessment officer (CCAO) or the county board of review can provide this number. Attach a copy of the property’s legal description if the county has not assigned a number or if the property is a division.

Line 7 — Write the dimensions (square footage) or acreage of this property.

Line 8 — Write the date on which ownership began. Attach a copy of proof of ownership (deed, contract for deed, or title insurance policy, etc.). If the property was obtained through condemnation, write the date the condemnation proceedings were filed and attach a copy of the condemnation order and proof of payment.

Step 2: Identify any previous exemptions or applications

Line 9 — Check the box to indicate whether or not the applicant has an Illinois sales tax exemption number. If “Yes”, write the exemption number.

Line 10 — Check the box to indicate whether or not a previous property tax exemption application has been filed for this property or applicant. If “Yes”, write the Illinois Department of Revenue docket number, if known.

Step 3: Identify the property’s use

Line 11 — Describe the specific activities that take place on this property. Write the exact date each activity began and how frequently it takes place. Do not state conclusions about the type of activity such as “charitable” or “educational”. If the property contains more than one building or a building contains more than one floor, separately describe the activities that take place in each building and on each floor. Include the square footage of each building and floor used for each activity.

Line 12 — Follow the instructions on the form.

Line 13 — Check the box to indicate whether or not the activities described on Line 11 began on the same date as the effective date of the lease on Line 5 or the date of ownership on Line 8, whichever is applicable. If “No”, explain in detail how the property was used between the lease or ownership date and the date these activities began.

Line 14 — Identify the use of each building on the property (e.g., classrooms, fire station). Write the square feet of ground area (SFGA) covered by each building, the number of stories, and indicate whether or not there is a basement.

Line 15 — Check the box to indicate whether or not any income is derived from the property. If “Yes”, explain in detail. If applica- ble, attach a copy of any written contracts, leases, or terms of oral agreement.

Line 16 — If granting this application will reduce the property’s assessed valuation by $100,000 or more, the municipality, school district, community college district, and fire protection district in which the property is located must be notified that this application has been filed. Check the box to indicate whether or not notice has been given to these taxing districts. Attach a copy of the

notices and postal return receipts.

Step 4: Attach documentation

The following documents must be attached:

•Proof of ownership (copy of the deed, contract for deed, title insurance policy, condemnation order and proof of payment, etc.)

•Picture of the property

•Notarized affidavit of use

•Copies of any contracts or leases on the property

Lines 18 through 22 — Mark an “X” next to any documents that are attached. Attaching the documents listed on Lines 18 through 22 may expedite processing.

Line 23 — If this property is used as a parking area, playground, lawn, or other ancillary use to an already exempt parcel, attach a copy of the Illinois Department of Revenue Exemption Certificate for the exempt parcel. Make a clear distinction between the parcel that is already exempt and the property for which exemption is now being sought. Describe how each parcel is used and indicate the proximity of the parcels to each other.

Step 5: Identify the person to contact regarding this application

Line 24 — Write the name, address, and phone number of the person the county board of review and the department should contact regarding this application.

Line 25 — If the applicant is not the owner, write the owner’s name, address, and phone number.

Step 6: Signature

The application must be signed, verifying that all of the informa- tion is true and correct to the best of the applicant’s knowledge and belief.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | PTAX-300-R is an application for Religious Property Tax Exemption in Illinois. |

| Applicable Entity | Illinois Department of Revenue |

| Governing Law(s) | 35 ILCS 200/15-5 through 15-160, 16-70, 16-130 |

| Required Attachments | Proof of ownership, picture of the property, notarized affidavit of use, copies of any contracts or leases. |

| Additional Documentation | Audited financial statements, copy of the applicant's bylaws and Articles of Incorporation, notices to taxing districts if applicable, plot plans, and any existing Illinois Department of Revenue Exemption Certificate. |

| Notification Requirement | If approval reduces assessed valuation by $100,000 or more, relevant taxing bodies must be notified. |

| Filing Location | County Board of Review where the property is located. |

| Exemption Determination Process | The process involves application review by the county board of review, recommendation, forwarding to the Department of Revenue for a final decision, and the option for a formal hearing if needed. |

Guide to Writing Ptax 300 R

Filing a PTAX-300-R form is a critical step for organizations seeking a property tax exemption for religious use in Illinois. This process involves presenting factual information about the property and how it's used by the religious institution. Accuracy and completeness are vital to expedite the review and approval process. Below are step-by-step instructions designed to simplify the completion of this form.

- Begin by identifying the county where the property is located in Step 1.

- Proceed to enter the specifics about the property, including the owner's name, property address, the property index number, and the dimensions or acreage.

- For organizations applying as lessees, indicate if you are leasing the property and provide the lease dates, attaching a copy of the lease agreement.

- Record the date when the ownership or control of the property was transferred to you and attach proof of ownership or the lease agreement if applicable.

- In the section about previous exemptions or applications (Step 2), discern whether an Illinois sales tax exemption number is held or if a previous application has been filed for this property.

- Under Step 3, thoroughly describe the property’s usage focusing on the religious activities carried out, specifying when each activity began and the frequency of these activities. If the property serves as a residence for a minister or similar official, provide details as required.

- Detail any income derived from the property and whether granting this exemption would decrease the property's assessed valuation by $100,000 or more, necessitating notification to certain municipal authorities.

- Attach all mandatory documentation for Step 4, such as proof of ownership, photographs of the property, a notarized affidavit of use, and any relevant contracts or leases. If applicable, mark clearly which of the additional documents listed you have attached.

- Provide contact information for the applicant's representative and, if different, the owner of the property in Step 5.

- The applicant or an authorized representative must sign the application, certifying the completeness and accuracy of the information provided.

- Lastly, submit the completed form and all attachments to the county board of review.

After submission, the county board of review will review the application, possibly require a hearing, and then make a recommendation to the Illinois Department of Revenue, which makes the final decision on the exemption. It’s essential to ensure all steps are followed thoroughly to avoid any delays in the process.

Understanding Ptax 300 R

Frequently Asked Questions about the PTAX-300-R Form:

What is the PTAX-300-R form used for?

This form is utilized by religious organizations to apply for a property tax exemption in Illinois. Specifically, it's designed for properties used for religious purposes, ensuring they are not subject to property tax if they meet certain criteria.

How do I determine if my organization should fill out the PTAX-300-R form?

If your organization operates for religious purposes and owns property used solely for these activities, you should complete this form. This includes worship spaces, housing for ministers, and other property directly supporting your religious mission.

What documents are required to accompany the PTAX-300-R form?

Essential documents include proof of ownership (like a deed), pictures of the property, a notarized affidavit of use explaining how the property supports your religious activities, and any contracts or leases associated with the property. Additional documents may expedite the review process.

Is there a deadline for filing the PTAX-300-R form?

Yes, but the specific deadline varies by county. It's crucial to contact your county board of review for the exact filing dates. Remember, this form concerns property tax exemptions for a particular tax year, so timely filing is important.

Can multiple parcels of property be included in one PTAX-300-R application?

In some cases, yes. If multiple parcels were acquired through the same deed or are contiguous and fit certain criteria, they can be included in a single application. Each scenario has specific requirements detailed in the form's instructions.

What happens if my organization leases the property rather than owns it?

Organizations leasing property for religious purposes can still apply for an exemption using the PTAX-300-R form. However, you must include information about the lease, such as its duration, and attach a copy of the lease agreement.

What steps are involved in the county's review of my PTAX-300-R application?

After submitting your application, the county board of review will examine it, possibly hold a hearing, and then make a recommendation for approval or denial. They forward their recommendation and your application to the Illinois Department of Revenue for a final decision.

If my organization's PTAX-300-R application is denied, what options do we have?

If your application is not approved, you can request a formal hearing. This request must be made within 60 days of the decision. During the hearing, you will have the opportunity to present additional evidence supporting your case for exemption.

Does filing the PTAX-300-R ensure my property is exempt from taxes?

No, filing this form is only the first step. Approval by both the county board of review and the Illinois Department of Revenue is necessary for your property to be officially exempt from property taxes.

Where can I get help filling out the PTAX-300-R form?

For assistance, consider reaching out to your county board of review. They can provide you with guidance specific to your situation. Additionally, legal professionals or tax advisors familiar with Illinois property tax laws can offer valuable support.

Common mistakes

Not attaching required documents: A notable mistake is failing to attach essential documents such as proof of ownership (deed, contract for deed, title insurance policy, etc.), a picture of the property, notarized affidavit of use, and any contracts or leases on the property. These documents are critical for processing the application.

Incorrect or incomplete property identification: Applicants often incorrectly fill out the property identification section. Details such as the property index number, street address, and the exact dimensions or acreage of the property must be accurately provided.

Skipping previous exemptions or applications information: Neglecting to disclose whether the property or applicant has previously filed for a tax exemption or if the applicant has an Illinois sales tax exemption number can delay processing. This information helps expedite the review of the application.

Inaccurate description of property’s use: An accurate and detailed description of the specific activities that take place on the property, including the square footage used for each activity, is essential. Vague or incorrect descriptions can lead to misunderstandings about the eligibility of the property for tax exemption.

Omission of income details or notification to taxing districts: Failing to disclose income derived from the property or not properly notifying the municipality, school district, community college district, and fire protection district when the application may reduce the property’s assessed valuation by $100,000 or more is a critical oversight. Accurate income details and proper notifications are required for a comprehensive review of the tax-exemption request.

When applying for a religious property tax exemption using the PTAX-300-R form, attention to detail and complete transparency are crucial. Ensuring that all required documentation is attached and accurately filling out every section of the form can significantly impact the application's success.

Documents used along the form

Filing the PTAX-300-R form is a crucial step for religious organizations seeking property tax exemption in Illinois. However, this process often requires additional forms and documents to provide a comprehensive view of the property's ownership, use, and exemption qualification. Understanding these documents is key to a successful application.

- Deed or Contract for Deed: This document proves ownership of the property. It must be attached to the PTAX-300-R to verify that the applicant legally owns the property in question.

- Title Insurance Policy: Similar to a deed, a title insurance policy serves as evidence of ownership. It provides a title search of the public records affecting the real estate concerned.

- Condemnation Order and Proof of Payment: For properties acquired through condemnation, these documents are necessary to establish the applicant’s ownership.

- Lease Agreement: If the applicant is not the owner but leases the property, a copy of the lease agreement must be included, detailing the terms under which the property is leased.

- Notarized Affidavit of Use: This sworn statement details how the property is used in ways that qualify it for a tax exemption. It must be notarized to attest to its veracity.

- Audited Financial Statements: While not mandatory, including the most recent audited financial statements can help expedite the application process by demonstrating the organization’s financial health and operations.

- Notice to Taxing Bodies: If the exemption application will reduce the property’s assessed valuation by $100,000 or more, notices to the relevant taxing bodies (municipality, school district, etc.) must be attached, along with postal return receipts.

- Articles of Incorporation: For organizations, a certified copy of the Articles of Incorporation may be required, including any amendments, to establish the legal basis of the entity seeking the exemption.

- Property Photos: Pictures of the property provide visual evidence to support the claim for exemption, helping to demonstrate the property's use and condition.

Together, these documents play a critical role in the exemption application process. They furnish the necessary evidence for the Illinois Department of Revenue and county boards to assess and, hopefully, approve the exemption request. It's important for organizations to gather and prepare these documents carefully to ensure a smooth and successful application process.

Similar forms

The PTAX-300-R form, designed for religious property tax exemption applications in Illinois, shares similarities with a variety of other documents used in property taxation and exemption processes. Understanding these documents shines a light on the intricate nature of tax exemption applications and property assessments.

One similar document is the PTAX-300 form, which is designed for non-homestead property exemptions outside of religious purposes. Like the PTAX-300-R form, this form requires detailed information about the property, including its use, ownership, and any income it generates. The main difference lies in the type of exemptions being sought, with PTAX-300 covering a broader range of non-homestead properties.

The PTAX-300-FS form, intended for federal and state agency non-homestead exemptions, parallels the PTAX-300-R in structure and content. Both forms necessitate comprehensive details about property use and ownership. The PTAX-300-FS focuses on properties owned by government entities, illustrating the government's exemption from local property taxes under certain conditions.

Application forms for homestead exemptions, while not identical, share the premise of providing detailed property information to qualify for tax reductions. Homestead exemption applications differ primarily in that they are designed for residential properties where the owner resides, as opposed to the PTAX-300-R's focus on properties used for religious purposes.

The Personal Property Declaration form, used for reporting movable assets owned by businesses, mirrors the PTAX-300-R in its requirement for detailed asset descriptions. Although it targets a different asset class, the emphasis on accurate and comprehensive reporting is a common thread.

Lease agreements, which may be attached to the PTAX-300-R form if the applicant is a lessee, are essential documents in property tax exemption processes. These agreements must outline the terms under which the property is leased, including use and duration, directly impacting the exemption status of the property in question.

Deeds and title insurance policies, referenced in the PTAX-300-R's documentation list, are foundational documents in establishing ownership and the right to apply for exemptions. These documents prove legal ownership, a prerequisite for any property tax exemption application, underscoring the interconnectedness of various legal documents in property taxation matters.

Notarized affidavits, similar to the affidavit of use attached to the PTAX-300-R application, serve as proof of the statements made within an application. These documents ensure that all information provided is accurate and truthful, a requirement that spans beyond tax exemption applications to encompass a wide range of legal processes.

Collectively, these documents illustrate the complex landscape of property taxation and exemption. Each plays a vital role in ensuring that properties are accurately assessed and rightfully exempted from taxation under applicable laws.

Dos and Don'ts

When filling out the PTAX-300-R Form, there are several important do's and don'ts to keep in mind in order to ensure the application process goes smoothly:

- Do thoroughly read all the instructions before starting the form to ensure understanding.

- Don't skip any steps outlined in the form; complete Steps 1 through 6 as required.

- Do attach all required documentation such as proof of ownership, pictures of the property, notarized affidavit of use, and any contracts or leases on the property.

- Don't leave any required fields blank. If a question does not apply, make sure to indicate with "N/A" or "Not Applicable."

- Do attach additional sheets if more space is needed to fully answer any questions, and clearly mark these sheets with the question number they correspond to.

- Don't provide vague descriptions of property use. Be as specific and detailed as possible to avoid delays in processing.

- Do notify the municipality, school district, community college district, and fire protection district if granting this application will reduce the property’s assessed valuation by $100,000 or more, including attaching copies of notices and postal return receipts.

- Don't forget to sign and date the form. The application must be signed, indicating that all information provided is true and correct to the best of the applicant’s knowledge.

- Do contact the county board of review where the property is located for any questions regarding filing deadlines and session dates.

Ensuring all these steps are followed can assist in a smoother application process for the religious property tax exemption. Remember to review your application for completeness and accuracy before submission to avoid any unnecessary delays.

Misconceptions

- Only religious organizations can apply: This is incorrect. The form is for properties owned by or used exclusively for religious purposes, regardless of the owning entity's primary function or status.

- It's only for properties within Chicago: This misconception is false. The form applies to religious property tax exemptions throughout the entire state of Illinois, not just Chicago or Cook County.

- All religious properties automatically qualify: Not true. The property must meet specific criteria regarding its use and ownership to qualify for a tax exemption.

- The form is complicated and requires legal expertise to complete: While it's comprehensive, the form outlines clear steps and required documentation for exemption application. It does not necessarily require a lawyer to complete, though consulting one can be beneficial.

- Submitting the PTAX-300-R form is all that's required: Incorrect. Along with the form, applicants must provide a proof of ownership, picture of the property, notarized affidavit of use, and any relevant contracts or leases.

- The form only needs to be filed once: This is false. If the property's use, ownership, or other relevant factors change, the form must be updated and resubmitted to reflect those changes.

- Filing the form ensures immediate exemption: Incorrect. The form is part of an application process that includes evaluation by the Illinois Department of Revenue and possibly the local county board of review. Approval is not guaranteed nor immediate.

- Any income from the property disqualifies it from exemption: Not necessarily true. While the property must be used primarily for religious purposes, incidental income generation does not automatically disqualify it, though details must be fully disclosed in the application.

- The form itself grants exemption upon completion: This is a common mistake. Completing and submitting the form is merely the first step. Only after review and approval by the respective authorities does the property receive its tax exemption status.

Key takeaways

Filling out and submitting the PTAX-300-R form is essential for religious organizations seeking property tax exemptions in Illinois. Here are key takeaways to guide you through the process:

- The Illinois Department of Revenue requires the PTAX-300-R form for religious property tax exemption applications. This specific form is geared towards properties used exclusively for religious purposes.

- Before you start the application, ensure you have clear proof of ownership like a deed or title insurance policy. This documentation is crucial and must be attached to your application.

- Accuracy is key when identifying the property on the form. You'll need to provide details such as the property index number (PIN), the street address, and the dimensions or acreage of the property.

- It's not just about ownership. If the applicant is leasing the property, information about the lease including dates must be disclosed. Attach a copy of the lease agreement for review.

- Detailing the property's use is a central part of the application. You need to describe the religious activities that take place, ensuring you clarify the frequency and duration of these activities. Such information helps solidify the eligibility for tax exemption.

- If your property serves multiple purposes or includes different facilities (e.g., housing for a minister), this must be fully detailed in the application. Be prepared to specify which parts of the property are used for which activities and whether any income is derived from the property.

- Notification requirements are in place for applications that could significantly reduce a property's assessed valuation. If applicable, municipalities, school districts, community college districts, and fire protection districts must be informed about the exemption application.

- Completing the application requires due diligence. Attach all necessary documentation as listed in the form, including photos of the property and notarized affidavits of use. Incomplete applications may lead to delays or denial of the exemption.

Following these guidelines will help ensure your PTAX-300-R application is complete and processed smoothly, potentially providing significant financial benefits for religious organizations through tax exemptions.

Popular PDF Documents

1099-g Georgia - The flexibility to report through various forms of electronic media supports employers in maintaining compliance efficiently.

Pag-ibig Calamity Loan Online - Includes a section for office use only, ensuring proper tracking and processing of calamity loan applications within Pag-IBIG Fund.