Get Ptax 300 Form

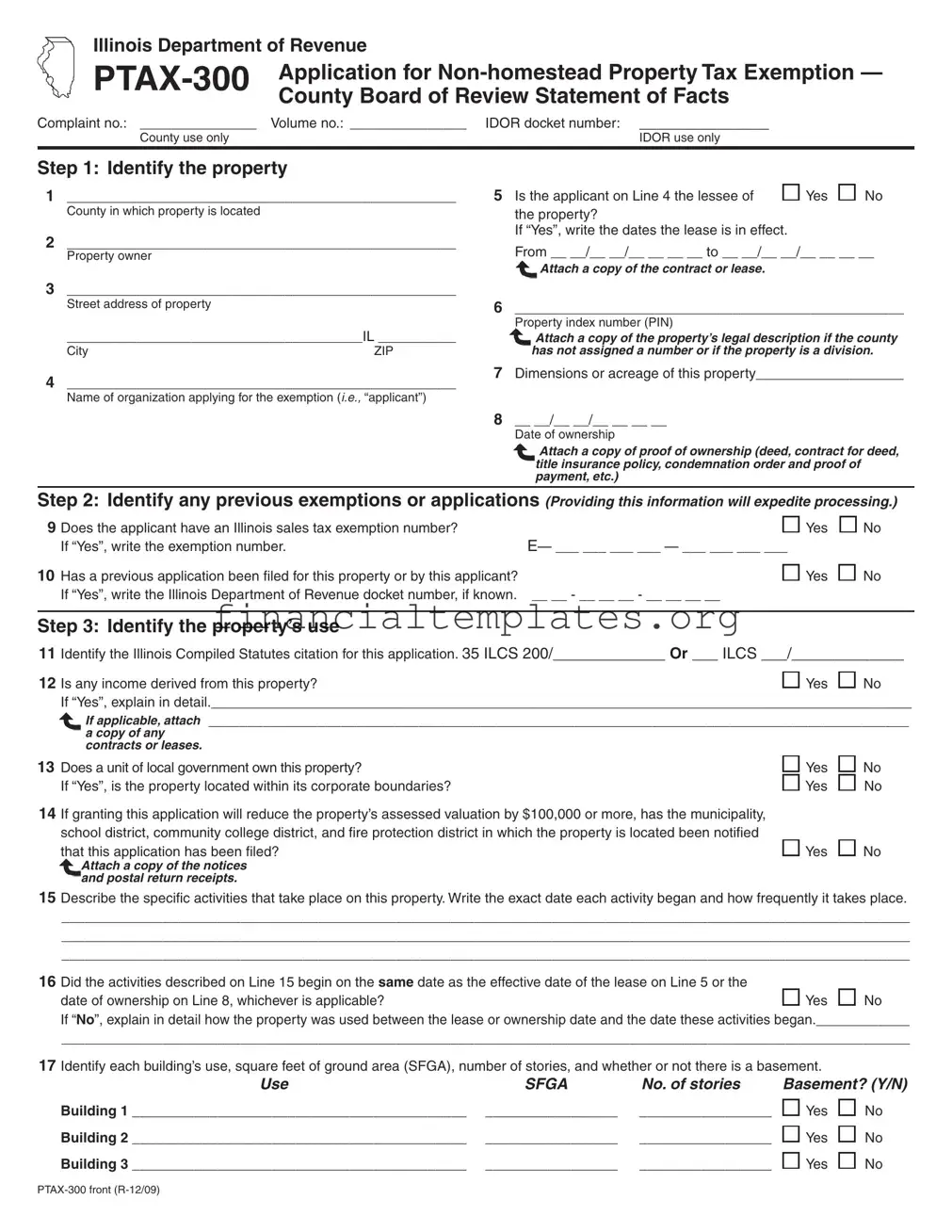

In navigating the complexities of property tax exemptions in Illinois, the PTAX-300 form emerges as a crucial document for entities seeking non-homestead property tax exemptions. Crafted by the Illinois Department of Revenue, this application caters to organizations aiming to secure exemptions on properties that do not serve as their primary residences. The form delineates a structured process, starting with the identification of the property through details such as ownership and street address, followed by previous exemption records, if any. Applicants are required to elucidate the property's usage, including income generation and activities conducted, which is instrumental in the assessment of the exemption eligibility. Moreover, the PTAX-300 prompts applicants to furnish supporting documentation — from proof of ownership to a notarized affidavit of use, among others. Its exhaustive steps ensure a thorough review by the county board of review, guiding entities through the nuances of the exemption application process. In essence, completing the PTAX-300 is a pivotal step for non-homestead properties in Illinois to be considered for tax exemptions, embedding a detailed procedural framework for applicants and authorities alike.

Ptax 300 Example

Illinois Department of Revenue

|

Application for |

|||||

|

County Board of Review Statement of Facts |

|

|

|||

|

|

|

|

|||

Complaint no.: _______________ Volume no.: _______________ |

IDOR docket number: _______________ |

|

|

|||

|

County use only |

|

IDOR use only |

|

|

|

Step 1: Identify the property |

|

|

|

|||

1 |

__________________________________________________ |

5 Is the applicant on Line 4 the lessee of |

Yes |

No |

||

|

County in which property is located |

|

the property? |

|

|

|

2 |

__________________________________________________ |

If “Yes”, write the dates the lease is in effect. |

|

|

||

From __ __/__ __/__ __ __ __ to __ __/__ __/__ __ __ __ |

||||||

|

Property owner |

|

||||

Attach a copy of the contract or lease.

Attach a copy of the contract or lease.

3__________________________________________________

Street address of property

______________________________________IL __________

City |

ZIP |

6__________________________________________________

Property index number (PIN)

Attach a copy of the property’s legal description if the county has not assigned a number or if the property is a division.

Attach a copy of the property’s legal description if the county has not assigned a number or if the property is a division.

4 __________________________________________________

Name of organization applying for the exemption (i.e., “applicant”)

7 Dimensions or acreage of this property___________________

8 __ __/__ __/__ __ __ __

Date of ownership

Attach a copy of proof of ownership (deed, contract for deed, title insurance policy, condemnation order and proof of payment, etc.)

Step 2: Identify any previous exemptions or applications (Providing this information will expedite processing.)

9 Does the applicant have an Illinois sales tax exemption number? |

|

If “Yes”, write the exemption number. |

E— ___ ___ ___ ___ — ___ ___ ___ ___ |

Yes

No

10Has a previous application been iled for this property or by this applicant?

If “Yes”, write the Illinois Department of Revenue docket number, if known. __ __ - __ __ __ - __ __ __ __

Yes

No

Step 3: Identify the property’s use

11 |

Identify the Illinois Compiled Statutes citation for this application. 35 ILCS 200/_____________ Or ___ ILCS ___/_____________ |

||

12 |

Is any income derived from this property? |

Yes |

No |

If “Yes”, explain in detail.__________________________________________________________________________________________

If applicable, attach __________________________________________________________________________________________

a copy of any contracts or leases.

13Does a unit of local government own this property?

If “Yes”, is the property located within its corporate boundaries?

14 If granting this application will reduce the property’s assessed valuation by $100,000 or more, has the municipality, school district, community college district, and ire protection district in which the property is located been notiied that this application has been iled?

Attach a copy of the notices and postal return receipts.

Yes Yes

Yes

No No

No

15 |

Describe the speciic activities that take place on this property. Write the exact date each activity began and how frequently it takes place. |

||

|

_____________________________________________________________________________________________________________ |

||

|

_____________________________________________________________________________________________________________ |

||

|

_____________________________________________________________________________________________________________ |

||

16 |

Did the activities described on Line 15 begin on the same date as the effective date of the lease on Line 5 or the |

|

|

|

date of ownership on Line 8, whichever is applicable? |

Yes |

No |

|

If “No”, explain in detail how the property was used between the lease or ownership date and the date these activities began.____________ |

||

|

_____________________________________________________________________________________________________________ |

||

17 Identify each building’s use, square feet of ground area (SFGA), number of stories, and whether or not there is a basement.

Use |

SFGA |

No. of stories |

Basement? (Y/N) |

Building 1 ___________________________________________ |

_________________ |

_________________ |

Building 2 ___________________________________________ |

_________________ |

_________________ |

Building 3 ___________________________________________ |

_________________ |

_________________ |

Yes

Yes

Yes

No

No

No

Step 4: Attach documentation

The following documents must be attached:

•Proof of ownership (copy of the deed, contract for deed, title insurance policy, condemnation order and proof of payment, etc.)

•Picture of the property

•Notarized afidavit of use

•Copies of any contracts or leases on the property

The documents listed on Lines 18 through 23 may be attached to expedite processing. Mark an “X” next to any documents that are attached.

18 ___ Audited inancial statements for the most recent year

19 ___ Copy of the applicant’s bylaws and complete certiied recorded copy of Articles of Incorporation, including purpose clause and all amendments

20 ___ Copy of the notices to the municipality, school district, community college district, and ire protection district in which the property is located and postal return receipts if granting this application will reduce the property’s assessed valuation by $100,000 or more

21 ___ Plot plan of each building’s location on the property with each building and land area labeled with property index numbers and speciic uses

22 ___ Copy of any Illinois Department of Revenue Exemption Certiicate

23 ___ Other (list) ________________________________________

_________________________________________________

_________________________________________________

Step 5: Identify the person to contact regarding this application

24 ____________________________________________________ |

25 _____________________________________________________ |

||||||

Name of applicant’s representative |

|

Owner’s name (if the applicant is not the owner) |

|

||||

____________________________________________________ |

_____________________________________________________ |

||||||

Mailing address |

|

|

Mailing address |

|

|

||

____________________________________________________ |

_____________________________________________________ |

||||||

City |

|

State |

ZIP |

City |

|

State |

ZIP |

( |

) |

— |

|

( |

) |

— |

|

____________________________________________________ |

_____________________________________________________ |

||||||

Phone number |

|

|

Phone number |

|

|

||

|

|

|

|

|

|

|

|

Step 6: Signature and notarization

State of Illinois |

) |

SS. |

County of ________________________________________ ) |

|

|

I, ______________________________________, _____________________________, being duly sworn upon oath, say that I have read

Name |

Position |

the foregoing application and that all of the information is true and correct to the best of my knowledge and belief.

_______________________________________________________

Afiant’s signature

Subscribed and sworn to before me this _____ day of _____________________________, 2______.

_______________________________________________________

Notary Public

County oficial use only. Do not write in this space

Step 7: County board of review statement of facts

1 |

Current assessment $__________________________________ |

For assessment year 2_______ |

|

|

2 |

Is this exemption application for a leasehold interest assessed to the applicant? |

Yes |

No |

|

|

If “Yes”, write the Illinois Department of Revenue docket number for the exempt fee interest to the owner, |

|

|

|

|

if known. ___ ___ — ___ ___ ___ — ___ ___ ___ ___ |

|

|

|

3 |

State all of the facts considered by the county board of review in recommending approval or denial of this exemption application. |

|||

|

_____________________________________________________________________________________________________________ |

|||

|

_____________________________________________________________________________________________________________ |

|||

|

_____________________________________________________________________________________________________________ |

|||

4 |

County board of review recommendation |

|

|

|

|

___ Full year exemption |

|

|

|

|

___ Partial year exemption from ___ ___ / ___ ___ / ___ ___ ___ ___ to ___ ___ / ___ ___ / ___ ___ ___ ___ |

|

|

|

|

___ Partial exemption for the following described portion of the property: ___________________________________________________ |

|||

|

__________________________________________________________________________________________________________ |

|||

|

___ Deny exemption |

|

|

|

5 |

Date of board’s action ___ ___ / ___ ___ / ___ ___ ___ ___ |

|

|

|

Step 8: County board of review certiication

I certify this to be a correct statement of all facts arising in connection with proceedings on this exemption application.

_______________________________________________________ Mail to: OFFICE OF LOCAL GOVERNMENT SERVICES MC |

||

Signature of clerk of county board of review |

ILLINOIS DEPARTMENT OF REVENUE |

|

|

||

|

101 WEST JEFFERSON STREET |

|

|

SPRINGFIELD IL 62702 |

|

General Instructions for Form

When must Form

Complete Form

•For a federal/state agency exemption, complete Form

•For a religious exemption, complete Form

Which steps must the applicant complete?

The applicant must complete Steps 1 through 6. The county board of review must com- plete Steps 7 and 8.

Complete all lines and attach all required documents or the county board of review will not accept the incomplete exemption application. If there is not enough space on this form to answer a question fully, attach additional sheets. On the top of each additional sheet, identify the number of each question to which a response is being made.

Note: The Cook County Board of Review requires that their complaint form be iled in addition to Form

What must be attached to Form

The following documents must be attached to Form

•Proof of ownership (deed, contract for deed, title insurance policy, copy of the con- demnation order and proof of payment, etc.)

•Picture of the property

•Notarized afidavit of use

•Copies of any contracts or leases on the property

To expedite processing, attach additional documents as speciied in Step 4.

Must any taxing bodies be notiied that an exemption application has been iled?

If granting this application will reduce the property’s assessed valuation by $100,000 or more, the municipality, school district, community college district, and ire protection dis- trict in which the property is located must be notiied that this application has been iled.

How many forms must be iled if an exemption for multiple parcels is being sought?

File one application in both of the following situations:

•Multiple parcels acquired by the same deed — Form

•A single parcel that was acquired by multiple deeds.

File a separate application for each parcel if multiple parcels were acquired by separate deeds, unless all four of the following conditions are met:

•The parcels are contiguous.

•All deeds were acquired before the year for which the exemption is now being sought.

•Form

•Form

Where is Form

File the completed and notarized Form

The county board of review considers exemption applications for the assessment year for which the board is in session only. It cannot consider an exemption for a previous or subsequent assessment year.

How is a property’s exempt status determined?

The following text is a brief outline of the procedures used to determine exempt status. For more information, see 35 ILCS

Step 1

Obtain Form

Step 2

The county board of review may hold a hear- ing to evaluate the application and support- ing documents.

Step 3

The county board of review completes Steps 7 and 8 and recommends whether or not the exemption should be granted before forward- ing Form

Step 4

The department assigns a docket number, reviews the facts regarding the application, and determines whether or not the exemp- tion should be granted.

Note: In some instances, the department will request more information from the applicant, who has 30 days from the date of the department’s request to provide that information.

The department mails its decision to

•the applicant,

•any intervenors,

•the county clerk, and

•the clerk of the county board of review.

The department’s decision is inal unless the applicant (or another party to the matter) requests a formal hearing.

How is a formal hearing requested if the applicant disagrees with the department’s decision?

Formal hearing requests must be made with- in 60 days after the date of the department’s decision. Mail requests for a formal hearing to the address provided on the exemption decision. The request will be forwarded to the Administrative Hearings Division.

Speciic Instructions for Form

Step 1: Identify the property

Line 1 — Write the name of the county in which this property is located.

Line 2 — Write the property owner as shown on the deed or other proof of ownership.

Line 3 — Write the property’s street address.

Line 4 — Write the name of the organization applying for the exemption (i.e., “applicant”).

Line 5 — Check the box to indicate whether or not the applicant on Line 4 is the lessee of the property. If “Yes”, write the dates the lease is in effect. Attach a copy of the contract or lease.

Line 6 — Write the property index number. The chief county as- sessment oficer or the county board of review can provide this number. Attach a copy of the property’s legal description if the county has not assigned a number or if the property is a division.

Line 7 — Write the dimensions (square footage) or acreage of this property.

Line 8 — Write the date on which ownership began. Attach a copy of proof of ownership (deed, contract for deed, or title insurance policy, etc.). If the property was obtained through condemnation, write the date the condemnation proceedings were iled and attach a copy of the condemnation order and proof of payment.

Step 2: Identify any previous exemptions or applications

Line 9 — Check the box to indicate whether or not the applicant has an Illinois sales tax exemption number. If “Yes”, write the exemption number.

Line 10 — Check the box to indicate whether or not a previous property tax exemption application has been iled for this property or applicant. If “Yes”, write the Illinois Department of Revenue docket number, if known.

Step 3: Identify the property’s use

Line 11 — Write the Illinois Compiled Statutes (ILCS) citation for this application. Most of the provisions may be found in 35 ILCS

Line 12 — Check the box to indicate whether or not any income is derived from the property. If “Yes”, explain in detail. If applica- ble, attach a copy of any written contracts, leases, or terms of oral agreement.

Line 13 — Check the box to indicate whether or not a unit of local government owns this property. If “Yes”, indicate whether or not the property is located within its corporate boundaries.

Line 14 — If granting this application will reduce the property’s assessed valuation by $100,000 or more, the municipality, school district, community college district, and ire protection district in which the property is located must be notiied that this application has been iled. Check the box to indicate whether or not notice has been given to these taxing districts. Attach a copy of the

notices and postal return receipts.

Line 15 — Describe the speciic activities that take place on this property. Write the exact date each activity began and how frequently it takes place. Do not state conclusions about the type of activity such as “charitable” or “educational”. If the property contains more than one building or a building contains more than one loor, separately describe the activities that take place in each building and on each loor. Include the square footage of each building and loor used for each activity.

Line 16 — Check the box to indicate whether or not the activities described on Line 15 began on the same date as the effective date of the lease on Line 5 or the date of ownership on Line 8, whichever is applicable. If “No”, explain in detail how the property was used between the lease or ownership date and the date these activities began.

Line 17 — Identify the use of each building on the property (e.g., classrooms, ire station). Write the square feet of ground area (SFGA) covered by each building, the number of stories, and indicate whether or not there is a basement.

Step 4: Attach documentation

The following documents must be attached:

•Proof of ownership (copy of the deed, contract for deed, title insurance policy, condemnation order and proof of payment, etc.)

•Picture of the property

•Notarized afidavit of use

•Copies of any contracts or leases on the property

Lines 18 through 22 — Mark an “X” next to any documents that are attached. Attaching the documents listed on Lines 18 through 22 may expedite processing.

Line 23 — If this property is used as a parking area, playground, lawn, or other ancillary use to an already exempt parcel, attach a copy of the Illinois Department of Revenue Exemption Certiicate for the exempt parcel. Make a clear distinction between the parcel that is already exempt and the property for which exemption is now being sought. Describe how each parcel is used and indicate the proximity of the parcels to each other.

Step 5: Identify the person to contact regarding this application

Line 24 — Write the name, address, and phone number of the person the county board of review and the department should contact regarding this application.

Line 25 — If the applicant is not the owner, write the owner’s name, address, and phone number.

Step 6: Signature and notarization

The application must be signed under oath, verifying that all of the information is true and correct to the best of the applicant’s knowledge and belief. This application must be notarized be- fore sending to the county board of review.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The PTAX-300 form is used to apply for a non-homestead property tax exemption in Illinois. |

| Governing Law | The application is governed by Illinois Compiled Statutes, particularly sections within 35 ILCS 200 related to property tax exemptions. |

| Applicant Requirements | Applicants must complete steps 1 through 6 of the form, providing detailed information about the property, any previous exemptions, the property's use, and attach required documentation. |

| Documentation for Submission | Submission must include proof of ownership, a picture of the property, notarized affidavit of use, contracts or leases related to the property, and potentially additional documents to expedite processing. |

Guide to Writing Ptax 300

Filing the PTAX-300 Application for Non-homestead Property Tax Exemption is a critical step for organizations seeking property tax relief in Illinois. This document must be accurately completed and submitted with the required documentation to the County Board of Review. The process involves identifying property details, prior exemptions or applications, the property’s use, attaching necessary documentation, identifying a contact person, and notarization. Following these steps carefully ensures the application is processed efficiently, paving the way for a potential exemption.

- Step 1: Identify the property.

- Enter the county where the property is located.

- Provide the property owner's name as shown on the deed or other proof of ownership.

- List the street address of the property, including city and ZIP code.

- Write the name of the organization applying for the exemption.

- Indicate if the applicant is the lessee of the property, and if so, attach a copy of the lease showing the effective dates.

- Enter the Property Index Number (PIN) and attach a legal description if necessary.

- State the property’s dimensions or acreage.

- Specify the date of ownership and attach proof of ownership.

- Step 2: Identify any previous exemptions or applications.

- Indicate if the applicant has an Illinois sales tax exemption number, including the number if available.

- State whether a previous application for this property or by this applicant has been filed, including the IDOR docket number if known.

- Step 3: Identify the property’s use.

- Provide the Illinois Compiled Statutes citation relevant to the application.

- Declare if any income is derived from the property and detail the nature of any such income.

- Indicate if a unit of local government owns the property and whether it’s within its corporate boundaries.

- If applicable, confirm notification of taxing bodies if the application’s approval would reduce the property’s assessed value by $100,000 or more.

- Describe the specific activities conducted on the property, including dates and frequencies.

- Specify if the activities began concurrently with the lease or ownership start date.

- List each building’s use, size, number of stories, and basement presence.

- Step 4: Attach documentation.

- Proof of ownership.

- Picture of the property.

- Notarized affidavit of use.

- Copies of any contracts or leases on the property.

- Optionally include financial statements, bylaws, articles of incorporation, and notification receipts to expedite processing.

- List any additional attached documents.

- Step 5: Identify the person to contact regarding this application.

- Write the name, address, and phone number of the applicant’s representative.

- If applicable, provide the owner’s contact information.

- Step 6: Signature and notarization.

- The application must be signed by the applicant under oath, then notarized.

Once the PTAX-300 form is completed and all necessary documents are attached, it should be submitted to the County Board of Review. This initiates the review process, which may include a hearing to evaluate the application and supporting documents. The County Board of Review will then recommend whether the exemption should be granted and forward the application to the Illinois Department of Revenue for a final decision. Following these steps meticulously will facilitate the application process and help avoid unnecessary delays.

Understanding Ptax 300

Who needs to complete Form PTAX-300?

Form PTAX-300 must be completed by organizations applying for a non-homestead property tax exemption in Illinois. This includes any non-residential property except when applying for exemptions specifically related to federal/state agencies or religious organizations. For exemptions pertaining to those entities, specific forms PTAX-300-FS or PTAX-300-R should be used, respectively.

What steps must be completed on the Form PTAX-300?

The applicant is responsible for completing Steps 1 through 6, which encompass providing detailed information about the property, including identification, previous exemptions or applications, and the property's use. The county board of review completes Steps 7 and 8. It's critical to fill out every part of the form and attach all required documentation. Any question not fully answered on the form itself should be addressed on additional attached sheets.

What documents must be attached to Form PTAX-300?

Required documents include proof of ownership (such as a deed or title insurance policy), photographs of the property, a notarized affidavit of use, and any contracts or leases relevant to the property's use. To expedite processing, additional documents listed in Step 4 may also be attached, like financial statements and bylaws.

Is it necessary to notify any taxing bodies when filing Form PTAX-300?

Yes, if the exemption application could reduce the property’s assessed valuation by $100,000 or more, pertinent taxing bodies like the municipality, school district, community college district, and fire protection district within the property's location must be notified. Proof of such notifications and postal return receipts should be attached.

How should one file Form PTAX-300 for multiple parcels?

You can file a single application for multiple parcels if they were acquired by the same deed and you provide any variation of use or other qualifying information for each property index number. Separate applications are needed if parcels were acquired by separate deeds unless certain conditions are met, like the parcels being contiguous and variations of use or other information being clearly identified for each.

Where is Form PTAX-300 filed?

The completed and notarized Form PTAX-300 should be filed with the county board of review where the property is located. It's important to contact the county board of review to ascertain the filing deadline and session dates as they consider exemption applications for the current assessment year only.

How is the property's exempt status determined?

After the Form PTAX-300 is filed, the county board of review evaluates the application and may conduct a hearing. Recommendations for approval or denial are then forwarded along with the application to the Department of Revenue, which reviews the facts and makes the final decision on the exemption status. If disagreed with the decision, a formal hearing can be requested within 60 days of the decision.

Common mistakes

Filling out the PTAX-300 form for a non-homestead property tax exemption can seem straightforward, but mistakes can easily be made. Here’s a list of common pitfalls applicants often encounter:

- Not verifying the county name where the property is located in Step 1, resulting in misfiled or delayed applications.

- Failing to attach a copy of the lease when the applicant is leasing the property, as required in Step 1, Line 5, which might lead to an incomplete application status.

- Omitting the property index number (PIN) or not attaching a legal description if the county has not assigned a number, which is crucial for identification.

- Forgetting to include proof of ownership or relevant documents like the deed or title insurance policy, making it hard to verify the applicant's claim to the property.

- Overlooking to state if a previous tax exemption application has been filed for the property, which is crucial for processing and avoiding redundancy.

- Leaving out the Illinois Compiled Statutes (ILCS) citation necessary for the exemption, leading to ambiguity in the legal basis for the application.

- Not specifying if the property generates income, which can affect the exemption status and requires detailed explanation and documentation if applicable.

- Failure to notify the relevant taxing bodies for properties that, if exempted, would reduce the property’s assessed valuation by $100,000 or more. This oversight can lead to legal complications.

- Not providing a detailed account of the specific uses of the property, including the start date of activities, which is crucial for determining exemption eligibility based on use.

Being meticulous in providing accurate information and attaching all necessary documents can significantly streamline the exemption process. Errors or omissions can delay the review or lead to the denial of the application, so it’s vital to review all sections carefully before submission.

Documents used along the form

When applying for a non-homestead property tax exemption in Illinois using the PTAX-300 form, it’s essential to know that there are several other forms and documents that may be necessary to include with your application to ensure a smooth processing experience. These documents provide additional details and evidence related to the property, its use, and the organization requesting the exemption. They play crucial roles in demonstrating eligibility for the exemption.

- Proof of Ownership: A copy of the deed, contract for deed, title insurance policy, or other legal documents that prove ownership of the property in question.

- Notarized Affidavit of Use: A sworn statement detailing how the property is used, helping to establish that the property’s use qualifies it for exemption under state law.

- Picture of the Property: Current photographs of the property which provide visual evidence of the property's condition and use.

- Audited Financial Statements: The most recent year's audited financial statements for the organization applying for the exemption can support the non-profit status or financial condition relevant to the exemption criteria.

- Articles of Incorporation: A certified copy of the Articles of Incorporation, including any amendments and the purpose clause, can validate the non-profit status and the primary activities of the organization.

- Notices and Postal Return Receipts: When the exemption could significantly impact local tax revenues, notification to affected taxing bodies is required. Copies of these notices and the receipts confirming their delivery must be included.

- Plot Plan: A detailed drawing of the property showing the location of buildings, land use, and property index numbers to clarify the layout and how different sections of the property are utilized.

- Contracts or Leases: Copies of any contracts or leases that pertain to the property can provide evidence of its use, especially if the property generates income that affects exemption eligibility.

- Illinois Department of Revenue Exemption Certificate: If applying for an exemption related to a parcel that complements an already exempt property, a copy of the existing exemption certificate can help establish continuity and relevance.

Understanding and gathering these documents can facilitate a smoother application process for a property tax exemption. Each piece of documentation plays a role in building a comprehensive view of the property's ownership, use, and qualifications for tax exemption. Ensuring completeness and accuracy in your application not only demonstrates diligence but can also expedite the review process.

Similar forms

The PTAX-300 form is closely related to the Form 990, Return of Organization Exempt From Income Tax, utilized by non-profit organizations in the United States. Both documents are designed to maintain the tax-exempt status of properties or organizations but diverge in scope—where the PTAX-300 focuses on property tax exemptions at a state level, Form 990 deals with federal income tax exemptions for non-profits. They share the commonality of requiring detailed descriptions of the activities that justify their tax-exempt status.

Similarly, the Schedule A of Form 990 parallels the PTAX-300 form by necessitating in-depth information about an organization's activities, purposes, and the basis for its tax exemption. Both forms scrutinize the entity's operations to ensure they align with criteria for tax-exempt status – PTAX-300 for property tax exemptions within Illinois and Schedule A for maintaining a non-profit's federal tax-exemption based on its charitable, religious, educational, or other activities.

The Application for Recognition of Exemption under Section 501(c)(3) of the Internal Revenue Code, or Form 1023, also mirrors the PTAX-300 form. Both applications play crucial roles in obtaining tax-exempt status, albeit in different jurisdictions and tax types. Where the PTAX-300 seeks property tax exemption for non-homestead properties at the state level, Form 1023 is a comprehensive federal application that establishes a nonprofit's eligibility for income tax exemption.

The Property Tax Appeal Board (PTAB) appeal form in Illinois shares similarities with the PTAX-300, as both involve the review and potential adjustment of property tax obligations. The PTAB appeal form is used to dispute assessment decisions, potentially leading to lowered property taxes, while the PTAX-300 aims for outright exemption based on the property's use. Both engage with property tax administration within the state, requiring detailed documentation and justification.

The Business Personal Property Statement, found in many jurisdictions, bears resemblance to the PTAX-300 form but serves to declare taxable business-owned personal property. While the PTAX-300 form seeks to exempt certain properties from taxation, the Business Personal Property Statement identifies assets subject to tax, highlighting the contrasting purposes yet similar requirement for detailed property descriptions within tax documentation.

The Special Assessment Exemption application in Illinois compares with the PTAX-300 as both seek property tax relief under specific conditions. While the PTAX-300 is used for properties serving certain roles, a Special Assessment Exemption might apply to properties improved in ways that benefit the community. These forms showcase the various avenues through which property owners can seek tax relief, emphasizing the nuanced differences between exemption types.

The Tax Increment Financing (TIF) application also aligns with the PTAX-300 form in its focus on property and its contribution to economic development. However, TIF applications generally seek to capture property tax revenue increments for redevelopment projects, contrasting with the PTAX-300’s goal of reducing or eliminating property tax liabilities based on nonprofit use. Both underscore the link between property use and tax incentives.

Homestead Exemption Applications across different states share the intent of the PTAX-300 form in providing tax relief but focus on residential properties as opposed to non-homestead properties. Homestead exemptions reduce the taxable value of a home, reflecting a shared objective with the PTAX-300 to ease tax burdens, albeit for differing property categories and purposes.

The Zoning Compliance Application parallels the PTAX-300 form in that both require detailed information about a property's use, but for distinctly different reasons. The Zoning Compliance Application is crucial for ensuring that property uses align with local zoning laws, potentially affecting its development and use, while the PTAX-300 seeks a tax exemption based on its use in line with state statutes.

Finally, the Local Improvement District (LID) application, while distinct in purpose, shares common ground with the PTAX-300. LID applications often involve property owners agreeing to tax assessments for improvements benefiting their properties. Unlike the PTAX-300’s aim for tax exemption, LID seeks investment in communal infrastructure, highlighting varied ways property taxation can be approached to meet community and individual needs.

Dos and Don'ts

When filling out the PTAX-300 form, certain practices should be followed to ensure accuracy and increase the likelihood of a successful application for a non-homestead property tax exemption in Illinois. Equally important are actions to avoid that could potentially delay or negatively impact the application's outcome. Below is a list of what you should and shouldn't do:

Do:

- Ensure that all information is accurate and clearly written to prevent misunderstandings or processing delays.

- Attach all required documentation, such as proof of ownership, pictures of the property, a notarized affidavit of use, and any relevant contracts or leases.

- Check whether the property's use complies with the Illinois Compiled Statutes citation provided in the form, and clearly identify the statute on the form.

- Provide a detailed description of the specific activities that take place on the property, including exact dates and frequencies, as this information is crucial for establishing exemption eligibility.

- Notify all required taxing bodies if granting the application will reduce the property's assessed valuation by $100,000 or more, attaching copies of the notices and postal return receipts to the application.

- Designate a contact person on the form who is knowledgeable about the application and can answer questions from the county board of review or the Department of Revenue.

Don't:

- Leave any sections of the form incomplete. An incomplete application may be rejected or cause delays in processing.

- Forget to sign and notarize the application. An unsigned or unnotarized application is considered invalid.

- Overlap information or make amendments that could cause confusion. If additional space is needed, attach separate sheets with clear references to the relevant sections of the form.

- Misrepresent any facts related to the property's use, ownership, or activities. Such inaccuracies could lead to the denial of the exemption application.

- Delay notifying the required taxing bodies if the application's approval could significantly affect the property's assessed valuation. Timely notification is essential for the process.

- Assume the county board of review has all necessary information without providing supporting documents and detailed descriptions of the property's use and activities.

Adhering to these guidelines will help streamline the application process and improve the chances of securing a property tax exemption.

Misconceptions

Understanding the paperwork and processes for property tax exemptions in Illinois, especially with the PTAX-300 form, can sometimes be complicated. Common misconceptions can lead to confusion or incorrect filings. Here, these misunderstandings are cleared up to ease the application process.

- Misconception 1: The PTAX-300 form is only for those seeking homestead exemptions.

This is incorrect. The PTAX-300 is specifically designed for non-homestead property tax exemptions. That includes properties used for specific activities that qualify them for an exemption from property taxes, other than those for personal residences or homesteads.

- Misconception 2: Any non-profit organization automatically qualifies for an exemption.

Qualification for property tax exemption requires more than just non-profit status. The organization must demonstrate that the property in question is being used in ways that align with their exempt purposes, as defined by Illinois Compiled Statutes.

- Misconception 3: Income-producing properties cannot receive exemptions.

Properties can still qualify for an exemption even if income is derived from them. What matters is the use of the income; if it supports the property’s tax-exempt activities, an exemption may still be possible.

- Misconception 4: The form is the only documentation needed.

Alongside the PTAX-300 form, applicants must provide additional documentation including proof of ownership, photos of the property, notarized affidavit of use, and any relevant contracts or leases.

- Misconception 5: Only the property owner can file the PTAX-300 form.

Lessee organizations of a property, with a lease specific to them, can apply for an exemption on the property they occupy, provided they meet other requirements and obtain necessary documentation.

- Misconception 6: Notification to local government entities is not necessary.

If the exemption being applied for could reduce the property’s assessed valuation by more than $100,000, local government entities such as schools and fire protection districts must be notified. This requirement is designed to mitigate potential impacts on local government revenue.

- Misconception 7: All properties under one organization require individual PTAX-300 forms.

A single PTAX-300 form can cover multiple parcels if they were acquired by the same deed or if they are contiguous and meet other specified conditions. Proper documentation must still be provided for each parcel.

- Misconception 8: The PTAX-300 is a one-time filing with permanent effects.

While the form does grant tax exemption, changes in property use, ownership, or other circumstances can affect exemption status. Periodic revalidation or refiling might be required to maintain exempt status.

Correctly understanding the PTAX-300 form and its requirements can significantly impact an organization’s ability to benefit from property tax exemptions. Knowledge of these misconceptions is crucial for a successful application process.

Key takeaways

Understanding the PTAX-300 form is crucial for organizations seeking a property tax exemption in Illinois. This document, issued by the Illinois Department of Revenue, is designed for properties that do not qualify as homesteads, which are primarily residences of homeowners. Below are key takeaways about filling out and using the PTAX-300 form:

- Complete the PTAX-300 form to apply for a non-homestead property tax exemption that is not directly related to federal/state agency exemptions or religious use, which have their specific forms.

- The applicant is responsible for completing Steps 1 through 6, which entail providing detailed information about the property, its use, and any contractual agreements related to its use. Required details include the property owner, street address, property index number (PIN), dimensions or acreage, date of ownership, and comprehensive descriptions of the property’s use.

- Documentation is a critical part of the application process. Attachments must include proof of ownership, photographs of the property, a notarized affidavit of use, and copies of any applicable contracts or leases. Additional documents may be required depending on the specific circumstances of the property and application.

- If the exemption being applied for could reduce the property’s assessed valuation by $100,000 or more, specific local government entities such as the municipality, school district, community college district, and fire protection district must be notified. Copies of these notifications and postal return receipts need to be attached to the application.

- The form inquires about any income derived from the property, which necessitates a detailed explanation if applicable. This may include attaching copies of contracts or leases showing terms of payment or income receipt.

- For organizations applying for tax exemptions across multiple parcels of land, a separate PTAX-300 form is needed for each parcel unless specific conditions are met. This is crucial for large campuses or entities with multiple non-contiguous pieces of land.

- The county board of review plays a significant role in the process by completing the final steps of the form. They provide a statement of facts based on their assessment and recommend approval or denial of the tax exemption application.

- The application must be filed with the county board of review where the property is located, adhering to their filing deadlines. This requirement emphasizes the need to prepare and submit the form in a timely manner to ensure consideration for the relevant tax year.

- A notarized signature is required to complete the form, affirming the accuracy and truthfulness of the information provided. The signature under oath highlights the legal responsibility of the applicant in representing facts about the property and its use.

By adhering to these guidelines and carefully completing each section of the PTAX-300 form, organizations can efficiently navigate the exemption application process, potentially leading to significant property tax savings for non-homestead properties in Illinois.

Popular PDF Documents

Personal Loan Application Form - Account verification steps are outlined for those in 403(b) Plans with multiple investment providers.

Form 990 Ez - The 990-EZ captures data about an organization's fundraising activities and spending on behalf of their mission.

Can You Change Your Business Address - It simplifies the process of communicating essential changes to the Missouri Department of Revenue.