Get Ptax 230 Form

The filing of Form PTAX-230 is a critical step for property owners who find themselves in disagreement with the assessment of their non-farm property's value. When these individuals believe that their property has been unfairly assessed in comparison to similar properties, has been subjected to a double assessment, or has been mistakenly deemed taxable, this form serves as a structured avenue to contest such assessments officially. It mandates a comprehensive submission of all pertinent details about the property in question, including its index number, a thorough description, and the contested assessment values. Additionally, property owners are provided with the option to request a hearing to present their case in person or to allow the board's decision to be made based on the submitted evidence. The decision to appeal, along with the necessary documentation — such as photographs or any other supporting evidence that would bolster the property owner's claim — to the Clinton County Board of Review underscore the seriousness with which this form is regarded. An aspect not to be overlooked within this process is the emphasis on deadlines, as established by the Chief County Assessment Officer (CCAO), compelling property owners to act within a specific time frame to ensure their complaint is considered. Moreover, this diligent procedure further continues beyond the local board's decision, allowing for an appeal to the State Property Tax Appeal Board, should the initial ruling not be in favor of the petitioner. This detailed approach to property assessment appeals reflects an effort to accommodate fair reassessment requests, recognizing the potential discrepancies in property valuations.

Ptax 230 Example

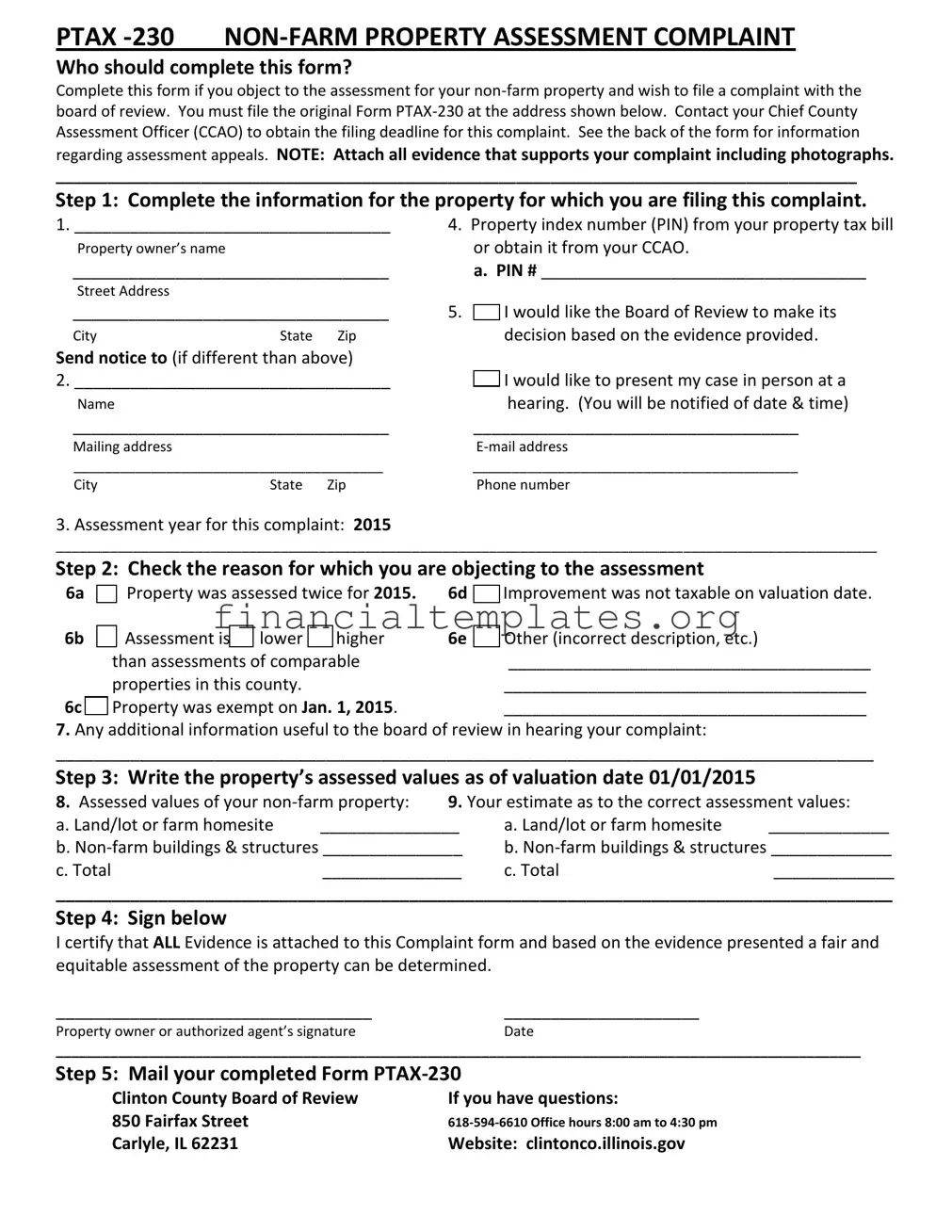

PTAX

Who should complete this form?

Complete this form if you object to the assessment for your

______________________________________________________________________________________________

Step 1: Complete the information for the property for which you are filing this complaint.

1. __________________________________ |

4. Property index number (PIN) from your property tax bill |

P ope t o e ’s ame |

or obtain it from your CCAO. |

__________________________________ |

a. PIN # ___________________________________ |

Street Address |

|

__________________________________ |

5. |

|

City |

State Zip |

|

Send notice to (if different than above)

I would like the Board of Review to make its decision based on the evidence provided.

2. __________________________________ |

|

|

I would like to present my case in person at a |

|

Name |

|

|

|

hearing. (You will be notified of date & time) |

__________________________________ |

___________________________________ |

|||

Mailing address |

|

|

||

________________________________________ |

__________________________________________ |

|||

City |

State Zip |

|

Phone number |

|

3. Assessment year for this complaint: 2015

__________________________________________________________________________________________________________

Step 2: Check the reason for which you are objecting to the assessment

6a

Property was assessed twice for 2015. |

6d |

__ Improvement was not taxable on valuation date.

6b |

|

Assessment is |

|

lower |

|

higher |

6e |

|

Other (incorrect description, etc.) |

|

|

than assessments of comparable |

|

_______________________________________ |

|||||

|

|

properties in this county. |

|

|

|

_______________________________________ |

|||

6c |

|

Property was exempt on Jan. 1, 2015. |

|

_______________________________________ |

|||||

|

|

||||||||

7.Any additional information useful to the board of review in hearing your complaint:

________________________________________________________________________________________

“tep 3: Write the property’s assessed values as of valuatio date 01/01/2015

8.Assessed values of your

a. Land/lot or farm homesite |

_______________ |

a. Land/lot or farm homesite |

_____________ |

b. |

b. |

||

c. Total |

_______________ |

c. Total |

_____________ |

__________________________________________________________________________________________

Step 4: Sign below

I certify that ALL Evidence is attached to this Complaint form and based on the evidence presented a fair and equitable assessment of the property can be determined.

__________________________________ |

_____________________ |

P ope t o e o autho ized age t’s sig atu e |

Date |

________________________________________________________________________________________________________

Step 5: Mail your completed Form

Clinton County Board of Review |

If you have questions: |

850 Fairfax Street |

|

Carlyle, IL 62231 |

Website: clintonco.illinois.gov |

Illinois Property Assessment Appeal Process Guide

_____________________________________________________________________________

General information

When going through the appeal process, you (property owner) are appealing the assessed value (assessment) of your property, not the tax bill. The tax bill amount is determined by the various tax rates applied to the assessment (after review and equalization by the board of review) by taxing districts (schools, parks, libraries, etc.) Tax rates are not an issue in the appeal process, only the assessment amount may be appealed.

Property is assessed each assessment year by

You appeal ust e filed ith the oa d of e ie 30 da s afte the CCAO’s pu li atio of the ha ges. Appeals filed late will not be heard. Once you receive the tax bill, it is generally too late to make an appeal fo that ea ’s

assessment. The board of review will mail you final notice of its decision.

See “Co tact I for atio o f o t fo help fili g a appeal o to o tai oa d of e ie ’s hea i g p o edu es.

How a tax bill is calculated

The county treasurer bills and collects property taxes for the year following the assessment year. Your tax bill is determined by taking the equalized assessed value (after board of review and state equalization) of your property and applying the aggregate tax rates from levies of all local taxing districts and units of local government. Your tax bill is calculated as follows:

Equalized assessed value – homestead exemptions = taxable value (assessment) X total tax rates of all taxing districts = total tax bill

Note: You a ualif fo a ho estead e e ptio hi h ill edu e ou p ope t ’s e ualized assessed alue.

Homestead exemptions are available for general homestead, home improvements, disabled persons, disabled veterans, returning veterans and senior citizens. See Co tact I for atio on front for assistance with homestead exemptions.

Formal Appeal

Proceed with a formal appeal to the board of review if any of the following claims can be supported:

Assesso ’s esti ate of fai a ket alue is highe tha a tual fair market value. Supported if you have recently purchased your property on the open market of if a professional appraisal is supplied.

Assessed value is at a higher percentage of market value than the prevailing township or county median level as shown in an assessment/sales ratio study.

Primary assessment is based on inaccurate information (incorrect measurement of lot or building, etc.). Assessment is higher than similar neighboring properties.

Steps to appeal

An appeal of an assessment (other than on farmland or farm buildings) has several steps to take. For farmland or farm building, you must file Form

Obtain property record card with assessed property valuation. Determine fair market value.

Determine prevailing level of assessment for jurisdiction. Determine the basis for your complaint.

File Form

Evidence needed

Refer to the evidence document needed as compiled by the Clinton County Board of Review. Submit photos and any pertinent documentation to substantiate your complaint.

Appeal to State Property Tax Appeal Board (PTAB)

If |

ou do ot ag ee ith the |

oa d’s de isio , ou a appeal i |

i |

uit ou t. Visit the PTAB’s |

e site at state.il.us/age /pta |

iti g to PTAB o fo appeal fo s a

file a tax objection complaint in d i fo atio .

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form PTAX-230 | For property owners objecting to the assessment of their non-farm property and wishing to file a complaint with the board of review. |

| Submission Requirement | Original PTAX-230 form must be filed at the specified address. |

| Filing Deadline | Property owners must contact their Chief County Assessment Officer (CCAO) to determine the filing deadline. |

| Evidence Attachment | All evidence supporting the complaint, including photographs, must be attached to the form. |

| Property Information | Includes property index number (PIN), address, and assessment year for the complaint. |

| Assessment Complaint Reasons | Reasons for objecting to the assessment can include double assessment, incorrect assessment compared to similar properties, exemption status, and others. |

| Assessed Value Dispute | Property owners are required to write the property’s assessed values as of the valuation date and their estimate of the correct assessment values. |

| Certification by Signature | Property owner or authorized agent must certify that all evidence is attached and a fair assessment can be determined from it. |

| Form Filing Location | Forms are to be mailed to the Clinton County Board of Review, with contact details provided for assistance. |

| Governing Law | Illinois law (35 ILCS 200/9-145) requires property assessments to be at 33 1/3% of its market value unless exempt or otherwise specified. |

Guide to Writing Ptax 230

Filing a PTAX-230 form is the formal way to contest the assessment of your non-farm property if you believe the valuation is inaccurate. This process allows property owners to present their case to the board of review, potentially leading to an adjustment in their property assessment. Below are detailed steps to guide you through the process of filling out a PTAX-230 form.

- Start by providing information related to the property in question.

- Enter the property owner's name.

- Include the Property Index Number (PIN) you can find on your property tax bill or source from your Chief County Assessment Officer (CCAO).

- List the street address, along with the city, state, and zip code of the property.

- If notices should be sent to a different address, provide that mailing address, email address, city, state, zip code, and phone number.

- Indicate the assessment year for which you are filing this complaint.

- Check the box that best describes the reason you are challenging the assessment, including if the property was assessed twice, the assessment is higher or lower than similar properties, or if there are inaccuracies such as incorrect property descriptions.

- Document any additional information that could support your case in the space provided.

- Provide the property's assessed values as of the valuation date (01/01/2015 for this form) and your estimate of the correct assessment values for both the land/lot and any non-farm buildings & structures, along with the total.

- Sign and date the form to certify that all evidence supporting your complaint has been attached.

- Mail your completed PTAX-230 form to the Clinton County Board of Review at 850 Fairfax Street, Carlyle, IL 62231. If you have questions or need assistance, contact the office at 618-594-6610 during their office hours from 8:00 am to 4:30 pm, or visit their website.

After submitting the PTAX-230 form, the appeal process begins. The board of review will consider all evidence presented, both from property record cards with assessed valuations and any additional documentation or photos you submit. If you disagree with the board's decision, further appeal options are available, including filing a tax objection complaint in circuit court or appealing to the State Property Tax Appeal Board (PTAB). For assistance with filing an appeal or more information on the process, refer to the contact information provided on the PTAX-230 form or consult with legal or real estate professionals.

Understanding Ptax 230

FAQ: Understanding and Filing Form PTAX-230 for Non-Farm Property Assessment Complaints

Who needs to fill out the PTAX-230 form?

If you're disputing the assessment of your non-farm property, you'll need to complete the PTAX-230 form. This includes any grievances regarding property assessments that seem incorrect or unfair compared to similar properties, or if you believe there's been an error in the assessment. Remember, to file this complaint, the form must reach the board of review by a specific deadline. To not miss this crucial window, verify the deadline with your Chief County Assessment Officer (CCAO) as soon as possible.What should be included with the PTAX-230 form?

Along with completing the form with all required details like property identification number (PIN), your contact information, and the specific reasons for your complaint, you must include evidence supporting your claim. This could range from photographs to documents illustrating discrepancies or errors in your property’s assessment. The clearer and more comprehensive your evidence is, the better chance you have of a favorable review.How can someone decide between opting for a hearing or a decision based on provided evidence?

On the PTAX-230 form, you have the choice to request a hearing where you can personally present your case or allow the board to make a decision based solely on the evidence you've submitted. Choosing the best option depends on your situation. If you feel that your documentation strongly supports your claim, you might opt for a decision based on evidence. However, if you believe that a hearing will better serve your case, where you can articulate and explain your situation further, then requesting a hearing would be the way to go. You will be notified of the date and time if a hearing is scheduled.Where should one file the completed PTAX-230 form?

After you have filled out the form and have your evidence ready, mail everything to the Clinton County Board of Review. Make sure to keep a copy for your records. The address to send your completed form and evidence is: 850 Fairfax Street, Carlyle, IL 62231. This step is vital in starting the appeal process for your property assessment.What happens after submitting the form?

Once your PTAX-230 form is filed, the board of review will examine your complaint and the evidence provided. You might be asked to attend a hearing if you've chosen that option or if the board requires further clarification. After reviewing your case, the board will mail you a final notice of its decision. If the decision is not in your favor, you have the option to appeal further. For details on this process, including necessary forms and deadlines, consult the Illinois Property Assessment Appeal Process Guide available through the provided contact information.

Common mistakes

When completing the PTAX-230 form, a sense of accuracy and attentiveness is required. Unfortunately, it's common for people to slip up in a few places. Here are some common mistakes that can trip you up:

- Not double-checking the Property Index Number (PIN): The PIN is crucial for identifying your property. Any mistake here can lead to your complaint being directed at the wrong property.

- Skipping over the option to present your case: You must indicate whether you’d like to present your case in person or if you're okay with the Board of Review making a decision based on the evidence provided. Overlooking this choice can affect your appeal process.

- Misidentifying the assessment year: Each year stands on its own in matters of property assessment. Ensure you're filing a complaint for the correct year.

- Choosing the wrong reason for objection: The form lists several reasons for objecting to the assessment. Picking the wrong one could weaken your case.

- Incomplete additional information: Often, individuals provide insufficient detail in the section that asks for additional information useful to the board. Expanding on your reasoning here can be invaluable.

- Lacking clarity in presenting assessed values: Inaccuracy in listing your property’s assessed values versus your estimate of correct values can confuse the reviewing authority.

- Forgetting to attach evidence: Evidence supports your claim. Not attaching pertinent documents, photos, or appraisals can result in an automatic dismissal of your complaint.

- Neglecting to sign the form: An unsigned form is often considered invalid. Make sure the property owner or authorized agent’s signature is not missing.

- Incorrect mailing: Ensuring that the completed form reaches the correct address is fundamental. Sending it to the wrong office can mean your complaint isn't considered.

When approaching the task of filling out the PTAX-230 form, being mindful of these common pitfalls can greatly increase your chances of a successful appeal. Remember, it’s about presenting your case clearly, accurately, and convincingly. Don’t let a simple oversight be the reason your appeal doesn’t go through. Double-check everything and provide as much relevant information and evidence as possible.

Documents used along the form

When filing a Form PTAX-230, "Non-Farm Property Assessment Complaint," several additional forms and documents might be required to support your case or provide necessary context. Understanding these can help streamline the process, ensuring all pertinent information and evidence are correctly submitted.

- Form PTAX-227, "Farm Property Assessment Complaint": Although the PTAX-230 is for non-farm properties, if you're challenging an assessment that involves both farm and non-farm assessments, you might also need to complete Form PTAX-227. This form is specifically for farm properties and addresses assessments related directly to agricultural use.

- Property Record Card: This card contains detailed information about your property, including its size, age, and use. It provides a basis for comparison during the assessment appeal process, helping to illustrate discrepancies or inaccuracies in the current assessment.

- Recent Appraisal Report: If you have had your property appraised recently, this report can be a crucial piece of evidence. It offers an expert's opinion on the fair market value of your property, which can support your claim that the assessed value is incorrect.

- Comparable Sales Data: This includes information about the sale prices of properties similar to yours in your area. If these sales show a trend different from your property’s assessed value, this data can be persuasive evidence that your assessment is out of line.

- Photographs of the Property: Photos can demonstrate issues not apparent in the official records, such as property conditions or improvements not reflected in the assessed value. These images can be compelling visual evidence to support your complaint.

Collecting and submitting the right documents with your PTAX-230 form is key to a successful appeal. Each piece of evidence should strengthen your argument that the property's assessed value does not accurately reflect its current market value or condition. Careful preparation and detailed documentation are your best allies in navigating the appeals process efficiently.

Similar forms

The IRS Form 1040, used for individual income tax returns, shares fundamental characteristics with the PTAX-230 in terms of structure and intent. Both forms aim to report and rectify financial information pertinent to tax obligations — the PTAX-230 for property assessments and the Form 1040 for personal income. Each form requires detailed information from the filer, including identification and financial details, and offers the option to attach supplementary documents (e.g., evidence for PTAX-230, and supporting tax documents for Form 1040) to substantiate the filer's claims or calculations.

The Uniform Residential Loan Application, employed in the mortgage lending process, parallels the PTAX-230 in its requirement for detailed property information. While the loan application gathers data to assess a borrower's eligibility for a mortgage, the PTAX-230 collects property details to contest an assessment. Both documents necessitate precise property descriptions, owner information, and financial details, underscoring the necessity for accuracy and completeness in official property-related submissions.

The Local Property Tax Appeal Form, which homeowners use to contest local property tax assessments, closely resembles the PTAX-230 in purpose and content. These forms are integral to the appeals process, enabling property owners to present a case for reassessment based on arguments such as overvaluation or discrepancies in property information. Each form facilitates a structured argument against current tax or assessment determinations, allowing for the submission of supporting evidence like appraisals or photographs to strengthen the owner's case.

The Business Property Statement (Form 571-L) in California, required for business personal property taxation, draws parallels with the PTAX-230 through its focus on accurate property valuation. Despite differing in the nature of the property (business versus non-farm residential property), both forms serve as official statements to respective authorities, detailing property attributes for tax purposes. There's a mutual reliance on the disclosure of factual and financial information to either assess or contest property values effectively.

The Change of Ownership Statement, found in real estate transactions, shares the PTAX-230's emphasis on accurate property description and ownership details. Triggered by the transfer of property, this document informs assessment officials of changes that may affect tax assessments. Similar to the PTAX-230, which seeks to correct or contest assessments, the Change of Ownership Statement plays a foundational role in ensuring property assessments reflect current ownership and property status, highlighting the importance of up-to-date and precise property information in taxation matters.

Dos and Don'ts

Filling out Form PTAX-230, the non-farm property assessment complaint form, can seem daunting. However, with these dos and don'ts, you'll navigate the process with ease:

Dos when filling out the PTAX-230 form:

- Gather all necessary documents before starting. This includes photographs, appraisals, or any evidence that supports your claim. Having everything on hand makes the process smoother.

- Check your Property Index Number (PIN) carefully. This number, available on your property tax bill or through your Chief County Assessment Officer (CCAO), is crucial for your complaint to be processed accurately.

- Be clear and detailed in your reason for objection. Whether it's an error in assessment or any other discrepancy, providing detailed information helps the board of review understand your perspective.

- Sign and date the form. An unsigned form is considered incomplete and won’t be processed. Remember to attach all evidence before signing.

Don'ts when filling out the PTAX-230 form:

- Don't miss the filing deadline. Contact your CCAO to know the exact deadline. Late submissions will not be reviewed, which could delay any adjustments to your assessment.

- Don't leave sections incomplete. Incomplete information can lead to delays or a dismissal of your complaint. If a section does not apply, mark it as "N/A" instead of leaving it blank.

- Don't forget to check the box indicating your preferred method of resolution. Whether you want the decision based on the evidence submitted or prefer a personal hearing, your choice must be clear.

- Don't underestimate the importance of evidence. The more relevant evidence you can provide, the stronger your case. Omitting supportive documentation can weaken your appeal.

With these guidelines, navigating the Form PTAX-230 process should be more straightforward, helping you present a strong case to the board of review.

Misconceptions

Many misconceptions exist regarding the PTAX-230 Non-Farm Property Assessment Complaint form. Understanding these misconceptions is crucial for property owners considering an appeal for their property assessment. Here are ten common misconceptions and the truth behind them:

- Only attorneys can file the PTAX-230 form. In reality, property owners or their authorized agents can complete and submit this form to contest their property assessment.

- The PTAX-230 form is for appealing the property tax amount. This is incorrect; the form is used to appeal the assessed value of the property, not the tax amount directly.

- Filing a PTAX-230 appeal guarantees a lowered assessment. Filing an appeal does not guarantee a change in the assessment. The board of review will decide based on the evidence provided.

- There is no deadline for filing the PTAX-230 form. There is a specific deadline to file the appeal, which can be obtained from the Chief County Assessment Officer (CCAO).

- The PTAX-230 form can be submitted without evidence. Evidence supporting the complaint is required for the board of review to consider the appeal.

- All appeals require a hearing in person. Property owners can choose if they would like to present their case in person or have the board decide based on the submitted evidence alone.

- The form is only for properties assessed too high. Appeals can also be filed for properties assessed too low or incorrectly, such as being assessed twice or listed as taxable when exempt.

- The PTAX-230 form can be filed electronically. Currently, the original form must be mailed to the address provided, electronic submissions are not mentioned as accepted.

- Once an appeal is filed, tax payments can be delayed until a decision is made. Property owners should continue paying their property taxes as billed to avoid late fees or penalties, even if an appeal is in process.

- Appealing through the PTAX-230 form is the final step. If the property owner disagrees with the board's decision, they can further appeal to the State Property Tax Appeal Board or in circuit court.

Understanding these aspects of the PTAX-230 form helps property owners navigate the appeal process more effectively. It's important to gather all necessary information and adhere to deadlines to ensure a smooth appeal process.

Key takeaways

Filing a PTAX-230 form is crucial if you're disputing the assessment of your non-farm property. It's a step towards ensuring that your property's assessment is fair and equitable. Here are five key takeaways to help guide you through the process:

- Know the Deadline: It's imperative to submit your PTAX-230 form by the filing deadline. This deadline can be obtained from your Chief County Assessment Officer (CCAO). Missing this deadline means your appeal will not be heard.

- Completion and Submission: Fully complete the form, ensuring every section is filled out with the correct information regarding your property. After attaching all necessary evidence to support your complaint, such as photographs, mail the original form to the specified address.

- Selecting the Appeal Basis: Clearly indicate the reason for your objection to the property's assessment. Whether it’s due to being assessed twice, improvements not taxable, or if the assessment is not in line with comparable properties, make your case clear.

- Documentation and Evidence: The strength of your appeal lies in the evidence submitted. This includes property photographs and any other documentation that supports your claim. Not submitting adequate evidence could weaken your appeal.

- Understanding the Appeal Process: Familiarize yourself with the entire appeal process, recognizing that you're appealing the assessed value of your property, not the tax amount. Should you disagree with the Board of Review's decision, know that you have the option to appeal to the State Property Tax Appeal Board (PTAB) or in circuit court.

Undertaking the PTAX-230 form appeal process is about ensuring that your property is assessed fairly and accurately. Careful attention to deadlines, meticulous completion of the form, and the provision of solid evidence are paramount in presenting a strong case to the Board of Review.

Popular PDF Documents

Cancellation of Debt Insolvency - Essential documentation for financial evaluation, documenting outstanding liabilities against asset values for insolvency determination.

How Many Times Can You Defer a Car Payment - Choose which month you'd like to skip a payment on your FCCU loan and apply by the deadline.