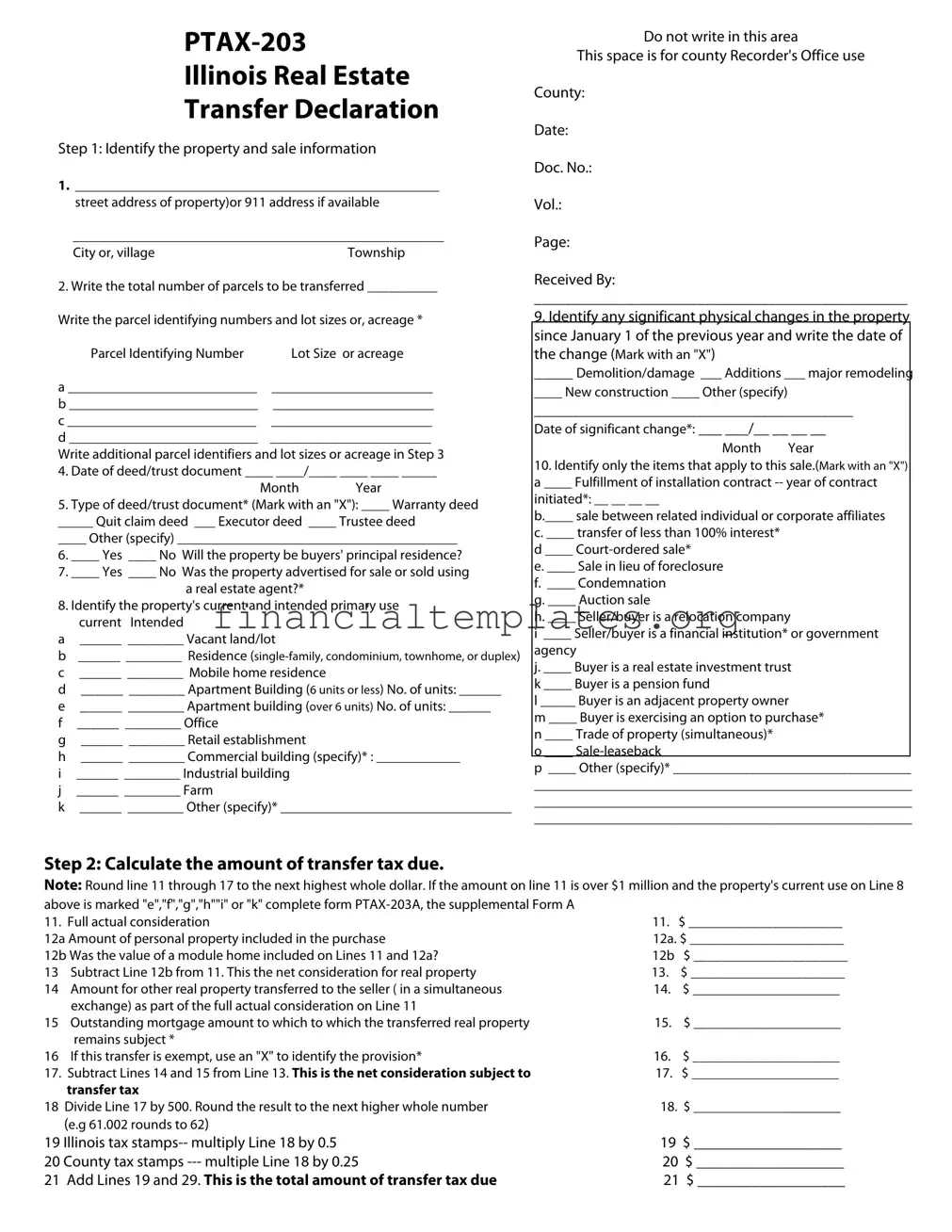

Get Ptax 203 Form

Engaging with real estate transactions in Illinois requires familiarity with the PTAX-203 Illinois Real Estate Transfer Declaration, a critical tool for both buyers and sellers navigating the transfer process. This document serves as a comprehensive delineation of the property in question, encompassing essential details such as property and sale information, parcel identifying numbers, size or acreage of lots, and specific types of deeds involved in the transaction. Its function extends to identifying whether the property will serve as the buyer’s principal residence and if a real estate agent facilitated the sale. Additionally, the PTAX-203 form delves into the property's current and intended use, ranging from residential dwellings to industrial buildings, and it even covers agricultural lands. Importantly, this form also prompts disclosure of any significant physical changes to the property, potentially affecting its valuation. Beyond these descriptive elements, the PTAX-203 plays a pivotal role in calculating the amount of transfer tax due, a crucial step for the legal completion of the property transfer. This calculation takes into account the full consideration of the sale, adjustments for personal or modular home property included in the transaction, and any existing mortgages, leading to the determination of net consideration subject to the transfer tax. Through its comprehensive scope, the PTAX-203 not only facilitates a smoother real estate transaction but also ensures compliance with Illinois state law, making it an indispensable tool for all parties involved.

Ptax 203 Example

Illinois Real Estate

Transfer Declaration

Step 1: Identify the property and sale information

1.____________________________________________________

street address of property)or 911 address if available

_____________________________________________________

City or, village |

Township |

2.Write the total number of parcels to be transferred __________

Write the parcel identifying numbers and lot sizes or, acreage *

Parcel Identifying Number |

Lot Size or acreage |

a ___________________________ |

_______________________ |

b ___________________________ |

_______________________ |

c ___________________________ |

_______________________ |

d ___________________________ |

_______________________ |

Write additional parcel identifiers and lot sizes or acreage in Step 3 4. Date of deed/trust document ____ ____/____ ____ ____ _____

Month Year

5.Type of deed/trust document* (Mark with an "X"): ____ Warranty deed

_____ Quit claim deed ___ Executor deed ____ Trustee deed

____ Other (specify) ________________________________________

6.____ Yes ____ No Will the property be buyers' principal residence?

7.____ Yes ____ No Was the property advertised for sale or sold using a real estate agent?*

8.Identify the property's current and intended primary use

current Intended

a______ ________ Vacant land/lot

b______ ________ Residence

c______ ________ Mobile home residence

d______ ________ Apartment Building (6 units or less) No. of units: ______

e______ ________ Apartment building (over 6 units) No. of units: ______

f______ ________ Office

g______ ________ Retail establishment

h______ ________ Commercial building (specify)* : ____________

i______ ________ Industrial building

j______ ________ Farm

k______ ________ Other (specify)* _________________________________

Do not write in this area

This space is for county Recorder's Office use

County:

Date:

Doc. No.:

Vol.:

Page:

Received By:

________________________________________________

9. Identify any significant physical changes in the property

since January 1 of the previous year and write the date of the change (Mark with an "X")

_____ Demolition/damage ___ Additions ___ major remodeling

____ New construction ____ Other (specify)

_________________________________________

Date of significant change*: ___ ___/__ __ __ __

Month Year

10.Identify only the items that apply to this sale.(Mark with an "X") a ____ Fulfillment of installation contract

b.____ sale between related individual or corporate affiliates c. ____ transfer of less than 100% interest*

d ____

e. ____ Sale in lieu of foreclosure f. ____ Condemnation

g. ____ Auction sale

h. ____ Seller/buyer is a relocation company

i ____ Seller/buyer is a financial institution* or government agency

j. ____ Buyer is a real estate investment trust k ____ Buyer is a pension fund

l _____ Buyer is an adjacent property owner

m ____ Buyer is exercising an option to purchase* n ____ Trade of property (simultaneous)*

o ____

p ____ Other (specify)* __________________________________

______________________________________________________

______________________________________________________

______________________________________________________

Step 2: Calculate the amount of transfer tax due.

Note: Round line 11 through 17 to the next highest whole dollar. If the amount on line 11 is over $1 million and the property's current use on Line 8

above is marked "e","f","g","h""i" or "k" complete form |

|

|

|

11. Full actual consideration |

11. |

$ ______________________ |

|

12a Amount of personal property included in the purchase |

12a. $ ______________________ |

||

12b Was the value of a module home included on Lines 11 and 12a? |

12b |

$ ______________________ |

|

13 |

Subtract Line 12b from 11. This the net consideration for real property |

13. |

$ ______________________ |

14 |

Amount for other real property transferred to the seller ( in a simultaneous |

14. |

$ _____________________ |

|

exchange) as part of the full actual consideration on Line 11 |

|

|

15 |

Outstanding mortgage amount to which to which the transferred real property |

15. |

$ _____________________ |

|

remains subject * |

|

|

16 |

If this transfer is exempt, use an "X" to identify the provision* |

16. |

$ _____________________ |

17. Subtract Lines 14 and 15 from Line 13. This is the net consideration subject to |

17. |

$ _____________________ |

|

|

transfer tax |

|

|

18 |

Divide Line 17 by 500. Round the result to the next higher whole number |

18. $ _____________________ |

|

|

(e.g 61.002 rounds to 62) |

|

|

19 Illinois tax |

19 |

$ ___________________ |

|

20 County tax stamps |

20 |

$ ___________________ |

|

21 Add Lines 19 and 29. This is the total amount of transfer tax due |

21 |

$ ___________________ |

|

Document Specifics

| Fact Name | Description |

|---|---|

| Form Identification | PTAX-203 Illinois Real Estate Transfer Declaration |

| Initial Purpose | Identifies property and sale information for real estate transfers |

| Required Information (Part 1) | Property street address, City or Village, Township, total number of parcels, parcel identifying numbers, lot sizes or acreage, and date of deed/trust document. |

| Property Use Information | Includes current and intended use of the property, identifying changes to the property, and property's primary use. |

| Sale Specifics | Details regarding the sale conditions, including type of sale, parties involved, and conditions such as foreclosure or court-ordered sale. |

| Transfer Tax Calculation | Provides steps to calculate the amount of transfer tax due, including considerations for properties over $1 million with specific uses requiring Form PTAX-203A. |

| Governing Law | Illinois Property Tax Code |

Guide to Writing Ptax 203

Completing the PTAX-203 Illinois Real Estate Transfer Declaration form is a crucial step in the process of transferring property ownership in Illinois. This form gathers important details about the property, the sale, and calculates the transfer tax due. It's important for both the buyer and seller to provide accurate information to ensure a smooth transaction. Below are step-by-step instructions on how to complete this form.

- For the property's identification and sale information, start by writing the street address of the property, including the 911 address if available, followed by the city or village, and township.

- Enter the total number of parcels being transferred and their respective parcel identifying numbers alongside the lot size or acreage. If there are additional parcels, note that details will be added in a later step.

- Fill in the date of the deed or trust document by providing the month and year.

- Mark the type of deed or trust document with an "X". Options include warranty deed, quit claim deed, executor deed, trustee deed, or other (specify if selected).

- Indicate with a "Yes" or "No" whether the property will be the buyer's principal residence.

- Answer "Yes" or "No" to whether the property was advertised for sale or sold using a real estate agent.

- For the property's current and intended primary use, mark the appropriate boxes that apply and specify the number of units for apartment buildings or if the building has an over 6 units specification, office, retail establishment, commercial building (specify if needed), industrial building, farm, or other (specify if needed).

- Identify any significant physical changes in the property since January 1 of the previous year and write the date of the change, marking the appropriate box with an "X".

- Mark with an "X" the items that apply to this sale, including fulfillment of an installment contract, sale between related individuals or corporate affiliates, etc., and provide specifics where requested.

For calculating the amount of transfer tax due:

- Write the full actual consideration in dollars.

- Enter the amount of personal property included in the purchase and the value of a modular home if applicable.

- Subtract Line 12b from Line 11 to get the net consideration for real property.

- Note the amount for other real property transferred to the seller as part of the full actual consideration.

- Write the outstanding mortgage amount to which the transferred real property remains subject.

- If this transfer is exempt, mark the provision with an "X".

- Subtract Lines 14 and 15 from Line 13 to find the net consideration subject to transfer tax.

- Divide Line 17 by 500 and round the result to the next higher whole number.

- Multiply Line 18 by 0.5 to calculate Illinois tax stamps.

- Calculate county tax stamps by multiplying Line 18 by 0.25.

- Add Lines 19 and 20 to find the total amount of transfer tax due.

Once completed, ensure all information is accurate and complete before submission. This ensures the real estate transfer process proceeds without unnecessary delays.

Understanding Ptax 203

What is the PTAX-203 form used for in Illinois?

The PTAX-203 form is a document used in Illinois for declaring real estate transfers. It collects information about the property being transferred, the sale, including the type of deed, the selling price, and the use of the property. This information aids in calculating the transfer tax due for the property sale.

Who needs to fill out the PTAX-203 form?

Individuals or entities involved in the transfer of real estate in Illinois are required to complete the PTAX-203 form. This includes both sellers and buyers of the property.

How do you identify the property on the PTAX-203 form?

To identify the property, you must provide the street address or 911 address if available, city or village, township, the total number of parcels being transferred, parcel identifying numbers, and the lot sizes or acreage for each parcel.

What information do you need to provide about the real estate transaction?

The form requires details such as the date of the deed or trust document, the type of deed or document, whether the property will be the buyer's principal residence, and if a real estate agent was used. It also asks about the property's current and intended primary use, significant physical changes to the property, and specifics of the sale including if it's a court-ordered sale, in lieu of foreclosure, etc.

How do you calculate the amount of transfer tax due?

To calculate the transfer tax, you start with the full actual consideration of the sale, subtract any personal property included in the sale, and adjust based on any mortgage amount that remains subject to the transferred real property. The net consideration subject to transfer tax is then divided by 500, and this result helps determine the Illinois and county tax stamps required.

What if the property sale price is over $1 million?

If the sale price is over $1 million and the property's current use is marked under certain categories (e.g., commercial, industrial), you must complete the PTAX-203A, a supplemental form, in addition to the PTAX-203 form.

Are there any exemptions from the transfer tax?

Yes, certain transfers may be exempt from the transfer tax. On the PTAX-203 form, there is a section to indicate if the transfer falls under an exempt provision by marking an "X" and specifying the provision.

Can you include personal property in the sale calculation?

Yes, the form allows you to include the value of personal property sold along with the real estate. This amount is then subtracted from the full actual consideration to determine the real property's net consideration for transfer tax purposes.

What happens if you omit significant physical changes to the property on the form?

Omitting significant physical changes can lead to an incorrect assessment of the property's value and potentially result in errors in the transfer tax calculation. Accurate reporting is crucial for the proper determination of taxes due.

Where do you submit the completed PTAX-203 form?

The completed PTAX-203 form should be submitted to the county Recorder's Office where the property is located. This is part of the process for officially recording the real estate transfer and ensuring that all applicable taxes are paid.

Common mistakes

Filling out the PTAX-203 Illinois Real Estate Transfer Declaration form accurately is crucial for a smooth property transfer. However, there are common mistakes that individuals make during this process. To ensure a seamless transaction, it is essential to be mindful of these pitfalls.

Not thoroughly verifying the property and sale information: The first section of the PTAX-203 requires detailed information about the property, including street address, city, township, and parcel identifying numbers. Overlooking these details can lead to complications in the property transfer process.

Incorrectly listing the total number of parcels: When properties are divided into multiple parcels, each must be correctly identified and listed. Missing parcels or inaccurately listed parcel sizes can significantly impact the transfer and tax calculation.

Omitting the deed type: The form requires the type of deed or trust document to be marked correctly. This classification affects the legal understanding of the transfer. Misidentifying the deed type can lead to legal discrepancies.

Failing to indicate the property's intended use: This information is crucial for tax purposes and future zoning considerations. Neglecting to provide accurate current and intended use can lead to incorrect tax assessment.

Oversights in reporting significant physical changes to the property: Any major alterations, additions, or damage to the property can affect its value and must be reported. Failure to disclose these changes can result in discrepancies in the property’s assessed value.

Incorrectly identifying the nature of the sale: The form requires specific details about the nature of the sale, which may include transactions like court-ordered sales, auctions, or transfers between related parties. Each type has different implications for tax and legal purposes.

Miscalculating the transfer tax: The calculation of transfer tax involves several steps and requires precision. Inaccuracies in calculating the net consideration subject to transfer tax or in filling out the supplemental Form A for properties over $1 million can result in incorrect tax liabilities.

Forgetting to round up tax calculations: The PTAX-203 instructions specify that certain calculations should be rounded to the next highest whole dollar. Neglecting this detail can lead to underpayment of taxes, potentially resulting in penalties.

Avoiding these mistakes not only helps in ensuring that the property transfer complies with Illinois law but also protects all parties involved from future legal and financial issues. Careful attention to detail when completing the PTAX-203 form is essential for a successful real estate transaction.

Documents used along the form

When dealing with property transfers in Illinois, specifically with filling out the PTAX-203 Illinois Real Estate Transfer Declaration form, several additional forms and documents often play a crucial role in the process. Completing the PTAX-203 form correctly necessitates detailed information about the property, its use, sale conditions, and more. Various other documents are required to effectively support or provide the necessary details for this process. Here's a look at six other forms and documents frequently used alongside the PTAX-203 form.

- Title Insurance Commitment: This document offers a preliminary report of the property's title history, indicating any existing liens, encumbrances, or defects in the title that might need to be addressed before the transfer is completed.

- Real Property Transfer Tax Declaration: Many municipalities require their own transfer tax declaration form in addition to the PTAX-203. This form generally collects similar information but is used for the calculation and collection of local transfer taxes.

- HUD-1 Settlement Statement: Now replaced by the Closing Disclosure form for most real estate transactions, the HUD-1 Settlement Statement provides a detailed breakdown of all the financial transactions and fees associated with the closing of a real estate transaction.

- Warranty Deed or Quit Claim Deed: Depending on the nature of the property transfer, a Warranty Deed (guaranteeing clear title) or a Quit Claim Deed (transferring ownership without guarantees) document is required to legally effect the change in ownership.

- Property Tax Bill: A current property tax bill may be necessary to provide proof of the property's tax status, ensuring that all taxes have been paid up to the date of transfer.

- PTAX-203A Supplemental Form A: For properties with a sale price of over $1 million and categorized under specific uses, this supplemental form is necessary for calculating additional transfer taxes due in Illinois.

Understanding and gathering these documents and forms are crucial steps in the real estate transfer process. Properly filled documents are not only a legal necessity but also ensure a smoother transition for both the buyer and seller, safeguarding against future disputes and complications. Whether you're a buyer, seller, or professional involved in the real estate transaction process, being well-equipped with information and the right documents is part of ensuring that property transfers are conducted efficiently and with due diligence.

Similar forms

The HUD-1 Settlement Statement is similar to the PTAX-203 form in that both are integral to real estate transactions but serve different stages. The HUD-1 outlines the actual costs of the closing, including fees, charges, and other monetary exchanges relevant to finalizing a property sale. It details the financial transactions between buyer, seller, and lender, which parallels the PTAX-203's role in declaring the details of the property transfer for tax purposes. Both documents ensure transparency and accuracy in the financial elements of real estate deals, facilitating smooth property transfers and accurate tax assessments.

The Uniform Residential Loan Application (URLA) bears similarities to the PTAX-203 because both involve detailed disclosures relating to real estate transactions. The URLA is used by prospective borrowers to apply for a mortgage, requiring comprehensive information about the borrower’s financial status, employment, and the property involved. Like the PTAX-203, which requires detailed information about the property being transferred, the URLA ensures parties have all necessary information to assess eligibility and risks associated with the transaction, aiding in the decision-making process for lending.

Another document akin to the PTAX-203 is the Grant Deed, which facilitates the actual transfer of real property from one party to another. Grant Deeds include descriptions of the property, much like the PTAX-203, which necessitates parcel identifying numbers and details about the land. Both documents play crucial roles in the legal transfer process, ensuring clear conveyance of property ownership, with the PTAX-203 aiding in the assessment of transfer taxes based on the declared value and details of the transaction.

The Mortgage Agreement can be compared to the PTAX-203 as both involve documentation of financial details related to property. A Mortgage Agreement outlines the terms under which the lender provides a loan to the borrower for purchasing property, including the loan amount, interest rate, and payment schedule. Though serving different purposes, both documents ensure parties in a real estate transaction are aware of and agree to the financial commitments being recorded, with the PTAX-203 focusing on tax implications of property transfer.

Lastly, the Deed of Trust closely aligns with the PTAX-203 due to its role in property transactions. This document involves three parties—the borrower, lender, and trustee—and concerns the legal transfer of property to a trustee as security for a loan. Similar to the PTAX-203’s function of recording relevant information for property transfer tax assessment, the Deed of Trust documents the parameters under which property is held as collateral, ensuring legal structures support the financial aspects of property ownership and transfer.

Dos and Don'ts

When filling out the PTAX-203 Illinois Real Estate Transfer Declaration, it is important to carefully follow guidelines to ensure accuracy and compliance. Below are four dos and don'ts to consider:

Dos:

- Double-check the street address or 911 address of the property to ensure it matches the legal description.

- Accurately write the total number of parcels being transferred and include all relevant parcel identifying numbers, along with the correct lot sizes or acreage.

- Clearly mark the type of deed or trust document with an "X" in the appropriate box, and specify if the option does not fit the provided categories.

- Be precise when identifying the property's current and intended primary use, ensuring that the intended use is correctly marked to reflect future plans.

Don'ts:

- Do not leave the date of the deed/trust document blank or inaccurately filled; confirming the month and year is crucial.

- Avoid guessing when marking items that apply to the sale in Step 2; only mark the "X" if certain conditions explicitly apply to your transaction.

- Do not include personal property value in the full actual consideration unless it is clearly part of the transaction outlined in Lines 11 and 12a.

- Avoid miscalculations in determining the amount of transfer tax due; ensure to accurately subtract lines and divide as instructed for the correct totals.

Misconceptions

Understanding the PTAX-203 form, or the Illinois Real Estate Transfer Declaration, is essential for Illinois property transfers, yet misconceptions about its requirements and purposes are common. Here are nine common misconceptions explained:

- Only residential properties require the PTAX-203 form. This misconception overlooks that the form is required for all real estate transfers, including commercial, industrial, agricultural, and other types of properties, not just residential homes.

- It's for the buyer to fill out and submit. Actually, both the buyer and seller have roles in completing portions of the PTAX-203 form. It's a collaborative effort to ensure accurate transfer and tax calculation.

- Legal representation is mandatory to complete the form. While having legal guidance can be helpful, particularly for complex transactions, it isn't a strict requirement. Parties to a transfer can fill out the form themselves if they understand the process and requirements.

- All property sales are subject to the transfer tax. There are exemptions available for certain types of property transfers, such as those made between certain family members or for governmental entities. It's essential to review the exemptions listed on the form.

- The form is only concerned with the sale price of the property. The PTAX-203 form requires much more than just the sale price. It asks for details about the property, intended use, any significant changes to it, the breakdown of the sale (including personal property), and other specific conditions of the sale.

- Parcel numbers are not crucial for form completion. The parcel identifying number and details about lot size or acreage are essential for accurately identifying the property being transferred. This information is critical for recording and tax purposes.

- Filing electronically isn’t an option. Depending on the county, electronic filing of the PTAX-203 form may be available and even preferred. It's best to check with the local recorder's office for their submission policies.

- There’s no need to disclose physical changes to the property. The form requires disclosure of significant physical changes to the property, such as demolition, new construction, or major remodeling, as these can affect the property's valuation and tax assessment.

- The transfer tax amount is fixed. The transfer tax is calculated based on the net consideration for the real property and can vary significantly from one transaction to another. It's not a fixed fee and requires careful calculation as delineated in the form instructions.

Clearing up these misconceptions is crucial for anyone involved in a property transaction in Illinois to ensure compliance and avoid potential issues with the real estate transfer process. Correct understanding and completion of the PTAX-203 form are integral steps in facilitating a smooth property transfer.

Key takeaways

Filling out the PTAX-203 form is an essential step in the property transfer process in Illinois. This form, also known as the Illinois Real Estate Transfer Declaration, plays a crucial role in documenting the sale and ensuring that all details are accurately recorded for tax purposes. Here are some key takeaways about filling out and using the PTAX-203 form:

- Accuracy is Key: The form requires detailed information about the property, including the street address, city, township, and parcel identifying numbers. It's vital to double-check these details to avoid errors that could delay the transfer process.

- Understanding the Types of Deeds: The PTAX-203 form asks for the type of deed or trust document being used for the transfer, such as a warranty deed, quit claim deed, executor deed, or trustee deed. Understanding the differences between these options ensures that you select the one that correctly represents the nature of the transaction.

- Principal Residence and Sale Conditions: You'll need to indicate whether the property will be the buyer's principal residence and whether a real estate agent was used. Additionally, identifying the property's current and intended primary use—such as a single-family home, apartment building, or commercial establishment—is necessary for accurate documentation and tax calculation.

- Calculating Transfer Tax: The PTAX-203 form includes steps to calculate the transfer tax due, which is based on the net consideration for real property after subtracting any included personal property value and outstanding mortgage amounts. Understanding how to accurately calculate this tax is crucial for completing the sale and ensuring compliance with Illinois tax laws.

Completing the PTAX-203 form with thorough attention to detail will facilitate a smoother property transfer process, ensuring that all parties meet their legal and financial obligations.

Popular PDF Documents

File Business Tax Extension - This form can be utilized by corporations, partnerships, and other entities needing extra time to complete their tax documentation.

Schedule C Irs - Provides a direct way to report primary source of business income.