Get Ptax Form

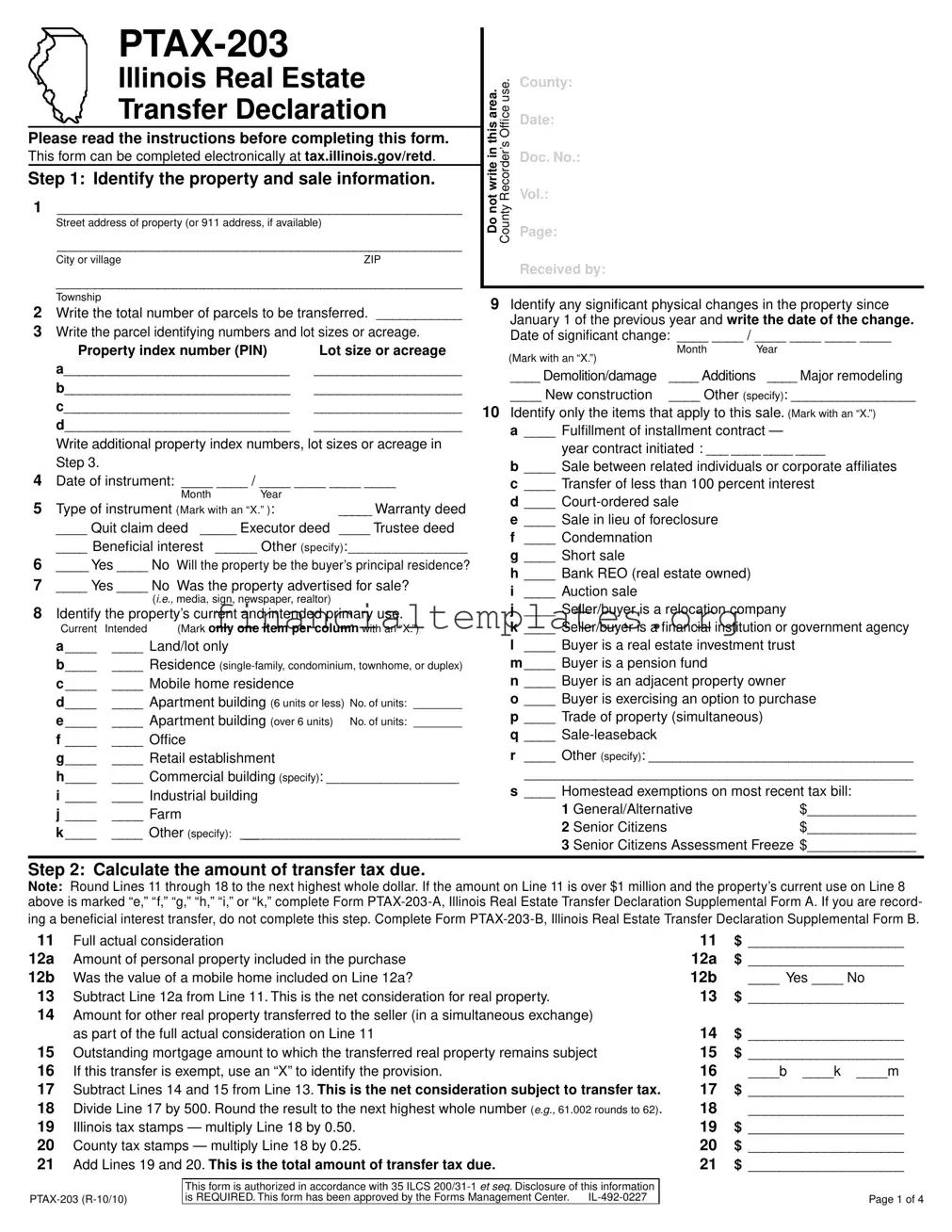

The PTAX-203 Illinois Real Estate Transfer Declaration form is a critical document in the conveyance of properties within the state, serving multiple purposes from the calculation of transfer taxes to providing a comprehensive snapshot of the transaction details. It mandates the disclosure of property details, including its address, property index number, lot size, and the classification of the property’s current and intended usage which could range from residential to industrial. Moreover, the declaration delves into the sale specifics such as the type of deed, whether the property will serve as the buyer's principal residence, and the presence of any advertising for sale. The form also inquires about significant physical changes to the property, delineates the nature of the transaction—highlighting instances like short sales, foreclosures, or if the sale is part of an installment contract—and outlines tax exemptions that might apply. Calculating the transfer tax due requires detailing the full consideration for the sale, subtracting any personal property included in the transaction, and adjusting for other property simultaneously exchanged. Completion of this form, which can be filled out electronically, is not just a procedural necessity but a legal requirement under the Real Estate Transfer Tax Law, emphasizing its importance in the transaction process and for record-keeping purposes by the Illinois Department of Revenue and county offices. Its accuracy is paramount, underscored by the stipulated criminal penalties for willful falsification or omission of required information, therefore underscoring the form's integrity in the real estate transfer process.

Ptax Example

Illinois Real Estate

Transfer Declaration

Please read the instructions before completing this form.

This form can be completed electronically at tax.illinois.gov/retd.

Step 1: Identify the property and sale information.

1____________________________________________________

Street address of property (or 911 address, if available)

____________________________________________________

City or villageZIP

____________________________________________________

Township

2Write the total number of parcels to be transferred. ___________

3 Write the parcel identifying numbers and lot sizes or acreage.

Property index number (PIN) |

Lot size or acreage |

a_____________________________ |

___________________ |

b_____________________________ |

___________________ |

c_____________________________ |

___________________ |

d_____________________________ |

___________________ |

Write additional property index numbers, lot sizes or acreage in Step 3.

4Date of instrument: ____ ____ / ____ ____ ____ ____

Month |

Year |

|

5 Type of instrument (Mark with an “X.” ): |

_____ Warranty deed |

|

____ Quit claim deed _____ Executor deed ____ Trustee deed |

||

____ Beneficial interest |

_____ Other (specify):______________ |

|

6____ Yes ____ No Will the property be the buyer’s principal residence?

7____ Yes ____ No Was the property advertised for sale?

(i.e., media, sign, newspaper, realtor)

8Identify the property’s current and intended primary use.

Current |

Intended |

(Mark only one item per column with an “X.”) |

a ____ |

____ Land/lot only |

|

b____ ____ Residence

c ____ ____ Mobile home residence

d____ ____ Apartment building (6 units or less) No. of units: _______

e ____ ____ Apartment building (over 6 units) No. of units: _______

f ____ ____ Office

g____ ____ Retail establishment

h____ ____ Commercial building (specify): _________________

i ____ ____ Industrial building

j ____ ____ Farm

k ____ ____ Other (specify): ____________________________

thisinwritenotDoarea. OfficeRecorder’sCountyuse. |

County: |

|

Date: |

||

|

||

|

Doc. No.: |

|

|

Vol.: |

|

|

Page: |

|

|

Received by: |

9Identify any significant physical changes in the property since January 1 of the previous year and write the date of the change.

Date of significant change: ____ ____ / ____ ____ ____ ____

MonthYear

(Mark with an “X.”)

____ Demolition/damage ____ Additions ____ Major remodeling

____ New construction ____ Other (specify): ________________

10Identify only the items that apply to this sale. (Mark with an “X.”) a ____ Fulfillment of installment contract —

year contract initiated : ___ ____ ____ ____

b ____ Sale between related individuals or corporate affiliates c ____ Transfer of less than 100 percent interest

d ____

e ____ Sale in lieu of foreclosure f ____ Condemnation

g ____ Short sale

h ____ Bank REO (real estate owned)

i____ Auction sale

j____ Seller/buyer is a relocation company

k____ Seller/buyer is a financial institution or government agency l ____ Buyer is a real estate investment trust

m ____ Buyer is a pension fund

n ____ Buyer is an adjacent property owner

o ____ Buyer is exercising an option to purchase p ____ Trade of property (simultaneous)

q ____

r____ Other (specify): __________________________________

__________________________________________________

s____ Homestead exemptions on most recent tax bill:

1 General/Alternative |

$______________ |

|

2 |

Senior Citizens |

$______________ |

3 |

Senior Citizens Assessment Freeze $______________ |

|

Step 2: Calculate the amount of transfer tax due.

Note: Round Lines 11 through 18 to the next highest whole dollar. If the amount on Line 11 is over $1 million and the property’s current use on Line 8 above is marked “e,” “f,” “g,” “h,” “i,” or “k,” complete Form

11 |

Full actual consideration |

11 |

$ ____________________ |

12a |

Amount of personal property included in the purchase |

12a |

$ ____________________ |

12b |

Was the value of a mobile home included on Line 12a? |

12b |

____ Yes ____ No |

13 |

Subtract Line 12a from Line 11. This is the net consideration for real property. |

13 |

$ ____________________ |

14Amount for other real property transferred to the seller (in a simultaneous exchange)

|

as part of the full actual consideration on Line 11 |

14 |

$ ____________________ |

15 |

Outstanding mortgage amount to which the transferred real property remains subject |

15 |

$ ____________________ |

16 |

If this transfer is exempt, use an “X” to identify the provision. |

16 |

____b ____k ____m |

17 |

Subtract Lines 14 and 15 from Line 13. This is the net consideration subject to transfer tax. |

17 |

$ ____________________ |

18 |

Divide Line 17 by 500. Round the result to the next highest whole number (e.g., 61.002 rounds to 62). |

18 |

____________________ |

19 |

Illinois tax stamps — multiply Line 18 by 0.50. |

19 |

$ ____________________ |

20 |

County tax stamps — multiply Line 18 by 0.25. |

20 |

$ ____________________ |

21 |

Add Lines 19 and 20. This is the total amount of transfer tax due. |

21 |

$ ____________________ |

This form is authorized in accordance with 35 ILCS

is REQUIRED. This form has been approved by the Forms Management Center.

Page 1 of 4

Step 3: Write the legal description from the deed. Write, type (minimum

Step 4: Complete the requested information.

The buyer and seller (or their agents) hereby verify that to the best of their knowledge and belief, the full actual consideration and facts stated in this declaration are true and correct. If this transaction involves any real estate located in Cook County, the buyer and seller (or their agents) hereby verify that to the best of their knowledge, the name of the buyer shown on the deed or assignment of beneficial interest in a land trust is either a natural person, an Illinois corporation or foreign corporation authorized to do business or acquire and hold title to real estate in Illinois, a partnership authorized to do business or acquire and hold title to real estate in Illinois, or other entity recognized as a person and authorized to do business or acquire and hold title to real estate under the laws of the State of Illinois. Any person who willfully falsifies or omits any information required in this declaration shall be guilty of a Class B misde- meanor for the first offense and a Class A misdemeanor for subsequent offenses. Any person who knowingly submits a false statement concerning the identity of a grantee shall be guilty of a Class C misdemeanor for the first offense and of a Class A misdemeanor for subsequent offenses.

Seller Information (Please print.)

_________________________________________________________________________ |

______________________________________ |

Seller’s or trustee’s name |

Seller’s trust number (if applicable - not an SSN or FEIN) |

________________________________________________________________________________________________________________

Street address (after sale)CityState ZIP

_________________________________________________________________________ ( |

) |

|

Seller’s or agent’s signature |

Seller’s daytime phone |

|

Buyer Information (Please print.)

_________________________________________________________________________ |

______________________________________ |

Buyer’s or trustee’s name |

Buyer’s trust number (if applicable - not an SSN or FEIN) |

________________________________________________________________________________________________________________

Street address (after sale)CityState ZIP

_________________________________________________________________________ ( |

) |

|

Buyer’s or agent’s signature |

Buyer’s daytime phone |

|

Mail tax bill to:

________________________________________________________________________________________________________________

Name or companyStreet addressCityState ZIP

Preparer Information (Please print.)

_________________________________________________________________________ |

______________________________________ |

Preparer’s and company’s name |

Preparer’s file number (if applicable) |

________________________________________________________________________________________________________________

Street addressCityState ZIP

_________________________________________________________________________ ( |

) |

|

|

Preparer’s signature |

Preparer’s daytime phone |

|

|

_______________________________________________ |

|

|

|

Preparer’s |

|

|

|

Identify any required documents submitted with this form. (Mark with an “X.”) ____ Extended legal description |

____Form |

||

|

____ Itemized list of personal property |

____Form |

|

To be completed by the Chief County Assessment Officer

1 |

__ __ __ |

__ __ __ |

__ __ __ |

__ __ __ __ |

__ __ |

__ __ |

3 |

Year prior to sale ___ ___ ___ ___ |

||

|

County |

|

Township |

Class |

Code 1 |

Code 2 |

4 |

Does the sale involve a mobile home assessed as |

||

|

|

|

|

|

|

|

|

|||

2 |

Board of Review’s final assessed value for the assessment year |

|

real estate? |

___ Yes ___ No |

||||||

|

prior to the year of sale. |

|

|

|

|

5 |

Comments |

|

||

|

Land |

|

___ , ___ ___ ___ , ___ ___ ___ , ___ ___ ___ |

|

|

|

||||

|

Buildings |

___ , ___ ___ ___ , ___ ___ ___ , ___ ___ ___ |

|

|

|

|||||

|

Total |

___ ___ , ___ ___ ___ , ___ ___ ___ , ___ ___ ___ |

|

|

|

|||||

Illinois Department of Revenue Use

Tab number

Page 2 of 4 |

Instructions for Form

General Information

The information requested on this form is required by the Real Estate Transfer Tax Law (35 ILCS

What is the purpose of this form?

County offices and the Illinois Department of Revenue use this form to collect sales data and to determine if a sale can be used in assessment ratio studies. This information is used to compute equalization factors. Equalization factors are used to help achieve a

Must I file Form

You must file either (1) Form

Which property transfers are exempt from real estate transfer tax?

The following transactions are exempt from the transfer tax under 35 ILCS

(a)Deeds representing real estate transfers made before January 1, 1968, but recorded after that date and trust documents executed before January 1, 1986, but recorded after that date.

(b)Deeds to or trust documents relating to (1) property acquired by any governmental body or from any governmental body,

(2) property or interests transferred between governmental bodies, or (3) property acquired by or from any corporation, society, association, foundation or institution organized and operated exclusively for charitable, religious or educational purposes. However, deeds or trust documents, other than those in which the Administrator of Veterans’ Affairs of the United States is the grantee pursuant to a foreclosure proceeding, shall not be exempt from filing the declaration.

(c)Deeds or trust documents that secure debt or other obligation.

(d)Deeds or trust documents that, without additional consideration, confirm, correct, modify, or supplement a deed or trust document previously recorded.

(e)Deeds or trust documents where the actual consideration is less than $100.

(f)Tax deeds.

(g)Deeds or trust documents that release property that is security for a debt or other obligation.

(h)Deeds of partition.

(i)Deeds or trust documents made pursuant to mergers, consolidations or transfers or sales of substantially all of the assets of corporations under plans of reorganization under the Federal Internal Revenue Code (26 USC 368) or Title 11 of the Federal Bankruptcy Act.

(j)Deeds or trust documents made by a subsidiary corporation to its parent corporation for no consideration other than the cancellation or surrender of the subsidiary’s stock.

(k)Deeds when there is an actual exchange of real estate and trust documents when there is an actual exchange of beneficial interests, except that that money difference or money’s worth paid from one to the other is not exempt from the tax. These deeds or trust documents, however, shall not be exempt from filing the declaration.

(l)Deeds issued to a holder of a mortgage, as defined in Section

(m)A deed or trust document related to the purchase of a principal residence by a participant in the program authorized by the Home Ownership Made Easy Act, except that those deeds and trust documents shall not be exempt from filing the declaration.

Can criminal penalties be imposed?

Anyone who willfully falsifies or omits any required information on Form

|

Misdemeanor |

Prison Term |

Maximum Fines |

|

|

Class A |

less than 1 year |

$2,500 |

|

|

Class B |

not more than 6 months |

$1,500 |

|

|

Class C |

not more than 30 days |

$1,500 |

|

|

|

|

|

|

|

|

|

|

|

The sellers and buyers or their agents must complete Steps 1 through 4 of this form. For transfers of a beneficial interest of a land trust, complete the form substituting the words “assignor” for “seller” and “assignee” for “buyer.”

Step 1: Identify the property and sale information.

Line 1 — Write the property’s street address (or 911 address, if available), city or village, zip code, and township in which the property is located.

Line 3 — Write all the parcel identifying numbers and the properties’ lot sizes (e.g., 80’ x 100’) or acreage. If only the combined lot size or acreage is available for multiple parcels, write the total on Line 3a under the “lot size or acreage” column. If transferring only a part of the parcel, write the letters “PT” before the parcel identifying number and write the lot size or acreage of the split parcel. If transferring a condominium, write the parcel identifying number and the square feet of the condominium unit. If surface rights are not being transferred, indicate the rights being transferred (e.g., “minerals only”). If transfer- ring

Line 4 — Write the month and year from the instrument.

Line 5 — Use an “X” to identify the type of instrument (i.e., deed, trust document, or facsimile) to be recorded with this form. For a deed-

Line 6 — Select “Yes” if the property will be used as the buyer’s principal dwelling place and legal residence.

Line 7 — Select “Yes” if the property was sold using a real estate agent or advertised for sale by newspaper, trade publication, radio/ electronic media, or sign.

Line 8 — Use an “X” to select one item under each of the column headings “Current” and “Intended.” “Current” identifies the current or most recent use of the property. “Intended” identifies the intended or expected use of the property after the sale. If the property has more than one use, identify the primary use only.

Line 8h, Commercial building — Write the type of business (bank, hotel/motel, parking garage, gas station, theater, golf course, bowling alley, supermarket, shopping center, etc.).

Line 8k, Other — Choose this item only if the primary use is not listed and write the primary use of the property.

Note: For Lines 8h and 8k, if the current and intended categories are the same but the specific use will change, (i.e., from bank to theater), write the current use on the line provided and write the intended use directly below the line provided.

Page 3 of 4 |

Line 9 — Use an “X” to identify any significant physical changes in the property since January 1 of the previous year. Write the date the change was completed or the property was damaged.

Line 10 — Select only the items that apply to this sale. A definition is provided below for all items marked with an asterisk.

Line 10a, Fulfillment of installment contract — The installment contract for deed is initiated in a calendar year prior to the calendar year in which the deed is recorded. Write the year the contract was initiated between the seller and buyer. Do not select this item if the installment contract for deed was initiated and the property was transferred within the same calendar year.

Line 10c, Transfer of less than 100 percent interest — The seller transfers a portion of the total interest in the property. Other owners will keep an interest in the property. Do not consider severed mineral rights when answering this question.

Line 10d,

Line 10g, Short sale — The property was sold for less than the amount owed to the mortgage lender or mortgagor, if the mortgagor has agreed to the sale.

Line 10h, Bank REO (real estate owned) — The first sale of the property owned by a financial institution as a result of a judgment of foreclosure, transfer pursuant to a deed in lieu of foreclosure, or con- sent judgment occurring after the foreclosure proceeding is complete.

Line 10k, Seller/buyer is a financial institution — “Financial institu- tion” includes a bank, savings and loan, credit union, Resolution Trust Company, and any entity with “mortgage company” or “mortgage corporation” as part of the business name.

Line 10o, Buyer is exercising an option to purchase — The sale price was predicated upon the exercise of an option to purchase at a predetermined price.

Line 10p, Trade of property (simultaneous) — Buyer trades or exchanges with the seller one or more items of real estate for part or all of the full actual consideration (sale price) on Line 11.

Line 10r, Other — Explain any special facts or circumstances involv- ing this transaction that may have affected the sale price or sale agreement or forced the sale of the property. This includes property that is subject to an existing lease or property that is part of an IRC §1031 Exchange.

Line 10s, Homestead exemptions on most recent tax bill — Write the dollar amount for any homestead exemption reflected on the most recent annual tax bill.

Step 2: Calculate the amount of transfer tax due.

Round Lines 11 through 18 to the next highest whole dollar.

Note: File

Line 11 — Write the full actual consideration (sale price). Full actual consideration is the amount actually paid, excluding any amount credited against the purchase price or refunded to the buyer for improvements or repairs to the property. Include the amount for other real estate transferred in a simultaneous exchange from the buyer to the seller, even if the transfer involves an even exchange. Also include the amount of outstanding mortgages to which the property remains subject at the time of the transfer.

Note: File

Line 12a — Write the amount of personal property items included in the sale price on Line 11. Do not include the value of a beneficial interest of a land trust. Personal property items are generally listed on the “bill of sale.” If you are uncertain as to whether an item is real estate or personal property, consult your attorney, tax advisor, or the chief county assessment officer.

On 81/2” x 11” paper, submit an itemized list of personal property (in- clude values) transferred from the seller to the buyer if this sale meets either of the following conditions:

•residential property — if the amount of personal property (not including the value of a mobile home) on Line 12a is greater than 5 percent of the sale price on Line 11, or

•

Residential personal property — Generally, “personal property” includes items that are not attached

•The value of the mobile home was included on Line 11.

•The value of the mobile home was not included on the real estate tax bill.

Commercial/industrial personal property — Generally, “personal property” is any item that is not a permanent improvement to the land and includes, but is not limited to, intangibles such as goodwill, licenses, patents, franchises, business or enterprise values; and certain tangibles such as inventories, cash registers and shopping carts,

Generally, “personal property” does not include building components (e.g., wiring and lighting, heating,

Line 14 — Write the amount of other real estate transferred from the buyer to the seller that was included in the sale price on Line 11. This value only applies to a simultaneous exchange between the par- ties involved in this transaction. Do not include the value of property involved in a deferred exchange under IRC §1031.

Line 15 — Write an amount only if the deed or trust document states that the transferred property remains subject to a mortgage at the time of the transfer.

Line 16 — Use an “X” to identify the letter of the provision for the exemption from the transfer tax (i.e., (b), (k), or (m)) that applies to this transfer. See “Which property transfers are exempt from real estate transfer tax?” in these instructions.

Step 3: Write the legal description from the deed.

Write the legal description from the deed. Use a minimum

Step 4: Complete the requested information.

Write the requested information for the seller, buyer, and preparer.

Write the addresses and daytime phone numbers where the seller and buyer can be contacted after the sale.

The seller and buyer (or their agents) and preparer must sign this form. By signing the form, the parties involved in the real estate transfer verify that

•they have examined the completed Form

•the information provided on this form is true and correct, and

•they are aware of the criminal penalties of law associated with falsifying or omitting any information on this form.

Use an “X” to identify any required documents submitted with this form.

Page 4 of 4 |

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The PTAX-203 form is used in Illinois for declaring real estate transfers to calculate and collect the appropriate real estate transfer tax, and for assessment ratio studies to ensure uniform property valuation across the state. |

| Mandatory Submission | Completing and filing the PTAX-203 form with the deed or trust document is required for all real estate transfers in Illinois, except those qualifying for an exempt status under specific conditions listed in the Real Estate Transfer Tax Law. |

| Exemptions | Certain real estate transfers are exempt from the transfer tax, including transfers to governmental bodies, deeds securing debt, and transfers involving charitable organizations, among others, as outlined in the Real Estate Transfer Tax Law (35 ILCS 200/31-45). |

| Legal Authority and Penalties | The authorization for the PTAX-203 form comes from the Real Estate Transfer Tax Law (35 ILCS 200/31-1 et seq.). Providing false information on the form can result in criminal penalties, including misdemeanor charges with possible prison time and fines. |

Guide to Writing Ptax

After gathering all the necessary information to complete the PTAX-203, Illinois Real Estate Transfer Declaration, individuals involved in the transfer of property will find this form instrumental for ensuring proper documentation and tax computation for the transaction. It serves as a comprehensive account of a real estate transfer, capturing details from property identification to sale specifics, and is required for the majority of real estate transactions within Illinois. It's important to proceed with accuracy to comply with state regulations and to facilitate the smooth processing of your real estate transfer.

- Begin with identifying the property and sale information. Provide the street address, city or village, ZIP code, and township of the property.

- Specify the total number of parcels involved in the transfer.

- List each parcel's identifying number and its size in terms of lot size or acreage.

- Fill in the date of the instrument with the correct month and year.

- Indicate the type of instrument being used for the transaction by marking the appropriate box with an “X.”

- Answer whether the property will serve as the buyer's principal residence by marking "Yes" or "No."

- Indicate whether the property was advertised for sale by marking "Yes" or "No."

- For each column under the current and intended primary use of the property, mark only one item with an “X.”

- Identify any significant physical changes to the property since January 1 of the previous year and note the date of change.

- Select the items that apply to your sale, marking each relevant box with an “X.”

Next, proceed to Step 2 to calculate the transfer tax due:

- Enter the full actual consideration amount.

- Document the value of any personal property included in the transaction.

- Derive the net consideration for real property by subtracting the amount in Line 12a from Line 11.

- If applicable, specify the amount for other real property transferred to the seller.

- State the outstanding mortgage amount that the transferred real property is subject to.

- Identify if this transfer is exempt from taxes and specify the provision.

- Subtract the amounts in Lines 14 and 15 from Line 13 to get the net consideration subject to transfer tax.

- Divide the amount in Line 17 by 500, rounding up to the nearest whole number to determine the tax base.

- Calculate the Illinois tax stamps required.

- Calculate the county tax stamps required.

- Sum Lines 19 and 20 to find the total transfer tax due.

Finally, for Step 3 and Step 4:

- Write or attach the legal description from the deed.

- Complete the form with the required seller and buyer information, including names, contact information, and signatures to verify the accuracy and truthfulness of all provided information.

By following these steps carefully and reviewing all entries for correctness, individuals can successfully prepare the PTAX-203 form for submission alongside their real estate transaction documents.

Understanding Ptax

-

What is the PTAX-203 form used for?

PTAX-203, Illinois Real Estate Transfer Declaration, is used to collect sales data and determine the applicability of sales in assessment ratio studies, contributing to the computation of equalization factors. These factors aim to achieve a state-wide uniform valuation of properties based on their fair market value.

-

Who needs to file the PTAX-203 form?

Anyone transferring real estate in Illinois must file Form PTAX-203 along with any required documents with the deed or trust document. An exemption notation on the original deed or trust document is required at the County Recorder’s office within the county where the property is located for those exempt from the transfer tax.

-

Are there any exemptions to filing the PTAX-203 form?

Yes, certain transactions are exempt from the transfer tax and, consequently, from filing the PTAX-203. These include transfers made before specific dates, transfers by or to governmental bodies, debt-securing deeds or trust documents, and transfers to not-for-profit entities, among others.

-

How do I determine the full actual consideration for property on the PTAX-203 form?

The full actual consideration is the total amount paid for the property, excluding amounts credited or refunded for property improvements or repairs. It includes other real estate transferred in a simultaneous exchange, even if the transfer involves an even exchange, and any outstanding mortgages subject at the time of the transfer.

-

What should I do if the value of personal property is included in the sale?

If the sale includes personal property value, indicate the amount on Line 12a of the form. For residential properties, itemize personal property transferred if its value exceeds 5 percent of the sale price. For non-residential properties, itemize if the personal property value exceeds 25 percent of the sale price.

-

Can criminal penalties be imposed for falsifying the PTAX-203 form?

Yes, willful falsification or omission of required information on the PTAX-203 form subjects individuals to criminal penalties. The first offense is classified as a Class B misdemeanor, with subsequent offenses escalating in severity. Misrepresenting the grantee's identity, especially in Cook County, can lead to similar legal consequences.

-

What happens if the property transferred remains subject to a mortgage?

If the property remains subject to a mortgage at the time of transfer, this amount should be stated on the form. It is part of the calculation for the net consideration subject to transfer tax.

-

Do I need to provide a legal description of the property on the PTAX-203 form?

Yes, a legal description of the property as outlined in the deed must be included in the PTAX-203 form. If the description is too lengthy, it can be attached separately, provided the document meets the size and font requirements specified.

-

Where can I complete the PTAX-203 form electronically?

The PTAX-203 form can be completed electronically by visiting the Illinois Department of Revenue website at tax.illinois.gov/retd. This digital option provides a convenient way to file the form accurately and efficiently.

Common mistakes

Filling out the PTAX-203 Illinois Real Estate Transfer Declaration requires attention to detail and an understanding of the information requested. Mistakes can lead to delays or inaccuracies in the real estate transfer process. Here are eight common mistakes people make when completing this form:

Not reading the instructions carefully before beginning the form, leading to errors in understanding what information is required where.

Incorrectly identifying the property by providing an inaccurate street address or omitting the parcel identifying numbers (PINs) and lot sizes or acreage, which are crucial for the property's identification.

Failing to write the total number of parcels to be transferred. This can cause confusion if the property consists of multiple parcels.

Leaving out the date of the instrument or incorrectly marking the type of instrument (e.g., warranty deed, quit claim deed, etc.), which is necessary for determining the legality and type of transaction.

Omitting or incorrectly stating whether the property will be the buyer’s principal residence. This information can affect tax implications.

Incorrectly identifying the property’s current and intended primary use or failing to mark one item per column with an “X”, which is important for tax assessment purposes.

Forgetting to note significant physical changes to the property since January 1 of the previous year. This is essential for accurate valuation and tax considerations.

Not accurately calculating the amount of transfer tax due, including mistakes in rounding lines 11 through 18 to the next highest whole dollar. This can affect the financial aspects of the transfer.

To avoid these mistakes, take the time to read the form and its instructions thoroughly, double-check the information provided, especially the financial and property identification details, and consult with a professional if any part of the form is unclear.

Documents used along the form

When dealing with real estate transactions, specifically property transfers in Illinois, the PTAX-203 form, or Illinois Real Estate Transfer Declaration, is not the only document you may encounter or require. Understanding the variety of forms and documents that often come into play can provide a clearer picture of the whole process and help ensure all legal and tax obligations are met. Here's a brief overview of some of the additional forms and documents you might need alongside the PTAX-203.

- PTAX-203-A Illinois Real Estate Transfer Declaration Supplemental Form A: This form is required when the property transfer involves an amount over $1 million and its current use is classified under specific categories such as commercial or residential buildings of a certain size.

- PTAX-203-B Illinois Real Estate Transfer Declaration Supplemental Form B: Used for recording the transfer of beneficial interest instead of the property itself, this form complements the primary PTAX-203 form under certain conditions.

- Warranty Deed: This document provides the highest level of buyer protection, guaranteeing theseller has the right to transfer the property and that it's free from all encumbrances.

- Quitclaim Deed: Unlike a warranty deed, a quitclaim deed transfers only the ownership interest the seller has in the property, if any, without any guarantees.

- Executor's Deed: Used when the property is being transferred from an estate, this deed indicates that an executor is authorized to act on behalf of the deceased property owner.

- Trustee's Deed: This type of deed is used when a property held in a trust is being transferred, with the trustee acting as the seller.

- Real Estate Sales Contract: A legally binding agreement between buyer and seller detailing the terms of the property sale.

- Title Insurance Policy: This provides protection against financial loss from defects in title to real estate. It's often required by lenders and recommended for cash purchases.

- Closing Disclosure: A five-page form that provides final details about the mortgage loan if one is involved, including the loan terms, projected monthly payments, and how much the buyer will pay in fees and other costs to get their mortgage and purchase the property.

Each of these documents plays an important role in the real estate transaction process, providing protections and guarantees for both the buyer and seller, as well as ensuring compliance with state laws and tax obligations. Having a comprehensive understanding of these forms and their purposes can aid in navigating the complexities of real estate transfers smoothly and efficiently.

Similar forms

The PTAX-203 Illinois Real Estate Transfer Declaration holds similarities with several other real estate and financial documents, all serving as key components in the transactions and reporting processes within their respective areas. First and foremost, the HUD-1 Settlement Statement, used in real estate transactions involving a loan, mirrors the PTAX-203 in its detail of the sales transaction. Both documents itemize the financial transactions involved in a property sale, including sale price, taxes, and other associated fees, ensuring all parties are aware of the financial breakdown of the transaction.

Another document closely related in function and form to the PTAX-203 is the Uniform Residential Loan Application (URLA). While the URLA focuses more on the borrower's financial information for loan approval, both the URLA and PTAX-203 collect detailed information pertinent to real estate transactions, establishing the financial health and intentions of the parties involved in the sale or transfer of property.

The Grant Deed, similar to the PTAX-203, is crucial for the real estate transfer process. It officially transfers ownership from the seller to the buyer, outlining the specifics of the property being transferred. Where the PTAX-203 focuses on the declaration of the transfer for tax purposes, the Grant Deed ensures the legal transfer of title, highlighting their complementary roles in property transactions.

Comparable to the PTAX-203 is the 1099-S form used by the Internal Revenue Service to report proceeds from real estate transactions. Both documents are integral for tax reporting, with the 1099-S capturing the sale's financial outcome and the PTAX-203 providing a detailed account of the property transfer specifics, ensuring compliance with tax obligations.

The Mortgage Application serves a role akin to that of the PTAX-203 by gathering extensive information necessary for processing real estate transactions. Though its primary focus is the borrower's capability to secure a loan for property acquisition, it intertwines with the PTAX-203's objective of documenting transaction details for tax and legal purposes.

Another document that shares similarities with the PTAX-203 is the Certificate of Title. This document officially proves ownership of the property and is fundamental in the transfer process, similar to how the PTAX-203 records transaction details for tax purposes. Together, they assure legal compliance and clear identification of property ownership.

Lastly, the Property Tax Bill, although not a direct participant in the transfer process, is contextually related to the PTAX-203 since it reflects the outcome of the property’s assessed value and ownership information updated through transactions documented by forms like the PTAX-203, impacting the property's taxation.

In essence, each of these documents, while serving unique purposes, collectively ensure the legality, financial clarity, and tax compliance of real estate transactions, making them all indispensable within the realm of property transfer and ownership documentation.

Dos and Don'ts

When completing the PTAX-203 Illinois Real Estate Transfer Declaration, there are specific actions that can facilitate an accurate and timely processing while others may lead to delays or inaccuracies in the transfer tax calculation. Below are essential dos and don'ts to consider:

Dos:

Read the instructions carefully before starting the form to ensure you understand the requirements for each section.

Ensure that all parcel identifying numbers and the properties’ lot sizes or acreage are accurately provided to avoid discrepancies in property identification.

Enter the full actual consideration (sale price) accurately, including all components as outlined in the form to ensure the correct calculation of transfer tax.

Report any significant physical changes in the property since January 1 of the previous year accurately, as this affects the assessment of the property’s value.

Verify all information for accuracy and completeness before submitting the form to avoid processing delays or penalties for incorrect information.

Don'ts:

Do not leave any required fields blank. If a section does not apply, indicate with ‘N/A’ or as instructed in the form guidelines.

Avoid approximating figures. Provide exact numbers for sale price, lot size, and personal property amounts included in the sale.

Do not forget to sign and date the form. Unsigned forms are considered incomplete and will not be processed.

Avoid using non-standard abbreviations or unclear descriptions, especially when describing the property’s current and intended use.

Do not falsify information. Willful falsification or omission of required information is subject to criminal penalties.

Misconceptions

Many misconceptions surround the PTAX-203 Illinois Real Estate Transfer Declaration form. Understanding these common misunderstandings can help ensure that the form is completed accurately and efficiently. Here's a closer look at some of those misconceptions:

All property transfers are exempt from real estate transfer tax. Not all property transfers are exempt. While there are specific exemptions listed under the Real Estate Transfer Tax Law, many transactions do not qualify for these exemptions and are subject to the tax.

Filing the PTAX-203 form is optional. This is incorrect. If you are engaged in a real estate transaction that does not qualify for an exemption, you are required to file the form with the county office where the property is located.

The form is only for residential properties. The PTAX-203 form is used for all types of real estate transactions, including commercial and agricultural properties, not just residential ones.

Personal property included in the sale does not need to be reported. On the contrary, Line 12a requires the inclusion of the amount of personal property in the purchase, which can affect the calculation of transfer taxes due.

Legal descriptions of the property are not necessary if you fill out the form electronically. Whether you complete the form electronically or by hand, a legal description of the property from the deed is required and should be attached if it does not fit in the provided space.

The seller is the only party responsible for completing the PTAX-203 form. Both the seller and the buyer (or their agents) are responsible for verifying and signing the form, ensuring all information provided is accurate and complete.

Any value under $100 does not need to be reported on the form. Although transactions where the actual consideration is less than $100 are exempt from the transfer tax, this does not mean they should not be reported. Every real estate transfer, regardless of its value, should be documented with the form unless it falls under a specific exemption.

The form must be submitted in paper form to the county office. The PTAX-203 form can be completed electronically via the Illinois Department of Revenue website, offering an alternative to paper submissions.

Only one parcel identifying number needs to be reported. If multiple parcels are being transferred, each parcel's identifying number and the lot sizes or acreage need to be reported in the designated section of the form.

Mortgages or debts secured by the property do not impact the form. Outstanding mortgage amounts to which the transferred real property remains subject should be reported, as it affects the net consideration subject to transfer tax.

By dispelling these misconceptions, individuals involved in real estate transactions in Illinois can accurately complete the PTAX-203 Real Estate Transfer Declaration form and comply with state requirements, streamlining the transfer process and avoiding potential penalties.

Key takeaways

Filling out the PTAX-203 form accurately is crucial for any real estate transaction in Illinois to ensure compliance with the Real Estate Transfer Tax Law. Here are key takeaways to help guide you:

- The PTAX-203 form is required for the transfer of real estate in Illinois, capturing details about the sale and property to assist county offices and the Illinois Department of Revenue in collecting sales data for assessment purposes.

- Electronic completion is an option via the official website, making the process more accessible and efficient.

- Step 1 of the form requires detailed information about the property, including the street address, city, ZIP code, township, and the parcel identifying numbers. Accuracy here is vital for correctly identifying the property in question.

- It's important to correctly indicate the type of deed or instrument being recorded, as well as whether the property will serve as the buyer's principal residence.

- The form also asks for information regarding the property’s current and intended primary use, highlighting the need for clear understanding of the property's use to determine correct tax implications.

- Financial considerations such as the full actual consideration (sale price), any personal property included in the sale, and outstanding mortgages are crucial for calculating the amount of transfer tax due.

- If the transfer falls into specific exempt categories, it's imperative to indicate this on the form to avoid unnecessary taxation.

- The legal description of the property, required in Step 3, must be included verbatim from the deed. This section binds the technical legal definition of the property to the form.

- Finally, both the buyer and seller, or their agents, must verify the accuracy of the information provided to avoid possible penalties for misinformation, emphasizing the importance of truthfulness in completing the form.

Adhering to these key points can simplify the process of filling out the PTAX-203 form, ensuring that all legal and tax obligations are met during a real estate transaction in Illinois.

Popular PDF Documents

IRS 709 - When you pay someone’s medical or educational expenses directly, IRS 709 is not required, despite the amount.

Irs Form 12256 - Users must indicate on the form whether the withdrawal is for a Collection Due Process hearing under IRC Sections 6320 or 6330, or both.