Get Prudential 401K Loan Form

In the realm of retirement planning, accessing funds before retirement generally goes against traditional advice; however, unforeseen financial hardships can necessitate such steps. The Prudential 401K Loan Form operates as a key player in this area, providing a structured pathway for participants of the Teamster-UPS National 401(k) Tax Deferred Savings Plan who face pressing financial needs. The comprehensive packet, which must be filled out meticulously in blue or black ink, encompasses various components – from a detailed procedure checklist and required attachments for substantiating hardship, to critical definitions that help delineate who qualifies as a dependent under these circumstances. Moreover, it encapsulates a choice of reasons for withdrawal, whether for evading foreclosure on a principal residence, covering medical bills, or facilitating the adoption process. Emphasizing meticulous completion and articulation of need, the form accompanies a fee structure, privacy notices, and an authorization section that underscores the gravity of accuracy and truthful representation. The loan initiation process, delineated as a dual-step procedure involving online or telephonic initiation followed by documentary submission, underscores Prudential's commitment to systematizing access to funds while highlighting the regulatory and tax implications thereof. With customer service support readily available, the form not only serves as a financial lifeline but also exemplifies the intricate balance between accessibility and regulation in managing retirement assets under duress.

Prudential 401K Loan Example

|

|

|

Instructions for Requesting a Hardship Loan |

|

|

|

|

|

|

|

|

|

|

1. |

Obtain and submit all required documentation that pertains to the reason for your request. |

|

|

||

Instructions |

|

Please refer to the Hardship Loan Request Required Documentation Instructions (located at the end |

|

|

|

|

of this document) for the documents you need to submit. |

|

|

|

Important: Requests received with documentation that is incomplete or does not meet the requirements |

|

|

|

described will not be processed until they are in good order, which could cause a substantial delay in |

|

|

|

receiving your funds. |

|

|

|

It is your responsibility to obtain and verify the documents you submit meet the stated requirements. |

|

|

4. Please be sure to update your 'Notification Preference' in the About You section, to be notified of the |

|

|

|

|

status of your request (if applicable). |

|

|

5. |

Mail or fax all forms and documentation, including the About You page, to: |

|

|

|

Prudential Retirement |

|

|

|

|

|

|

|

PO Box 5640 |

|

|

|

Scranton, PA 18505 |

|

|

|

OR |

|

|

|

Fax it to |

|

|

|

|

|

|

Upon receipt of your hardship loan request, all documents will be reviewed by Prudential. |

|

|

|

||

Approval/ |

• |

If your paperwork is not in good order, the hardship loan request will be denied. We will notify you of |

|

Denial of |

|

our findings. Please note that the documents submitted will not be returned to you, therefore, please |

|

Hardship |

|

make copies for your records. |

|

|

|

||

Loan |

• |

If it is determined that you qualify for a hardship loan based on current Internal Revenue Code |

|

Request |

|

regulations and Plan provisions, Prudential will process your request. |

|

οIn the event of an audit you must retain documentation to support your claim of financial hardship and to demonstrate compliance. Tax or legal counsel should be consulted regarding the permissibility of any loan.

Customer Service representatives are available to answer general questions you may have about your loan or about your Plan. Call

Personal assistance with a Customer Service representative is available Monday through Friday, 8 a.m. to 9 p.m. Eastern Time, except on holidays.

Our representatives look forward to providing you with information in English, Spanish, or many other languages through an interpreter service.

Account information is available for the hearing impaired by calling us at

Ed. 05/18/2020 |

Important information and signatures required on the following pages |

Plan number: 006009

Page 1 of 22

771

Hardship Loan Information

|

|

|

Plan number |

|

|

|

|

|

|

|

|

||||||||

About You |

|

|

|

0 |

|

6 |

|

0 |

|

0 |

|

|

9 |

|

|

||||

|

0 |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|||||||||||||

Social Security number |

|||||||||||||||||||

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

- |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

First name

|

|

Sub Plan number |

|

|

|

|||||||||

|

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

1 |

||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

MI |

Last name |

||||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

||||||||

Address

City |

State |

ZIP code |

-

Date of birth |

|

|

|

|

|

|

|

|

|

|

Gender |

|

|

|

|

Fax Number |

|

|

|

||||||||||||

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

M |

|

|

|

F |

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

month |

|

day |

|

year |

|

|

|

|

|

|

|

|

|

|

|

|

|

area code |

|

|

|

||||||||||

Preferred Email address (how Prudential Retirement will contact you, if needed)

-

Daytime telephone number

- |

|

|

|

|

|

- |

|

|

area code

Mobile telephone number

- |

|

|

|

|

|

- |

|

|

area code

Notification Preference (how you prefer Prudential to contact you for this request, choose one): ___ Email ___SMS Text

Please note: If neither email or text are selected (or both), we will default to email if provided.

Please review all the enclosed information before proceeding.

Ed. 05/18/2020 |

Important information and signatures required on the following pages |

Plan number: 006009

Page 2 of 22

I hereby request a Hardship Loan for the following reason(s). I agree to provide the applicable documentation as described in the Hardship Loan Request Required Documentation Instructions.

Reason(s) |

**Please refer to Important Notice to Participants Taking a Hardship Loan for additional information on |

|||

for |

||||

definition of dependent in IRC Section 152. |

||||

Hardship |

||||

Please Note: |

||||

Loan |

||||

|

• The minimum amount for a loan is $1,000.00. |

|||

|

• The minimum amount for Immediate and Heavy Financial Need Loan is $2500.00. |

|||

|

|

Exception: if under $2500.00, you can be approved for the maximum available loan amount, as long: |

||

|

|

o The available loan amount meets the $1000.00 minimum |

||

|

|

o Your documentation supports $2500.00 or more |

||

|

• We can only approve loan funds for up to the documented financial need. |

|||

|

• Multiple reasons can be used for one loan (minimums must still be met). |

|||

|

|

|

Medical/Dental expenses incurred by me, my spouse, or any of my dependents. |

|

|

|

|

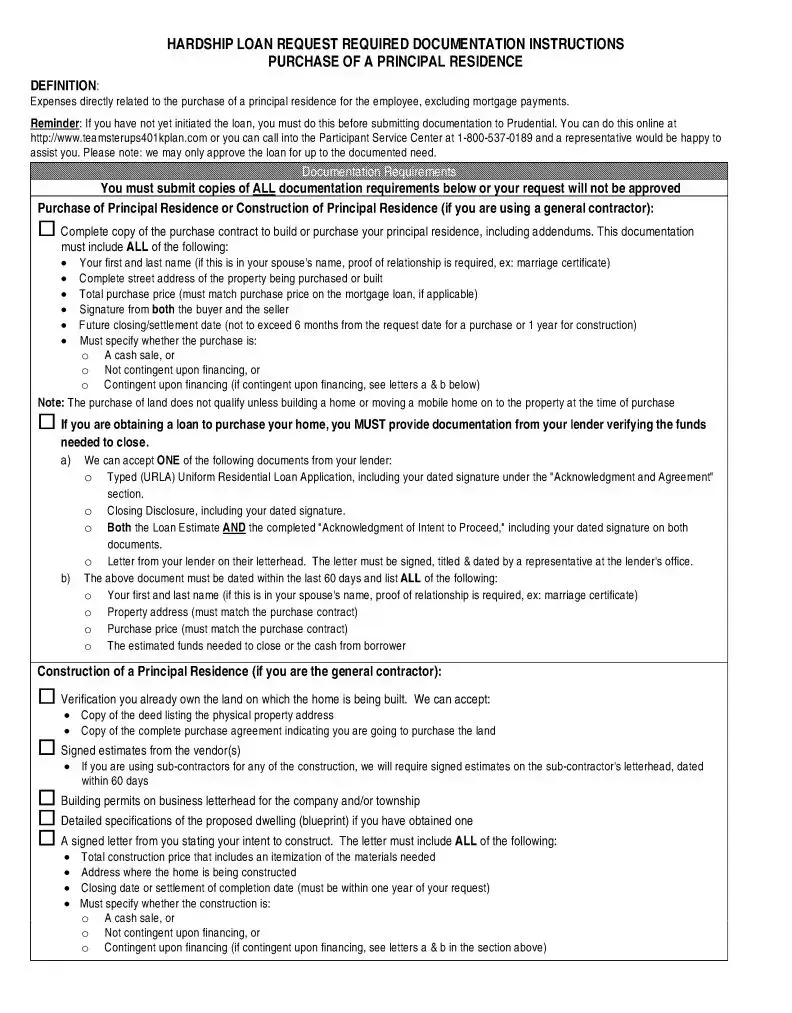

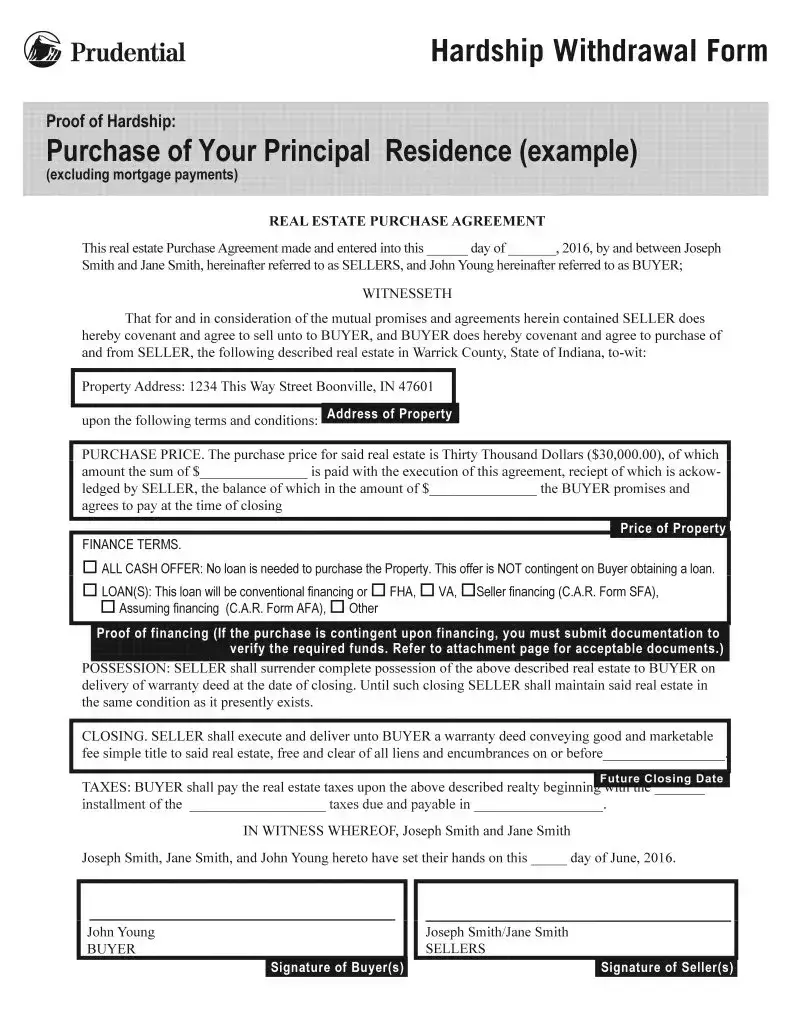

Purchase (excluding mortgage payments) of my principal residence. |

|

|

|

|

||

|

|

|

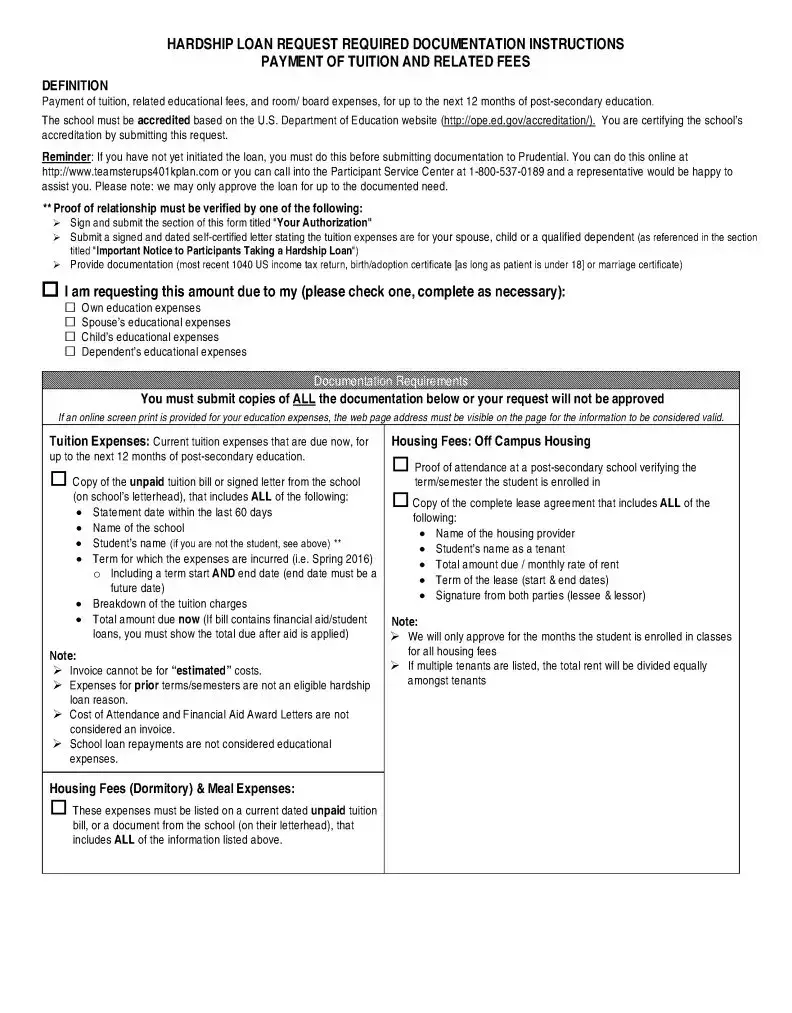

Payment of tuition for the next 12 months of |

|

|

|

|

any of my children or dependents. You are certifying the schools' accreditation by submitting |

|

|

|

|

this request. |

|

|

|

|

Payments needed to prevent eviction or imminent foreclosure from my principal residence. |

|

|

|

|

Payment of burial or funeral expenses for my deceased parent, spouse, child or dependent. |

|

|

|

|

||

|

|

|

Expenses for the repair of damage to my principal residence that qualifies for a casualty |

|

|

|

|

||

|

|

|

deduction. |

|

|

|

|

Costs directly related to the placement of a child with the Participant in connection with the |

|

|

|

|

adoption of such child by the participant or by the participant and his or her spouse. |

|

|

|

|

Costs or expenses creating an immediate and heavy financial need that cannot reasonably be |

|

|

|

|

||

|

|

|

satisfied through any other means. Expense must be due to an unforeseen event. |

|

Ed. 05/18/2020 |

Important information and signatures required on the following pages |

Plan number: 006009

Page 3 of 22

|

|

• |

The processing fee is $75.00 and will be automatically charged to your account. The processing fee is |

|

|

|

|||

Fees |

• |

|||

A $25.00 annual maintenance fee will be charged to your account in the amount of $6.25 per quarter for |

||||

|

|

|||

|

|

|

the duration of the hardship loan. |

|

Your

I certify that the information I have provided is true and correct and will be relied upon in processing my request and the tax implications regarding this disbursement. I understand that any failure in this regard,

inaccurate assertion or misrepresentation may jeopardize the ability of my employer to offer a plan and may Authorizationsubject me to disciplinary action, including severance from employment. I will be responsible for its accuracy

in the event any dispute arises with respect to the transaction. I certify all other distributions (other than hardship distributions) and

Privacy Act Notice:

Since your Plan engages the services of Prudential Retirement to qualify hardships on their behalf, this information is to be used by Prudential Retirement in determining whether you qualify for a financial hardship under your retirement Plan. It will not be disclosed outside Prudential Retirement except as required by your Plan and permitted by law for regulatory audits. You do not have to provide this information, but if you do not, your application for a hardship may be delayed or rejected.

Consent:

By signing below, I consent to allow Prudential Retirement to request and obtain information for the purposes of verifying my eligibility for a financial hardship under this Plan.

The Plan will assess a 2 percent

By signing the Consent section of this form, I am certifying that this request is for me or a qualified dependent as defined on the following page titled "Important Notice to Participants Taking a Hardship

Loan."

If you are requesting an Immediate and Heavy Financial Need Loan, by signing this form, you certify that this need cannot be reasonably satisfied by any other means.

X |

Date |

Participant’s signature

Ed. 05/18/2020 |

Important information and signatures required on the following pages |

Plan number: 006009

Page 4 of 22

Important Notice to Participants Taking a Hardship Loan

Terms and Conditions

Important: Loan initiations for the Teamster UPS 401k plan are automated. There are two steps to completing a loan initiation.

1.You must initiate the loan by either: Logging onto your account at www.teamsterups401kplan.com or by calling

2.You must submit the required back up documentation for the loan to process.

•The minimum amount for a loan is $1,000.00 ($2,500.00 for Immediate and Heavy Financial Need Loan).

•The maximum amount for a loan is 50% of the account balance (excluding SMA and not to exceed $50,000 in a

•Maximum duration for hardship loan is 5 years.

•Maximum duration for a primary residence hardship loan is 20 years.

•No more than 2 loans may be outstanding at any one time.

•If a loan defaults, it will not affect your credit, but will be reported as a distribution and you will be responsible for any applicable taxes or penalties. You will not be permitted to take another loan until the defaulted loan is repaid.

Dependent

The definition of "dependent" is important in the application of the "deemed hardship loan" standards that pertain to 401(k) plans. Unless a specific exception applies, a dependent must either be a "qualifying child" or a "qualifying relative". These terms are defined as follows:

Qualifying Child

A qualifying child is a child or descendant of a child of the taxpayer. A child is a son, daughter, stepson, stepdaughter, adopted child or eligible foster child of the taxpayer. A qualifying child also includes a brother, sister, stepbrother or stepsister of the taxpayer or a descendant of any such relative. In addition, the individual must have the same principal place of abode as the participant for more than half of the taxable year, the individual must not have provided over half of his own support for the calendar year, and the individual must not have attained age 19 by the end of the calendar year. An individual who has attained age 19 but is a student who will not be 24 as of the end of the calendar year and otherwise meets the requirements above is also considered a qualifying child. Special rules apply to situations such as divorced parents, disabled individuals, citizens or nationals of other countries, etc. Please see your tax advisor for further details regarding special situations.

Qualifying Relative

A qualifying relative is an individual who is not the participant's "qualifying child", but is the participant's: child, descendant of a child, brother, sister, stepbrother, stepsister, father, mother, ancestor of the father or mother, stepfather, stepmother, niece, nephew, aunt, uncle,

Ed. 05/18/2020 |

Important information and signatures required on the following pages |

Plan number: 006009

Page 5 of 22

Page 6 of 22

Page 7 of 22

Page 8 of 22

Page 9 of 22

Page 10 of 22

Document Specifics

| Fact Name | Description |

|---|---|

| Customer Service Availability | Customer Service is reachable for assistance with the Prudential 401K Loan form from Monday through Friday, 8 a.m. to 9 p.m. Eastern Time, except on holidays. |

| Language Support | Information is provided in English, Spanish, and additional languages through interpreter services. |

| Accessibility for the Hearing Impaired | Account information can be accessed by the hearing impaired by calling 1-877-760-5166. |

| Online Account Access | Account information can be reviewed online at www.prudential.com/online/retirement, generally available 24/7. |

| Required Paperwork Compliance | If paperwork is not in order, the hardship loan distribution request may be processed as per Internal Revenue Code regulations. |

| Hardship Reasons and Documentation | Specific reasons for the hardship loan withdrawal are listed, each requiring appropriate documentation as proof of the financial need. |

| Loan Fees | A processing fee of $75.00 charged automatically and a $25.00 annual maintenance fee divided into quarterly payments are applied to the loan. |

| Dependent Definition | Specifies the definition of a "dependent" as either a "qualifying child" or a "qualifying relative" per the terms set forth for a deemed hardship loan withdrawal. |

Guide to Writing Prudential 401K Loan

When you're in need of financial assistance due to a hardship, the Prudential 401K Loan form can be a pathway to accessing funds from your retirement plan. While the process may seem daunting at first, understanding the steps involved can ease the process. Whether you're dealing with medical bills, facing foreclosure, or have another qualifying emergency, it’s crucial to fill out the form accurately to avoid delays or denial of your request. Remember, thoroughness is key, as the completeness of your application impacts the review process. Below is a straightforward guide to filling out your Prudential 401K Loan form correctly.

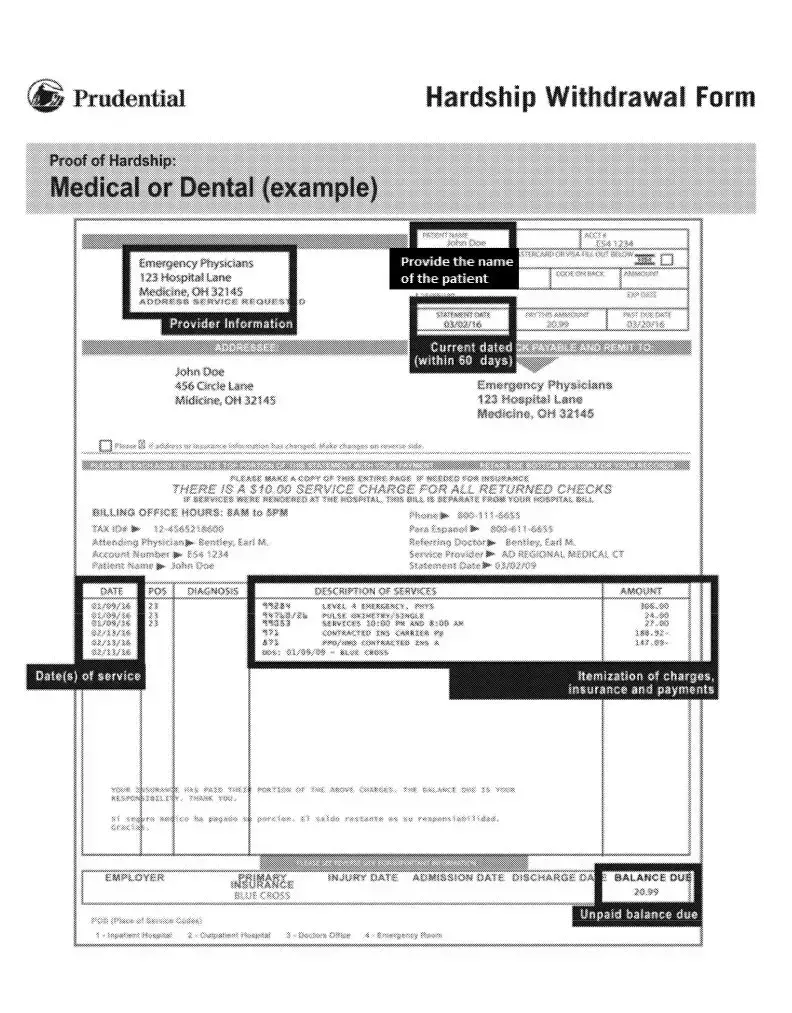

- Begin by gathering all necessary documents that evidence your financial hardship. This could include bills, estimates, eviction notices, or tuition costs, depending on your specific situation.

- Print the form using blue or black ink for clarity and legibility.

- Fill out the “About You” section with your personal information, including your Plan number, Sub plan number, Social Security number, full name, address, contact information, and date of birth. Ensure all details are accurate to prevent any processing delays.

- Select the reason for your hardship loan withdrawal from the options provided on the form. It’s important to choose only one reason that best describes your situation.

- Attach the required documentation supporting your hardship claim, as specified in the “Attachments to the Hardship Loan Request Form and Hardship Documentation” section. This could include medical bills, purchase agreements, tuition invoices, eviction or foreclosure notices, funeral expenses, or repair estimates.

- Review the fees associated with processing the hardship loan, which will be automatically deducted from your account.

- Sign and date the authorization section, confirming the accuracy of the information provided and agreeing to the terms. Your signature also indicates your understanding of the potential tax implications of your withdrawal.

- Double-check the form and attached documents to ensure all necessary information is included and correct.

- Mail or fax the completed form and all required attachments to Prudential Retirement at the address or fax number provided on the form.

- If you have not already done so, initiate the loan process by logging onto your account at the provided URL or by calling the toll-free number. This step is crucial for the loan to be processed.

After submitting your hardship loan request, Prudential Retirement will review your application and attached documentation to determine eligibility based on the criteria set forth by your retirement plan. It is important to note that failure to complete any part of the form or provide the necessary supporting documents could result in a delay or denial of your request. Furthermore, keep copies of all documents for your records, as submitted materials will not be returned. Should you encounter any difficulties or have questions while completing the form, Prudential Customer Service representatives are available to assist you. Their support is accessible via phone Monday through Friday, from 8 a.m. to 9 p.m. Eastern Time. Taking the time to carefully follow these steps can help streamline the process and increase the likelihood of accessing the funds you need during a financial hardship.

Understanding Prudential 401K Loan

-

What is the purpose of a Prudential 401K loan form?

This form is used to request a hardship loan withdrawal from your retirement plan, allowing you to borrow from your 401(k) savings under circumstances of financial hardship. It outlines the procedures and required documentation for submitting a request.

-

Can I receive assistance in completing the forms?

Yes, customer service representatives are available to assist you Monday through Friday, 8 a.m. to 9 p.m. Eastern Time, except on holidays. Assistance is provided in English, Spanish, and other languages through an interpreter service.

-

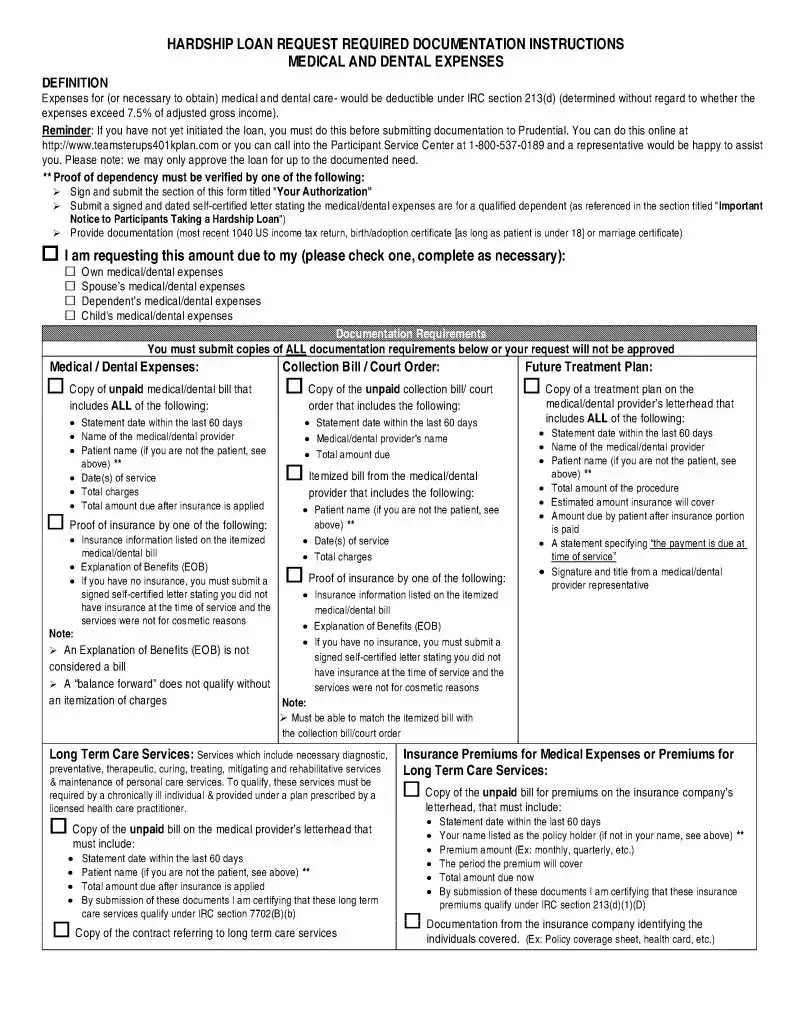

What documents are needed to request a hardship loan?

Along with the Hardship Loan Withdrawal Request Form, you must provide documentation evidencing financial need relevant to the reason for your hardship loan request. The exact documents required are detailed in the Attachment to the Hardship Loan Request provided.

-

What happens if my paperwork is not in good order?

If your paperwork is not complete or if any required documents are missing, your hardship loan request cannot be processed. It's important to review and comply with all specified requirements for documentation.

-

How are loan amounts determined?

The minimum loan amount is $1,000.00, with a maximum amount being 50% of your account balance, excluding certain investments, not to exceed $50,000 within a 12-month period. Previous outstanding loans across UPS-sponsored plans may affect the maximum amount available for a new loan.

-

What are the repayment terms for a hardship loan?

Hardship loans must typically be repaid within 5 years. However, loans taken for the purchase of a primary residence can have a repayment period of up to 15 years. No more than two loans may be outstanding at any one time.

-

Are there fees associated with obtaining a hardship loan?

Yes, there is a $75.00 processing fee which will be automatically charged and is non-refundable, even if the loan request is not processed. Additionally, a $25.00 annual maintenance fee will be charged in quarterly installments of $6.25 for the duration of the loan.

-

What constitutes a financial hardship?

- Medical/Dental expenses

- Purchase of a principal residence

- Payment of tuition for post-secondary education

- Payments to prevent eviction or foreclosure

- Payment of burial or funeral expenses

- Expenses for repair of damage to principal residence characterizable as a casualty deduction

- Costs related to adoption

Each category requires specific documentation as proof of the hardship.

-

What impact does a defaulted loan have on my credit or tax situation?

A defaulted loan does not affect your credit rating but will be reported as a distribution, making you responsible for any applicable taxes or penalties. You are not allowed to take another loan until the defaulted loan is repaid.

-

Who is considered a dependent for the purpose of a hardship loan?

A dependent can be a qualifying child (including those related by blood, marriage, adoption, or foster care) or a qualifying relative, where you provide over half of the individual's support for the calendar year. The specific definitions and additional exceptions or special situations should be discussed with your tax advisor.

Common mistakes

Filling out a Prudential 401K Loan form is an important step for individuals seeking to obtain a loan from their retirement savings under certain hardship conditions. To ensure a smooth process and avoid delays, here are seven common mistakes to avoid:

- Not using blue or black ink: The instructions specify that the form should be completed using blue or black ink. Using other colors or pencil can cause issues with readability and processing.

- Skipping sections: Every relevant section of the form must be filled out. Missing information can lead to delays or denial of the loan request.

- Incomplete documentation: Failing to attach all required documentation to substantiate the hardship claim is a common oversight. Each hardship category has specific documentation requirements that must be met.

- Selecting multiple reasons for hardship: The form states to choose one reason only per request. Selecting multiple reasons for a single hardship loan application can invalidate the request.

- Incorrect calculation of the loan amount: The maximum loan amount is 50% of the account balance, up to $50,000, within a 12-month period. Errors in calculation or exceeding the limit can cause the application to be rejected.

- Forgetting to sign the form: The form requires the participant's signature to process the request. An unsigned form is considered incomplete and cannot be processed.

- Not using the correct address or fax number for submission: The form must be sent to the address or fax number provided. Sending it to the wrong place can result in unnecessary delays.

By paying close attention to these areas, applicants can improve their chances of a smooth approval process for their hardship loan. It's also recommended to keep copies of all documents submitted for one's records, as the original documents will not be returned.

Documents used along the form

When it comes to managing your finances, especially in challenging situations like applying for a Prudential 401K Loan, being well-prepared with the right documents is crucial. The Prudential 401K Loan form is just the starting point. Here's a guide to other essential forms and documents you might need to ensure a smoother process.

- Loan Application Form – This is the initial form you fill out to express your intent to borrow from your 401K plan, summarizing your personal information, the amount requested, and the purpose of the loan.

- Hardship Documentation – To support a hardship loan request, you'll need documents proving the nature of your hardship, such as medical bills, eviction notices, or tuition bills, depending on the reason for your loan.

- Employment Verification Letter – Some plans require proof of current employment. This letter from your employer confirms your job status and income, which might influence loan approval.

- Loan Agreement – After approval, this legal document outlines the terms of your loan, including repayment schedule, interest rate, and any penalties for late or missed payments.

- Beneficiary Designation Form – Though not directly related to the loan process, ensuring this form is up to date is crucial as it dictates who receives your plan's assets in case of your demise.

- Annual Account Statements – Recent statements might be required to verify the available balance from which you can borrow, ensuring compliance with plan rules regarding maximum loan amounts.

- Amortization Schedule – This document breaks down your payment plan over the term of the loan, showing both the principal and interest components of each installment.

- Direct Deposit Authorization Form – If you prefer the loan to be deposited directly into your bank account, this form collects your bank details and authorizes the transaction.

- IRS Form 1099-R – For loans that are not repaid and thus considered distributions, this form reports the amount to the IRS as income for tax purposes.

Familiarizing yourself with these documents will not only help streamline the application process for a Prudential 401K Loan but also prepare you for the financial management it entails. Remember, understanding and organizing your paperwork is the first step towards financial empowerment in handling loans responsibly.

Similar forms

The Prudential 401K Loan Form is closely related to a variety of financial and legal documents individuals might encounter throughout their lives. Understanding these similarities can provide a clearer perspective on the nature and importance of handling the form correctly.

One similar document is the mortgage application form. Much like the 401K loan form, a mortgage application requires proof of financial stability and personal identification details. Both documents evaluate financial need and capability, scrutinizing the applicant's background to ensure they meet specific criteria, particularly focusing on financial hardship and repayment ability.

Another document related to the 401K loan form is the student loan application form. This document also requires detailed personal and financial information and evidence of the need for financial assistance. Both forms assess the applicants' future ability to repay the loan, factoring in their current financial status and potential future earnings.

The hardship withdrawal request from an IRA or other retirement account shares a significant resemblance to the 401K loan form. It typically requires the applicant to demonstrate a genuine need for emergency funds, supported by appropriate documentation. This process ensures that withdrawals are truly for hardship reasons, mirroring the stringent requirements of the 401K loan process.

The credit card application process also bears similarity. Applicants must provide extensive personal financial information, similar to the 401K loan form. Lenders evaluate this information to determine the applicant's creditworthiness and ability to manage debt, a key aspect of both financial documents.

Insurance claim forms are akin to the 401K loan form in their requirement for detailed documentation and evidence. Whether for auto accidents, home damage, or medical needs, claimants must substantiate their claims with adequate documentation, paralleling the 401K loan's documentation requirements for hardship evidence.

Adoption application forms share the necessity for thorough personal evaluation found in the 401K loan form. Prospective parents must provide comprehensive personal, financial, and lifestyle information, much like the detailed scrutiny applied to 401K loan applicants, to ensure their capability to provide a stable environment.

Finally, applications for financial aid or scholarships resonate with the Prudential 401K loan form. Students and families must disclose in-depth financial details and justify their need for assistance, akin to how 401K loan applicants must prove financial hardship.

In essence, while these documents serve various purposes, from securing a home to providing an education, or ensuring financial stability in retirement, they all require a detailed examination of one's personal and financial situation. The careful documentation and substantiation of need, alongside an assessment of repayment ability, form a common thread that ties these processes together.

Dos and Don'ts

When filling out the Prudential 401K Loan form, it is essential to follow specific guidelines to ensure the process is seamless and your request is processed efficiently. Below are the dos and don'ts to consider:

Do:- Use blue or black ink: This ensures that your submission is legible and meets the standard requirement for paper submissions.

- Provide detailed documentation: Attach all relevant documents that substantiate the nature of your hardship. This is crucial for the approval of your loan request.

- Check your account information: Before submission, make sure all your account details are accurate. Incorrect information can delay the process.

- Sign and date the form: Your signature verifies that the information provided is true and correct, making it a critical step in the application process.

- Retain copies for your records: Since the original documents will not be returned, keeping copies is vital for your records.

- Seek assistance if needed: Customer service is available to help with the completion of forms or to answer any questions regarding the distribution or plan.

- Leave sections incomplete: Ensure all relevant sections of the form are filled out. Incomplete forms can result in the denial of your loan request.

- Submit without reason: Your hardship loan request must include the specific reason for the loan. Failing to indicate the reason can result in processing delays or denials.

- Forget to include supporting documentation: Omitting necessary documents to support your hardship claim will lead to the rejection of your loan request.

- Ignore procedural checklist: The checklist provided is a valuable resource to ensure all steps are followed, and necessary items are included before submission.

- Delay the submission: Submit your loan request and supporting documents promptly to avoid delays in the review and approval process.

- Disregard privacy and consent statements: Understanding and acknowledging these sections are crucial as they pertain to the use of your information and the terms and conditions of your loan request.

Following these instructions can significantly impact the outcome of your Prudential 401K Loan application, facilitating a smoother process.

Misconceptions

When considering taking a loan from your Prudential 401(k) account, it's essential to have accurate information. Unfortunately, there are several misconceptions about the process that can lead to confusion. Here, we aim to clarify some of those misunderstandings.

- Misconception 1: The process is complicated and without assistance.

Many people believe that applying for a 401(k) loan is a complex process that they have to navigate on their own. However, Prudential provides customer service representatives who are ready to assist with completing forms and answering questions about the loan or the plan. This personal assistance is available in multiple languages through an interpreter service, ensuring that help is accessible to everyone.

- Misconception 2: You can't get help if you're hearing impaired.

Another common misconception is that there's no accommodation for individuals who are hearing impaired. In reality, Prudential has made provisions to ensure that account information is available for the hearing impaired by offering a dedicated contact number.

- Misconception 3: It takes a long time to get information about your loan.

Some applicants assume that they will have to wait a long time to get any information about their account or loan status. However, account information, including details relevant to your loan, is generally available 24/7 through Prudential's website. This allows for immediate access to your information at any time, which can be especially comforting during the stressful period of financial hardship.

- Misconception 4: If your paperwork isn't perfect, your request will be automatically denied.

It's often feared that any mistake on the loan request form will lead to immediate denial. While it's true that the paperwork must be in good order, Prudential reviews each submission carefully. If they determine that you qualify based on the merits of your request and the supporting documents, they will process your hardship loan. Thus, while accuracy is important, your request isn't doomed by minor errors as long as the essential criteria are met.

Understanding these aspects of the Prudential 401(k) loan process can help demystify the experience, making it clearer that support and resources are available to guide participants through their times of need.

Key takeaways

Here are key takeaways regarding the Prudential 401K Loan form:

- The hardship loan request form requires you to fill out all relevant sections, clearly state the reason for the loan, and attach appropriate documentation proving financial need.

- Approval of the loan request depends on a thorough review of the completed form alongside all required supporting documents. If any documentation is missing or incomplete, the request cannot be processed.

- Customer Service representatives are accessible for assistance in filling out the forms or addressing any questions about the plan, available in multiple languages.

- There is a $75 processing fee charged to your account for the hardship loan request, which is non-refundable even if the loan is not processed, and an annual maintenance fee of $25, divided into quarterly payments.

- The hardship loan has restrictions on the amount that can be borrowed: the minimum loan amount is $1,000, and the maximum loan amount is 50% of the account balance or $50,000, whichever is lesser, within a 12-month period.

- Specific types of expenses such as medical/dental expenses, purchase of a principal residence, tuition payments, prevention of eviction or mortgage foreclosure, funeral expenses, repairs for damage to a principal residence, and adoption-related costs are valid reasons for a hardship withdrawal.

- A participant's authorization section requires a signature to verify that all provided information is accurate and acknowledges the potential tax implications and penalties for inaccurate information.

It is vital to review all documents and requirements thoroughly before submission to ensure a smooth processing experience.

Popular PDF Documents

Library Loan - Ensure your interlibrary loans comply with copyright laws by indicating the relevant provisions on the request form.

IRS 8822 - Used to update the IRS with your new address to receive official communications.

House Tax Form - Learn which tangible personal property items must be reported on the DR-405 form and their associated penalties for non-compliance.