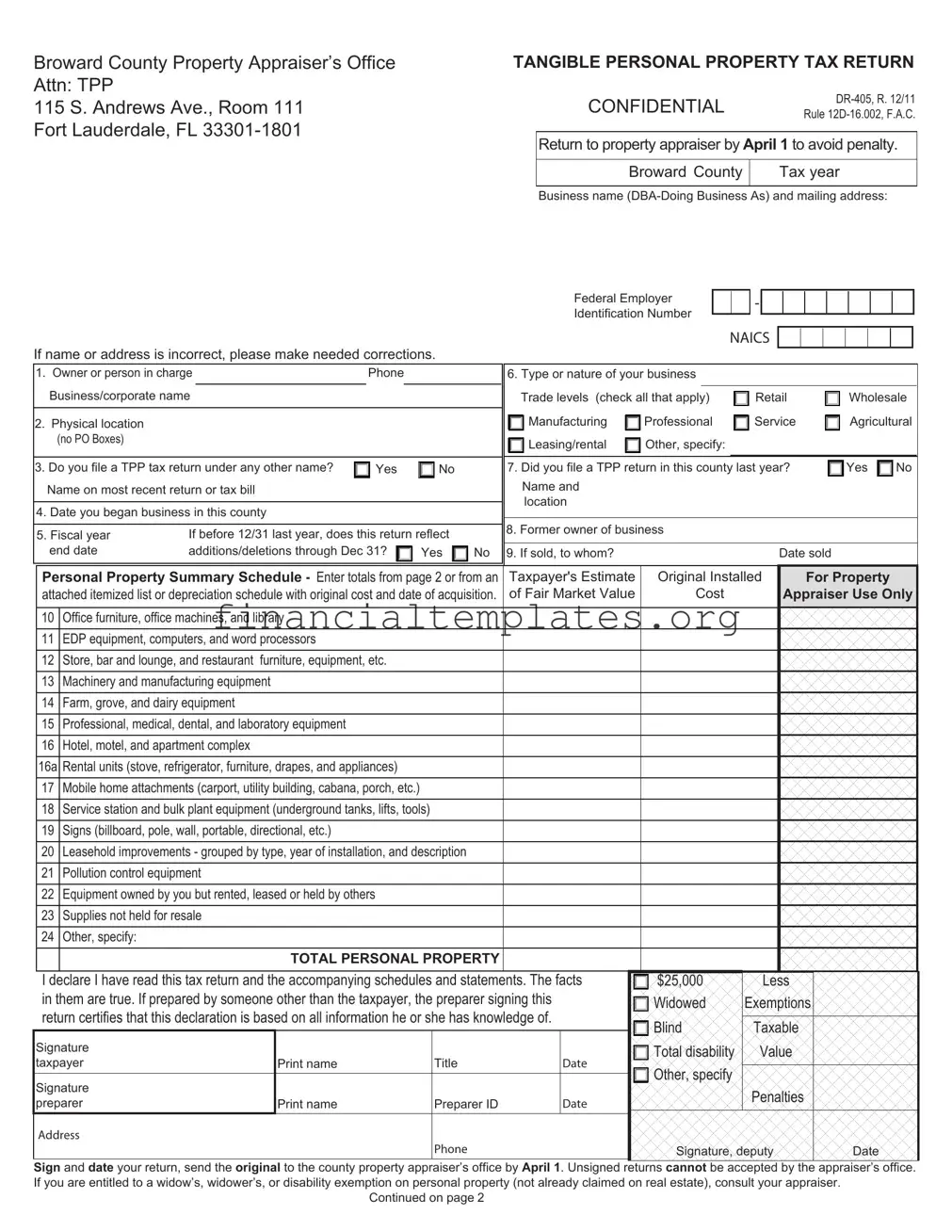

Get Property Tax Return Form

Understanding the Property Tax Return form, specifically the Tangible Personal Property Tax Return (DR-405) as detailed by the Broward County Property Appraiser’s Office, requires a comprehensive examination of its components and the implications for business owners. This form is pivotal for businesses in declaring the value of their tangible personal property for tax purposes. Required to be returned to the property appraiser by April 1 to steer clear of penalties, it necessitates accurate and timely attention. It covers a wide array of assets from office furniture and computers to manufacturing equipment and leasehold improvements, capturing the summary of these assets along with their original cost and current market value estimations. Additionally, it includes provisions for reporting any changes in asset status over the tax year, such as disposals or acquisitions. Business owners must also take note of the eligibility criteria for exemptions that could reduce their tax liability, emphasizing the importance of understanding every line item on this form. Failure to comply by either not filing the return or submitting inaccurate details can result in hefty penalties, underscoring the form’s critical nature in the realm of business property taxation.

Property Tax Return Example

Broward County Property Appraiser’s Office |

TANGIBLE PERSONAL PROPERTY TAX RETURN |

||

Attn: TPP |

|

|

|

115 S. Andrews Ave., Room 111 |

|

CONFIDENTIAL |

|

|

Rule |

||

Fort Lauderdale, FL |

|

|

|

|

Return to property appraiser by April 1 to avoid penalty. |

||

|

|

||

|

|

|

|

|

|

Broward County |

Tax year |

|

|

|

|

|

|

Business name |

|

Federal Employer

Identification Number

If name or address is incorrect, please make needed corrections.

NAICS

1. |

Owner or person in charge |

Phone |

|

|

6. Type or nature of your business |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business/corporate name |

|

|

|

|

|

|

Trade levels (check all that apply) |

|

Retail |

|

Wholesale |

|||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

2. |

Physical location |

|

|

|

|

|

|

|

|

Manufacturing |

|

Professional |

|

Service |

|

Agricultural |

|||||

|

(no PO Boxes) |

|

|

|

|

|

|

|

|

Leasing/rental |

|

Other, specify: |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Do you file a TPP tax return under any other name? |

|

|

Yes |

|

No |

7. Did you file a TPP return in this county last year? |

|

Yes |

No |

||||||||||||

|

|

|

|

||||||||||||||||||

|

Name on most recent return or tax bill |

|

|

|

|

|

|

Name and |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

location |

|

|

|

|

|

|

|

|

|

4. Date you began business in this county |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

5. Fiscal year |

If before 12/31 last year, does this return reflect |

|

8. Former owner of business |

|

|

||||

|

|

|

|

|

|||||

end date |

additions/deletions through Dec 31? |

Yes |

No |

9. If sold, to whom? |

|

|

Date sold |

||

Personal Property Summary Schedule - Enter totals from page 2 or from an |

Taxpayer's Estimate |

Original Installed |

For Property |

||||||

attached itemized list or depreciation schedule with original cost and date of acquisition. |

of Fair Market Value |

Cost |

|

Appraiser Use Only |

|||||

10 |

Office furniture, office machines, and library |

|

|

|

|

|

|

||

11 |

EDP equipment, computers, and word processors |

|

|

|

|

|

|

||

12 |

Store, bar and lounge, and restaurant furniture, equipment, etc. |

|

|

|

|

|

|

||

13 |

Machinery and manufacturing equipment |

|

|

|

|

|

|

||

14 |

Farm, grove, and dairy equipment |

|

|

|

|

|

|

||

15 |

Professional, medical, dental, and laboratory equipment |

|

|

|

|

|

|

||

16 |

Hotel, motel, and apartment complex |

|

|

|

|

|

|

||

16a |

Rental units (stove, refrigerator, furniture, drapes, and appliances) |

|

|

|

|

|

|

||

17 |

Mobile home attachments (carport, utility building, cabana, porch, etc.) |

|

|

|

|

|

|

||

18 |

Service station and bulk plant equipment (underground tanks, lifts, tools) |

|

|

|

|

|

|||

19 |

Signs (billboard, pole, wall, portable, directional, etc.) |

|

|

|

|

|

|

||

20 |

Leasehold improvements - grouped by type, year of installation, and description |

|

|

|

|

|

|||

21 |

Pollution control equipment |

|

|

|

|

|

|

||

22 |

Equipment owned by you but rented, leased or held by others |

|

|

|

|

|

|

||

23 |

Supplies not held for resale |

|

|

|

|

|

|

||

24 |

Other, specify: |

|

|

|

|

|

|

|

|

|

|

TOTAL PERSONAL PROPERTY |

|

|

|

|

|||

I declare I have read this tax return and the accompanying schedules and statements. The facts |

$25,000 |

|

Less |

||||||

in them are true. If prepared by someone other than the taxpayer, the preparer signing this |

Widowed |

Exemptions |

|||||||

return certifies that this declaration is based on all information he or she has knowledge of. |

|||||||||

Blind |

Taxable |

||||||||

|

|

|

|

|

|

||||

Signature |

|

|

|

|

Total disability |

Value |

|||

taxpayer |

Print name |

Title |

|

DATE |

|||||

|

Other, specify |

|

|

||||||

|

|

|

|

|

|

|

|

||

Signature |

|

|

|

|

|

Penalties |

|

|

|

|

|

|

|

|

|

|

|||

preparer |

Print name |

Preparer ID |

DATE |

|

|

|

|

||

|

|

|

|

|

|

||||

ADDRESS |

|

PHONE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature, deputy |

|

Date |

|||

|

|

|

|

|

|

||||

Sign and date your return, send the original to the county property appraiser’s office by April 1. Unsigned returns cannot be accepted by the appraiser’s office. If you are entitled to a widow’s, widower’s, or disability exemption on personal property (not already claimed on real estate), consult your appraiser.

Continued on page 2

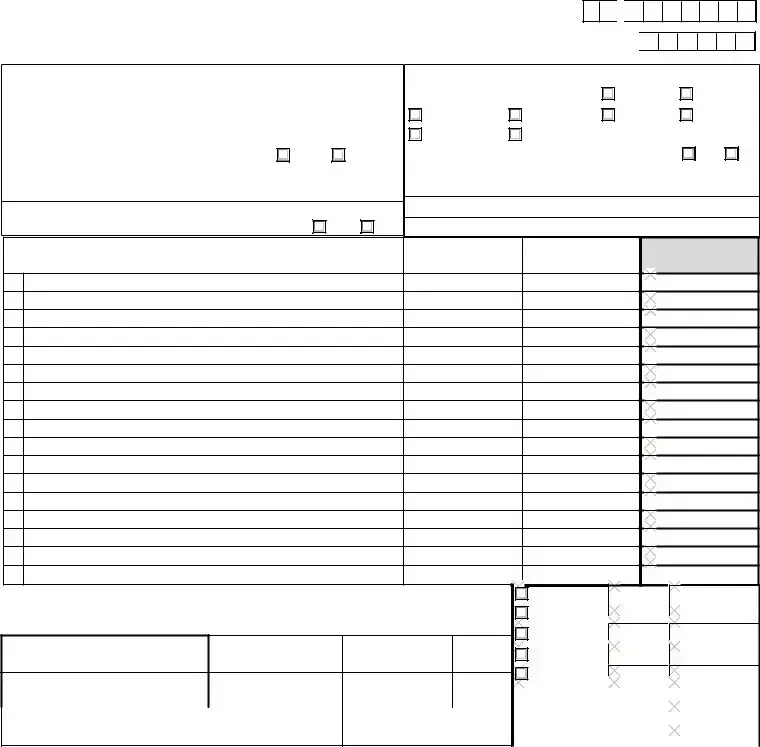

TANGIBLE PERSONAL PROPERTY |

Report all property owned by you including fully depreciated items still in use.

ASSETS PHYSICALLY REMOVED DURING THE LAST YEAR

Description |

Age |

Year |

Taxpayer's Estimate |

Original Installed |

Disposed, sold, or traded and to whom? |

Acquired |

of Fair Market Value |

Cost |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LEASED, LOANED, OR RENTED EQUIPMENT Complete if you hold equipment belonging to others. |

|

|

Lease |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Name and Address of Owner or Lessor |

Description |

|

|

Year |

|

Year of |

Monthly |

Original Installed Option |

|||||||||||

|

Acquired |

Manufacture |

Rent |

|

Cost |

|

Yes No |

||||||||||||

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE FOR LINE 22, PAGE 1 |

Equipment owned by you but rented, leased, or held by others. Enter total on page 1. |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease |

Name/address of lessee |

|

|

Year |

Monthly |

|

|

|

Taxpayer's |

|

Original |

||||||||

Description |

Age |

|

Term |

|

Estimate of Fair |

Cond* |

Installed Cost |

||||||||||||

Number |

Actual physical location |

|

|

Acquired |

Rent |

|

|

|

Market Value |

|

|

New |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULES FOR PAGE 1, LINES 10 - 21, 23, and 24 |

|

|

|

APPRAISER’S USE ONLY |

|||

Enter line number from page 1. |

Age |

Year |

Taxpayer's Estimate |

COND* |

Original Installed |

|

|

Acquired |

of Fair Market Value |

Cost |

|

VALUE |

|||

Description |

Cond* |

||||||

Enter totals on page 1. |

|

TOTAL |

|

TOTAL |

|

TOTAL |

|

|||

|

|

Enter line number from page 1. |

Age |

Year |

Taxpayer's Estimate |

COND* |

Original Installed |

|

|

VALUE |

|

|

Description |

Acquired |

of Fair Market Value |

Cost |

Cond* |

||||

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter totals on page 1. |

|

TOTAL |

|

TOTAL |

|

TOTAL |

|

|||

|

|

Enter line number from page 1. |

Age |

Year |

Taxpayer's Estimate |

COND* |

Original Installed |

|

|

VALUE |

|

|

|

Acquired |

of Fair Market Value |

Cost |

Cond* |

||||

|

|

Description |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter totals on page 1.

TOTAL

TOTAL

TOTAL

TOTAL

*Condition: enter good, avg (average), or poor. |

Add pages, if needed. |

See instructions on pages 3 and 4. |

INSTRUCTIONS

Complete this form if you own property used for commercial purposes that is not included in the assessed value of your business' real property. This may include office furniture, computers, tools, supplies, machines, and leasehold improvements. Return this to your property appraiser's office by April 1. Keep a copy for your records.

Report your summary totals on page 1. Use page 2 or an attached, itemized list with original cost and date acquired for each item to provide the details for each category. Contact your local property appraiser if you have questions.

If you ask, the property appraiser will give you an extension for 30 days and may grant an additional 15 days. You must ask for the extension in time for the property appraiser to consider the request and act on it before April 1.

Each return is eligible for an exemption up to $25,000. By filing a

WHAT TO REPORT

Include on your return:

1.Tangible Personal Property. Goods, chattels, and other articles of value (except certain vehicles) that can be manually possessed and whose chief value is intrinsic to the article itself.

2.Inventory held for lease. Examples: equipment, furniture, or fixtures after their first lease or rental.

3.Equipment on some vehicles. Examples: power cranes, air compressors, and other equipment used primarily as a tool rather than a hauling vehicle.

4.Property personally owned, but used in the business.

5.Fully depreciated items, whether written off or not. Report at original installed cost.

Do not include:

1.Intangible Personal Property. Examples: money, all evidences of debt owed to the taxpayer, all evidence of ownership in a corporation.

2.Household Goods. Examples: wearing apparel, appliances, furniture, and other items ordinarily found in the home and used for the comfort of the owner and his family, and not used for commercial purposes.

3.Most automobiles, trucks, and other licensed vehicles. See 3 above.

4.Inventory that is for sale as part of your business. Items commonly referred to as goods, wares, and merchandise that are held for sale.

LOCATION OF PERSONAL PROPERTY

Report all property located in this county on January

1.You must file a single return for each site in the county where you transact business. If you have freestanding property at multiple sites other than where you transact business, file a separate, but single, return for all such property located in the county.

Examples of freestanding property at multiple sites include vending and amusement machines, LP/ propane tanks, utility and cable company property, billboards, leased equipment, and similar property not customarily located in the offices, stores, or plants of the owner, but is placed throughout the county.

PENALTIES

Failure to file - 25% of the total tax levied against the property for each year that no return is filed

Filing late - 5% of the total tax levied against the property covered by that return for each year, each month, and part of a month, that a return is late, but not more than 25% of the total tax

Unlisted property

RELATED FLORIDA TAX LAWS

§192.042, F.S. - Assessment date: Jan 1 §193.052, F.S. - Filing requirement §193.062, F.S. - Filing date: April 1 §193.063, F.S. - Extensions for filing §193.072, F.S. - Penalties

§193.074, F.S. - Confidentiality §195.027(4), F.S.- Return Requirements §196.183, F.S. - $25,000 Exemption

§ 837.06, F.S. - False Official Statements

See line and column instructions on page 4.

LINE INSTRUCTIONS

Within each section, group your assets by year of acquisition. List each item of property separately except for “classes” of personal property. A class is a group of items substantially similar in function, use, and age.

Line 14 - Farm, Grove, and Dairy Equipment

List all types of agricultural equipment you owned on January 1. Describe property by type, manufacturer, model number, and year acquired. Examples: bulldozers, draglines, mowers, balers, tractors, all types of dairy equipment, pumps, irrigation pipe - show feet of main line and sprinklers, hand and power sprayers, heaters, discs, fertilizer distributors.

Line 16 and 16a - Hotel, Motel, Apartment and Rental Units (Household Goods)

List all household goods. Examples: furniture, appliances, and equipment used in rental or other commercial property. Both residents and nonresidents must report if a house, condo, apartment, etc. is rented at any time during the year

Line 17 - Mobile Home Attachments

For each type of mobile home attachment (awnings, carports, patio roofs, trailer covers, screened porches or rooms, cabanas, open porches, utility rooms, etc.), enter the number of items you owned on January 1, the year of purchase, the size (length X width), and the original installed cost.

Line 20 - Leasehold Improvements, Physical Modifications to Leased Property

If you have made any improvements, including modifications and additions, to property that you leased, list the original cost of the improvements. Group them by type and year of installation.

Examples: slat walls, carpeting, paneling, shelving, cabinets. Attach an itemized list or depreciation schedule of the individual improvements.

Line 22 - Owned by you but rented to another

Enter any equipment you own that is on a loan, rental, or lease basis to others.

Line 23 - Supplies

Enter the average cost of supplies that are on hand. Include expensed supplies, such as stationery and janitorial supplies, linens, and silverware, which you may not have recorded separately on your books.

Include items you carry in your inventory account but do not meet the definition of “inventory” subject to exemption.

COLUMN INSTRUCTIONS

List all items of furniture, fixtures, all machinery, equipment, supplies, and certain types of equipment attached to mobile homes. For each item, you must report your estimate of the current fair market value and condition of the item (good, average, poor). Enter all expensed items at original installed cost.

Do not use “various” or “same as last year” in any of the columns. These are not adequate responses and may subject you to penalties for failure to file.

Taxpayer's Estimate of Fair Market Value

You must report the taxpayer's estimate of fair market value of the property in the columns labeled "Taxpayer's Estimate of Fair Market Value." The amount reported is your estimate of the current fair market value of the property.

Original Installed Cost

Report 100% of the original total cost of the property in the columns labeled "Original Installed Cost." This cost includes sales tax, transportation, handling, and installation charges, if incurred. Enter only unadjusted figures in "Original Installed Cost" columns.

The original cost must include the total original installed cost of your equipment, before any allowance for depreciation. Include sales tax, freight- in, handling, and installation costs. If you deducted a

Assets Physically Removed

If you physically removed assets last year, complete the columns in the first section of page 2. If you sold, traded, or gave property to another business or person, include the name in the last column.

Leased, Loaned, and Rented Equipment

If you borrowed, rented, or leased equipment from others, enter the name and address of the owner or lessor in the second section of page 2. Include a description of the equipment, year you acquired it, year of manufacture (if known), the monthly rent, the amount it would have originally cost had you bought it new, and indicate if you have an option to buy the equipment at the end of the term.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Identification | The form is known as the Tangible Personal Property Tax Return, form number DR-405, revision date 12/11. |

| Authority | Guided by Florida Administrative Code, Rule 12D-16.002. |

| Office Address | Broward County Property Appraiser’s Office, 115 S. Andrews Ave., Room 111, Fort Lauderdale, FL 33301-1801. |

| Submission Deadline | Forms must be returned by April 1st to avoid penalties. |

| Penalty for Late Filing | Failure to meet the deadline can result in penalties, up to 25% of the total tax levied. |

| $25,000 Exemption | Filing the DR-405 form on time automatically applies for a $25,000 exemption. |

| Governing Laws | Relevant Florida Statutes include §§192.042, 193.052, 193.062, 193.063, 193.072, 193.074, 195.027(4), 196.183, and 837.06. |

Guide to Writing Property Tax Return

Filling out the Tangible Personal Property Tax Return form is a straightforward process, crucial for businesses to accurately report personal property not included in assessed real property value. This form aids in ensuring businesses pay the correct amount of property tax, and it must be returned to the property appraiser's office by April 1 to avoid penalties. Below are the steps to properly fill out the form, simplifying the process and ensuring accuracy in your submission.

- Start by entering the business name under "Business name (DBA-Doing Business As)" and provide the mailing address. If the pre-printed information is incorrect, make the necessary corrections.

- Input the Federal Employer Identification Number in the designated space.

- Under "Owner or person in charge," provide the required details including the phone number.

- For the section on "Physical location," ensure no PO Boxes are used; only physical addresses are acceptable.

- Answer whether you file a TPP tax return under any other name by checking either "Yes" or "No". If yes, provide the name used.

- Indicate the type or nature of your business by checking the appropriate box(es) that apply to your business activity.

- If you began your business before the end of last year, specify the start date and confirm if the return reflects additions or deletions through December 31 by selecting "Yes" or "No".

- Answer questions about previous TPP returns filled in this county and about the former owner of the business, if applicable.

- In the Personal Property Summary Schedule, enter the total amounts for each category of personal property you own, including office furniture, computers, manufacturing equipment, etc.

- Calculate and enter the Taxpayer's Estimate of Fair Market Value for each item or category.

- Sign and date the form, ensuring accuracy and truthfulness of the disclosed information. If someone other than the taxpayer prepares the form, he or she must also sign and print their name along with their Preparer ID and address.

- Review the entire form to ensure all necessary sections are completed and all entries are accurate. Attach any additional pages or schedules as required.

- Mail the original completed form to the Broward County Property Appraiser’s Office by the due date to avoid any penalties for late submission.

After the form has been submitted, it is beneficial to keep a copy for your records. Should there be any disputes or questions regarding your filing, having a copy readily available will be immensely helpful. Additionally, staying organized with your documentation can make it easier to fill out future tax forms or respond to any inquiries from the tax office.

Understanding Property Tax Return

What is a Tangible Personal Property Tax Return (Form DR-405)?

The Tangible Personal Property Tax Return (Form DR-405) is a document businesses in Broward County must file with the Property Appraiser's Office. It reports the property used for commercial purposes that is not included in the assessed value of the business' real property. This includes items such as office furniture, computers, tools, supplies, and leasehold improvements.

Who needs to file this form?

Business owners in Broward County who have tangible personal property used for commercial purposes should file this form. This includes properties not physically attached to the building or land and thus not included in real property assessments.

When is the form due?

The deadline to submit the Tangible Personal Property Tax Return to the Property Appraiser's Office is April 1st. Filing by this date helps avoid penalties.

What can happen if I do not file or if I file late?

Failing to file results in a 25% penalty of the total tax levied against the property for each year a return isn't filed. Filing late incurs a 5% penalty per month on the taxable amount, not exceeding 25% in total. Unlisted property is subject to a 15% penalty of the tax attributable to the omitted property.

What information is required to complete the form?

Required information includes business details (name and address), Federal Employer Identification Number, description of the business, physical location of the property, type of property, and details of property ownership, such as acquisition date and original installed cost. You must also include estimates of fair market value for all listed properties.

Is there an exemption available?

Yes, there is an automatic exemption of up to $25,000 for tangible personal property. To qualify for this exemption, you must file the DR-405 form on time.

Can I file for an extension?

Yes, you may request a 30-day extension, with a possibility of an additional 15 days. The request for an extension must be made in such time that the Property Appraiser's Office can consider and act upon it before the April 1st deadline.

What should not be reported on this form?

Do not report intangible personal property, household goods, most vehicles, and inventory held for sale in the ordinary course of business.

How do I determine the fair market value of my property?

The fair market value should be the taxpayer's estimate of what the property would sell for on the open market. It requires an honest assessment of the property's value considering its condition (good, average, or poor) and any depreciation.

What happens if there are errors in the filing?

Inaccuracies or omissions can lead to penalties or an incorrect assessment of your tax liability. It's crucial to review your form for accuracy and completeness before submission. If errors are discovered after filing, you should contact the Property Appraiser's Office promptly to correct the record.

Common mistakes

Filling out the Property Tax Return form accurately is crucial for businesses to ensure compliance and avoid penalties. However, many make mistakes during this process. Understanding these common errors can help avoid them in the future.

- Not Reporting All Tangible Personal Property: Businesses often overlook or forget to report items that are fully depreciated or not currently in use. Every piece of personal property used in the business needs to be reported, regardless of its depreciation status.

- Incorrect Valuations: Placing incorrect values on property is a common mistake. This can include overestimating the value of an item leading to higher taxes, or underestimating, which can result in penalties for underreporting.

- Failing to Report Leased, Loaned, or Rented Equipment: Any equipment that a business leases, rents, or has borrowed needs to be reported. Businesses commonly miss including these items, especially if the equipment is not on the premises.

- Not Updating Information: If there are changes to the business's mailing address, location, or ownership, these need to be updated on the form. Using outdated information can lead to miscommunications and misplaced tax documents.

- Missing the Filing Deadline: The deadline is crucial. Late filings can result in penalties. Planning ahead and starting the process early can help ensure the form is submitted on time.

- Overlooking Available Exemptions: There are exemptions available that can reduce a business's tax burden. Not applying for these exemptions, such as the $25,000 exemption for filing on time, is a missed opportunity for savings.

- Signature and Date Omissions: A simple but often overlooked mistake is failing to sign and date the form. An unsigned return is considered incomplete and will not be processed, potentially leading to penalties.

By paying close attention to these common pitfalls and ensuring that all property is reported accurately and on time, businesses can avoid unnecessary complications and penalties with their Property Tax Returns.

Documents used along the form

When filing a Property Tax Return, it's essential to understand that there are other crucial documents and forms that often need to be submitted alongside it. These documents provide additional details, verify ownership and values, or offer further clarification about the property in question. Knowing what these documents are and preparing them in advance can streamline the process and ensure compliance with all relevant requirements.

- Proof of Ownership: This document establishes the taxpayer's legal ownership of the property. It could be a deed or a registration certificate.

- Income and Expense Statements: These records give an overview of the property's financial performance over the tax year, especially for properties generating rental income.

- Depreciation Schedules: For businesses, a detailed list showing the depreciation of property assets is crucial. This includes purchase dates, costs, and depreciation methods used.

- Insurance Policies: Documentation proving property insurance can help establish the value and the insurable interest of the property owner.

- Lease Agreements: If the property involves leasing or rental activities, copies of current lease agreements will be required to demonstrate terms and income received.

- Property Appraisals: Recent appraisals can support the claimed value on the tax return, providing evidence if the property's value is under dispute.

- Improvement Records: Receipts, permits, and contractor invoices related to property improvements can affect the property's assessed value and tax implications.

- Previous Year Tax Returns: Including the last year's tax return can offer a point of reference for changes in value, income, or property use.

Having these documents ready and accessible for the property tax return process not only aids in accurate and efficient filing but also prepares property owners for any inquiries or audits that may follow. It is recommended to keep these records well-organized and to seek the guidance of a professional if there are any uncertainties or unique circumstances pertaining to one's property.

Similar forms

The Property Tax Return form shares similarities with the Federal Tax Return, primarily the U.S. Internal Revenue Service (IRS) Form 1040 for individuals. Both documents serve the purpose of reporting income, deductions, and relevant tax liabilities for a specific period, typically a year. They are structured to include detailed sections for the taxpayer to provide financial information, with schedules and appendices for itemizing deductions and reporting additional income or losses. The emphasis on accurate and detailed financial disclosure underpins the resemblance between these two forms, even though their focus on different types of taxes—property versus income—distinguishes them.

Similarly, a Business License Application form echoes aspects of the Property Tax Return, as both involve the declaration of business-related information to a governmental authority. A Business License Application often requires details about the business’s name, location, type of activities, and owner information—paralleling sections about business location, activities, and ownership found on the Property Tax Return. These documents collectively ensure businesses are registered for regulatory, tax, and legal purposes, forming an essential part of compliance for companies across jurisdictions.

The Schedule C (Profit or Loss from Business) of the IRS tax forms also mirrors the Property Tax Return. Schedule C is used by sole proprietors to report the income and expenses of their business, directly affecting their taxable income. This comparison is apt because both forms require a detailed listing of business assets, though the Schedule C focuses on the operational financial performance while the Property Tax Return emphasizes the reporting of tangible personal property for tax assessment purposes.

State Sales Tax Filings present another document with similarities. These filings, required by states that impose sales tax, necessitate businesses to report periodic sales information and remit the collected tax from customers. Both this and the Property Tax Return necessitate meticulous record-keeping and reporting of business operations, although they diverge in their focus on sales versus property values.

The Uniform Commercial Code (UCC) Financing Statement parallels the Property Tax Return form in its function of declaring ownership over assets. The UCC Financing Statement is filed by creditors to announce a security interest in the property of a debtor, ensuring their claim is recorded. Like the Property Tax Return, it involves listing out assets in detail, albeit for different reasons—one for tax assessment and the other for securing interest in collateral.

Another related document is the Personal Financial Statement, often used by lenders to evaluate a borrower's creditworthiness. Similar to sections of the Property Tax Return that require disclosures of assets, the Personal Financial Statement demands comprehensive listings of an individual's assets and liabilities. Both forms are integral to financial assessment processes, though they cater to different audiences and objectives.

The Inventory Report, required for businesses to account for inventory levels at year-end, also shares characteristics with the Property Tax Return. Both documents require a detailed listing of assets, whether it be personal property for tax purposes or products and materials for inventory tracking. The goal of accuracy connects these forms—accurate inventory levels are crucial for business management, just as precise property listings are vital for tax assessment.

Lastly, the Fixed Asset Register, used by companies to track the acquisition, depreciation, and disposal of fixed assets, resembles the Property Tax Return in its focus on tangible assets. While the Fixed Asset Register serves more as an internal control and financial management tool, and the Property Tax Return serves a tax reporting purpose, both necessitate detailed records of business assets over time.

Dos and Don'ts

When filling out the Property Tax Return form for tangible personal property, attention to detail and adhering to deadlines can have a significant impact on your tax responsibilities. Here is a guide to help navigate the do's and don'ts of this process:

- Do ensure you file the form by April 1 to avoid any penalties. Late submissions can lead to unnecessary fines.

- Do read through the instructions carefully before starting to fill out the form. This can save time and prevent mistakes.

- Do report all tangible personal property used for commercial purposes that is not included in the assessed value of your business's real property.

- Do include a complete and accurate itemized list or depreciation schedule for each category of items reported, with original cost and date of acquisition.

- Do check the correct trade levels that apply to your business operation, such as retail, wholesale, manufacturing, leasing/rental, etc.

- Don't forget to sign and date your return. Unsigned returns cannot be accepted.

- Don't leave any relevant sections incomplete. Double-check that all applicable sections of the form are filled out correctly.

- Don't underestimate the importance of listing fully depreciated items still in use. They must be reported at their original installed cost.

- Don't include intangible personal property, household goods not used for commercial purposes, most vehicles, and inventory held for sale.

- Don't hesitate to contact your local property appraiser if you have questions or need clarification on how to properly fill out the form.

By following these guidelines, you can ensure a smoother process when filing your Property Tax Return form. Always remember, when in doubt, seeking advice from the property appraiser's office can provide clarity and prevent potential errors.

Misconceptions

Many individuals and business owners navigate the complexities of Property Tax Return forms, often leading to misconceptions about their preparation, requirements, and implications. Clearing up these misconceptions is essential for ensuring compliance and accuracy in property tax reporting.

- Misconception 1: Personal household items must be included. Many believe that all personally owned assets, including household items, must be reported on the Tangible Personal Property Tax Return. However, items used for personal comfort within the home, such as clothing and general home furnishings not used for commercial purposes, are not taxable under this category.

- Misconception 2: Only items currently in use should be reported. There's a common misconception that only the assets currently in use for business operations need to be listed on the form. Contrarily, all assets owned by the business, including those that are fully depreciated or not currently in active use but still capable of being used, should be reported.

- Misconception 3: Filing the form is optional if the business has a minimal amount of tangible personal property. Some business owners think that if their tangible personal property's value is below a certain threshold, they are exempt from filing. However, filing a DR-405 form is required for all businesses with tangible personal property to ensure they receive the $25,000 exemption. Not filing can result in losing this exemption and incurring penalties.

- Misconception 4: The form only needs to be filed once. A recurring misunderstanding is that the Tangible Personal Property Tax Return form is a one-time requirement. Instead, it must be filed annually to account for any changes in the business's tangible personal assets, such as acquisitions or dispositions.

- Misconception 5: Intangible assets should be included in the return. Intangible assets like copyrights, trademarks, goodwill, and software are often thought to be required on the Property Tax Return form. However, the form is specifically for tangible personal property, excluding intangible assets that do not have a physical presence.

- Misconception 6: Late filing or inaccuracies do not carry penalties. Many underestimate the importance of filing accuracy and timeliness, believing that errors or lateness in filing the Property Tax Return will not result in significant repercussions. The reality is that failure to file, late filing, or inaccuracies can lead to penalties, including a 25% penalty of the total tax levied for failure to file and additional penalties for late or inaccurate filings.

Understanding and correcting these misconceptions are crucial steps to ensure that business owners and individuals properly comply with tax regulations, accurately report their tangible personal property, and take advantage of available exemptions to avoid unnecessary penalties.

Key takeaways

Filling out and using the Property Tax Return form correctly is essential for businesses to ensure they comply with local tax regulations and to take advantage of any exemptions or deductions they are entitled to. Here are key takeaways to help guide you through this process:

- Timeliness is crucial: Submitting the Property Tax Return form (DR-405) to your county property appraiser by April 1 is important to avoid penalties. Late submissions are subject to a penalty of 5% of the total tax levied for each month or part of a month that the return is late, up to a maximum of 25%.

- Eligibility for Exemptions: By filing the DR-405 form on time, businesses automatically apply for a $25,000 exemption. Missing the filing deadline results in the loss of this exemption, increasing the taxable value of the property.

- Reporting Requirements: You must report all tangible personal property used in your business that is not included in the assessed value of real property. This includes items like office furniture, computers, and machinery, as well as fully depreciated items still in use.

- Accuracy Matters: When completing the form, provide detailed descriptions of property items, including the original installed cost and the date of acquisition. Itemizing your assets accurately can affect your tax liability and compliance with state laws.

- Ownership and Usage: You need to report personal property that you own but is used in your business, as well as items that are leased, loaned, or rented to others. The form also requires information on assets disposed of in the last tax year.

- Seek Professional Help If Needed: The complexity of determining fair market value for personal property and navigating tax exemptions can be challenging. Consulting with a tax professional or the local property appraiser’s office may provide clarification and help ensure that you are meeting all requirements and taking advantage of potential tax benefits.

Understanding these aspects of filing the Property Tax Return form can help businesses manage their tax obligations effectively and avoid unnecessary penalties. Always keep a copy of the completed form and any correspondence for your records.

Popular PDF Documents

California Property Tax Exemption - Applicants can sign and mail the completed form to the Homestead Tax Credit Division in Baltimore.

Notice to Pay Rent or Quit California - Directs tenants' attention to a legal dispute over unpaid rent, underlining their need to act by appearing in court and presenting their defense.