Get Property Tax 50 285 Form

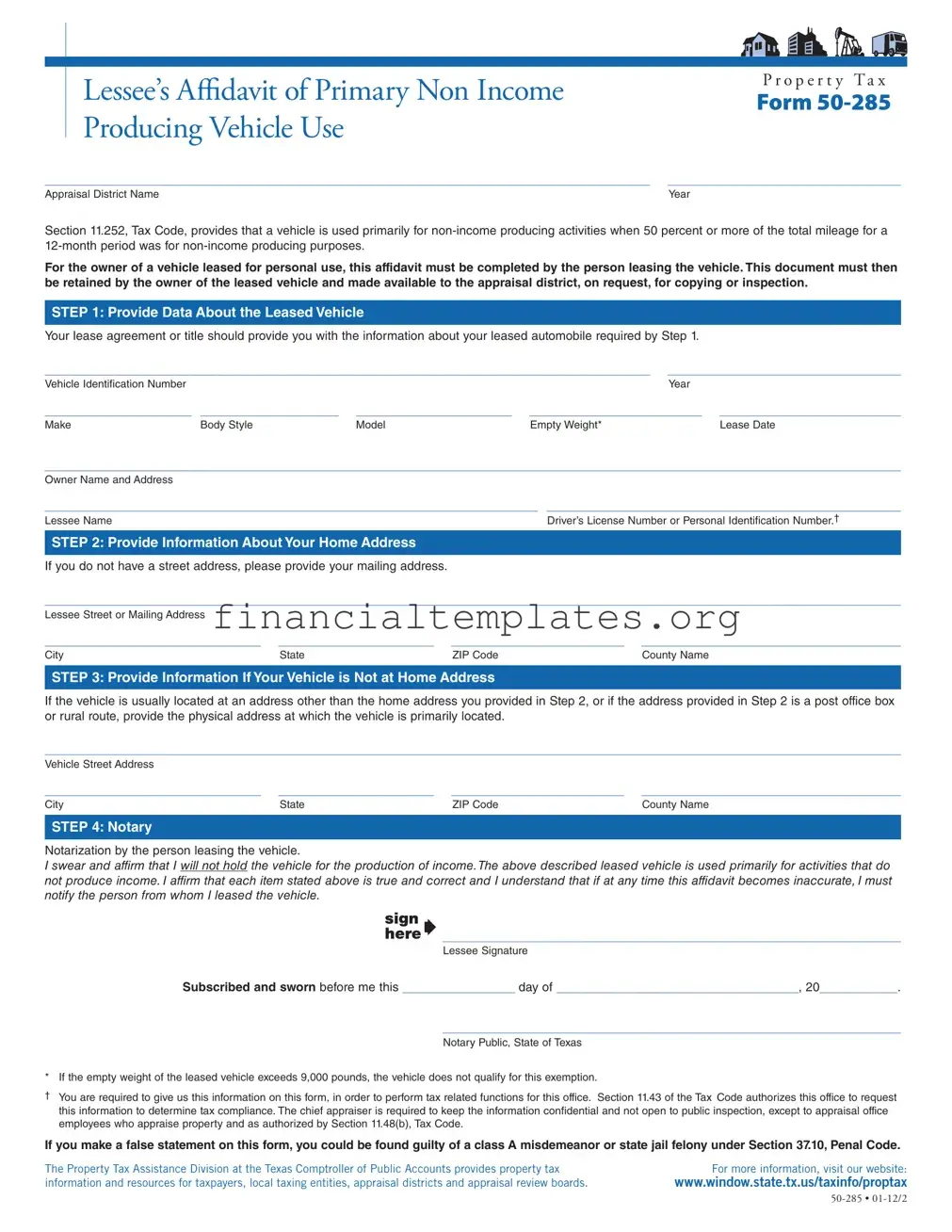

Understanding the nuances of the Property Tax 50-285 form, also known as Lessee’s Affidavit of Primary Non-Income Producing Vehicle Use, is crucial for individuals leasing vehicles for personal, non-income producing activities. According to Section 11.252 of the Tax Code, a vehicle qualifies for this designation when it is used for non-income producing purposes more than 50 percent of the time over a 12-month period. The form requires lessees to provide comprehensive details about the leased vehicle, including the Vehicle Identification Number, make, model, body style, empty weight, and the lease date, alongside the owner’s and lessee’s name and address details. Additionally, if the vehicle is primarily located at a different address than the lessee’s home or if the home address is a post office box or rural route, this alternative address must be documented. The affidavit necessitates notarization to affirm the lessee’s statement that the vehicle is predominantly used for non-income generating activities and acknowledges the penalties for providing false information. The directive to retain this form for possible appraisal district inspections underscores the importance of accuracy and honesty in its completion. This form serves a pivotal role in ensuring tax compliance and offers a clear process for lessees to certify their vehicle’s primary use, thereby affecting its tax treatment.

Property Tax 50 285 Example

Lessee’s Affidavit of Primary Non Income Producing Vehicle Use

P r o p e r t y Ta x

FORM

______________________________________________________________________ |

___________________________ |

Appraisal District Name |

Year |

Section 11.252, Tax Code, provides that a vehicle is used primarily for

For the owner of a vehicle leased for personal use, this affidavit must be completed by the person leasing the vehicle. This document must then be retained by the owner of the leased vehicle and made available to the appraisal district, on request, for copying or inspection.

STEP 1: Provide Data About the Leased Vehicle

Your lease agreement or title should provide you with the information about your leased automobile required by Step 1.

______________________________________________________________________ ___________________________

Vehicle Identiication NumberYear

_________________ ________________ |

__________________ |

____________________ |

_____________________ |

|

Make |

Body Style |

Model |

Empty Weight* |

Lease Date |

___________________________________________________________________________________________________

Owner Name and Address

_________________________________________________________ _________________________________________

Lessee Name |

Driver’s License Number or Personal Identiication Number.† |

STEP 2: Provide Information About Your Home Address

If you do not have a street address, please provide your mailing address.

___________________________________________________________________________________________________

Lessee Street or Mailing Address

_________________________ |

__________________ |

____________________ |

______________________________ |

City |

State |

ZIP Code |

County Name |

STEP 3: Provide Information If Your Vehicle is Not at Home Address

If the vehicle is usually located at an address other than the home address you provided in Step 2, or if the address provided in Step 2 is a post office box or rural route, provide the physical address at which the vehicle is primarily located.

___________________________________________________________________________________________________

Vehicle Street Address

_________________________ |

__________________ |

____________________ |

______________________________ |

City |

State |

ZIP Code |

County Name |

STEP 4: Notary

Notarization by the person leasing the vehicle.

I swear and affirm that I will not hold the vehicle for the production of income.The above described leased vehicle is used primarily for activities that do not produce income. I affirm that each item stated above is true and correct and I understand that if at any time this affidavit becomes inaccurate, I must notify the person from whom I leased the vehicle.

_____________________________________________________

_____________________________________________________

Lessee Signature

Subscribed and sworn before me this _____________ day of ____________________________, 20_________.

_____________________________________________________

Notary Public, State of Texas

* If the empty weight of the leased vehicle exceeds 9,000 pounds, the vehicle does not qualify for this exemption.

†You are required to give us this information on this form, in order to perform tax related functions for this office. Section 11.43 of the Tax Code authorizes this office to request this information to determine tax compliance. The chief appraiser is required to keep the information conidential and not open to public inspection, except to appraisal office employees who appraise property and as authorized by Section 11.48(b), Tax Code.

If you make a false statement on this form, you could be found guilty of a class A misdemeanor or state jail felony under Section 37.10, Penal Code.

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax |

For more information, visit our website: |

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards. |

www.window.state.tx.us/taxinfo/proptax |

Document Specifics

| Fact Name | Description |

|---|---|

| Document Purpose | The FORM 50-285 serves as an affidavit for lessees affirming that the leased vehicle is primarily used for non-income producing activities, meaning more than 50% of its use is not for generating income. |

| Governing Law | Section 11.252 of the Tax Code underpins the form, providing the legal framework for the definition of primary non-income producing vehicle use. |

| Notarization Requirement | A notary public must notarize the form, confirming the lessee's statement about the non-income producing use of the vehicle. |

| Privacy and Legal Consequences | Lessee's personal information is to be kept confidential as required by Section 11.43 of the Tax Code, with false statements on this form potentially leading to class A misdemeanor or state jail felony, pursuant to Section 37.10 of the Penal Code. |

| Weight Restriction and Information Requirement | Vehicles with an empty weight exceeding 9,000 pounds are ineligible for this exemption. The lessee's driver’s license number or personal identification number is mandatory for tax-related functions, as authorized by Section 11.48(b) of the Tax Code. |

Guide to Writing Property Tax 50 285

Filling out the Property Tax 50-285 form is a requirement for individuals leasing vehicles primarily for non-income producing activities in Texas. This affidavit verifies that more than half of the vehicle's total mileage over a 12-month period was for personal use, which is critical for tax purposes. Each step below guides you through the required information to successfully complete the form.

- Provide Data About the Leased Vehicle:

- Fill in the Vehicle Identification Number (VIN) and Year of the vehicle.

- Specify the Make, Body Style, and Model of the vehicle.

- Enter the Empty Weight of the vehicle (note: vehicles over 9,000 pounds do not qualify).

- List the Lease Date when the agreement started.

- Provide the Owner Name and Address as listed on the lease agreement or title.

- Enter the Lessee Name along with the Driver’s License Number or Personal Identification Number.

- Provide Information About Your Home Address:

- State your Street or Mailing Address accurately.

- Include City, State, ZIP Code, and County Name for complete address details.

- Provide Information If Your Vehicle is Not at Home Address:

- If the vehicle's primary location is different from your home address, provide the Vehicle Street Address where it is mainly located.

- Again, include City, State, ZIP Code, and County Name for this address.

- Notary Notarization:

- The lessee must sign the affidavit, affirming that the vehicle is primarily used for non-income producing activities.

- The date when the lessee signs the affidavit must be clearly mentioned.

- A Notary Public must then subscribe and swear to the accuracy of the lessee’s statements, including the date of notarization.

After you've completed the steps above, ensure all the information is accurate and truthful. Remember, providing false information can lead to serious legal consequences. Once finalized, retain this document as it must be presented to the appraisal district upon request for copying or inspection. This form serves as an important piece of documentation for tax compliance purposes related to your leased vehicle.

Understanding Property Tax 50 285

What is the purpose of the Property Tax 50-285 form?

The Property Tax 50-285 form, known as the Lessee’s Affidavit of Primary Non Income Producing Vehicle Use, is specifically designed to be used by individuals leasing a vehicle primarily for personal, non-income producing activities. According to Section 11.252 of the Tax Code, a vehicle qualifies under this category if over 50% of its total mileage in a 12-month period is used for purposes not generating income. The lessee must complete this form to affirm the vehicle's usage and retain it for inspection or copying by the appraisal district upon request.

How do you determine if a vehicle qualifies for the exemption provided by the form?

A vehicle qualifies for the exemption if it meets certain criteria outlined in the form, which includes the vehicle being used primarily (over 50% of the total mileage) for non-commercial, personal purposes within a specified 12-month period. Additionally, if the vehicle’s empty weight exceeds 9,000 pounds, it does not qualify for this exemption. The leaser's assertion and the information provided in the form are subject to verification by the appraisal district.

Whose responsibility is it to complete and retain the Property Tax 50-285 form?

The person leasing the vehicle is responsible for accurately completing the Property Tax 50-285 form. Afterward, it is the vehicle owner's responsibility to retain the completed affidavit and present it to the appraisal district for inspection or copying upon request. It ensures the documented vehicle use complies with the tax code for qualifying exemptions.

What information is needed to fill out the Property Tax 50-285 form?

Completing the form requires detailed information about the leased vehicle, including the Vehicle Identification Number (VIN), year, make, model, body style, empty weight, and lease date. It also asks for personal identification information such as the owner's name and address, the lessee’s name, driver’s license number, or personal identification number. Furthermore, it requires providing the lessee's home address, or mailing address if a street address isn't available, and the physical location of the vehicle if it's not housed at the lessee's address.

Is notarization required for the Property Tax 50-285 form?

Yes, the form necessitates notarization as a compulsory step in its completion. The affidavit includes a segment for the lessee's signature, affirming under oath the truthfulness of the provided information. This section must be signed in the presence of a notary public, who will then complete the notarization to legally validate the affidavit. The notarization ensures the document's authenticity and the accountability of the lessee regarding the claims made about the vehicle's use.

What are the consequences of providing false information on the Property Tax 50-285 form?

Submitting false information on the Property Tax 50-285 form is treated seriously and can lead to legal repercussions. The form explicitly warns that making a false statement may result in being charged with a Class A misdemeanor or a state jail felony under Section 37.10 of the Penal Code. Thus, it is crucial for the lessee to provide accurate and truthful information to maintain compliance and avoid potential penalties.

Where can additional information about the Property Tax 50-285 form and related tax compliance be found?

For further information regarding the Property Tax 50-285 form or other property tax-related queries, individuals are encouraged to visit the official website of the Texas Comptroller of Public Accounts. The Property Tax Assistance Division, accessible through www.window.state.tx.us/taxinfo/proptax, offers a wealth of resources, including comprehensive guides on property tax, specific forms like the 50-285, and their applicable sections within the Texas Tax Code. This platform serves as a critical tool for taxpayers, local taxing entities, appraisal districts, and appraisal review boards for ensuring tax compliance and accessing necessary tax information and resources.

Common mistakes

Filling out the Property Tax 50-285 form, or Lessee’s Affidavit of Primary Non-Income Producing Vehicle Use, seems straightforward, but mistakes can be easily made. These errors might complicate the process, leading to delays or even the rejection of your affidavit. Here are five common mistakes people make while completing this form:

Not double-checking the vehicle identification information: Step 1 asks for detailed information about the leased vehicle, including the Vehicle Identification Number (VIN), year, make, model, body style, empty weight, and lease date. Failing to verify these details against your lease agreement or vehicle title can result in discrepancies that may cause issues with the appraisal district.

Incorrectly reporting the home address in Step 2: Providing inaccurate or incomplete address information can lead to communication issues. Specifically, if you use a P.O. Box or rural route without including a physical address, the district might have trouble locating the property for verification purposes.

Forgetting to provide the physical location of the vehicle in Step 3, if it’s different from the home address: This is a particularly easy step to overlook if the vehicle is primarily kept at a workplace or another location. Failure to disclose the actual location of the vehicle can be viewed as withholding information.

Overlooking the weight restriction: The form clearly states that if the empty weight of the leased vehicle exceeds 9,000 pounds, the vehicle does not qualify for the exemption. People often miss this detail and proceed with the application for vehicles that are fundamentally ineligible, wasting time and effort.

Not taking the notarization requirement seriously: Step 4 requires notarization, which is a formal process of having a legal professional verify the identity of the signer and their signature. Some people either skip this step or do not prepare the necessary identification for the notary. This oversight can invalidate the entire affidavit.

Being diligent in gathering accurate information for the Property Tax 50-285 form is crucial. Take your time, review each step, and ensure all the data is correct and verifiable. Avoiding these common mistakes will smooth out the process of claiming your vehicle as primarily used for non-income producing purposes.

Documents used along the form

When dealing with property tax matters, especially concerning leased vehicles for personal use, the Property Tax Form 50-285 is essential. However, navigating through the nuances of property tax obligations often requires additional forms and documents. These not only complement the affidavit but ensure compliance and accuracy in reporting. Here's a look at four important documents often used alongside Form 50-285:

- Lease Agreement: This contract between the lessee and the lessor outlines the terms of the vehicle's lease. It provides detailed information about the leased vehicle, including the lease period and payment terms, which are necessary to corroborate details on the Form 50-285.

- Vehicle Registration: This document verifies the vehicle's registration with the appropriate state authority. It contains crucial details such as the vehicle identification number (VIN), make, model, and the name of the registered owner, data that should be consistent with the information provided on Form 50-285.

- Insurance Policy: Often, the insurance policy for a leased vehicle contains information about the vehicle's primary use and the addresses associated with it, whether it's garaged or commonly parked. This data can serve as supporting evidence for the non-income producing use of the vehicle.

- Driver's License or State ID: This personal identification helps validate the identity of the person leasing the vehicle. It couples with the Form 50-285's requirement for the lessee's driver's license number or personal identification number, ensuring that the affidavit is being filed by the correct individual.

Together, these documents form a comprehensive dossier that supports the affidavit's declarations made in the Property Tax Form 50-285. For those navigating the complexities of tax obligations related to leased vehicles, amassing and accurately completing these documents is crucial for ensuring compliance and avoiding potential legal issues.

Similar forms

The Vehicle Exemption Certificate, akin to the Property Tax Form 50-285, serves a specific purpose for vehicle owners. Two documents centralize around vehicles, but the Vehicle Exemption Certificate focuses on exempting a vehicle from certain taxes or fees under specified conditions. Similar to the Form 50-285, which requires detailed information about the vehicle and its use, the Exemption Certificate necessitates comprehensive data about the vehicle to validate its exemption. Both documents ensure vehicles are appropriately categorized within tax frameworks, though their end goals slightly differ, with one aiming for tax exemption while the other focuses on confirming primary use.

The Homestead Exemption Application shares similarities with the Property Tax Form 50-285, as both involve property tax regulations but apply to different property types. The Homestead Exemption specifically concerns real estate, allowing homeowners to claim tax relief for their primary residence. Despite the difference in property types, both documents require the owner to provide personal identification and property details, establishing their eligibility for tax benefits. The connection lies in their mutual objective to afford tax relief, fostering a reduced financial burden on the taxpayer.

The Business Personal Property Rendition is another document with elements common to the Property Tax Form 50-285. This form is used by businesses to report the value of their personal property assets for taxation purposes. Both documents gather detailed information about the property in question—vehicles for Form 50-285 and tangible personal property for the Business Rendition. Each form plays a crucial role in the respective tax assessment process, ensuring accurate property valuation and proper tax determination based on reported details.

The Agricultural Use or Timberland Appraisal form, while distinct in its focus on land used for agricultural or timber purposes, parallels the Property Tax Form 50-285 in its foundational aim to secure tax benefits. Landowners provide specifics about their land's use to qualify for reduced tax rates, similar to how lessees of vehicles declare their vehicle's primary function to access tax advantages. In both instances, accurately reporting usage is paramount to receiving tax considerations, underscoring the importance of transparency in tax-related declarations.

Lastly, the Application for Disabled Veteran's or Survivor's Exemptions shares with the Property Tax Form 50-285 the purpose of granting tax relief to a specific group, albeit through different criteria. Veterans or their survivors can apply for property tax exemptions based on disability status, requiring detailed personal and property information similar to what's requested on the Form 50-285. Both documents underscore the government's effort to alleviate the tax burdens for deserving individuals by taking into account their unique circumstances or contributions.

Dos and Don'ts

When filling out the Property Tax 50-285 form, known as the Lessee’s Affidavit of Primary Non-Income Producing Vehicle Use, certain practices should be followed to ensure the accuracy and validity of the information provided. This form is crucial for individuals leasing vehicles and claiming that these vehicles are used mainly for non-income producing purposes. Missteps in completing this document can lead to repercussions, including potential legal issues.

Things You Should Do:

Review your lease agreement or title carefully to accurately fill in the vehicle identification number, year, make, body style, model, empty weight, and lease date in Step 1. These details must match your official documents.

Provide your accurate home address in Step 2. If your vehicle is not located at this address, you must also provide the physical location of the vehicle in Step 3, ensuring no discrepancies.

Retain a copy of the completed affidavit and any supporting documents for your records. This documentation should be readily available for review by the appraisal district upon request.

Ensure that the affidavit is properly notarized. This includes signing the document in the presence of a notary and ensuring the notary completes their section correctly.

Things You Shouldn't Do:

Do not leave any required fields blank. Incomplete forms may be considered invalid, leading to potential delays or denial of your claim.

Avoid providing false or misleading information. Remember, making a false statement on this form could be considered a Class A misdemeanor or state jail felony under Section 37.10, Penal Code.

Do not underestimate the importance of the vehicle's empty weight. If the vehicle exceeds 9,000 pounds empty weight, it does not qualify for this exemption.

Refrain from neglecting to update the affidavit if circumstances change. If the information on the form becomes inaccurate, it is your responsibility to notify the owner of the leased vehicle.

Completing the Property Tax 50-285 form accurately and truthfully is essential for lessees to comply with Texas tax code requirements. Following these guidelines will help ensure that the process is smooth and free from complications.

Misconceptions

Understanding the Property Tax 50-285 form can often lead to confusion and misinformation. To clarify, here are 10 common misconceptions:

Every vehicle qualifies for the exemption. Only vehicles with an empty weight of under 9,000 pounds are eligible. Vehicles exceeding this weight do not qualify, including many larger trucks and SUVs.

The form applies only to vehicles used in business. In fact, the form is specific to lessees asserting that their leased vehicle is used primarily for activities that do not produce income.

Submitting the form guarantees an exemption. While the form is a necessary step, the appraisal district ultimately determines exemption eligibility based on the provided information.

The form should be submitted to the Texas Comptroller. Actually, the document must be retained by the owner of the leased vehicle and is only submitted to the appraisal district upon request.

A digital signature is sufficient for Step 4's notarization requirement. The form requires a traditional wet signature, attested to by a notary public, to verify the lessee's affidavit.

Lessee's home address details are optional. Providing accurate home and, if applicable, vehicle location addresses are critical components of the form, ensuring proper assessment and compliance.

Once submitted, the form applies indefinitely. Should any information on the affidavit change, making it inaccurate, the lessee is obliged to notify the vehicle's owner immediately.

Personal identification number (PIN) is an optional detail. A driver's license number or personal identification number is indeed required, serving as a means to verify the lessee's identity.

False statements carry no penalty. Making a false statement on this form is a serious offense, potentially resulting in a class A misdemeanor or state jail felony.

The form is only relevant to Texas residents. While the form is used within Texas, it applies to any leased vehicle utilized primarily for non-income producing purposes, regardless of the lessee's residency.

By dispelling these misconceptions, lessees can ensure they accurately complete the 50-285 form, maintaining compliance and securing any applicable exemptions in alignment with Texas property tax laws.

Key takeaways

Filling out the Property Tax 50-285 form is crucial for leasing a vehicle in Texas, particularly if the vehicle is primarily used for non-income producing purposes. To ensure the process is completed accurately and to best advantage, here are eight key takeaways:

- Vehicle Information: It's essential to gather all necessary details about the vehicle prior to starting the form. The Vehicle Identification Number (VIN), year, make, model, body style, empty weight, and lease date are all required in Step 1.

- Lessee Information: As the person leasing the vehicle, you must provide your name, driver’s license number or personal identification number, and address. Ensure this information is accurate and matches other official documents.

- Home Address: Provide your current home address. If you use a P.O. box or a rural route, ensure you also supply a physical location where the vehicle is primarily kept.

- Vehicle Location: If the vehicle is primarily located at a different address from your home, specify the vehicle's primary location. This ensures tax assessment is applied correctly based on the vehicle’s primary use location.

- Notarization: Your affidavit needs to be notarized. This means you'll sign the document in the presence of a Notary Public who confirms your identity and your acknowledgment that the vehicle is used primarily for non-income producing activities.

- Weight Limit: The exemption discussed in this form does not apply if the empty weight of the leased vehicle exceeds 9,000 pounds. Vehicles above this weight threshold do not qualify.

- Confidentiality: Your personal information provided on the form is kept confidential, used solely for tax purposes and disclosed only as authorized under the Tax Code. This includes details like your driver's license or personal identification number.

- Legal Consequences: Falsifying information on the 50-285 form can lead to serious legal repercussions, including potential charges of a class A misdemeanor or state jail felony. It’s crucial to ensure all information is accurate and truthful.

For additional clarity and resources related to property tax information, taxpayers are encouraged to visit the Texas Comptroller of Public Accounts website. This affidavit is a significant document for lessees of vehicles, indicating that the primary use of the leased vehicle is not for income-generating purposes. Following these key points will aid in the correct and timely completion of the Property Tax 50-285 form.

Popular PDF Documents

Income Based Repayment Eligibility - Income documentation should be no older than 90 days at the time of your IBR application submission.

IRS 990-T - The IRS Form 990-T is used by tax-exempt organizations to report and pay taxes on unrelated business income.