Blank Release of Promissory Note Form

When a borrower successfully pays off the loan outlined in a Promissory Note, a crucial document comes into play - the Release of Promissory Note form. This document officially acknowledges that the borrower has fulfilled their obligations under the Promissory Note, effectively clearing them from the debt they owed. It serves as a legal confirmation, ensuring that the lender cannot make any further claims regarding the specific loan. For both parties involved, the completion and signing of this form mark the end of their financial transaction relating to the Promissory Note. Its importance cannot be understated as it acts as a protective measure for the borrower and provides a clear record of the debt being fully paid. The process of drafting, executing, and storing this form is straightforward but requires careful attention to detail to ensure that it accurately reflects the loan's payoff and adheres to all relevant legal standards.

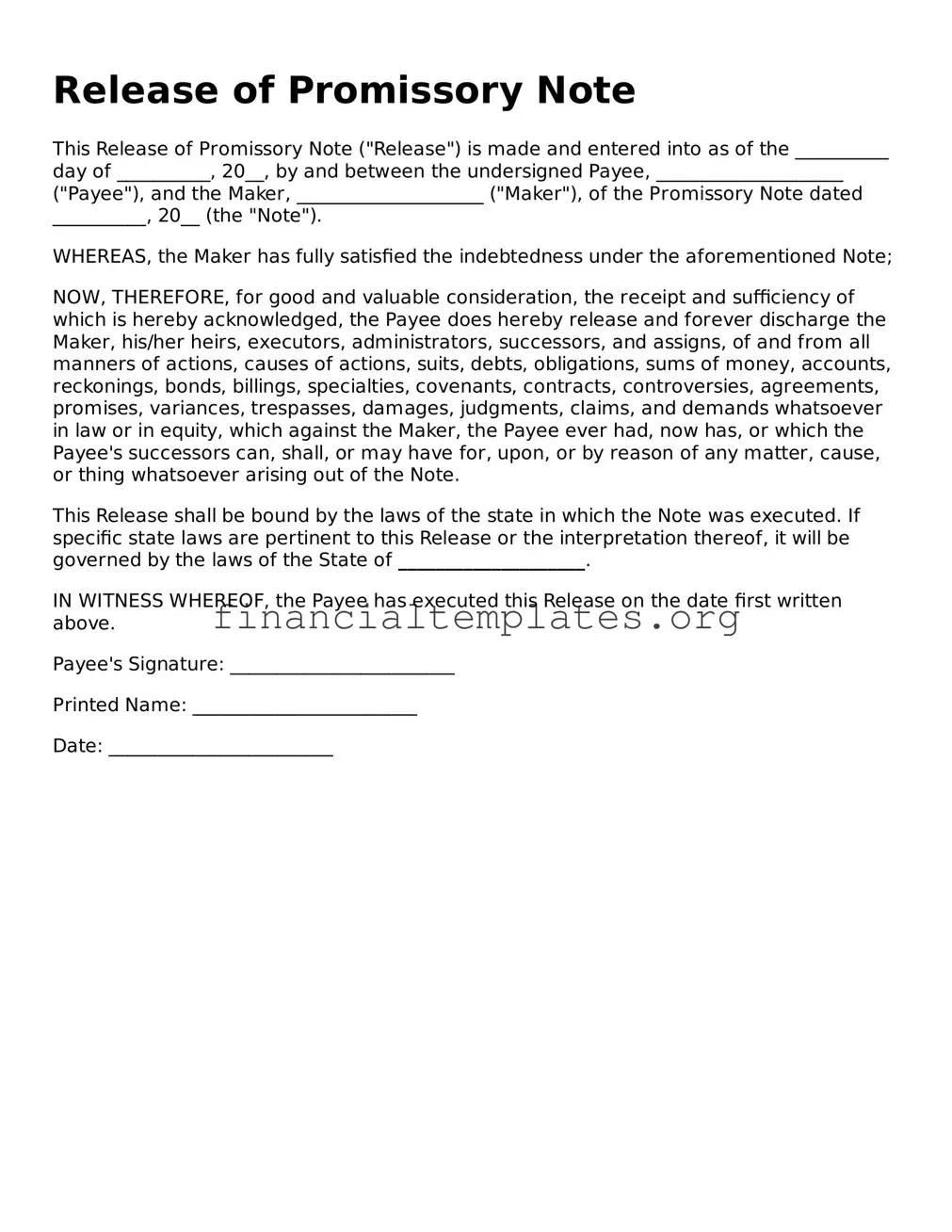

Release of Promissory Note Example

Release of Promissory Note

This Release of Promissory Note ("Release") is made and entered into as of the __________ day of __________, 20__, by and between the undersigned Payee, ____________________ ("Payee"), and the Maker, ____________________ ("Maker"), of the Promissory Note dated __________, 20__ (the "Note").

WHEREAS, the Maker has fully satisfied the indebtedness under the aforementioned Note;

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Payee does hereby release and forever discharge the Maker, his/her heirs, executors, administrators, successors, and assigns, of and from all manners of actions, causes of actions, suits, debts, obligations, sums of money, accounts, reckonings, bonds, billings, specialties, covenants, contracts, controversies, agreements, promises, variances, trespasses, damages, judgments, claims, and demands whatsoever in law or in equity, which against the Maker, the Payee ever had, now has, or which the Payee's successors can, shall, or may have for, upon, or by reason of any matter, cause, or thing whatsoever arising out of the Note.

This Release shall be bound by the laws of the state in which the Note was executed. If specific state laws are pertinent to this Release or the interpretation thereof, it will be governed by the laws of the State of ____________________.

IN WITNESS WHEREOF, the Payee has executed this Release on the date first written above.

Payee's Signature: ________________________

Printed Name: ________________________

Date: ________________________

PDF Properties

| Fact Name | Description |

|---|---|

| Purpose of the Form | The Release of Promissory Note form is used when a borrower has fulfilled the terms of the promissory note, effectively releasing them from their obligation to the lender. |

| Key Component | This form includes a declaration that the borrower has paid the debt in full and that the lender releases any future claims against the borrower related to the promissory note. |

| Significance of Release | Executing this release is crucial as it legally frees the borrower from the debt obligation, preventing the lender from taking future action to collect the same debt. |

| State-Specific Requirements | Some states may have specific requirements or language that must be included in the form to be legally valid within that jurisdiction. |

| Governing Law | The governing law clause specifies which state's laws will apply to the interpretation of the Release of Promissory Note and any disputes that may arise from it. |

| Notarization | In certain cases, notarization of the Release of Promissory Note may be required to validate the identities of the parties involved and the document itself. |

| Document Retention | Both the borrower and the lender should retain copies of the release form for their records to provide proof of the debt's satisfaction and release. |

| Impact on Credit Reporting | Following the release, the borrower can request that the lender notify credit bureaus to update their credit report to reflect the fulfilled obligation, potentially improving their credit score. |

| Additional Documentation | Sometimes, additional documentation proving the fulfillment of all obligations under the promissory note may be attached to the Release of Promissory Note as evidence. |

Guide to Writing Release of Promissory Note

Upon the full repayment of a debt under a promissory note, it is essential that both parties involved - the lender and the borrower - accurately complete a Release of Promissory Note form. This document officially certifies that the borrower has fulfilled the financial obligations outlined in the original promissory note, effectively releasing them from further payments. Handling this form with diligence ensures a clean, legal conclusion to the agreement, safeguarding both parties' interests. The steps below guide you through the necessary process to fill out the form properly.

- Begin by entering the date on which the Release of Promissory Note is being completed. This acknowledges when the borrower has been officially released from their obligations under the note.

- Include the full legal names and addresses of both the lender and the borrower. Precision here is crucial to clearly identify the parties involved in the original agreement and this subsequent release.

- Detail the information regarding the original promissory note, including its date of issuance and the total amount borrowed. This links the release directly to the specific agreement being resolved.

- Specify the total amount paid by the borrower to fulfill the debt. This not only confirms that the obligations have been met but also serves as a record of the transaction.

- Both the lender and the borrower need to sign the form, thus acknowledging the completion of the agreement and the release of the debt. Ensure that this step is not overlooked, as it legally binds the document.

- For additional legal validation, have the form notarized. While this step might not be mandatory, it adds a layer of authenticity and can be very helpful in preventing future disputes over the agreement's conclusion.

Once the Release of Promissory Note form is fully completed and signed, it is advisable for both the lender and the borrower to retain copies for their records. This form is a pivotal document that officially concludes the financial transaction between the two parties, protecting everyone involved should any questions or concerns about the debt's repayment arise in the future. Properly managing this form represents the final step in the promissory note process, cleanly severing the financial ties created by the original loan agreement.

Understanding Release of Promissory Note

-

What is a Release of Promissory Note form?

A Release of Promissory Note form is a document used by a lender to acknowledge that the borrower has paid back the money owed under a promissory note. This form effectively cancels the borrower's obligation to repay and marks the promissory note as paid in full.

-

When should I use a Release of Promissory Note form?

You should use this form when the borrower has completed all payments under the promissory note. It's a way to formally recognize the end of the borrower's debt and prevent any future claims of unpaid debt under the same promissory note.

-

Who needs to sign the Release of Promissory Note form?

The lender, or the person who is owed the debt, needs to sign the form. In some cases, it might also be advisable for the borrower to sign, acknowledging the release of their debt.

-

Do I need a witness or notary for the Release of Promissory Note form?

Whether a witness or notary is required can depend on state laws. While some states do not mandate the presence of a witness or notary, having the document notarized can add a layer of authenticity and help protect against potential disputes.

-

What information is needed for a Release of Promissory Note?

The form requires basic information including the date of the promissory note, the amount of the loan, the names of both the lender and borrower, and the date the loan is paid in full. If applicable, details of any security or collateral should also be mentioned.

-

Is the Release of Promissory Note the same as a debt settlement?

No, they are not the same. A debt settlement indicates the borrower and lender have agreed on a lesser amount than originally owed to settle the debt, often due to financial hardship on the borrower's part. A Release of Promissory Note is used when the full amount has been paid according to the terms of the original agreement.

-

What happens if I don't use a Release of Promissory Note form?

Without this form, there could be a misunderstanding or dispute in the future regarding whether the debt is still owed. The borrower lacks formal proof of debt satisfaction, and the lender might inadvertently claim unpaid debts.

-

Can I create a Release of Promissory Note form myself?

Yes, you can create the form yourself, but it is important to ensure that it includes all necessary legal terms and information. To be certain it complies with your state laws and addresses your specific situation, you might consider consulting a legal professional or using a professionally drafted template.

-

Where can I find a Release of Promissory Note form?

Release of Promissory Note forms can be found through online legal services, law offices, or financial institutions. It's crucial to use a source that ensures the form is up to date and compliant with your state's regulations.

Common mistakes

When dealing with a Release of Promissory Note form, it's essential to approach it with diligence and care. This legal document signifies that a loan has been fully paid off, and the borrower is released from their obligation to the lender. However, mistakes can be made during its completion, which could lead to unnecessary complications. Here are eight common errors to avoid:

Not verifying that all the payment details are accurate. It is crucial to ensure that the payment record matches the ledger before drafting the release, to confirm that the debt has indeed been fully settled.

Forgetting to include the original promissory note date. The date when the promissory note was initially signed is a key detail that should always be included in the release form.

Omitting the names and contact information of both the borrower and the lender. This might seem like simple information, but it's essential for the document's legal validity.

Leaving out the promissory note's reference number. This number is used to identify the specific agreement between the lender and the borrower, and without it, there could be confusion or disputes later on.

Not having the document witnessed or notarized, if required by state law. This oversight can question the authenticity of the document, potentially leading to legal challenges.

Failure to provide a complete release statement. This statement should clearly indicate that the borrower is released from their debt obligation, and any ambiguity could be problematic.

Signing the document without ensuring that all parties have read and understood its contents. This can lead to misunderstandings or allegations of misrepresentation.

Not keeping a copy of the signed release for personal records. Retaining a copy is crucial for both the borrower and the lender, as it serves as proof that the debt has been paid and the obligation ended.

By avoiding these mistakes, both borrowers and lenders can ensure that the release process is smooth and that the Release of Promissory Note form accurately reflects the resolution of the debt.

Documents used along the form

When dealing with the finalization of debts or loans, the Release of Promissory Note form often does not stand alone. Surrounding this crucial document, a suite of additional forms and documents might be utilized to ensure a thorough and legally sound process. These documents not only provide a comprehensive framework for the transaction but also secure the interests of all parties involved. Below is a list of four documents typically used in conjunction with a Release of Promissory Note form.

- Loan Agreement: This document outlines the terms and conditions under which the loan was provided. It includes details such as repayment schedule, interest rates, and collateral, if any. The Loan Agreement serves as the foundational agreement between the borrower and lender from which the promissory note derives its terms.

- Amendment Agreement: Sometimes, the original terms of a promissory note or loan agreement need adjustments. An Amendment Agreement records any changes agreed upon by the involved parties, ensuring that modifications are legally binding and acknowledged by both sides.

- Security Agreement: If the loan is secured against the borrower's assets, a Security Agreement is essential. This document provides the lender with a security interest in specified assets as collateral, giving the lender rights to seize assets in case of default on the loan.

- Guaranty: To further protect the lender's interests, a Guaranty might be requested. This document involves a third party, known as a guarantor, who agrees to repay the loan if the original borrower defaults. It's a form of financial assurance for the lender.

Understanding and properly executing these documents in conjunction with a Release of Promissory Note ensures that all parties are fully aware of their rights and obligations. It encapsulates a mutual agreement on the conclusion of a debt obligation, providing a clear path for both the borrower's release of liability and the lender's acknowledgement of debt satisfaction. These documents, when correctly managed, form a robust legal framework that secures the interests of all entities involved in the lending process.

Similar forms

The Release of Promissory Note form shares similarities with a Loan Agreement, as both documents outline the terms between a borrower and a lender. Specifically, a Loan Agreement sets forth the initial terms under which money is borrowed, such as interest rate and repayment schedule, whereas the Release of Promissory Note is used at the end of this relationship to acknowledge that the borrower has fulfilled their obligations under those initial terms, effectively closing the loop on the financial transaction.

A Mortgage Release (or Satisfaction of Mortgage) document is another closely related form, acting as the mortgage world's equivalent to the Release of Promissory Note. When a borrower pays off their mortgage, the lender provides a Mortgage Release to indicate that the lien on the property has been removed, just as the Release of Promissory Note indicates that the borrower is no longer indebted under the promissory note's terms.

A Lien Release is similarly connected, being used in various contexts to indicate that a debt has been paid and any claim over the debtor's property is removed. While the Release of Promissory Note specifically concerns the termination of obligations under a promissory note, a Lien Release applies more broadly to any property that was held as security against a wide array of debts, not just loans or promissory notes.

The Debt Settlement Agreement also parallels the Release of Promissory Note, but with a focus on negotiation. This agreement is used when the debtor cannot pay back the original amount owed and comes to a new agreement with the creditor on a reduced amount. The Release of Promissory Note confirms the fulfillment of the original terms, whereas a Debt Settlement Agreement redefines those terms to accommodate an altered repayment structure.

An Affidavit of Debt is another document that appears in the constellation of financial agreements and releases. Although it primarily serves to legally affirm that a debtor owes a certain amount to the creditor, it can be seen as a precursor to requiring a Release of Promissory Note, since the affidavit might be used in proceedings to enforce the promissory note's terms before it can be ultimately released.

Payment Agreement Forms also share a close relationship with the Release of Promissory Note by outlining a plan for repayment between two parties. Where a Payment Agreement Form specifies the conditions and schedule for repayment, a Release of Promissory Note comes into play after these agreed payments have been successfully made, signifying the end of the borrower's payment obligations.

Lastly, the General Release form, while broader in application, overlaps in purpose with the Release of Promissory Note. A General Release can be used to waive all forms of claims between parties, including those related to financial transactions. While it encompasses a wider range of potential disputes, when used in a financial context, it similarly signals the resolution of obligations that might have been specified in a Promissory Note, among other agreements.

Dos and Don'ts

When filling out the Release of Promissory Note form, it is important to follow specific guidelines to ensure that the release is processed accurately and effectively. Here are seven dos and don’ts to consider:

- Do thoroughly review the promissory note and any related documentation before starting the release process. This ensures understanding of the obligations and terms.

- Do verify that all payments under the promissory note have been made. Confirmation of full payment is essential before a release can be properly executed.

- Do provide accurate information about the borrower, lender, and the original promissory note in the release form. Accuracy in details is critical for legal validity.

- Do sign the release form in the presence of a notary public when required. Notarization can provide an added layer of legal assurance and validity to the document.

- Don't leave any sections of the form blank. Complete all required fields to avoid delays or questions about the release.

- Don't forget to keep a copy of the completed release form and any correspondence about the release for your records. Documenting this process is important for both parties.

- Don't hesitate to seek legal advice if there are any questions or uncertainties about the release process or the form itself. Consulting a professional can prevent potential legal issues.

Misconceptions

When dealing with the financial instrument known as a promissory note, parties involved often encounter misconceptions about the process of releasing such a note. A Release of Promissory Note form plays a crucial role in formalizing the termination of the obligation once the borrower fulfills the terms agreed upon. Understanding what this release entails, and correcting common misunderstandings, is vital for both lenders and borrowers to ensure clarity and legal compliance.

- Misconception 1: Any informal communication serves as an official release. Contrary to what some might think, a Release of Promissory Note requires a formal, written agreement that clearly states the borrower is released from their obligation. Oral agreements or informal acknowledgments, such as an email saying "thank you for the payment," do not legally suffice.

- Misconception 2: The release automatically occurs once the debt is paid off. In reality, the completion of payment is a necessary condition, but the release itself must be actively issued by the lender. This action signifies that the lender acknowledges the debt as paid in full and legally releases the borrower from further obligations.

- Misconception 3: A Release of Promissory Note is unnecessary if the loan is between friends or family members. Regardless of the relationship between the lender and the borrower, formalizing the conclusion of the loan agreement prevents potential misunderstandings or legal disputes in the future. It serves as a clear declaration that the debt has been satisfied.

- Misconception 4: Only the original lender can issue the release. While typically, the original lender is the one to release the obligation, in cases where the promissory note has been sold or transferred, the current holder of the note has the authority and the responsibility to issue the release once the terms have been met by the borrower.

Key takeaways

When a borrower has fully paid off a loan, the lender often provides a document called the Release of Promissory Note form. This document serves as proof that the debt has been satisfied and the borrower is released from their obligations under the note. Understanding the correct way to fill out and use the Release of Promissory Note form is crucial for both lenders and borrowers. Here are six key takeaways to consider:

- Ensure accuracy of information: It's vital that all the information on the Release of Promissory Note form is accurate. This includes the names of the lender and borrower, the original amount of the loan, and the date the loan was fully paid off. Mistakes can lead to disputes or confusion in the future.

- Clear description of the promissory note: The form should clearly identify the promissory note being released by including its date and any identifying number or information. This specificity prevents any ambiguity about which debt is being discharged.

- Payment verification: Before signing the release, the lender should verify that all payments have been received and that no outstanding balance remains. This may include principal, interest, and any applicable fees.

- Signatures are necessary: Both the lender and borrower should sign the Release of Promissory Note form. Depending on state laws, witnesses or a notary public may also be required to sign the document, thus ensuring its validity and preventing challenges.

- Keep copies of the document: After the form is fully executed, both parties should retain copies of the release for their records. Having this documentation can prove invaluable if there are future disputes or if the borrower needs to demonstrate that the debt has been paid.

- Understand the legal effect: Filling out and signing the Release of Promissory Note form legally releases the borrower from their obligations under the promissory note. It's a conclusive step in the lending process, signifying the end of that particular financial agreement.

By following these guidelines, lenders and borrowers can ensure the process is handled correctly and efficiently, providing peace of mind and legal protection for both parties.

Other Types of Release of Promissory Note Templates:

Bill of Sale With Promissory Note for Automobile - A legally binding note that signifies a borrower's commitment to repay the funds used for acquiring a car, detailing the loan's terms.