Blank Promissory Note for a Car Form

When diving into the world of car ownership through private sales or agreements not involving traditional financial institutions, a Promissory Note for a Car form becomes an invaluable document. This form acts as a binding agreement between the buyer and the seller, detailing the financial arrangement for the purchase of the vehicle. It outlines the amount borrowed and the payment plan, including interest rates if applicable, ensuring transparency and understanding between both parties. Besides serving as a legal safeguard to enforce payment, it clarifies the terms of the loan, specifying the repayment schedule, late fees, and the consequences of default. This meticulous document not only facilitates a smoother transaction but also provides a sense of security for both the seller and buyer, establishing a clear path to car ownership without the complexities often associated with bank loans. By encompassing all these aspects, the Promissory Note for a Car form is cornerstone in personal vehicle transactions, making it an essential tool for anyone looking to buy or sell a car through a private financial arrangement.

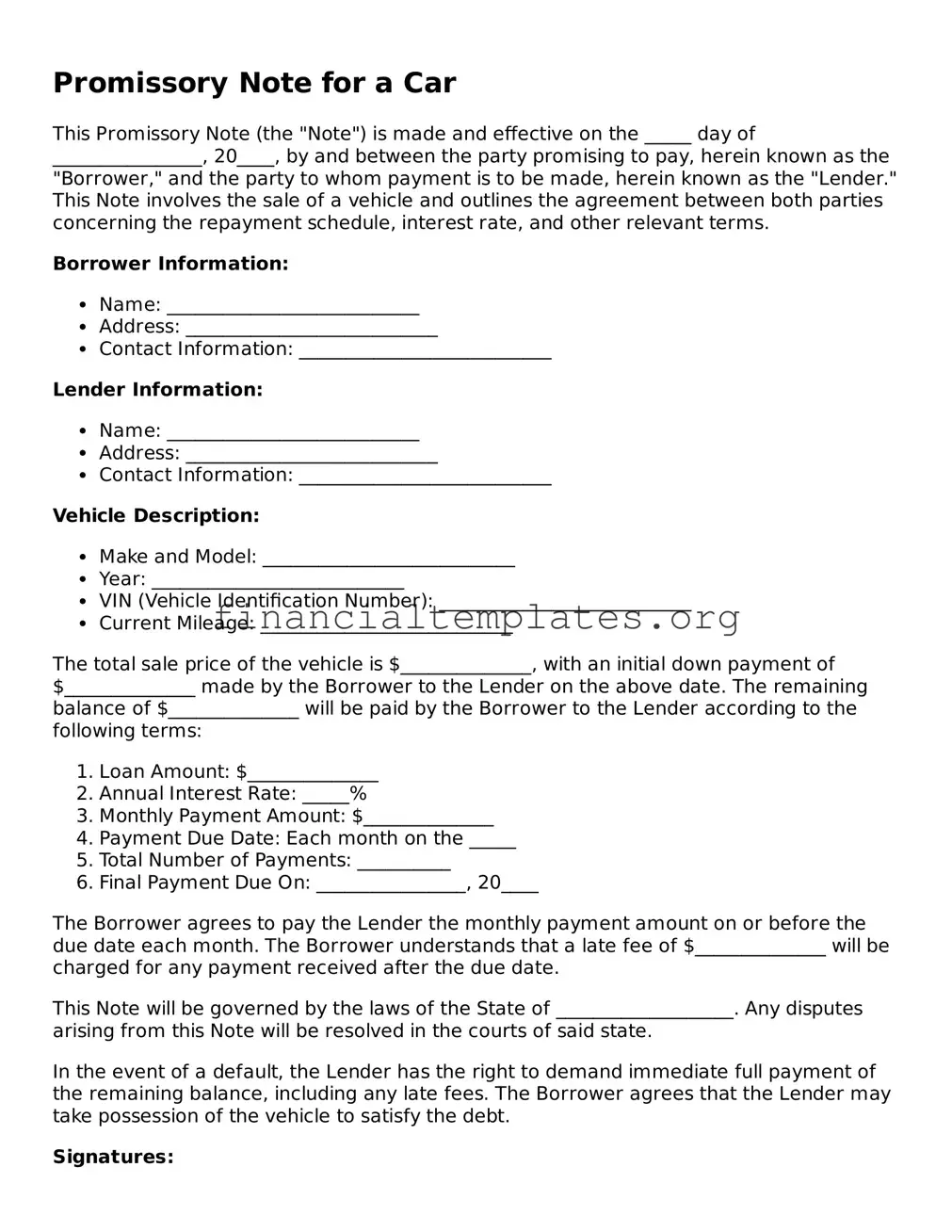

Promissory Note for a Car Example

Promissory Note for a Car

This Promissory Note (the "Note") is made and effective on the _____ day of ________________, 20____, by and between the party promising to pay, herein known as the "Borrower," and the party to whom payment is to be made, herein known as the "Lender." This Note involves the sale of a vehicle and outlines the agreement between both parties concerning the repayment schedule, interest rate, and other relevant terms.

Borrower Information:

- Name: ___________________________

- Address: ___________________________

- Contact Information: ___________________________

Lender Information:

- Name: ___________________________

- Address: ___________________________

- Contact Information: ___________________________

Vehicle Description:

- Make and Model: ___________________________

- Year: ___________________________

- VIN (Vehicle Identification Number): ___________________________

- Current Mileage: ___________________________

The total sale price of the vehicle is $______________, with an initial down payment of $______________ made by the Borrower to the Lender on the above date. The remaining balance of $______________ will be paid by the Borrower to the Lender according to the following terms:

- Loan Amount: $______________

- Annual Interest Rate: _____%

- Monthly Payment Amount: $______________

- Payment Due Date: Each month on the _____

- Total Number of Payments: __________

- Final Payment Due On: ________________, 20____

The Borrower agrees to pay the Lender the monthly payment amount on or before the due date each month. The Borrower understands that a late fee of $______________ will be charged for any payment received after the due date.

This Note will be governed by the laws of the State of ___________________. Any disputes arising from this Note will be resolved in the courts of said state.

In the event of a default, the Lender has the right to demand immediate full payment of the remaining balance, including any late fees. The Borrower agrees that the Lender may take possession of the vehicle to satisfy the debt.

Signatures:

By signing below, both the Borrower and the Lender agree to the terms and conditions of this Promissory Note.

Borrower's Signature: ___________________________ Date: ________________

Lender's Signature: ___________________________ Date: ________________

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Promissory Note for a Car is a binding legal document where a borrower agrees to pay back a lender for the purchase of a vehicle over a specified period, including any agreed-upon interest. |

| Key Components | Includes the amount borrowed, interest rate, repayment schedule, collateral description (the car), and signatures of both parties. |

| Interest Rates | Interest rates must be explicitly stated and should not exceed state-specify usury limits to remain valid and enforceable. |

| Governing Laws | Vary by state, affecting the interest rate, enforcement, and other terms of the note. Ensure compliance with local regulations. |

| Default Consequences | If the borrower fails to make payments, the lender has the right to repossess the vehicle or pursue other legal remedies. |

| Signing Requirements | Must be signed by both the lender and borrower to be legally binding. Notarization may be required depending on the state. |

Guide to Writing Promissory Note for a Car

After deciding to purchase or sell a car through private sale, you'll likely need to document the terms of the loan if the buyer isn't paying the full amount upfront. A Promissory Note for a Car is a straightforward way to formalize the details of the loan, including the repayment schedule, interest rate, and what happens if the buyer fails to make payments on time. Filling out this form correctly is crucial to ensure both parties are protected and understand their obligations. Follow these steps to accurately complete the Promissory Note for a Car.

- Date the Note: At the top of the document, write the date the promissory note is being made.

- Identify the Parties: Clearly state the legal names of both the borrower and the lender.

- Detail the Loan Amount: Specify the exact amount of money being loaned for the purchase of the car.

- Include the Interest Rate: Enter the agreed-upon annual interest rate. Make sure this complies with state law to avoid it being considered usurious.

- Outline the Repayment Schedule: This section should detail when payments will start, how often they will be made (e.g., monthly), the amount of each payment, and when the final payment will be due.

- Address Late Payments: Describe any fees or penalties for late payments, including how many days after a missed payment before the penalty is applied.

- Define Default Conditions: Clearly define what constitutes a default on the loan, what the consequences will be, and the notice period the borrower has to remedy the default before those consequences come into effect.

- Securing the Note: If the loan is secured with the car itself, include a description of the car (make, model, year, and VIN).

- Governing Law: State which U.S. state's laws will govern the interpretation and enforcement of the note.

- Signatures: Both the borrower and the lender need to sign and date the promissory note. It's also advisable, though not always required, to have the signatures witnessed or notarized for additional legal protection.

Once all these steps are followed and the form is filled out completely, both parties should keep a copy of the promissory note for their records. This document will serve as a legally binding agreement that outlines the responsibility of the borrower to repay the loan under the agreed-upon terms. It's an essential part of any private vehicle sale where the purchase is not paid in full upfront. Paying careful attention to each step will help prevent future misunderstandings or disputes.

Understanding Promissory Note for a Car

-

What is a Promissory Note for a Car?

A Promissory Note for a Car is a legal document that outlines an agreement between a buyer and a seller where the buyer promises to pay the seller a specified amount for the purchase of a car. This document includes detailed information about the repayment schedule, the amount of each payment, the interest rate if applicable, and the consequences of failing to make payments on time.

-

Who needs to sign the Promissory Note for a Car?

Both the buyer and the seller need to sign the Promissory Note for a Car. Their signatures are essential to make the agreement legally binding and enforceable. Witnesses or a notary public may also be required to sign, depending on state laws.

-

Is an interest rate always included in a Promissory Note for a Car?

No, an interest rate is not always included in a Promissory Note for a Car. The inclusion of interest is subject to the agreement between the buyer and the seller. If they agree on an interest-free loan, the note will reflect that decision. However, if interest is part of the agreement, the note must clearly state the rate, how it is calculated, and when it is applied.

-

Can the payment terms be customized in the Promissory Note?

Yes, the payment terms in a Promissory Note for a Car can be customized according to the agreement between the buyer and the seller. The terms can specify the payment schedule, the number of payments, and the amount of each payment. It is important for both parties to agree on terms that are clear, feasible, and legally enforceable.

-

What happens if the buyer fails to make payments as agreed?

If the buyer fails to make payments as agreed in the Promissory Note for a Car, the seller has the legal right to pursue various remedies. These may include repossessing the car or taking legal action to recover the owed amount. The specific consequences should be outlined in the Promissory Note, providing clarity to both buyer and seller about the steps that can be taken in case of a default.

-

Is a Promissory Note legally binding in all states?

Yes, a Promissory Note for a Car is legally binding in all states when it is properly executed, which means it must contain the necessary terms, be signed by all parties, and comply with state laws. However, the legal requirements, such as witness or notary requirements, can vary from state to state.

-

Do I need a lawyer to create a Promissory Note for a Car?

While it is not mandatory to have a lawyer to create a Promissory Note for a Car, consulting with one can be very beneficial. A lawyer can provide valuable advice on including all necessary terms, ensuring the note complies with state laws, and protecting your rights and interests. However, several templates and software programs are available if parties choose to draft the document themselves.

-

Can the Promissory Note for a Car be modified after signing?

Yes, the Promissory Note for a Car can be modified after signing, but any modifications must be agreed upon by both the buyer and the seller. It is best to document these modifications in writing and have both parties, and any witnesses or a notary public, sign the updated agreement to ensure the changes are legally binding.

-

What should I do if I lose the original Promissory Note for a Car?

If the original Promissory Note for a Car is lost, it is important to act quickly. Notify the other party of the loss and make arrangements for a signed, written statement that acknowledges the loss of the original document and outlines the terms of the original agreement. It may also be wise to consult with a legal professional to ensure that the replacement agreement is legally sound and to understand any potential implications of losing the original document.

Common mistakes

When individuals embark on the process of securing a purchase or loan for an automobile through a promissory note, the clarity and accuracy of the information provided are paramount. A Promissory Note for a Car is a binding legal agreement that outlines the borrower's promise to pay back a specified sum of money to the lender. Mistakes made during the completion of this form can lead to a range of complications—from minor inconveniences to significant legal disputes. Let’s examine four common errors to avoid:

- Not Specifying Payment Details Clearly: One of the most common mistakes is failing to spell out the payment terms in clear, unambiguous terms. This includes the total loan amount, interest rate, payment schedule (dates and amounts), and the duration of the loan. Precision in these details helps prevent misunderstandings between the parties involved.

- Omitting Relevant Information about the Parties: Another frequent error is not providing complete information about both the borrower and the lender. This information includes full legal names, addresses, and contact details. Incomplete or inaccurate information can lead to difficulties in enforcing the agreement, should the need arise.

- Ignoring State-Specific Requirements: Each state may have unique legal requirements or provisions that need to be included in the promissory note. Overlooking these state-specific requirements can render the note legally unenforceable or lead to other legal challenges.

- Inadequate Description of the Collateral: In cases where the car itself is being used as collateral for the loan, failing to adequately describe the vehicle can be a critical mistake. This description should include the make, model, year, and VIN (Vehicle Identification Number). A precise description ensures the lender has a clear claim to the collateral if the borrower defaults on the loan.

Avoiding these mistakes requires a combination of attention to detail and an understanding of the legal obligations and repercussions involved in creating a promissory note for a car. For individuals who are unsure, consulting with a legal expert can provide the necessary guidance to ensure that the promissory note is completed correctly and is legally binding.

Documents used along the form

When purchasing or selling a car with financing involved, a Promissory Note for a Car form is crucial, but it is often one piece in a larger puzzle of necessary documentation. This promissory note represents a binding agreement between the seller and buyer, outlining the repayment schedule for the loan amount. However, to ensure a smooth and legally compliant transaction, several other forms and documents typically accompany this note. They serve various purposes, from verifying the vehicle’s condition to ensuring both parties meet their legal and financial obligations.

- Bill of Sale: This document acts as evidence of the transaction between the buyer and seller, detailing the specifics of the sale, including the purchase price. It serves as a receipt for the buyer and is often required for the buyer to register the vehicle in their name.

- Title: The vehicle title proves ownership and is transferred from the seller to the buyer. It's critical to ensure the title is clear, meaning it has no liens against it unless the lien is the new loan being secured for the purchase.

- Odometer Disclosure Statement: Required by federal law for any vehicle transaction, this statement records the vehicle's actual mileage at the time of sale. It helps protect against odometer fraud.

- As-Is Sales Agreement: If the car is being sold "as-is," meaning the seller will not make repairs or offer warranties for any issues, this agreement outlines that the buyer accepts the vehicle in its current condition.

- Loan Agreement: If a bank or another third-party lender is financing the vehicle purchase, a loan agreement detailing the loan terms, interest rate, and payment schedule is necessary. This document is separate from the Promissory Note for a Car when the lender is a financial institution rather than the seller.

- Insurance Proof: Most states require proof of insurance before allowing registration of the vehicle. The buyer typically needs to provide proof of at least a minimum level of coverage.

While the Promissory Note for a Car formalizes the loan's specifics, each of these documents plays a vital role in the broader context of a vehicle sale. They collectively ensure the legality of the sale, safeguard the interests of both buyer and seller, and help in establishing the car's legal ownership and operability under the law. Understanding the purpose and necessity of each document can significantly smooth the process of buying or selling a car with financing involved.

Similar forms

A promissory note for a car is similar to a personal loan agreement, as both outline the terms under which money has been lent and needs to be repaid. These documents specify the amount borrowed, interest rate if applicable, repayment schedule, and what happens in the case of a default. The key difference is that a personal loan agreement can cover a range of purposes beyond just purchasing a vehicle.

It also bears resemblance to a mortgage agreement, albeit on a typically smaller scale and with a different type of asset as collateral. Like a mortgage, a promissory note for buying a car details the borrower's promise to repay the lent amount under agreed conditions, but it is secured against the car rather than real estate.

Similar in nature to a student loan agreement, a promissory note for a car sets forth the terms of repayment for borrowed funds. Both include specific details about the loan amount, interest rate, payment schedule, and consequences of failing to meet the agreed-upon terms. However, the purpose of borrowing and the collateral, if any, differ significantly.

Amortization schedules are closely related to promissory notes for cars, as both deal with the breakdown of loan payments over time. While the promissory note states the terms of the loan, the amortization schedule provides a detailed table of each payment, portioned into interest and principal, showing the balance decrease over the loan term.

Bills of Sale are often used in conjunction with promissory notes for cars. The bill of sale proves the transfer of ownership of the car from the seller to the buyer, while the promissory note details the buyer’s agreement to pay the seller a certain amount for the vehicle. Together, they ensure a legally binding sale and payment plan between the two parties.

Similar to a leasing agreement, promissory notes for cars outline payment terms for the use of an asset. However, leasing agreements usually pertain to renting assets rather than purchasing them. They detail the lease term, monthly payments, and use conditions, contrasting with promissory notes that focus on repayment terms for borrowed money to own an asset outright.

Guaranty agreements share common ground with promissory notes for cars, as they also involve promises regarding the payment of debt. A guaranty agreement involves a third party who guarantees to repay the debt if the original borrower fails to do so, adding an extra layer of security for the lender that is not typically detailed in a standard promissory note.

Finally, promissory notes for cars resemble loan modification agreements in that both can alter the terms of an existing financial agreement. While a loan modification agreement changes the terms of an existing loan due to the borrower's inability to meet the original terms, a promissory note may be revised if both lender and borrower agree to modify the repayment terms or balance owed.

Dos and Don'ts

When filling out the Promissory Note for a Car, ensuring accuracy and clarity in the document is crucial. This note is a legally binding agreement that outlines the borrower's promise to repay the lender, typically covering transactions for purchasing a vehicle. Below are eight important dos and don’ts to help guide you through this process:

- Do ensure all parties’ full legal names are correctly spelled and their contact information is up-to-date. This clarity helps avoid confusion over who is obligated under the note.

- Do specify the total loan amount in both words and numbers to prevent any discrepancies or misunderstandings about the total sum being borrowed.

- Do accurately describe the car, including its make, model, year, and Vehicle Identification Number (VIN), to clearly identify the subject of the promissory note.

- Do include the interest rate, being clear whether it is simple or compounded interest, and how often it is to be calculated. This information will determine the overall cost of the loan for the borrower.

- Don't leave any sections blank. If a section does not apply, mark it as "N/A" (not applicable) to indicate that it has been considered and intentionally left blank.

- Don't forget to specify the payment plan, including the amount of each payment, the frequency of payments (e.g., monthly), and the duration of the loan. This schedule will be crucial for both parties to understand the repayment expectations.

- Don't sign the document without ensuring that every detail is correct and that both the borrower and the lender understand their obligations. Mistakes could lead to legal complications down the line.

- Don't neglect to have witnesses or a notary public present at the time of signing, if your state laws require it. This may help validate the document's authenticity and enforceability.

Misconceptions

When it comes to the Promissory Note for a car, misinformation can easily spread. To ensure clarity, let's address and correct some common misconceptions about this important document.

- Misconception 1: A Promissory Note is the same as a Car Sale Contract. While both are crucial when selling or buying a car, a Promissory Note and a Car Sale Contract serve different purposes. The Promissory Note outlines the repayment plan for the car's purchase price if not paid in full upfront. In contrast, a Car Sale Contract details the agreement of sale, including the car's condition, warranties, and the terms of sale.

- Misconception 2: Signing a Promissory Note means you don't need a Bill of Sale. This is incorrect. The Promissory Note focuses on the payment terms, while the Bill of Sale proves the transfer of ownership. Both documents are essential for a secure transaction and for protecting both the buyer's and seller's interests.

- Misconception 3: A Promissory Note is legally binding without being witnessed or notarized. Although a Promissory Note is a contractual agreement between the buyer and seller, having it witnessed or notarized can add a layer of security and authenticity. This process verifies the identity of the signing parties and helps enforce the document in case of disputes.

- Misconception 4: Once signed, the terms of a Promissory Note cannot be changed. This is not necessarily true. As with many agreements, the terms of a Promissory Note can be modified if both parties agree to the changes. Any amendments should be documented in writing and signed by both parties, ensuring that the agreement remains up-to-date and reflective of any new terms.

Understanding the specifics of a Promissory Note for a car is essential for conducting a transaction that is both legally sound and fair to all parties involved. By dispelling these common misconceptions, buyers and sellers can navigate the process more smoothly and with confidence.

Key takeaways

When entering into an agreement for purchasing a car, the Promissory Note serves as a binding legal document between the buyer and the seller. Here are key takeaways to consider when filling out and using the Promissory Note for a Car form:

- Include Comprehensive Details: It's crucial to fill out the Promissory Note with all pertinent details including the full names and addresses of both the buyer and the seller, the make, model, and year of the car, the VIN (Vehicle Identification Number), and the total purchase price.

- Detail the Payment Plan: Clearly outline the payment agreement within the Promissory Note. Specify the loan amount, interest rate (if any), repayment schedule (number of payments, frequency, etc.), and the final due date for the full payment.

- Understand the Legal Obligations: Both parties should be aware that the Promissory Note is a legally binding document. The seller has the right to seek legal recourse, including repossessing the car, if the buyer fails to meet the terms of the agreement. Conversely, the buyer is legally protected should the seller fail to uphold the terms regarding the car’s condition or ownership.

- Notarize the Agreement: Though not always required, getting the Promissory Note notarized can add an extra layer of legal protection. A notarized document can help prevent disputes over the authenticity of signatures or the terms of the agreement.

Both the buyer and the seller should retain a copy of the Promissory Note for their records. Should any disagreements or legal issues arise, the Promissory Note will serve as a critical piece of evidence outlining the agreement that was made. Properly completing and understanding the Promissory Note for a Car is essential for protecting the interests of both parties involved in the vehicle transaction.

Other Types of Promissory Note for a Car Templates:

How to Cancel a Promissory Note - Finalizes the borrower's obligation to the lender, allowing for closure and financial planning.