Blank Promissory Note Form

A promissory note is akin to a roadmap for borrowing, laying out the terms and conditions under which money has been lent and must be repaid. This pivotal financial document is instrumental in both personal and business settings, as it legally binds the borrower to repay their debt to the lender according to the specified schedule and with any agreed-upon interest. It strikes at the core of lending transactions, detailing the promise made by one party to pay back another. The importance of this form cannot be overstated, as it serves as a clear record of the loan's parameters, offering security and peace of mind to the lender, while ensuring that the borrower is fully aware of their obligations. From simple loans between friends and family to more complex arrangements involving businesses or real estate, the promissory note form embodies the essence of trust and agreement in financial dealings.

Promissory Note Document Subtypes

Promissory Note Example

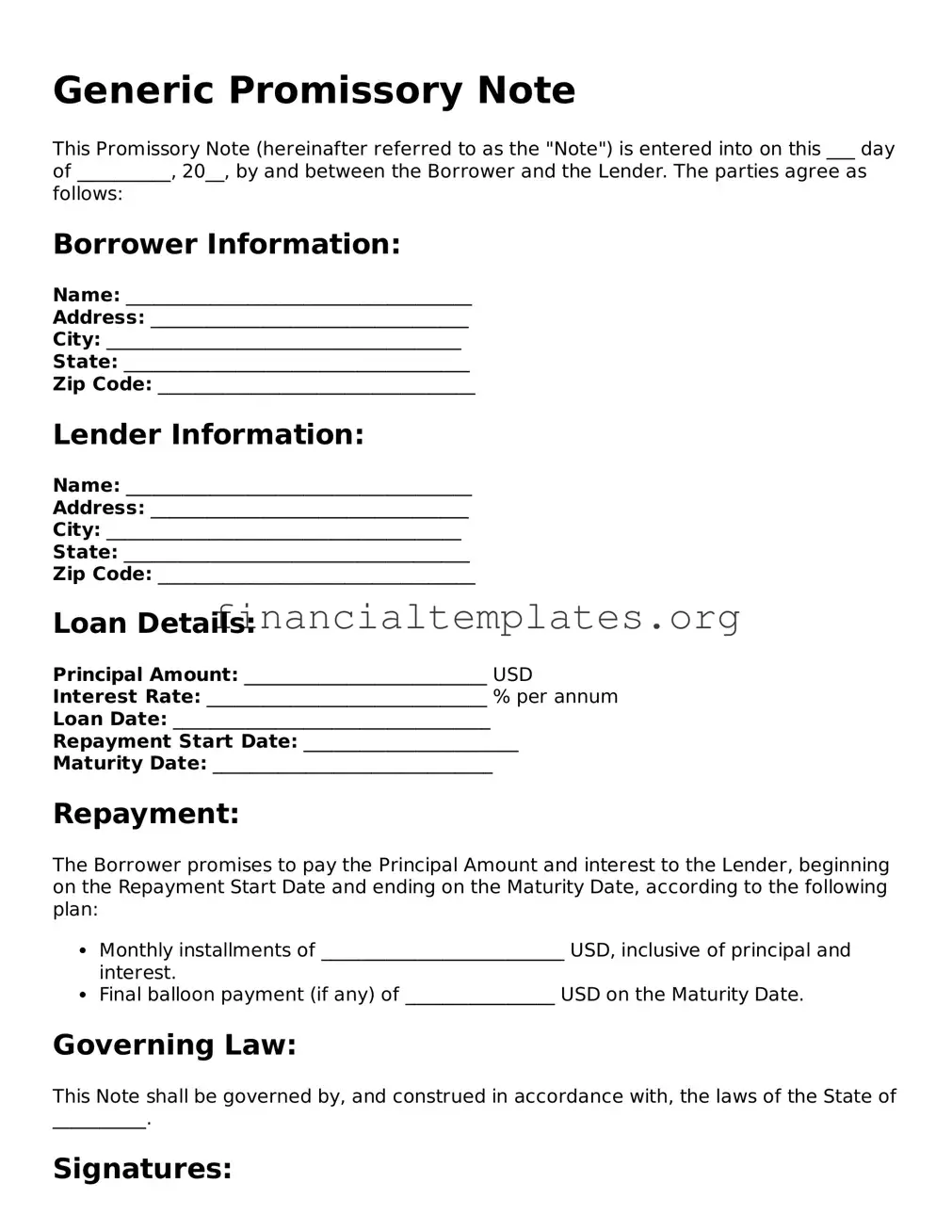

Generic Promissory Note

This Promissory Note (hereinafter referred to as the "Note") is entered into on this ___ day of __________, 20__, by and between the Borrower and the Lender. The parties agree as follows:

Borrower Information:

Name: _____________________________________

Address: __________________________________

City: ______________________________________

State: _____________________________________

Zip Code: __________________________________

Lender Information:

Name: _____________________________________

Address: __________________________________

City: ______________________________________

State: _____________________________________

Zip Code: __________________________________

Loan Details:

Principal Amount: __________________________ USD

Interest Rate: ______________________________ % per annum

Loan Date: __________________________________

Repayment Start Date: _______________________

Maturity Date: ______________________________

Repayment:

The Borrower promises to pay the Principal Amount and interest to the Lender, beginning on the Repayment Start Date and ending on the Maturity Date, according to the following plan:

- Monthly installments of __________________________ USD, inclusive of principal and interest.

- Final balloon payment (if any) of ________________ USD on the Maturity Date.

Governing Law:

This Note shall be governed by, and construed in accordance with, the laws of the State of __________.

Signatures:

By signing below, the Borrower and the Lender agree to the terms of this Note.

Borrower's Signature: __________________________

Date: _________________________________________

Lender's Signature: ___________________________

Date: _________________________________________

PDF Properties

| Fact | Detail |

|---|---|

| Definition | A Promissory Note is a written promise to pay a specified sum of money to a specified person at a specified time or on demand. |

| Key Components | Principal amount, interest rate, repayment schedule, and signatures of the involved parties. |

| Types | There are secured and unsecured Promissory Notes, distinguished by whether collateral is backing the loan. |

| Interest Rate | The interest rate must be clearly stated and should comply with state usury laws to avoid being considered illegal. |

| Repayment Schedule | Details how repayments will be made, including the frequency and the amount of each payment. |

| Collateral | Required only for secured Promissory Notes, it specifies the asset(s) pledged as security for the loan. |

| Governing Law | States have specific laws that govern the execution, enforcement, and penalties related to Promissory Notes. |

| Default Terms | The conditions under which a borrower is considered in default and the remedies available to the lender should be clearly stated. |

| Lender and Borrower Information | Include the full names, addresses, and contact information of both the lender and the borrower. |

| State-Specific Requirements | Some states have unique requirements regarding notarization, witnesses, or specific disclosures that must be included in the Promissory Note. |

Guide to Writing Promissory Note

Completing a Promissory Note form is a crucial step in formalizing the agreement between a borrower and a lender. It establishes a legally binding commitment by the borrower to repay the loan under the conditions agreed upon. This document details the loan amount, interest rate, repayment schedule, and what happens if the borrower fails to make payments. Ensuring that this form is filled out accurately and completely is essential to protect both parties' interests and to avoid potential disputes in the future.

To fill out the Promissory Note form, follow these steps:

- Start by entering the date the promissory note is being created at the top of the form.

- Write the full legal names of both the borrower and the lender, along with their respective addresses.

- Specify the loan amount in words and then in numbers to avoid any confusion.

- Detail the interest rate, clearly stating whether it is a fixed or variable rate, and provide the calculation method if applicable.

- Outline the repayment schedule. Include the number of payments, frequency (monthly, quarterly, annually, etc.), and the due date for the first payment. Also, clearly mention the final payment date.

- Include any additional terms about late fees, prepayment penalties, or what happens in case of a default.

- Both parties should carefully review the promissory note to confirm that all the terms and conditions are correct and fully understood.

- Have the borrower and the lender sign and date the promissory note. Witnesses or a notary public may also be required, depending on state laws.

Once completed, it's important to keep the Promissory Note in a safe place. Both the borrower and the lender should have a copy. This document serves as a critical record of the loan and the commitment to repay it, making it invaluable in maintaining a clear understanding and agreement between the parties involved.

Understanding Promissory Note

-

What is a Promissory Note?

A promissory note is a written promise to pay a specific sum of money to another person or entity at a specified time or on demand. It's a form of financial agreement that outlines the borrower's obligation to repay a loan to the lender, and it can include details on interest rates, repayment schedule, and consequences of non-payment. Essentially, it's a legally binding IOU that provides clarity and protection for both parties involved.

-

Who needs to use a Promissory Note?

Individuals or businesses that borrow or lend money can benefit from using a promissory note. For borrowers, it's a commitment to repay the loan under agreed-upon terms, which can help build trust with the lender. For lenders, it serves as a legal document that can be used in court if the borrower fails to fulfill their repayment obligations. It's particularly useful in personal loans between friends or family members, or in business settings where a formal loan agreement is necessary.

-

What are the key elements that should be included in a Promissory Note?

- Amount Borrowed: The principal amount of the loan.

- Interest Rate: The percentage of the principal charged by the lender as interest.

- Repayment Terms: How and when the loan will be repaid, including any installment plan.

- Maturity Date: The final deadline for repaying the loan in full.

- Parties Involved: The legal names and addresses of the borrower and lender.

- Collateral: Any assets promised to the lender if the borrower fails to repay.

- Signatures: Both parties must sign the document for it to be legally binding.

These elements ensure the promissory note is comprehensive and legally enforceable, providing a clear agreement that protects both the borrower and the lender.

-

Is a Promissory Note legally binding?

Yes, a promissory note is a legally binding document once it has been signed by both the borrower and the lender. It confirms the borrower's promise to repay the loan according to the terms outlined in the document. If the borrower fails to meet their obligations, the lender has the right to pursue legal action to enforce repayment, which could include taking possession of any collateral listed in the note or seeking a judgment for the amount owed. It's essential for both parties to fully understand and agree to the terms before signing to ensure that the promissory note serves its intended purpose as a secure and reliable form of agreement.

Common mistakes

When filling out a Promissory Note, attention to detail is crucial to avoid making errors that could have significant implications. Below, we explore common mistakes people frequently make in this process:

Not specifying the full legal names of the parties involved. It's essential for clarity and legal enforceability.

Omitting the loan amount or writing it inaccurately. Precision in stating the borrowed amount is critical for record-keeping and legal purposes.

Failing to include the interest rate, which can lead to misunderstandings or legal disputes over how much extra money the borrower needs to repay.

Forgetting to set a repayment schedule. A clear timetable for repayments helps in managing financial expectations and obligations.

Neglecting to determine the consequence of late payments. This omission can weaken the lender's position in enforcing timely payments.

Not detailing the security for the loan, if applicable. Specifying collateral can be crucial for secured loans, giving lenders a right to certain assets if the loan is not repaid.

Skipping the inclusion of a governing law clause. Identifying the applicable state law can be instrumental in resolving legal disputes.

Overlooking the need for a co-signer when required. This mistake can pose a risk to the lender, especially with unsecured loans or borrowers with a poor credit history.

Failing to get the promissory note signed and dated by all parties. Signatures are essential for enforceability.

Ignoring the requirement to notarize the document, if applicable. In certain jurisdictions or for specific amounts, notarization may be necessary for legal validity.

Avoiding these mistakes can help ensure that a Promissory Note is legally binding and clear in its terms, protecting the interests of both the lender and borrower.

Documents used along the form

When someone decides to borrow or lend money, completing a Promissory Note is a crucial step in the process. However, this document does not stand alone. To ensure a smooth transaction and protect the interests of both parties, several other forms and documents are often used in conjunction with a Promissory Note. Each of these documents serves unique purposes, ranging from establishing the terms of the loan to detailing the steps for repayment, and even securing the loan with collateral. Let's explore some of these important documents.

- Loan Agreement: This is a comprehensive contract that outlines the terms and conditions of the loan. Unlike a Promissory Note, which is a promise to pay, the Loan Agreement includes detailed clauses about the obligations of both the lender and the borrower.

- Security Agreement: When a loan is secured with collateral, this document is vital. It lists the assets pledged as security for the loan, ensuring that the lender can claim these assets if the loan is not repaid.

- Amortization Schedule: This document breaks down the payment plan for the loan into installments, showing both the interest and principal components of each payment, so the borrower knows exactly what they owe and when.

- Guaranty: A guaranty is used when there is a third party guarantor who promises to repay the loan if the original borrower fails to do so. It adds an extra layer of security for the lender.

- Mortgage Agreement: If real estate is used as collateral for a loan, this agreement secures the loan by putting a lien on the property, which means the lender can foreclose on the property if the borrower defaults on the loan.

- Deed of Trust: Similar to a Mortgage Agreement, this document is used in some states to place a lien on real property. The difference is that it involves a third party, a trustee, who holds the legal title until the loan is fully repaid.

- UCC-1 Financing Statement: For loans secured with personal property (anything that's not real estate), this document is filed to publicly announce the lender's interest in the borrower's personal property as collateral.

- Late Payment Notice: Should the borrower fail to make a payment on time, this notice is sent as a formal reminder and warning of potential future actions if the payment is not received.

- Release of Promissory Note: Once the loan is fully repaid, this document is issued to formally release the borrower from their obligations under the Promissory Note, signaling the end of the loan agreement.

While the Promissory Note is the centerpiece of any lending agreement, these additional documents are indispensable in addressing all aspects of the loan arrangement. Each plays a role in clarifying the terms, protecting the interests of the involved parties, and ensuring the enforcement of the agreement. Crafting a clear and comprehensive set of loan documents can help prevent misunderstandings and conflicts, making for a smoother financial transaction for everyone involved.

Similar forms

A promissory note, a written promise to pay a certain sum of money, shares similarities with a Loan Agreement. Both documents outline the terms under which money is borrowed and must be repaid. However, a Loan Agreement is more comprehensive, covering additional details such as the repayment schedule and consequences of default. Essentially, while a promissory note may serve as a simple IOU, a Loan Agreement offers a more formal and detailed financial commitment between the parties involved.

Mortgage Agreements also bear resemblance to promissory notes, with the main similarity lying in their use to secure loans with property. In a Mortgage Agreement, the borrower agrees to pledge real estate as collateral for the loan, which is detailed in the promissory note. The key difference is that the promissory note acts as evidence of the debt itself, whereas the Mortgage Agreement secures the note with the property, specifying the legal ramifications should the borrower fail to repay.

IOUs, short for "I owe you," are informal documents acknowledging debt, much like promissory notes. However, while an IOU typically notes the amount owed and the debtor, it lacks the detailed repayment terms, interest rates, and legal protections found in a promissory note. Thus, while both signify acknowledgment of debt, promissory notes provide a more legally binding and detailed agreement between the lender and borrower.

Another document similar to a promissory note is the Personal Guarantee. This guarantees that an individual will fulfill a commitment or repay a debt, usually in the context of business loans or leases. While a promissory note binds only those who sign it to the repayment of a debt, a Personal Guarantee extends the responsibility to the personal assets of the guarantor, providing an additional layer of security for the creditor.

Deeds of Trust are used in some states as an alternative to traditional mortgages, functioning alongside promissory notes in the process of securing a loan with property. While the promissory note serves as the borrower's pledge to repay the loan, the Deed of Trust transfers the legal title of the property to a trustee until the loan is paid in full. This arrangement provides another method of ensuring the lender's investment is protected.

Credit Agreements, which encompass terms under which credit is extended by a lender to a borrower, share elements with promissory notes. Both documents outline the amount of money loaned, the repayment schedule, and the interest rate. However, Credit Agreements are typically more complex and can involve revolving lines of credit, unlike the typically fixed sum referenced in a promissory note.

Installment Sales Contracts, utilized when purchases are made on a payment plan, also resemble promissory notes. These contracts detail the purchase price, down payment, and the amounts and dates of installment payments, very much like a promissory note details repayment of a loan. The main difference lies in the context; while promissory notes can be used for any loan, Installment Sales Contracts are specific to the sale of goods.

Bond Issues represent an investment in which the investor loans money to an entity (corporate or governmental) that borrows the funds for a defined period at a fixed interest rate, similar to the interest and repayment terms found in a promissory note. Although both involve a promise to repay the amount borrowed with interest, bonds are typically used for raising capital by companies or governments, offering more complexity and regulatory oversight than a promissory note.

Dos and Don'ts

Understanding the proper way to fill out a Promissory Note is crucial if you want to ensure its legality and effectiveness. While it might seem straightforward, a few best practices and pitfalls to avoid can significantly impact the outcome. Here's a concise guide to help you navigate the process correctly.

Things You Should Do

- Include Full Names and Addresses: Always provide the complete legal names and addresses of both the borrower and the lender. This clarity helps prevent any confusion about the parties involved.

- Be Clear About the Loan Amount: Specify the exact amount of money being loaned. This precision is critical to avoid any disputes about the loan amount.

- Detail Repayment Terms: Clearly outline how and when the loan will be repaid. Include specifics about payment schedules, whether payments are due monthly or at another agreed interval, and specify if the repayment is in installments or a lump sum.

- State the Interest Rate: If the loan involves interest, you must specify the annual percentage rate (APR). Also, clarify if the interest is simple or compounded and how frequently it will be calculated.

Things You Shouldn't Do

- Leave Blank Spaces: Avoid leaving any blank spaces on the form. Blank spaces can lead to alterations or misunderstandings after the note has been signed. If a section doesn’t apply, it’s better to write “N/A” or “0” to indicate it’s not applicable.

- Omit Signatures and Dates: Every promissory note must be signed and dated by all parties involved for it to be legally binding. Skipping this step can render the document unenforceable.

- Ignore State Laws: Every state has its own set of laws governing loans and interest rates. Ensure that the terms of your promissory note comply with these laws to prevent it from being considered illegal or unenforceable.

- Forget to Keep a Copy: After all parties sign the note, each should retain a copy for their records. This documentation is essential for legal protection and to resolve any future disagreements.

Misconceptions

When it comes to promissory notes, various misconceptions can lead to misunderstandings and mismanagement of these financial instruments. Clearing up these misconceptions ensures that both the borrower and lender engage with promissory notes accurately and responsibly. Here are six common misconceptions about promissory notes:

- Promissory notes are only for unsecured loans. This misconception overlooks the fact that promissory notes can be either secured or unsecured. A secured promissory note is backed by collateral, which the lender can claim if the borrower defaults on the loan. An unsecured promissory note, on the other hand, does not have collateral backing it, making it potentially riskier for the lender.

- Only banks can issue promissory notes. It's a common belief that promissory notes are financial instruments exclusive to banks and formal financial institutions. However, private individuals can also create and issue them, as long as the document complies with state laws and clearly outlines the loan's terms and conditions.

- Signing a promissory note means immediate repayment. The belief that signing a promissory note requires immediate repayment misunderstands the purpose and terms outlined in the note. The repayment schedule, including start date and due dates, is detailed in the agreement, offering a clear timeline for repayment which often begins after an agreed-upon period, not immediately after signing.

- Verbal agreements are as binding as written promissory notes. While verbal agreements can be legally binding under certain circumstances, a written promissory note provides a concrete, clear record of the terms agreed upon by all parties. This helps prevent misunderstandings and provides a strong legal foundation should enforcement issues arise.

- Promissory notes and loan agreements are identical. Though they are similar and often used in conjunction with each other, promissory notes and loan agreements serve different purposes. A promissory note is a written promise to pay a specific sum of money by a certain date. A loan agreement is a more comprehensive document that includes a promissory note but also outlines the full terms and conditions of the loan, such as the obligations of each party and the consequences of default.

- There's no need to update a promissory note once it's drafted. Circumstances change, and the terms outlined in a promissory note at its inception may not suit the parties involved throughout the life of the loan. It's important to review and potentially update a promissory note to reflect changes such as adjusted repayment schedules or interest rates. Both parties must agree to any changes, and the updated terms must be added to the original document or included in a new agreement.

Understanding these nuances ensures that promissory notes serve their intended purpose effectively, respecting the interests and needs of both lenders and borrowers. It reminds us that clarity, mutual agreement, and adherence to legal standards are paramount in financial dealings.

Key takeaways

When filling out and using a Promissory Note form, it's important to pay close attention to detail and understand the obligations and rights that it establishes. Below are key takeaways to consider:

- Clear Identification of Parties: The form must clearly identify the borrower and the lender by their full legal names to ensure there's no ambiguity regarding who is involved.

- Loan Amount: It must specify the exact amount of money being loaned. This amount should be written in numbers and spelled out to avoid any confusion or alteration.

- Interest Rate: The interest rate should be expressly stated, including whether it's fixed or variable, to prevent any disputes over the amount of interest due over the term of the loan.

- Repayment Terms: Detailed repayment terms, including the schedule (monthly, quarterly, lump-sum, etc.), start date, and location of payments, provide clarity and reduce the potential for misunderstandings.

- Security or Collateral: If the loan is secured, the Promissory Note should describe the collateral in detail. This description helps protect the lender's interest in the collateral.

- Signatures: Both the borrower and the lender must sign the form. Signatures legally bind the parties to the terms of the Promissory Note.

- Prepayment Terms: The form should address whether the borrower is allowed to pay off the loan early and if any penalties apply for prepayment. Clarity on this point avoids unexpected costs for the borrower.

- Late Fees and Penalties: Clearly define any applicable late fees or penalties for missed payments to incentivize timely repayment and compensate the lender for the increased risk.

- Governing Law: Specify which state's laws will govern the Promissory Note. This is crucial for resolving any legal disputes that might arise.

- Amendments: If any changes to the agreement are necessary, the Promissory Note should outline the process for making amendments. Typically, any changes should be in writing and signed by both parties.

Understanding and carefully adhering to these key points when filling out and using a Promissory Note can help ensure a smooth lending process and avoid legal complications down the line.

Popular Documents

North Carolina Estimated Tax Payments - Accompanying instructions aid taxpayers in accurately projecting their yearly income and the taxes owed, offering clarity on the calculation process.

What Is a 1098t - This form helps delineate which educational expenses were paid out of pocket versus those covered by financial aid, affecting the calculation of potential tax benefits.

ACH Payment Authorization Form - Both parties can keep a copy of the form for their records, ensuring transparency and accountability in the payment process.