Get Policy Loan Request Form

Navigating through the intricacies of obtaining a policy loan can be daunting for policyholders. The Policy Loan Request form, provided by companies such as Western Reserve Life Assurance Co. of Ohio and Transamerica Life Insurance Company, serves as a cornerstone for policyholders aiming to borrow against their life insurance policies. This form outlines essential information including the policy number, owner details, and any changes in contact information, which is critical, especially if a change of address or telephone number has occurred recently. It's worth noting the stringent measures such as possible delays or the need for additional verification in case of recent changes to the policy owner's details to prevent fraud. The form meticulously details the terms and conditions under which a loan can be processed, including the minimum loan amount, the impact of the loan on the policy’s cash value and death benefits, and the specific procedures for loan repayment. Furthermore, it underscores the importance of understanding the potential tax implications and the risk of policy lapse if the loan plus interest exceeds the policy’s account value. This comprehensive approach ensures that both the policyholder and the insurance company are well-protected throughout the loan process.

Policy Loan Request Example

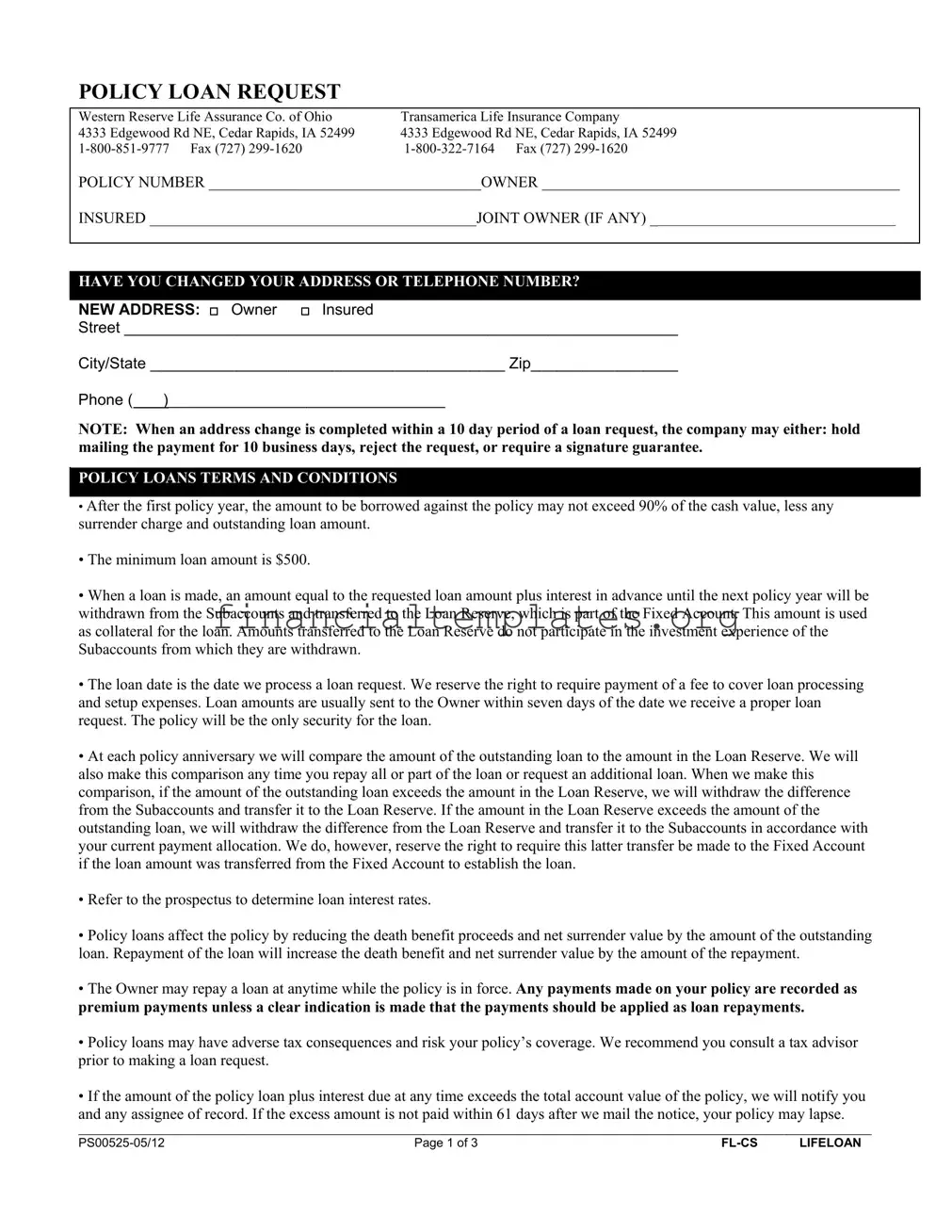

POLICY LOAN REQUEST

|

Western Reserve Life Assurance Co. of Ohio |

Transamerica Life Insurance Company |

||

|

4333 Edgewood Rd NE, Cedar Rapids, IA 52499 |

4333 Edgewood Rd NE, Cedar Rapids, IA 52499 |

||

|

|

|||

|

POLICY NUMBER ___________________________________OWNER ______________________________________________ |

|||

|

INSURED __________________________________________JOINT OWNER (IF ANY) ___________________________________ |

|||

|

|

|

||

|

|

|

||

|

HAVE YOU CHANGED YOUR ADDRESS OR TELEPHONE NUMBER? |

|

||

|

|

|

|

|

|

NEW ADDRESS: Owner |

Insured |

|

|

Street ________________________________________________________________

City/State _________________________________________ Zip_________________

Phone ( )________________________________

NOTE: When an address change is completed within a 10 day period of a loan request, the company may either: hold mailing the payment for 10 business days, reject the request, or require a signature guarantee.

POLICY LOANS TERMS AND CONDITIONS

•After the first policy year, the amount to be borrowed against the policy may not exceed 90% of the cash value, less any surrender charge and outstanding loan amount.

•The minimum loan amount is $500.

•When a loan is made, an amount equal to the requested loan amount plus interest in advance until the next policy year will be withdrawn from the Subaccounts and transferred to the Loan Reserve, which is part of the Fixed Account. This amount is used as collateral for the loan. Amounts transferred to the Loan Reserve do not participate in the investment experience of the Subaccounts from which they are withdrawn.

•The loan date is the date we process a loan request. We reserve the right to require payment of a fee to cover loan processing and setup expenses. Loan amounts are usually sent to the Owner within seven days of the date we receive a proper loan request. The policy will be the only security for the loan.

•At each policy anniversary we will compare the amount of the outstanding loan to the amount in the Loan Reserve. We will also make this comparison any time you repay all or part of the loan or request an additional loan. When we make this comparison, if the amount of the outstanding loan exceeds the amount in the Loan Reserve, we will withdraw the difference from the Subaccounts and transfer it to the Loan Reserve. If the amount in the Loan Reserve exceeds the amount of the outstanding loan, we will withdraw the difference from the Loan Reserve and transfer it to the Subaccounts in accordance with your current payment allocation. We do, however, reserve the right to require this latter transfer be made to the Fixed Account if the loan amount was transferred from the Fixed Account to establish the loan.

•Refer to the prospectus to determine loan interest rates.

•Policy loans affect the policy by reducing the death benefit proceeds and net surrender value by the amount of the outstanding loan. Repayment of the loan will increase the death benefit and net surrender value by the amount of the repayment.

•The Owner may repay a loan at anytime while the policy is in force. Any payments made on your policy are recorded as premium payments unless a clear indication is made that the payments should be applied as loan repayments.

•Policy loans may have adverse tax consequences and risk your policy’s coverage. We recommend you consult a tax advisor prior to making a loan request.

•If the amount of the policy loan plus interest due at any time exceeds the total account value of the policy, we will notify you

and any assignee of record. If the excess amount is not paid within 61 days after we mail the notice, your policy may lapse.

___________________________________________________________________________________________________________________________________

Page 1 of 3 |

LIFELOAN |

REQUEST INFORMATION

Partial Loan Net Amount $ _______________________ Gross Amount $_____________________

Maximum Available Note: WRL will hold recent payments for 15 days.

Is the Policy on Monthly Draft? □ Yes □ No

If YES, would you like your Payments to go towards Loan Repayment? □ Yes □ No

DISBURSEMENT METHOD INFORMATION

I would like to receive my disbursement sent: (Please select only one option)

By Regular Mail

Overnight (fee applies)

Wire Transfer (fee applies) Trust bank accounts must be titled with the name of the Trust and NOT the Trustee’s name.

________________________________________ ___________________________________________________________

Bank Name |

Bank Address |

|

_________________________ |

___________________________________ |

___________________________________ |

Bank Phone Number |

Bank Routing Number |

Bank Account Number |

___________________________________________________________________________________________________________________________________

Page 2 of 3 |

LIFELOAN |

SIGNATURES

Signature of Policy Owner __________________________________________________________ Date ________________

_______________________________________________________________________

Print Name / Title (POA, Trustee, Guardian, etc.)

Signature of Power of Attorney ______________________________________________________ Date _________________

Signature of Joint Owner or Spouse___________________________________________________ Date ________________

Signature is required for jointly owned policies

Signature of Assignee______________________________________________________________ Date ________________

Request must contain the owner’s signature.

NOTE: Medallion Signature Guarantee required for withdrawal of $500,000 or more. A Medallion Signature Guarantee will also be required where proceeds are to be sent to an address other than the address of record. Signatures must be guaranteed by a national or state bank or a member of a national stock exchange or any other institution which is an eligible guarantor institution as defined by the rules and regulations of the Securities and Exchange Commission. A Notarization is not acceptable.

MEDALLION SIGNATURE GUARANTEE

Signature: ____________________________________

Please Note: Unless we have been notified of a community or marital property interest in this contract, we will rely on our good faith belief that no such interest exists and will assume no responsibility for inquiry. The contract owner agrees to indemnify and hold the Insurance Company harmless from the consequences of accepting this transaction.

Faxes may be accepted up to $499,999.

___________________________________________________________________________________________________________________________________

Page 3 of 3 |

LIFELOAN |

Document Specifics

| Fact Name | Description |

|---|---|

| Form Identification | Policy Loan Request for Western Reserve Life Assurance Co. of Ohio and Transamerica Life Insurance Company |

| Submission Addresses | 4333 Edgewood Rd NE, Cedar Rapids, IA 52499 with contact numbers for submission and queries. |

| Minimum Loan Amount | The minimum loan amount that can be requested is $500. |

| Loan Conditions | Only up to 90% of the cash value, less any surrender charges and outstanding loan amounts, can be borrowed after the first policy year. |

| Interest and Repayment | Loan interest rates are defined in the prospectus, and the owner may repay a loan at any time the policy is in force. |

| Impact on Policy | A loan reduces the policy's death benefit and net surrender value by the amount of the outstanding loan, while repayment will increase them accordingly. |

| Governing Law | The forms and transactions are likely governed by the laws of Ohio, where Western Reserve Life Assurance Co. of Ohio is based, and federal regulations as applicable. |

Guide to Writing Policy Loan Request

Requesting a policy loan requires careful completion of the Policy Loan Request form. This process involves providing detailed information about your policy, deciding on the loan amount, and specifying how you'd like to receive the funds. Remember, loans against your policy can affect your policy’s benefits and cash value, so it's important to consider the terms and conditions. Follow these instructions to ensure your request is processed smoothly.

- Enter your POLICY NUMBER in the designated space.

- Write the names of the OWNER, INSURED, and JOINT OWNER (IF ANY) in the corresponding fields.

- Check if you have changed your address or telephone number recently. If yes, provide the NEW ADDRESS for both owner and insured, including street, city/state, zip code, and phone number.

- Read the POLICY LOANS TERMS AND CONDITIONS carefully to understand the implications of taking out a loan against your policy.

- Under LIFELOAN REQUEST INFORMATION, specify the Partial Loan Net Amount and Gross Amount, and take note of the Maximum Available amount you can request. Decide if the policy is on monthly draft and whether you'd like your payments to go towards loan repayment.

- Choose your preferred DISBURSEMENT METHOD. You can select to have the disbursement sent by regular mail, overnight (for a fee), or wire transfer (for a fee). Provide your bank details if opting for wire transfer, including bank name, address, phone number, routing number, and account number.

- Sign and date the form in the LIFELOAN SIGNATURES section. Make sure the policy owner, any power of attorney, joint owner or spouse, and assignee (if applicable) sign the form. Printed names and titles should also be provided for clarity.

- If withdrawing $500,000 or more, obtain a MEDALLION SIGNATURE GUARANTEE. Note that this is also required if the proceeds are to be sent to an address different from the address of record. Be aware that notarization is not acceptable in place of a signature guarantee.

Once completed, you can submit your Policy Loan Request form via fax, as specified on the form. Keep in mind, processing times may vary, but loan amounts are generally sent to the owner within seven days of receipt of a proper request. Always consider consulting with a tax advisor before proceeding, as taking a loan against your policy's value may have tax implications and affect your coverage.

Understanding Policy Loan Request

FAQs about the Policy Loan Request Form

- What is the minimum loan amount I can request?

The minimum amount you are allowed to borrow against your policy is $500. This ensures that loans are for substantial amounts, helping manage the administrative overhead efficiently.

- Can I request a loan in the first year of my policy?

No, loans can only be requested after the first policy year. This allows time for your policy's cash value to build up, providing a base for the loan.

- How much can I borrow against my policy?

You can borrow up to 90% of the policy's cash value, minus any surrender charges and outstanding loan amounts. This limit helps to ensure that the policy remains in force and continues to provide coverage.

- What happens if I change my address or phone number?

If you have recently changed your address or phone number, notify the company as soon as possible. For security reasons, if the address change occurs within a 10-day period of a loan request, the company may choose to hold the payment for 10 business days, reject the request, or require a signature guarantee to process the loan.

- How will a policy loan affect my life insurance policy?

Policy loans reduce the death benefit and net surrender value of the policy by the outstanding loan amount. Repaying the loan restores the death benefit and net surrender value by the amount repaid. However, taking a loan against your policy may have adverse tax consequences and potentially risk the coverage of your policy.

- What are the consequences of failing to repay the policy loan?

If the total loan amount plus accrued interest exceeds the policy's total cash value, the insurance company will notify the policy owner. If the excess amount is not repaid within 61 days of the notice, the policy may lapse, potentially ending the insurance coverage.

It's important to carefully consider the implications of a policy loan and consult a tax advisor if necessary. This ensures that you make informed decisions regarding your life insurance policy and its benefits.

Common mistakes

Filling out a Policy Loan Request form correctly is crucial to ensure that the process is smooth and without delay. Often, individuals make mistakes that can lead to the rejection of their request or a delay in processing. Here are some common errors to avoid when filling out the Policy Loan Request form:

Not checking the policy number: One of the most common mistakes is entering the wrong policy number or leaving it blank. The policy number is a unique identifier and is crucial for processing your loan request.

Omitting owner or insured information: Failing to provide complete details about the policy owner and the insured can lead to delays. It's important to include full names and check for any joint owners.

Skipping address or phone number updates: If you've recently changed your address or phone number, it's essential to update this information on the form. Neglecting this step can cause communication issues.

Ignoring loan terms and conditions: Not reading the loan terms and conditions carefully may lead to misunderstandings about the loan amount, interest rates, and repayment options. Ensure you understand these terms before submitting your request.

Selecting incorrect disbursement method: Ensure you select your preferred disbursement method—regular mail, overnight, or wire transfer—and provide accurate banking information if required. Incorrect information could delay or misdirect funds.

Forgetting to sign the form: The form requires the signatures of the policy owner, and potentially a joint owner or assignee. Missing signatures can invalidate your request.

To ensure a smooth loan request process, double-check all entries on your form, pay close attention to the details required, and understand the terms and conditions. Addressing these common mistakes can help avoid delays and ensure that your policy loan request is processed efficiently.

Documents used along the form

When applying for a policy loan, it's not just the loan request form that you'll need to consider. There are several other documents that are commonly used in the application process. Each of these documents plays a crucial role in ensuring the transaction proceeds smoothly and that all legal and company-specific requirements are comprehensively addressed. Let's take a closer look at some of these essential documents.

- Loan Agreement: Outlines the terms and conditions of the loan itself, including the interest rate, repayment schedule, and what happens in case of default.

- Change of Address Form: If the policy owner has recently moved, this form updates the mailing and contact information to ensure all correspondence reaches the new address.

- Automatic Payment Authorization Form: For policy owners who prefer the convenience of automatic loan repayments, this document sets up regular payments from a bank account.

- Signature Guarantee Form: Required for large loan amounts or when sending proceeds to a new address, this form verifies the identity of the person signing the policy loan request.

- Bank Information Form: Needed for direct deposit of loan funds, it includes bank routing and account numbers.

- Power of Attorney Documentation: If someone other than the policy owner is completing the loan request, this document proves their legal authority to act on the owner’s behalf.

- Amendment Agreement: If there are any changes to the terms of the loan after the initial agreement, those changes are documented here.

- Surcharge Disclosure Form: If applicable, this discloses any additional fees or surcharges that may be associated with the loan.

- Tax Advice Acknowledgment Form: Since taking out a policy loan may have tax implications, some companies require acknowledgement that the policy owner has been advised to seek tax advice.

Gathering and completing these documents can seem daunting at first. However, each plays an important role in the policy loan process, ensuring that all aspects of the loan are clear, legal, and aligned with the policy owner's needs and obligations. Understanding and properly preparing these forms can significantly streamline the application process, allowing for a smoother and more efficient transaction.

Similar forms

The "Change of Beneficiary" form, which policyholders use to update the beneficiary designations on their life insurance policies, shares similarities with the Policy Loan Request form. Both documents require policyholder action affecting the terms or benefits of the policy. Like the loan request, changing a beneficiary impacts the policy's eventual payout, necessitating careful identification of the policy and parties involved.

A "Life Insurance Application" form, where individuals apply for life insurance coverage, has parallels to the Policy Loan Request form. In both cases, detailed personal information, including the insured's name and address, is crucial for processing. Furthermore, both forms might require additional documentation or verification, reflecting the insurance company's need to assess risk and confirm the details provided.

The "Address Change Notification" form, used to update contact information with the insurance company, resembles the Policy Loan Request form in its administrative nature. Both forms involve modifying the policyholder's details on record, underscoring the importance of accurate, current information for communication and processing transactions, including loans against the policy.

A "Life Insurance Claim Form," submitted to request payout upon the insured's death, shares the requirement for precise policy and owner information, similar to the loan request form. Both forms trigger financial transactions from the insurer -- one a loan disbursement, the other a death benefit -- predicated on the policy's details and the contractual obligations of the insurance company.

The "Automatic Premium Loan Provision" form, enabling automatic loan applications against a policy's cash value to cover unpaid premiums, shares functional parallels with the Policy Loan Request form. Both deal with the policy's cash value and loans, although their triggers and purposes differ, demonstrating how policyholders can leverage their policy's cash value in various ways.

A "Policy Surrender Form," used when a policyholder decides to terminate their policy for its cash value, is conceptally akin to the Policy Loan Request form. While one requests a loan against the policy, the other ends the policy -- both involve detailed understanding of the policy's terms and the implications on the policy's value and the insured's coverage.

The "Premium Payment Option Change" form, used to modify how a policy's premiums are paid, relates to the Policy Loan Request form through the landscape of policy management and the impact on cash flows. Altering payment methods and receiving a policy loan both necessitate an understanding of the policy's financial aspects, including cash values and premium payments.

The "Benefit Update Form," which policyholders use to adjust the levels or types of coverage within their policy, engages with policy modifications similar to the Policy Loan Request form. Both forms reflect changes to the policy's structure or benefits, albeit in different contexts, emphasizing the policyholder's role in managing their insurance coverage.

Lastly, the "Collateral Assignment" form, where a policy's benefits are assigned as collateral for a loan, is related in its use of the policy's value in financial transactions. Like the policy loan request, it involves both the policyholder and insurer in a formal agreement about the policy's financial utility, respecting legal and contractual boundaries.

Dos and Don'ts

When completing the Policy Loan Request form, it's critical to get it right to avoid errors that could delay or invalidate your request. Here are the dos and don'ts to keep in mind:

Do:

- Review the terms and conditions carefully. Understanding the impact of a policy loan on your insurance and its terms is crucial for making an informed decision.

- Verify your policy number and personal information. Double-check that all details, such as the policy number and owner information, are correct to prevent processing delays.

- Indicate your disbursement method clearly. Choose only one method of receiving the loan amount and ensure all necessary bank details are provided accurately if opting for wire transfer.

- Sign the request form. Your signature is mandatory; ensure that all required parties, such as the joint owner or assignee if applicable, also sign the form.

- Consult a tax advisor if unsure about potential implications. Taking out a policy loan may have tax consequences; getting professional advice is advisable.

Don't:

- Overlook any address or phone number changes. If your address or phone number has changed, provide the new details to prevent issues with your request.

- Request more than the maximum allowable loan amount. Remember, the loan cannot exceed 90% of the cash value of your policy after deductions.

- Ignore the processing time and signatures requirement for large withdrawals. For withdrawals of $500,000 or more, a Medallion Signature Guarantee is required. Understand the specifics to avoid unnecessary delays.

- Forget to specify your preference for loan repayment. If you want your monthly drafts to go towards repaying the loan, make it clear in your request.

- Underestimate tax and coverage implications. Be aware that a policy loan can affect your insurance coverage and can have adverse tax effects.

Misconceptions

When dealing with a Policy Loan Request form, several misconceptions commonly arise. Understanding the correct information can help policyholders navigate the process efficiently. Here are five common misconceptions explained:

- Policy loans are automatically the best financial option. While policy loans can provide a convenient source of funds, they are not necessarily the most cost-effective or suitable option for every individual. The loans reduce the policy's death benefit and net surrender value. Therefore, it's crucial to consider other financial avenues and consult with a financial advisor before proceeding.

- There's no need to repay the loan as long as premiums are paid. Though policy loans offer flexibility in repayment, failing to repay the loan can significantly impact the policy's value and the death benefit. Any outstanding loan plus interest could eventually exceed the policy's cash value, risking policy lapse. It's important to understand the repayment terms and plan accordingly.

- Loan interest rates are negligible or non-existent. Contrary to what some policyholders might think, policy loans come with interest rates that can vary. These rates are determined by the insurance company and can have a substantial impact on the overall cost of borrowing against a policy. Policyholders should refer to their policy prospectus or contact the company for the current rates.

- You can borrow up to 100% of the policy's cash value. In reality, the amount that can be borrowed is limited to a maximum of 90% of the cash value, minus any surrender charges and outstanding loan balances. This is to protect the policy's integrity and ensure the insurance company can still cover the death benefit.

- The process to request a policy loan is lengthy and complicated. While it's true that there are specific steps and requirements, such as completing the Policy Loan Request form and possibly obtaining a Medallion Signature Guarantee for large withdrawals, the overall process is designed to be straightforward. Most companies aim to disburse loan amounts within a few days of receiving a proper request, making it a relatively quick way to access funds.

Understanding these misconceptions can help policyholders make more informed decisions when considering a policy loan. Always read the loan terms carefully and consider consulting with a tax advisor or financial planner to understand the implications fully.

Key takeaways

Understanding the nuances of the Policy Loan Request form can serve as a critical guide for individuals looking to borrow against their life insurance policies. Here are key takeaways to ensure a smooth and informed process:

- Loan eligibility kicks in after the first policy year, allowing borrowers to request up to 90% of their policy's cash value, considering any surrender charges and outstanding loan amounts.

- The minimum amount one can borrow is set at $500, making it a viable option for significant financial needs rather than small, everyday expenses.

- Upon loan approval, the equivalent of the loan amount plus the interest for the upcoming year is moved to a Loan Reserve within the Fixed Account, securing the loan but also removing these funds from potentially higher-earning subaccounts.

- Processing times are relatively quick, with loan disbursements usually occurring within seven days of receiving a properly completed loan request.

- Each policy anniversary triggers a comparison between the outstanding loan and the Loan Reserve amounts. Adjustments are made accordingly to ensure the loan remains adequately secured.

- Interest rates on policy loans are detailed in the policy's prospectus, emphasizing the importance of reviewing this document for specific loan terms.

- Policy loans directly impact the policy's death benefit and net surrender value, with loan repayments restoring these values accordingly.

- Repayment flexibility allows policy owners to make loan repayments at any time, provided clear instructions are given to apply payments towards the loan instead of premium payments.

- Borrowers should be aware of potential adverse tax consequences and the risk of impacting their policy coverage, making consultation with a tax advisor a prudent step.

- A loan that, including interest, surpasses the total policy account value prompts a notification to the owner and any assignees, with a 61-day period to rectify the overage before the policy risks lapsing.

It's pivotal to approach the decision to take out a policy loan with care, considering both the immediate financial relief it can provide and its long-term impact on the insurance policy's value and the benefits it can deliver. Furthermore, ensuring all requested information is accurately reported and understanding the terms and conditions in full can prevent unexpected complications and help maintain the policy’s intended protective role.

Popular PDF Documents

South Carolina State Tax Form - Directions for claiming a subsistence allowance for days served in specific capacities, reducing taxable income.

What Is Estimated Tax? - Quarterly tax payments made with the 1040-ES can help taxpayers avoid interest and penalties.

What Is a W2 - A document summarizing your gross earnings and how much of those earnings went to taxes.