Get Phoenix Az Sales Tax Form

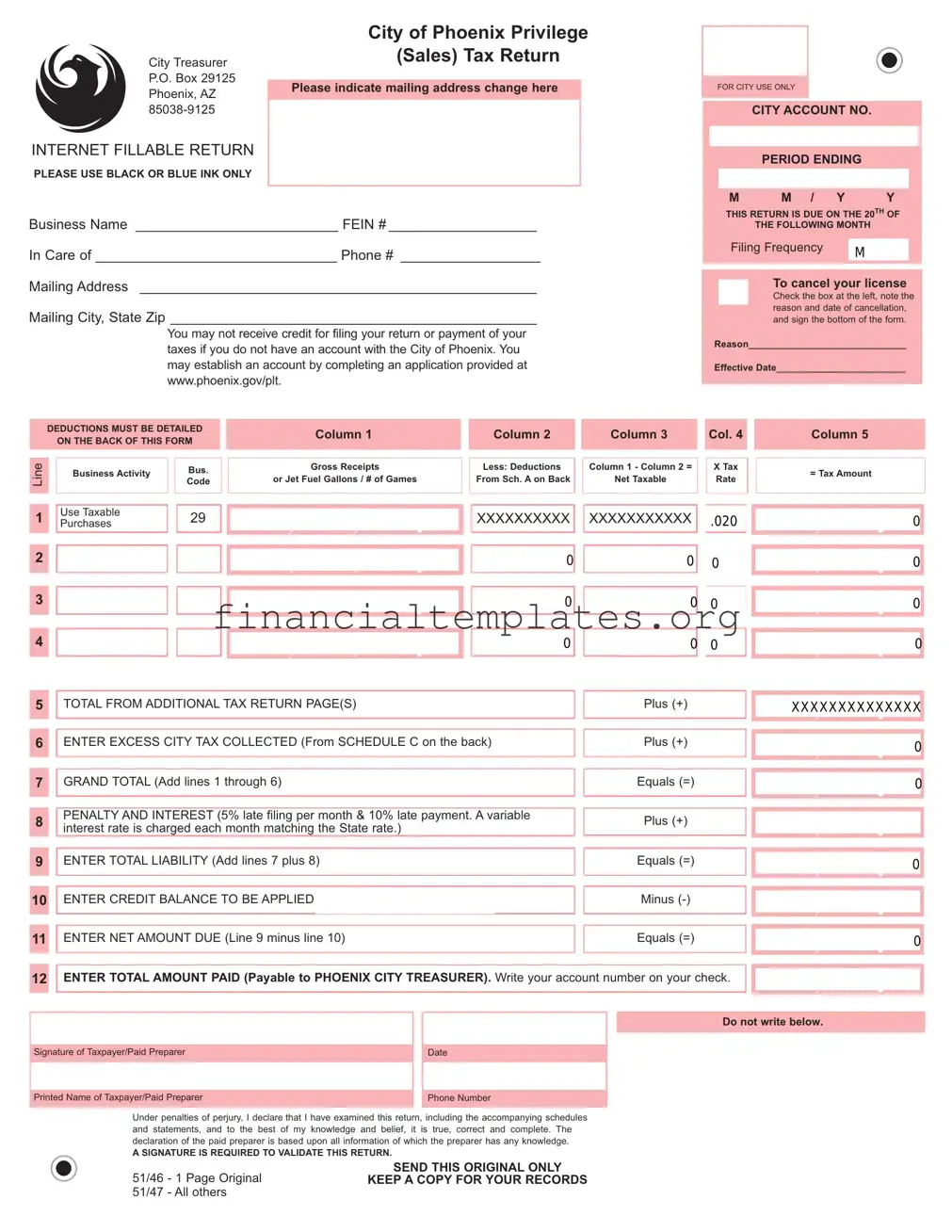

Understanding the nuances of local tax obligations is crucial for businesses operating within specific jurisdictions, such as the City of Phoenix, Arizona. The Phoenix AZ Sales Tax Form, formally referred to as the City of Phoenix Privilege (Sales) Tax Return, represents a critical compliance document for local businesses. Managed by the City Treasurer and requiring submission to a designated P.O. Box, this document facilitates the reporting and payment of local sales taxes. The form meticulously outlines various sections including business and taxpayer information, filing details, and calculates tax liabilities based on gross receipts, allowable deductions, and applicable rates for different types of business activities. It also provides a framework for reporting additional taxes collected, credits, penalties, and interest, if any. Importantly, detailed instructions for deductions (Schedule A) and the handling of credit balances or excess tax collected (Schedules B and C) support businesses in accurately calculating their tax due. The form emphasizes the importance of black or blue ink for clarity, indicates procedures for license cancellation, and underscores the necessity of timely filing—specifically by the 20th of the month following the reporting period—to avoid penalties. This document is not only a tax return but a comprehensive tool for ensuring businesses contribute their fair dues to the municipal coffers, thereby supporting local infrastructure, services, and community development.

Phoenix Az Sales Tax Example

City Treasurer P.O. Box 29125 Phoenix, AZ

INTERNETFILLABLE RETURN

PLEASE USE BLACK OR BLUE INK ONLY

City of Phoenix Privilege

(Sales) Tax Return

|

|

|

Please indicate mailing address change here |

|

FOR CITYUSE ONLY |

|

|

|

CITYACCOUNT NO.

PERIOD ENDING

M |

M / Y |

Y |

Business Name __________________________ FEIN #___________________

In Care of _______________________________ Phone # __________________

Mailing Address ____________________________________________________

Mailing City, State Zip ________________________________________________

You may not receive credit for filing your return or payment of your taxes if you do not have an account with the City of Phoenix. You may establish an account by completing an application provided at www.phoenix.gov/plt.

THIS RETURN IS DUE ON THE 20TH OF

THE FOLLOWING MONTH

Filing Frequency |

M |

|

To cancel your license Check the box at the left, note the reason and date of cancellation, and sign the bottom of the form.

Reason______________________________

Effective Date_________________________

DEDUCTIONS MUST BE DETAILED

ON THE BACK OF THIS FORM

Line |

|

Business Activity |

|

Bus. |

|

|

Code |

||

|

|

|

||

|

|

|

|

|

Column 1

Gross Receipts

or Jet Fuel Gallons / # of Games

Column 2 |

|

Column 3 |

|

|

|

|

|

|

|

|

|

Less: Deductions |

|

Column 1 - Column 2 = |

|

From Sch. Aon Back |

|

Net Taxable |

|

|

|

|

|

Col. 4

XTax Rate

Column 5

= Tax Amount

1 |

Use Taxable |

29 |

Purchases |

, |

, |

|

|

|

|

. |

|

XXXXXXXXXX XXXXXXXXXXX |

.020

,

0

.

2 |

, |

, |

0 |

0 |

0

,

0

. |

.

3

, |

, |

0

0 |

0 |

,

0

. |

.

4 |

|

|

|

|

|

, |

, |

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 0

,

0

.

5 TOTALFROM ADDITIONALTAX RETURN PAGE(S) |

Plus (+)

XXXXXXXXXXXXXX

,

.

6 ENTER EXCESS CITYTAX COLLECTED (From SCHEDULE C on the back) |

Plus (+)

,

0

7 |

|

GRAND TOTAL(Add lines 1 through 6) |

||

|

|

|

|

|

|

|

|

|

|

8 |

|

PENALTYAND INTEREST(5% late filing per month & 10% late payment. Avariable |

||

|

interest rate is charged each month matching the State rate.) |

|||

|

|

|

|

|

9 |

|

ENTER TOTALLIABILITY(Add lines 7 plus 8) |

||

|

|

|

|

|

|

|

|

|

|

10 |

|

ENTER CREDITBALANCE TOBE APPLIED |

(From SCHEDULE B on back) |

|

|

|

|

|

|

Equals (=)

Plus (+)

Equals (=)

Minus

,

,

,

,

.

0

.

.

0

.

.

11 ENTER NETAMOUNTDUE (Line 9 minus line 10) |

Equals (=)

,

0

.

12ENTER TOTALAMOUNT PAID (Payable to PHOENIX CITY TREASURER). Write your account number on your check.

,

.

Do not write below.

Signature of Taxpayer/Paid Preparer

Printed Name of Taxpayer/Paid Preparer

Date

Phone Number

Under penalties of perjury, I declare that I have examined this return, including the accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct and complete. The declaration of the paid preparer is based upon all information of which the preparer has any knowledge.

ASIGNATURE IS REQUIRED TO VALIDATE THIS RETURN.

SEND THIS ORIGINAL ONLY

51/46 - 1 Page Original KEEPACOPY FOR YOUR RECORDS 51/47 - All others

Account

No.

City of Phoenix Privilege (Sales) Tax Return — page 2

Schedule A - Details of Deductions: Enter the deductions included in the gross used in computing your city

privilege (sales) tax. Please note: Not all deductions are available to all business classifications.

The line numbers at the top of each column correspond with the line numbers on the front page (no Line 1 is listed).

SCHEDULE A |

Ded Code |

||

Deduction Description |

|||

|

|

|

|

|

|

|

|

Total combined tax |

64 |

||

(State, county, and city) |

|||

|

|||

|

|

|

|

Bad debt on which tax was |

|

81 |

|

paid |

|

|

|

|

|

||

Sales for resale |

54 |

||

|

|

||

|

|

|

|

Repair, service or installation |

63 |

||

labor |

|

||

|

|

||

Discounts/Refunds/Returns |

52 |

||

|

|

||

|

|

||

Freight out or delivery |

74 |

||

charges |

|||

|

|||

|

|

||

Sales to qualified health org. |

65 |

||

|

|

||

|

|

||

Sales to U.S. Government- |

56 |

||

Byretailer 50% deductibl |

|

||

|

|

||

Sales to U.S. Government- |

57 |

||

By manufacturer (100% deductible) |

|||

|

|

||

|

|

||

55 |

|||

|

|

||

|

|

||

82 |

|||

|

|

||

|

|

||

35% Construction Contracting |

70 |

||

|

|

||

|

|

||

Exempt Subcontracting |

71 |

||

Income |

|||

|

|||

|

|

||

62 |

|||

|

|

||

|

|

||

Food stamp sales |

93 |

||

|

|

||

|

|

|

|

Sales of motor vehicle |

59 |

||

gasoline and use fuel |

|||

|

|||

|

|

||

Sales/Leases of exempt |

73 |

||

machinery & equipment |

|||

|

|||

|

|

||

Prescription drugs/prosthetics |

58 |

||

|

|

||

|

|

||

Lottery ticket sales |

68 |

||

|

|

|

|

Misc. Deductions - Please explain here.

|

|

Line 2 Bus. Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

. |

|

|

|

|

|

, |

, |

|

|

|

|

. |

|

|

|

|

|

, |

, |

|

|

|

|

. |

|

|

|

|

, |

, |

|

|

|

|

|

. |

|

|

|

|

, |

, |

|

|

|

|

|

. |

|

|

|

|

, |

, |

|

|

|

|

|

. |

|

|

|

|

, |

, |

|

|

|

|

|

. |

|

|

|

|

, |

, |

|

|

|

|

|

. |

|

|

|

|

, |

, |

|

|

|

|

|

. |

|

|

|

|

, |

, |

|

|

|

|

|

. |

|

|

|

|

, |

, |

|

|

|

|

|

. |

|

|

|

|

, |

, |

|

|

|

|

|

. |

|

|

|

|

, |

, |

|

|

|

|

|

. |

|

|

|

|

, |

, |

|

|

|

|

|

. |

|

|

|

|

, |

, |

|

|

|

|

|

. |

|

|

|

|

, |

, |

|

|

|

|

|

. |

|

|

|

|

, |

, |

|

|

|

|

|

. |

|

|

|

|

, |

, |

|

|

|

|

|

. |

|

|

|

|

, |

, |

|

|

|

|

|

. |

|

Line 3 Bus. Code |

|

|

|

|

|

|

|

|

|

|

, |

, |

|

|

|

. |

|

|

|

, |

, |

|

|

|

. |

|

|

|

, |

, |

|

|

|

. |

|

|

|

, |

, |

|

|

|

. |

|

|

|

, |

, |

|

|

|

. |

|

|

|

, |

, |

|

|

|

. |

|

|

|

, |

, |

|

|

|

. |

|

|

|

, |

, |

|

|

|

. |

|

|

|

, |

, |

|

|

|

. |

|

|

|

, |

, |

|

|

|

. |

|

|

|

, |

, |

|

|

|

. |

|

|

|

, |

, |

|

|

|

. |

|

|

|

, |

, |

|

|

|

. |

|

|

|

, |

, |

|

|

|

. |

|

|

|

, |

, |

|

|

|

. |

|

|

|

, |

, |

|

|

|

. |

|

|

|

, |

, |

|

|

|

. |

|

|

|

, |

, |

|

|

|

. |

|

|

|

, |

, |

|

|

|

. |

|

|

|

Line 4 Bus. Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

|

|

. |

|

Other Ded:

, |

, |

|

|

|

|

. |

|

, |

, |

|

|

|

|

. |

|

, |

, |

|

|

|

|

. |

|

TOTAL DEDUCTIONS (Copy to Front)

0

, |

, |

. |

|

|

, |

, |

0 |

|

|

|

. |

|

0

, |

, |

. |

|

|

SCHEDULE B Credit Details (please verify credit before claiming)

Account Credit |

|

B |

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

, |

, |

|

|

+ |

|

||||

|

|

|

. |

|||

Total Schedule B |

, |

, |

|

|||

|

|

|

|

|||

SCHEDULE C

Excess Tax Collected |

|

|

Line 2 |

|

|

|

|

|

|

|

|

By business class code |

|

C |

Line 3 |

|

|

|

+ Line 4 |

|

|

|

|

Total Schedule C |

|

|

|

,

,

,

.

.

.

(copy total to front, line 10) |

. |

(copy total to front, line 6)

,

0

.

POSTMARKS ARE NOT ACCEPTED AS EVIDENCE OF TIMELY FILING.

FOR ASSISTANCE, CALL: City of Phoenix

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | The form is specifically for reporting City of Phoenix Privilege (Sales) Tax and must be filled out with black or blue ink only. |

| 2 | Mailing address changes can be indicated directly on the form, ensuring the city has the most current information. |

| 3 | It's critical to have a City of Phoenix account to receive credit for tax returns or payments; if not, an application must be completed at www.phoenix.gov/plt. |

| 4 | To cancel a license, a specific box must be checked, including the reasoning and effective date, then signed at the bottom of the form. |

| 5 | This tax return is due on the 20th of the month following the reporting period. |

| 6 | Deductions must be detailed on the back of the form and include a wide range of categories from bad debt to sales to the U.S. government. |

| 7 | Penalties for late filing and late payment are clearly outlined, including a 5% late filing fee per month and a 10% late payment fee, alongside a variable interest rate matching the State rate. |

| 8 | The form requires the taxpayer or paid preparer's signature to validate the return, under the penalties of perjury. |

| 9 | For assistance, taxpayers are directed to contact the City of Phoenix via phone, TTY, fax, or visit their website, highlighting the channels available for support. |

Guide to Writing Phoenix Az Sales Tax

Filling out the Phoenix AZ Sales Tax Form requires detailed attention to ensure accurate reporting and compliance with local tax obligations. By following a step-by-step approach, businesses can accurately calculate and report their sales tax liability. This process not only helps in fulfilling legal requirements but also in maintaining a positive standing with tax authorities. The following steps have been designed to guide through the completion of the form, ensuring all necessary information is correctly inputted and submitted.

- Begin by writing the City Account Number at the top right, followed by the period ending date in the format MM/YY.

- Under "Business Name," provide the official name of your business, and input the Federal Employer Identification Number (FEIN) in the designated space.

- If the mailing address of the business has changed, mark the checkbox provided and fill in the new address details below.

- To cancel your license, check the box next to the cancellation section, state the reason and effective date of cancellation, then sign at the bottom of the form.

- On the main table, starting with Line 1, enter the business activity code, business gross receipts, and allowable deductions. Calculate the net taxable amount by subtracting deductions from gross receipts.

- Proceed by entering the tax rate applicable to each business activity. Multiply the net taxable amount by the tax rate to calculate the tax amount due.

- Sum all amounts for each line entry to calculate the total from additional tax return page(s) on Line 6.

- Add any excess city tax collected (from Schedule C on the back) on Line 7.

- Calculate the grand total by adding lines 1 through 6, entering it on Line 8.

- For penalties and interest due to late filing or payment, calculate 5% of the total for late filing per month and 10% for late payment. Enter this amount on Line 9.

- Add the total liability and penalty/interest, then subtract any credit balance to be applied (from Schedule B on the back) to determine the net amount due on Line 11.

- Enter the total amount paid with your submission to the Phoenix City Treasurer on Line 12. Ensure to include your account number on your check.

- Complete the form by signing and dating at the bottom, confirming the declaration under penalty of perjury that the information provided is accurate.

After completing the form, verify all entered information for accuracy. Send the original document to the City Treasurer's office and keep a copy for your records. Remember, timely filing and accurate reporting are crucial to avoid penalties and maintain compliance with the City of Phoenix tax regulations.

Understanding Phoenix Az Sales Tax

Below are some frequently asked questions (FAQs) about the Phoenix, AZ Sales Tax form that might help guide you through completing and submitting your form correctly.

- How do I know if I need to fill out the Phoenix Sales Tax form?

If you are conducting business in the City of Phoenix that involves selling goods, leasing tangible personal property, or providing certain types of services, you are likely required to fill out the City of Phoenix Privilege (Sales) Tax Return. This form helps you report and pay the sales tax you've collected from customers. If you're unsure, visiting www.phoenix.gov/plt can provide more guidance on whether your business activities fall under taxable services.

- When is the Phoenix Sales Tax form due?

All Phoenix Sales Tax returns are due on the 20th of the month following the reporting period. If the 20th falls on a weekend or holiday, the due date moves to the next business day. It's important to submit your form on time to avoid any late filing or payment penalties, which include a 5% late filing fee per month and a 10% late payment fee, in addition to variable interest charges that match the state rate monthly.

- What should I do if I need to cancel my license?

If you're looking to cancel your City of Phoenix business license, you can do so directly on the sales tax return form. Make sure to check the box indicating a mailing address change or license cancellation, provide a reason and the effective date for the cancellation, and sign at the bottom of the form. Remember, cancellation does not exempt you from filing returns and paying taxes up to the cancellation date.

- How can I claim deductions on the Phoenix Sales Tax form?

The City of Phoenix allows businesses to claim deductions on taxable sales for various reasons, such as sales for resale, bad debts, and exempt sales, among others. To claim these, detail your deductions in Schedule A on the back of the form. Each type of deduction has a specific code and requires you to outline the business activity, gross receipts, and applicable deductions. Precise instructions for filling out Schedule A are found on the second page of the form. Be thorough—because all deductions must be detailed to be accepted.

Overall, understanding and correctly completing the Phoenix Sales Tax form is crucial for businesses operating within the city limits. For additional assistance or clarifications, the City of Phoenix provides resources and contact information on their website, or you can call their dedicated help line.

Common mistakes

When filling out the Phoenix, AZ Sales Tax form, a number of common mistakes can lead to errors in the submission process. These missteps can result in delays, inaccurate tax liabilities, or even penalties. Below are six errors often encountered:

- Using the wrong ink color - The form specifies the use of black or blue ink only. Filling out the form in different ink may cause issues with processing.

- Incorrect business information - It's crucial to accurately provide the Business Name and FEIN (Federal Employer Identification Number). Wrong information here can link the tax return to the incorrect business account.

- Not updating the mailing address - If there has been a change in the mailing address and it's not indicated on the form, crucial correspondence from the City Treasurer's office might not reach the business.

- Failure to detail deductions on the back of the form - Deductions must be detailed in the specified sections on the back of the form. Omitting these details can lead to the rejection of these deductions.

- Omitting the signature - A signature is required to validate the return. Without the taxpayer or paid preparer’s signature, the form is considered incomplete.

- Incorrectly calculating totals - This can happen both in adding up the gross receipts and deductions, as well as in calculating the net amount due. An incorrect total can result in either underpayment or overpayment of taxes.

Avoiding these mistakes can significantly streamline the filing process, ensuring that the business remains compliant with City of Phoenix's tax obligations.

Documents used along the form

When submitting the City of Phoenix Privilege (Sales) Tax Return, it's important to be mindful of the additional paperwork that may be required to support or supplement the information provided in the return. These documents play a crucial role in ensuring that the tax filing is accurate, complete, and compliant with the city's requirements. Here are four forms and documents often used alongside the Phoenix AZ Sales Tax form:

- Business License Application: Before a business can start filing sales tax returns, it must be registered with the City of Phoenix. This application is the initial step to obtain the necessary license to legally operate within the city, laying down the foundation for future tax filings.

- Transaction Privilege Tax Exemption Certificate: This document is used by businesses when purchasing goods for resale, production, or incorporation into products they sell. It allows them to buy goods tax-free, on the condition that those goods will be resold and thus, the sales tax will be collected from the end customer.

- Annual Business Activity Statement: While not a mandatory requirement for every sales tax return, this comprehensive statement provides a summary of the business's yearly transactions. It offers a detailed record that can assist in the accurate reporting of sales tax liabilities.

- Schedule C – Excess Tax Collected: As referenced in the sales tax form, this schedule is essential for reporting any additional city tax collected over the taxable amount. It ensures accurate accounting and reimbursement of over-collected taxes.

Together, these documents help businesses maintain accurate records and comply with tax laws, ensuring that the City of Phoenix receives the appropriate tax revenues. It's crucial for businesses to understand the importance of each document and its role in the tax filing process to avoid errors and potential penalties. Remember, thorough and precise documentation supports transparency and efficiency in tax administration, benefiting both the business and the city.

Similar forms

The IRS Form 1040, the U.S. Individual Income Tax Return, bears resemblance to the Phoenix AZ Sales Tax form in its structure and purpose of declaring income or sales and calculating taxes due. Both forms require filers to report amounts, apply specific tax rates, and determine the total tax liability. They each provide sections for deductions, credits, and adjustments to accurately arrive at the net amount owed to the government.

Similar to the Phoenix AZ Sales Tax form, the IRS Form 1120, used by corporations to report their income, gains, losses, deductions, and to figure out their federal income tax liability, shares a commonality in its function of tax calculation and reporting for a specific period. Both documents necessitate detailed breakdowns of financial activities and the application of tax rates to compute the total tax due.

The State Sales Tax Return forms used by businesses across various U.S. states draw a parallel to the Phoenix form in their core function: to calculate and report sales tax collected from customers. These state-specific forms, much like the Phoenix form, require businesses to list gross receipts, allowable deductions, and the net taxable amount to determine the sales tax liability for the period.

Form 941, the Employer's Quarterly Federal Tax Return, while focused on payroll taxes, shares the concept of periodic tax liability reporting with the Phoenix AZ Sales Tax form. Each requires the entity to report amounts pertinent to the calculation of taxes owed to a governmental authority, along with adjustments and previously made payments.

The Schedule C (Form 1040) component, which sole proprietors use to report profits or losses from their business, aligns with the Phoenix AZ Sales Tax form in giving a detailed account of business financial activity. Both necessitate a thorough itemization of income and expenses (or deductions) to accurately determine tax liabilities or business profit.

The Uniform Commercial Code (UCC) financing statement resembles the Phoenix tax form in its requirement for detailed information reporting, though for different purposes. Where the Phoenix form deals with tax reporting, the UCC form is concerned with declaring a security interest in collateral offered for loans, showcasing how varied documents necessitate precise information reporting.

The Unemployment Insurance Tax Reporting Forms, much like the Phoenix AZ Sales Tax form, require employers to report wages paid and calculate taxes due. Both forms are integral to funding respective government programs and demand accurate reporting of financial transactions to compute tax liabilities.

The Business Property Tax Statements, which businesses file to report the taxable property they own, reflect a similarity in objective to the Phoenix sales tax form. Both aim to assess tax obligations based on owned assets or conducted sales, requiring details about the values involved to calculate taxes properly.

The Excise Tax Returns, used for reporting taxes on specific goods and services, share a common goal with the Phoenix sales tax form: to calculate and report taxes due to governmental authorities. Both forms require detailed transaction reporting and tax rate application on taxable items or services.

Lastly, the Alcohol Beverage Tax Returns, while focusing on a specialized product, resemble the mechanism of the Phoenix sales tax form by necessitating detailed sales reporting and tax calculation for a distinct category of products. Each form plays a pivotal role in ensuring compliance and proper tax remittance for regulated activities or sales.

Dos and Don'ts

Filling out the Phoenix AZ Sales Tax form requires attention to detail and understanding the specific instructions provided. Achieving a correct and timely submission can save businesses from unnecessary penalties. Here are some essential dos and don'ts to keep in mind:

Do:- Use the specified ink: Only fill out the form using black or blue ink. This ensures that the form is legible and processed correctly without any delays.

- Review deduction details: Make sure to detail deductions on the back of the form accurately. It's essential to reference Schedule A for correct documentation and categorization of deductions to avoid any errors in calculation.

- Sign the return: A signature is necessary for the return to be valid. Ensure that the taxpayer or a paid preparer signs the form before submission. This step is critical as it certifies that the information provided is true and complete to the best of the signee's knowledge.

- Keep a copy for your records: Always retain a copy of the completed sales tax return. This practice is essential for your records and future reference, especially if questions or issues arise at a later date.

- Ignore the deadline: Keep in mind that this return is due on the 20th of the following month. Failing to submit on time can lead to penalties and interest charges.

- Forget to indicate mailing address changes: If your mailing address has changed, make sure to mark the indicated box and update the information. This ensures that all correspondence reaches you in a timely manner.

- Skip the account number on payment: When you make a payment, write your account number on your check. This step is crucial for ensuring that your payment is applied correctly to your account.

- Assume postage date is the filing date: Remember, postmarks are not accepted as evidence of timely filing. Ensure that your return is actually received by the City of Phoenix before the deadline to avoid late filing consequences.

Following these guidelines will help ensure that your Phoenix AZ Sales Tax form is filled correctly and submitted on time, avoiding potential errors and penalties.

Misconceptions

Understanding the City of Phoenix Privilege (Sales) Tax Return can sometimes be challenging due to misconceptions surrounding its requirements and instructions. Here are eight common misconceptions that need clarification:

- Any ink color is acceptable for filling out the form: The form specifically states that only black or blue ink is acceptable. Using any other ink color can lead to processing errors or delays.

- The tax return is only due if you have sales to report: A common misunderstanding is that businesses only need to file a return if they have taxable sales within the period. However, the City of Phoenix requires filing even if there are no taxable sales to report for the period.

- Postmarks are considered for timely filing: The City of Phoenix does not accept postmarks as evidence of timely filing. Returns must be received by the due date to avoid penalties.

- You can establish an account when filing your first return: To file a sales tax return with the City of Phoenix, an account must be established beforehand. This can be done by completing an application available on their website, not simply by submitting a tax return form.

- All business types are eligible for the same deductions: Not every deduction listed on Schedule A is available for all business categories. Each deduction has specific criteria that must be met.

- Sales to the U.S. Government are always 100% deductible: The form differentiates between sales to the U.S. Government by retailers and manufacturers. Retailers can only deduct 50%, while manufacturers can deduct 100%.

- You must report and pay taxes on bad debts: If you've paid sales tax on amounts that have later become bad debts, these amounts can be deducted. This corrects the assumption that you must both report and pay sales tax on bad debts.

- Deductions need not be detailed: A significant misconception is that a simple total of deductions is sufficient. The City of Phoenix requires detailed deductions on the back of the form to properly account for and verify each deduction claimed.

Addressing these misconceptions is crucial for businesses to comply correctly with the City of Phoenix's tax reporting requirements and avoid unnecessary penalties. Always refer to the most current documentation and resources provided by the City of Phoenix to ensure compliance.

Key takeaways

Filling out and properly submitting the Phoenix, AZ Sales Tax Form is crucial for businesses operating within the city to comply with local tax regulations. Here are some key takeaways to ensure accuracy and compliance:

- Use only black or blue ink when filling out the form to ensure readability and prevent any processing delays.

- It's important to note that the tax return is due on the 20th of the month following the reporting period. This deadline helps businesses avoid penalties and interest charges due to late filings.

- If there has been a change in the mailing address or if the business license needs to be canceled, it is imperative to indicate these changes directly on the form. This helps maintain accurate records and ensures that all correspondence reaches the correct address.

- Details regarding deductions must be clearly outlined on the back of the form in the designated Schedule A area. This detailed breakdown is essential for the correct calculation of the net taxable amount and for avoiding discrepancies during tax audits.

- All financial figures must be meticulously checked before submission, including the calculation of penalties and interest for late filings and payments, to ensure that the total liability and net amount due are correct. Precise calculations prevent future discrepancies or adjustments.

For any questions or need for assistance, the City of Phoenix provides resources and contacts, such as a dedicated phone line and website, to help businesses file their sales tax returns correctly. Keeping a copy of the submitted form for your records is also advised for future reference or in case of audits.

Popular PDF Documents

IRS 943 - Agribusinesses must file form 943 annually to stay compliant with IRS regulations.

Minnesota Tax Form - Access the detailed penalties and interest section if your payment is overdue to calculate additional charges.

IRS 13614-C - The document helps identify the taxpayer’s filing status, dependents, and any significant financial changes during the tax year that may affect their tax situation.