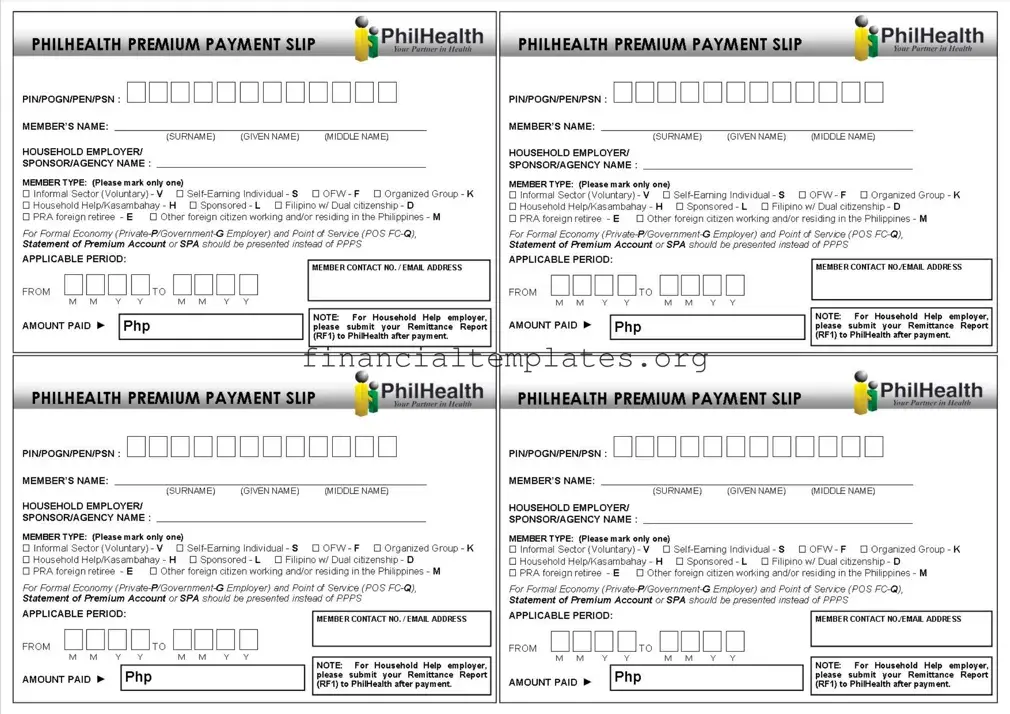

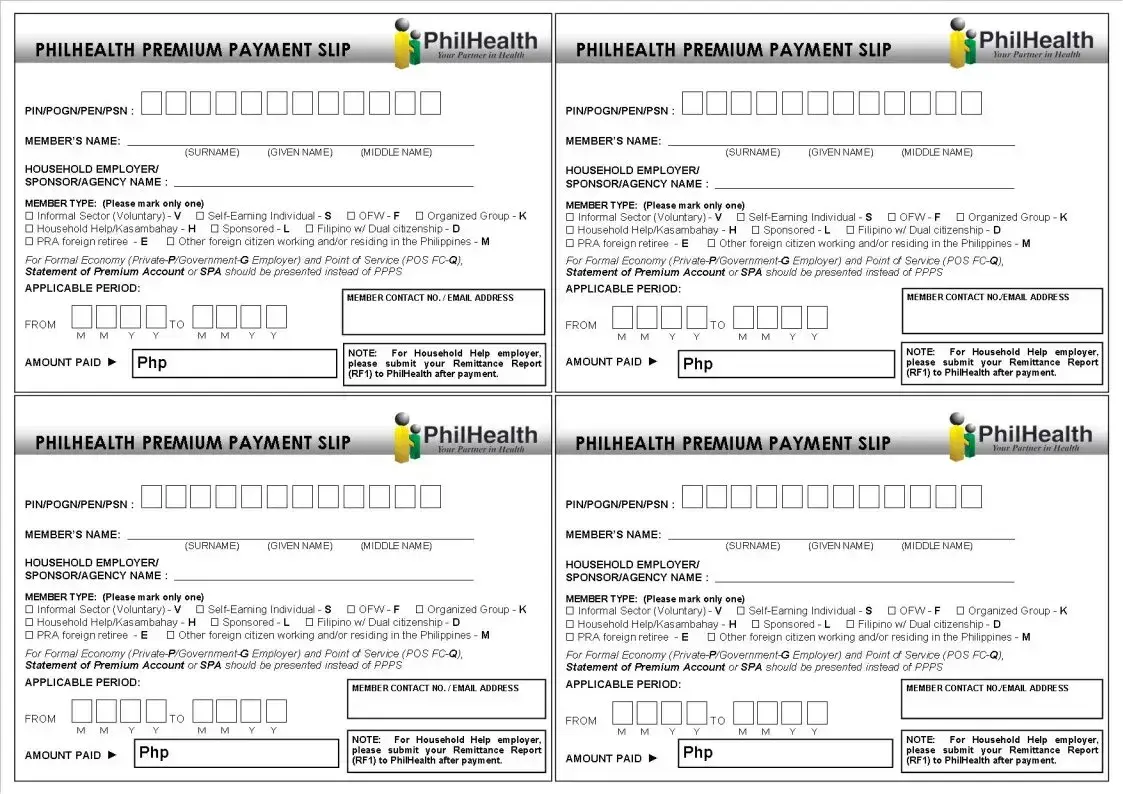

Get Philhealth Payment Form

The Philhealth Premium Payment Slip is a vital document for members of the Philippines Health Insurance Corporation (PhilHealth), serving as a tangible link between healthcare support and beneficiaries. Designed to cater to a wide array of individuals, including those in the formal and informal sectors, OFWs (Overseas Filipino Workers), household employees, sponsored members, Filipinos with dual citizenship, and even foreign retirees and other foreign citizens residing or working in the Philippines, this form ensures that everyone has access to healthcare financing. It meticulously captures member information such as name, PhilHealth Identification Number (PIN), and the category to which the member belongs. Moreover, it specifies the payment period and the amount, providing a clear record for both the payer and PhilHealth. For household employers, an additional step is required: the submission of a Remittance Report (RF1) post-payment, emphasizing the structured approach PhilHealth takes to maintain transparency and accountability in health contributions. This form not only represents a financial transaction but also symbolizes the individual's participation in a collective effort to ensure accessible healthcare for all Filipinos, showcasing the government's commitment to health and wellness.

Philhealth Payment Example

Document Specifics

| Fact Name | Description |

|---|---|

| Identification Section | Includes PIN/POGN/PEN/PSN and Member's Name indicating the importance of accurately identifying the member for record-keeping and processing. |

| Member Types | Details various member categories such as Informal Sector, Self-Earning Individual, OFW, etc., allowing for tailored contributions based on employment status and capacity. |

| Payment Information | Captures payment specifics like applicable period and amount paid, essential for updating member contributions and ensuring continuous coverage. |

| Special Instructions for Household Employers | Household employers must submit a Remittance Report (RF1) post-payment, highlighting the procedure for ensuring accurate records of household helper contributions. |

Guide to Writing Philhealth Payment

Filling out a PhilHealth Premium Payment Slip is an important step toward ensuring that healthcare contributions are properly credited, maintaining coverage and benefits. It's vital to complete the form accurately to prevent any issues with healthcare services when they are most needed. Here are step-by-step instructions to guide you through the process.

- Start by entering your unique PIN/POGN/PEN/PSN number in the designated box. This number is essential for identifying your PhilHealth account.

- In the MEMBER'S NAME section, write your surname, given name, and middle name in their respective fields.

- If applicable, fill in the HOUSEHOLD EMPLOYER/ SPONSOR/AGENCY NAME section. This is relevant for individuals whose premiums are paid for by an employer, sponsor, or agency.

- Choose your MEMBER TYPE by marking only one of the provided boxes that best describes your current status (e.g., Informal Sector (Voluntary), Self-Earning Individual, OFW, etc.). It is crucial to select the category that accurately reflects your current situation as it affects your contribution rate and benefits.

- Enter the APPLICABLE PERIOD for the payment in the format MMYY (from - to). This indicates the coverage period for which the payment applies.

- Provide your MEMBER CONTACT NO./EMAIL ADDRESS in the space given. This information is used for sending notifications or essential communication regarding your PhilHealth account.

- In the AMOUNT PAID section, write the total amount of your contribution in Philippine Peso (Php).

- For household employers, it's noted that a Remittance Report (RF1) must be submitted to PhilHealth after the payment is made. This additional step ensures that contributions for household help/kasambahay are properly documented.

After completing the form, double-check all entries for accuracy. Mistakes can lead to delays or discrepancies in your coverage. Once satisfied, submit the form to the appropriate PhilHealth office or authorized collecting agents. Keep a copy of the payment slip and any receipts as proof of payment for your records.

Understanding Philhealth Payment

FAQs about the PhilHealth Premium Payment Slip

What is a PhilHealth Premium Payment Slip?

This slip is a form that PhilHealth members use to make their premium payments. It captures essential details like the member's name, type, PIN/POGN/PEN/PSN, contact information, payment period, and the amount paid.

Who needs to fill out this payment slip?

All members making premium payments directly to PhilHealth, including informal sector workers, OFWs, household employers, self-earning individuals, and other specified categories, must fill out this slip.

Can I submit the Payment Slip for any type of member category?

Yes, this slip is designed for various member categories including informal sector workers, self-earning individuals, OFWs, household helps, and Filipinos with dual citizenship among others. Formal economy workers and those availing of the Point of Service (POS) should present a Statement of Premium Account (SPA) instead.

What is the purpose of marking a member type on the form?

Identifying the member type helps PhilHealth in processing payments accurately, ensuring that members are categorized correctly for appropriate benefit entitlements and contributions.

How do I know which member type to select?

Select the member type that best describes your current employment or living situation. Categories include informal sector workers, self-earning individuals, OFWs, sponsored members, and others as mentioned on the slip.

What should I do if I'm a household employer?

Household employers are required to fill out the slip for premium payments and also submit the Remittance Report (RF1) to PhilHealth after the payment is made.

How is the applicable period for payment determined?

The applicable period refers to the coverage months that you're paying premiums for. It's indicated on the slip by filling in the start and end months and years (MMYY).

Where can I find more information if I have questions?

For further assistance, members can reach out to PhilHealth through their contact number or email address provided on their official website, or visit a nearby PhilHealth office for in-person inquiries.

Common mistakes

Filling out a PhilHealth Premium Payment Slip requires attention to detail. Common mistakes can lead to delays or errors in recording your payment. Here are seven common mistakes to watch out for:

Incorrectly filled PIN/POGN/PEN/PSN: It's crucial to enter the correct identification number as this links your payment to your profile. A single mistake can misallocate your contribution.

Leaving the member type unmarked or marking more than one: You must specify only one member type. Marking more than one or leaving this section blank confuses the categorization of your contribution.

Omitting the applicable period: Forgetting to indicate the period your payment covers may result in your payment not being attributed to the correct span, potentially affecting your coverage.

Inaccurate member contact information: Providing outdated or incorrect contact details may prevent PhilHealth from reaching out to you for any concerns or updates regarding your account.

Incorrect amount paid: It's important to ensure the amount paid matches the required contribution for the period. Differences can lead to short or excess payments, affecting your benefits.

Misidentifying the member’s name format: Filling the surname, given name, and middle name in the wrong boxes can create inconsistencies in your record, making it difficult to verify your information.

For household employers, failing to submit the Remittance Report (RF1): The RF1 form is necessary alongside your payment to document your household help's contribution properly. Skipping this step can result in unrecorded payments.

Documents used along the form

When it comes to managing healthcare contributions in the Philippines, the PhilHealth Premium Payment Slip is an essential document for members. However, this form is often not the only document needed to ensure smooth processing and compliance with PhilHealth's requirements. There are several additional forms and documents that members may need to prepare and submit along with their payment slips. Let's briefly describe some of these supplementary documents.

- RF1 - Employer's Remittance Report: This form is mandatory for employers who are reporting and remitting contributions for their household help. It details the amount paid for each employee, the applicable period, and other relevant information to ensure proper crediting to each member's account.

- Statement of Premium Account (SPA): For members in the formal economy (either working in the private sector or government), this document serves as an official record of their premium contributions. It's especially useful for verifying past payments and for resolving any discrepancies in members' accounts.

- MDR - Member Data Record: While this document doesn’t accompany the premium payment directly, it is crucial for members to keep their MDR updated. It contains the member's personal and beneficiary information, which is vital for claim processing.

- PhilHealth ID Card: Although not strictly a form, the PhilHealth ID Card is often required as proof of membership when making transactions with PhilHealth, including premium payments. It can also be necessary when availing of health services from accredited providers.

In summary, while the PhilHealth Premium Payment Slip is a critical document for members, it's often just a part of the paperwork needed for complete and compliant transactions with PhilHealth. Understanding and preparing the additional forms such as the RF1, SPA, MDR, and having the PhilHealth ID card can help ensure a smooth process, whether it's for payment, claims, or any other services.

Similar forms

The PhilHealth Premium Payment Slip shares similarities with the Federal Tax Deposit Coupon used in the United States. Both documents are crucial for the payment of specific contributions or taxes related to employment and health or social security benefits. The Federal Tax Deposit Coupon, much like the PhilHealth form, requires identification details of the payer and specifies the period for which the payment is being made. Both forms play a vital role in ensuring compliance with financial obligations to government institutions.

Another document similar to the PhilHealth Payment form is the Social Security System (SSS) Contribution Payment Form. This form is used by employers and individually paying members to remit their SSS contributions. Like the PhilHealth Payment Slip, the SSS form collects information on the payer's identity, the payment period, and the amount to be paid. These forms are essential for maintaining eligibility and access to benefits under their respective systems.

The Utility Bill Payment Slip is also comparable to the PhilHealth Premium Payment Slip. While one pertains to healthcare contributions and the other to utility services like electricity or water, both serve as instruments for remittance of payments. They both require the payer’s details, billing period, and the payment amount. These documents ensure that services or coverages are not interrupted due to non-payment.

Lastly, the Insurance Premium Payment Slip bears resemblance to the PhilHealth Payment form. Insurance slips are used for remitting premiums for life, property, or health insurance policies. Similar to the PhilHealth slip, these documents require payer identification, cover the period for which the payment applies, and specify the amount being paid to maintain the insurance coverage without lapse.

Dos and Don'ts

When completing the PhilHealth Premium Payment Slip, there are several practices to keep in mind to ensure the form is filled out accurately and completely. Here are some dos and don'ts:

- Do ensure that all information provided is accurate, including your PhilHealth Identification Number (PIN) and full name to avoid any discrepancies or delays in processing.

- Do double-check the member type selected. Make sure it accurately reflects your current status to prevent any issues with coverage or benefits.

- Do accurately input your contact information, including your phone number and email address. This ensures PhilHealth can reach you if there are any questions or further information needed.

- Do carefully enter the applicable period for your payment in the format MMYY (month and year), to ensure your coverage is applied correctly.

- Do verify the amount paid is correct and corresponds with your salary bracket or category to prevent underpayment or overpayment.

- Don't leave any required fields blank. Incomplete forms may be rejected or returned, causing delays in your coverage.

- Don't guess information. If you're unsure about a detail, such as your PIN or which member category you fall under, consult the PhilHealth website or contact customer service for guidance.

- Don't use abbreviations or nicknames. Use your legal name and complete titles to ensure consistency with official documents and records.

- Don't forget to attach any required documents, such as the Remittance Report (RF1) for household employers. Failing to submit required documentation may result in processing delays.

Following these guidelines can streamline the process of paying your PhilHealth premiums and help maintain your eligibility for health benefits. Always review your payment slip before submission to ensure all information is current and accurate.

Misconceptions

Understanding the PhilHealth Premium Payment Slip involves deciphering its components and navigating through common misconceptions. Here are seven widespread misunderstandings and the facts to set the record straight.

Only employed individuals need to fill it out: A common misconception is that the PhilHealth Premium Payment Slip is exclusively for employed people. The truth is, it caters to various member types, including voluntary or informal sector members, self-earning individuals, overseas Filipino workers (OFWs), and even non-citizens residing or working in the Philippines. This diversity ensures broad health coverage for different sectors of society.

One form fits all: People often think one generic form is used for all types of members. However, specific sections and instructions must be followed depending on the member's classification (e.g., informal sector, OFW, household help, sponsored). For formal economy members and Point of Service (POS), a Statement of Premium Account is necessary instead.

It's only for recording current payments: While it's essential for current premium remittances, the form also plays a crucial role in updating member information and ensuring accurate records for future claims and benefits.

Household employers are exempt from submission: A notable error is the belief that household employers do not need to submit additional documents after payment. In contrast, they must provide a Remittance Report (RF1) to ensure proper crediting of contributions for their employees.

Submission deadlines are flexible: Some members might think deadlines for the premium payment slip are flexible. However, adhering to specified periods is critical to maintain eligibility for benefits and avoid penalties or interest due to late payments.

Email contact is optional: The contact section, especially for email addresses, might be seen as optional, but providing current contact information is crucial. It helps PhilHealth communicate important notices, updates, and even facilitate online transactions or inquiries efficiently.

Foreigners are not eligible: There's a misconception that foreigners cannot be covered by PhilHealth. The form clearly accommodates foreign nationals working or residing in the Philippines, including those with dual citizenship and retired foreign authority (PRA) retirees, emphasizing PhilHealth's inclusive approach to health coverage.

By clarifying these misconceptions, members can better understand their responsibilities, obligations, and the benefits of the PhilHealth Premium Payment Slip, ensuring a smoother and more informed experience with the Philippine health insurance system.

Key takeaways

Understanding and accurately completing the PhilHealth Payment Slip is crucial for ensuring that health premiums are properly credited to the right account. Here are key takeaways for correctly filling out and utilizing this form:

- Verify Member Information: Double-check the accuracy of the Personal Identification Number (PIN/POGN/PEN/PSN) and the member's name, including the surname, given name, and middle name, to prevent any discrepancies in payment records.

- Specify Member Type: Mark the appropriate box for the member type clearly. Options include Informal Sector, Self-Earning Individual, OFW, Organized Group, Household Help/Kasambahay, Sponsored, Filipino with Dual citizenship, PRA foreign retiree, and Other foreign citizen working and/or residing in the Philippines. For Formal Economy workers and Point of Service (POS), a Statement of Premium Account is required instead.

- Accurate Period Coverage: Enter the applicable period in MMYY format to ensure payments are attributed to the correct coverage dates.

- Contact Information: Providing a current contact number or email address is essential for receiving updates or notices regarding one’s PhilHealth account.

- Amount Paid: Indicate the precise amount paid in Philippine Pesos (Php) to avoid any confusion regarding the payment status.

- Special Note for Household Employers: For those employing household help, it's mandatory to submit a Remittance Report (RF1) to PhilHealth after making the payment. This ensures that the contributions are properly documented and credited.

- Submission: After completing the PhilHealth Premium Payment Slip, ensure that it is submitted to an authorized collecting agent or PhilHealth office to complete the transaction.

- Keep Records: It’s advisable to keep a copy of the payment slip and any receipts as proof of payment. These documents can be vital in case of disputes or for future reference.

By paying close attention to these details, members can maintain their PhilHealth contribution records accurately and enjoy uninterrupted access to healthcare benefits. If there are uncertainties in filling out the form, it's recommended to consult directly with PhilHealth or its accredited partners for guidance.

Popular PDF Documents

D-400 Tax Form - Through Line 5, businesses are reminded of their responsibility to account for interest on late tax payments.

1065 Tax Form - It’s imperative for taxpayers to keep thorough records of all transactions related to Schedule E activities to support reported income and deductions.

Form 8233 - A form required for international workers to apply for a reduced rate of tax withholding in the U.S.