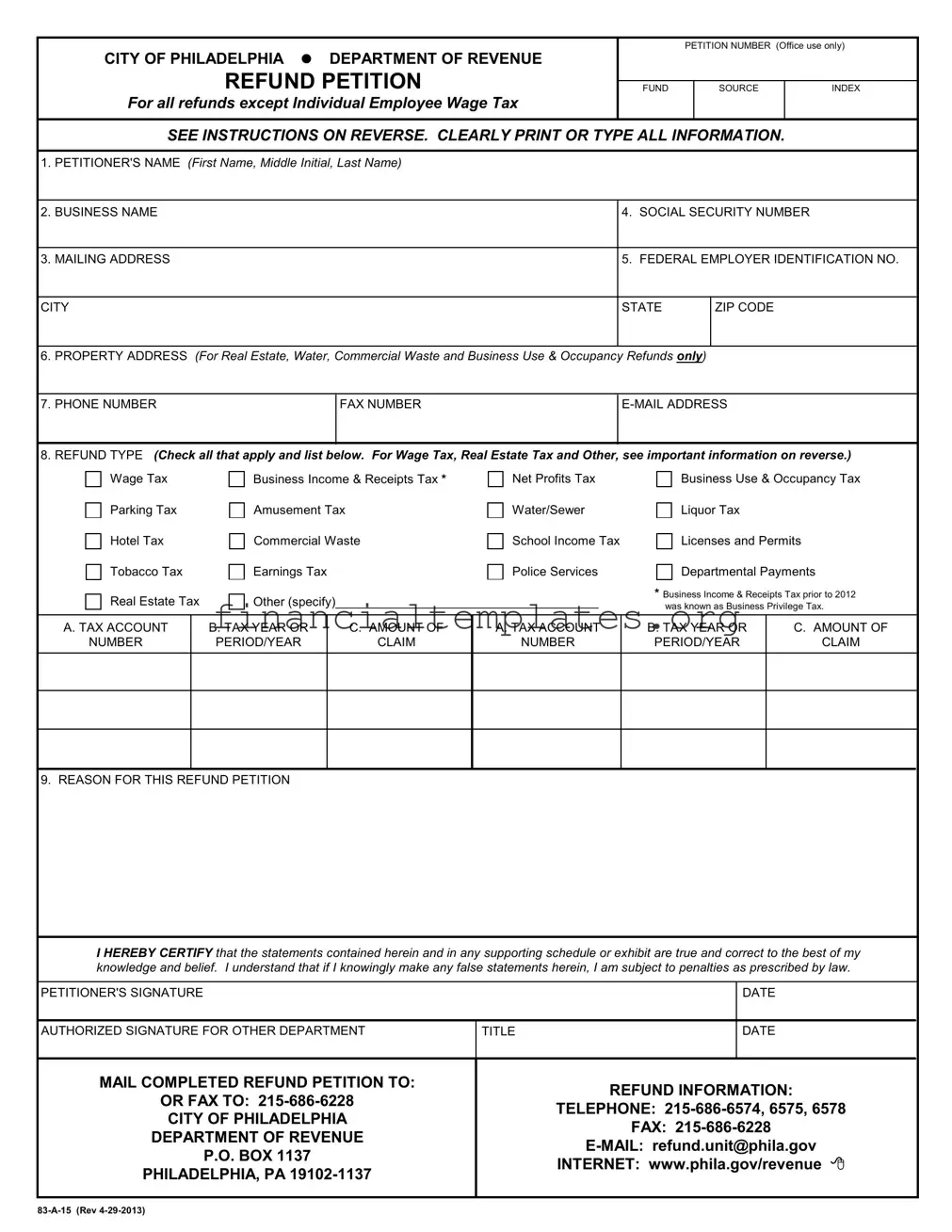

Get Philadelphia Wage Tax Refund Petition Form

Navigating the complexities of tax refunds can be challenging, especially for those dealing with the Philadelphia Wage Tax Refund Petition form. This crucial document, entrusted by the City of Philadelphia Department of Revenue, is the gateway for individuals and businesses seeking refunds for overpaid taxes, not limited to the Individual Employee Wage Tax. From specifying petitioner details like name and address to identifying the exact type of refund requested—be it Wage Tax, Real Estate Tax, Business Income & Receipts Tax, among others—clarity and accuracy in completing each section are paramount. The form demands the tax account number, tax year or period, and the amount of the claim, requiring petitioners to articulate the reason behind their refund request. Importantly, it also outlines the prerequisites for submitting various types of refund requests, such as additional letters for wage tax refunds or evidence of payment for real estate taxes. With penalties in place for false statements, signatories must certify the truthfulness of the information provided, underscoring the form's role not only as a request for reimbursement but also as a document of legal importance. To support petitioners through the process, detailed instructions and contact information for further assistance are provided, ensuring that the necessary steps for a valid refund petition are clear and accessible.

Philadelphia Wage Tax Refund Petition Example

|

|

|

PETITION NUMBER (Office use only) |

|

CITY OF PHILADELPHIA |

DEPARTMENT OF REVENUE |

|

|

|

REFUND PETITION |

|

|

|

|

FUND |

SOURCE |

INDEX |

||

For all refunds except Individual Employee Wage Tax

SEE INSTRUCTIONS ON REVERSE. CLEARLY PRINT OR TYPE ALL INFORMATION.

1. PETITIONER'S NAME (First Name, Middle Initial, Last Name)

2.BUSINESS NAME

3.MAILING ADDRESS

CITY

4.SOCIAL SECURITY NUMBER

5.FEDERAL EMPLOYER IDENTIFICATION NO.

STATE |

ZIP CODE |

|

|

6. PROPERTY ADDRESS (For Real Estate, Water, Commercial Waste and Business Use & Occupancy Refunds only)

7. PHONE NUMBER

FAX NUMBER

8.REFUND TYPE (Check all that apply and list below. For Wage Tax, Real Estate Tax and Other, see important information on reverse.)

|

|

Wage Tax |

|

|

Business Income & Receipts Tax * |

|

|

Net Profits Tax |

|

|

Business Use & Occupancy Tax |

||||

|

|

Parking Tax |

|

|

Amusement Tax |

|

|

|

Water/Sewer |

|

|

Liquor Tax |

|

||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Hotel Tax |

|

|

Commercial Waste |

|

|

School Income Tax |

|

|

Licenses and Permits |

||||

|

|

|

|

|

|

|

|

||||||||

|

|

Tobacco Tax |

|

|

Earnings Tax |

|

|

|

Police Services |

|

|

Departmental Payments |

|||

|

|

|

|

|

|

|

|

|

|||||||

|

|

Real Estate Tax |

|

|

Other (specify)______________________________________ |

* Business Income & Receipts Tax prior to 2012 |

|||||||||

|

|

|

|

|

was known as Business Privilege Tax. |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. TAX ACCOUNT |

|

B. TAX YEAR OR |

|

C. AMOUNT OF |

|

A. TAX ACCOUNT |

B. TAX YEAR OR |

C. AMOUNT OF |

|||||||

|

NUMBER |

|

PERIOD/YEAR |

|

CLAIM |

|

|

NUMBER |

PERIOD/YEAR |

CLAIM |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. REASON FOR THIS REFUND PETITION

I HEREBY CERTIFY that the statements contained herein and in any supporting schedule or exhibit are true and correct to the best of my knowledge and belief. I understand that if I knowingly make any false statements herein, I am subject to penalties as prescribed by law.

PETITIONER'S SIGNATURE |

|

DATE |

|

|

|

AUTHORIZED SIGNATURE FOR OTHER DEPARTMENT |

TITLE |

DATE |

|

|

|

MAIL COMPLETED REFUND PETITION TO: |

REFUND INFORMATION: |

|

|

OR FAX TO: |

|

||

TELEPHONE: |

|||

CITY OF PHILADELPHIA |

|||

FAX: |

|

||

DEPARTMENT OF REVENUE |

|

||

|

|||

P.O. BOX 1137 |

|

||

INTERNET: www.phila.gov/revenue |

|||

PHILADELPHIA, PA |

|||

|

|

||

Instructions for Completing the Refund Petition

This form is to be used for all refund requests except Individual Employee Wage Tax. If you need to file an individual employee wage petition, refer to the contact information on the front of this form. Employers must use this petition for withheld wage tax refund requests.

1.Individuals - Enter the name of the petitioner.

2.Business Name - For

3.Mailing Address - Enter the address where the refund is to be mailed.

4 and 5. Social Security and Federal Employer Identification Numbers - Individuals must enter a Social

Security number. All other entities must enter a Federal Employer Identification Number.

6.Property Address - This is required for all Real Estate, Water/Sewer, Commercial Waste and Business Use & Occupancy petitions. Enter the address of the property for which the refund is being requested.

7.Contact Information - Provide a phone number, fax number and

8.Refund Type - Check the appropriate block(s). If the type is not listed on the front of this form, check "Other" and specify the type of refund requested. A single Refund Petition may be used for multiple tax types and years.

A.Tax Account Number - Enter the tax specific account number(s).

B.Tax Years and/or Tax Periods - If tax is an annual tax, enter year. If tax is periodic,

e.g., quarterly or monthly, enter period(s) and year(s).

C.Amount of Claim - Enter the amount of the refund requested.

9.Reason for Refund - Enter reason for refund. If you have additional documentation, attach to this petition.

Wage Tax - Additional information is required before a decision can be made on your refund request. Provide a letter on company letterhead (signed by an officer of the company) stating that the additional tax withheld has been returned to the employees. If your refund request is resulting from a duplicate payment, provide supporting documentation. If you have questions about your filing requirements, application of payments or tax balances, call Taxpayer Services at

Real Estate - Refund requests must be accompanied by a copy of the front and back of the canceled check(s). If the refund is due to a sale of the property or refinancing, you must also supply a copy of the settlement sheet. Mortgage companies must supply a copy of the disbursement/check listing.

This petition must be signed and dated! If you have any questions regarding the preparation of this petition, see the contact information on the front of this form.

OFFICE USE ONLY - Licenses and Permits; Interdepartmental Refunds and Other - All petitions must include the signature and title of the Department's authorized designee, along with the Fund, Source and Index Code of the payment in addition to the petitioner's signature.

Document Specifics

| Fact Name | Description |

|---|---|

| Application | The form is utilized for all types of refund petitions within the City of Philadelphia, excluding Individual Employee Wage Tax requests. |

| Dual Function | It serves both individuals and businesses seeking refunds for overpaid taxes. |

| Required Information | Petitioners need to provide details such as taxpayer's name, Social Security or Federal Employer Identification Number, and contact information. |

| Property Address Requirement | For certain refunds like Real Estate and Water/Sewer, the address of the property in question must be provided. |

| Refund Types | The form covers a broad spectrum of tax types, from Business Income & Receipts Tax to Real Estate Tax, allowing for specific or multiple refund requests. |

| Documentation Requirement | Depending on the type of refund, additional documentation such as company letters or copies of canceled checks may be necessary. |

| Governing Law | The form and its processes fall under the jurisdiction of the City of Philadelphia Department of Revenue, adhering to local tax laws and regulations. |

Guide to Writing Philadelphia Wage Tax Refund Petition

When seeking a refund from the City of Philadelphia Department of Revenue, the Philadelphia Wage Tax Refund Petition form is a critical document. This form allows businesses and individuals to request a return of taxes that were overpaid, paid in error, or for which they are entitled to a refund for other reasons. Below, you'll find step-by-step guidance on filling out this form to ensure your petition is complete and ready for processing. Remember, accuracy and completeness are key to a successful refund petition.

- Petitioner's Name: Start by entering your full name - first name, middle initial, and last name in the space provided.

- Business Name: If the petition is being filed on behalf of a business entity, enter the business's legal name.

- Mailing Address: Write down the mailing address where the refund should be sent. Be sure to include the city, state, and zip code.

- Social Security Number: Individuals must provide their Social Security Number. Ensure this is filled in accurately.

- Federal Employer Identification No.: For entities other than individuals, enter the business's Federal Employer Identification Number (FEIN).

- Property Address: For refunds related to Real Estate, Water/Sewer, Commercial Waste, and Business Use & Occupancy, the address of the property in question is required.

- Contact Information: Provide a current phone number, fax number, and email address where you can be reached regarding the petition.

- Refund Type: Check the box that corresponds to the type of tax refund you are requesting. If your specific type isn't listed, select "Other" and specify the refund type in the space provided.

- Tax Account Number: Enter tax-specific account number(s) related to your refund claim.

- Tax Years and/or Periods: Specify the tax year(s) or period(s) for which you are requesting a refund.

- Amount of Claim: Enter the total amount of the refund you are claiming.

- Reason for Refund: Clearly state the reason for your refund petition. Attach any additional documentation that supports your claim.

- Certification: The petition must be signed and dated at the bottom, certifying that the information provided is true and correct to the best of your knowledge. If applicable, the authorized signature for other departments must also be included.

Once completed, review the petition for accuracy. Mail your completed refund petition to the City of Philadelphia Department of Revenue at the address provided on the form, or you may opt to fax it to the number listed. If you have questions or require assistance, the contact details on the form will direct you to the appropriate department for support. Submitting a complete and accurately filled form is the first step toward processing your refund request efficiently.

Understanding Philadelphia Wage Tax Refund Petition

- What is the purpose of the Philadelphia Wage Tax Refund Petition form?

The Philadelphia Wage Tax Refund Petition form is used for requesting refunds for various taxes collected by the City of Philadelphia, including but not limited to wage tax, business income and receipts tax, net profits tax, and real estate tax. It excludes individual employee wage tax refunds, which require a different process. - Who needs to fill out this form?

Both individuals and entities may need to fill out this form. Individuals should provide their personal information, while non-individual entities must include their business name and Federal Employer Identification Number. - What information is required to complete the form?

The form requires detailed information, including the petitioner's name or business name, mailing address, social security or Federal Employer Identification Number, property address for certain types of refunds, contact information, type of refund requested, tax account number, tax year or period, amount of claim, and the reason for the refund. - How can I specify the type of tax refund I am requesting?

In section 8 of the form, you must check the appropriate block(s) for the type of tax refund you're requesting. If the specific tax type is not listed, you can select "Other" and manually specify the type of refund you are seeking. - What documentation is required for a wage tax refund request?

For a wage tax refund, you must provide a letter on company letterhead signed by an officer of the company, stating that the additional tax withheld has been returned to the employees. If the refund is due to a duplicate payment, appropriate supporting documentation is necessary. - What if my refund request concerns real estate tax?

For real estate tax refunds, you need to attach a copy of both the front and back of the canceled check used for payment. If the refund is related to a property sale or refinancing, a copy of the settlement sheet is also required. Mortgage companies must provide a disbursement/check listing. - Where should the completed form be sent?

Completed refund petitions should be mailed to the City of Philadelphia Department of Revenue, P.O. BOX 1137, Philadelphia, PA 19102-1137. Alternatively, they can be faxed to 215-686-6228 or emailed to refund.unit@phila.gov. - How do I know which tax account number to use?

Your specific tax account number is unique to the tax type or payment being refunded. This information should have been provided to you in your tax payment records or correspondence from the City of Philadelphia Department of Revenue. - What should I do if I have additional documentation supporting my refund request?

Any additional documentation that supports your refund request should be attached to the petition form. Make sure to reference this documentation in the "Reason for Refund" section to ensure it is reviewed as part of your request. - Who can I contact if I have questions about completing the form or my refund status?

For questions regarding form completion or to inquire about the status of a refund request, you can call Taxpayer Services at 215-686-6600. They can provide guidance and updates related to your specific situation.

Common mistakes

Filling out the Philadelphia Wage Tax Refund Petition form requires careful attention to detail. Mistakes can lead to delays or the rejection of a refund request. Here are six common errors people make when completing this form:

Incorrect or Incomplete Names: Petitioners sometimes fill out their names incorrectly or incompletely. It is crucial to provide the full legal name in the petitioner's name section to ensure the request is processed correctly.

Missing Business Names for Non-Individual Entities: Non-individual petitioners often forget to include their business name. This information is essential for entities seeking a refund, as it differentiates the application from those submitted by individuals.

Inaccurate Mailing Addresses: A common mistake is providing incorrect or outdated mailing addresses. This leads to delays in receiving the refund, as the Department of Revenue needs the correct address to mail the refund check.

Mixing Up Identification Numbers: Petitioners sometimes enter their Social Security Number (SSN) or Federal Employer Identification Number (FEIN) in the wrong field, or they might provide incorrect numbers. Individuals should provide their SSN, while businesses and other entities must include their FEIN.

Omitting Property Address for Certain Refunds: For refunds relating to Real Estate, Water/Sewer, Commercial Waste, and Business Use & Occupancy, the property address is a requirement that is often overlooked. This specific information is critical for processing the refund related to these services.

Incorrect Refund Type Selection: Selecting the wrong refund type or failing to specify the refund type when "Other" is selected is another common error. This selection is crucial to direct the petition to the correct department for processing.

To prevent these mistakes, it is recommended that petitioners:

Review their personal and business information for accuracy before submission.

Ensure the correct address is provided to avoid delays in refund delivery.

Double-check the entered SSN or FEIN to prevent processing issues.

Clearly identify the applicable property address if the refund is related to real estate, water/sewer, commercial waste, or business occupancy.

Select the correct refund type and provide additional information if "Other" is selected to expedite the process.

Documents used along the form

When submitting a Philadelphia Wage Tax Refund Petition, individuals and businesses often need to include additional documentation to support their refund claim. The complexity of tax laws and the necessity for thorough documentation means these accompanying forms and documents are critical to ensuring a smooth refund process. Here's a list of other forms and documents commonly used alongside the Philadelphia Wage Tax Refund Petition form:

- Copy of the Taxpayer’s W-2 or 1099 Forms: These documents serve as proof of the wages earned and taxes paid during the relevant tax year, which is essential for verifying the amount of refund claimed.

- Proof of Tax Payments: This includes bank statements, pay stubs, or copies of checks used to pay the Philadelphia Wage Tax. It provides a clear record that the taxpayer has fulfilled their tax obligations, from which they are now seeking a refund.

- Letter of Employment: If the refund claim is related to taxes withheld by an employer in error, a letter from the employer acknowledging the mistake and outlining the correction efforts made can be invaluable.

- Power of Attorney (POA) Form: For individuals who are having their refund petition filed by a third party, such as a tax preparer or attorney, a POA form authorizes that individual to act on the taxpayer’s behalf.

- Affidavit of Lost Check: If the refund request is due to a misplaced or stolen refund check originally issued by the City of Philadelphia, an affidavit of lost check is necessary to process a reissuance.

- Amended Tax Return(s): For situations where the refund petition is based on an error in the original tax filing, an amended tax return correcting the mistake helps validate the refund claim.

The proper compilation and submission of these forms and documents can significantly influence the outcome of a Philadelphia Wage Tax Refund Petition. It is essential for petitioners to meticulously gather and present all relevant information to the City of Philadelphia Department of Revenue, ensuring that their request for a refund is based on clear, concise, and accurate documentation. This attention to detail not only streamlines the process but also maximizes the likelihood of a favorable resolution.

Similar forms

The Federal Income Tax Return (Form 1040) shares similarities with the Philadelphia Wage Tax Refund Petition form in that both require personal identification information from the taxpayer, such as Social Security Number for individuals or Federal Employer Identification Number for businesses. Furthermore, both forms necessitate specifying the tax year or period in question and the amount claimed, whether a refund from overpayment or due taxes.

A State Sales Tax Refund Application also has commonalities with the Philadelphia form, particularly in its structure that demands a detailed description of the reason for the refund. Similar to requesting a refund for overpaid sales taxes on specific transactions, the Philadelphia form requires a clear explanation and categorization of the tax type for which a refund is sought, evidence of overpayment, and proper documentation for verification.

Unemployment Compensation Adjustment Forms used for correcting or disputing unemployment tax rates or benefit charges mirror the Philadelphia Wage Tax Refund Petition. Both involve providing detailed employer or individual information, the specific period or tax year under review, and a thorough justification for the requested adjustment, supported by necessary documentation.

The Property Tax Refund (Renter's and Homeowner's) forms echo elements of the Philadelphia Wage Tax Refund Petition by necessitating property address details for claims related to real estate. They require taxpayers to furnish proof of overpayment through documents like settlement sheets for sales or refinancing, similar to how the Philadelphia form asks for proof related to various tax refund types including real estate.

Business License Renewal applications, while primarily for maintaining operational legality, resemble the Philadelphia form in the structure of requiring business identification details, such as the Federal Employer Identification Number. Moreover, they often include sections for adjustments or corrections based on past overpayments, akin to the refund request process of the Philadelphia Wage Tax Refund Petition.

The Worker’s Compensation Insurance Refund Request forms, utilized when an employer has overpaid premiums, reflect the Philadelphia form's demand for exact business identification and reason for the claim. Both forms necessitate detailed explanations of why a refund is due and the calculation of the overpaid amount, backed by evidence from payment records.

Amended Tax Returns for Individuals or Businesses allow taxpayers to correct errors on previously filed returns and claim refunds for overpayments. Like the Philadelphia form, these amended returns require detailed taxpayer information, a precise account of what is being amended, the specific tax years involved, and a clear reason for the amendment, along with any supporting documentation.

Finally, the Excise Tax Refund Claims, used for requesting refunds on specific goods or services, share the Philadelphia Form’s approach to tax-specific refund requests. Both necessitate identifying the specific tax account, detailing the period and reason for the refund, and providing a meticulous claim amount. They similarly require substantiation through documentation such as invoices, receipts, or explanatory letters.

Dos and Don'ts

Do: Clearly print or type all information to ensure legibility and prevent processing delays.

Do: Verify and enter the correct Petitioner's Name, including the first name, middle initial, and last name, as inaccuracies could lead to processing errors.

Do: Specify the correct Tax Account Number, as failure to do so could result in your petition being applied to the wrong account or tax type.

Do: Clearly specify the tax year or tax period for which you are requesting a refund to ensure that your petition is processed for the correct timeframe.

Do: Include the amount of claim with precision to expedite the refund process and avoid any discrepancies.

Do: Provide a clear reason for the refund petition. Include any relevant details or supporting documentation to substantiate your claim.

Do: Check and enter the correct mailing address for where the refund is to be sent to ensure the check reaches the intended recipient.

Do: Include contact information, such as a phone number, fax number, or email address, to facilitate communication regarding your petition.

Do: Double-check all entered information for accuracy before submitting to minimize delays or rejections.

Do: Sign and date the petition. An unsigned form may be considered invalid and can delay processing.

Don't: Leave any fields blank. Complete all required sections to avoid processing delays or denials due to incomplete information.

Don't: Use correction fluid or tape. Errors should be neatly crossed out and corrected to maintain the integrity of the document.

Don't: Forget to include supporting documentation when necessary, such as letters on company letterhead for wage tax refunds or copies of checks for real estate refunds.

Don't: Overlook the instructions on the reverse side of the form, as they provide critical guidance for completing the petition accurately.

Don't: Guess on dates, amounts, or other factual information. Ensure accuracy to avoid processing errors.

Don't: Submit the form without checking the appropriate box for the type of refund requested or failing to specify if the type is "Other."

Don't: Ignore the need to provide a detailed reason for your refund request. Vague or incomplete explanations can lead to unnecessary delays.

Don't: Mail or fax the petition without making a copy for your records. Keeping a copy ensures you have proof of submission and a reference if there are questions.

Don't: Discard or forget the contact information for the Department of Revenue, as you may need to follow up on your petition.

Don't: Submit false or misleading information, as this could lead to penalties under the law.

Misconceptions

When it comes to navigating the complexities of tax laws and specific forms like the Philadelphia Wage Tax Refund Petition, misconceptions can easily arise. Clearing up these misunderstandings is crucial to ensure you're properly informed and equipped to handle your tax matters accurately. Here are ten common misconceptions about the Philadelphia Wage Tax Refund Petition form:

- Misconception 1: The form is only for individuals seeking wage tax refunds. The truth is, while individual employees use a different process, this particular form is utilized by employers for withheld wage tax refund requests on behalf of their employees.

- Misconception 2: Any type of tax refund can be requested with this form. In reality, the form specifies it is not for Individual Employee Wage Tax refunds but covers a wide array of other refund types, including Business Income & Receipts Tax, Net Profits Tax, and many others.

- Misconception 3: You only need to fill out parts of the form relevant to you. The correct approach is to clearly print or type all requested information to avoid processing delays or rejection.

- Misconception 4: Electronic submissions are accepted. As of the last update, submissions are directed to be mailed or faxed to the provided contact information, emphasizing the importance of checking the latest submission guidelines.

- Misconception 5: Personal contact information is optional. Providing a phone number, fax number, and e-mail address is necessary for potential communications about the refund petition.

- Misconception 6: The form is self-explanatory and doesn't require additional documentation. Often, specific refund types, like wage tax or real estate tax refunds, require accompanying letters or documents, highlighting the need to carefully review the instructions and furnish all required information.

- Misconception 7: The petitioner's signature is the only one that matters. If the refund is related to departmental payments or involves certain permits, the signature and title of the Department's authorized designee are also required.

- Misconception 8: Filling out the petition guarantees a refund. Submission of this form starts the review process; accuracy, completeness, and eligibility are key factors in determining whether a refund will be issued.

- Misconception 9: Social Security Numbers are necessary for all petitioners. While individuals must provide their Social Security Number, business entities must use their Federal Employer Identification Number instead.

- Misconception 10: The instructions on the form are exhaustive. The form includes basic guidance, but additional questions should be directed to the contact information provided, ensuring clarity and compliance with current requirements.

Understanding these misconceptions and seeking clarification when needed can greatly enhance your ability to correctly use the Philadelphia Wage Tax Refund Petition form. Whether you're an individual employee, a business owner, or acting on behalf of an entity, knowing the specifics can help streamline the tax refund process and set realistic expectations.

Key takeaways

When completing the Philadelphia Wage Tax Refund Petition form, petitioners should provide clear, accurate information, since errors or omissions may delay processing. This guide outlines key takeaways to assist in the filing process:

- Correct form usage: This form is intended for various refunds except for Individual Employee Wage Tax, which requires a different process.

- Petitioner’s Information: The form requires the petitioner’s full name, including a middle initial, to accurately document who is requesting the refund.

- Business and Property Addresses: For entities, a business name and federal employer identification number are required, alongside property addresses for specific tax types.

- Contact Details: Providing a current phone number, fax number, and email address ensures that the Department of Revenue can contact the petitioner if necessary.

- Specifying the Refund Type: Petitioners must check the appropriate tax type they are seeking a refund for, marking "Other" if the type is not listed and specifying what it is.

- Tax Account Details: Accurately entering the tax account number(s), tax year(s), or period(s), and the amount being claimed is crucial for the refund process.

- Reason for Refund: Clearly stating the reason for the refund request, and attaching any requisite documentation, supports the petition’s processing.

- Required Signatures: The petition must be signed and dated by the petitioner to be considered valid. For departmental refunds, an authorized designee’s signature is also necessary.

- Additional Documentation: Depending on the refund type, such as Wage Tax or Real Estate, additional specific documentation might be required to support the petition.

It's important to review the instructions provided on the form carefully and to ensure that all required sections are filled out accurately to avoid delays. If there are any questions or concerns during the process, the City of Philadelphia Department of Revenue offers contact information for assistance.

Popular PDF Documents

How to Get W2 If You Moved - Instructions for requesting a reissued W-2, including the reasons for the request and the importance of providing accurate information.

File Business Tax Extension - Filers must be aware of the IRS's updates or changes to the form or the extension process to remain in compliance.

IRS 7200 - Form 7200 facilitates employers in managing cash flow while still fulfilling their payroll obligations.