Get Philadelphia Transfer Tax Form

The Philadelphia Transfer Tax form is a critical document for individuals involved in the transfer of real estate within the city. This comprehensive form requires detailed information and adherence to specific instructions to ensure a smooth transaction. Key sections include correspondence details, vital transfer data involving grantor(s) and grantee(s), property location specifics, and a thorough breakdown of valuation data to determine the actual financial consideration of the property in question. Additionally, the form addresses exemption data for transactions that may be exempt from tax under specific conditions, such as transfers through will or intestate succession, to industrial development agencies, or between principal and agents, among others. Completing this form accurately is pivotal for anyone looking to file in duplicate with the Recorder of Deeds — whether the transaction involves full consideration set forth in a deed, is a deed with consideration, by gift, or if a tax exemption is claimed. Failure to provide accurate tax parcel numbers, consideration values, and exemption details when applicable could result in legal and financial ramifications. Moreover, the documentation requires the signature of a responsible person connected with the transaction, underlining the seriousness and legal weight of the form.

Philadelphia Transfer Tax Example

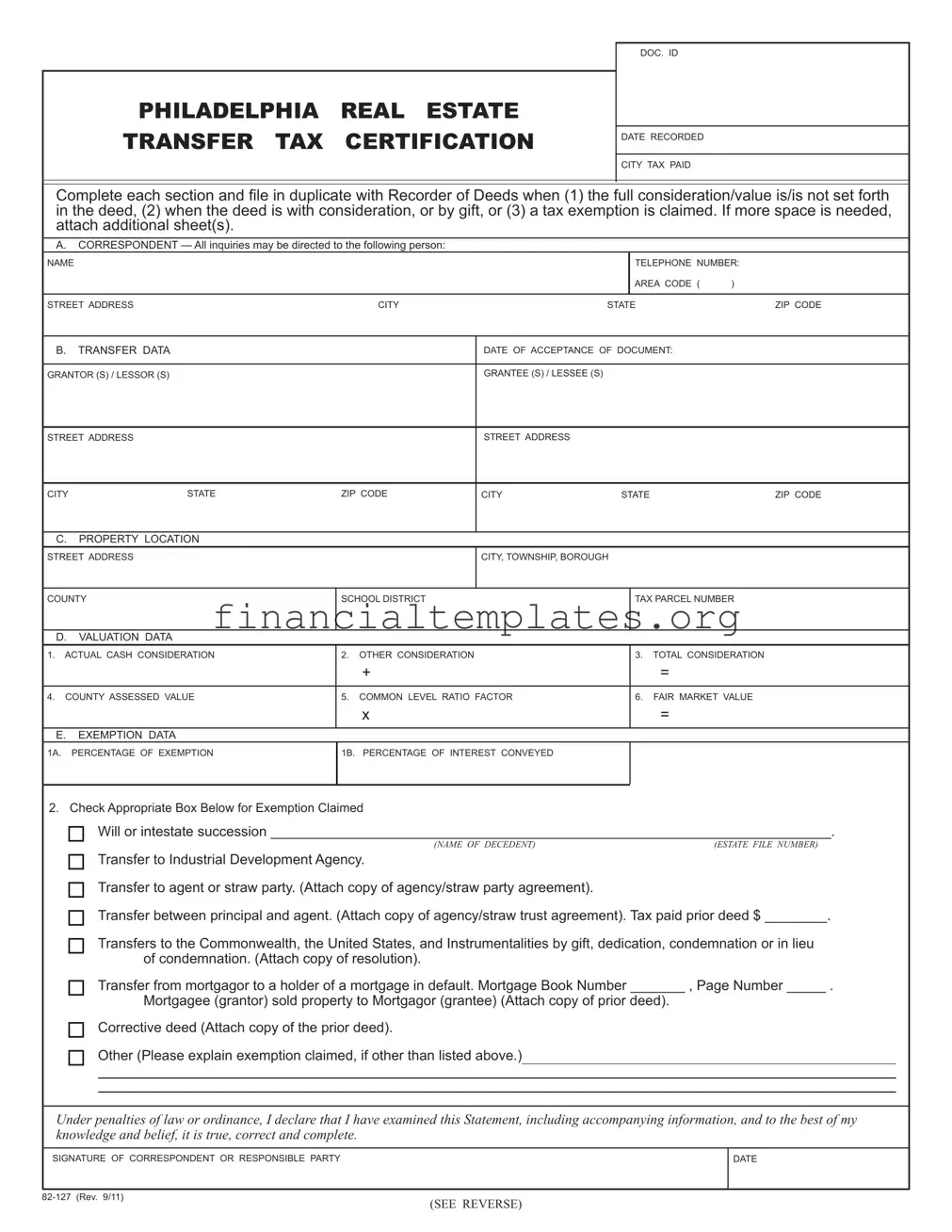

PHILADELPHIA REAL ESTATE TRANSFER TAX CERTIFICATION

DOC. ID

DATE RECORDED

CITY TAX PAID

Complete each section and fi le in duplicate with Recorder of Deeds when (1) the full consideration/value is/is not set forth in the deed, (2) when the deed is with consideration, or by gift, or (3) a tax exemption is claimed. If more space is needed, attach additional sheet(s).

A.CORRESPONDENT — All inquiries may be directed to the following person:

NAME

TELEPHONE |

NUMBER: |

|

AREA CODE |

( |

) |

STREET ADDRESS |

CITY |

STATE |

ZIP CODE |

B.TRANSFER DATA

GRANTOR (S) / LESSOR (S)

DATE OF ACCEPTANCE OF DOCUMENT:

GRANTEE (S) / LESSEE (S)

STREET ADDRESS

STREET ADDRESS

CITY |

STATE |

ZIP CODE |

CITY |

STATE |

ZIP CODE |

C.PROPERTY LOCATION

STREET ADDRESS

CITY, TOWNSHIP, BOROUGH

COUNTY

SCHOOL DISTRICT

TAX PARCEL NUMBER

D.VALUATION DATA

1. |

ACTUAL CASH CONSIDERATION |

2. |

OTHER CONSIDERATION |

3. |

TOTAL CONSIDERATION |

|

|

|

+ |

|

= |

|

|

|

|

|

|

4. |

COUNTY ASSESSED VALUE |

5. |

COMMON LEVEL RATIO FACTOR |

6. |

FAIR MARKET VALUE |

|

|

|

x |

|

= |

|

|

|

|

|

|

E.EXEMPTION DATA

1A. PERCENTAGE OF EXEMPTION

1B. PERCENTAGE OF INTEREST CONVEYED

2. Check Appropriate Box Below for Exemption Claimed

Will or intestate succession ________________________________________________________________________.

(NAME OF DECEDENT) |

(ESTATE FILE NUMBER) |

Transfer to Industrial Development Agency.

Transfer to agent or straw party. (Attach copy of agency/straw party agreement).

Transfer between principal and agent. (Attach copy of agency/straw trust agreement). Tax paid prior deed $ ________.

Transfers to the Commonwealth, the United States, and Instrumentalities by gift, dedication, condemnation or in lieu of condemnation. (Attach copy of resolution).

Transfer from mortgagor to a holder of a mortgage in default. Mortgage Book Number _______ , Page Number _____ .

Mortgagee (grantor) sold property to Mortgagor (grantee) (Attach copy of prior deed).

Corrective deed (Attach copy of the prior deed).

Other (Please explain exemption claimed, if other than listed above.)

Under penalties of law or ordinance, I declare that I have examined this Statement, including accompanying information, and to the best of my knowledge and belief, it is true, correct and complete.

SIGNATURE OF CORRESPONDENT OR RESPONSIBLE PARTY

DATE

(SEE REVERSE)

INSTRUCTIONS FOR COMPLETING PHILADELPHIA REAL ESTATE TRANSFER TAX CERTIFICATION

Section A Correspondent: Enter the name, address and telephone number of party completing this form.

Section B Transfer Data: Enter the date on which the deed or other document was accepted by the Party(ies). Enter the name and address of the Grantor(s)/Lessor(s) and Grantee(s)/Lessee(s). You must list all names.

Attach additional sheet(s) with full name and address of parties involved, if necessary. You reserve the right to, etc.

Section C Property Location: This section deals with the property being transferred; complete fully. Include the tax parcel number where applicable and the county where the Statement is being filed.

Section D Valuation Data: Complete for all transactions.

1.Actual Cash Consideration - Enter that amount.

2.Other Consideration - Enter the total amount of

3.Total Consideration - Indicate on line 3 the total of lines 1 and 2. This will be the total consideration for the purchase of the property.

4.County Assessed Value - Enter the actual assessed value of the property as per records of the county assessment office.

5.Common Level Ratio Factor - Enter the county common level ratio factor applicable for the county in which the property is located. An explanation of this factor is provided below.

6.Fair Market Value - Multiply the county assessed value (4) and the county common level ratio factor

(5) and enter the result in block 6.

Section E Exemption Data: Complete only for transactions where an exemption is claimed.

1a. Percentage of Exemption - Enter the percentage of the total consideration claimed as exempt.

1b. Percentage of Interest Conveyed - Enter percentage of interest conveyed.

2.Check Appropriate Box for Exemption Claimed - Boxes are provided for the most often used Pennsylvania realty exemptions. Each is explained in order of appearance on the Realty Transfer Statement of Value form.

"Will or Intestate Succession" - A transfer by Will for no or nominal consideration, or under the intestate succession laws is exempt from tax. Provide the name of the decedent and estate fi le number in the space provided.

"Transfer To or From Agent or Straw Party" - A transfer to or from an agent is exempt from tax if a transfer to or from the agent's principal by the third party would be exempt from tax. Attach a copy of the agency/straw party agreement and a statement explaining the exemption claimed.

"Transfer Between Principal and Agent" - A transfer between an agent or principal for no or nominal consideration is exempt. Attach a copy of the agency/straw trust agreement. Enter the tax paid on the prior deed in the space provided.

"Transfer to the Commonwealth, the United States and Instrumentalities by Gift, Dedication, Condemnation or in lieu of Condemnation." - (Attach a copy of resolution)

"Transfer from Mortgagor to Holder of a Mortgage in Default" - A transfer from a mortgagor to a holder of a mortgage in default, whether pursuant to a foreclosure or in lieu, thereof, is exempt. Provide the mortgage book number and page number where mortgage is recorded, and property was transferred directly from the Mortgage to the Mortgagor.

"Corrective Deed" - A deed for no or nominal consideration which corrects a deed that was previously recorded but does not extend or limit the title or interest under the prior deed is exempt from tax. (Attach copy of the prior deed).

"OTHER" (PLEASE EXPLAIN EXEMPTION CLAIMED IF OTHER THAN THOSE LISTED ABOVE.) When claiming an exemption other than those listed, you must specify which exemption is claimed. When possible, provide the applicable statutory citation. Attach additional pages, if necessary.

COMMON LEVEL RATIO FACTOR

This is a property valuation factor provided by the Department of Revenue by which the county assessed value is multiplied to determine the taxable value of real estate for all

THIS STATEMENT MUST BE SIGNED BY A RESPONSIBLE PERSON CONNECTED WITH THE TRANSACTION.

Document Specifics

| Fact | Description |

|---|---|

| Document Title | Philadelphia Real Estate Transfer Tax Certification |

| Governing Law | Pennsylvania State Law and City of Philadelphia Ordinances |

| Form Requirement | Must be filed in duplicate with the Recorder of Deeds |

| Sections Covered | A: Correspondent, B: Transfer Data, C: Property Location, D: Valuation Data, E: Exemption Data |

| Valuation Process | Includes actual cash consideration, other consideration, total consideration, county assessed value, common level ratio factor, fair market value calculation |

| Exemptions | Detailed section on how to claim tax exemptions, with examples provided |

| Common Level Ratio Factor | A key factor in determining taxable value for real estate transactions |

| Completion Significance | The form must be signed by a responsible person connected with the transaction, under penalties of law or ordinance |

Guide to Writing Philadelphia Transfer Tax

When dealing with property transactions in Philadelphia, the Real Estate Transfer Tax Certification plays a crucial role. This document ensures that all real estate transfers are properly documented and taxed in accordance with city regulations. While it may seem daunting at first, completing this form accurately is imperative for a smooth transaction. Below, you'll find a step-by-step guide to help fill out the Philadelphia Transfer Tax form correctly.

- Section A - Correspondent:

- Enter the complete name, street address, city, state, zip code, and telephone number (with the area code) of the person responsible for completing this form.

- Section B - Transfer Data:

- Fill in the date when the document or deed was officially accepted.

- Input the full names and addresses of both the grantor(s)/lessor(s) and the grantee(s)/lessee(s). If additional space is needed, attach extra sheets with the complete information.

- Section C - Property Location:

- Provide the street address, city, township, or borough, county, and the tax parcel number of the property being transferred.

- Section D - Valuation Data:

- In part 1, enter the actual cash consideration for the property.

- For part 2, detail any other form(s) of consideration (non-cash items like securities, other properties, etc.).

- Part 3 requires you to add the amounts from parts 1 and 2 to present the total consideration for the property transaction.

- In part 4, input the county's assessed value of the property.

- For part 5, write the common level ratio factor applicable to the county where the property is located. This can typically be found at the Recorder of Deeds' office or their official website.

- Part 6 involves calculating the fair market value by multiplying the county assessed value (4) by the common level ratio factor (5), and inputting the result.

- Section E - Exemption Data:

- If claiming an exemption, indicate the percentage of the total consideration that is exempt in part 1a, and the percentage of interest being conveyed in part 1b.

- Check the appropriate box for the exemption being claimed. If it is not specifically listed, select "Other" and provide a clear explanation on an attached sheet. For all exemptions, when necessary, attach supporting documents such as copies of deed, agency agreements, or resolutions.

- Signing the Form: The form must be signed by a responsible person connected with the transaction, indicating that the data provided is accurate to the best of their knowledge and belief.

Completing the Philadelphia Transfer Tax form is a step towards ensuring all parties comply with local tax laws pertaining to property transfers. Careful attention to detail and accuracy when filling out this form will help ensure the transaction proceeds without unnecessary delays or legal complications.

Understanding Philadelphia Transfer Tax

What is the purpose of the Philadelphia Real Estate Transfer Tax Certification form?

This form is used for recording with the Recorder of Deeds in the event of a real estate transfer in Philadelphia. Its purpose is to declare the full consideration/value involved, articulate the terms when a deed is executed with consideration, or by gift, or when a tax exemption is claimed. Completing this form in detail is necessary for accurately assessing and collecting the city's transfer tax.

How do I complete Section A, "Correspondent"?

In Section A, you are required to input the name, address, and telephone number of the person responsible for completing the form. This individual will be the main contact for any inquiries related to the information provided on the document. Make sure to include the area code with the telephone number.

What information is needed for Section D, "Valuation Data"?

Section D collects detailed information about the financial aspects of the transaction, including:

- Actual Cash Consideration: The cash amount involved in the purchase.

- Other Consideration: The value of non-cash transactions, which might include other properties, securities, existing mortgages or liens, and considerations for improvements.

- Total Consideration: This is the sum of the Actual Cash Consideration and the Other Consideration, representing the complete value of the property purchase.

- County Assessed Value: The official value placed on the property by the county's assessment office.

- Common Level Ratio Factor: A factor used to adjust the county assessed value to reflect the fair market value, as determined by the State Tax Equalization Board. This value is critical for transactions that aren't conducted at arm's length or involve acquired companies and leases.

Calculating the fair market value by multiplying the County Assessed Value and the Common Level Ratio Factor gives the tax base for the transaction.

How do I claim an exemption in Section E, "Exemption Data"?

To claim an exemption, accurately complete Section E with these steps:

- Indicate the percentage of the total consideration you're claiming as exempt in 1a.

- Specify the percentage of the interest conveyed in 1b.

- Check the appropriate box that matches the exemption you're claiming. You'll find a range of options, from transfers due to will or intestate succession, to transfers to or from agents or straw parties, and more. For each exemption claimed, provide any required supporting documentation, such as agency agreements, resolution copies, or prior deeds.

- If your exemption does not fit any listed category, select "Other" and clearly describe the nature of your exemption claim. Whenever possible, include the applicable law or statutory citation.

Correctly identifying and substantiating your exemption claim is crucial for ensuring that the transaction is accurately processed and taxed.

Where can I find the Common Level Ratio Factor?

The Common Level Ratio Factor is published by the Department of Revenue and reflects the ratio of assessed values to current fair market values based on real estate sales in each county. This factor adjusts the assessed value to ensure taxation reflects fair market value accurately. A statewide list of these factors is available at the Recorder of Deeds office in each county, ensuring that individuals can easily access the necessary information for their real estate transactions.

Common mistakes

Filling out the Philadelphia Transfer Tax form correctly is crucial for a smooth property transfer process. However, there are common mistakes that can lead to delayed processing or incorrect tax calculations. Below are eight common errors to avoid:

- Not completing each section in duplicate. The form requires filing in duplicate with the Recorder of Deeds. Missing this step can lead to processing delays.

- Incorrectly reporting the full consideration/value. Whether the transaction involves full consideration, is by gift, or if a tax exemption is claimed, it is essential to accurately report the value set forth in the deed.

- Failing to list all parties involved. The Correspondent and Transfer Data sections must include complete names and addresses of all parties. Omitting any party can invalidate the form.

- Overlooking the need for additional sheets. If more space is needed for any section, additional sheets must be attached. Neglecting this can result in incomplete submissions.

- Incorrect calculation of the Total Consideration. The Total Consideration is the sum of Actual Cash Consideration and Other Consideration. Errors in this calculation affect tax liability.

- Not properly identifying the property location. Complete details including the street address, city, township, borough, and tax parcel number are necessary for accurate recording.

- Miscalculating Fair Market Value. The Fair Market Value is determined by multiplying the County Assessed Value with the Common Level Ratio Factor. Incorrect application of these values leads to wrong tax assessments.

- Inadequately detailing the exemption claimed. When claiming an exemption, it is crucial to check the appropriate box and provide all required attachments and explanations. Vague or incomplete exemption details can lead to the rejection of the exemption claim.

To ensure compliance and accurate tax calculation, avoiding these mistakes is paramount. Proper attention to detail and thorough review before submission can help streamline the property transfer process in Philadelphia.

Documents used along the form

Transferring property in Philadelphia entails dealing with various documents, one of which is the Philadelphia Real Estate Transfer Tax Certification. This form plays a pivotal role in the real estate transaction process, ensuring the correct transfer taxes are paid. However, this form doesn't work alone. Several other forms and documents often accompany it to streamline the transfer process, enhance accuracy, and comply with state and local regulations. Let's take a closer look at some of these essential documents.

- Statement of Value: This document is crucial when the sale price of the property does not reflect its true market value or when a transfer tax exemption is being claimed. It provides a detailed explanation of the transaction's value to justify the amount declared on the transfer tax form.

- Deed: The core document in any real estate transaction, a deed, legally transfers ownership from the seller (grantor) to the buyer (grantee). It includes vital information such as the property's legal description, the parties involved, and any warranties.

- Title Report: Before transferring property, a title report is often reviewed to ensure the title is clear of any liens, disputes, or encumbrances. This document outlines the history of ownership and any issues that might affect the sale.

- HUD-1 Settlement Statement: Though now often replaced by the Closing Disclosure for residential transactions involving a mortgage, the HUD-1 itemizes all costs, fees, and charges to both the buyer and seller. It’s crucial for ensuring all financial aspects of the transfer are transparent and agreed upon.

- Mortgage Documents: If the transaction involves financing, mortgage documents outline the terms of the loan, the obligations of the borrower, and the lender's rights. These documents are important for recording the mortgage against the property as security for the loan.

- Exemption Documents: When a transfer tax exemption is claimed on the Philadelphia Transfer Tax form, specific documents substantiating the exemption must be attached. These could include evidence of a family transfer, public utility easement, or other situations that qualify for an exemption under the law.

While the Philadelphia Real Estate Transfer Tax Certification is a key document, it's just a part of a much larger puzzle in property transactions. The accompanying documents provide a comprehensive picture, ensuring legal compliance, financial transparency, and a smooth transfer process. Whether you're a first-time homebuyer or an experienced real estate professional, understanding these documents and their roles in the transfer process is crucial for any property transaction in Philadelphia.

Similar forms

The Uniform Residential Loan Application form shares similarities with the Philadelphia Real Estate Transfer Tax Certification document in its comprehensive collection of data concerning financial transactions associated with real estate. Like the Transfer Tax form, which requires detailed information about the sale or transfer of property, including consideration paid and tax exemption details, the Uniform Residential Loan Application seeks to understand the financial background, employment history, and creditworthiness of an applicant to determine loan eligibility. Both documents play pivotal roles in their respective real estate processes by ensuring all necessary financial and personal information is accurately recorded and assessed.

A Warranty Deed form, which is used to guarantee that a property seller has the right to sell the property and that it is free from hidden liens or claims, has notable parallels to the Transfer Tax document. Both require detailed descriptions of the property, including location and valuation, ensuring that all parties have clear, legally sound documentation regarding the property's status and the terms of its transfer. While the Warranty Deed focuses on the legal rights associated with the property, the Transfer Tax form encompasses financial aspects of the transfer, including taxation and exemptions.

The HUD-1 Settlement Statement, which outlines all closing costs in a real estate transaction, also mirrors the Philadelphia Transfer Tax Certification form in its role in the finalization of property transfers. Both documents detail financial transactions, with the HUD-1 providing an itemized list of all charges and credits to the buyer and seller, and the Transfer Tax form calculating taxes due based on the sale value and exemptions. Each serves to provide transparency and ensure all financial aspects of a transfer are duly recorded for both parties' records and for legal compliance.

Affidavit of Title, a document that the seller provides, asserting ownership and disclosing any known defects, liens, or encumbrances, shares objectives with the Philadelphia Transfer Tax Certification. Both require declarations regarding the property, ensuring that any transactions are conducted with full knowledge of the property's status. The Affidavit ensures that the seller is the rightful owner and discloses issues affecting the property’s title, while the Transfer Tax document calculates and records tax liabilities based on the transaction's specifics.

The Deed of Trust, which secures a real estate transaction by holding the property title in trust until the loan is paid, also aligns with the Transfer Tax document in terms of securing interests in a property transaction. While the Deed of Trust involves lenders, trustees, and borrowers in the property's financial arrangement, the Transfer Tax form centers on the government's interest, ensuring tax obligations are met. Both ensure that obligations are defined and met before, during, and after the transfer of property ownership.

Certificate of Occupancy, which certifies a building's compliance with building codes and readiness for occupancy, complements the Transfer Tax form through its role in the legal and regulatory framework of real estate transactions. The Certificate ensures the property is safe and meets standards, while the Transfer Tax document ensures that transaction-related financial regulations, including taxation, are followed, covering different, yet crucial, aspects of property transfer legality and compliance.

The Real Estate Purchase Agreement lays down the terms of the sale between buyer and seller, similar to how the Transfer Tax document outlines financial terms related to taxation and exemptions. Both are essential to the legal and financial aspects of real estate transactions, with the Purchase Agreement detailing the agreement specifics, and the Transfer Tax form ensuring compliance with tax obligations.

A Grant Deed, which transfers property ownership while warranting that the property has not been sold to someone else, aligns with the Transfer Tax document in function and purpose by facilitating transparent and legally sound property transfers. The Grant Deed focuses on the transfer and assurances related to titles, whereas the Transfer Tax form addresses the financial dimensions of these transfers, particularly taxation.

The Property Disclosure Statement, requiring sellers to disclose known property defects, complements the Transfer Tax form by providing transparency and protection in real estate transactions. While the Disclosure Statement focuses on the property's condition, the Transfer Tax form ensures financial transparency regarding the transaction's value and tax implications, both critical for informed decision-making and compliance.

Lastly, the Mortgage Agreement, which outlines the terms of a property loan, shares similarities with the Transfer Tax Certification by detailing financial obligations tied to property. Both documents serve the purpose of ensuring clarity and compliance in the financial aspects of property transactions - the Mortgage Agreement through the loan's terms, and the Transfer Tax form through the taxation based on the transaction's value.

Dos and Don'ts

Filling out the Philadelphia Transfer Tax form is an important process that accompanies the transfer of real estate ownership within the city. To ensure accuracy and compliance, here are several key do's and don'ts to keep in mind:

- Do ensure that all sections of the form are completed fully. Missing information can lead to processing delays or questions from the Recorder of Deeds.

- Do double-check the accuracy of the property location information, including the tax parcel number and the accurate county designation. Errors here can cause significant complications.

- Do include all necessary documentation for exemptions claimed. If you're claiming an exemption, such as a transfer by gift, make sure to attach all the required supporting documentation, such as a copy of the resolution or agreement.

- Don't guess on valuation data. The Actual Cash Consideration, Other Consideration, and Fair Market Value sections should reflect accurate numbers supported by documentation or affidavits if necessary. Estimations can lead to incorrect tax calculations.

- Don't overlook the Common Level Ratio Factor. This factor is crucial in calculating the fair market value for tax purposes, especially in non-arm's length transactions. Ensure the correct year's factor is applied.

- Don't forget to sign the form by the correspondent or responsible party. An unsigned form is incomplete and will not be processed, potentially halting the entire transfer process.

Following these guidelines will help facilitate a smoother transaction process, ensuring that all aspects of the transfer tax form are properly addressed and compliant with city regulations.

Misconceptions

Many people encounter misunderstandings when dealing with the Philadelphia Transfer Tax form. Here is a list of nine common misconceptions and clarifications to help understand the process better.

- Misconception: The Philadelphia Transfer Tax form is only required for property sales involving cash consideration.

Clarification: This form must be completed for all types of real estate transfers, regardless of whether the consideration is in cash, other forms of value, or even if there is no consideration, such as in gifts or certain exempt transactions.

- Misconception: All property transfers are exempt from the transfer tax.

Clarification: Only specific types of transfers qualify for exemptions, such as those due to will or intestate succession, certain transactions involving government bodies, or between principal and agent under specific conditions. Proper documentation must be provided to claim an exemption.

- Misconception: The valuation data section is not crucial if the transaction is exempt from tax.

Clarification: The valuation data section helps in determining the fair market value of the property and is important for all transfers, including those that may be exempt from tax. This information is required for record-keeping and ensures compliance with regulations.

- Misconception: Filing the form electronically is not allowed.

Clarification: Electronic filing may be available and can streamline the process. It's important to check with the Philadelphia Recorder of Deeds for the most current filing methods.

- Misconception: The form is only necessary for residential property transfers.

Clarification: The Philadelphia Transfer Tax form is required for the transfer of all types of real estate, including commercial, residential, and industrial properties, to properly document the transaction and calculate any taxes due.

- Misconception: The common level ratio factor is a constant value.

Clarification: The common level ratio factor varies by county and is updated periodically to reflect changes in the property market. It's important to use the current ratio when calculating fair market value for tax purposes.

- Misconception: If incorrect information is accidentally provided, amending the form is impossible.

Clarification: Amendments can be made to the form if errors are discovered. It's essential to refile with the corrected information to avoid complications or additional taxes.

- Misconception: The contact information of the correspondent is irrelevant.

Clarification: Providing accurate contact information for the responsible party or correspondent is crucial. This allows the Recorder of Deeds or other officials to reach out if there are questions or issues with the filing.

- Misconception: The signature of the correspondent signifies legal responsibility for the tax payment.

Clarification: Signing the form as the correspondent or responsible party certifies that the information provided is accurate to the best of their knowledge. It does not transfer the obligation for tax payments from the seller or grantor to the correspondent.

Understanding these aspects can help in accurately completing the Philadelphia Transfer Tax form and ensuring compliance with local laws and regulations.

Key takeaways

When submitting the Philadelphia Transfer Tax form, it's essential to understand the following key points to ensure accuracy and compliance:

- The form must be filed in duplicate with the Recorder of Deeds under specific conditions: if the full consideration or value is or isn't set forth in the deed, the deed involves consideration, is a gift, or when a tax exemption is claimed.

- Section A necessitates the correspondent's complete contact information, including name, telephone number, address, and area code, ensuring any inquiries related to the form can be directed correctly.

- In Section B, details about the transfer data are crucial. This includes the date of document acceptance and comprehensive information about both the grantor(s)/lessor(s) and the grantee(s)/lessee(s), including names and addresses.

- The location of the property being transferred must be completely detailed in Section C, including the street address, city, township, borough, county, school district, and tax parcel number, if applicable.

- Section D focuses on valuation data involving the actual cash consideration, other considerations, total consideration, the county assessed value, the common level ratio factor, and the fair market value based on these inputs.

- For transactions claiming an exemption, Section E should be filled out, highlighting the percentage of exemption, percentage of interest conveyed, and specifying the exemption being claimed.

- Exemption claims require supporting documentation, such as copies of agreements, resolutions, or prior deeds as applicable. This documentation is crucial for validating the exemption claimed.

- The Common Level Ratio Factor is a critical element used to calculate the taxable value of real estate for certain transactions. It represents the ratio of assessed values to the current fair market values based on actual sales data.

- Accuracy is paramount. The form necessitates a declaration that all provided information, including accompanying documents, is true, correct, and complete to the best of the knowledge and belief of the person filling it out.

- The form must be signed by a responsible person involved in the transaction, indicating the official acknowledgment and accuracy of the information provided.

- It's possible to attach additional sheets if more space is needed for any section of the form, ensuring that detailed and precise information can be supplied without constraint.

Understanding these key aspects helps ensure that the Philadelphia Transfer Tax form is filled out accurately and in compliance with the required legal standards, making the process smoother for all parties involved.

Popular PDF Documents

IRS 4137 - Through form 4137, the IRS promotes a systematic approach to the inclusion of all earned income in tax assessments.

Can Someone Take Over My Car Loan - Helps protect both the seller and buyer by clearly outlining the terms of the car payment takeover.

Acquisition or Abandonment of Secured Property - The form plays a role in the broader context of managing and understanding foreclosure-related tax consequences.