Get Pfms Generated Payment Form

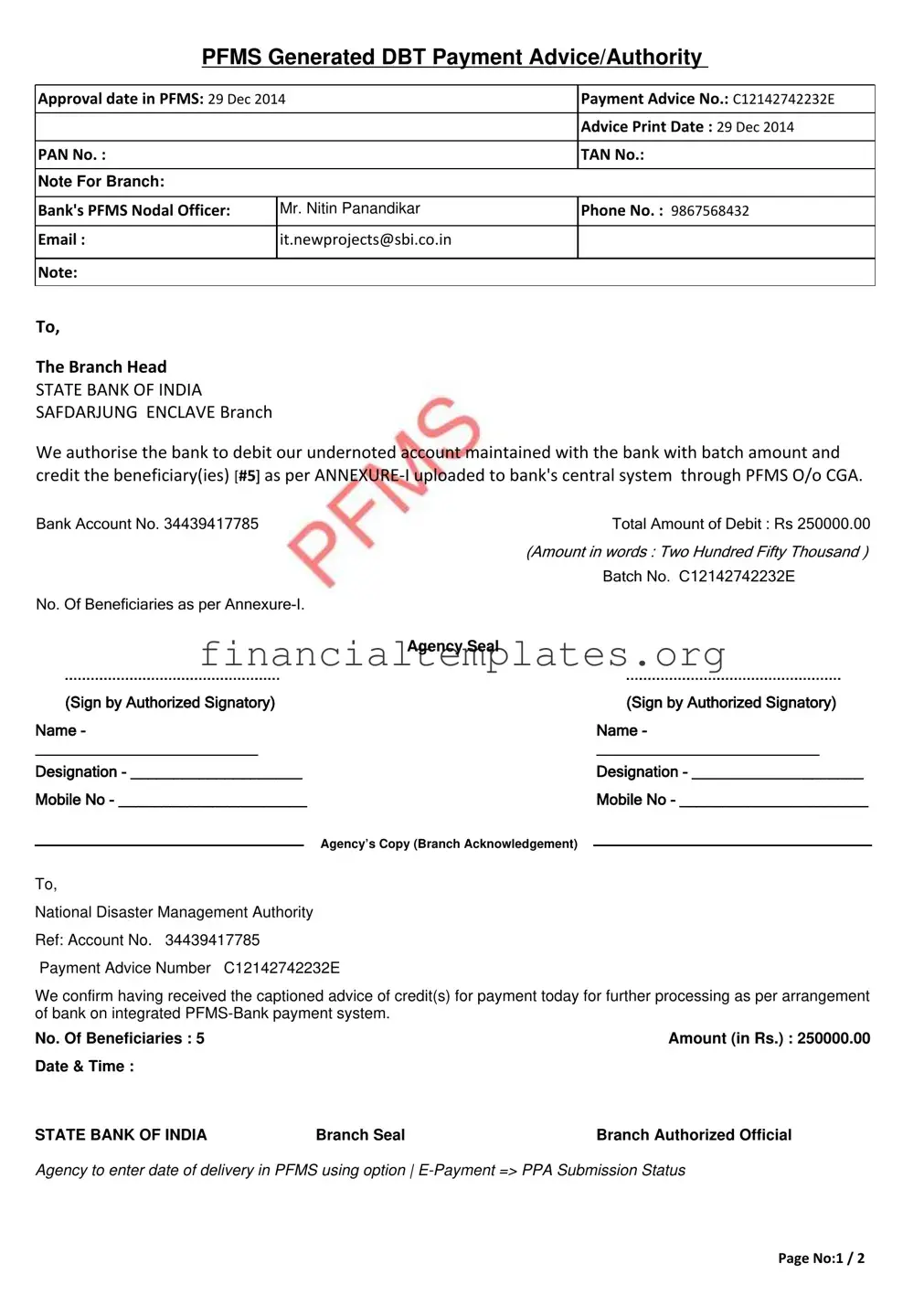

The Pfms Generated Payment form plays a crucial role in facilitating Direct Benefit Transfer (DBT) payments, streamlining the process between government agencies and beneficiaries. Initiated on December 29, 2014, this document serves as an authoritative instruction for banks, particularly in this instance for the State Bank of India, Safdarjung Enclave Branch, to debit a specified agency account and credit the amounts to individual beneficiaries as per detailed annexure. The form lists the payment advice number, batch number, bank account details for debit, total amount to be debited, and number of beneficiaries, ensuring a transparent and traceable transaction process. Furthermore, it functions under the oversight of dedicated bank officials, exemplified by the appointment of a PFMS Nodal Officer, facilitating communication and resolution of potential issues. The annexure attached with the form details beneficiary information, including names, bank details, and payment amounts, confirming the targeted distribution of funds. This mechanism underscores the government's commitment to enhancing the efficacy of financial disbursements through the Public Financial Management System (PFMS), ensuring that benefits reach the intended individuals efficiently and securely.

Pfms Generated Payment Example

PFMS Generated DBT Payment Advice/Authority

Approval date in PFMS: 29 Dec 2014 |

Payment Advice No.: C12142742232E |

|

|

|

|

|

|

Advice Print Date : 29 Dec 2014 |

|

|

|

PAN No. : |

|

TAN No.: |

|

|

|

Note For Branch: |

|

|

|

|

|

Bank's PFMS Nodal Officer: |

Mr. Nitin Panandikar |

Phone No. : 9867568432 |

|

|

|

Email : |

it.newprojects@sbi.co.in |

|

|

|

|

Note: |

|

|

|

|

|

To,

The Branch Head

STATE BANK OF INDIA

SAFDARJUNG ENCLAVE Branch

We authorise the bank to debit our undernoted account maintained with the bank with batch amount and credit the beneficiary(ies) [#5] as per

Bank Account No. 34439417785 |

|

Total Amount of Debit : Rs 250000.00 |

|

|

|

(Amount in words : Two Hundred Fifty Thousand ) |

|

|

|

|

Batch No. C12142742232E |

No. Of Beneficiaries as per |

|

|

|

|

|

Agency Seal |

|

.................................................. |

|

.................................................. |

|

(Sign by Authorized Signatory) |

|

(Sign by Authorized Signatory) |

|

Name - |

|

Name - |

|

__________________________ |

|

__________________________ |

|

Designation - ____________________ |

|

Designation - ____________________ |

|

Mobile No - ______________________ |

|

Mobile No - ______________________ |

|

|

|

Agency’s Copy (Branch Acknowledgement) |

|

|

|

|

|

To,

National Disaster Management Authority

Ref: Account No. 34439417785

Payment Advice Number C12142742232E

We confirm having received the captioned advice of credit(s) for payment today for further processing as per arrangement of bank on integrated

No. Of Beneficiaries : 5 |

|

Amount (in Rs.) : 250000.00 |

Date & Time : |

|

|

STATE BANK OF INDIA |

Branch Seal |

Branch Authorized Official |

Agency to enter date of delivery in PFMS using option |

Page No:1 / 2

ANNEXURE

(All page to be stamped and initial and last page to be signed in FULL with stamp)

Payment Advice No.: C12142742232E

Sr.N |

Name of |

Bank Name |

Account Number |

Aadhaar |

|

IFSC/IIN/MICR |

Amount(In |

o. |

Beneficiary |

|

|

Number |

|

Code |

Rs.) |

|

|

|

|

|

|

|

|

1 |

GHULAM AKBAR |

THE JAMMU AND |

0143040860004378 |

|

|

JAKA0UKHRAL |

50,000.00 |

|

MALIK SO MOHD |

KASHMIR BANK LTD |

|

|

|

|

|

|

ABDULLAH MALIK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

JAMAL DIN SO GH |

THE JAMMU AND |

0250040860000183 |

|

|

JAKA0KHERRI |

50,000.00 |

|

AKBAR |

KASHMIR BANK LTD |

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

MOHAMMAD |

THE JAMMU AND |

0250040100007438 |

|

|

JAKA0KHERRI |

50,000.00 |

|

RAMZAN SO GHULAM |

KASHMIR BANK LTD |

|

|

|

|

|

|

QADIR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

MOHD RAMZAN SO |

THE JAMMU AND |

0250040100003254 |

|

|

JAKA0KHERRI |

50,000.00 |

|

REHMAN |

KASHMIR BANK LTD |

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

MOHD YOUSAF SO |

THE JAMMU AND |

0250040100000812 |

|

|

JAKA0KHERRI |

50,000.00 |

|

MOHD MUNWAR |

KASHMIR BANK LTD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Amount(Rs) |

250000.00 |

|

|

|

|

|

|

|

|

|

Please acknowledge and do the needful as prescribed by bank to complete transactions.

Page No:2 / 2

Document Specifics

| Fact Name | Detail |

|---|---|

| Approval Date | 29 Dec 2014 |

| Payment Advice Number | C12142742232E |

| Total Amount of Debit | Rs 250,000.00 (Two Hundred Fifty Thousand) |

| Bank's PFMS Nodal Officer | Mr. Nitin Panandikar, Phone: 9867568432, Email: it.newprojects@sbi.co.in |

| Number of Beneficiaries | 5 |

| Governing Law(s) | Integrated PFMS-Bank payment system through Office of Controller General of Accounts (O/o CGA) |

Guide to Writing Pfms Generated Payment

Filling out a PFMS (Public Financial Management System) Generated Payment form is a crucial step in facilitating Direct Benefit Transfers (DBT) authorized by agencies to beneficiaries’ bank accounts. This document permits the transfer of funds from one account to multiple beneficiaries efficiently and securely. Below is a guide to accurately completing this form.

- Begin with the section titled "PFMS Generated DBT Payment Advice/Authority." Here, note the Approval date in PFMS, which for this example is 29 Dec 2014.

- Enter the Payment Advice No., which is C12142742232E, and the Advice Print Date, also 29 Dec 2014.

- Proceed to fill in the PAN No. and TAN No. fields, if applicable. These details are crucial for the identification and tax purposes of the remitting agency.

- In the section "Note For Branch," include the designated Bank's PFMS Nodal Officer details. For this example, write down Mr. Nitin Panandikar as the officer, alongside his phone number (9867568432) and email (it.newprojects@sbi.co.in).

- Address the form to the Branch Head of the specified bank, in this case, STATE BANK OF INDIA SAFDARJUNG ENCLAVE Branch.

- Authorize the bank to debit the account mentioned, which is 34439417785, with the total amount of debit indicated as Rs 250000.00 and in words, Two Hundred Fifty Thousand.

- Indicate the Batch No., which should match the Payment Advice No. (C12142742232E).

- Input the number of beneficiaries, in this case, #5, and ensure all relevant details are included in ANNEXURE-I.

- Ensure the form is stamped and signed by the Authorized Signatory, with both their name and designation clearly printed below their signatures.

- Complete the agency’s copy for the branch acknowledgment, verifying the account number and payment advice number as before.

- Check off that the total number of beneficiaries and the total amount are the same as previously noted, and make note of the acknowledgment by the receiving branch, including the delivery date in PFMS.

After completing the form, it's essential to review all entries for accuracy to ensure smooth processing. The provided details facilitate the bank's understanding of the transfer request, aiding in the efficient and secure deposit of funds to the intended beneficiaries. Properly executed, this form is instrumental in the seamless execution of financial transactions within the integrated PFMS-Bank payment system.

Understanding Pfms Generated Payment

-

What is PFMS?

PFMS stands for Public Financial Management System. It is a web-based application used by the Government of India to track program funds and ensure that the government's social welfare schemes reach the beneficiaries directly through Direct Benefit Transfer (DBT).

-

What is a PFMS Generated Payment form?

A PFMS Generated Payment form is an official document produced by the PFMS to authorize a payment transaction. It details the payment advice or authority approval, including specifics like the approval date, payment advice number, the total amount to be debited, the beneficiary details, and instructions to the bank for processing the payment.

-

How do I interpret the Payment Advice No. mentioned in the form?

The Payment Advice No. is a unique identifier for the payment transaction. It is used to track and manage the transaction through the PFMS and the banking system. Each transaction will have its own distinct Payment Advice No. for record-keeping and verification purposes.

-

Who is Mr. Nitin Panandikar?

Mr. Nitin Panandikar is designated as the bank's PFMS Nodal Officer. His role involves coordinating between the bank and the PFMS to facilitate the processing of the DBT payments. He can be contacted for any queries or issues related to the transaction specified in the form.

-

What is the importance of the 'Agency Seal' and signatures?

The 'Agency Seal' and the signatures of authorized signatories serve as a formal endorsement of the transaction. They verify that the payment request has been approved by the concerned agency and authorize the bank to proceed with the debit and credit transactions as specified in the form.

-

What should I do if I spot an error in the transaction details?

If you find any discrepancies or errors in the transaction details, it is crucial to contact the bank's PFMS Nodal Officer immediately. Provide them with the Payment Advice No. and specify the errors to be corrected. Timely communication can help prevent incorrect transactions.

-

What does the 'Total Amount of Debit' signify?

The 'Total Amount of Debit' indicates the total sum of money to be deducted from the agency's account for the purpose of crediting the specified beneficiaries. In this case, it is Rs 250,000.00. This is the aggregate amount allocated for distribution among the listed beneficiaries.

-

Is it necessary to confirm receipt of the payment advice with the bank?

Yes, confirming the receipt of payment advice with the issuing bank is a good practice. It ensures that the bank is aware of the receipt and proceeds with the necessary actions for payment processing as outlined in the advice.

-

What is ANNEXURE-I?

ANNEXURE-I is a detailed list that accompanies the PFMS Generated Payment form. It contains the names, bank details, and the payment amounts for each beneficiary. This annexure is crucial for the bank to correctly distribute the funds to the intended recipients.

-

What steps should be taken after the bank completes the transaction?

After the bank completes the transaction, the agency should verify that the beneficiaries have received the correct amounts. It may involve checking with the beneficiaries or monitoring bank statements. Any discrepancies should be reported to the bank's PFMS Nodal Officer for resolution.

Common mistakes

Filling out forms can sometimes be tricky, and when it comes to financial forms like the PFMS Generated Payment form, accuracy is paramount. There are common mistakes people often make during this process, which can lead to delays in transactions or even the rejection of the payment advice. Here are five such errors:

-

Not verifying the PFMS Generated DBT Payment Advice/Authority Approval date and the Payment Advice No. These details are crucial for identifying the transaction, and any discrepancy can make verification and reconciliation difficult for both the issuing agency and the bank.

-

Overlooking the importance of accurately entering the Bank Account No. associated with the transaction. This account is debited the total amount, hence it is critical to double-check the numbers to prevent funds from being mistakenly sent to the wrong account.

-

Misunderstanding the Total Amount of Debit section. This should match the sum total of individual payments listed in Annexure-I. Any mismatch here could signal an error in calculation or entry, prompting a review that could delay processing.

-

Incorrectly listing or forgetting to include beneficiary details in ANNEXURE-I. Each beneficiary's name, bank details, and Aadhar number (if applicable) must be listed clearly and correctly. Even minor mistakes can cause payments to fail, affecting those who are meant to benefit from these funds.

-

Not ensuring that all pages of the payment advice, especially ANNEXURE -I, are stamped and signed as required. The initial and last pages must be fully signed with an agency seal. This formalizes the document, making it a legally acceptable request to the bank. Ignoring this step can invalidate the payment request.

Besides these specific mistakes, a general piece of advice is to maintain clear communication with the bank's PFMS Nodal Officer. Ensuring that every detail is filled out correctly and double-checking with the guidelines provided by the bank or the nodal officer can save a lot of time and hassle. Patience and attentiveness while filling out these forms are crucial for a smooth transaction process.

Documents used along the form

When handling financial transactions and payments through the Public Financial Management System (PFMS), especially using the PFMS Generated Payment form, various supporting documents are often required to ensure compliance, accuracy, and authorization of the transactions. These documents not only provide a detailed record but also serve to verify the legitimacy of the payments being processed. Here is an overview of five such documents often used alongside the PFMS Generated Payment form:

- Authorization Letter for Payment: This document grants permission to debit the specified account for the payment. It includes details such as the account name, number, the amount to be debited, and the authorized signatory's information. It serves as a formal request to the bank to process the payment as instructed in the PFMS form.

- Beneficiary Details Form: A comprehensive list that gives detailed information about each beneficiary, including their names, bank account details, PAN numbers, and amounts to be credited. This form ensures that the payments are accurately deposited into the correct accounts.

- Bank Acknowledgement Receipt: Once the payment is processed, the bank issues an acknowledgment receipt. This receipt is proof that the bank has received the payment instructions and has either processed or is in the process of processing the payments to the beneficiaries.

- Compliance Checklist: This document outlines any regulatory requirements or checks that must be completed before the payment can be processed. It includes verifications such as anti-money laundering (AML) checks, sanctions screenings, and other compliance-related validations.

- Transaction Summary Report: After the payment batch is processed, a summary report detailing each transaction's status is generated. This report includes transaction details such as payment amounts, beneficiary names, transaction dates, and any errors or failures in processing. It is crucial for record-keeping and reconciliation purposes.

In the context of efficiently managing payments and ensuring all regulatory and internal compliance standards are met, these documents play a pivotal role. By maintaining comprehensive records and adhering to established procedures, organizations can enhance the accuracy, integrity, and traceability of financial transactions processed through the PFMS.

Similar forms

The Pfms Generated Payment form is akin to a Direct Deposit Authorization form used by employers to transfer employee salaries directly to their bank accounts. Both documents serve to communicate to a bank that a specific amount of money should be electronically transferred to designated accounts. Just as the Pfms form lists beneficiaries, account numbers, and amounts to be credited, the Direct Deposit form includes similar details to ensure that funds reach the correct recipient. This process eliminates the need for physical checks, streamlining the payment process.

Similarly, the Pfms form shares commonalities with an Electronic Funds Transfer (EFT) Authorization form, which is widely used to allow for the transfer of funds between accounts electronically. The EFT form, like the Pfms form, requires detailed information about the sender and recipient's bank accounts, including routing and account numbers. Both documents ensure that transactions are processed efficiently and securely, reducing the risk of errors associated with manual handling.

Another document resembling the Pfms Generated Payment form is a Wire Transfer Request form. Such a form is typically used to request the immediate transfer of funds from the sender's account to a recipient's account, often across different banks or even countries. Both the Wire Transfer form and the Pfms Payment form necessitate precise details about the involved bank accounts and the amounts being transferred to guarantee accurate and prompt processing of the funds.

Lastly, the Government Voucher forms, used for processing payments related to government services or refunds to citizens, also share characteristics with the Pfms Generated Payment form. Both kinds of documents require authorization for the disbursement of funds and include specific details about the payees and the amounts to be paid. This structured approach ensures accountability and traceability of public funds, promoting transparency in financial transactions.

Dos and Don'ts

When preparing to fill out the Public Financial Management System (PFMS) Generated Payment form, it's essential to follow specific guidelines to ensure accuracy and compliance with financial regulations. Below are six key dos and don'ts to consider:

- Verify all the details against official documents to ensure accuracy before submission, such as the correct bank account numbers, PAN (Permanent Account Number), and TAN (Tax Deduction and Collection Account Number).

- Double-check the total amount for debit and ensure it matches the sum of the individual payments to the beneficiaries as detailed in Annexure-I.

- Ensure the payment advice date and the approval date in PFMS are correctly entered and match the information provided in the documentation.

- Contact the bank’s PFMS Nodal Officer using the provided phone number and email address for any queries or clarifications needed before submission.

- Make sure the agency seal and the signatures of the authorized signatory are affixed to the document as required.

- Retain a copy of the submitted form and the branch acknowledgment for your records.

Do:

- Submit the form without reviewing it for completeness and correctness. Missing or incorrect information can lead to delays or rejection of the payment processing.

- Forget to include the payment advice number and batch number on the form, as these are critical for tracking and processing the payment.

- Overlook the detailed list of beneficiaries in Annexure-I. Each beneficiary's bank details, account numbers, and payment amounts must be clearly and accurately listed.

- Disregard the need to update the date of delivery in PFMS using the E-Payment => PPA Submission Status option, as it's crucial for the timely processing of payments.

- Ignore the instructions and notes provided specifically for the branch, such as the note for the State Bank of India Safdarjung Enclave branch, as they contain essential information for the bank’s handling of the document.

- Assume that once submitted, no further action is needed on your part. Stay proactive in following up with the bank to confirm the processing of the payment.

Don't:

Misconceptions

When it comes to understanding the PFMS (Public Financial Management System) Generated Payment form, there are several misconceptions that can lead to confusion. Here are ten common misunderstandings and clarifications for each:

Only government agencies can use the PFMS for transactions. While PFMS is primarily used by agencies for direct benefit transfers (DBT), other entities authorized by the government can also use this platform for various transactions.

The payment advice number is the same as the transaction ID. The payment advice number is a unique identifier for the payment advice document, not the transaction itself. Each transaction has its own distinct ID.

Beneficiary Aadhaar numbers are required for PFMS payments. Although the list in the PFMS payment advice might include Aadhaar numbers, payments can be processed with account numbers and IFSC codes, adhering to privacy norms.

Pan and TAN numbers are mandatory for all transactions. The necessity of PAN (Permanent Account Number) and TAN (Tax Deduction and Collection Account Number) varies depending on the nature of the transaction and the entities involved.

PFMS payments can only be processed by the State Bank of India. PFMS is designed to work with multiple banks. The designated bank for a transaction depends on the agency's or beneficiary's banking arrangements.

Paying agencies need to manually inform beneficiaries about payments. While direct communication is advisable, the PFMS also sends automated notifications to beneficiaries once a payment is processed, provided contact details are available.

PFMS Generated Payment forms are only valid on the advice print date. The advice print date is when the document is generated, not the only day it's valid for use. Transactions can be processed after this date within a reasonable timeframe.

Every PFMS transaction requires a new payment advice form. While unique transactions do require distinct payment advices, multiple payments to the same entity may be consolidated as per guidelines.

Payments through PFMS are instant. While PFMS aims to streamline and expedite transactions, processing times can vary depending on the banks involved, the time of submission, and other factors.

All transactions are public once made through PFMS. Transactions are recorded and auditable for transparency and accountability. However, sensitive information is safeguarded and not made public, respecting privacy concerns.

Understanding these facets of the PFMS Generated Payment form ensures accurate and efficient handling, benefiting both the issuing agencies and the recipients. It's important to always refer to the latest guidelines and support provided by PFMS for the most accurate information.

Key takeaways

Understanding the Pfms Generated Payment form can be crucial for ensuring accurate and timely financial transactions. Here are five key takeaways to keep in mind:

- The Pfms Generated Payment form serves as an authorization for the bank to debit an account specified by the agency and credit the listed beneficiaries accordingly. This process plays a vital role in the disbursement of Direct Benefit Transfers (DBT).

- Each form includes vital details such as the Payment Advice Number and the Advice Print Date, which are essential for tracking and record-keeping. Ensuring these details are accurate can help in the efficient processing of payments.

- The form requires the designation, name, and contact information of the authorized signatory, underscoring the importance of accountability and the ability to reach out for any clarifications or issues that might arise during the transaction process.

- It is imperative for the form to include a detailed annexure listing all beneficiaries. This annexure should detail each beneficiary's name, bank name, account number, and the amount to be credited. Proper completion and verification of this annexure can prevent transaction errors.

- For the transaction to proceed smoothly, the document emphasizes the need for acknowledgment from the receiving bank branch. This includes the processing of the advice of credits, hinting at a system of checks and balances to ensure the accuracy and legitimacy of the fund transfer.

In conclusion, the Pfms Generated Payment form is a critical document that facilitates the efficient and accurate distribution of funds to identified beneficiaries. Paying attention to its requirements and ensuring its proper completion can significantly contribute to the success of financial transactions within the framework of the Public Financial Management System (PFMS).

Popular PDF Documents

Tax Form 8863 - The Lifetime Learning Credit, also claimed via Form 8863, offers up to $2,000 in credits per tax return, not limited by the number of years in school or level of education.

Dwc 25 - Important first step in Florida's workers' compensation process, requiring detailed injury and employer information.