Get Personal Loan Application Form

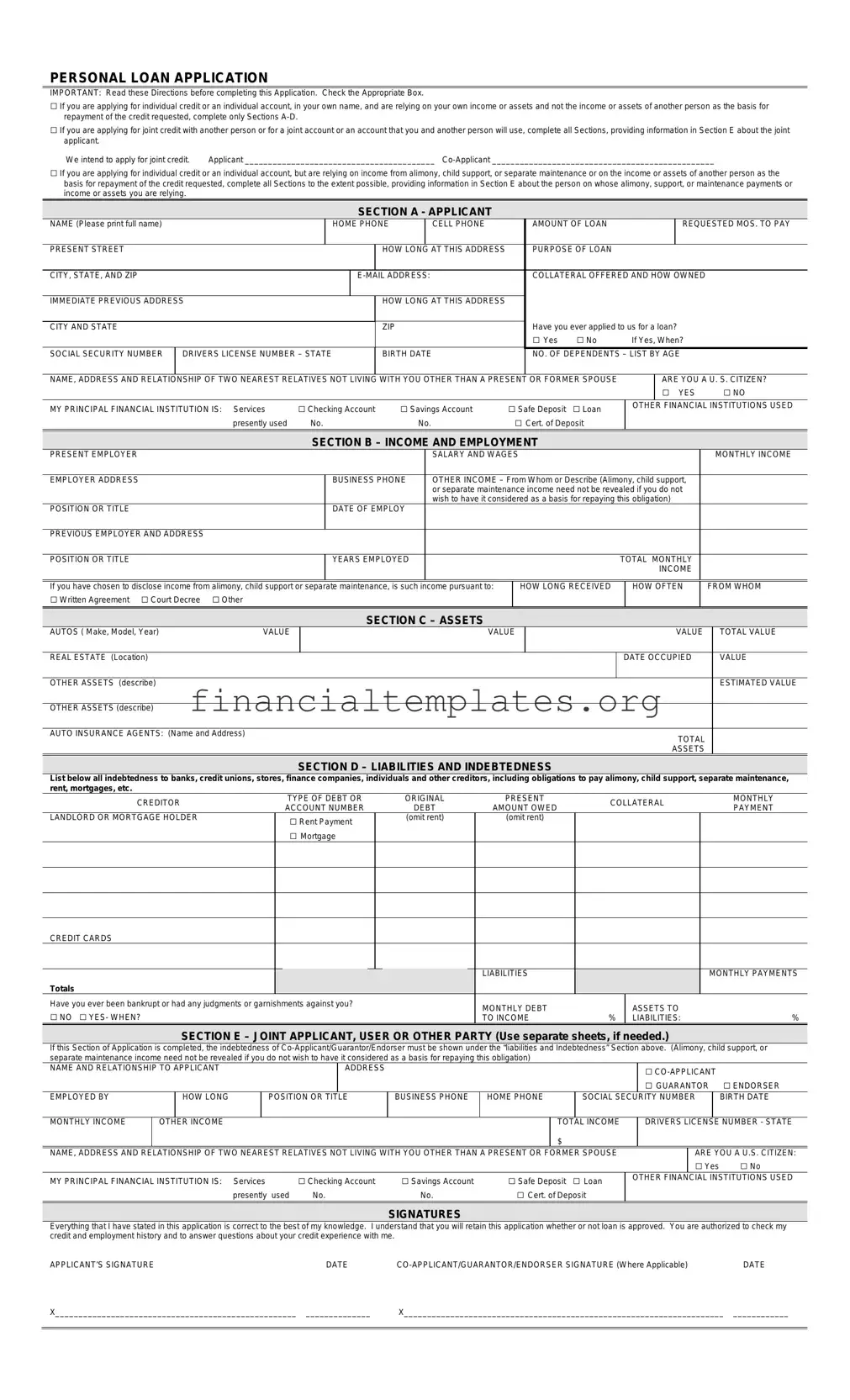

Applying for a personal loan involves a detailed process as outlined in the Personal Loan Application form, where applicants are required to read directions carefully before completing the form. This form caters to various borrower needs, whether applying for individual credit based solely on one's income and assets, seeking joint credit, or relying on another's financial support, including alimony, child support, or separate maintenance. Applicants must fill out sections ranging from personal information, employment and income details, to assets and liabilities. The form distinguishes between applying solely and jointly, necessitating additional details about the co-applicant in joint applications. Information on income sources, such as salaries, wages, and other earnings, including those from legal agreements like alimony or child support, is crucial for assessing the ability to repay the loan. Applicants disclose their assets and liabilities, providing a comprehensive financial snapshot. This includes current employment status, salary, previous employment, real estate, autos, and other significant assets, alongside debts such as credit card liabilities, mortgages, and other obligations. The application also inquires about bankruptcy history, judgments, or garnishments, ensuring a thorough review of the applicant's financial responsibility. Completing the form accurately is essential, as it ends with a declaration that all stated information is correct and grants the lender authority to verify credit and employment history. This documentation is a cornerstone of the loan review process, designed to protect both the lender and borrower by ensuring loans are granted based on accurate, comprehensive financial information.

Personal Loan Application Example

PERSONAL LOAN APPLICATION

IMPORTANT: Read these Directions before completing this Application. Check the Appropriate Box.

□If you are applying for individual credit or an individual account, in your own name, and are relying on your own income or assets and not the income or assets of another person as the basis for repayment of the credit requested, complete only Sections

□If you are applying for joint credit with another person or for a joint account or an account that you and another person will use, complete all Sections, providing information in Section E about the joint applicant.

We intend to apply for joint credit. |

Applicant _________________________________________ |

□If you are applying for individual credit or an individual account, but are relying on income from alimony, child support, or separate maintenance or on the income or assets of another person as the basis for repayment of the credit requested, complete all Sections to the extent possible, providing information in Section E about the person on whose alimony, support, or maintenance payments or income or assets you are relying.

SECTION A - APPLICANT

NAME (Please print full name) |

|

|

|

IHOME PHONE |

|

ICELL PHONE |

|

|

|

|

AMOUNT OF LOAN |

|

|

|

|

|

IREQUESTED MOS. TO PAY |

|||||||

PRESENT STREET |

|

|

|

|

|

HOW LONG |

AT THIS ADDRESS |

|

|

|

|

PURPOSE OF LOAN |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

CITY, STATE, AND ZIP |

|

|

|

|

|

|

|

|

COLLATERAL OFFERED AND HOW OWNED |

|

|

|||||||||||||

IMMEDIATE PREVIOUS ADDRESS |

|

|

|

|

|

HOW LONG AT THIS ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Have you ever applied to us for a loan? |

|

|

||||||||

CITY AND STATE |

|

|

|

|

|

ZIP |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

□ Yes |

□ No |

|

|

|

If Yes, When? |

|

|

|||

SOCIAL SECURITY NUMBER |

IDRIVERS LICENSE NUMBER – STATE |

BIRTH DATE |

|

|

|

|

NO. OF DEPENDENTS – LIST BY AGE |

|

|

|||||||||||||||

NAME, ADDRESS AND RELATIONSHIP OF TWO NEAREST RELATIVES NOT LIVING WITH YOU OTHER THAN A PRESENT OR FORMER SPOUSE |

|

|

|

|

ARE YOU A U. S. CITIZEN? |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I□ YES |

|

□ NO |

||

MY PRINCIPAL FINANCIAL INSTITUTION IS: |

Services |

□ Checking Account |

□ Savings Account |

□ Safe Deposit |

□ Loan |

|

I |

OTHER |

FINANCIAL INSTITUTIONS USED |

|||||||||||||||

|

|

presently used |

|

No. |

|

No. |

|

|

□ Cert. of Deposit |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

SECTION B – INCOME AND EMPLOYMENT |

|

|

|

|

|

|

|

|

|

|

||||||||||

PRESENT EMPLOYER |

|

|

|

|

|

|

|

SALARY AND WAGES |

|

|

|

|

|

|

|

|

|

|

|

MONTHLY INCOME |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

EMPLOYER ADDRESS |

|

|

|

BUSINESS PHONE |

|

OTHER INCOME – From Whom or Describe (Alimony, child support, |

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

or separate maintenance income need not be revealed if you do not |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

wish to have it considered as a basis for repaying this obligation) |

|

|

|

||||||||||||

POSITION OR TITLE |

|

|

|

DATE OF EMPLOY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PREVIOUS EMPLOYER AND ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

POSITION OR TITLE |

|

|

|

YEARS EMPLOYED |

|

|

|

|

|

|

|

|

TOTAL MONTHLY |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

If you have chosen to disclose income from alimony, child support or separate maintenance, is such income pursuant to: |

|

I |

HOW LONG RECEIVED |

|

I |

HOW OFTEN |

|

FROM WHOM |

||||||||||||||||

□ Written Agreement □ Court Decree □ Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

SECTION C – ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

AUTOS ( Make, Model, Year) |

VALUE |

|

I |

|

|

VALUE |

|

I |

|

|

|

|

|

|

VALUE |

|

TOTAL VALUE |

|||||||

REAL ESTATE (Location) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE OCCUPIED |

|

VALUE |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|||

OTHER ASSETS (describe) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ESTIMATED VALUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER ASSETS (describe) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

AUTO INSURANCE AGENTS: (Name and Address) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

||

SECTION D – LIABILITIES AND INDEBTEDNESS

List below all indebtedness to banks, credit unions, stores, finance companies, individuals and other creditors, including obligations to pay alimony, child support, separate maintenance, rent, mortgages, etc.

CREDITOR |

TYPE OF DEBT OR |

ORIGINAL |

PRESENT |

COLLATERAL |

MONTHLY |

|

ACCOUNT NUMBER |

DEBT |

AMOUNT OWED |

PAYMENT |

|||

|

|

|||||

LANDLORD OR MORTGAGE HOLDER |

□ Rent Payment |

(omit rent) |

(omit rent) |

|

|

|

|

□ Mortgage |

|

|

|

|

CREDIT CARDS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

MONTHLY PAYMENTS |

Totals |

|

|

|

|

|

|

|

|

Have you ever been bankrupt or had any judgments or garnishments against you? |

|

|

MONTHLY DEBT |

|

ASSETS TO |

|

|

|

□ NO □ YES- WHEN? |

|

|

|

|

|

|||

|

|

TO INCOME |

% |

ILIABILITIES: |

% |

|||

SECTION E – JOINT APPLICANT, USER OR OTHER PARTY (Use separate sheets, if needed.)

If this Section of Application is completed, the indebtedness of

NAME AND RELATIONSHIP TO APPLICANT |

|

ADDRESS |

|

|

|

|

□ |

|

||||

|

|

|

|

|

|

|

|

|

□ GUARANTOR |

□ ENDORSER |

||

EMPLOYED BY |

|

HOW LONG |

POSITION OR TITLE |

BUSINESS PHONE |

HOME PHONE |

|

SOCIAL SECURITY NUMBER |

|

BIRTH DATE |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

MONTHLY INCOME |

OTHER INCOME |

|

|

|

|

TOTAL INCOME |

DRIVERS LICENSE NUMBER - STATE |

|||||

|

|

|

|

|

|

|

$ |

|

|

|

|

|

NAME, ADDRESS AND RELATIONSHIP OF TWO NEAREST RELATIVES NOT LIVING WITH YOU OTHER THAN A PRESENT OR FORMER SPOUSE |

|

ARE YOU A U.S. CITIZEN: |

||||||||||

|

|

|

|

|

|

|

|

|

|

□ Yes |

□ No |

|

MY PRINCIPAL FINANCIAL INSTITUTION IS: Services |

□ Checking Account |

□ Savings Account |

□ Safe Deposit □ Loan |

presently used |

No. |

No. |

□ Cert. of Deposit |

OTHER FINANCIAL INSTITUTIONS USED

SIGNATURES

Everything that I have stated in this application is correct to the best of my knowledge. I understand that you will retain this application whether or not loan is approved. You are authorized to check my credit and employment history and to answer questions about your credit experience with me.

APPLICANT’S SIGNATURE |

DATE |

DATE |

|

X____________________________________________________ |

______________ |

X_____________________________________________________________________ |

____________ |

|

|

|

|

Document Specifics

| Fact Name | Description |

|---|---|

| Application Types | There are options for individual credit based solely on the applicant's income/assets, joint credit, or individual credit relying on income from sources like alimony or another person's income/assets. |

| Required Information Sections | Sections A-D are mandatory for all applicants. Section E is required for information on a joint applicant, guarantor, or endorser if applicable. |

| Income Disclosure | Applicants can choose whether to disclose income from alimony, child support, or separate maintenance in their application. |

| Governing Laws | While the form does not specify, state-specific laws regarding personal loans and credit applications would govern the processing and approval of the loan application. These might include consumer protection laws and financial regulation statutes relevant to the state in which the application is submitted. |

Guide to Writing Personal Loan Application

Filling out a personal loan application requires careful attention to detail and accuracy in providing your personal, financial, and employment information. It's a straightforward process, but ensuring all details are correct is crucial for a smooth application process. Each section asks for specific information that helps the lender evaluate your loan request. Once completed, the application undergoes a review process where your credit score, employment history, and financial situation are evaluated to determine loan eligibility and terms.

- Decide if you are applying for individual or joint credit. Check the appropriate box at the top of the application form.

- Section A: Fill in your personal information, including your full name, contact details, loan amount requested, and purpose of the loan. If applicable, provide details about the collateral you are offering.

- If you've applied for a loan with the lender before, indicate this by checking 'Yes' and providing the date of your previous application.

- Include your social security number, driver's license number, birth date, and the number of dependents.

- List the names, addresses, and relationships of two nearest relatives not living with you, excluding a present or former spouse.

- Indicate whether you are a U.S. citizen and details about your principal and other financial institutions used.

- Section B: Provide detailed information about your employment, including your employer's name, address, your position, salary, other sources of income, and previous employment.

- If disclosing income from alimony, child support, or separate maintenance, specify the basis of this income (e.g., court decree, written agreement).

- Section C: List all your assets including automobiles, real estate, and other valuables, along with their estimated values.

- Section D: Detail your current liabilities and indebtedness including loans, credit cards, and other obligations. Include monthly payments and indicate whether you have experienced bankruptcy, judgments, or garnishments against you.

- Section E: If applying for joint credit or if another person will be responsible for this loan with you, fill in information about the co-applicant, guarantor, or endorser, including their personal, financial, and employment details. Their indebtedness should be included in the liabilities section.

- Sign and date the application. If there is a co-applicant, guarantor, or endorser, ensure they sign and date the application as well.

Once you have filled in all necessary sections accurately, review the application to ensure completeness and correctness. Submit the application to the lender for processing. Following submission, you might be contacted for additional information or documentation. Approval times can vary, but you will usually receive a response regarding the status of your application in a timely manner.

Understanding Personal Loan Application

Who needs to fill out a Personal Loan Application form?

Anyone seeking to obtain a personal loan either for their individual use or jointly with another person should complete this form. If applying for individual credit based solely on your financial resources, complete Sections A-D. In contrast, applying for joint credit or if relying on someone else's financial support for loan repayment, all Sections, including E with information on the co-applicant or financial supporter, must be filled out.

What information is required in Section A of the form?

Section A seeks comprehensive personal information including full name, contact details (home phone, cell phone, email address), current and previous residences, social security and driver’s license numbers, birth date, number of dependents, and details about two nearest relatives not living with you. Additionally, it requires information to determine the loan amount, purpose, collateral offered, if any, and citizenship status.

How should income and employment details be provided in Section B?

Applicants must disclose their employment status, including employer name, address, salary, and other sources of income. If choosing to include alimony, child support, or separate maintenance as income, it should be specified whether these come from a written agreement, court decree, or other arrangements. This section helps evaluate an applicant's capacity to repay the loan through monthly income.

Can I omit information about alimony, child support, or separate maintenance income?

Yes, applicants have the option not to reveal income from alimony, child support, or separate maintenance if they do not wish it to be considered for repaying the obligation. This allows for privacy and discretion in financial matters, though disclosing it could improve the assessment of repayment ability.

What details are needed concerning assets in Section C?

Applicants should list tangible assets like automobiles and real estate, including makes, models, years, values, and occupation dates. This section also requests information on other assets, such as savings or investments, and their estimated values. Listing assets accurately plays a crucial role in securing the loan by showing financial stability.

What should I include in the liabilities and indebtedness section?

Section D asks for a detailed list of all obligations—ranging from rent or mortgage payments to credit card debts and loans from financial institutions. It requires creditor names, account numbers, types of debt, original amounts, current balances, collateral if any, and monthly payments. Disclosing financial obligations is essential for evaluating the debt-to-income ratio, a key factor in loan approval decisions.

What happens after I submit the application form?

After submitting the form, the lender will review your application, which includes verifying the information provided, checking your credit and employment history, and assessing your ability to repay the loan. This process may result in either approval or rejection of the loan request. You will be informed of the decision, and if approved, you will receive further instructions on the next steps to finalize the loan process.

Common mistakes

Not reading the directions carefully before starting the application leads to incorrectly filled sections. It's important to review the instructions at the beginning to determine which sections apply based on the type of credit being requested.

Leaving sections incomplete, particularly when applying for joint credit, is a common error. If applying with another person, ensure all information required for both parties is provided in the application, especially in Section E.

Failing to specify the purpose of the loan in clear terms can cause processing delays. Applicants should clearly articulate the reason for their loan request in the space provided.

Omitting details about income sources or incorrectly reporting income can affect loan approval chances. For instance, not mentioning income from alimony, child support, or separate maintenance if one chooses to have it considered for the loan repayment.

Underreporting or not listing all debts and liabilities in Section D, including obligations like alimony or child support, mortgages, and credit card debts, can lead to an inaccurate evaluation of the applicant's financial situation.

Not disclosing bankruptcy history, judgments, or garnishments against them when asked. This information is critical as it affects creditworthiness and the decision to grant a loan.

Failure to sign the application or having missing signatures, especially if applying for joint credit. Every application must be signed by the applicant and, where applicable, by the co-applicant/guarantor/endorser to validate the information provided and authorize the credit check.

Documents used along the form

When individuals apply for a personal loan, they typically need to provide additional documents and forms alongside the Personal Loan Application form. These documents play a crucial role in the approval process, as they offer lenders a comprehensive view of the applicant's financial situation, reliability, and creditworthiness. Below is a list of documents often required with a personal loan application.

- Proof of Identification: This document verifies the identity of the applicant. It can be a government-issued ID such as a driver's license, passport, or social security card.

- Proof of Income: To demonstrate the applicant's ability to repay the loan, proof of income is necessary. This could be recent pay stubs, tax returns from the last two years, or bank statements showing consistent income.

- Credit Report Authorization Form: This form gives the lender permission to request and review the applicant's credit report, which is essential for assessing credit history and risk.

- Employment Verification Form: Some lenders require an employment verification form to be filled out by the applicant's employer. This form confirms the employment details and the income stated in the application.

- Bank Statements: Lenders often request recent bank statements (usually the last two or three months) to verify the applicant's financial stability and cash flow.

- Proof of Residence: This could be a utility bill, lease agreement, or a mortgage statement that confirms the applicant's current address.

- Debt Schedule: If applicable, a list of outstanding debts including credit card debt, other loans, and any additional financial obligations can be requested to assess the applicant's existing financial burdens.

These documents complement the Personal Loan Application by providing a detailed financial profile of the applicant. They enable lenders to make informed decisions on loan approvals. For applicants, having these documents prepared in advance can streamline the loan application process, making it more efficient and increasing the likelihood of approval.

Similar forms

The Mortgage Loan Application form is quite similar to the Personal Loan Application form in its structure and purpose. While both forms are designed to evaluate the borrower's financial standing, a Mortgage Loan Application specifically focuses on obtaining a loan to purchase real estate. It requires detailed information about the property in question, including its value and location, akin to how the Personal Loan Application requests collateral details. The emphasis on income, employment history, and current liabilities exists in both forms to assess the applicant's repayment capacity.

A Credit Card Application form also shares many similarities with the Personal Loan Application form, especially in the aspects of evaluating creditworthiness. It gathers comprehensive personal and financial data from the applicant, including income, current debts, and employment information. However, unlike personal loans that might be secured against collateral, credit card applications often rely on unsecured credit, focusing heavily on credit history and scores to determine eligibility and credit limits.

An Auto Loan Application form is another document that mirrors the structure of the Personal Loan Application. It specifically caters to individuals seeking finance to purchase a vehicle. Similar to the personal loan application, it requires the applicant to detail their financial status, including income, assets, and liabilities. However, it goes further to include specific information about the vehicle, such as make, model, and year, serving as collateral for the loan.

The Business Loan Application form, while designed for a business rather than an individual's financial needs, parallels the Personal Loan Application in its thorough examination of financial health. It delves into the business's finances, including revenue, expenses, and existing debts, akin to how personal loan applications assess individual income and liabilities. Additionally, it requires information about the business owners, which can be compared to the section detailing the applicant's personal information in a personal loan application.

A Student Loan Application form, intended to offer financial assistance for educational purposes, similarly requires detailed personal and financial information from the applicant. Like personal loan applications, it assesses the borrower's capacity to repay the loan, focusing on aspects such as income sources and existing debts. However, it uniquely considers potential future earnings based on the applicant's field of study and the cost of the educational program being financed.

The Rental Application form, although primarily used for securing rental housing and not a loan, demands extensive personal and financial information from the applicant akin to a Personal Loan Application. It evaluates the applicant’s ability to fulfill financial commitments by examining income, employment, and credit history. Additionally, like joint or co-applicant details in loan applications, rental applications often require information about other occupants or guarantors to ensure financial stability.

Dos and Don'ts

When approaching the task of filling out a Personal Loan Application form, meticulous attention to detail and a clear understanding of the requirements are key to a successful application process. The following lists highlight the practices to adopt and the mistakes to avoid, ensuring that applicants can navigate this process with confidence.

Do:

- Read all instructions carefully before beginning to fill out the application. This ensures that you understand which sections apply to your situation, whether applying for individual or joint credit.

- Provide accurate and complete information in every section that applies to you. Incomplete applications can lead to unnecessary delays or, worse, denial of the loan.

- Consider disclosing all income sources, including alimony, child support, or separate maintenance, if you feel it strengthens your application. Remember, this is optional and should be chosen based on whether it will help demonstrate your ability to repay the loan.

- Sign and date the application. An unsigned application is considered incomplete and cannot be processed.

Don't:

- Leave sections blank that apply to your situation. If unsure about a specific question, seek clarification instead of skipping it. Blank responses can lead to misunderstandings about your financial situation.

- Forget to list all liabilities and debts, including mortgages, rent, credit cards, and other obligations. Accurate reporting of your financial obligations is crucial for assessing your repayment capability.

- Omit the details of a co-applicant if you are applying for joint credit. Ensure that both you and the co-applicant provide comprehensive information regarding your financial status.

- Provide false information. Errors or attempts to conceal true financial conditions can not only result in the denial of the current application but could also impact future attempts to obtain credit.

Filling out a Personal Loan Application with thoroughness and honesty is not just about securing the loan—it's about establishing trust with the lender. Applicants should remember that a well-documented and accurately completed application is the first step in a positive lending relationship.

Misconceptions

When it comes to applying for a personal loan, many applicants have misconceptions about the process and the form they need to fill out. It's important to understand the facts to enhance your chances of approval and ensure you're providing the correct information.

Here are four common misconceptions about the Personal Loan Application form:

- Income from alimony or child support must always be disclosed.

This is not true. The form clearly indicates that income from alimony, child support, or separate maintenance doesn't need to be revealed if you don't want it considered as a basis for repaying the obligation. While providing this information can potentially strengthen your application by showing additional income, it is not a requirement.

- Joint accounts are only for married couples.

Many people believe that joint credit is exclusively for married couples, but the form does not specify marital status as a criterion for applying for joint credit. Friends, business partners, or any two individuals who want to share the responsibility of a loan can apply for joint credit, providing full information about both applicants as required.

- Previous addresses are irrelevant to your loan application.

Contrary to this belief, your previous living situations can be an important aspect of your credit history. The form asks for your immediate previous address and how long you lived there not only to verify your stability but also as part of the background check. Moving frequently may impact the lender's view of your reliability.

- Only your salary counts as income.

It's a common misunderstanding that lenders are only interested in income from employment. However, the application form provides space for applicants to include other sources of income, such as from investments or rental properties. All verifiable income can strengthen your loan application by demonstrating your ability to repay the loan.

Understanding these nuances can help applicants submit their loan application form with more confidence and accuracy, possibly influencing the final decision in their favor.

Key takeaways

When approaching the Personal Loan Application form, it's essential to understand the process and requirements. The following key takeaways will help ensure the application is filled out correctly and efficiently:

- Decide if you're applying for an individual or joint credit before starting. This choice determines the sections you'll need to complete.

- For individual credit based solely on your income or assets, complete Sections A through D. This streamlines the process by focusing on your financial situation.

- If applying for joint credit, all sections must be filled, including Section E for the joint applicant. This includes detailing the co-applicant's information to assess joint financial responsibility.

- Usefulness of Section E extends beyond joint applications; it's also for those depending on someone else's income for loan repayment. This involves disclosing information about the person whose financial support you're relying on.

- Accurately reporting income, including alimony, child support, or separate maintenance, is crucial. However, disclosure of such income is optional and does not need to be considered in the obligation repayment unless you choose to disclose it.

- All assets and liabilities must be disclosed in detail, providing a clear picture of your financial position. This includes real estate, autos, credit accounts, and any other indebtedness.

- Signing the application asserts that all information provided is accurate and permits the lender to verify the information, including conducting credit and employment checks.

- Remember, completing the application does not guarantee approval, but accurate and thorough completion can aid in the assessment process.

Following these guidelines will help ensure your Personal Loan Application is properly completed, aiding in the smooth processing of your request.

Popular PDF Documents

IRS Schedule O 990 or 990-EZ - This schedule is essential for transparency, providing a narrative account of how a non-profit adheres to IRS regulations and standards of conduct.

Where to Report Interest Income on 1040 - This form is also a critical tool for tax preparers, providing a structure for reporting investment income on client returns.

How to File Power of Attorney in California - It grants someone you trust the power to oversee and resolve your tax matters.