Get Pensco Expense Payment Form

Managing investments and ensuring that expenses are paid in a timely manner are crucial aspects of handling an account with PENSCO. The PENSCO Expense Payment form, designated as IRA-5201, serves as a streamlined procedure for accountholders to instruct PENSCO to disburse funds from their accounts to cover specific expenses. This form requires detailed information, including account and investment data, payment details, and, if applicable, capital improvement information, highlighting the importance of providing comprehensive documentation such as bills or invoices upon submission. With options for payment methods including wire, ACH, or check, and clear instructions for capital improvements that could enhance the asset's value, this form embodies a thorough approach to account management. Additionally, it sets prerequisites for payments over $5,000 and payments to property managers, ensuring clarity and security in financial transactions. The form also emphasizes the accountholder's responsibility for the payment’s validity and legal compliance, underscoring PENSCO's policy of not offering investment advice but focusing on executing authorized transactions in line with the Custodial Agreement and prevailing laws. In essence, the PENSCO Expense Payment form is a vital tool for accountholders, designed to facilitate the efficient management of investment-related expenses, while safeguarding both the account holder and PENSCO through a detailed authorization process.

Pensco Expense Payment Example

Toll Free:

www.pensco.com

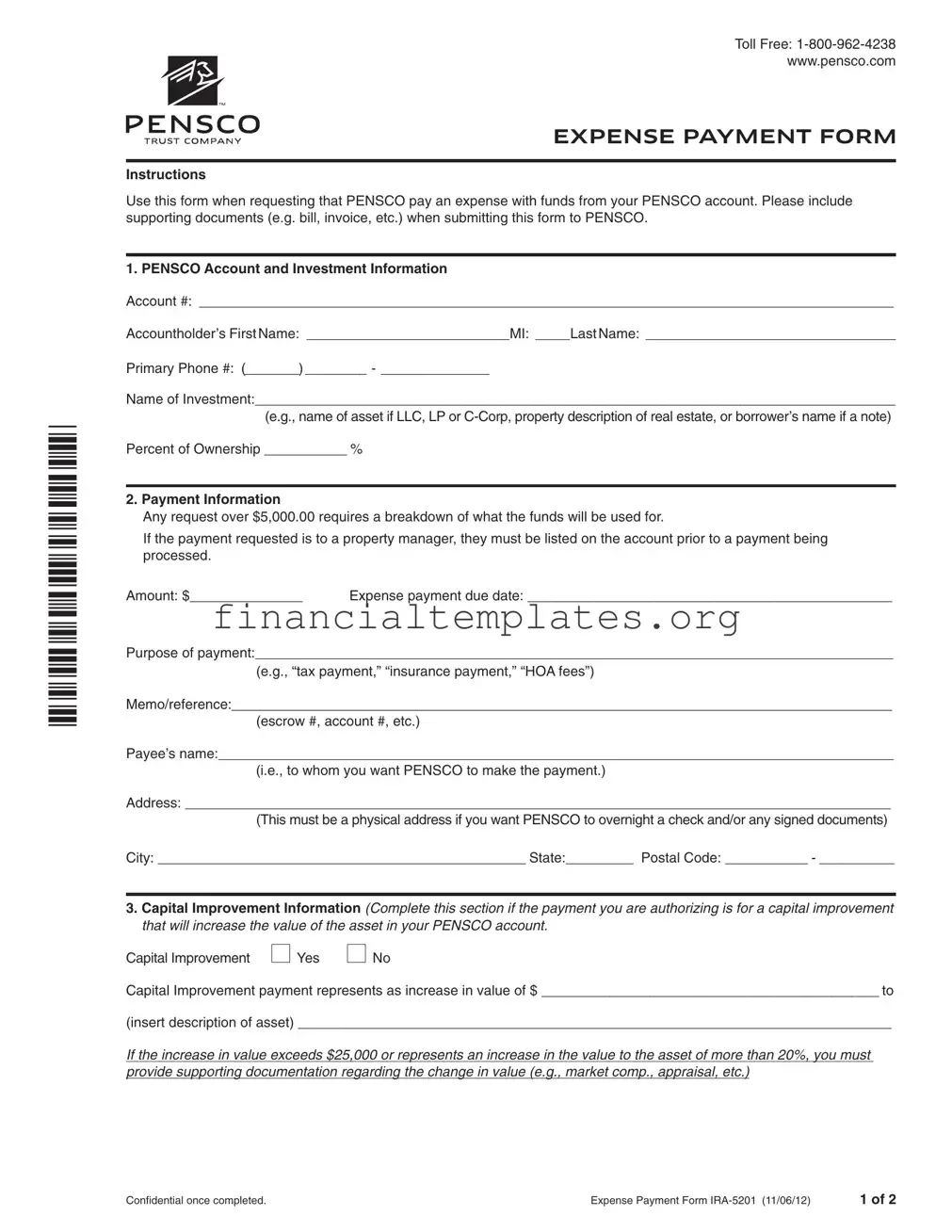

EXPENSE PAYMENT FORM

Instructions

Use this form when requesting that PENSCO pay an expense with funds from your PENSCO account. Please include supporting documents (e.g. bill, invoice, etc.) when submitting this form to PENSCO.

1. PENSCO Account and Investment Information

Account #: _______________________________________________________________________________________________________

Accountholder’s First Name: ______________________________MI: _____Last Name: _____________________________________

Primary Phone #: (________) _________ - ________________

Name of Investment:_______________________________________________________________________________________________

(e.g., name of asset if LLC, LP or

2.Payment Information

Any request over $5,000.00 requires a breakdown of what the funds will be used for.

If the payment requested is to a property manager, they must be listed on the account prior to a payment being processed.

Amount: $_______________ Expense payment due date: ______________________________________________________

Purpose of payment:_____________________________________________________________________________________

(e.g., “tax payment,” “insurance payment,” “HOA fees”)

Memo/reference:________________________________________________________________________________________

(escrow #, account #, etc.)

Payee’s name:__________________________________________________________________________________________

(i.e., to whom you want PENSCO to make the payment.)

Address: ______________________________________________________________________________________________

(This must be a physical address if you want PENSCO to overnight a check and/or any signed documents) City: _________________________________________________ State:_________ Postal Code: ___________ - __________

3.Capital Improvement Information (Complete this section if the payment you are authorizing is for a capital improvement that will increase the value of the asset in your PENSCO account.

Capital Improvement |

Yes |

No |

Capital Improvement payment represents as increase in value of $ __________________________________________________ to

(insert description of asset) ________________________________________________________________________________________

If the increase in value exceeds $25,000 or represents an increase in the value to the asset of more than 20%, you must provide supporting documentation regarding the change in value (e.g., market comp., appraisal, etc.)

Confidential once completed. |

Expense Payment Form |

1 of 2 |

4.Payment Instructions

Select one method (Please refer to your current Fee Schedule for applicable fees. You must pay qualified investing fees with cash from your account).

A.  Wire (fee applies) Bank name: _______________________________________________________________________________

Wire (fee applies) Bank name: _______________________________________________________________________________

ABA #/routing #: __________________________________________ Bank account #: ___________________________________

Other Instructions: ___________________________________________________ Bank phone #: (______) _______ - ______________

Overnight signed documents to the payee (fee applies)

B . |

ACH (Please make sure the receiving bank can support ACH) Bank Name: ____________________________________ |

ABA #/routing #: __________________________________________ Bank account #: ___________________________________

Other Instructions: ___________________________________________________ Bank phone #: (______) _______ - ______________

Overnight signed documents to the payee (fee applies)

C.

Check

Check

Please mail to the payee address in Section 2

Please mail to the payee address in Section 2

Mail check to other: ___________________________________________________________________________________________

Mail check to other: ___________________________________________________________________________________________

Address: _________________________________________________________________________________________________________

City: _________________________________________________ State:_________ Postal Code: ___________ - __________

Overnight signed documents to the payee (fee applies)

5.Authorization

The person signing this form must be an authorized party for the account on file with PENSCO.

I agree to release, indemnify, defend, and hold PENSCO harmless for any claims arising out of this payment. This includes, but is not limited to, claims that this payment is not prudent, proper, legal, or diversified. I also understand and agree PENSCO will not be responsible to take any action should the investment noted herein become subject to default, including fraud, insolvency, bankruptcy, or other court order or legal process. This payment is further subject to all terms and conditions of the accountholder’s Custodial Agreement within PENSCO and all applicable State and Federal laws.

Authorized By: _____________________________________________________________________________________________________________

(Printed name of authorizing party)

________________________________________________________________________________________________ |

_______________________ |

Authorized Party Signature (Required) |

Date |

Phone: |

Send mail to: |

For express deliveries: |

Fax to: |

PENSCO Trust Company |

PENSCO Trust Company |

www.pensco.com |

P.O. Box 173859 |

717 17th Street, Suite 2200 |

|

Denver, CO |

Denver, CO |

PENSCO does not provide investment advice, does not sell investments, and does not offer tax or legal advice. PENSCO does not evaluate, recommend or endorse any advisory firm or investment. Investments are not FDIC insured and are subject to risk, including the loss of principal.

Confidential once completed. |

Expense Payment Instructions |

2 of 2 |

Document Specifics

| Fact Name | Description |

|---|---|

| Form Title | EXPENSE PAYMENT FORM IRA-5201 |

| Contact Information | Toll Free: 1-800-962-4238, www.pensco.com |

| Purpose of Form | To request PENSCO to pay an expense using funds from your PENSCO account. |

| Supporting Documents Requirement | Supporting documents (bill, invoice, etc.) must be included when submitting the form. |

| Payment Information Details | Requests over $5,000.00 require a breakdown of the funds' usage. Property manager payments require prior listing on the account. |

| Capital Improvement Section | Complete if authorizing payment for a capital improvement to increase asset value in the PENSCO account. Supporting documentation is required for increases over $25,000 or more than 20% asset value increase. |

| Payment Instructions Options | Three payment methods available: Wire, ACH, or Check. Each method might involve fees as per the current fee schedule. |

| Authorization Requirements | The form must be signed by an authorized party of the account, agreeing to release and indemnify PENSCO from any arising claims. |

| Governing Laws | Payment is subject to terms of the Custodial Agreement and applicable State and Federal laws. |

| Disclaimer | PENSCO does not provide investment, tax, or legal advice, nor does it evaluate, recommend, or endorse any investment. |

Guide to Writing Pensco Expense Payment

When it's time to request that PENSCO Trust Company handle an expense using your account funds, the Expense Payment Form is your go-to document. This procedure ensures that your funds are allocated appropriately and efficiently for payments like taxes, insurance, or capital improvements related your investments. It's important to attach any relevant documents, such as bills or invoices, to support your request. Follow these steps carefully to complete the form accurately.

- Begin with the PENSCO Account and Investment Information section. Fill in your account number, your first, middle initial, and last names exactly as they appear on your account. Include your primary phone number and clearly describe the name of the investment, plus your percent of ownership.

- In the Payment Information section, specify the amount you're requesting. If the request exceeds $5,000.00, detail what the funds will be used for. Include the expense payment due date, the purpose of the payment, any relevant memo or reference, the payee’s name, and their complete address. If the payment is for a property manager, confirm they're listed on the account.

- If the payment authorizes capital improvement likely to increase the value of the asset, complete the Capital Improvement Information. Mark yes or no to indicate if it's for capital improvement, and detail the expected increase in value to the asset in your PENSCO account. If the increase exceeds $25,000 or more than 20%, provide supporting documentation.

- Choose your Payment Instructions method: Wire, ACH, or Check. Fill out the relevant bank details, including name, ABA/routing number, and account number. Provide any other instructions and the bank phone number. Specify if you'd like overnight delivery of documents to the payee, noting that a fee applies.

- Finally, in the Authorization section, the authorized party must print their name, sign, and date the document, confirming they understand the terms and conditions linked with this payment. This section is crucial for validating your request.

Once completed, you can send the form and any accompanying documents to PENSCO via mail, express delivery, or fax, using the provided addresses and number. This step is vital for processing your request. Remember, completing the form accurately and attaching all required documentation ensures a smooth process for your expense payment.

Understanding Pensco Expense Payment

-

What is the purpose of the PENSCO Expense Payment Form?

The PENSCO Expense Payment Form is designed for accountholders to request payment of expenses directly from their PENSCO account. This form should be used when you need PENSCO to pay a bill, invoice, or any other expense related to your investment(s) held within your PENSCO account. Supporting documents for the expense, such as the bill or invoice, must be included with the form submission.

-

How do I fill out the payment information section if my payment request is over $5,000?

For payment requests exceeding $5,000, you must provide a detailed breakdown of what the funds will be used for alongside your request. This helps ensure transparency and proper use of the funds from your PENSCO account. Additionally, if the payment is meant for a property manager, they must be previously listed on the account for the payment to be processed.

-

What are the options for sending payments, and are there any fees associated?

You have three payment methods to choose from: Wire, ACH, or Check. Each payment method may have applicable fees as outlined in your current Fee Schedule. It's important to note that these fees must be covered by cash from your PENSCO account. When selecting a payment method, ensure you fill out all required banking information and specify any other instructions needed to successfully complete the payment.

-

What should I do if the payment is for a capital improvement?

If the payment you're authorizing is for a capital improvement that will increase the value of the asset held in your PENSCO account, you must indicate this by completing the Capital Improvement section of the form. If the increase in value is over $25,000 or more than 20%, additional supporting documentation, such as a market comparison or appraisal, is required to substantiate the change in value.

-

Who is authorized to sign the PENSCO Expense Payment Form?

The form must be signed by an authorized party who is on file with PENSCO for the account. By signing, you agree to release and hold PENSCO harmless for any claims that may arise from this payment, affirming your understanding that PENSCO is not responsible for the performance of the investment or for taking action in the event of default, fraud, or other significant events related to the investment.

-

How do I submit the completed Expense Payment Form?

Once you have completed the form and gathered all necessary supporting documents, you can submit it via mail or by express deliveries to the addresses provided. Additionally, there's an option to fax the form and documents to PENSCO at 303-614-7032. Ensure all parts of the form are filled out correctly and that you've included all required documentation to avoid delays in processing your payment request.

Common mistakes

Filling out a form might seem straightforward, but it's easy to slip up, especially when handling financial documents such as the PENSCO Expense Payment form. Knowing where these pitfalls lie can help you avoid them. Here are six common mistakes people make:

Not including supporting documents: It's crucial to attach bills, invoices, or any other supporting document when you're requesting PENSCO to pay an expense. Skipping this can delay processing.

Incorrect account information: Entering the wrong account number or not fully completing the accountholder's name sections can lead to confusion or incorrect processing of your request.

Forgetting to list the property manager for payments over $5,000 or those to property managers: If your request exceeds $5,000 or is directed to a property manager, ensure they're listed on the account. Omitting this information can halt the transaction.

Incomplete payment details: Not specifying the payment's purpose or forgetting to include a memo/reference can lead to unnecessary inquiries and delays.

Selecting an incorrect payment method without adequate details: Whether choosing Wire, ACH, or Check as your payment method, make sure all related fields are correctly filled out, including the bank's name, ABA/routing number, and account number. Mistakes here can prevent the payment from reaching its destination.

Authorization issues: The form requires the signature of an authorized party. If the signer isn't authorized or fails to sign, PENSCO won't process the request. Double-check that the person signing is authorized and doesn't forget to sign and date the form.

Avoiding these mistakes not only streamlines the process but ensures your transactions are processed efficiently and accurately. Always double-check your form before submission to ensure everything is in order.

Documents used along the form

When handling financial and investment documents, accuracy and completeness are imperative. Along with the PENSCO Expense Payment Form, several other forms and documents are often used to ensure that all transactions are processed effectively and in compliance with relevant laws and regulations. Below is a list of documents that are frequently utilized alongside the PENSCO Expense Payment Form.

- Account Opening Form: This form initiates the creation of a new account with PENSCO. It captures personal information, investment preferences, and financial details necessary to establish an account.

- Investment Authorization Form: Used to authorize a particular investment within a PENSCO account. It details the investment type, amount, and specific instructions regarding the purchase or sale of the investment.

- Funds Transfer Request Form: Facilitates the transfer of funds into or out of a PENSCO account. It includes banking details, the amount to be transferred, and authorization to execute the transfer.

- Beneficiary Designation Form: Allows account holders to designate or change the beneficiaries for their account. This form is crucial for estate planning and ensuring assets are distributed as intended upon the accountholder's death.

- Fee Schedule: A detailed list of fees associated with the PENSCO account and various transactions. It helps account holders understand the costs involved in managing their investments.

- Change of Address Form: Used to update the accountholder's address on file. Keeping contact information current is vital for receiving important account notifications and documents.

Each of these documents plays a specific role in the management and operation of a PENSCO account. Together, they ensure that accountholders can easily navigate their investment decisions, maintain accurate and up-to-date account information, and comply with all applicable legal and regulatory requirements.

Similar forms

The Pensco Expense Payment form, used for managing expenses from a PENSCO account, shares similarities with a Traditional IRA Distribution Request form. Both documents involve moving funds from retirement accounts, but while the Expense Payment form focuses on account expenses, a Traditional IRA Distribution Request is used by accountholders to withdraw funds for personal use. Both require detailed account information, including the account number and accountholder’s personal details, and both may necessitate specifying the purpose of the transaction, though the contexts differ substantially.

A Real Estate Purchase Agreement is another document that bears resemblance to the Pensco Expense Payment form in certain aspects. They both involve significant financial transactions related to real estate. The Expense Payment form may be used to cover real estate-related expenses from a PENSCO account, such as property management or capital improvements, necessitating detailed information about the property. Meanwhile, a Real Estate Purchase Agreement outlines terms for buying or selling property, including payment details, though its scope is broader, focusing on the entire transaction rather than just expense payments.

A Business Expense Reimbursement form, often used within companies to manage employee expenses, also shares commonalities with the Pensco Expense Payment form. Both forms request reimbursement or payment of expenses, requiring detailed information about the expenses incurred and the purpose. However, the Business Expense Reimbursement form is typically used for operational expenses incurred by employees, while the Pensco form relates to expenses paid from a retirement investment account.

The Request for Proposal (RFP) Payment Form, utilized in business transactions when seeking proposals for services or products, shares a procedural resemblance to the Pensco Expense Payment form. Both require detailed information about the payment, including the purpose and recipient. The key difference lies in their application; the RFP Payment Form is used in the context of soliciting and paying for proposals, whereas the Pensco form is specific to covering expenses from an investment account.

Another document with similarities is the Contractor Payment Application form, used in the construction industry to request payment for completed work. Like the Pensco form, it requires detailed information about the payment and includes provisions for explaining the purpose of the payment, such as labor, materials, or other expenses. However, the Contractor Payment Application specifically relates to payments in the context of construction projects, contrasting with the investment-focused Pensco form.

Lastly, the Charity Donation Request form, used to solicit funds for charitable causes, shares a common goal of transferring funds but diverges significantly in context and execution. Like the Pensco form, it may require details about the payment purpose and recipient. However, the intention behind a Charity Donation Request is to garner support for a cause, distinct from the financial management intentions of the Pensco Expense Payment form, which focuses on managing investment-related expenses.

Dos and Don'ts

When filling out the PENSCO Expense Payment Form, there are specific steps you should follow and others you should avoid to ensure the process is smooth and compliant. Here are some important dos and don'ts:

- Do include all necessary supporting documents, such as bills or invoices, when submitting your form. This helps verify the expenses and speeds up the processing time.

- Don't leave any fields blank. If a section does not apply to your request, consider filling it with "N/A" to indicate that you did not overlook it.

- Do provide detailed payment information, including the payment due date and a clear purpose of the payment. Specificity helps ensure that funds are allocated correctly.

- Don't request a payment to a property manager who is not listed on the account prior to the payment being processed. This is crucial to follow for compliance and record-keeping.

- Do complete the Capital Improvement section if your payment request is related to an improvement that will increase the value of the asset in your PENSCO account. Accuracy in this section is vital for record accuracy and asset management.

- Don't underestimate the value of providing an accurate and comprehensive memo or reference. This information can be essential for tracking and reconciliation purposes.

- Do select the correct payment method and ensure all information, such as bank details or address for check mailing, is accurate to avoid delays.

- Don't ignore the fee schedule related to your chosen payment method. Knowing the applicable fees in advance helps you manage your account effectively.

- Do read and understand the authorization section before signing. By signing, you acknowledge and agree to the terms stated, including indemnifying PENSCO against claims arising from this payment.

- Don't forget to print your name and provide your signature and the date on the authorization section. Unsigned forms cannot be processed, which could delay your payment.

Following these guidelines when completing the PENSCO Expense Payment Form helps ensure that your request is processed efficiently and without unnecessary delay. Attention to detail and compliance with the form requirements protect both you and PENSCO from potential misunderstandings or legal complications.

Misconceptions

When dealing with the PENSCO Expense Payment Form, there are several misconceptions that can lead to confusion or errors in submission. Correcting these misunderstandings ensures smoother transactions and better compliance with PENSCO's requirements.

- Misconception #1: Any amount of expense can be requested without additional documentation.

- Misconception #2: Payment to any property manager can be processed automatically.

- Misconception #3: Electronic forms of payment are the only options available.

- Misconception #4: The form is only for real estate-related payments.

- Misconception #5: Capital improvements don’t require special documentation unless they are over $25,000.

- Misconception #6: PENSCO provides investment advice.

- Misconception #7: Submission implies PENSCO’s responsibility for the investment’s performance.

This is incorrect. For requests over $5,000, a detailed breakdown of the expenses is required. This helps PENSCO understand how the funds will be utilized.

Actually, if the payment is directed to a property manager, they must be listed on the account beforehand. This is a crucial step to ensure funds are directed appropriately and securely.

While electronic payments such as ACH and wire transfers are popular, checks are also an option. The form accommodates various payment methods to cater to different preferences and requirements.

The form is versatile and can be used for various expenses related to your PENSCO account, including but not limited to real estate. It's important to specify the purpose of the payment accurately.

While it's true that significant improvements over $25,000 or that increase the value by more than 20% need documentation, any capital improvement should be disclosed. This is because they can impact the overall value of your investment.

PENSCO does not offer investment advice, nor does it sell investments or offer tax or legal advice. The form clearly mentions that PENSCO should not be seen as an advisor but rather as a facilitator of transactions authorized by the account holder.

By signing the authorization, account holders agree to release PENSCO from claims related to the payment’s prudence, legality, or any adverse outcomes, including default or fraud. This highlights the importance of personal due diligence and responsibility.

Understanding these misconceptions and correcting them can lead to a smoother process when using the PENSCO Expense Payment Form. Always ensure you provide complete and accurate information, and remember to include supporting documents when necessary. This will facilitate a more efficient processing of your requests.

Key takeaways

Filling out and using the PENSCO Expense Payment Form necessitates a careful approach to ensure that requests are processed efficiently and in compliance with relevant regulations. Here are six key takeaways to guide you through this process:

- It is essential to accompany your form with supporting documents such as bills or invoices. This provides verification for the expense and facilitates a smoother payment process.

- Detailing your PENSCO account and investment information accurately is crucial. This includes providing your account number, your name, primary phone number, and specifics about the investment (e.g., asset name or property description).

- For any payment requests exceeding $5,000.00, a breakdown of the funds' intended use is required. This helps in clarifying the purpose and necessity of the payment, ensuring transparency.

- If the payment is for property management services, the property manager must already be listed on the account before the payment can be processed. This highlights the importance of pre-arranging and verifying third-party associations with your PENSCO account.

- When authorizing payments for capital improvements that significantly increase the value of the asset in your account (exceeding $25,000 or more than 20% increase in value), supporting documentation such as market comparisons or appraisals must be provided. This ensures that the value increase is justified and accurately represented.

- Choose your payment method wisely (Wire, ACH, or Check), considering the fees associated with each option as outlined in the current Fee Schedule. This decision affects how quickly the payee receives the funds and the total cost of the transaction.

Selecting the appropriate payment method and properly authorizing the form are vital steps. The form’s signer releases PENSCO from any claims related to the payment’s prudence or legality and acknowledges the risk involved in the investment. In essence, understanding and adhering to these guidelines when working with the PENSCO Expense Payment Form will ensure that your investment and payment activities are conducted smoothly and in accordance with all regulatory requirements.

Popular PDF Documents

IRS 2106 - The IRS 2106 form is used by employees to deduct work-related expenses not reimbursed by their employer.

Form 1099-c - Income from canceled debt reported on a 1099-C must be included in taxable income unless exclusions or exceptions apply.

IRS W-2 - Employer-generated record indicating total wages paid and taxes deducted for an employee.