Get Payment Requisition Form

At the heart of most financial and material transactions within a company or between businesses lies the humble yet crucial Payment Requisition form. This document serves a multi-faceted role, from initiating purchases to ensuring that financial transactions are accurately accounted for. A standard Payment Requisition form consists of several key components including the date of the request, a unique number for tracking, detailed information about the desired purchase such as item number, quantity, description, unit of purchase, unit price, and total cost. It also specifies the job number, to whom the purchase should be delivered, and any particular specifications that need to be adhered to. Additionally, the form typically includes a section for the requester to sign off, often coupled with recommendations for suppliers, ensuring that procurement follows predefined guidelines and preferences. This document not only facilitates the operational workflow by clearly communicating requirements to the purchasing department or external vendors but also plays a pivotal role in budgeting and financial management by capturing anticipated expenditure. Moreover, the inclusion of a detailed description and specifications of the requested items or services helps in maintaining clarity and preventing misunderstandings, thus streamlining the procurement process.

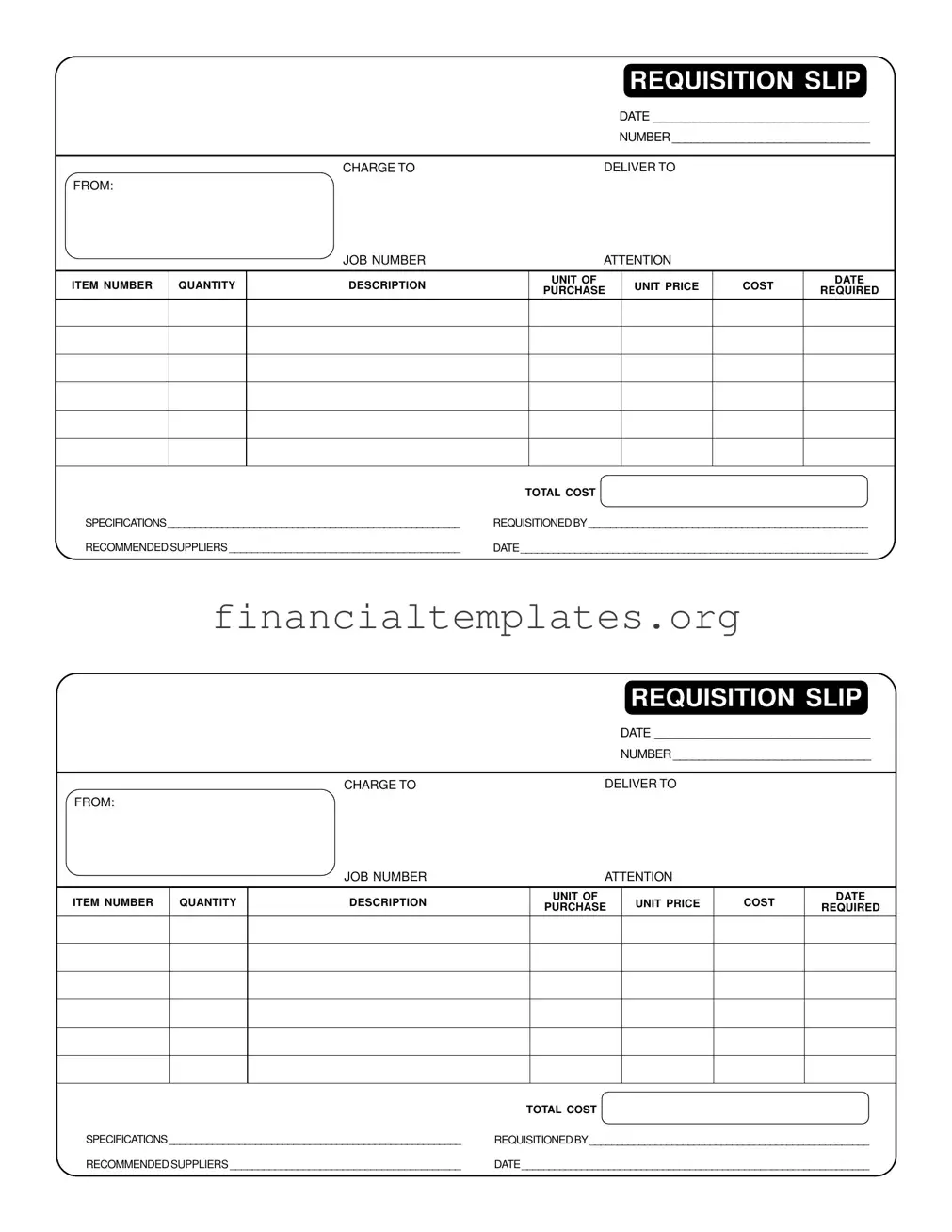

Payment Requisition Example

|

REQUISITION SLIP |

|

DATE __________________________________ |

|

NUMBER _______________________________ |

|

|

CHARGE TO |

DELIVER TO |

FROM:

JOB NUMBER |

ATTENTION |

ITEM NUMBER

QUANTITY

DESCRIPTION

UNIT OF

PURCHASE

UNIT PRICE

COST

DATE

REQUIRED

TOTAL COST

SPECIFICATIONS ______________________________________________________ REQUISITIONED BY ___________________________________________________

RECOMMENDED SUPPLIERS _________________________________________ DATE ________________________________________________________________

|

REQUISITION SLIP |

|

DATE __________________________________ |

|

NUMBER _______________________________ |

|

|

CHARGE TO |

DELIVER TO |

FROM:

JOB NUMBER |

ATTENTION |

ITEM NUMBER

QUANTITY

DESCRIPTION

UNIT OF

PURCHASE

UNIT PRICE

COST

DATE

REQUIRED

TOTAL COST

SPECIFICATIONS ______________________________________________________ REQUISITIONED BY ___________________________________________________

RECOMMENDED SUPPLIERS _________________________________________ DATE ________________________________________________________________

Document Specifics

| Fact Name | Details |

|---|---|

| Purpose | The Payment Requisition form is used for requesting payments for goods or services. |

| Fields Included | This form includes fields for date, requisition number, charge details, delivery details, job number, attention, item specifics like number, quantity, description, unit of purchase, unit price, cost, date required, total cost, specifications, requester's information, and recommended suppliers. |

| Specification Section | There is a section for specifications to provide detailed descriptions or requirements regarding the purchase. |

| Recommended Suppliers | The form allows the person requisitioning the purchase to recommend suppliers, facilitating the purchasing process. |

| Document Tracking | With requisite fields for requisition slip date and numbers, the form facilitates systematic tracking and managing of payment requests. |

| Governing Laws | While this is a standard format, specific states may have varying laws that govern the usage of payment requisition forms. Users should refer to state-specific laws for compliance. |

| Usage | Typically, departments within an organization use this form to request payments for vendor services or procurement of goods, ensuring an organized process for financial transactions. |

Guide to Writing Payment Requisition

Completing the Payment Requisition form properly ensures the prompt processing of your order. It's important to fill in all details accurately to avoid any delays. This form is used to requisition items or services, specifying the cost and delivery details. Follow these step-by-step instructions to fill out the form correctly.

- Start by entering the date at the top of the form where it says "REQUISITION SLIP DATE". Make sure to use the format MM/DD/YYYY.

- Next, fill in the number associated with this requisition in the space provided next to "NUMBER".

- Write the account to be charged where it states "CHARGE TO". Be sure to use the correct account code.

- Under "DELIVER TO", specify the location where the items or services should be delivered.

- In the "FROM" section, indicate the job number, if applicable, to track which project this requisition is for.

- Address the requisition to a specific person by filling in the "ATTENTION" line.

- For each item or service being requisitioned, fill in the "ITEM NUMBER", "QUANTITY", "DESCRIPTION", "UNIT OF PURCHASE", "UNIT PRICE", and "COST". If you have more items than lines provided, attach a separate sheet with the same information.

- State the "DATE REQUIRED" for each item or service to ensure timely delivery.

- Calculate the "TOTAL COST" of all items and services and enter this amount at the bottom of the list.

- Include any specific "SPECIFICATIONS" that the supplier needs to know to fulfill the order properly.

- Sign the form where it says "REQUISITIONED BY" to authorize the requisition.

- Recommend suppliers by listing their names under "RECOMMENDED SUPPLIERS".

- Finally, date the bottom of the form under the supplier recommendation section to confirm when the requisition was completed.

Once the form is fully completed, review all the details to ensure accuracy. Submit the form to the designated department or individual responsible for processing requisitions. They will review the information and initiate the purchasing process. Timeliness and attention to detail are crucial throughout this step to facilitate smooth operations and timely delivery of the requested items or services.

Understanding Payment Requisition

-

What is a Payment Requisition form?

A Payment Requisition form is a document used by departments within an organization to request payment for goods or services. This form typically includes details such as the date, requisition number, detailed descriptions of the items or services requested, quantity, unit of purchase, unit price, and total cost, along with information about the requestor and recommended suppliers. The form serves as a formal request to the finance department or designated approving authority to allocate funds or process payment as specified.

-

Who should use a Payment Requisition form?

This form is used by individuals or departments within an organization that needs to request payment for goods or services. It is particularly useful for employees in procurement, project management, or any role that involves organizing payment for external services or supplies. The form facilitates a smooth transaction process, ensuring all financial requests are documented and approved according to the organization's policies.

-

How do I fill out a Payment Requisition form?

- Start by entering the date and requisition number for reference.

- Fill in the ‘Charge To’ and ‘Deliver To’ sections to specify the budget allocation and delivery details.

- Complete the ‘From,’ ‘Job Number,’ and ‘Attention’ fields to identify the requester and the person or department to be notified upon delivery or payment.

- In the itemization section, list each item or service with its quantity, description, unit of purchase, unit price, and cost. Include the date required for each item to ensure timely procurement.

- Enter any special specifications needed to fulfill the requisition.

- Include the name of the person requisitioning the order and list any recommended suppliers if applicable.

- Finally, date the form to complete it.

-

Can I specify preferred suppliers on the Payment Requisition form?

Yes, there is a section on the form for recommended suppliers. This helps in steering the procurement process towards vendors with whom the organization has established trust, potentially negotiated pricing, or specific quality standards. Including preferred suppliers can streamline the approval and purchasing process, although the final decision might still be subject to review based on the organization's purchasing policies.

-

What happens after I submit the form?

Once submitted, the Payment Requisition form is reviewed by the appropriate authorities within the organization, such as managers, financial controllers, or procurement officers. They will assess the requisition for completeness, accuracy, and compliance with the organization's policies and budget. The form may undergo several approvals before the finance department processes the payment. It is also possible that additional information or clarification could be requested to fulfill the requisition.

-

Is there a difference between a Payment Requisition form and a Purchase Order?

Yes, there is a notable difference. A Payment Requisition form is an internal document used to request payment within an organization. In contrast, a Purchase Order is an external document sent to a vendor to order goods or services. The Payment Requisition can lead to the creation of a Purchase Order if the requested items or services need to be sourced from external suppliers. Essentially, the Requisition initiates the purchasing process, while the Purchase Order is part of the contractual agreement with the vendor.

-

What should I do if I make a mistake on the form?

It is important to review the form for any errors before submission to avoid delays in the payment or procurement process. However, if a mistake is discovered after submission, contact the department or individual responsible for processing the form immediately. They will advise on the best course of action, which may involve submitting a corrected form or providing additional documentation to rectify the error.

-

Who approves the Payment Requisition form?

The approval process for a Payment Requisition form varies depending on the organization's structure. Typically, the form requires approval from direct supervisors, department managers, or the budget authorities to ensure expenditures align with budget allocations and organizational policies. In some cases, the finance or procurement department might also need to approve the form, especially for large or out-of-budget requisitions.

Common mistakes

When filling out the Payment Requisition form, several mistakes are commonly made. Being aware of these can save time and prevent processing delays.

- Leaving fields blank: All fields should be completed to ensure the requisition is processed efficiently. Empty fields can cause unnecessary delays.

- Incorrect Job Numbers: It’s vital to double-check the job number for accuracy. An incorrect job number can lead to budgeting errors or misallocation of funds.

- Inaccurate Quantity: The quantity of items requested must be precise. Overestimating or underestimating quantities can result in budget discrepancies or insufficient supplies.

- Misstating Unit Price: Each item’s unit price must be verified for accuracy. Errors here can affect the total cost calculation, leading to financial inaccuracies.

- Unclear Descriptions: Item descriptions should be detailed and clear. Vague descriptions can cause confusion and delays in order fulfillment.

- Forgetting the ‘Date Required’: Specifying when items are needed by is critical. Failure to do so can result in items not being delivered when needed, potentially causing project delays.

- Omitting Recommended Suppliers: If there are preferred suppliers for certain items, this information should be included. Not doing so can result in purchases from non-preferred suppliers, possibly at higher costs or lower quality.

- Signature Missing: A requisition must be signed to be considered valid. An unsigned form is one of the most common reasons for a requisition to be returned.

By paying attention to these details, individuals can ensure their Payment Requisition forms are filled out correctly and processed without unnecessary hindrance.

Documents used along the form

When managing finances within an organization, the payment requisition form is a critical document used to request payment for goods or services. However, this form rarely exists in isolation. Several other forms and documents often accompany it, each playing a vital role in ensuring the accuracy and propriety of the financial transaction. Understanding these accompanying documents helps streamline the payment process and uphold financial accountability.

- Purchase Order (PO): This document is generated by the buyer and issued to the seller, specifying the types, quantities, and agreed prices for products or services. It serves as a legal offer to buy and becomes a binding contract when accepted by the seller. A purchase order outlines the specifics of the deal, laying the groundwork for the payment requisition.

- Invoice: An invoice is issued by the seller and sent to the buyer. It details the goods or services provided, quantities, prices, payment terms, and total amount due. This document is crucial as it initiates the payment process and is often attached to the payment requisition form to substantiate the request for payment.

- Delivery Receipt: This document confirms the receipt of goods or services and often includes details like the date of delivery, quantity, and condition of the items received. It is used to verify that the goods or services billed on the invoice have indeed been delivered as agreed, ensuring that payments are only made for items that have been properly received.

- Contract or Agreement: When the payment is for a service or a large purchase, a contract or agreement detailing the terms and conditions of the transaction is often involved. This document provides a comprehensive overview of the expectations and obligations of both parties. It may be referenced in the payment requisition process to ensure that the payment terms align with the contractual agreement.

In essence, the payment requisition form is part of a larger ecosystem of documents that facilitate clear communication, legal compliance, and financial accountability between buyers and sellers. Understanding and properly utilizing these documents ensures that each payment is justified, accurate, and in accordance with the agreed-upon terms. This protects both the organization's and the vendor's interests, fostering a healthy business relationship.

Similar forms

An Invoice is similar to a Payment Requisition form in how it requests the transfer of funds, but it is typically issued after services have been rendered or goods have been delivered. Whereas a Payment Requisition is an internal document, used within an organization to seek approval for a payment before the transaction is completed, an invoice is an external document sent to a client or customer asking for payment for services or goods provided. Both documents list details such as the amount to be paid, descriptions of the services or goods, and payment terms, but an invoice also often includes information on late payment fees and is a formal request for payment from an external entity.

A Purchase Order (PO) also shares similarities with a Payment Requisition form, particularly in the way it authorizes the expenditure of funds before the purchase of goods or services. However, a Purchase Order is more detailed regarding the agreement between the buyer and seller. It serves as a legally binding agreement once accepted by the seller, detailing the types and quantities of products or services, agreed-upon prices, and delivery dates. While a Payment Requisition form is an internal request to initiate the buying process within an organization, a PO is issued to the supplier as a commitment to buy according to specified terms.

An Expense Report is another document similar to a Payment Requisition form with its purpose of requesting reimbursement for expenses incurred. Employees use Expense Reports to provide a detailed account of expenditures for which they seek compensation, often including receipts or invoices as proof of purchase. Both documents are used for financial transactions and require approval from a higher authority within the organization. However, Expense Reports are specifically focused on recouping money spent during the course of business activities, contrasting with Payment Requisitions that may cover a broader range of payment needs including procurement of goods or services not previously paid for out-of-pocket by an employee.

Lastly, the Check Request Form bears resemblance to the Payment Requisition form as it is used to ask for payment issuance, typically in the form of a check. Both forms are internal documents initiating the process of payment and require detailed information about the payment purpose, amount, and recipient. The Check Request Form, specifically, is used when an invoice is not present but a payment still needs to be made, providing an alternative method to process payments without the standard invoice procedure. Although both serve to facilitate payments, the Check Request Form is particularly useful for non-standard transactions, including refunds, reimbursements, or any payment not tied directly to an invoice.

Dos and Don'ts

When filling out a Payment Requisition form, accurately reporting the required information is paramount. To help guide through this process, here are a list of actions that should and shouldn't be undertaken.

Do:Ensure all information is legible and written in black or blue ink to make every detail clear and readable.

Double-check all numerical entries for accuracy, including quantities, unit prices, and total costs, to prevent any misunderstandings or delays.

Provide a detailed description for each item requested, including specifications, to ensure the correct item is ordered or service is provided.

Include the job number and attention details to ensure the request is properly directed and processed without unnecessary delay.

Recommend suppliers by listing their names and contact information, if known, to expedite the purchasing process.

Sign and date the form to authorize the requisition and to indicate the request is reviewed and approved.

Leave any sections blank; if a section does not apply, write 'N/A' (not applicable) to indicate that the information was considered but deemed unnecessary.

Use pencil or non-permanent ink that can easily be erased or become illegible, compromising the integrity of the requisition.

Estimate costs without doing due diligence; accurate cost estimations are essential for budgeting and financial planning.

Forget to specify the date required for each item or service to ensure timely delivery and project continuity.

Overlook the importance of listing multiple recommended suppliers when possible, to provide options and potentially better pricing or availability.

Rush through filling out the form without reviewing the entire document for completeness and accuracy.

Misconceptions

When it comes to the payment requisition process, several misconceptions often circulate, leading to confusion. By clarifying these points, individuals and businesses can navigate the system more effectively. Below are five common misconceptions about the Payment Requisition form:

It's only for large corporations: A common belief is that Payment Requisition forms are exclusively used by large corporations. In reality, businesses of all sizes use these forms to streamline the purchase requisition process and ensure proper record-keeping for all transactions, big or small.

It's too complex for small purchases: Another misconception is that the Payment Requisition form is overly complicated and not worth the effort for smaller transactions. However, using such a form helps in maintaining a clear, organized record of all purchases, which can be crucial for tracking expenses and budgeting, regardless of the transaction size.

It replaces receipts: Some people mistakenly believe that once a Payment Requisition form is filled out and processed, there’s no need to keep receipts of the transaction. Actually, receipts are essential for reconciling accounts and auditing purposes, and the Payment Requisition form serves as a complementary document, not a replacement.

Approval is guaranteed: Submitting a Payment Requisition form does not ensure approval of the funds requested. The form starts the process by documenting the need and specifying the request, and then it typically goes through an approval chain where it can be approved or denied based on various factors such as budget constraints and necessity.

Electronic forms are less valid: With the rise of digital processes, some may think that electronic Payment Requisition forms are not as valid as paper ones. This is not the case; digital forms are equally valid and, in fact, can offer advantages such as easier tracking, quicker processing, and reduced physical storage needs.

Understanding these misconceptions can lead to more efficient and effective financial management practices. By utilizing Payment Requisition forms appropriately, businesses and organizations can greatly benefit from the organized, accountable approach they provide to handling transactions.

Key takeaways

Filling out a Payment Requisition form is an essential part of managing financial transactions within many organizations. Whether you're requesting supplies, paying for services, or handling project expenditures, understanding how to properly complete and use this form can streamline the process and ensure efficient payment handling. Here are five key takeaways to keep in mind:

- Accuracy is critical. As you fill out each section—DATE, NUMBER, CHARGE TO, DELIVER TO, JOB NUMBER, and so forth—double-check your entries for accuracy. Mistakes can lead to payment delays or incorrect processing, affecting project timelines and relationships with vendors.

- Detail the specifications. The SPECIFICATIONS section is your opportunity to provide clear and detailed descriptions of what is being requested. This clarity can help suppliers understand your needs better and fulfill the requisition accurately, avoiding unnecessary complications or exchanges.

- Include recommended suppliers. If you have preferred or recommended suppliers, stating them can ensure that your organization benefits from established relationships, potentially securing better prices or faster delivery times.

- Signatures matter. The section REQUISITIONED BY requires a signature, underlining the importance of accountability in the requisition process. Signing off on a requisition confirms that the request has been reviewed and approved by the appropriate person or department.

- Timelines are important. Don't forget to fill in the DATE REQUIRED field. Indicating when items are needed by helps prioritize orders and manage project timelines effectively. Leaving this blank can lead to confusion and delays, impacting project outcomes.

Remember to review your Payment Requisition form thoroughly before submission. This careful attention to detail can save time and prevent errors, paving the way for smoother operations and financial transactions.

Popular PDF Documents

Fasfa Parent Plus Loan - A comprehensive guide for applying for a Parent PLUS Loan at Blue Ridge Community College, including initial FAFSA submission.

4506-t Tax Form - By providing access to tax return transcripts quickly, it aids in the resolution of tax-related disputes with state or local authorities.