Get Payment Request Form

In today's fast-paced world, efficient and secure transactions are more critical than ever for businesses looking to maintain smooth operations and strong partnerships. At the heart of these transactions often lies a crucial document known as the ACH Payment Request Form. This form serves as a bridge between vendors and their banking institutions, streamlining the process of transferring funds through Automated Clearing House (ACH) methods. It contains essential sections that gather vendor information including business name, contact details, and banking information like the bank name, account, and routing numbers. Additionally, it outlines the preferred method for sending remittance advice, which is vital for record-keeping and reconciliation purposes. By filling out this form, vendors give companies like NV Energy the authority to initiate payments directly to their bank accounts, a method that is not only time-efficient but also minimizes the risks associated with physical checks. However, it is designed with an understanding of the importance of flexibility and control, as it allows vendors to terminate this authorization by providing written notice. Importantly, it underscores the need for such notification to be given in a timely manner, ensuring both parties can adjust accordingly without disrupting financial operations.

Payment Request Example

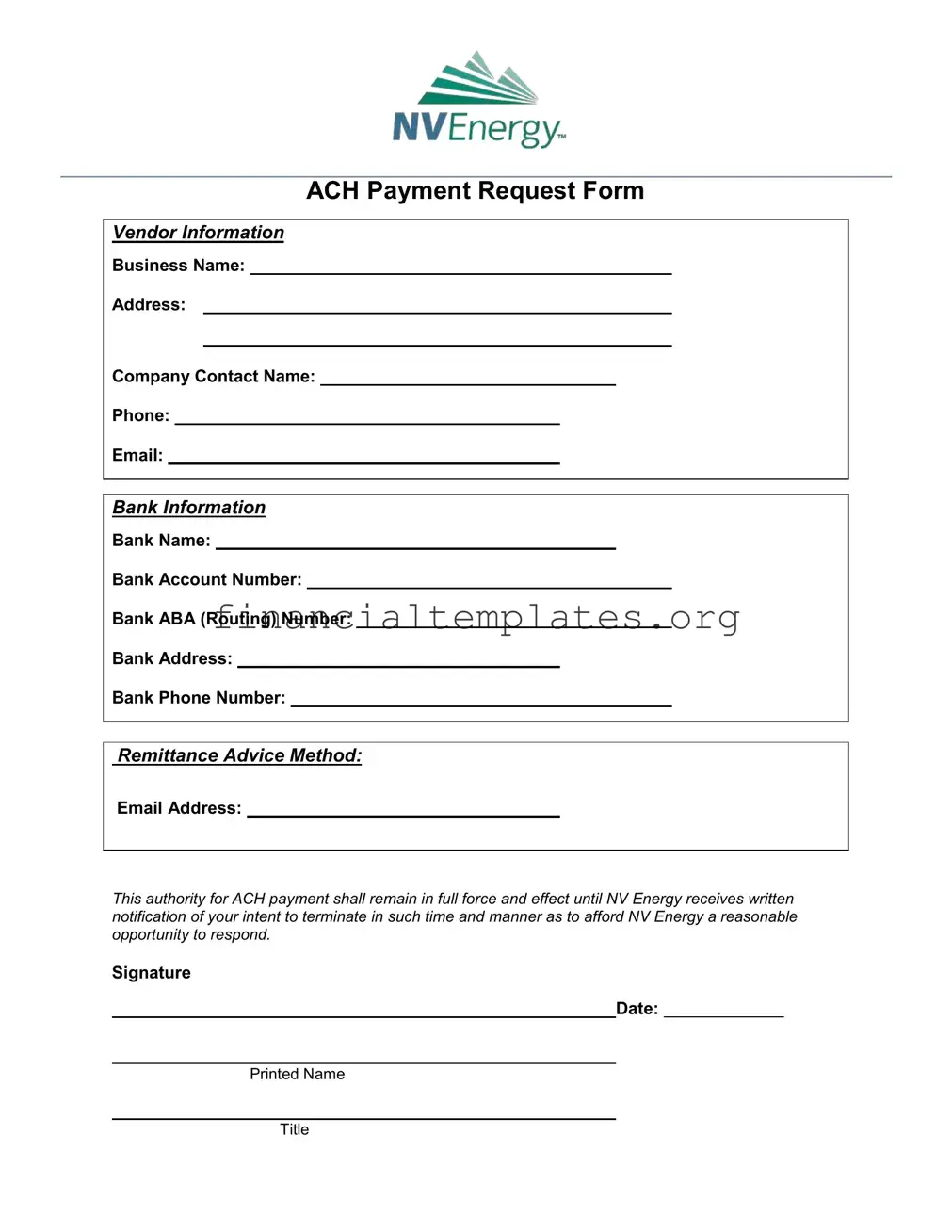

ACH Payment Request Form

VENDOR INFORMATION

Business Name:

Address:

Company Contact Name:

Phone:

Email:

BANK INFORMATION

Bank Name:

Bank Account Number:

Bank ABA (Routing) Number:

Bank Address:

Bank Phone Number:

REMITTANCE ADVICE METHOD:

Email Address:

This authority for ACH payment shall remain in full force and effect until NV Energy receives written notification of your intent to terminate in such time and manner as to afford NV Energy a reasonable opportunity to respond.

Signature

Date:

PRINTED NAME

TITLE

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Purpose | This form is used to request ACH (Automated Clearing House) payments. |

| Vendor Information Required | Includes Business Name, Address, Company Contact Name, Phone, and Email. |

| Bank Information Needed | Details required are Bank Name, Bank Account Number, Bank ABA (Routing) Number, Bank Address, and Bank Phone. |

| Remittance Advice Method | Specifies that the preferred method for remittance advice is via Email Address. |

| Termination Clause | The authority for ACH payment remains effective until NV Energy is given written notice of intent to terminate, providing reasonable time to respond. |

| Signature Requirement | Authorization is completed with the Signature, Date, Printed Name, and Title of the signatory. |

Guide to Writing Payment Request

Filling out a Payment Request form is essential for ensuring that transactions between businesses and their vendors are processed efficiently and securely. This form, specifically designed for ACH payments, facilitates the transfer of funds directly from one bank account to another, reducing the need for physical checks. It's crucial to provide accurate and detailed information to avoid any delays or issues with the payment process. Below are the steps to accurately complete the form, ensuring a smooth financial operation.

- Vendor Information:

- Enter the official Business Name as registered or legally recognized.

- Provide the full Address of the business, including city, state, and zip code.

- List the Company Contact Name who can be reached for inquiries about the payment.

- Include a reliable Phone number for the contact.

- Finish this section with the Email address of the contact or business where correspondence can be sent.

- Bank Information:

- State the Bank Name that holds the account from which the payment will be made.

- Add the Bank Account Number to be charged.

- Write down the Bank ABA (Routing) Number to ensure the transaction goes to the correct institution.

- Provide the Bank Address, completing with the full physical or postal address.

- Include the Bank Phone Number for verification or inquiries.

- Remittance Advice Method:

- Specify an Email Address where remittance advice or payment notifications should be sent.

- Authorization:

- Read the statement regarding the authority for ACH payment thoroughly to understand the commitment.

- Sign the form to validate the request. Ensure the signature matches the authorized personnel for the account.

- Print the Name and Title of the signatory for official record purposes and clarity.

- Finally, date the form to indicate when the authorization was given.

Once the form is completely filled out, it signifies that the vendor authorizes ACH payments to be made from their bank account to NV Energy's account for the services rendered or goods provided. It is vital to communicate any changes to banking details or the desire to terminate this authorization directly to NV Energy, providing them with enough time to make necessary adjustments. This process ensures that both parties have a clear understanding of the payment process, strengthening business relationships and facilitating smoother transactions.

Understanding Payment Request

What is an ACH Payment Request Form?

An ACH Payment Request Form is a document used to gather necessary information from a vendor who wishes to receive payments through the Automated Clearing House (ACH) network. This form collects details about the vendor's business and bank accounts, ensuring payments are processed accurately and efficiently.

Who needs to complete the ACH Payment Request Form?

Vendors seeking to receive payments electronically from companies such as NV Energy must complete the form. It is essential for businesses looking to streamline their payment processes and reduce the reliance on paper checks.

What information is required on the ACH Payment Request Form?

The form requires detailed vendor information, including:

- Business Name

- Address

- Company Contact Name

- Phone

- Bank Name

- Bank Account Number

- Bank ABA (Routing) Number

- Bank Address

- Bank Phone

How is the ACH Payment Request Form submitted?

The completed form should be submitted to the requesting company, in this case, NV Energy, following their submission guidelines. Typically, this may involve emailing a scanned copy of the signed form or delivering it through a secure online portal.

Is there a deadline for submitting the ACH Payment Request Form?

While specific deadlines may vary by company, it is advisable to submit the completed form at the earliest opportunity to ensure timely processing of payments. Any deadline information will likely be communicated by the company requesting the form.

Can the ACH Payment Request Form be revoked or changed?

Yes, the authority for ACH payments remains in effect until written notification of intent to terminate or change details is received. It is important to allow reasonable time for the company, NV Energy in this instance, to process this request.

What is the significance of signing the ACH Payment Request Form?

Signing the form authorizes the company to make payments to the vendor's bank account through the ACH network. It is a necessary step to validate the payment arrangement and protect against unauthorized transactions.

How is personal and bank information kept secure?

Companies receiving the ACH Payment Request Form must comply with data protection regulations to ensure the security of the personal and banking information provided. Always submit forms through secure methods as instructed by the company.

Are there fees associated with receiving payments through ACH?

Generally, receiving ACH payments involves lower fees than other electronic transactions. However, it's wise to consult with your bank about any potential costs.

What should be done if there are errors in the submitted form?

If errors are found after submission, contact the company immediately to provide corrected information. Early detection and communication are crucial to avoid payment delays or issues.

Common mistakes

When filling out the ACH Payment Request Form, it’s crucial to provide accurate and complete information to ensure the payment process runs smoothly. Here are six common mistakes to avoid:

Not providing complete Vendor Information. This includes the business name, address, contact name, phone number, and email. Incomplete information can delay the payment process.

Entering incorrect Bank Information. This encompasses the bank name, account number, ABA (routing) number, bank address, and phone number. Mistakes in this section can lead to payments being sent to the wrong account.

Omitting the Remittance Advice Method. Failing to specify how you wish to receive your remittance advice – typically via email – can lead to confusion or delays in confirming payments.

Neglecting to provide a signature and date. This oversight can invalidate the entire request, as these elements are crucial for authorizing the payment process.

Forgetting to print the name and title under the signature line. Without this information, it may be unclear who authorized the payment request, especially in larger organizations.

Failure to notify NV Energy in writing of any intent to terminate the authorization. It must be done in a timely manner, allowing reasonable opportunity for NV Energy to respond. Ignoring this procedure could lead to unwanted payments being processed.

For optimal processing of ACH payment requests, attention to detail in completing the form is essential. Avoiding these common mistakes can significantly streamline the payment procedure.

Documents used along the form

When completing a Payment Request form, especially for ACH transactions, it's essential to have all necessary documentation prepared and ready for submission. This ensures a smoother process and reduces the likelihood of delays. Let's take a look at five other forms and documents commonly used alongside the Payment Request form.

- Invoice: Provides detailed information about the transaction, including the services or products provided, quantities, prices, and total due. It serves as the basis for the payment request.

- W-9 Form: Required for new vendors or consultants in the United States. This form collects taxpayer identification numbers and certification, helping to ascertain the payee's tax status for reporting purposes.

- Purchase Order: Issued by the buyer to the seller, detailing the types, quantities, and prices for products or services. It serves as authorization for the seller to proceed with the transaction.

- Contract or Agreement: A document that outlines the terms and conditions of the relationship between the two parties, specifying what services or goods will be exchanged and the corresponding payment terms.

- Receipts or Proof of Delivery: Evidence that the products or services were delivered as agreed. This document might be required to accompany the payment request to show that the transaction met the agreed-upon terms.

Gathering these documents before submitting a Payment Request can significantly enhance the efficiency of the processing. It not only helps in establishing the legitimacy of the transaction but also ensures that both parties have a clear understanding of what has been agreed upon, leading to fewer disputes and a smoother financial relationship.

Similar forms

An Invoice is fundamentally similar to a Payment Request form. Both documents serve the purpose of requesting payment for services or goods rendered, containing essential details such as the business name, contact information, and specifics about the payment required. An Invoice, however, typically goes into more detail regarding the products or services provided, including quantities, descriptions, and the total amount due, serving as a detailed request for payment after a transaction has already occurred.

A Direct Deposit Form shares similarities with the ACH Payment Request form, particularly in the context of providing bank information to facilitate a transaction. Both forms collect critical financial data, like bank name, account number, and routing number, to enable electronic transfers. The distinct purpose of a Direct Deposit Form is to arrange for the deposit of funds into an individual's account, commonly used for salary or benefits payments, meanwhile, an ACH Payment Request is typically used by businesses to receive payments electronically from customers or clients.

The Wire Transfer Request is another document that bears resemblance to the ACH Payment Request form. It specifically requests the transfer of funds electronically between two bank accounts, leveraging the bank's wire network. Both forms necessitate detailed banking information, including the account and routing numbers, to accurately direct where funds should be deposited or withdrawn. However, wire transfers are generally faster and might involve fees, while ACH is often used for domestic transactions with fewer or no fees.

A Standing Order Mandate is closely related to the ACH Payment Request form, as it allows for regular, scheduled transfers between bank accounts. This document captures bank details similar to the ACH form, to ensure accurate and timely transactions. The key difference lies in the continuity and frequency of payment: a Standing Order Mandate is used to set up recurring payments for an indefinite period until cancelled, whereas an ACH Payment Request is often a one-off or periodic request for funds transfer.

Vendor Setup Forms pair nicely with the notion of the ACH Payment Request form by collecting vendor information and banking details to facilitate payment. These forms are typically used by businesses at the beginning of a vendor relationship to ensure all necessary details are on file for future payments. While a Vendor Setup Form may gather more comprehensive information about the vendor, including tax IDs and business classification, both forms are integral in establishing the foundation for electronic payment transactions.

The Bank Account Verification Letter aligns with components of the ACH Payment Request form, primarily in verifying the ownership and legitimacy of the bank account details provided. This letter, usually issued by the bank, includes the account holder's name, account number, and sometimes the routing number, echoing the banking information captured in an ACH Payment Request. This verification process is crucial for preventing fraud and ensuring the security of electronic financial transactions.

A Payment Authorization Form is another document quite akin to the ACH Payment Request form, particularly in its function to authorize the transfer of funds from an individual or entity’s account. It includes permission for a business to debit an account for a specified amount, quite like how the ACH form allows a vendor to request payment electronically. The authorization is central to both forms, though a Payment Authorization may also be used for recurring billing in addition to one-time payments.

Lastly, the Purchase Order (PO) document, while distinct in its primary function, shares a procedural similarity with the ACH Payment Request form. A PO is issued by a buyer to a seller, authorizing the purchase of goods or services under specified terms and conditions. It precedes the actual financial transaction, setting the stage for a subsequent payment request, which may be fulfilled via an ACH Payment Request form. Here, the link is in the sequence of purchase and payment processes, with each document playing a pivotal role in the procurement and payment cycle.

Dos and Don'ts

Completing a Payment Request form accurately ensures timely and correct payments to vendors or service providers. When filling out the ACH Payment Request form, there are essential guidelines to follow and common pitfalls to avoid. Here are some do's and don'ts to consider:

Do:Ensure all information is complete and accurate. Double-check the business name, address, and company contact information to avoid any delays.

Include the correct bank account and routing numbers. Mistakes can lead to funds being misdirected.

Verify the bank's name and address. This identification helps to eliminate any confusion during the transaction process.

Provide a current email address for remittance advice. This ensures you receive confirmation of the transaction.

Sign and date the form. A signature is a verification of the request and authorization for the payment to be processed.

Leave any fields blank. Incomplete information can result in processing delays or payment failure.

Use outdated or incorrect banking information. This could not only delay the payment but could also result in lost funds.

Forget to include the title of the signatory. The title clarifies the authority of the person completing and signing the form.

Ignore the requirement to notify NV Energy in writing if you intend to terminate this authority for ACH payment. Proper notification ensures all parties are aware of changes in payment procedures.

Neglect to print the form out for a physical signature. While digital processes are convenient, a physical signature often serves as a key verification step.

Misconceptions

Many people hold misconceptions about the Payment Request form, especially when it involves Automated Clearing House (ACH) payments. These misunderstandings can lead to mistakes in payment processes or delays. Here are five common misconceptions clarified for better understanding:

- A Signature is Only a Formality: The signature and printed name at the bottom of the form are critical. They validate the request, authorizing the company to process payments directly from or to your bank account. Without these, the form is incomplete and cannot be processed.

- Email Address is Optional for Remittance Advice: Providing an email address for remittance advice purposes is often misunderstood as optional. However, including an email ensures you receive detailed information about each transaction, aiding in your financial tracking and record-keeping.

- Bank Information is Not Confidential: There's a misconception that sharing bank account and routing numbers compromises security. In reality, this information is essential for facilitating ACH payments, and businesses handling these forms are required to protect your data.

- Any Email Can be Used for Notification: The belief that any email address is suitable for receiving termination notifications is incorrect. It's essential to provide an official or primary email that you check regularly to ensure you receive timely updates on your payment status.

- Changes Can Be Made Orally: Some assume that changes to the ACH Payment Request form, such as cancelling the service, can be done over the phone or verbally. In truth, written notification is necessary to document the request and protect all parties involved.

Understanding these key points can streamline the payment request process, ensuring that transactions are executed smoothly and efficiently.

Key takeaways

Filling out a Payment Request form accurately is instrumental in ensuring that transactions are processed smoothly and efficiently. Here are some key takeaways to consider:

- Verify Vendor Details: Ensure that all vendor information including the business name, address, contact name, phone number, and email are up-to-date and accurately entered. This prevents any delays in payment processing due to incorrect information.

- Bank Information Accuracy: Double-check the bank name, account number, Routing (ABA) number, and bank address. Mistakes in banking details can lead to failed transactions or funds mistakenly sent to the wrong account.

- Utilize Correct Forms: Make certain you're using the precise form required by the entity you're dealing with, in this instance, NV Energy. Using the wrong form can cause unnecessary delays.

- Remittance Advice Method: Clearly state the preferred method of receiving payment details, usually via email. This ensures that you have a record of the payment and can reconcile it with your invoices.

- Written Termination Notice: Be aware that this authorization for ACH payment remains effective until written notice of termination is received. It highlights the need for maintaining records of any changes or cancellations.

- Provide a Signature and Date: The form is not complete without the authorized individual’s signature and the date signed. This serves as official consent for the payment process.

- Print Name and Title: Clearly print the name and title of the person authorizing the ACH payment. This adds an extra layer of verification and is helpful for record-keeping.

- Understand the Terms: It’s crucial to thoroughly understand the terms indicated in the payment request form, saving time and preventing any unforeseen issues.

By paying close attention to these aspects, businesses can facilitate a smoother, more reliable payment process. Ensuring accuracy and clarity in the Payment Request form is a foundational step towards successful financial management.

Popular PDF Documents

Schedule C Irs - Eligibility hinges on not having deductible home office expenses.

IRS Schedule K-1 1041 - By outlining the share of investment income, like dividends and interest, the form ensures beneficiaries report and pay taxes accordingly.