Get Payment Dispute Form

In navigating the complexities of healthcare payments, the Provider Payment Dispute and Correspondence Submission Form stands out as a crucial tool for healthcare providers. This form, designed expressly for the purpose of addressing payment disputes and claim correspondence, offers a streamlined pathway for providers to communicate with Amerigroup regarding discrepancies in payments or requests for additional information on claims. It is essential for both participating and nonparticipating providers, with a special note for the latter when dealing with Medicare members to include a Centers for Medicare & Medicaid Services (CMS) Waiver of Liability form if the member has potential financial liability. By filling out the member and provider’s fundamental information alongside the dispute or correspondence details, providers can ensure that their concerns are addressed promptly and efficiently. This document also highlights the option for providers to articulate their reasons for disputes or requests for information, supported by attached medical records or additional documents as needed. Thus, this form is not only a procedural requirement but also a means of ensuring that the channels of communication between healthcare providers and Amerigroup remain clear, effective, and conducive to resolving financial disagreements and clarifying claim specifics.

Payment Dispute Example

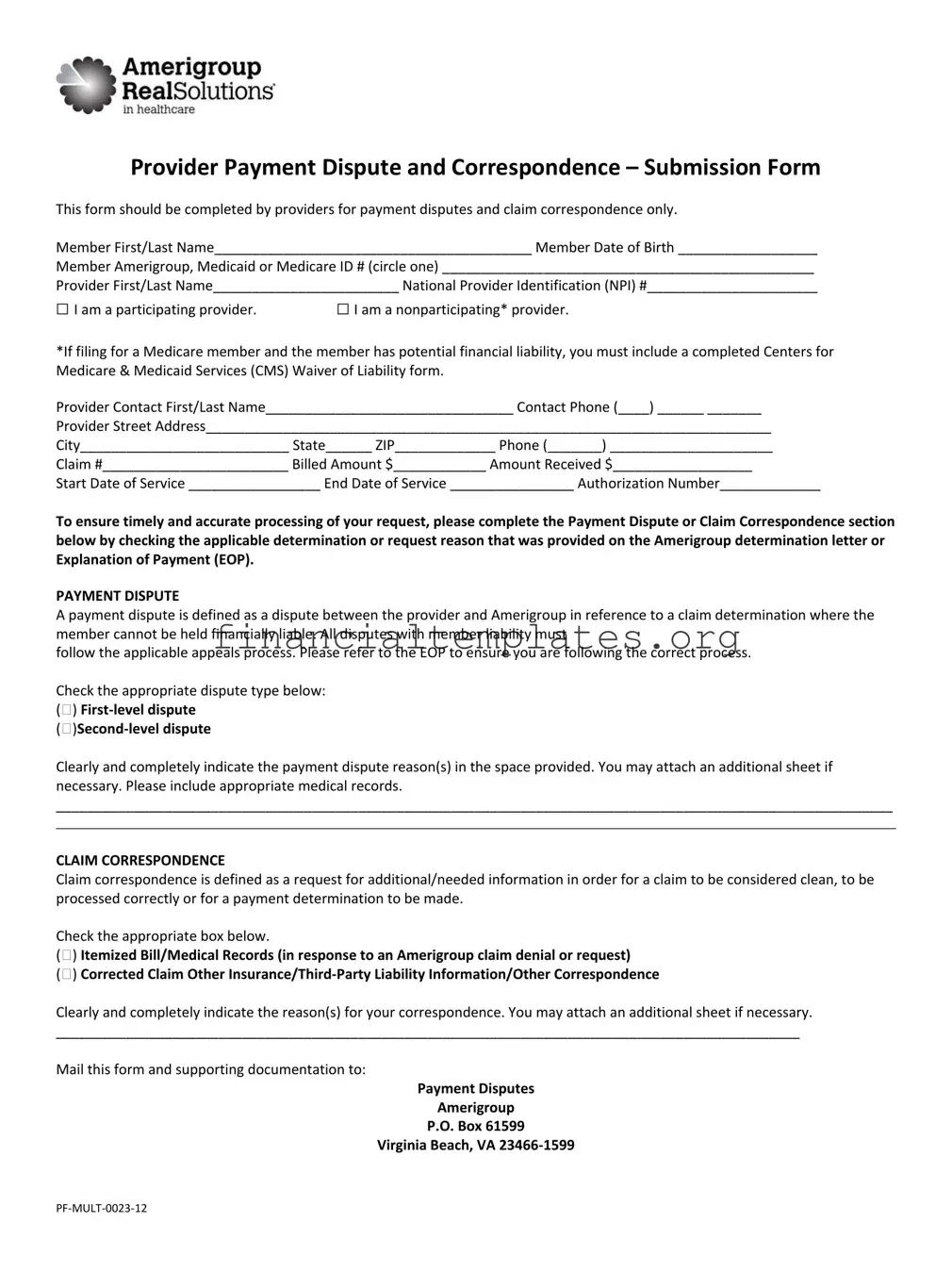

Provider Payment Dispute and Correspondence – Submission Form

This form should be completed by providers for payment disputes and claim correspondence only.

Member First/Last Name_________________________________________ Member Date of Birth __________________

Member Amerigroup, Medicaid or Medicare ID # (circle one) ________________________________________________

Provider First/Last Name________________________ National Provider Identification (NPI) #______________________

□I am a participating provider.

□I am a nonparticipating* provider.

*If filing for a Medicare member and the member has potential financial liability, you must include a completed Centers for Medicare & Medicaid Services (CMS) Waiver of Liability form.

Provider Contact First/Last Name________________________________ Contact Phone (____) ______ _______

Provider Street Address_________________________________________________________________________

City___________________________ State______ ZIP_____________ Phone (_______) _____________________

Claim #________________________ Billed Amount $____________ Amount Received $__________________

Start Date of Service _________________ End Date of Service ________________ Authorization Number_____________

To ensure timely and accurate processing of your request, please complete the Payment Dispute or Claim Correspondence section below by checking the applicable determination or request reason that was provided on the Amerigroup determination letter or Explanation of Payment (EOP).

PAYMENT DISPUTE

A payment dispute is defined as a dispute between the provider and Amerigroup in reference to a claim determination where the member cannot be held financially liable. All disputes with member liability must

follow the applicable appeals process. Please refer to the EOP to ensure you are following the correct process.

Check the appropriate dispute type below: ()

Clearly and completely indicate the payment dispute reason(s) in the space provided. You may attach an additional sheet if necessary. Please include appropriate medical records.

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

CLAIM CORRESPONDENCE

Claim correspondence is defined as a request for additional/needed information in order for a claim to be considered clean, to be processed correctly or for a payment determination to be made.

Check the appropriate box below.

() Itemized Bill/Medical Records (in response to an Amerigroup claim denial or request)

() Corrected Claim Other

Clearly and completely indicate the reason(s) for your correspondence. You may attach an additional sheet if necessary.

________________________________________________________________________________________________

Mail this form and supporting documentation to:

Payment Disputes

Amerigroup

P.O. Box 61599

Virginia Beach, VA

Document Specifics

| Fact Name | Fact Detail |

|---|---|

| Form Purpose | For providers to submit payment disputes and claim correspondence only. |

| Provider Type Identification | Providers must indicate whether they are participating or nonparticipating providers. |

| Nonparticipating Provider Condition | If filing for a Medicare member with potential financial liability, a completed CMS Waiver of Liability form must be included. |

| Payment Dispute Definition | A dispute between the provider and Amerigroup regarding claim determination where the member cannot be financially liable. |

| Claim Correspondence Definition | A request for additional/needed information for a claim to be considered clean, processed correctly, or for a payment determination to be made. |

| Submission Address | Payment Disputes Amerigroup P.O. Box 61599 Virginia Beach, VA 23466-1599 |

Guide to Writing Payment Dispute

After filling out the Payment Dispute form, it will be processed by the concerned department to address the payment disputes between providers and Amerigroup effectively. The information provided will be thoroughly reviewed to ensure accurate resolution. It is critical to fill out the form with accurate and comprehensive details to facilitate a smooth process.

- Start by writing the member's first and last name.

- Enter the member's date of birth in the specified format.

- Circle the type of ID the member has (Amerigroup, Medicaid, or Medicare) and write down the ID number.

- Indicate your first and last name in the provider section.

- Write your National Provider Identification (NPI) number.

- Check the box to identify if you are a participating or nonparticipating provider. If you check nonparticipating and you're filing for a Medicare member who might have financial liability, attach a completed CMS Waiver of Liability form.

- Provide the name of the provider contact person, along with their phone number.

- Fill in the provider's street address, including city, state, and ZIP code. Follow this by adding a contact phone number.

- Enter the claim number, billed amount, and amount received.

- Specify the start and end dates of the service.

- Include the authorization number if applicable.

- Choose the dispute type: First-level dispute or Second-level dispute by checking the appropriate box.

- In the space provided, clearly and completely indicate the reason(s) for the payment dispute. Attach additional sheets if needed and include relevant medical records.

- For claim correspondence, check the appropriate box for Itemized Bill/Medical Records, Corrected Claim, Other Insurance/Third-Party Liability Information or other correspondence.

- Explain the reason(s) for your correspondence in the space provided and attach additional sheets if necessary.

- After completing the form and attaching any relevant documents, mail everything to the address given: Payment Disputes, Amerigroup, P.O. Box 61599, Virginia Beach, VA 23466-1599.

Understanding Payment Dispute

What is the purpose of the Payment Dispute and Correspondence Submission Form?

The Payment Dispute and Correspondence Submission Form is designed for use by providers to address and resolve payment disputes and to submit claim-related correspondence with Amerigroup pertaining to Medicaid, Medicare, or Amerigroup members. This form should be utilized when a provider disagrees with a claim determination that does not involve member financial liability or requires the submission of additional information for a claim to be processed accurately.

Who should complete this form?

Healthcare providers, both participating and non-participating, who are disputing a payment decision by Amerigroup or need to submit claim correspondence, should complete this form. Providers need to include details such as the member’s name and ID number, provider information including National Provider Identification (NPI) number, and details of the claim in question.

Are there any specific conditions under which a nonparticipating provider must submit additional documentation for Medicare members?

Yes, if a nonparticipating provider is filing a dispute for a Medicare member and the member has potential financial liability, a completed Centers for Medicare & Medicaid Services (CMS) Waiver of Liability form must be included with the dispute submission. This requirement helps protect the financial interests of Medicare members.

What information is required on the form?

The form asks for comprehensive information including the member’s full name, date of birth, and ID number; provider names and NPI number; provider contact information; claim details such as the billed amount, amount received, dates of service, and authorization number. Additionally, providers must specify whether the submission is for a payment dispute or claim correspondence, and detail the reason for the dispute or correspondence.

How does one specify the type of dispute?

Providers must indicate whether they are submitting a first-level or second-level dispute by checking the appropriate box on the form. This clarification is crucial for Amerigroup to understand the stage of dispute resolution and process the request efficiently. If more space is needed to elaborate on the dispute reason, providers may attach an additional sheet.

What should be included in claim correspondence?

In the claim correspondence section, providers can request the addition of itemized bills or medical records, the submission of a corrected claim, or provide other necessary information such as third-party liability details. Providers must clearly indicate their correspondence reason and can attach additional sheets if the space provided is insufficient.

Where should the completed form and supporting documentation be sent?

The completed form, along with any supporting documentation, should be mailed to: Payment Disputes Amerigroup, P.O. Box 61599, Virginia Beach, VA 23466-1599. This address is specifically designated for the submission of payment disputes and claim correspondence to ensure timely and accurate processing.

Is it necessary to include medical records with the dispute submission?

Yes, when submitting a payment dispute, it is recommended to include appropriate medical records that support the claim. This documentation is vital for a thorough evaluation of the dispute, enabling Amerigroup to make a well-informed decision.

Can additional information be attached if the form does not provide enough space?

Providers may attach additional sheets if the space on the form is insufficient to clearly and completely indicate the payment dispute reasons or claim correspondence details. This flexibility ensures that providers can fully present their case or provide all necessary information for claim processing.

Common mistakes

Filling out a Payment Dispute form accurately is crucial for a timely resolution. However, people often make mistakes that can delay or negatively impact the process. Identifying these errors can help providers avoid common pitfalls.

Not specifying the member's insurance type - It's essential to circle whether the member's coverage is under Amerigroup, Medicaid, or Medicare. Neglecting to select one can result in processing delays.

Forgetting the Waiver of Liability form - If you're a nonparticipating provider filing for a Medicare member with potential financial liability, failing to include a completed CMS Waiver of Liability form can halt the process.

Omitting contact information - Sometimes the provider's contact name or phone number is missing. This oversight makes it challenging to reach out for any clarifications or additional information.

Incomplete claim details - Providers often forget to fill in all the claim-related fields, such as the start and end dates of service, which are critical for the claim's assessment.

Not checking the appropriate dispute type or request reason - Selecting the correct dispute type or correspondence reason is vital for proper routing and processing, and yet this step is frequently overlooked.

Lack of supporting documentation - Failure to attach relevant medical records or an additional sheet explaining the dispute reasons further holds up the review process.

Avoiding these mistakes can streamline the submission process, ensuring that disputes are resolved efficiently and effectively.

Documents used along the form

When navigating the intricacies of healthcare payments, providers often find themselves needing to utilize additional forms and documents alongside the Payment Dispute Form. This ensures that their dispute or inquiry is comprehensively addressed. Here is a selection of frequently used documents.

- Explanation of Payment (EOP) or Explanation of Benefits (EOB): This document accompanies the payment from insurance companies to providers. It details what services were paid for, the amount paid, and any patient responsibility. It is crucial for identifying discrepancies in payment.

- Centers for Medicare & Medicaid Services (CMS) Waiver of Liability Form: Required when filing disputes for Medicare members with potential financial liability. It protects providers from financial liability for services Medicare denies.

- Itemized Bill: A detailed bill showing all the services provided to the patient, including dates of service, the charge for each service, and total charges. It is necessary when more detailed financial documentation is needed to support a dispute.

- Corrected Claim Form: Used to resubmit a claim that was initially submitted with errors or incomplete information. It is crucial for ensuring the claim is processed correctly after discrepancies are resolved.

- Medical Records: These provide evidence of the medical services provided to the patient and justify the claim. They are often attached to support a payment dispute or claim correspondence request.

- Other Insurance/Third-Party Liability Information Form: Required when a patient has another insurance provider that may be responsible for paying some or all of the medical expenses. This form helps determine the correct primary and secondary payers.

Together, these documents play a vital role in the resolution of payment disputes and claim correspondences. They provide the necessary context, evidence, and details required for insurance companies to process and resolve any issues efficiently. It is essential for healthcare providers to be familiar with these forms and to submit them accurately to ensure the financial stability of their practices.

Similar forms

The Payment Dispute form shares similarities with the Prior Authorization Request form. Both forms are crucial for healthcare providers and involve the submission of detailed patient and provider information, aimed at obtaining either payment for services rendered or approval for specific health services before they are performed. They must include patient and provider identifiers, such as names and ID numbers, to ensure accurate processing. Additionally, both forms often require supporting documentation or medical records to support the request, emphasizing the need for thorough and clear communication between healthcare providers and insurance companies.

Another document similar to the Payment Dispute form is the Appeal form for denied claims. Both documents are used after an initial decision has been made by the insurance company, with the Appeal form focusing on overturning a denial of coverage for services provided, and the Payment Dispute form addressing disagreements over the payment amount for services rendered. Both forms necessitate the inclusion of specific reasons for the dispute or appeal, detailed patient information, and may also require attaching additional documents or medical records to support the provider's case.

The Explanation of Payment (EOP) or Explanation of Benefits (EOB) document complements the Payment Dispute form. While the EOP or EOB is sent by the insurance company to explain the payments made, the deductions applied, and the services for which the payment is intended, the Payment Dispute form is used by providers to challenge these payments or lack thereof. Essentially, the EOP or EOB provides the basis for filing a Payment Dispute form whenever discrepancies or disagreements arise regarding the payment details documented by the insurance company.

Lastly, the Payment Dispute form is closely related to the Claims Submission form. Both are essential steps in the medical billing process, with the Claims Submission form initiating the request for payment by detailing the services provided to the patient, while the Payment Dispute form is utilized when the provider disagrees with the payment decision made by the insurance company. They share the need for accurate and comprehensive patient and service information, ensuring that the exchange between healthcare providers and insurance companies is seamless and disputes are minimized.

Dos and Don'ts

Filling out a Payment Dispute form is a crucial step in challenging payment determinations. Yet, it can sometimes be confusing. To streamline the process and maximize your chances of success, here are some dos and don'ts you should consider:

Dos:

Ensure all relevant sections of the form are thoroughly completed. This includes member and provider details, claim information, and the specific reasons for the payment dispute.

Circle the correct member ID type (Amerigroup, Medicaid, or Medicare) to avoid processing delays.

Check the appropriate box to indicate your participating or nonparticipating provider status. If you are filing for a Medicare member and the member has potential financial liability, do remember to include a completed CMS Waiver of Liability form.

Provide detailed reasoning in the payment dispute or claim correspondence section. If the space provided is insufficient, attach additional sheets as necessary.

Include appropriate medical records or supporting documentation that strengthens your dispute or claim.

Verify that the contact information for the provider is accurate and up to date. Errors here could lead to communication delays or misplacements.

Check for and adhere to submission deadlines to ensure your dispute is considered in a timely manner.

Keep a copy of all documents submitted for your records. This is essential for future reference or follow-up communication.

Review the form before submitting to ensure that all information is correct and no sections have been overlooked.

Mail the form and all accompanying documents to the correct address provided on the form to ensure it reaches the intended recipient.

Don'ts:

Do not leave any required fields empty. Incomplete forms may be returned or result in processing delays.

Do not use unclear or vague language when describing the reason for your dispute or claim. Clarity and specificity are key to understanding and resolution.

Avoid submitting the dispute without appropriate documentation or medical records, as this can weaken your case.

Do not forget to check the relevant boxes or circle the correct options provided on the form, as this guides the processing path of your dispute.

Resist the temptation to deviate from the prescribed format, including adding unnecessary information that is not requested, as it may complicate the review process.

Do not ignore the contact details section, assuming the provider's information on file is up-to-date. Confirm and provide current contact information.

Do not submit the form to an incorrect address, as it could result in significant delays or the loss of your submission.

Avoid waiting until the last moment to submit your form. Processing takes time, and delays can affect the outcome.

Do not overlook the need to indicate whether you are submitting a first-level or second-level dispute. This affects how your dispute is handled.

Lastly, do not neglect to maintain a personal copy of the submission package. Tracking and follow-ups are easier when you have your own record of what has been sent.

By adhering to these guidelines, you can improve the completeness and clarity of your Payment Dispute form submission, enhancing the likelihood of a favorable outcome.

Misconceptions

When discussing the Payment Dispute form, particularly in the context of healthcare providers disputing payments from insurance entities like Amerigroup, it is important to clarify common misconceptions that might arise. Understanding these misconceptions is crucial for both the efficiency of dispute resolution and the financial stability of healthcare providers. Here, we aim to demystify some of these often-misunderstood aspects.

Only participating providers can file a dispute. This is not true. The form clearly distinguishes between participating and non-participating providers, allowing either to submit a dispute. This ensures that all providers have a channel to dispute payments, although non-participating providers might need to adhere to additional requirements such as submitting a CMS Waiver of Liability form when filing for a Medicare member.

A Payment Dispute form can be submitted for any issue related to payment. Actually, this form is specifically designed for payment disputes and claim correspondence only. It's not intended for other types of inquiries or complaints. Providers should ensure that their issue directly relates to payment disputes or claim correspondence before submission.

All disputes will automatically involve member financial liability. The form and its instructions make it clear that a payment dispute is defined as a disagreement where the member cannot be held financially liable. If a member's financial liability is involved, the dispute must follow a different process, typically involving appeals.

Submitting a form guarantees a reversal of the payment decision. Submission of the Payment Dispute form initiates a review process but does not guarantee a decision in favor of the provider. It's a necessary step for the reconsideration of the claim, but outcomes depend on the merits of each case, including adherence to policies and the provision of required documentation.

Any additional documents can be attached haphazardly. While the form allows for the attachment of additional sheets if necessary, it requires that all provided information, including medical records or other documentation, be relevant and clearly linked to the payment dispute or claim correspondence in question. Proper organization and clarity in the presentation of supplementary documents are essential for timely and accurate processing.

By addressing these misconceptions head-on, providers can navigate the payment dispute process more effectively, ensuring that their disputes are submitted correctly and processed efficiently. Understanding the specifics outlined on the form and in the accompanying instructions is paramount for any provider seeking clarity and resolution in the payment dispute process.

Key takeaways

When dealing with Payment Disputes, it's essential to have a clear understanding of how to properly complete and use the submission form. Here are several key takeaways to ensure your dispute is handled efficiently:

- Complete all required sections: It's vital to fill in every required field accurately, including member and provider information, claim details, and the specific reasons for the dispute or claim correspondence.

- Specify the dispute type: Clearly indicate whether you are filing a first-level dispute or a second-level dispute. Understanding the distinction between these levels can impact the resolution process.

- Include necessary documentation: Attach all relevant medical records, invoices, or additional sheets that support your dispute or claim correspondence. This documentation can be crucial for a thorough review.

- Indicate the member’s financial liability: If the dispute involves a Medicare member with potential financial liability, include a completed Centers for Medicare & Medicaid Services (CMS) Waiver of Liability form.

- Distinguish between disputes and correspondences: A payment dispute is related to claim determinations where the member can't be held financially liable. In contrast, claim correspondence refers to requests for additional information needed for claim processing or correction.

- Use the correct mailing address: Send the completed form and any supporting documents to the specified Amerigroup P.O. Box address. Ensuring the form is sent to the correct address helps avoid processing delays.

- Follow the Amerigroup determination letter or Explanation of Payment (EOP) guidelines: Referencing these documents can provide guidance on the appropriate process to follow, whether you’re making a dispute or submitting claim correspondence.

Understanding these key aspects and meticulously preparing your Payment Dispute form can lead to more effective and timely resolution of disputes. Adequate documentation and clarity in your submission are critical for a successful outcome.

Popular PDF Documents

Schedule 8812 - Provides clarity on integrating the child tax credit with other key forms and worksheets.

Nebraska Form 13 - Clarifies how sales tax paid in another state affects the vehicle's tax treatment when registered in Nebraska.